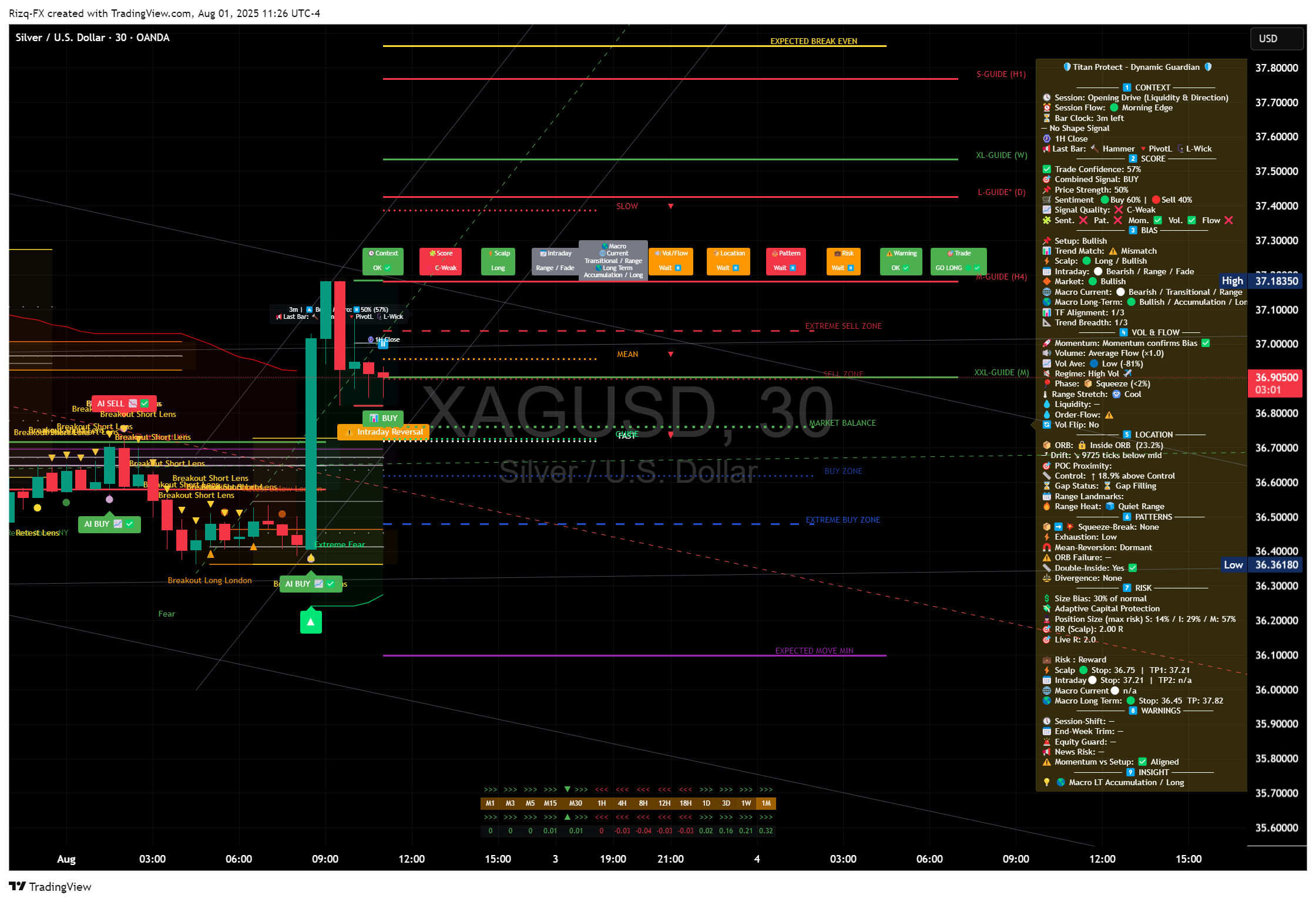

CFDs on Silver (US$ / OZ) forum

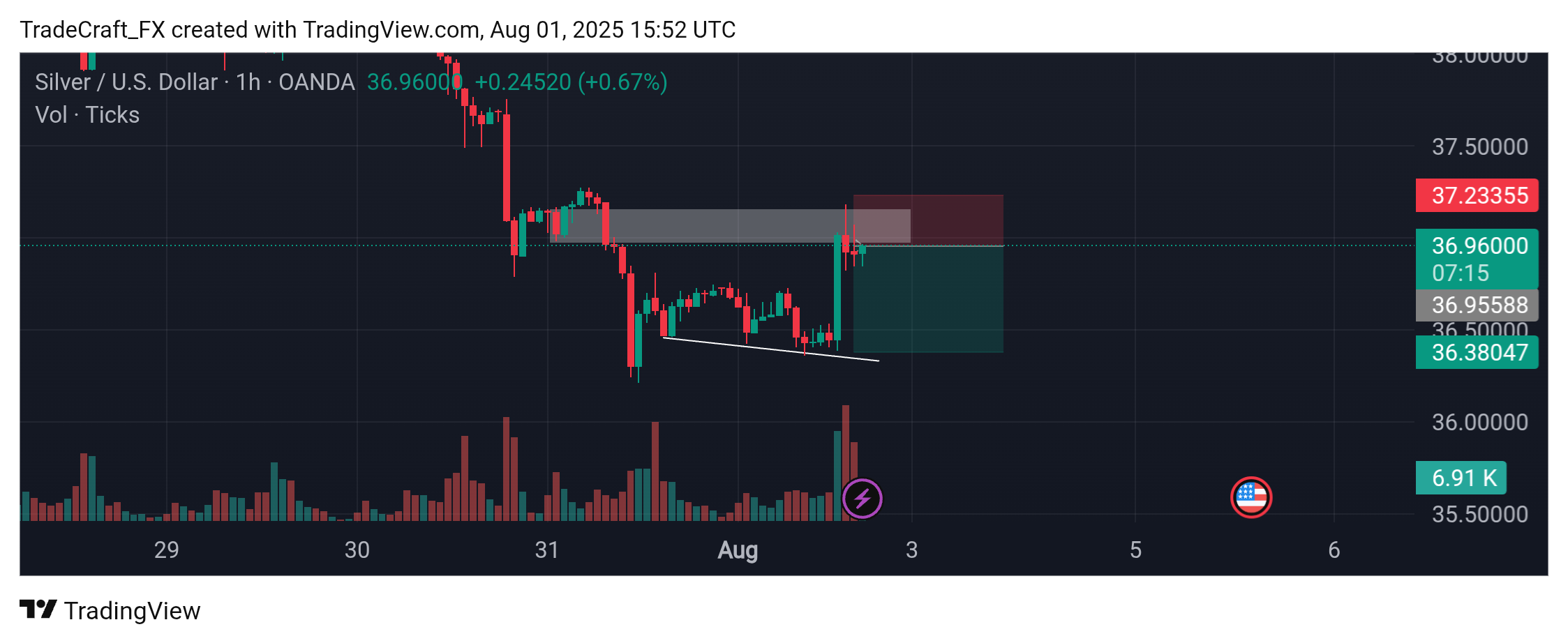

Target 36.68200 36.37800

SL 37.23700

This setup based on inducement!

tradingview.com/x/V7fiXE0o

POD03 – Minds Summary

🛢️ Rotation Beneath the Surface — Macro Flow Resets Across FX, Crypto, and Commodities

📆 Friday, August 1, 2025 | ⏰ 14:50 London / 09:50 NY

📦 Market Context: Surface calm hides strategic repositioning in metals, currencies, and digital assets — rotation is happening without price conviction. SILVER

SILVER  GOLD

GOLD  DXY

DXY  NAS100USD

NAS100USD

________________________________________

📉 Data Recap

• DXY stable near 98.95 — masking internal rotation into defensive FX

• VVIX elevated at 95.2 — confirming underlying volatility risk

• BTC holds above 117K — but ETH and alts face quiet liquidation

• Gold stable near $3,325 — silver and copper now attracting fresh flow

• Crude oil slips under $68 — compression continues, no risk-on breakout

________________________________________

🔍 Flow Notes

• ES/NQ Futures: Holding structure, but spot indices lag — conviction lacking

• FX: GBP stalling, while JPY, CHF, and EUR reassert quiet leadership

• Crypto: BTC not bought — just not sold; ETHBTC fading = trust breakdown

• Metals: Silver and copper bid quietly; gold flat, palladium fades

• Crude: Dealer compression dominates — energy remains a no-confidence sector

________________________________________

🎯 Trade Ideas

• 🟢 Long: Silver > $38.60 — clean reflation proxy flow

• 🟢 Long: EUR/GBP > 0.8665 — EUR retaking cross leadership

• 🔴 Short: NZD/USD < 0.5850 — risk FX still being faded

• 🔴 Short: OP/USD < 0.7050 — failed gamma bounce

• ⚖️ Neutral: Gold — no breakout, wait for confirmation

________________________________________

📊 Summary Highlights from Today’s Full Analysis

Basis Edge: Futures hold structure while spot stalls; conviction remains futures-led, not price-led

FX Focus: GBP stalls while EUR, JPY, CHF regain leadership; macro rotation reasserts itself

Digital Flow: BTC steady but not bid; ETH and altcoins quietly repriced lower — trust has narrowed

Raw Materials Radar: Silver and copper accumulate quietly; gold range-bound; energy still suppressed

→ Rotation is real — but it’s silent, strategic, and waiting for conviction. Don’t mistake stability for confidence.

________________________________________

🧠 Macro-Flow Insight

• Institutional flow is not chasing breakouts — it’s preparing for regime change

• FX leadership has shifted quietly — GBP out, JPY/EUR/CHF in

• Crypto shows internal price honesty — only BTC is being held

• Metals rotation continues beneath the surface — silver/copper > gold

• Spot weakness vs futures strength signals hesitation, not confirmation

________________________________________

🎯 Final Outlook

Across FX, crypto, and commodities, rotation is the signal — not direction.

Institutions are repositioning quietly: building reflation exposure in metals, rotating out of risk FX and altcoins, and using futures over spot.

Stay disciplined. Watch for signal alignment — not headlines.

________________________________________

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

🎯 Summary posts only. Full context via DM.

⚠️ Educational content only. Not investment advice.

📉 Data reflects macro-aligned positioning as of August 1, 2025 (reported August 1)

🛢️ Rotation Beneath the Surface — Macro Flow Resets Across FX, Crypto, and Commodities

📆 Friday, August 1, 2025 | ⏰ 14:50 London / 09:50 NY

📦 Market Context: Surface calm hides strategic repositioning in metals, currencies, and digital assets — rotation is happening without price conviction.

________________________________________

📉 Data Recap

• DXY stable near 98.95 — masking internal rotation into defensive FX

• VVIX elevated at 95.2 — confirming underlying volatility risk

• BTC holds above 117K — but ETH and alts face quiet liquidation

• Gold stable near $3,325 — silver and copper now attracting fresh flow

• Crude oil slips under $68 — compression continues, no risk-on breakout

________________________________________

🔍 Flow Notes

• ES/NQ Futures: Holding structure, but spot indices lag — conviction lacking

• FX: GBP stalling, while JPY, CHF, and EUR reassert quiet leadership

• Crypto: BTC not bought — just not sold; ETHBTC fading = trust breakdown

• Metals: Silver and copper bid quietly; gold flat, palladium fades

• Crude: Dealer compression dominates — energy remains a no-confidence sector

________________________________________

🎯 Trade Ideas

• 🟢 Long: Silver > $38.60 — clean reflation proxy flow

• 🟢 Long: EUR/GBP > 0.8665 — EUR retaking cross leadership

• 🔴 Short: NZD/USD < 0.5850 — risk FX still being faded

• 🔴 Short: OP/USD < 0.7050 — failed gamma bounce

• ⚖️ Neutral: Gold — no breakout, wait for confirmation

________________________________________

📊 Summary Highlights from Today’s Full Analysis

Basis Edge: Futures hold structure while spot stalls; conviction remains futures-led, not price-led

FX Focus: GBP stalls while EUR, JPY, CHF regain leadership; macro rotation reasserts itself

Digital Flow: BTC steady but not bid; ETH and altcoins quietly repriced lower — trust has narrowed

Raw Materials Radar: Silver and copper accumulate quietly; gold range-bound; energy still suppressed

→ Rotation is real — but it’s silent, strategic, and waiting for conviction. Don’t mistake stability for confidence.

________________________________________

🧠 Macro-Flow Insight

• Institutional flow is not chasing breakouts — it’s preparing for regime change

• FX leadership has shifted quietly — GBP out, JPY/EUR/CHF in

• Crypto shows internal price honesty — only BTC is being held

• Metals rotation continues beneath the surface — silver/copper > gold

• Spot weakness vs futures strength signals hesitation, not confirmation

________________________________________

🎯 Final Outlook

Across FX, crypto, and commodities, rotation is the signal — not direction.

Institutions are repositioning quietly: building reflation exposure in metals, rotating out of risk FX and altcoins, and using futures over spot.

Stay disciplined. Watch for signal alignment — not headlines.

________________________________________

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

🎯 Summary posts only. Full context via DM.

⚠️ Educational content only. Not investment advice.

📉 Data reflects macro-aligned positioning as of August 1, 2025 (reported August 1)