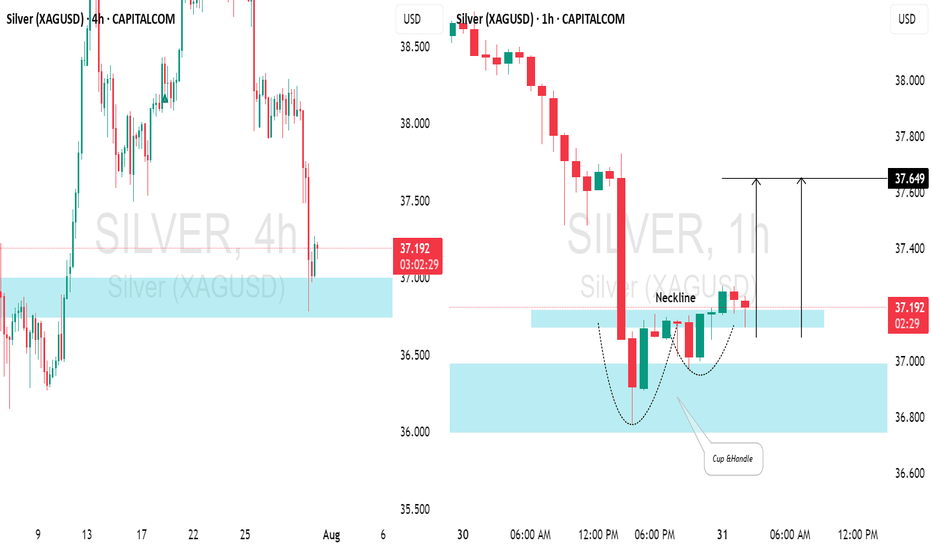

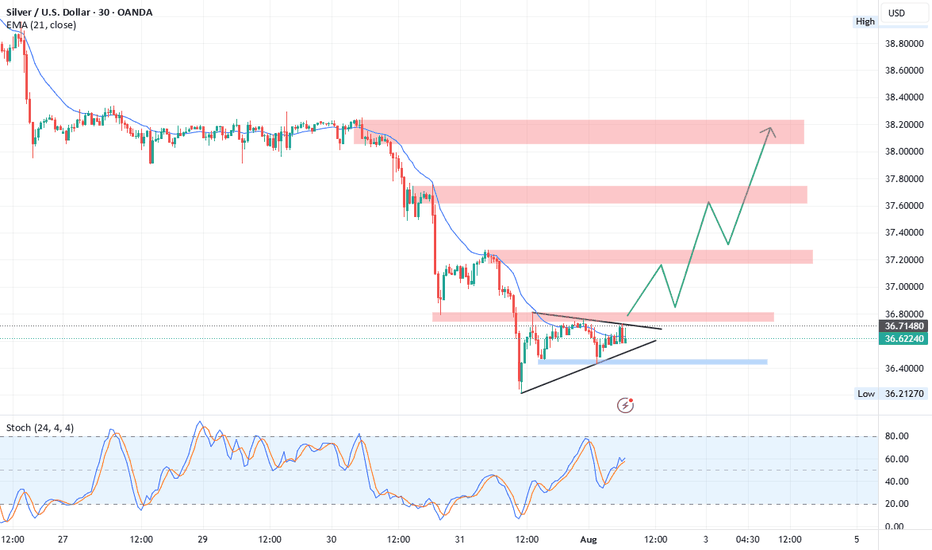

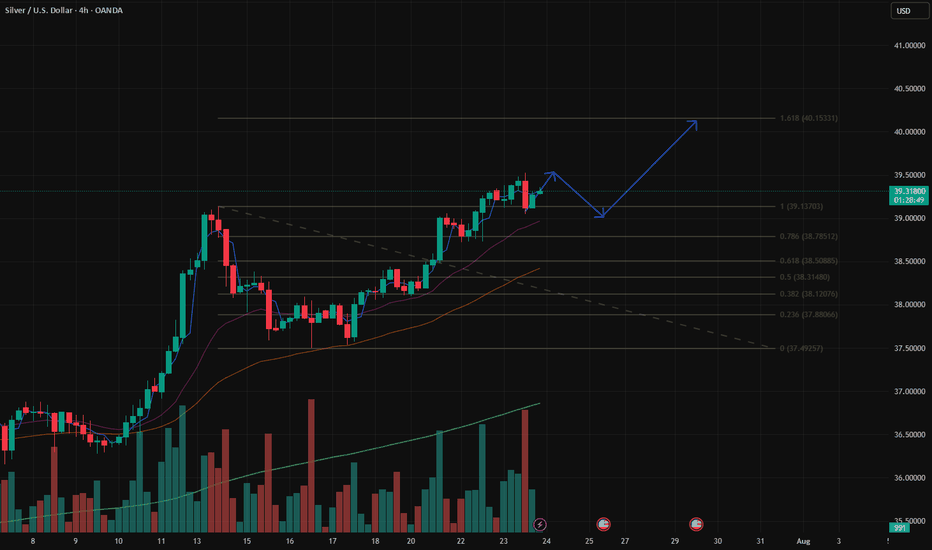

SILVER (XAGUSD): Time for Pullback📈SILVER appears to be oversold following yesterday's decline.

After testing a significant daily / intraday support level, there's a noticeable bullish reversal.

The price formed a cup & handle pattern on the hourly chart and has broken above its neckline. We can expect a pullback to at least 37.64.

SILVER trade ideas

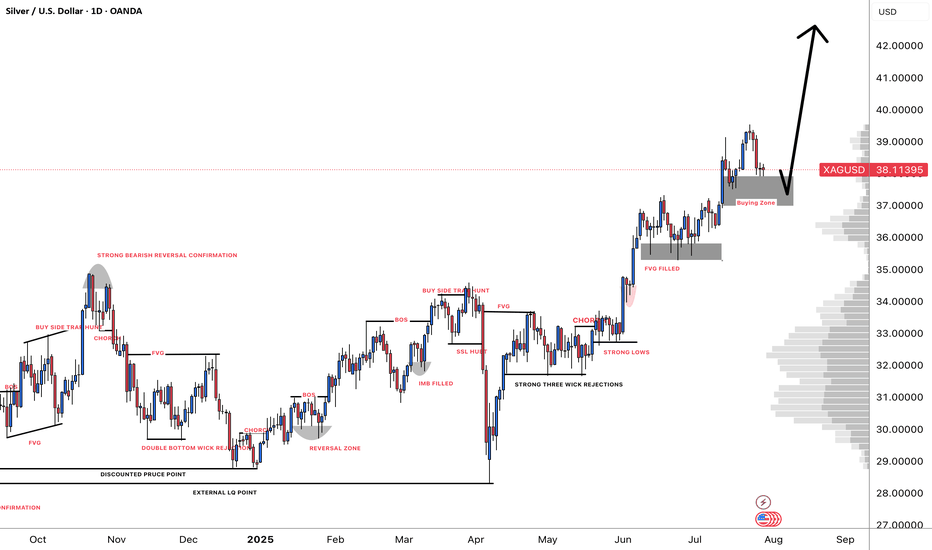

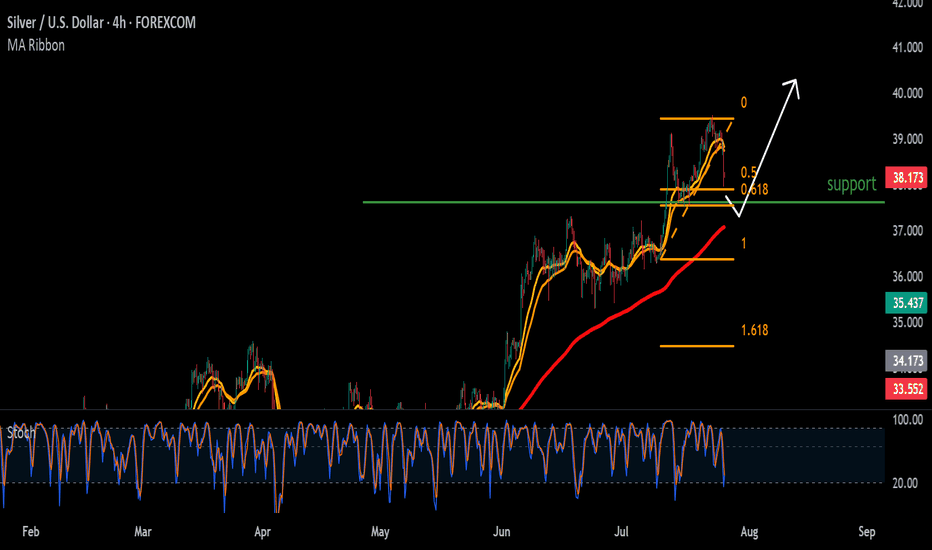

#XAGUSD: A Strong Bullish Move, Possible Target at $45?Silver is currently experiencing a correction, but the overall price remains bullish. Analysing the data, we can see a potential price reversal in our area of interest. Following the recent higher high, price is poised to create another record high. We should closely monitor volume and price behaviour. A strong volume signal would indicate a potential bullish move in the future.

Good luck and trade safely.

Like and comment for more!

Team Setupsfx_

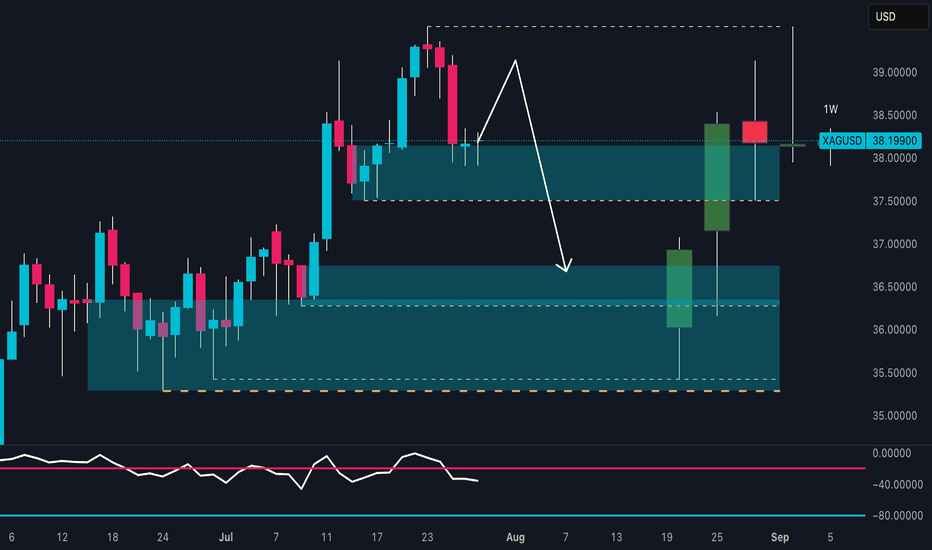

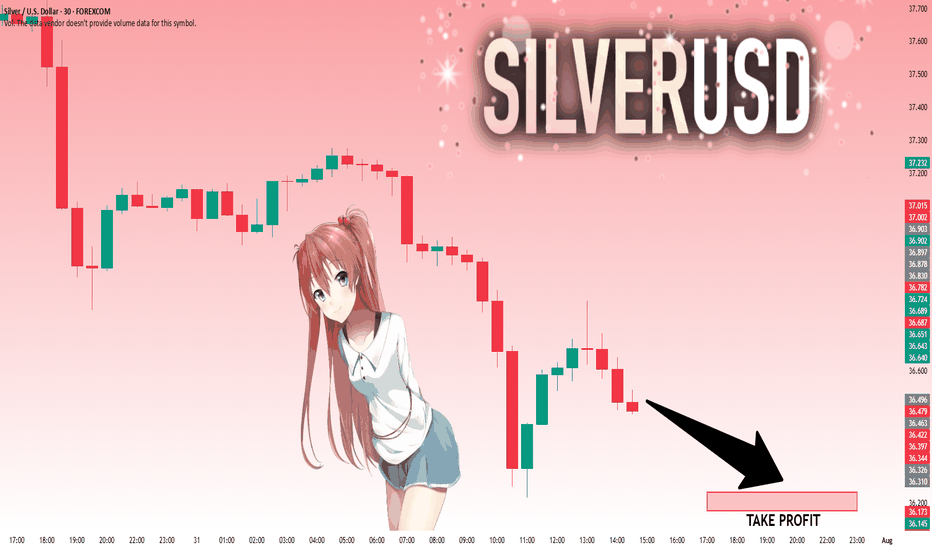

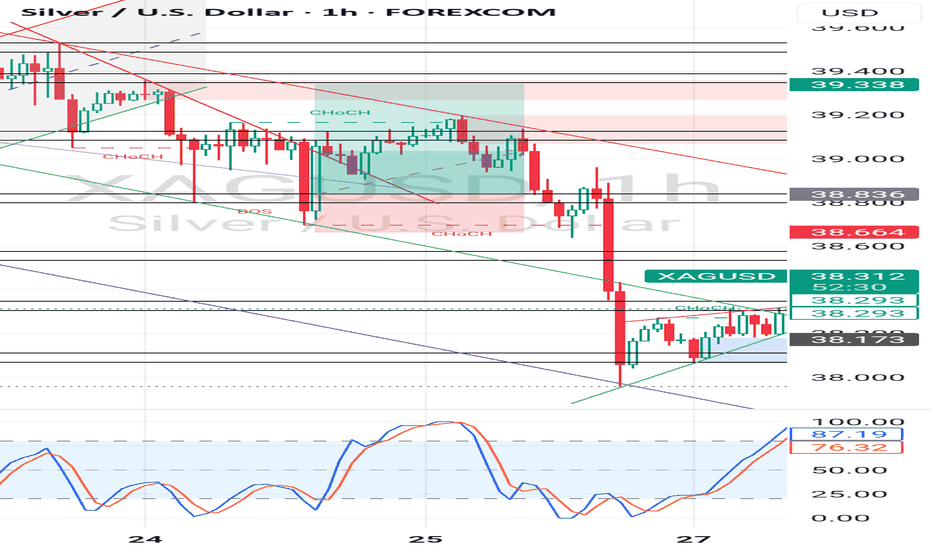

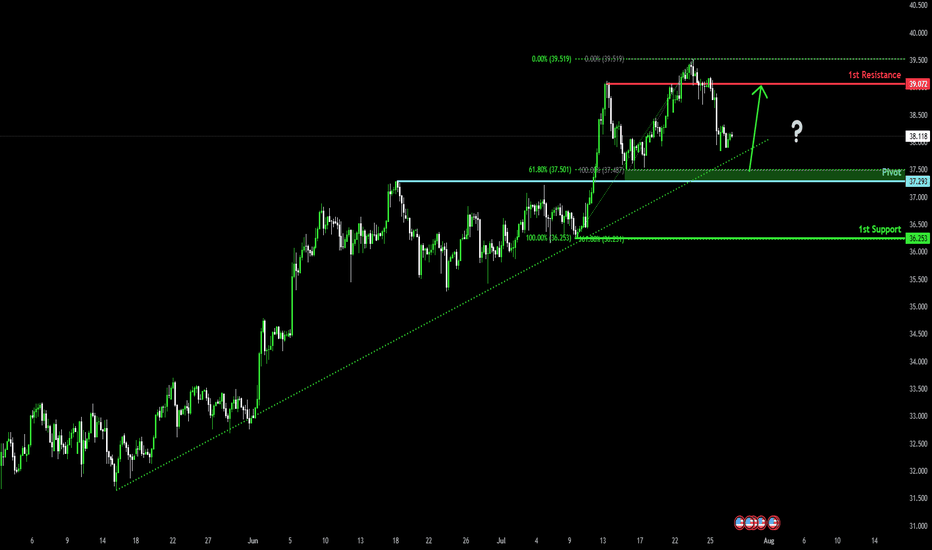

SILVER Is About to Collapse? Watch This Critical Supply Zone!Price recently tapped a high near 39.20 before sharply rejecting from the 38.80–39.20 supply zone, confirming strong selling pressure. The current structure shows:

- Supply zone tested and rejected

- Likely return to the previous demand zone (36.50–36.00)

- RSI is turning down, confirming loss of momentum

A pullback toward 38.30–38.50, followed by a bearish continuation toward the 36.50 area, which acts as a key structural and institutional support.

🗓️ Seasonality

Historically, July is bullish for silver:

Last 5Y average: +0.89%

Last 2Y average: +2.18%

However, August–September are bearish months:

August: mildly positive, but weak

September: consistently negative across all time frames (-0.86% to -1.10%)

This increases the probability of a downward move starting in early August, in line with current price action rejection.

🪙 Commitment of Traders (COT) – July 22

Non-Commercials (speculators):

Longs: +656

Shorts: -516

Commercials (hedging):

Longs: +1,337

Shorts: +916

➡️ Commercials are increasing both long and short exposure, while non-commercials remain net long — a sign of moderate optimism.

However, long positioning is slowing down compared to previous weeks. A potential exhaustion in bullish momentum is forming.

📉 Sentiment

52% short vs 48% long

Volume: more lots on the short side (492 vs 454)

Sentiment remains neutral to slightly contrarian bullish, but not extreme. This may allow for a fake breakout before a deeper move down.

🧩 Operational Summary

Main bias: Bearish short to mid-term (starting August), supported by:

- Technical rejection at supply

- Negative seasonal tendencies ahead

- RSI showing momentum loss

- COT showing stabilization, not accumulation

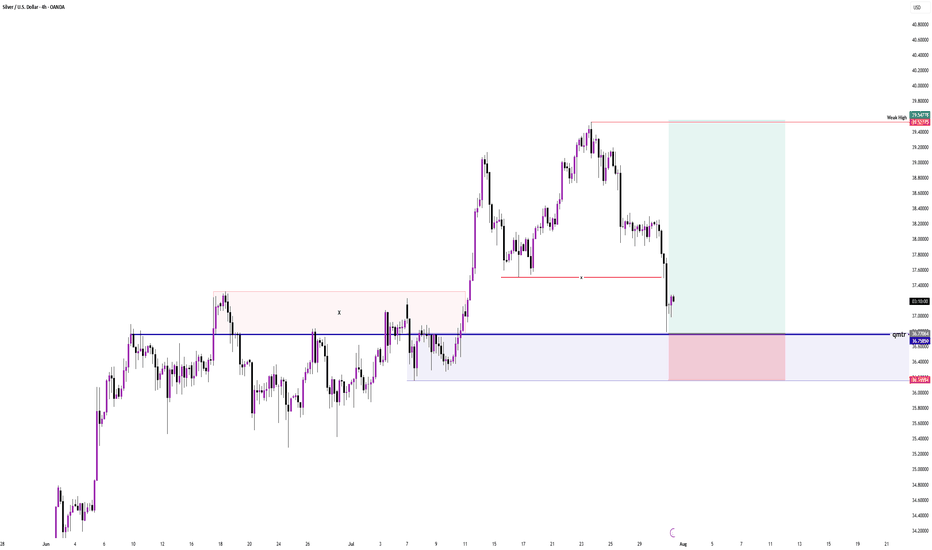

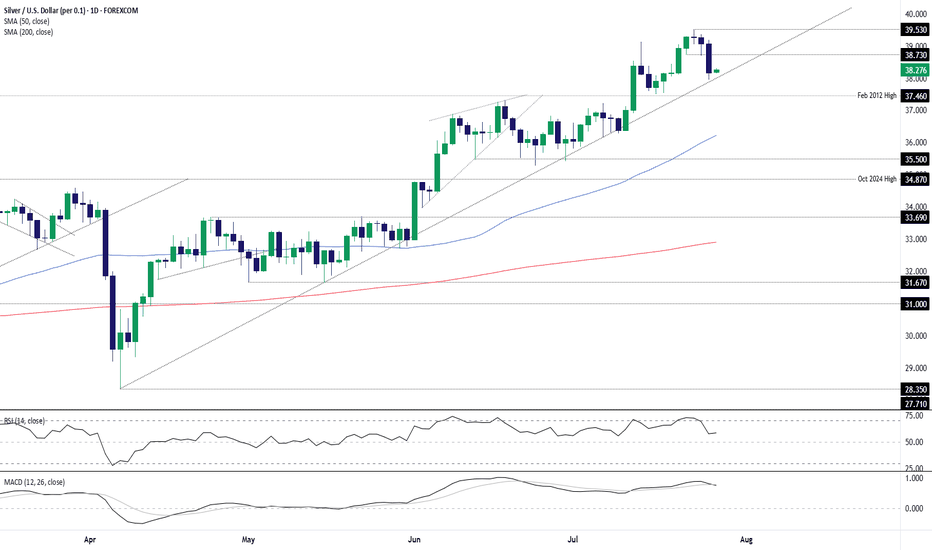

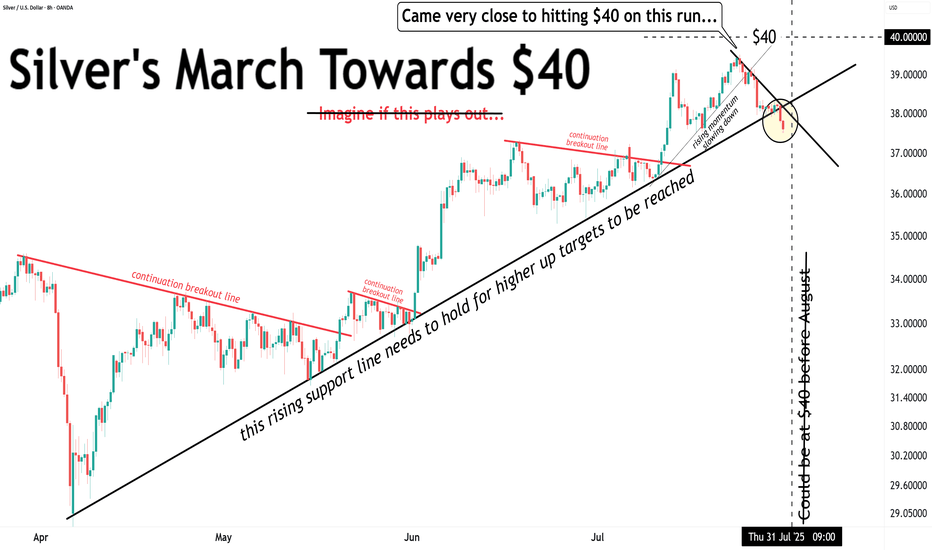

XAGUSD – Reversal Signs After the Run Toward $40Lately, I’ve been a strong advocate for a Silver rally toward $40, and indeed, we got a solid move, with price reaching as high as $39.50, not touching 40 though...

Just like with Gold, the last 3 days of last week turned bearish, and now it looks like we may be entering the early stage of a correction.

📉 Current Setup:

- The rejection from $39.50, right below the psychological $40 level, is significant

- I’ll be monitoring for a possible short entry if we get a rebound into the $38.80–$39.00 zone

- A new high above $39.50 would invalidate this setup

📌 On the downside, if price breaks below the confluence support at $37.70–$38.00, that would confirm the reversal and could lead to an acceleration toward $35.50 support

Conclusion:

The bullish narrative on Silver is pausing here. Until a new high is made, I’m looking to sell the bounce and follow the momentum if the breakdown under support is confirmed.

Let’s see how this plays out this week. 🧭

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

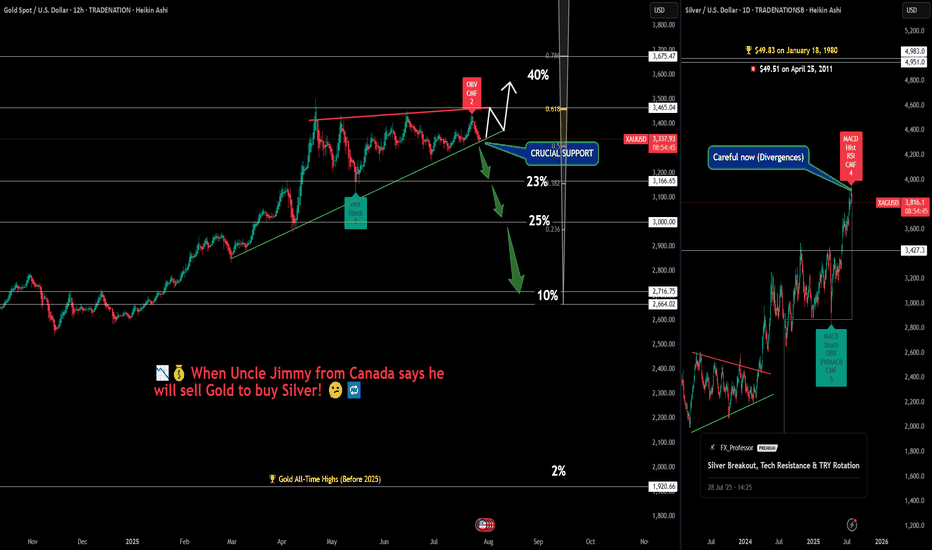

When Gold Believers Flip – Uncle Jimmy, Silver & New Safe Havens💰📉 When Gold Believers Flip – Uncle Jimmy, Silver, and the New Safe Havens 🧠🔄

Let me tell you a story that says more than any chart ever could.

📜 Meet Uncle Jimmy (from Canada) . He’s not really my uncle, but out of respect, that’s what I call him.

A true OG — early stockbroker, big mustache , 20+ apartments, a life built on commissions, charts, and one sacred truth: '' Gold never lies. ''

He's bought gold at every dip, every crisis, every whisper of war or inflation.

But now?

“I’m thinking of selling gold to buy silver.” ( WHAT?! 😳👀💥)

That’s it. That’s the moment.

📉 A gold maxi flipping into silver. A generational pivot.

And that’s the real divergence the chart doesn’t always show.

⚖️ Macro Sentiment Rotation:

📊 Gold

Sitting on crucial support. Breakout potential to $3,465+ remains — but divergences (OBV, CMF) are stacking. A breakdown? Targets stretch down to $3,000 or even $2,716.

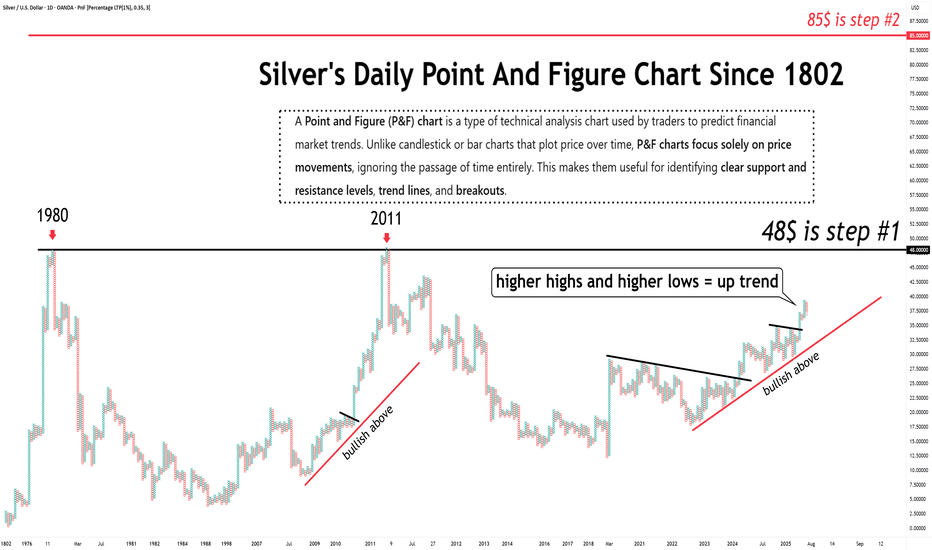

🪙 Silver

Just hit $38.14 — now eyeing the legendary $49.83 ATH from 1980. Legacy capital rotating in. Silver’s moment? (My chart says 'wait a bit'...divergences!)

💻 NASDAQ/Tech

Some now call it the “new safe haven” — not because of bonds, but because of trust in corporate resilience vs. geopolitical chaos. When Nasdaq rises, silver often outperforms gold — risk appetite returns, and so does industrial metal demand.

₿ Bitcoin

And then there’s Bitcoin…

The safe haven that legacy minds still don’t trust.

I told Uncle Jimmy to buy it at:

→ $4,000

→ $18,000

→ $45,000

→ Even $70,000.... I stopped doing that at some point, he just wouldn't get it, or wouldn't make a move into the 'crypto unknown'. Respect!

So...He never did. Maybe Bitcoin just became what gold once was — but for the next generation. Not for Big Jimmy.

🧠 What to Watch:

Sentiment is shifting

Safe havens are evolving

Charts show structure — but stories show psychology

Whether you're long metals, crypto, or tech — the key is knowing when beliefs break and rotations begin.

Watch price. Listen to sentiment. And never underestimate Uncle Jimmy.

What would you tell Jimmy today if he was your uncle? Let me know below!

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

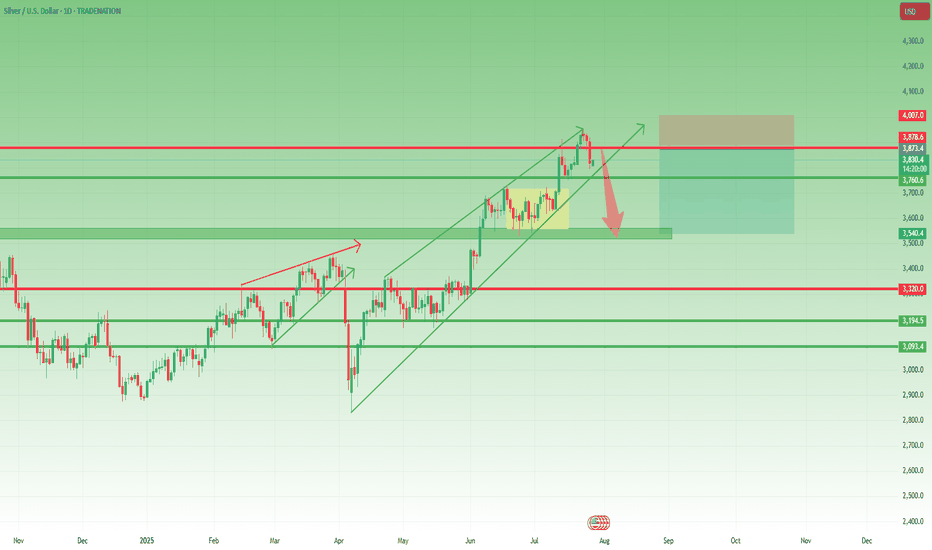

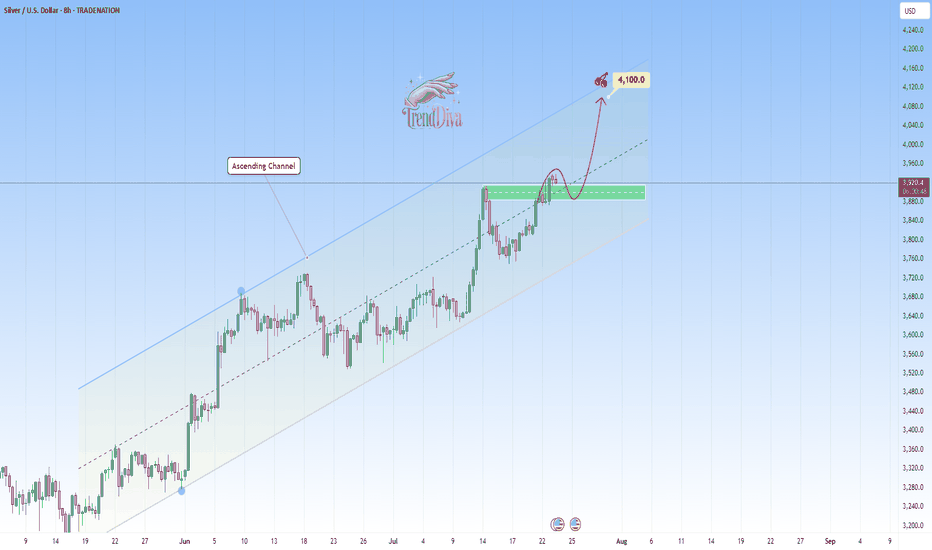

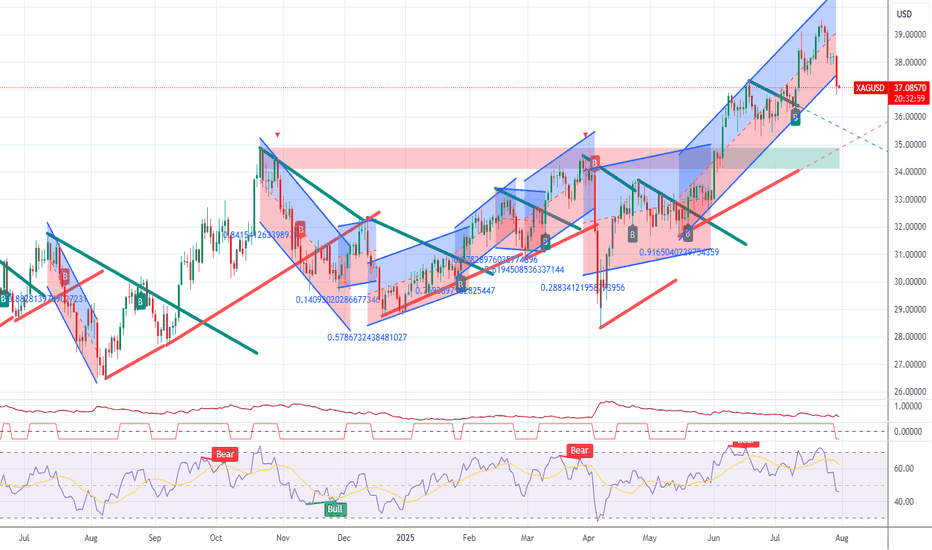

SILVER Analysis - Can buyers push toward 4,100$?TRADENATION:XAGUSD is trading within a clear ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting there's chances for potential continuation on the upside.

The price has recently broken above a key resistance zone and now came back for a retest. If this level holds as support, it would reinforce the bullish structure and increase the likelihood of a move toward the 4,100 target, which aligns with the channel’s upper boundary.

As long as the price remains above this support zone, the bullish outlook stays intact. However, a failure to hold above this level could invalidate the bullish scenario and increase the likelihood of a deeper pullback.

Remember, always confirm your setups and use proper risk management.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

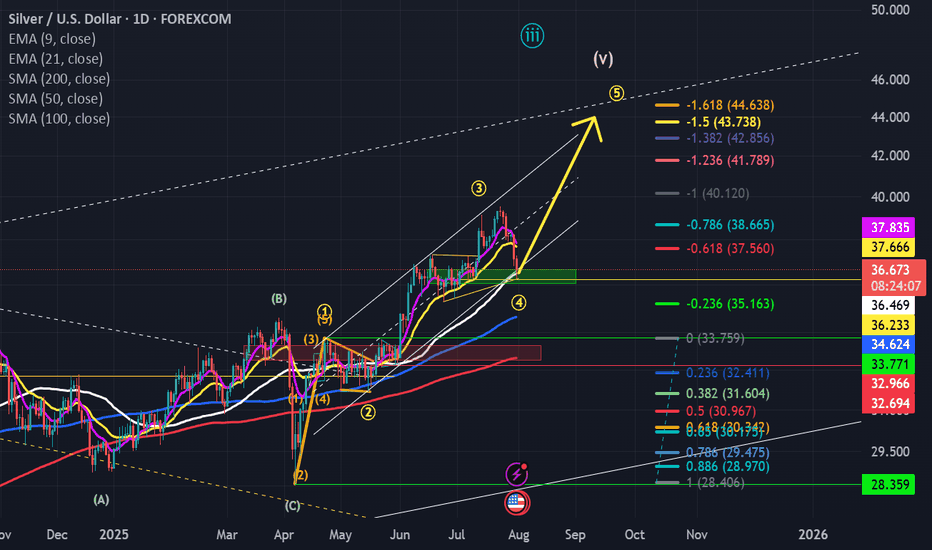

One more move up and then we should sell for now....This pb has allowed the shorts to cash in...we are at signficant support (middle of prior funnel) and the bottom of the channel...in my opinion, we resume the move up...but I think $42-$44 zone is the likely pivot pt for a significan move back down...back to mid to low $30's...This current pb is will shake off the weak hands! However, let this be a lesson...avoid leverage or you may pay dearly....

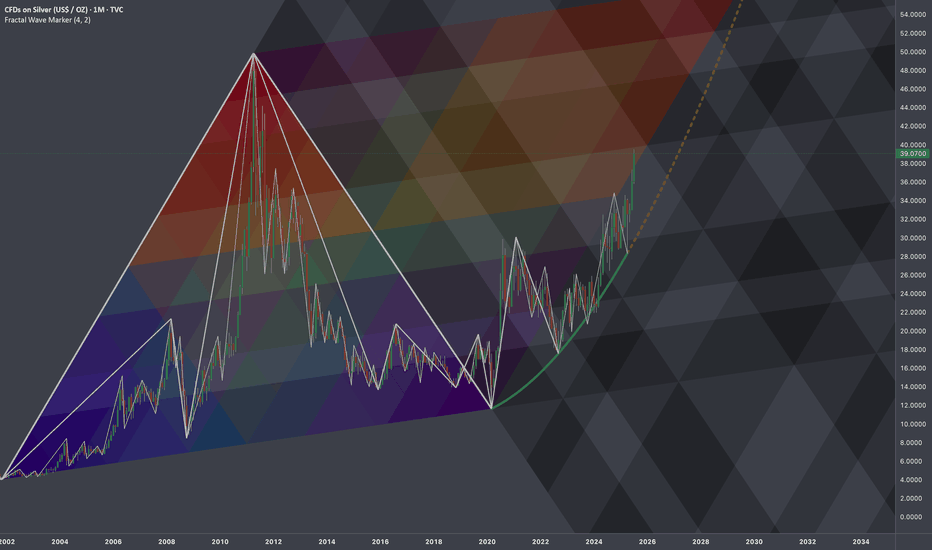

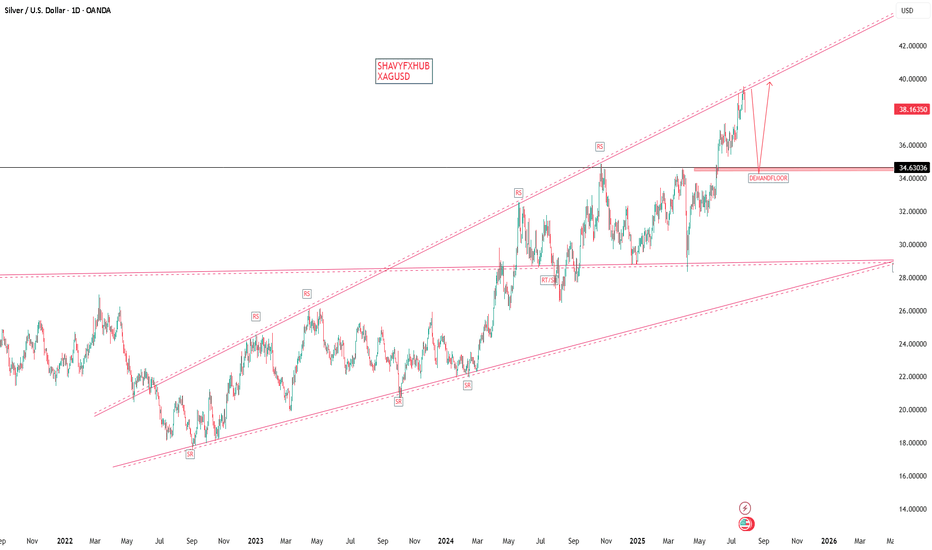

$SILVER: Fractal Geometry (Cycle 2001-2020)Research Notes

Working out probabilistic texture using multiple fibonacci channels on just 3 coordinates of fractal cycle (late 2001 - 2020) on linear scale (on log chart it would still be relevant, so you can switch to view with right click on price scale for selection).

To describe behavior of price and key levels on smaller scale starting from covid we'll use

L-H-L:

Using coordinates to express surface area of broken cycle with fibs mimicking rise, fall and side mapping cycle:

I'd look for patterns of bullish exhaustion only after price crosses the curve.

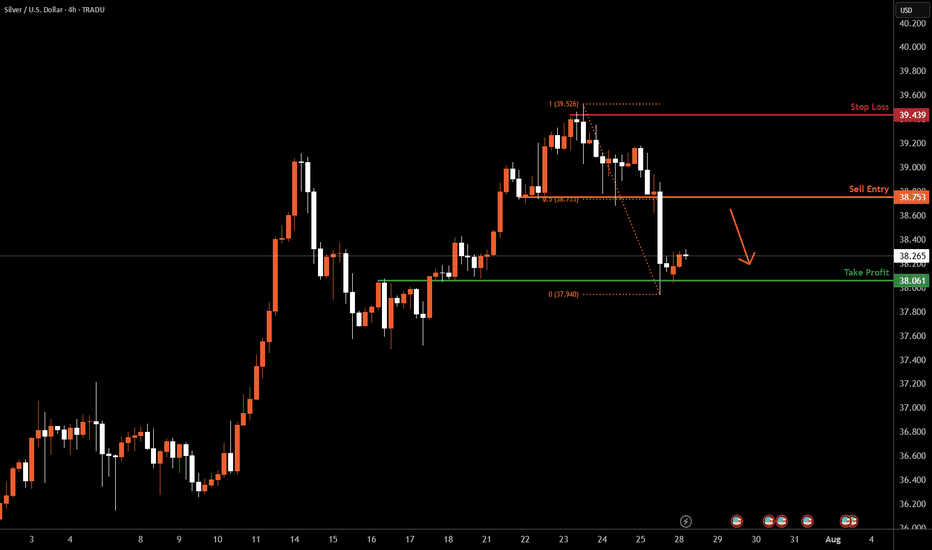

XAGUSD H4 I Bearish Reversal Based on the H4 chart analysis, we can see that the price is rising toward our sell entry at 38.75, which is a pullback resistance aligning with a 50% Fibo retracement.

Our take profit will be at 38.06, an overlap support level.

The stop loss will be placed at 39.43, a swing-high resistance level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SILVER: Will Go Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 36.490 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 36.231..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

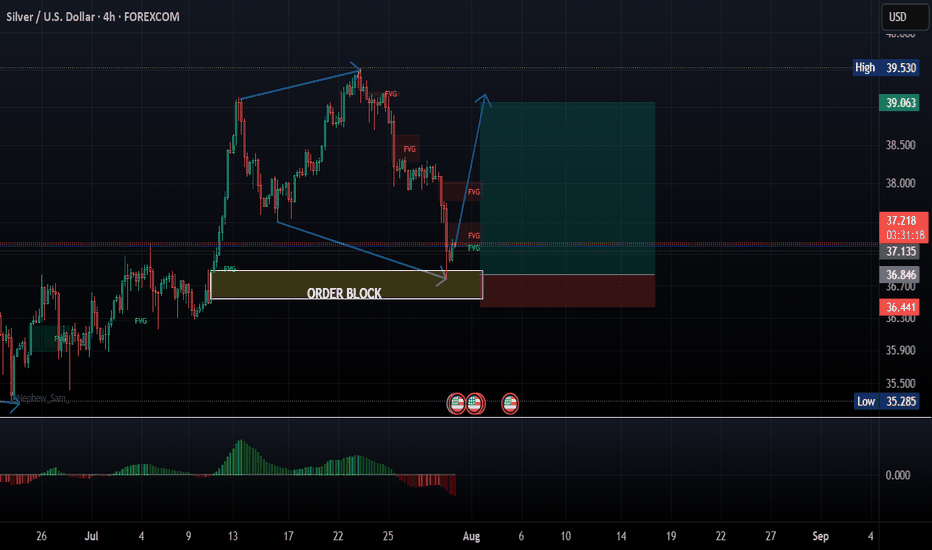

XAGUSD/SILVER LONG 1:5 RReason for entry:

1. Expanding flat structure

2. Order block reaction

3. 5th wave in play

4. 4 HR engulfing candle

Entry: 37.204

Stop loss: 36.454

Take Profit:39.073

Strategy: Wait for engulfing candle to enter

Place trade at break even at 1:2R or move stop loss to 1:1 R when in PROFIT

XAGUSD Technical Outlook (Silver/USD)Currently, Silver is trading inside a symmetrical triangle formation , signaling a potential breakout.

Upside Scenario:

A breakout above 36.80 resistance may trigger strong bullish momentum. The next target zone lies at 37.18 – 37.30, which is a relatively weak resistance and could potentially form a Head and Shoulders pattern . If momentum continues, Silver could extend gains toward 37.75 and 38.00 resistance levels.

Downside Scenario:

If the triangle breaks to the downside, we may see a short corrective move toward 3 6.25 – 36.20 support zone before any possible rebound.

Overall, the chart structure currently favors an upside breakout with continuation toward higher resistance zones.

XAG USD LONG RESULT Silver price broke down the Ascending Channel it was trading in and gormed a weak falling wedge pattern with low selling pressure, so I expected buyers to change the momentum and go for the upside, which did just not reaching to the oder block I set.

But a good trade overall, still closed at BE.

Better Setups Ahead 💪

_THE_KLASSIC_TRADER_.

Silver dips to trendline, bulls eye bounceSilver’s latest pullback has seen it move back towards long-running uptrend support, creating a decent entry level for longs with price momentum favouring buying dips over selling rips.

Longs could be established above the trendline with a stop beneath for protection, targeting minor resistance at $38.73 initially and, if broken, the July 23 swing high of $39.53. If the latter were to be achieved, price and momentum signals at the time should dictate whether to hold for a potential test of the psychologically important $40 level.

The price has already bounced off the uptrend on numerous occasions since being established, enhancing the appeal of the setup. While RSI (14) and MACD are not screaming buy when it comes to market momentum, they’re tilted bullish rather than bearish, favouring upside.

If silver were to break and close beneath the uptrend, the bullish bias would be invalidated.

Good luck!

DS

XAGUSD SILVER ON 3OTH we are expecting a strong fundamental data .

ADP Non-Farm Employment Change forecast 82K previous -33K

Advance GDP q/q forecast 2.4% previous -0.5% Advance GDP Price Index q/q forecast 2.3% previous 3.8%

Pending Home Sales m/m0.3% 1.8%

7:00pm

USD

Federal Funds Rate

4.50% 4.50%

USD

FOMC Statement

7:30pm

USD

FOMC Press Conference.

we will be watching the data outlook for clear directional bias.

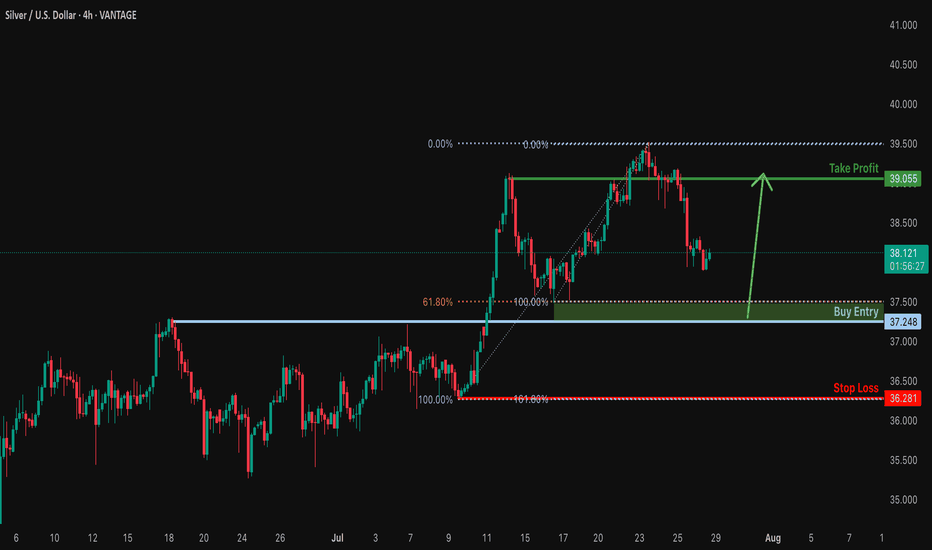

Bullish bounce for the Silver?The price is falling towards the support level whch i anoverlap support that is slighly below the 61.8%Fibonacci retraecment and could bounce from this level to our takeprofit.

Entry: 37.24

Why we like it:

There is an overlap support that is slightly below the 61.8% Fibonacci retracement.

Stop loss: 36.28

Why we like it:

There is a swing low support that aligns with the 161.8% Fibonacci extension.

Take profit: 39.05

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Falling towards pullback support?The Silver (XAG/USD) is falling towards the pivot, which is a pullback support and could rise to the 1st resistance.

Pivot: 37.29

1st Support: 36.25

1st Resistance: 39.07

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.