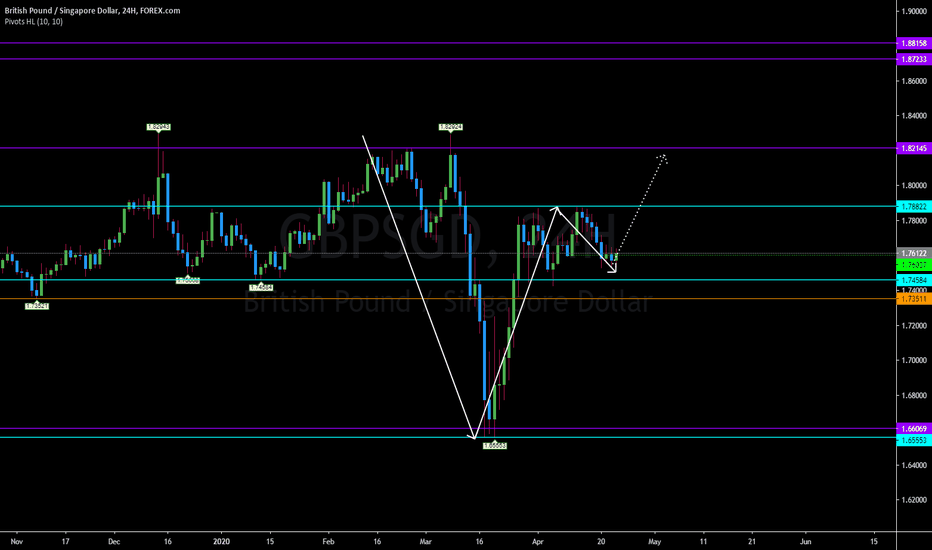

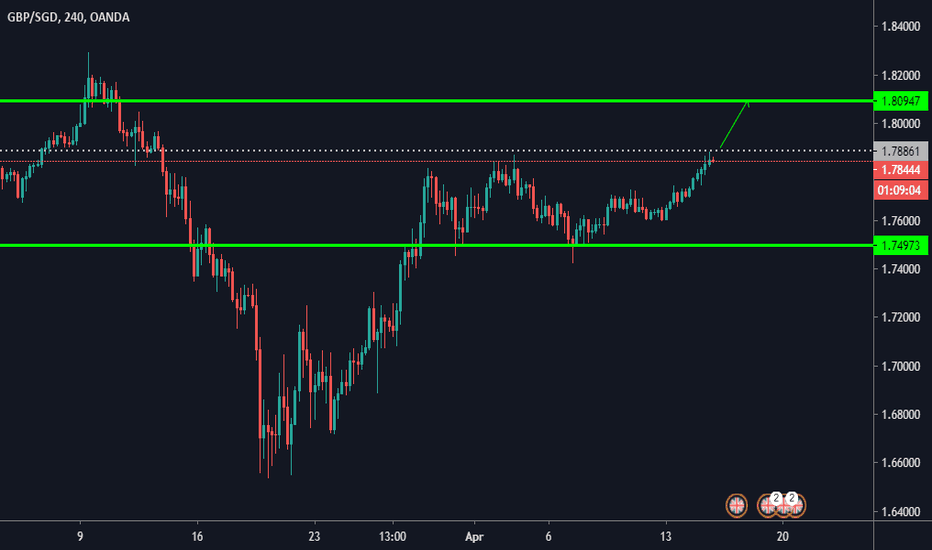

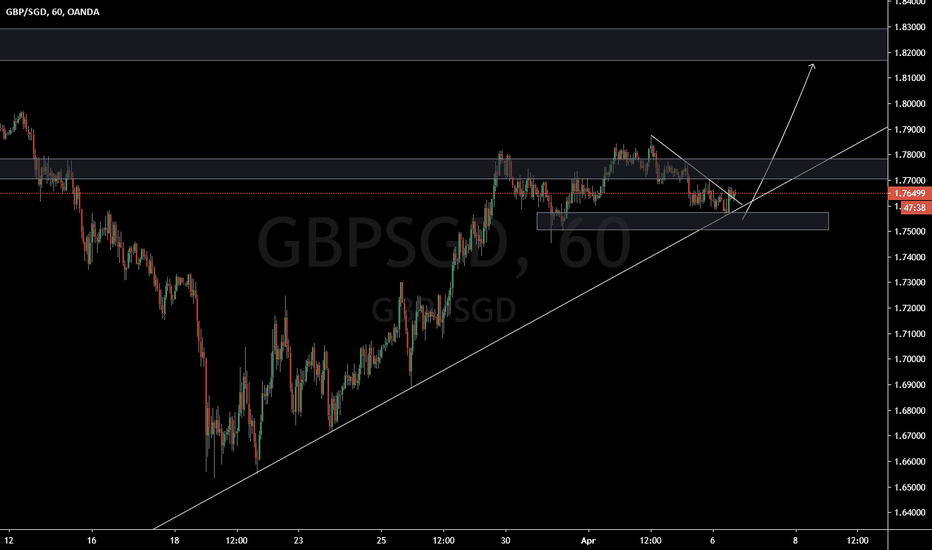

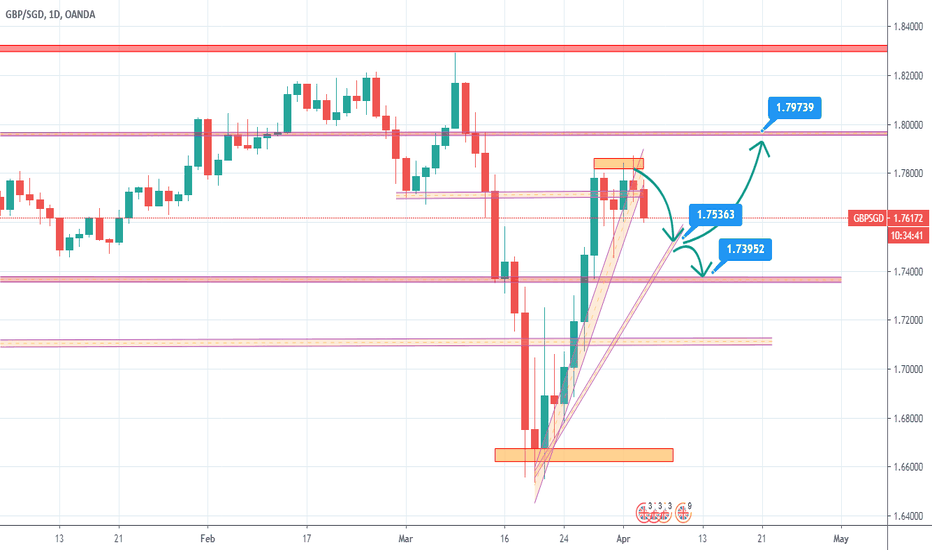

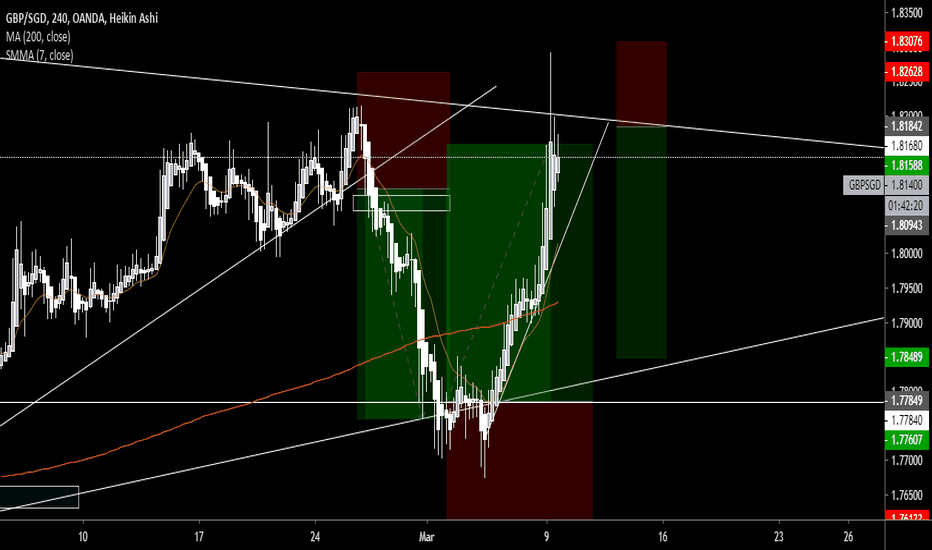

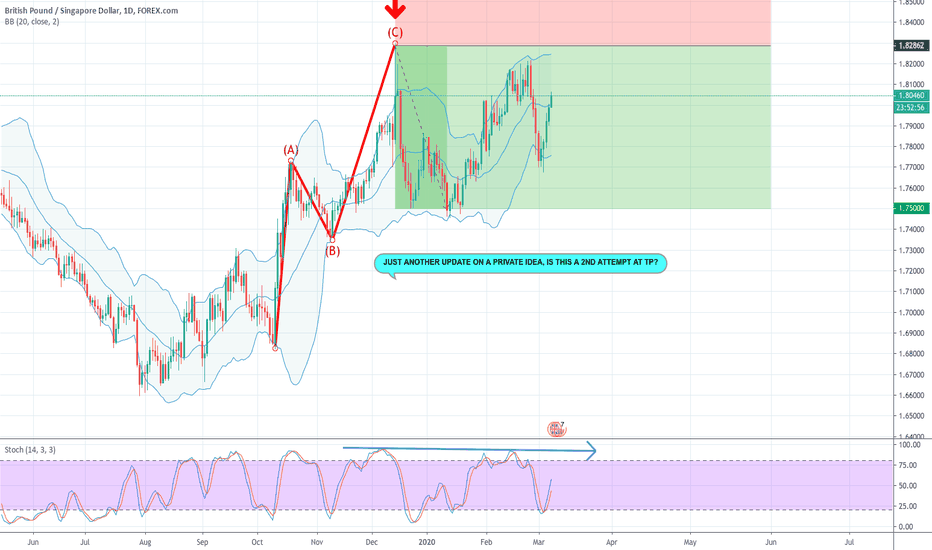

We've held above the prior monthly and weekly on GBP/SGD.GBP/SGD is showing some signs of accumulation as we've held above monthly and weekly support in our current uptrend.

I like a test of previous monthly resistance indicated by the dashed white line.

-----

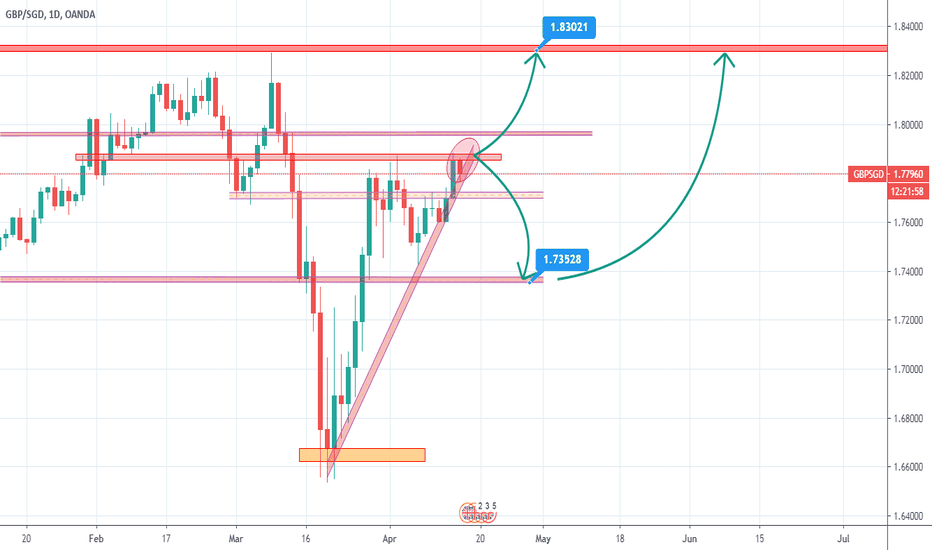

The S/R color coding system I'm developing for myself:

To see multiple timeframe levels at once, use a color coding system:

A. Light Blue: Weekly Levels (W)

B. Green: Daily Levels (D)

C. Purple: Monthly Levels and above (MO)

D. Orange: 3 day levels. (3D).

E. Red: (12 hour levels and below.)

Note: You can actually see higher timeframe levels by simply counting the number of candles when viewing the lower timeframes. I.e. count back 7 daily candles, look at where we've closed the last daily, and that's your weekly level.

1. The S/R system that I use involves examining trend on a multiple timeframe basis. The idea is that trend confirms and re-confirms itself as time goes on, or else the trend fails.

2. Support/Resistance Identification

A.To identify a level, I start by taking an area where at least "2" candles have closed at nearly the nearly the same price. This is how I identify support/resistance. The more closes at or near the same price, the more valid the level. But only "2" are required.

B. To be clear, the lines you see are NOT the S/R levels themselves. They are derived *from* the S/R level by taking it's high/low.

3. Color Coding for trend.

Then I take the high/low of that group and mark that as a color-coded level. I then expect price to come back and revisit that level, although it isn't necessary.

4. Range-Bound Trading.

Range-bound markets can be tough to trade because the trend can be difficult to identify. In range-bound conditions, I like to take good R/R trades at the lows or the highs of the range, and then exiting the trade at the opposite side. If the range breaks, however, you can then enter trades on the side of trend.

SGDGBP trade ideas

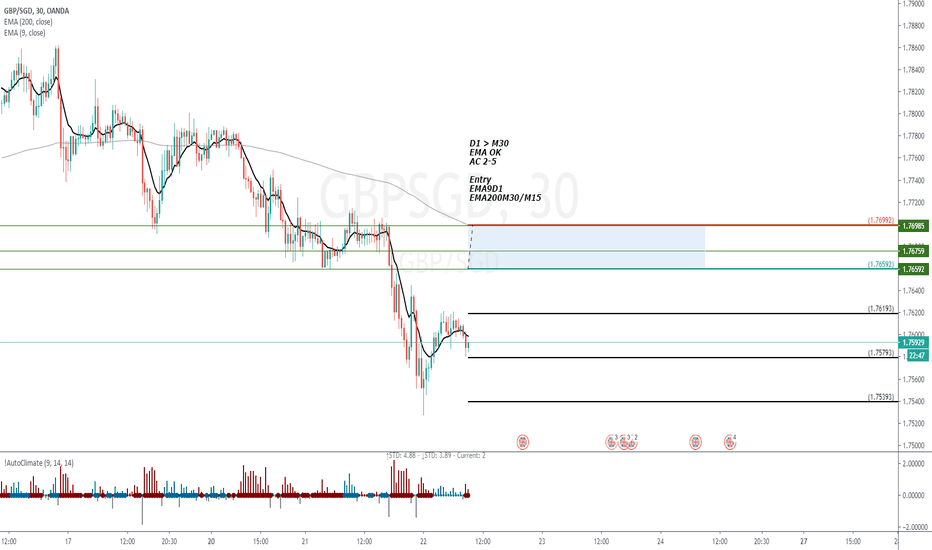

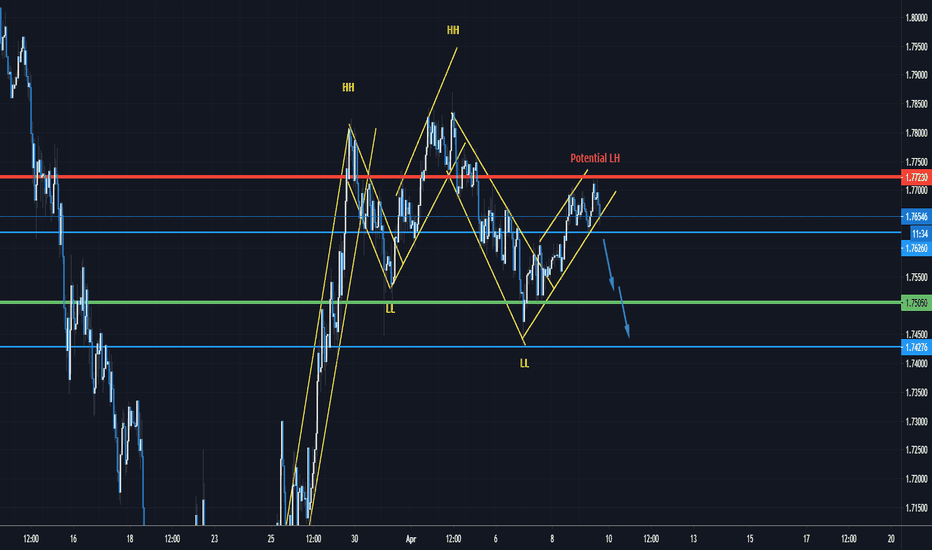

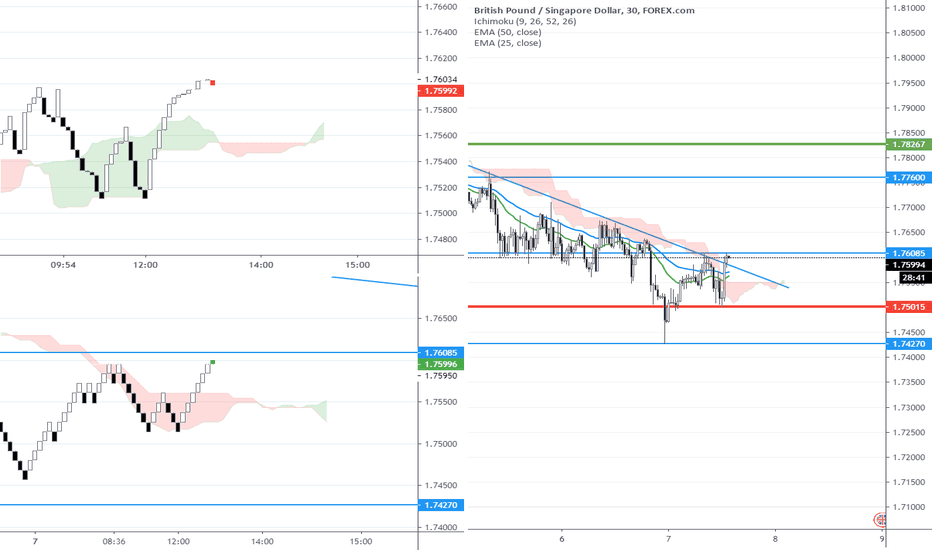

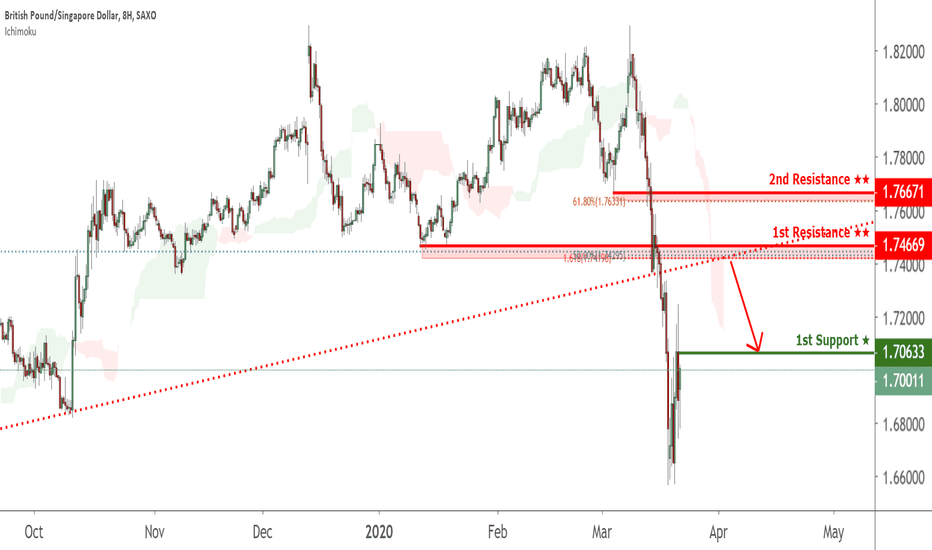

GBP|SGD - Short OpportunityThere is an opportunity to short the GBP|SGD

- Short entries may be initiated on break of 1.76260

- Stop Losses should be above the swing high of corrective 1.77230 (Red Horizontal)

- Target Point A: 1.75050 (Green Horizontal)

- Target Point B: 1.74276

All remaining target and intermediary support zones to the downside are marked below entry by consecutive horizontal lines (blue.)

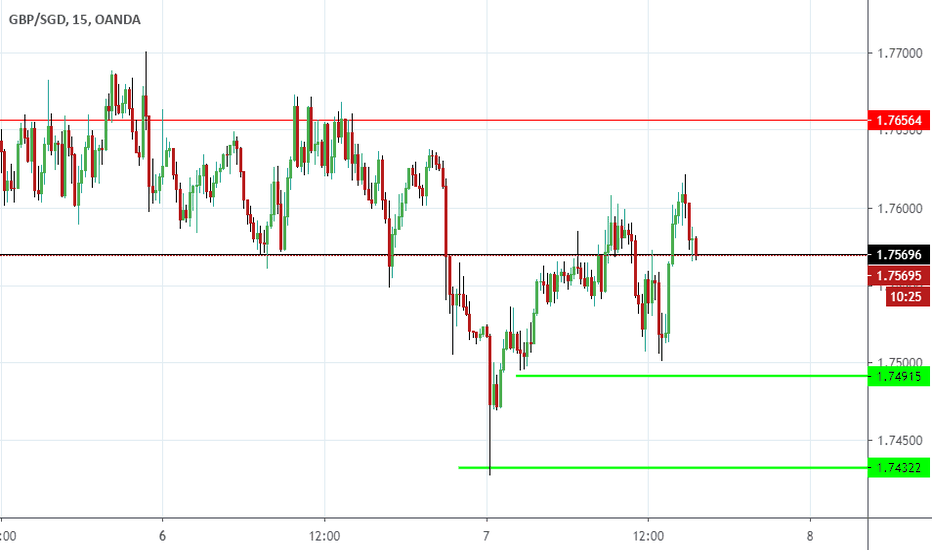

GBP|SGD - Long OpportunityThere is an opportunity to long the GBP|SGD on break of the recent swing high pivot after we established a lower high at 1.75015

- Long entries may be initiated on break of 1.76071

- Stop Losses should be below the last swing low of 1.75015 (Red Horizontal)

- Target Point A : 1.78267 (Green Horizontal)

All remaining target and intermediary resistance zones to the upside are marked above entry by consecutive horizontal lines (blue.)

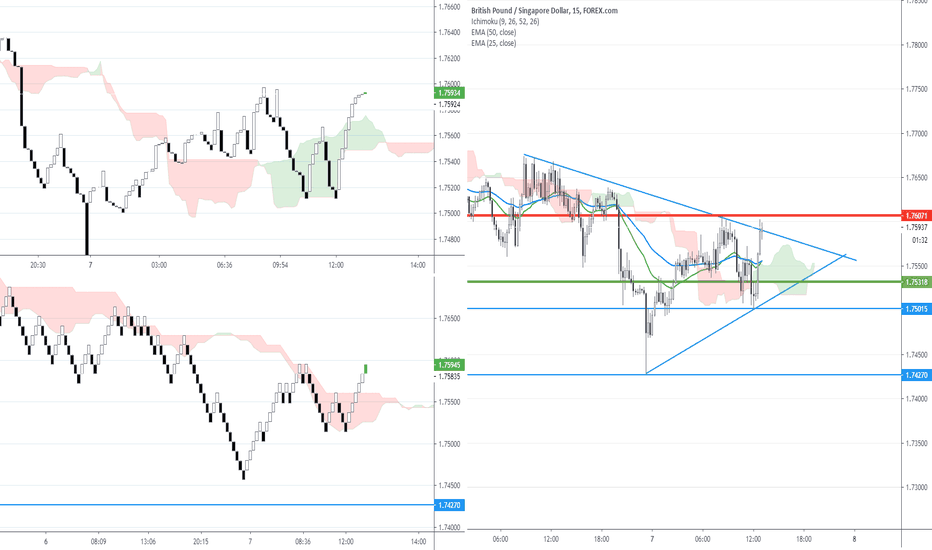

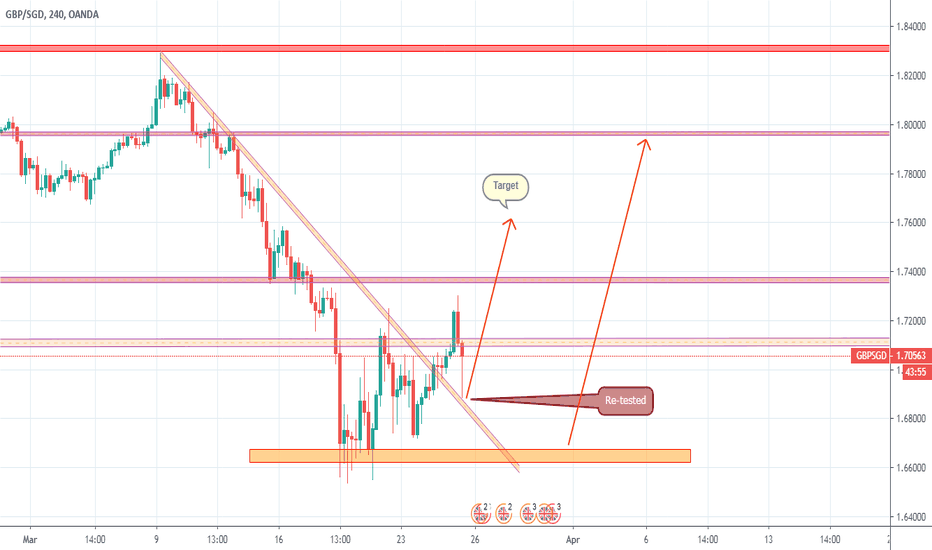

GBP|SGD - Short OpporunityThere is an opportunity to short the GBP|SGD on the touch of the pendant channel resistance..

- Short entries may be initiated now or on touch.

- Stop Losses should be above the last swing high of 1.76094 (Red Horizontal)

- Target Point A (Safe): 1.75318 (Green Horizontal)

All remaining target and intermediary support zones to the downside are marked below entry by consecutive horizontal lines (blue.)

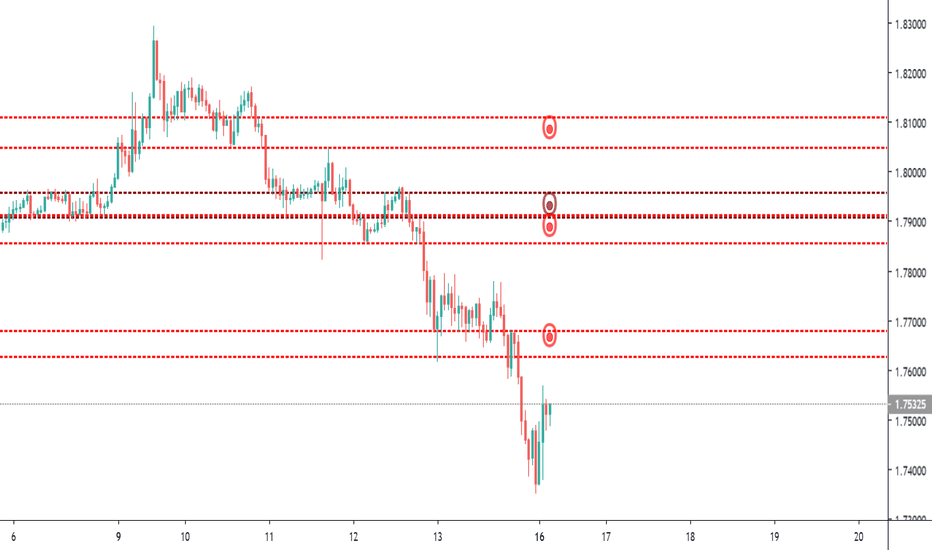

GBPSGD 1h AutoUFOs™ Trade Alert! 16 March 2020Basic Approach:

-Short Entry @ 1.7635

-Protective Stop Loss @ 1.7685

-Take Profit @ 1.7585

Rationale:

-Sell Un-Filled Orders (Red UFO ) available in the 4h time-frame

-Buy Un-Filled Orders (Green UFO ) further below allowing for the current trend to continue developing

Boosting Options:

-Trade in the direction set by the overall Market Environment

-Select Take Profit Targets located at a reasonable/achievable distance

-Higher time-frame key price points such as moving average values or Fibonacci retracements coinciding with the entry price

-Confirmation-style Market Order execution after waiting for price to travel in and out of the entry UFO

-Apply Trade Management techniques to lock in profits once the trade begins moving in the right direction

--------

They are many ways on how to trade, but prices would not move unless Un-Filled Orders (UFOs) get filled.

Join our YouTube Channel ‘tradewithufos’ and be notified of upcoming live trading sessions.

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

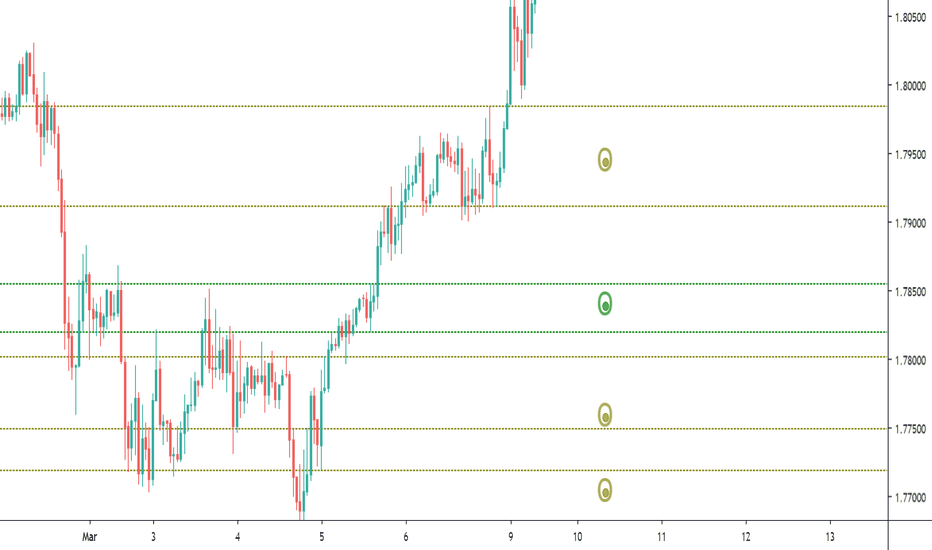

GBPSGD 1h AutoUFOs™ Trade Alert! 10 March 2020Basic Approach:

-Long Entry @ 1.7855

-Protective Stop Loss @ 1.7815

-Take Profit @ 1.7895

Rationale:

-Buy Un-Filled Orders (Green UFO ) available in the 1h time-frame

-Sell Un-Filled Orders (Red UFO ) further above allowing for the current trend to continue developing

Boosting Options:

-Trade in the direction set by the overall Market Environment

-Select Take Profit Targets located at a reasonable/achievable distance

-Higher time-frame key price points such as moving average values or Fibonacci retracements coinciding with the entry price

-Confirmation-style Market Order execution after waiting for price to travel in and out of the entry UFO

-Apply Trade Management techniques to lock in profits once the trade begins moving in the right direction

--------

They are many ways on how to trade, but prices would not move unless Un-Filled Orders (UFOs) get filled.

Join our YouTube Channel ‘tradewithufos’ and be notified of upcoming live trading sessions.

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

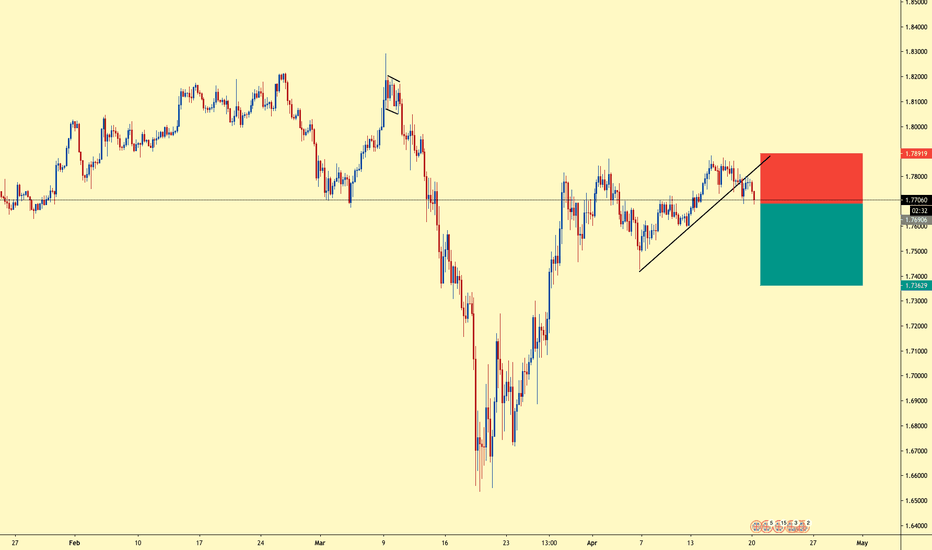

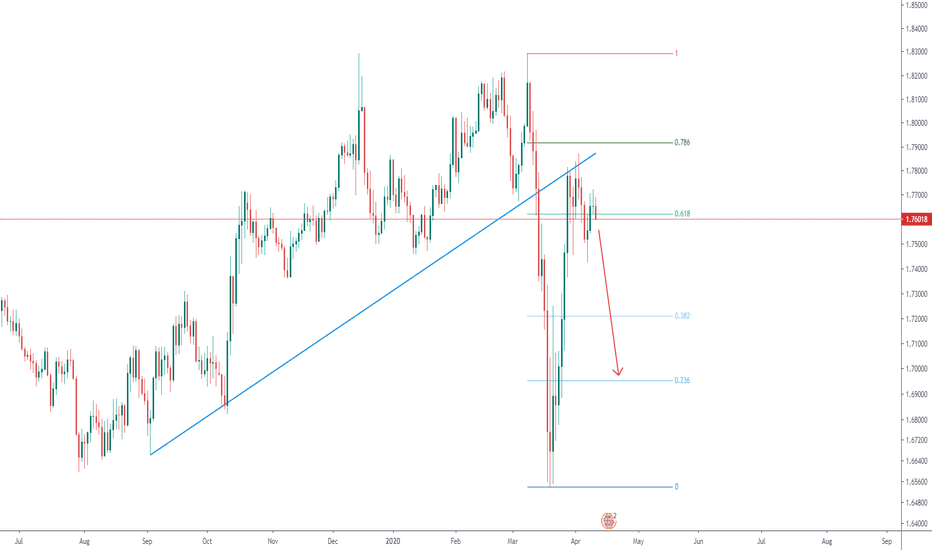

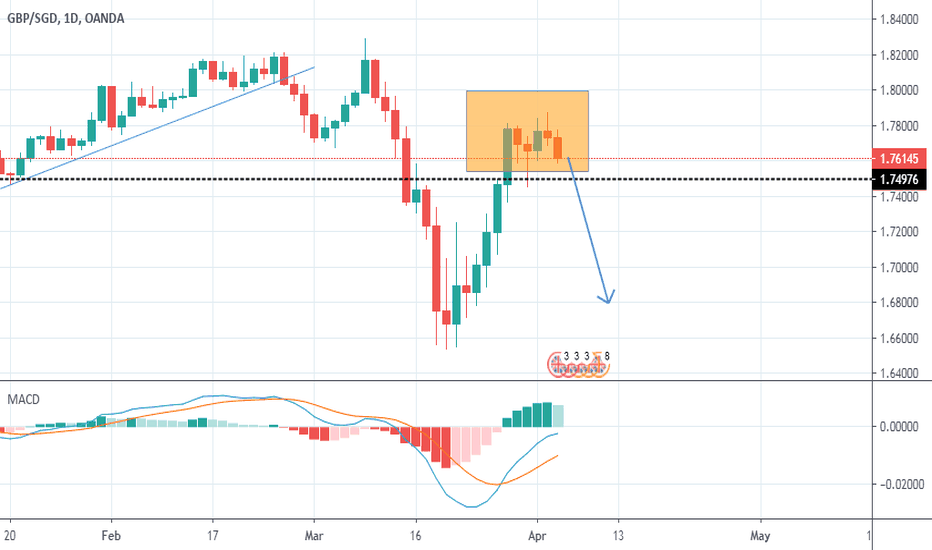

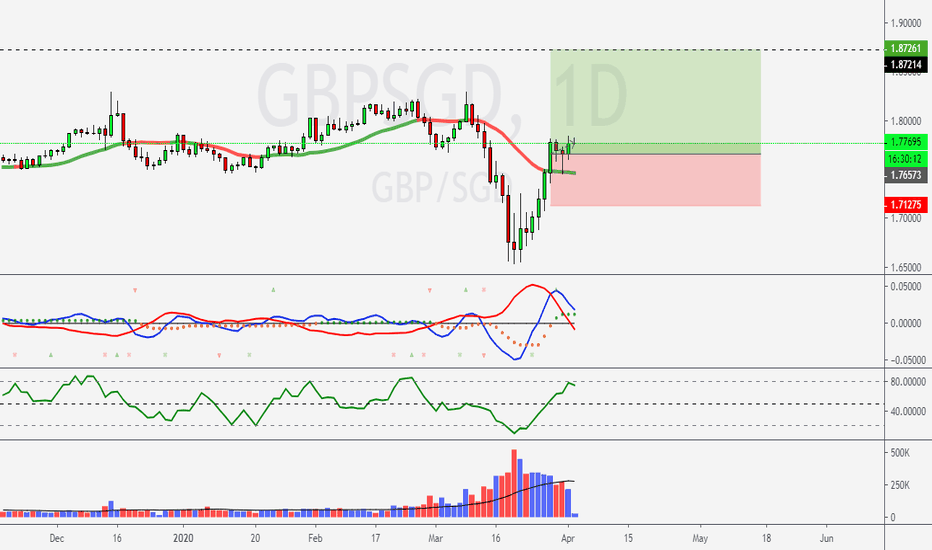

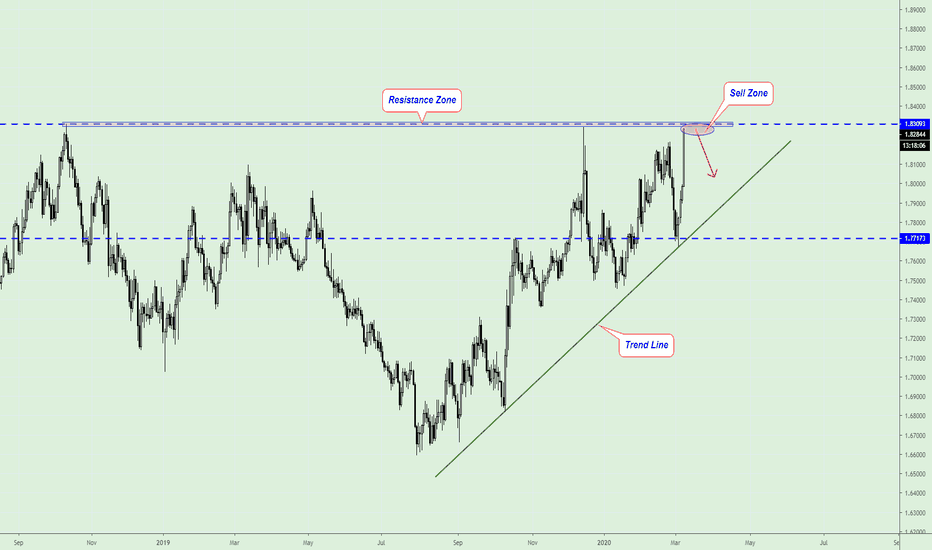

GBPSGD, The pullback is possible!We can look for Sell entry now.

Reasons:

- the price is under the Resistance Zone;

- it has risen up with huge ATR, that's why the pullback is possible;

- but the target should be not far because the trend is bullish;

Dear followers, the best "Thank you" will be your likes and comments!

Before to trade my ideas make your own analysis.

Thanks for your support!