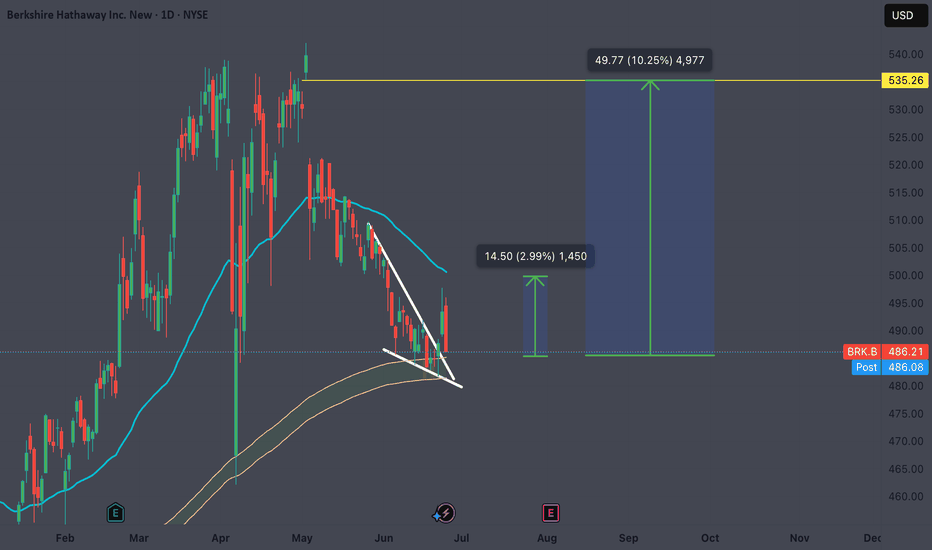

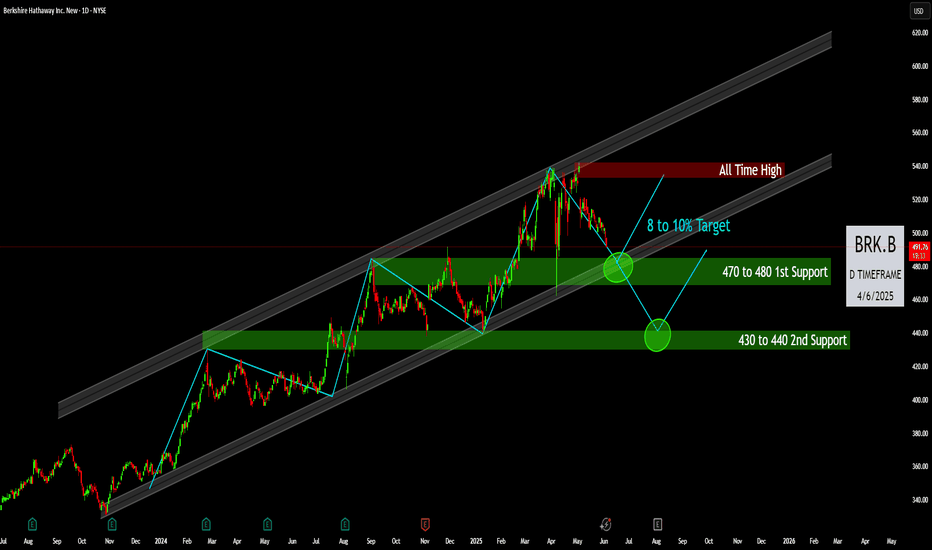

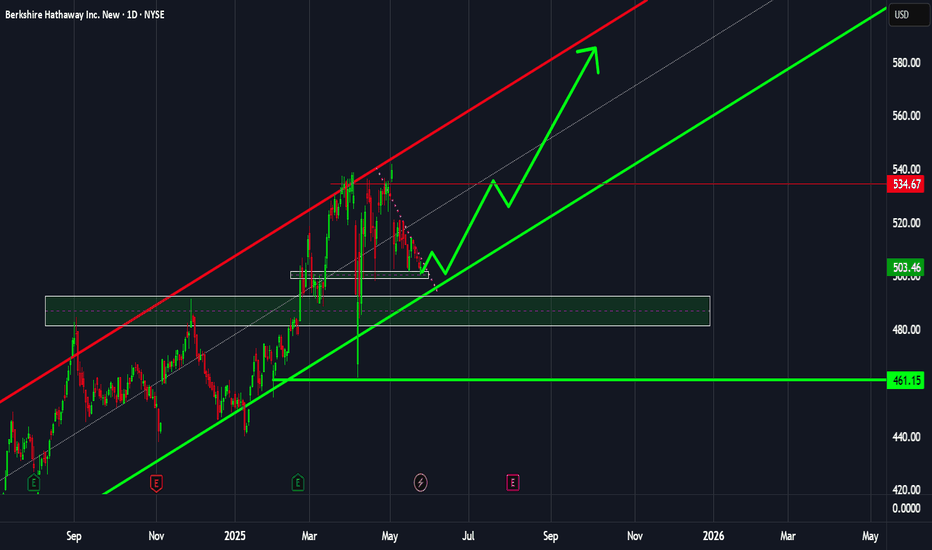

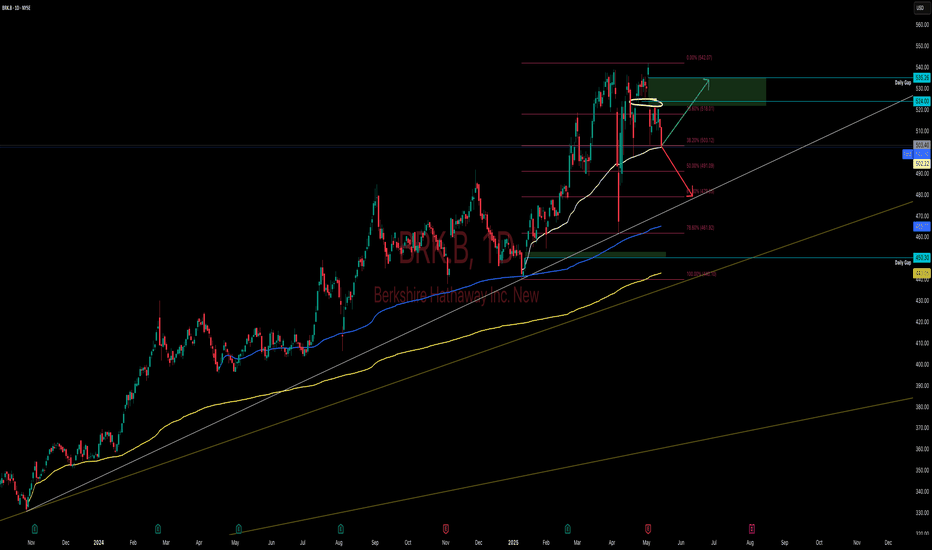

Berkshire Bounce ImminentNYSE:BRK.B Ready To Bounce!

- Breakout and now retesting descending wedge

- Overnight gap up from June 23rd to 24th was filled today

- Retesting top band of 200ema cloud

Targets:

- 3% to 50ma

- 10% to gap fill at $535

If you take anything away from this post, remember this:

Do NOT fade Uncl

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

33.22 CHF

80.83 B CHF

337.34 B CHF

1.34 B

About Berkshire Hathaway Inc.

Sector

Industry

CEO

Warren Edward Buffett

Website

Headquarters

Omaha

Founded

1839

FIGI

BBG006TLNCF0

Berkshire Hathaway, Inc. is a holding company, which engages in the provision of property and casualty insurance and reinsurance, utilities and energy, freight rail transportation, finance, manufacturing, and retailing services. It operates through the following segments: Insurance, Burlington Northern Santa Fe, LLC (BNSF), Berkshire Hathaway Energy (BHE), Pilot Travel Centers (PTC), Manufacturing, McLane, and Service and Retailing. The Insurance segment includes the underwriting of GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group. The BNSF segment involves the operation of railroad systems. The BHE segment focuses on regulated electric and gas utility, power generation and distribution, and real estate brokerage activities. The PTC segment consists of managing travel centers and marketing of wholesale fuel. The Manufacturing segment refers to industrial, consumer and building products, home building, and related financial services. The McLane segment covers the wholesale distribution of groceries and non-food items. The Service and Retailing segment relates to the provision of shared aircraft ownership programs, aviation pilot training, electronic components distribution, retailing businesses, automobile dealerships and trailer, and furniture leasing services. The company was founded by Oliver Chace in 1839 and is headquartered in Omaha, NE.

Related stocks

Berkshire Hathaway: Time to consider exitsHello,

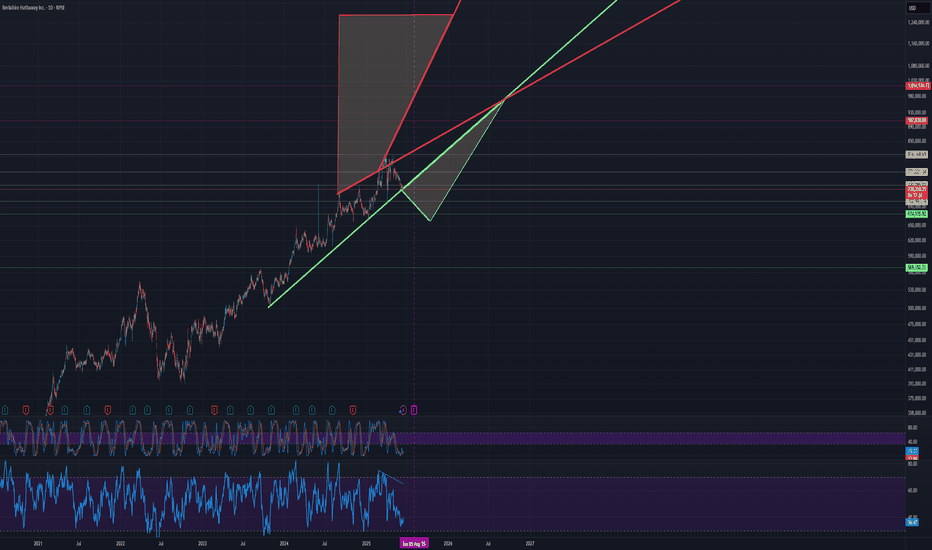

Despite recent market volatility, Berkshire Hathaway (BRK.A, BRK.B) has demonstrated resilience, with its stock rising approximately 16% year-to-date in 2025, significantly outperforming the S&P 500’s 2% decline. This performance has fueled speculation about Warren Buffett’s strategy, partic

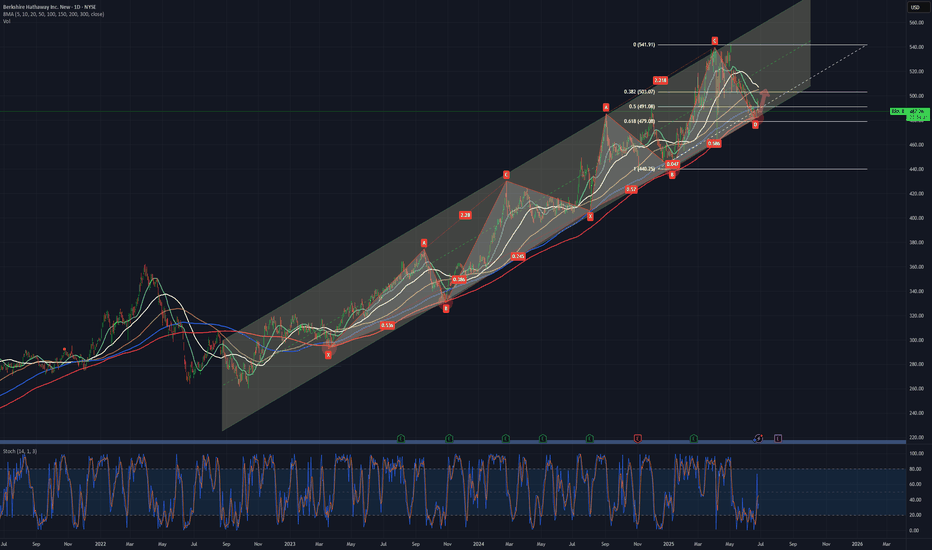

BRK.B Long The stock has been trading within a defined channel for nearly five years, suggesting it may be approaching a pivotal bottom. If this turns out to be the case, we could have the opportunity to acquire additional shares of this outstanding company at more attractive prices. It's crucial to stay vigil

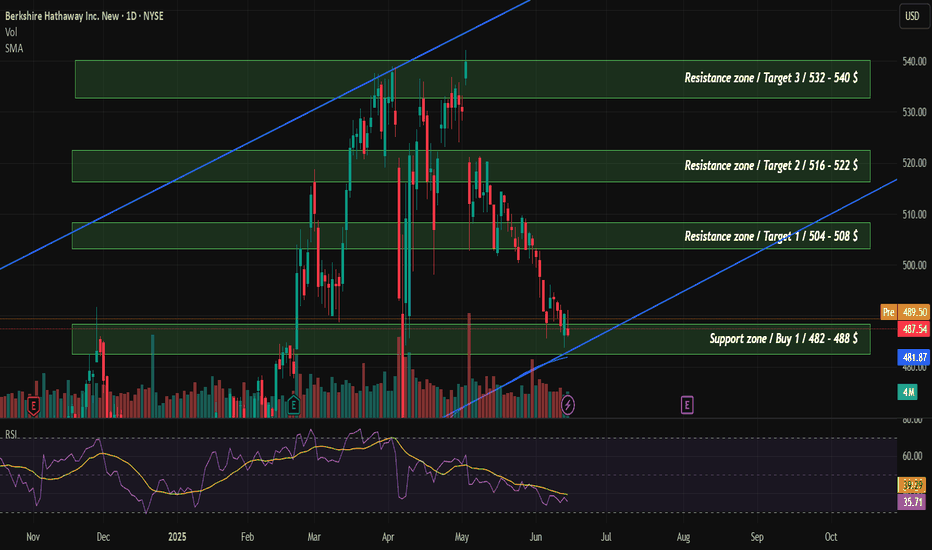

BRK.B: Channel-Bound & Targeting New HighsThis chart for Berkshire Hathaway Class B (BRK.B) presents a clear and actionable technical setup, operating within a well-defined long-term bullish channel.

Dominant Bullish Channel: BRK.B is clearly trading within a well-established, upward-sloping channel. This channel dictates the long-term

I have almost good fundamental views about Berkshire HathawayHello Traders and Investors,

According to my fundamental analysis considering EPS revisions and forecasts and also by taking the analysis TP and recommendations. I give a good score to BRK-B.

By considering the technical matters I think BRK.B, while is not a really good option for short-term, coul

Emotional 4% gap on Warren Buffett "leaving"Keeping eye on possible 10-day option entry on 4% gap that is just irrational quick sell-off.

reasons for gap to fill up:

-nothing changes, Buffet was not making decisions single-handedly anyway and passing knowledge is his strong side, not the opposite

- he will remain chairman of the board

-hones

BRK.B Technical Analysis – May 2025Berkshire Hathaway (BRK.B) has pulled back about 38.2% from its 2025 high, a key Fibonacci retracement level that’s often seen as potential support in strong uptrends. It’s also sitting right at the anchored VWAP from this year’s low, which adds weight to this level as a possible bounce zone.

The s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

E

D4914006

Eastern Energy Gas Holdings, LLC 3.9% 15-NOV-2049Yield to maturity

8.04%

Maturity date

Nov 15, 2049

N

ENRN5056545

Northern Natural Gas Co. 4.1% 15-SEP-2042Yield to maturity

7.56%

Maturity date

Sep 15, 2042

N

ENRN5163032

Northern Natural Gas Co. 3.4% 16-OCT-2051Yield to maturity

7.34%

Maturity date

Oct 16, 2051

B

BRK5147453

Berkshire Hathaway Energy Company 2.85% 15-MAY-2051Yield to maturity

7.19%

Maturity date

May 15, 2051

E

BRK5455546

Eastern Gas Transmission and Storage, Inc. 3.9% 15-NOV-2049Yield to maturity

7.01%

Maturity date

Nov 15, 2049

See all BRK/B bonds

Curated watchlists where BRK/B is featured.

Frequently Asked Questions

The current price of BRK/B is 206.82 CHF — it hasn't changed in the past 24 hours. Watch BERKSHIRE HATH stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange BERKSHIRE HATH stocks are traded under the ticker BRK/B.

We've gathered analysts' opinions on BERKSHIRE HATH future price: according to them, BRK/B price has a max estimate of 483.63 CHF and a min estimate of 396.89 CHF. Watch BRK/B chart and read a more detailed BERKSHIRE HATH stock forecast: see what analysts think of BERKSHIRE HATH and suggest that you do with its stocks.

BRK/B reached its all-time high on Oct 10, 2018 with the price of 226.00 CHF, and its all-time low was 121.80 CHF and was reached on Aug 24, 2015. View more price dynamics on BRK/B chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BRK/B stock is 0.00% volatile and has beta coefficient of 0.50. Track BERKSHIRE HATH stock price on the chart and check out the list of the most volatile stocks — is BERKSHIRE HATH there?

Today BERKSHIRE HATH has the market capitalization of 837.62 B, it has decreased by −0.36% over the last week.

Yes, you can track BERKSHIRE HATH financials in yearly and quarterly reports right on TradingView.

BERKSHIRE HATH is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

BRK/B earnings for the last quarter are 3.95 CHF per share, whereas the estimation was 4.18 CHF resulting in a −5.40% surprise. The estimated earnings for the next quarter are 3.99 CHF per share. See more details about BERKSHIRE HATH earnings.

BERKSHIRE HATH revenue for the last quarter amounts to 79.43 B CHF, despite the estimated figure of 80.41 B CHF. In the next quarter, revenue is expected to reach 73.76 B CHF.

BRK/B net income for the last quarter is 4.07 B CHF, while the quarter before that showed 17.89 B CHF of net income which accounts for −77.22% change. Track more BERKSHIRE HATH financial stats to get the full picture.

No, BRK/B doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 30, 2025, the company has 392.4 K employees. See our rating of the largest employees — is BERKSHIRE HATH on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BERKSHIRE HATH EBITDA is 61.72 B CHF, and current EBITDA margin is 19.46%. See more stats in BERKSHIRE HATH financial statements.

Like other stocks, BRK/B shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BERKSHIRE HATH stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BERKSHIRE HATH technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BERKSHIRE HATH stock shows the buy signal. See more of BERKSHIRE HATH technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.