SHIBWETH_811BEE.USD trade ideas

PatternsThank you for your time.

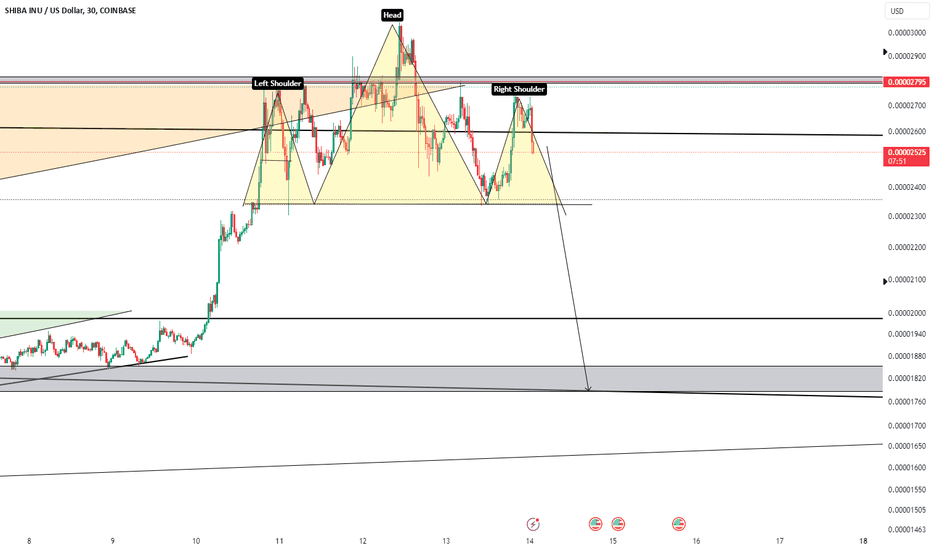

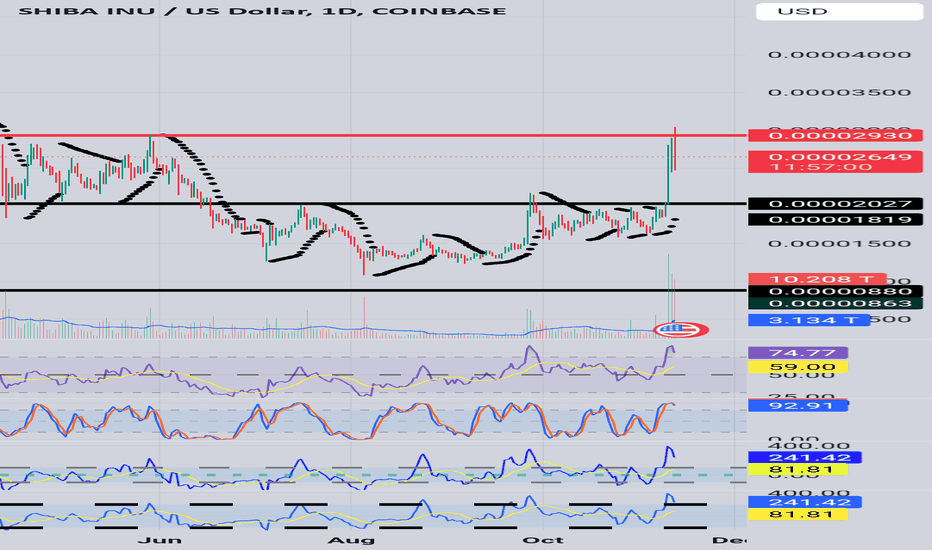

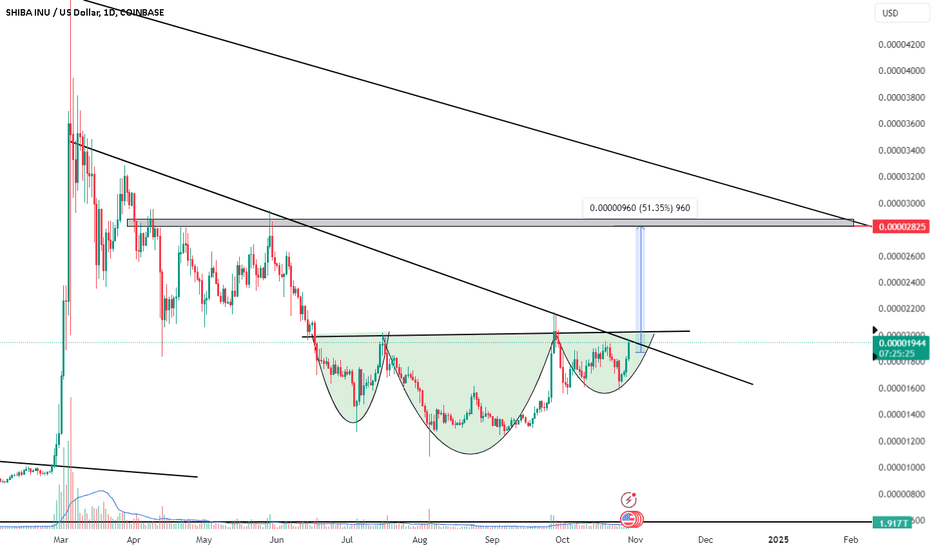

Chart patterns are very subjective, but do you see a bull flag pattern and a inverted head and shoulder pattern inside of it forming? We need a confirmed break out from the parallel structure and the resistance line combine with good RSI readings and SRSI readings to confirmed theory. Candle is still printing

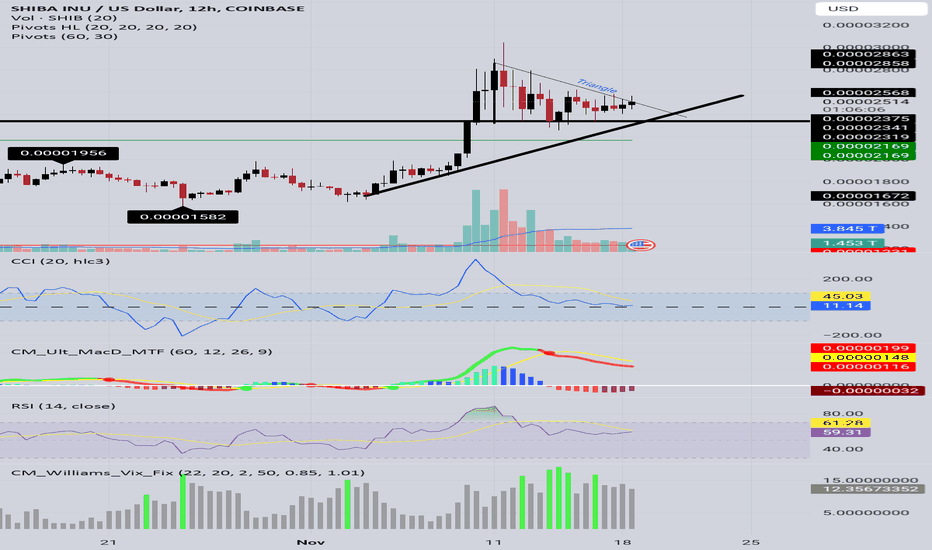

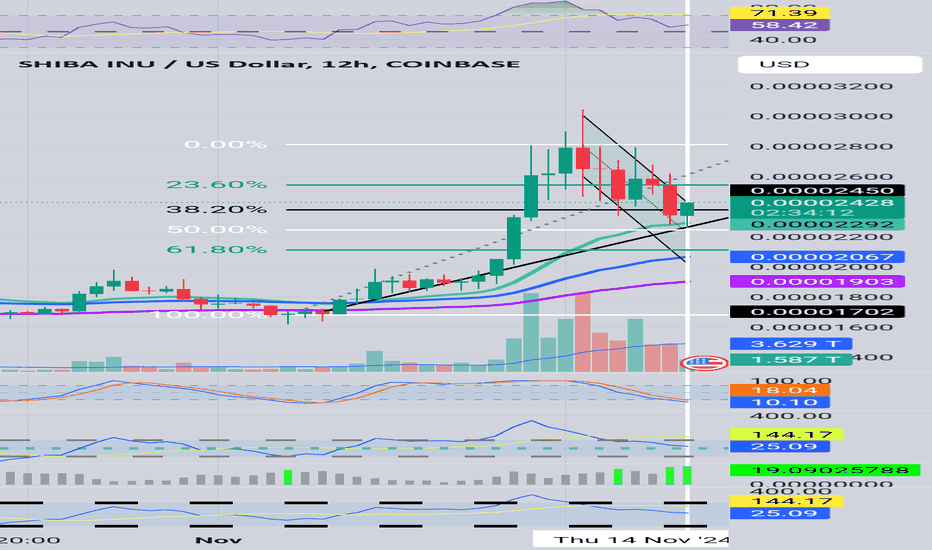

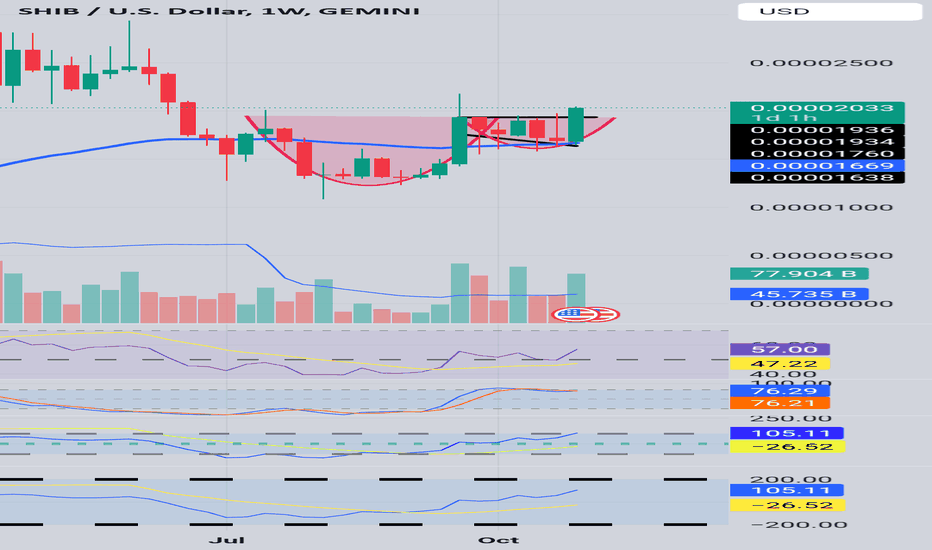

SHIBA still in the fightPositives- the signal for the bottom CM Williams Fix Vix indicator is flashing green, hypothesizing that the bottom is in or forming

-price forming above the 21 EMA

-RSI is healthy but not spectacular

-CCI is positive but not high

-price forming around 50% Fib Level

Negatives

-no bullish candle printed yet

-still in downward parallel channel

- no bullish activity yet on the SRSI

Be very careful and keep an eye on the negatives check timeframes and wait for the candle to print.

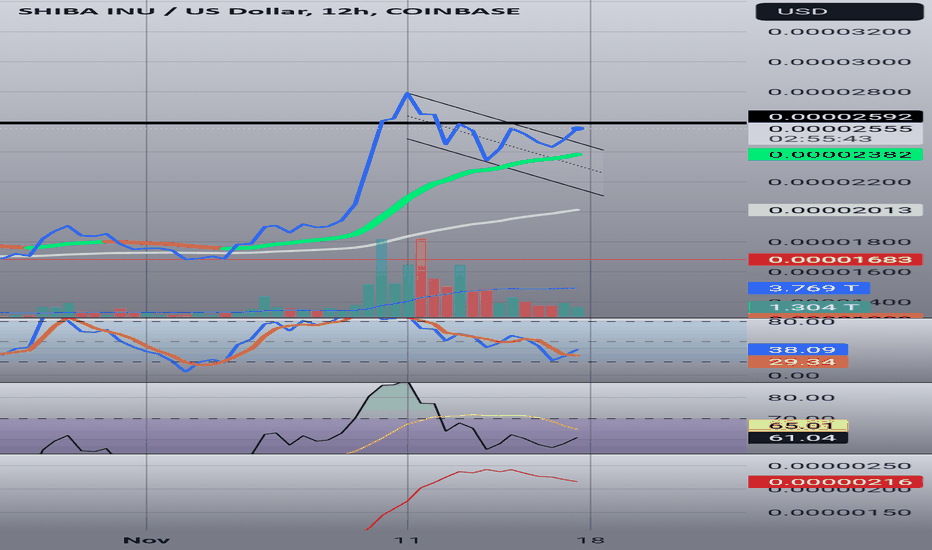

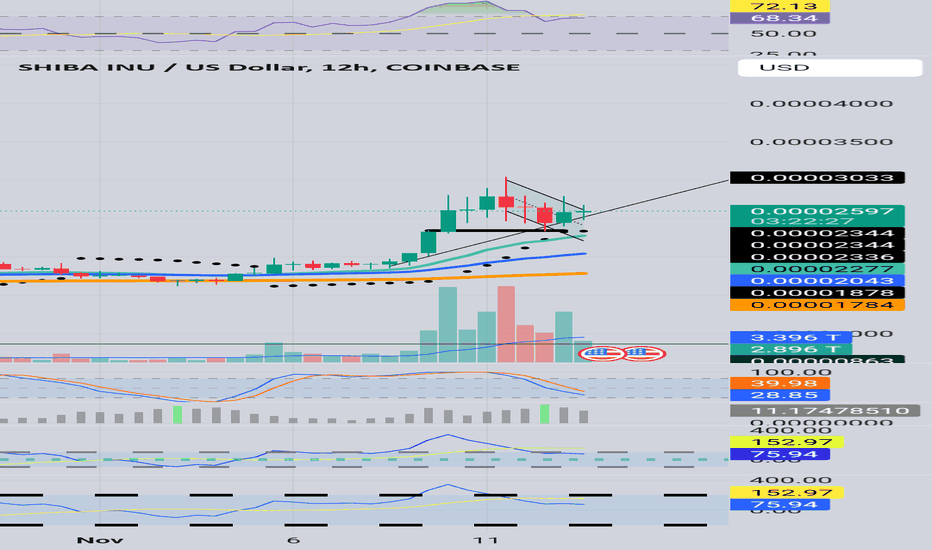

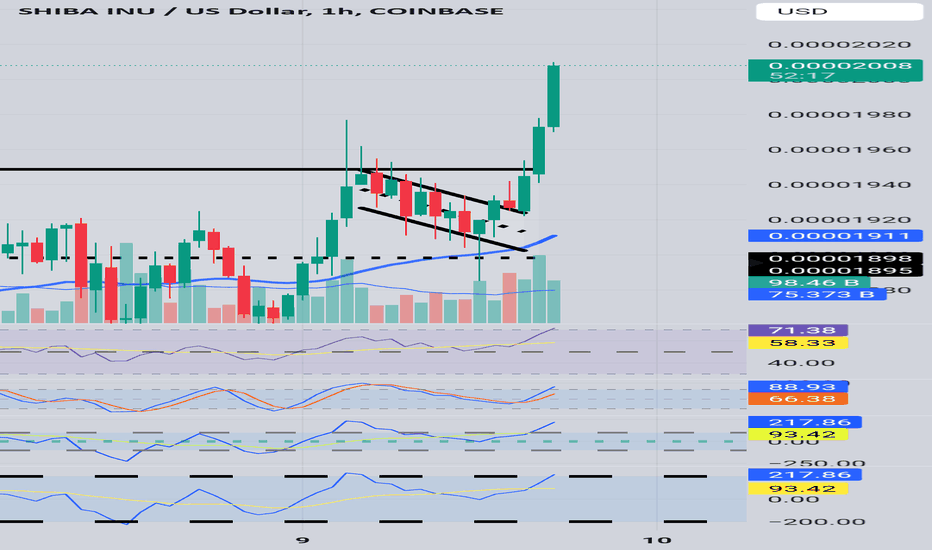

Friendly ReminderJust a friendly notification, to check resistance levels and Oversold/overbought indicators and watch out for candles and wait for the candle to print. SHIB is lingering around a resistance level and RSI and SRSI and CCI levels indicate caution overbought territory. Have a bless day.

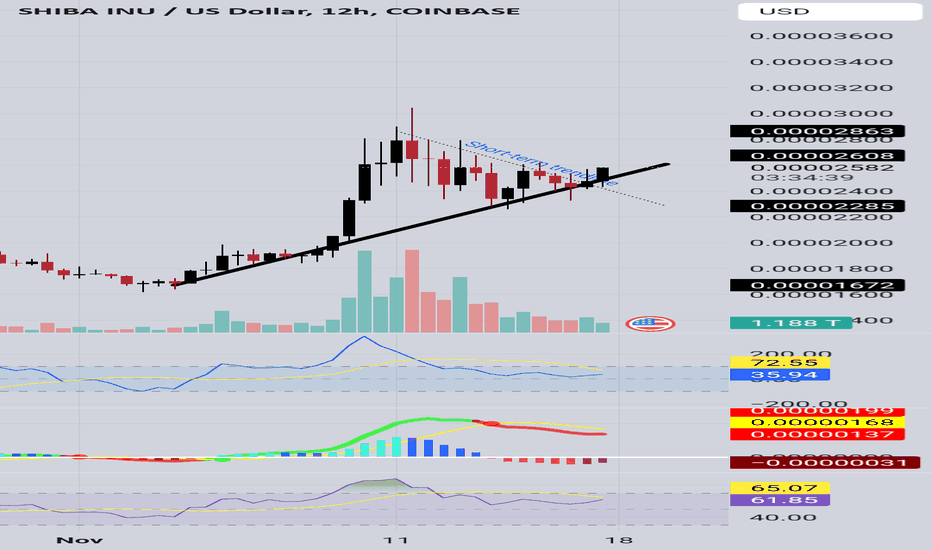

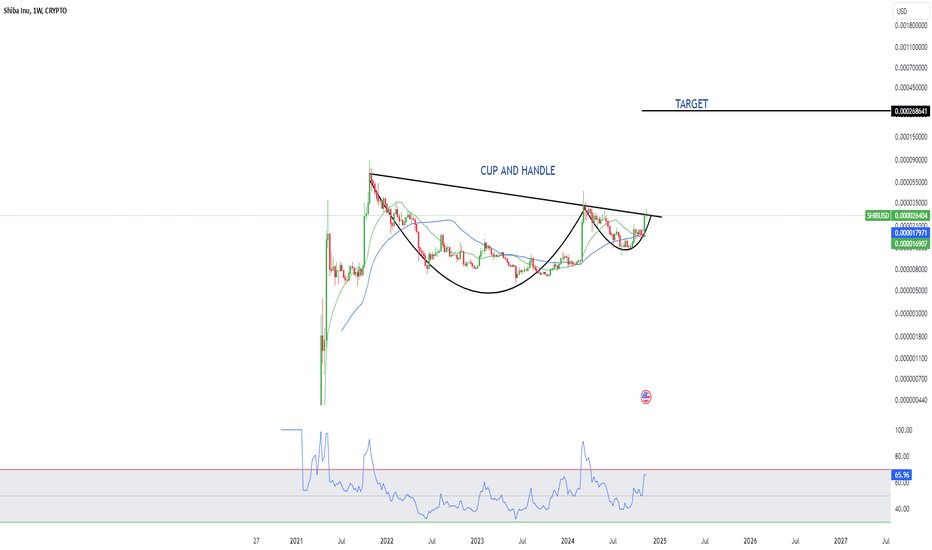

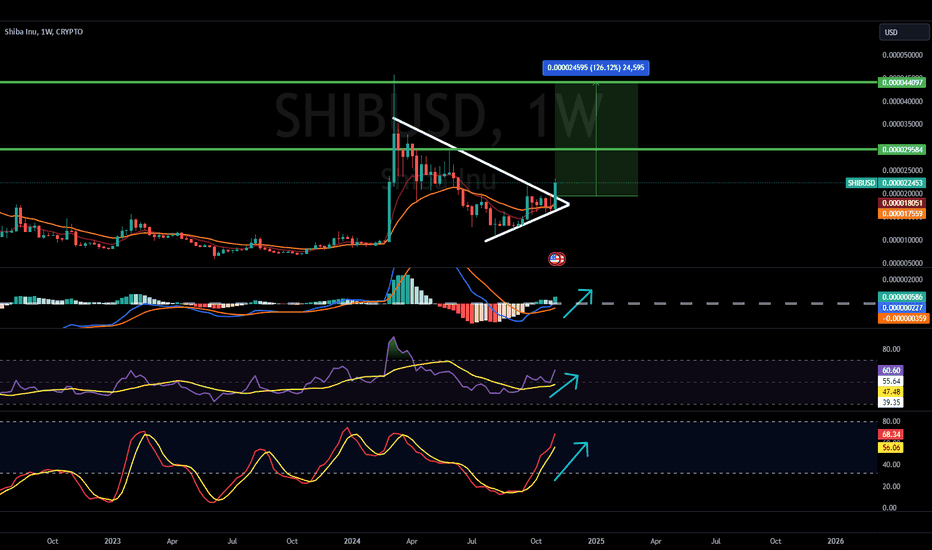

SHIB IS PRIMED FOR A MASSIVE 123% MOVE HIGHERCRYPTOCAP:SHIB

SHIB IS BREAKING OUT AND IT'S A BUY RIGHT NOW!

ITS A #HIGHFIVESETUP MEANING THE FOLLOWING:

1.) BULLISH uptrend on MACD (blue over orange

2.) BULLISH uptrend on RSI (higher lows)

3.) BULLISH uptrend on Stoch (red over yellow)

4.) We have a volume shelf with a volume gap

5.) Breakout on the symmetrical triangle pattern

Price Targets for this Weekly chart:

PT1: 0.000029584

PT2: 0.000044097

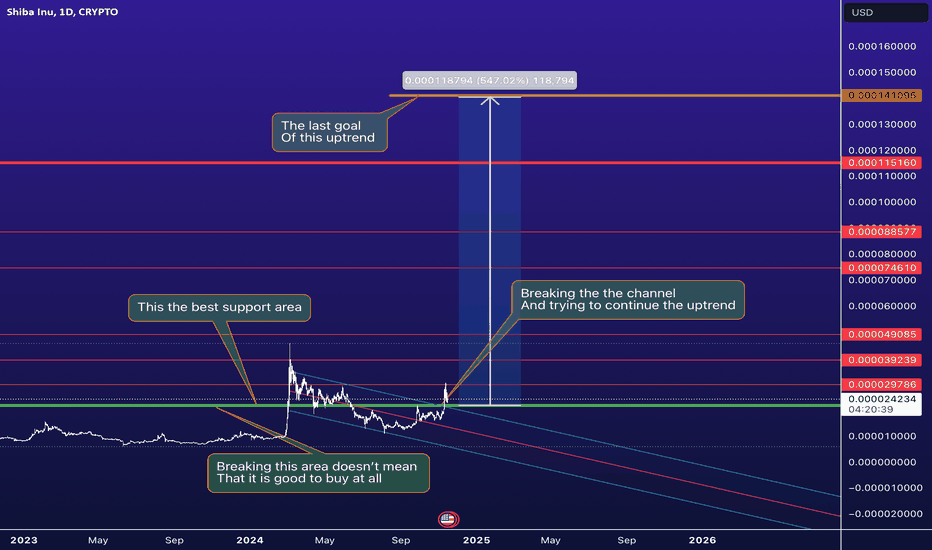

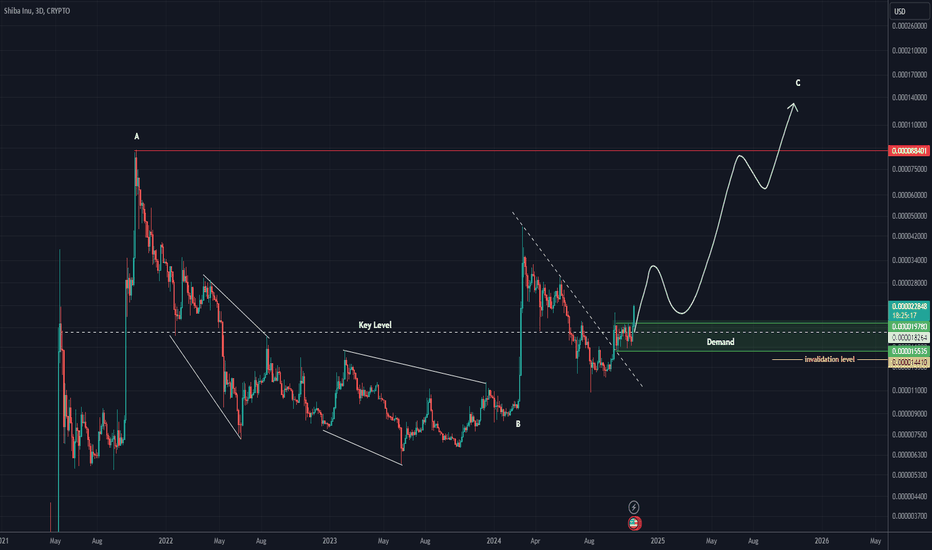

SHIB Looks BullishShiba appears to be entering a bullish wave C.

By maintaining the green range that overlaps with the KEY level, it can go to the ATH.

You should not have an emotional entry, you must have a set position to enter.

Shiba's market cap is 13B, which is a bit heavy, and you shouldn't expect big profits from this coin.

The target is above ATH

Closing a daily candle below the invalidation level will violate this analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

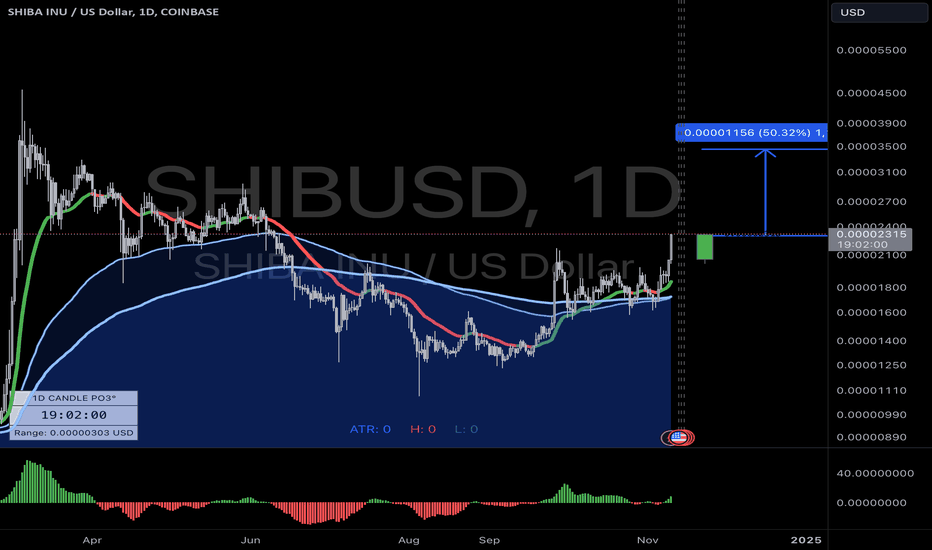

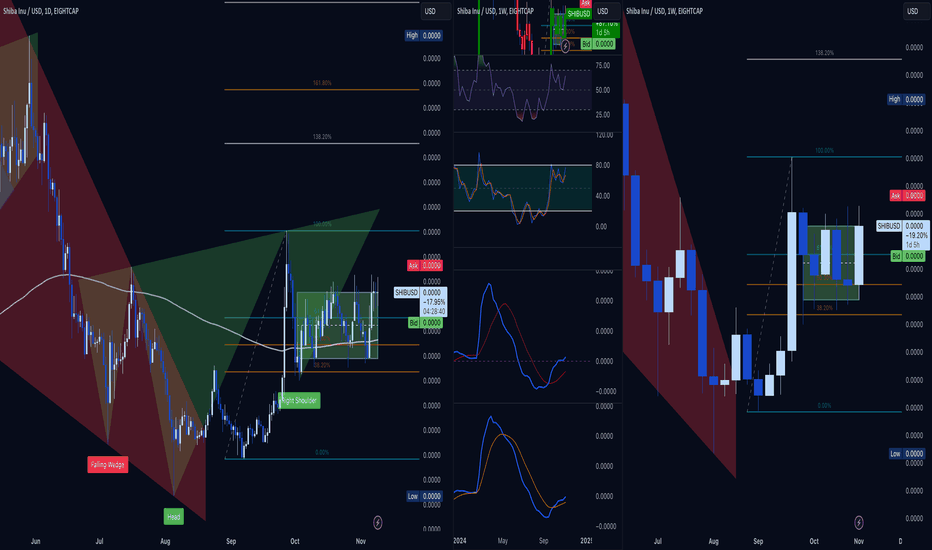

ShibUSD...all setup on Daily & Weekly charts. Plz see.

I don't hold this particular Crypto and I am not taking this trade as such as I have enough that could go wrong already.

But this one has a Daily head n shoulders pattern which will be a rocket upwards, bullish macd and rsi momentum and the weekly chart lines up in a similar vein.

Hmmm, I think this one has an awful spread on the buy, but i'm not certain.

Oh, what I also like about this trade is that the 200ema (white thicker line) is situated right below price on the daily.

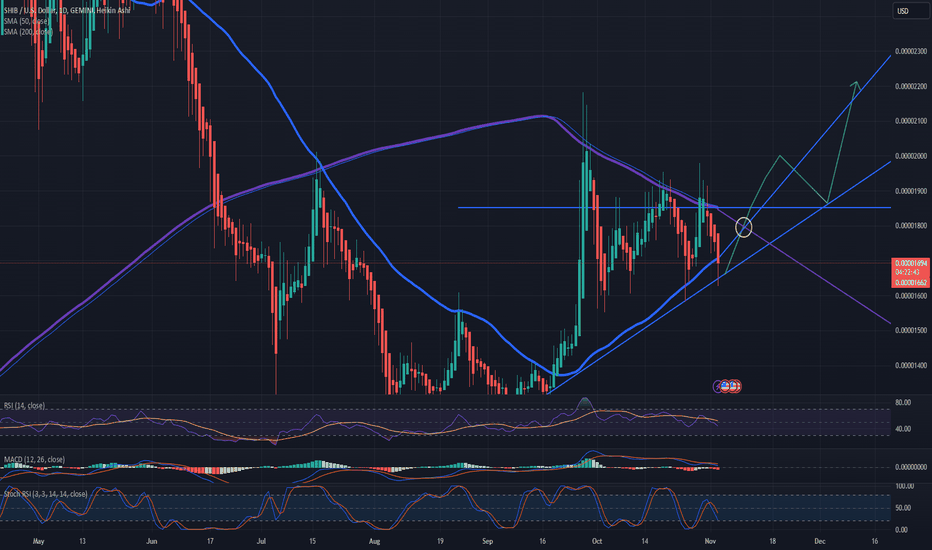

SHIB/USD daily chart analysisFor a bullish bias to remain intact, SHIB/USD should stay above the ascending trendline, ideally with support from the 50-day SMA and increasing Stochastic RSI.

For breakout confirmation, look for a close above the 200-day SMA, a breach of recent swing highs, and strong trading volume, all of which would reinforce the probability of an extended upward move.

Shiba Ready to Explode? Two Patterns Point to Massive VolatilityAltcoins like Shiba Inu are gaining momentum as Bitcoin edges closer to a new all-time high.

For Shiba, the last 135 days of price action on the 3-day chart reveal two significant patterns. First, an inverse head and shoulders pattern suggests that a breakout above the October 18 high could drive Shiba Inu up by 37.71%, reaching the upper level indicated on the chart. Additionally, over the last 30 days, Shiba Inu appears to be in a smaller rectangle-like pattern that would also trigger on a move above the October 18 high, signaling a potential 20.95% gain. Ideally, the market would trade sideways for the next 48 hours just below this key level, setting up an excellent risk-to-reward ratio for a breakout opportunity.

What’s your take on Shiba Inu’s potential?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.