SNXUSDT trade ideas

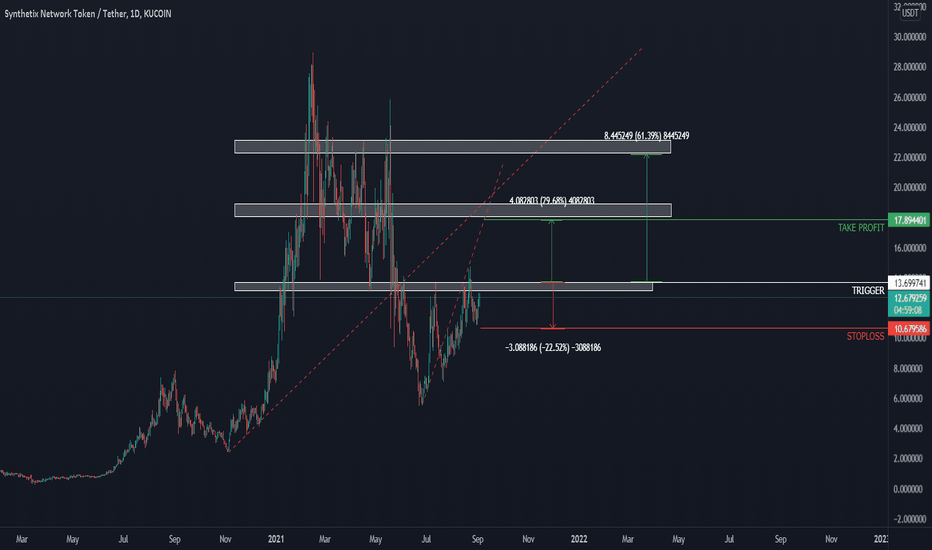

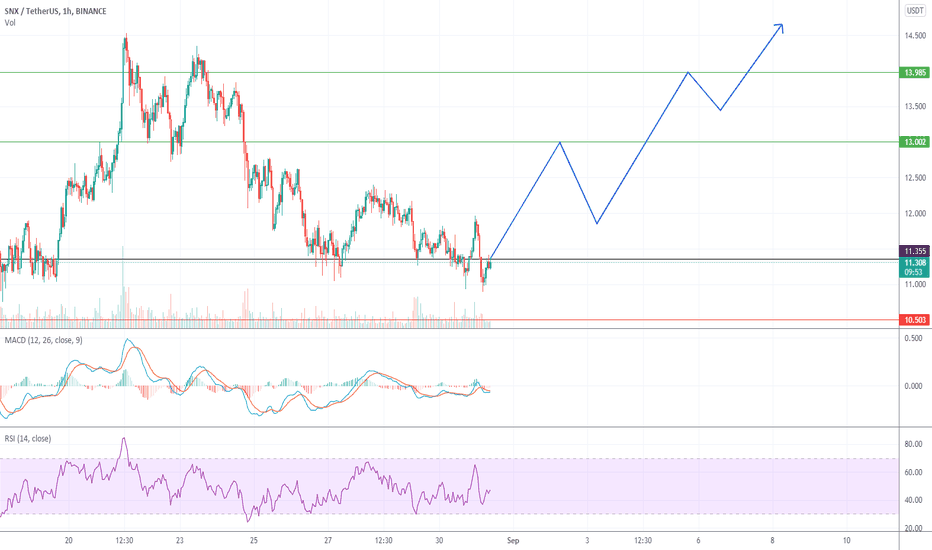

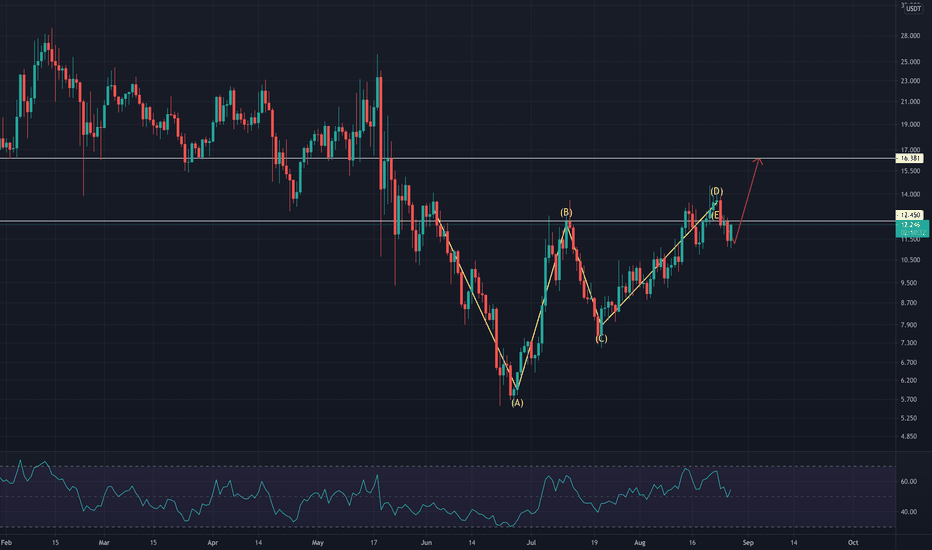

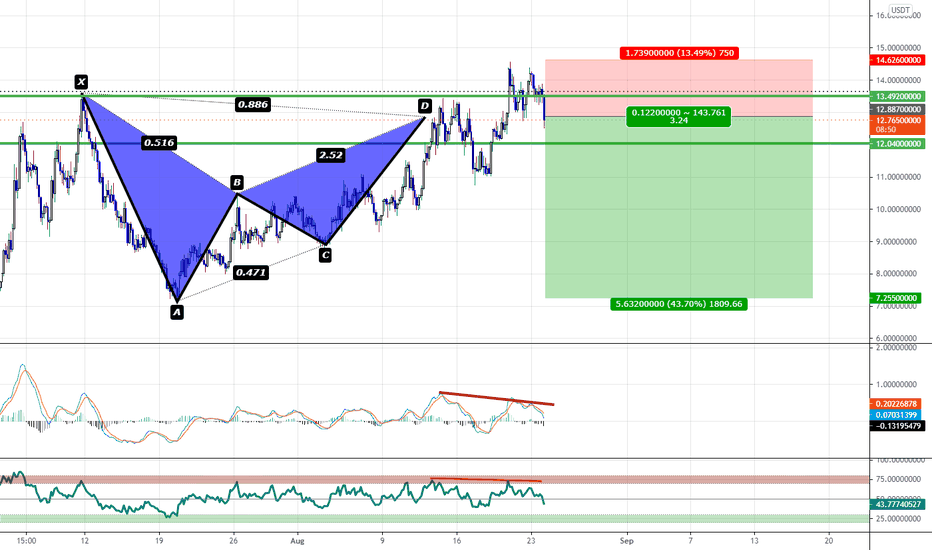

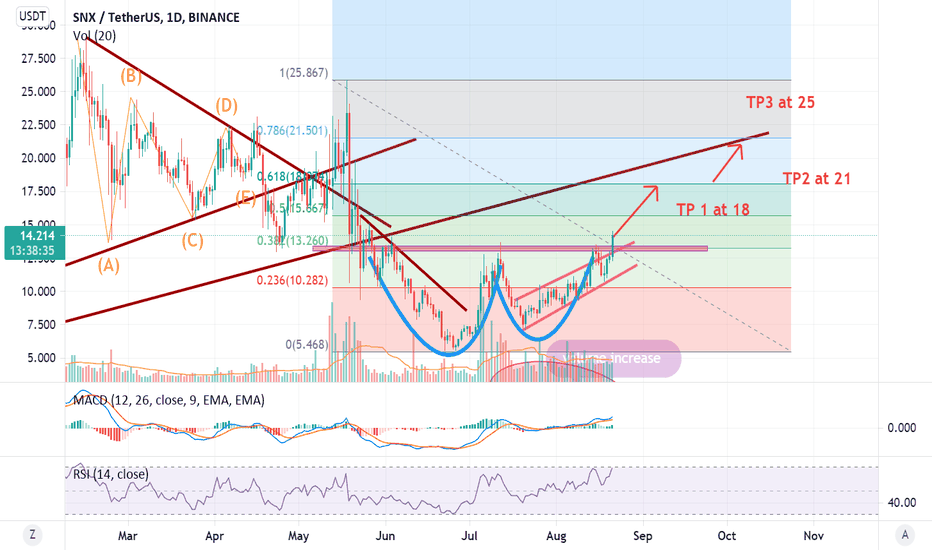

SNXUSDT LONG IN BINANCE AND KUCOINR/R with first target is about = 1.3 !!!

but you need money management in this trade because of my stoploss price !!!

you can set a "buy stop limit" order on the trigger price !!!

after that sell 50% of your position on tp1 and upgrade your stoploss to your trigger price and wait for tp2 or more ... it means : risk free !!!!

just like and folowfor more ... 8D

SNX 70% COMING ! What Is Synthetix (SNX)?

Synthetix is a decentralized finance (DeFi) protocol that provides on-chain exposure to a wide variety of crypto and non-crypto assets. The protocol is based on the Ethereum (ETH) blockchain and offers users access to highly liquid synthetic assets (synths). Synths track and provide returns on the underlying asset without requiring one to directly hold the asset.

The platform aims to broaden the cryptocurrency space by introducing non-blockchain assets, providing access to a more robust financial market.

Who Are the Founders of Synthetix?

The network was launched in September 2017 by Kain Warwick under the name Havven (HAV). About a year later the company rebranded to Synthetix.

Kain Warwick is the founder of Synthetix and a non-executive director at the blueshyft retail network. Prior to founding Synthetix, Warwick has worked on several other cryptocurrency projects. He also founded Pouncer, a live auction site exclusive to Australia.

Peter McKean, the project’s CEO, has over two decades of experience in software development. He previously worked as a programmer at ICL Fujitsu.

Jordan Momtazi, the COO of Synthetix, is a business strategist, market analyst and sales leader with several years of experience in blockchain, cryptocurrency, digital payments and e-commerce systems.

Justin J. Moses, the CTO, was the former director of engineering at MongoDB and deputy practice head of engineering at Lab49. He also co-founded Pouncer.

What Makes Synthetix Unique?

Synthetix is a decentralized exchange (DEX) and a platform for synthetic assets. The protocol is designed in a way that exposes users to the underlying assets via synths, without having to hold the underlying asset.

The platform allows users to autonomously trade and exchange synths. It also has a staking pool where holders can stake their SNX tokens and are rewarded with a share of the transaction fees on the Synthetix Exchange.

The platform tracks the underlying assets using smart contract price delivery protocols called oracles. Synthetix allows users to trade synths seamlessly, without liquidity/slippage issues. It also eliminates the need for third-party facilitators.

SNX tokens are used as collateral for the synthetic assets that are minted. This means that whenever synths are issued, SNX tokens are locked up in a smart contract.

Since launch, the protocol has transitioned to the Optimistic Ethereum mainnet to help reduce the gas fees on the network and lower oracle latency.

How Many Synthetix (SNX) Coins Are There in Circulation?

The maximum supply of SNX is 212,424,133 coins, of which 114,841,533 SNX is in circulation as of February 2021.

At the seed round and token sale stages, Synthetix sold more than 60 million tokens and was able to raise $30 million. Of the total 100,000,000 coins issued during the ICO, 20% was allocated to the team and advisors, 3% to bounties and marketing incentives, 5% to partnership incentives and 12% to the foundation.

How Is the Synthetix Network Secured?

The SNX token is compatible with Ethereum’s ERC20 standard. The Synthetix network is secured through proof-of-stake (PoS) consensus. Synthetix holders stake their SNX and earn returns from the network fees.

Another way for SNX stakers to earn rewards is via the protocol’s inflationary monetary policy, known as staking rewards.

Where Can You Buy Synthetix (SNX)?

SNX tokens can be purchased at top exchanges, such as:

Binance

OKEx

Coinbase Pro

Uniswap (V2)

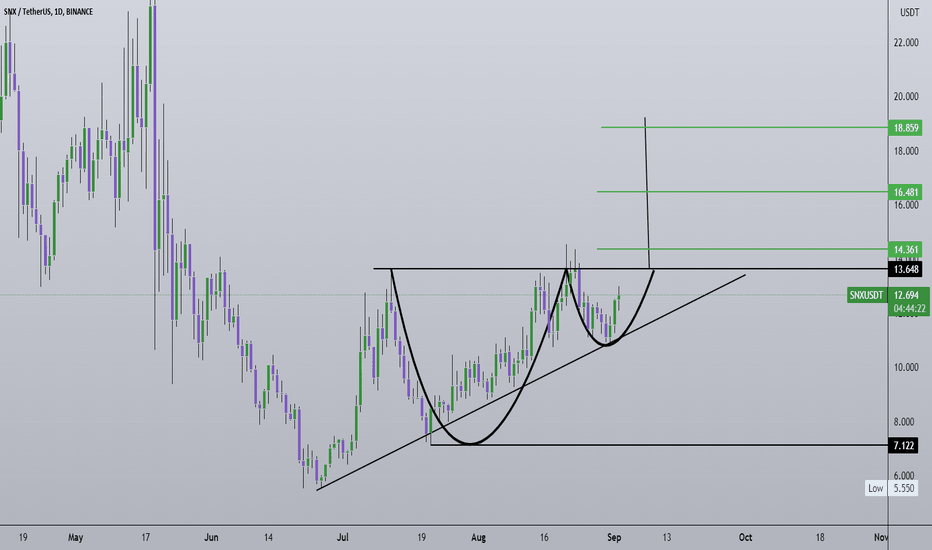

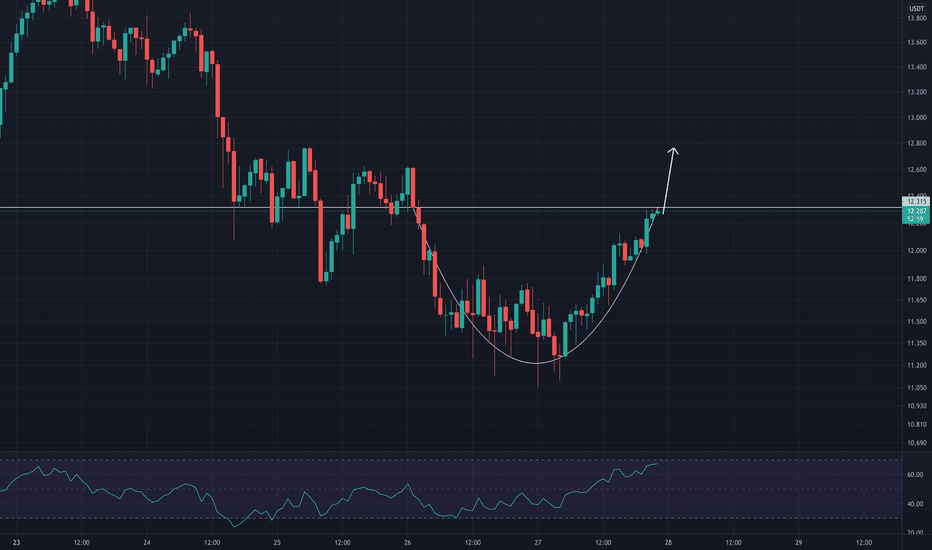

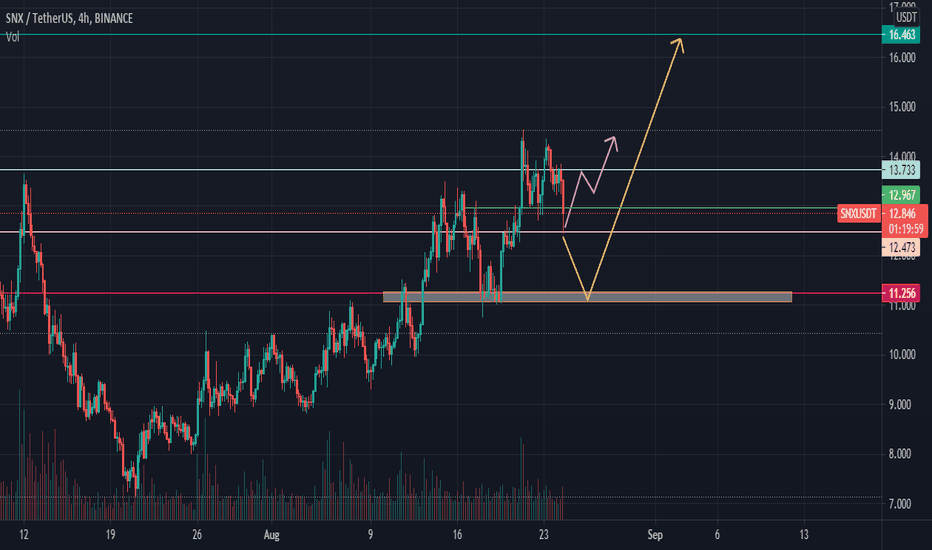

SNXUSDT Adam & Eve Double BottomsAdam & Eve Bottoms

SNXUSDT has formed Adam &Eve double bottoms as seen in the chart. Left Bottom which is in slightly curve shape like V forms Adam because this slightly curve shape shows only Wicks of candlesticks whereas their bodies are above to that point and formed a V shape Which indicates Adam because in Adam bottom only wicks of candlesticks reaches to a certain levels or zones whereas their bodies are present above as shown in pattern at 11.114 .

Now, if we talk about right bottom as shown in the chart then candlesticks has formed Eve bottom because Eve bottom is formed in curve shape such as U shape but not U where most of the candlesticks are present with their bodies somewhere at the same levels or zones of Adam bottom. After forming a curve like U shape indicates a trend reversal from bearish to bullish.

When both bottoms are formed then we check the previous price action from where rejection was faced and results in double bottom and draw a trend line at that point which is called as Resistance as shown in chart at point 12.329.Now just wait for the breakout and retesting as shown in chart because double bottom indicates bullish trend. After retesting its resistance will be its support level and we will open our trades where their are different points for TPs.

TP points

13.276

13.827

14.335

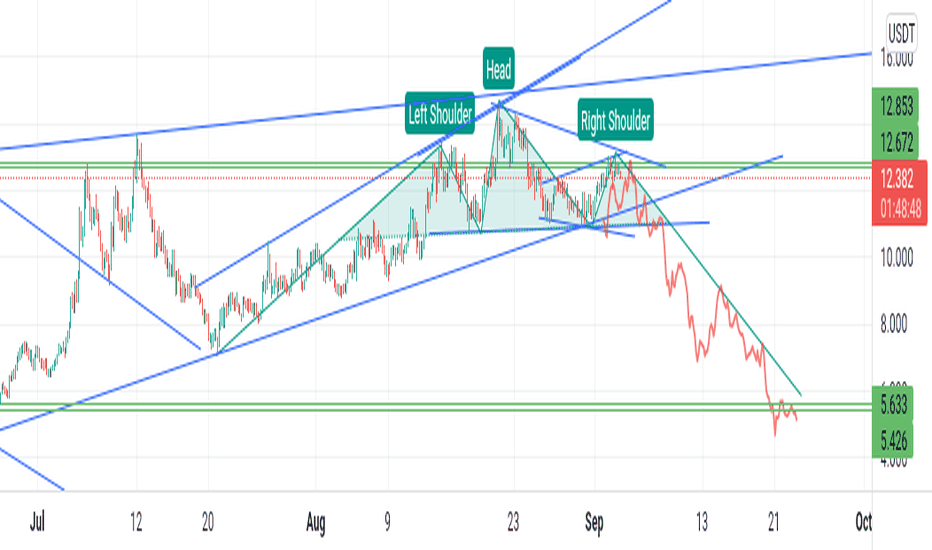

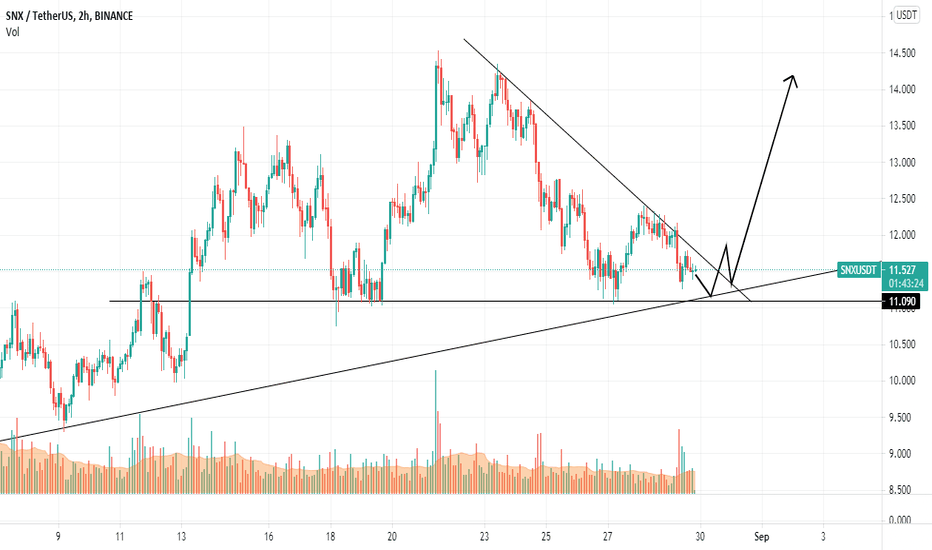

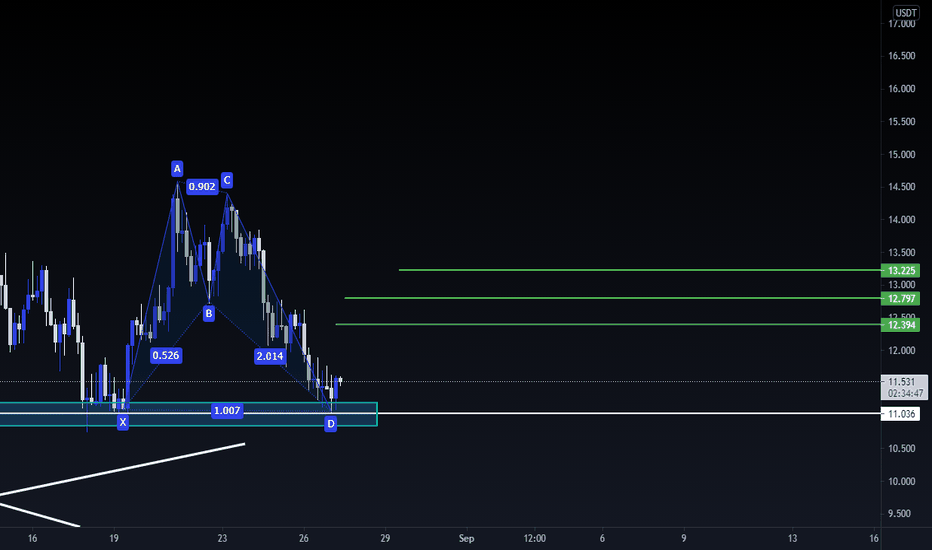

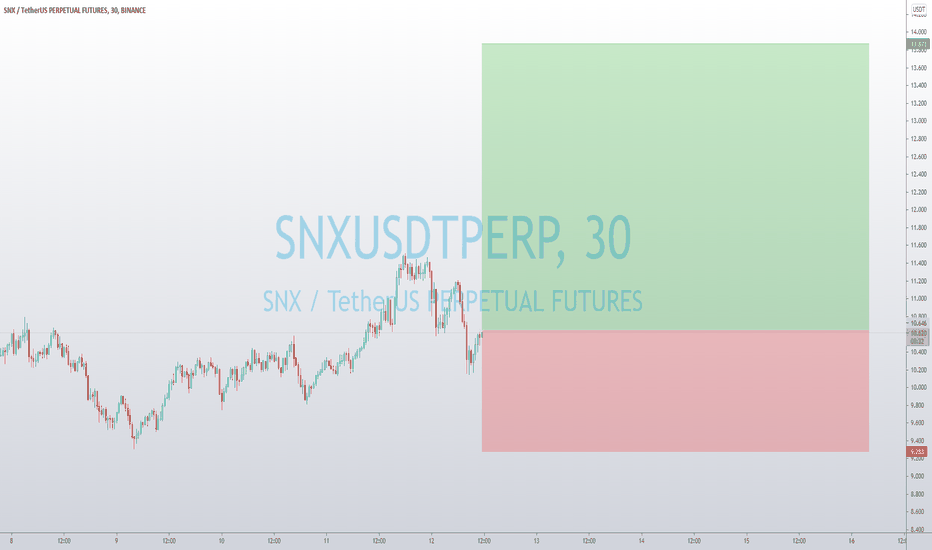

SNX/USDT 1H UpdateMarket Cap $2,116,653,547

24 Hour Trading Vol $114,309,742

Fully Diluted Valuation $2,859,320,550

Total Value Locked (TVL) $2,097,098,088

Fully Diluted Valuation / TVL Ratio 1.37

Market Cap / TVL Ratio 1.01

Circulating Supply 172,443,028

Total Supply 232,947,851

Max Supply 232,947,851

SNX/USDT UpdateMarket Cap $2,116,653,547

24 Hour Trading Vol $114,309,742

Fully Diluted Valuation $2,859,320,550

Total Value Locked (TVL) $2,097,098,088

Fully Diluted Valuation / TVL Ratio 1.37

Market Cap / TVL Ratio 1.01

Circulating Supply 172,443,028

Total Supply 232,947,851

Max Supply 232,947,851

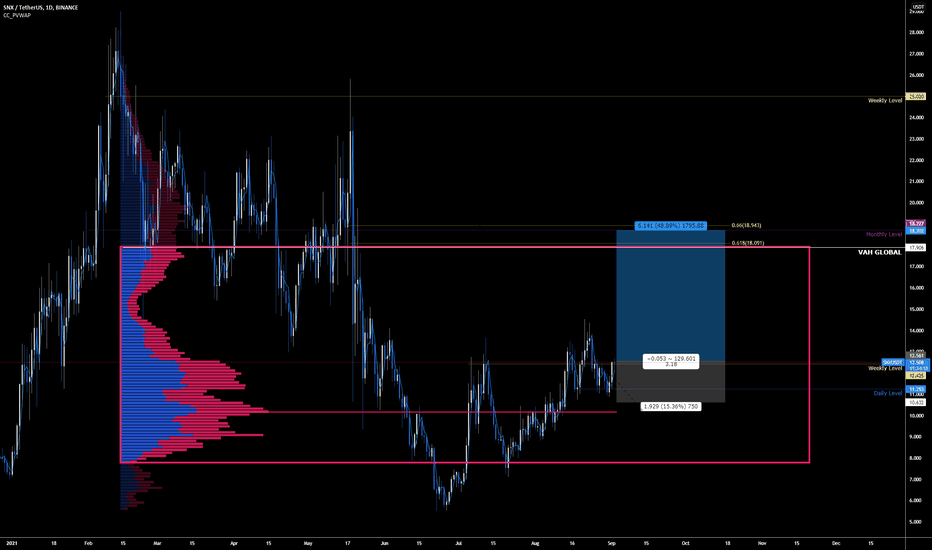

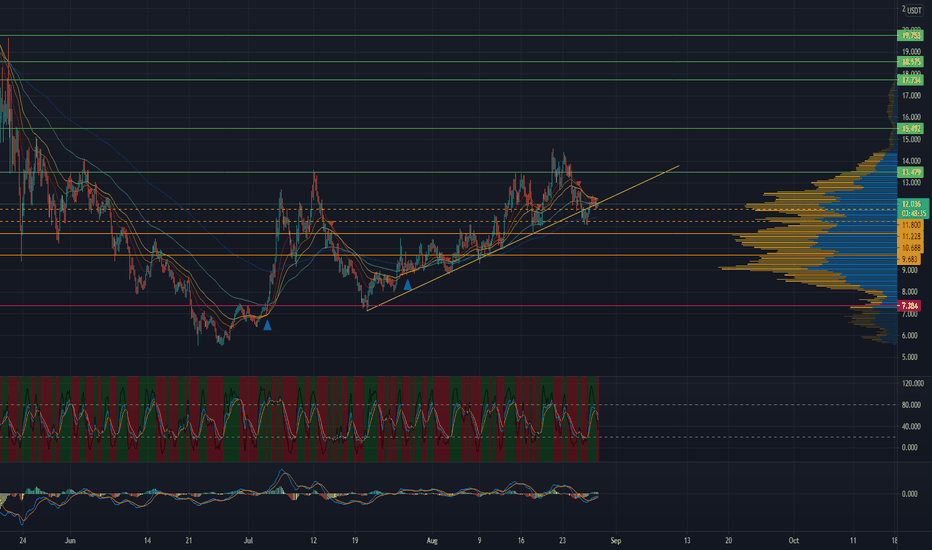

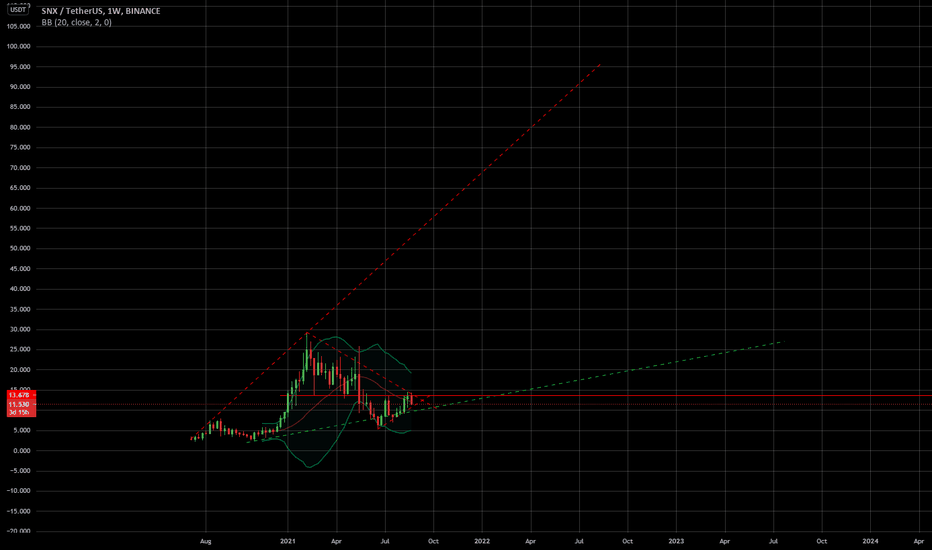

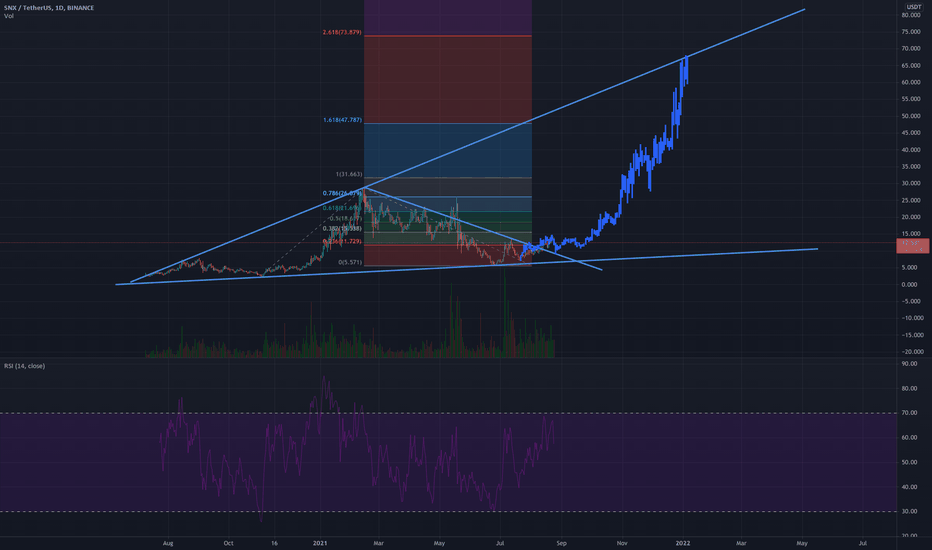

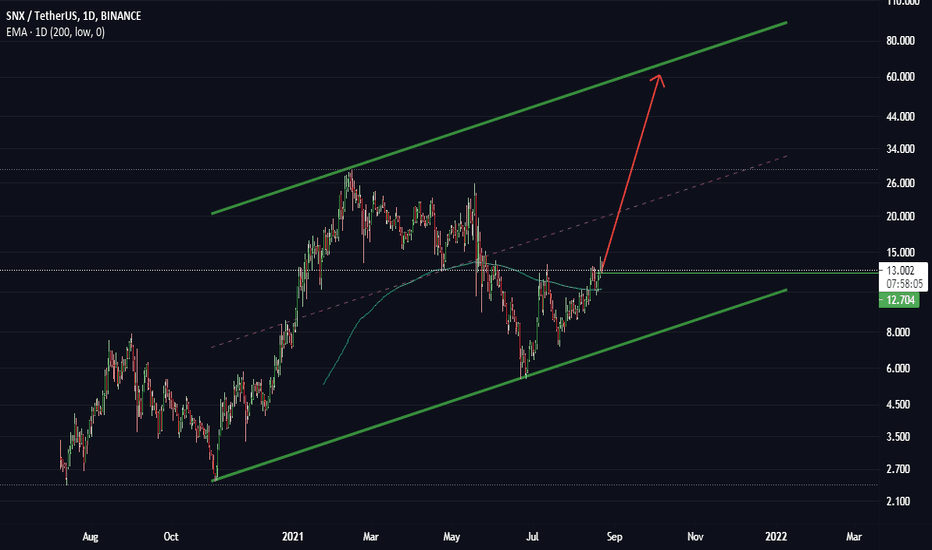

Bullish for SNXOne of my favourite DEFI project looks bullish after breaking the resistance at $13. It might retest the resistance again after reaching the 0.5 fib level, which is approximately at $15.5.

But looking at weekly chart, the MACD crosses below, which is but not always bullish. But I do believe is MACD crosses in weekly chart, it signals a bullish move in the price.

I think the price will reach $18. But breaking the red resistant line on the chart, which coincide with the 0.782 fib level, might be slightly more difficult. But crossing that, it will send the price to $25 or even breaking the ATH.

But all depends on BTC if it manages to break the 0.618 fib level at 50K....Hopefully BTC doesn't drag the market down again