SOLUSD.P trade ideas

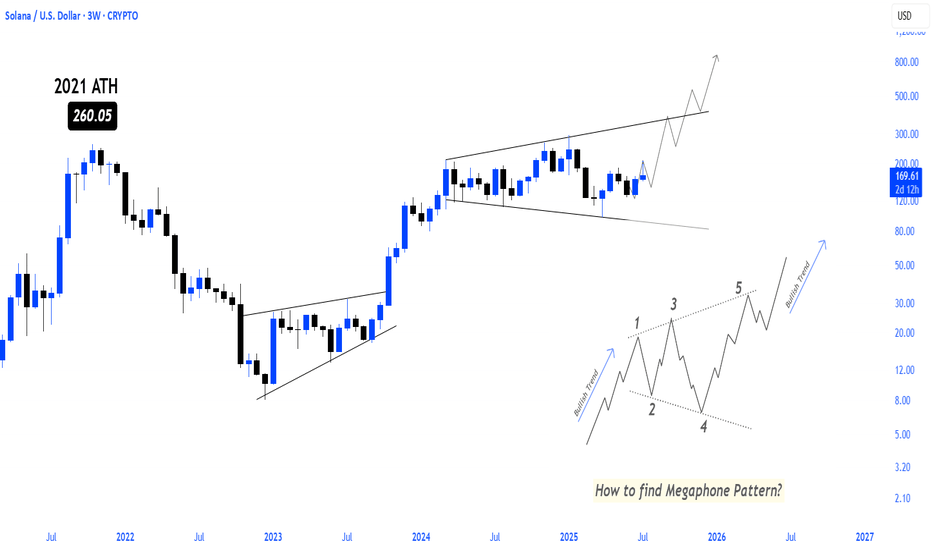

Very Bullish!!

Solana chart looks very bullish. The price is currently dropping but I think it is a very healthy correction.

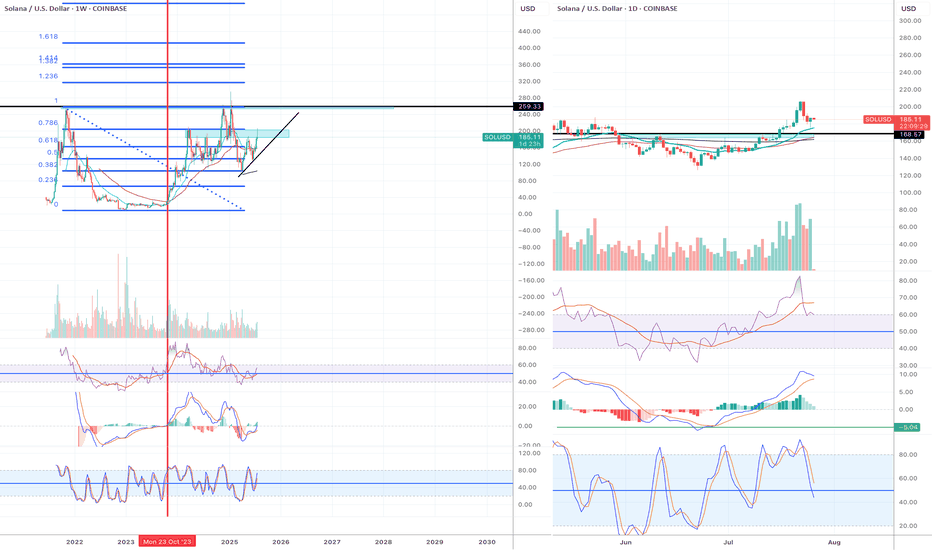

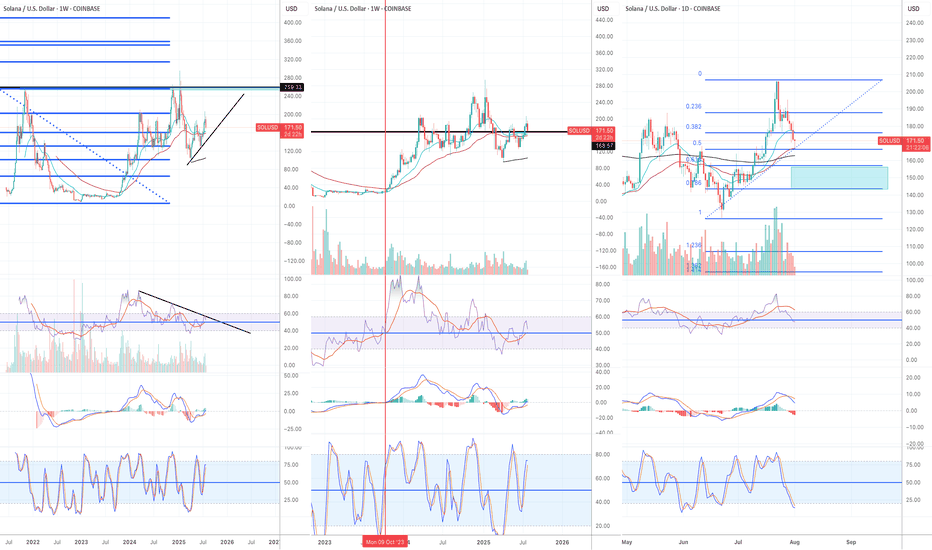

Weekly chart:

1) all momentum indicators just entered the bull zone.

2) The chart is forming higher highs.

Daily:

1) EMA55 finally crossed EMA200. The last time they crossed was October 2023 (see red vertical line in the chart) and it was the beginning of the macro bull trend.

2) Momentum indicators have reached overbought territory and crossed to the downside, however, given weekly momentum indicators have just entered the bull zone, this move is likely to be corrective action.

3) When EMA55 and EMA200 cross, the price often retraces initially to EMAs (21, 55 or 200). Once it completes the pull back, I anticipate the price to move to the previous ATH and beyond.

This is the time when high leverage trading volume increases.

Be careful not get wicked out. Focus on monthly/weekly/daily charts and ignore the noise in the lower timeframes.

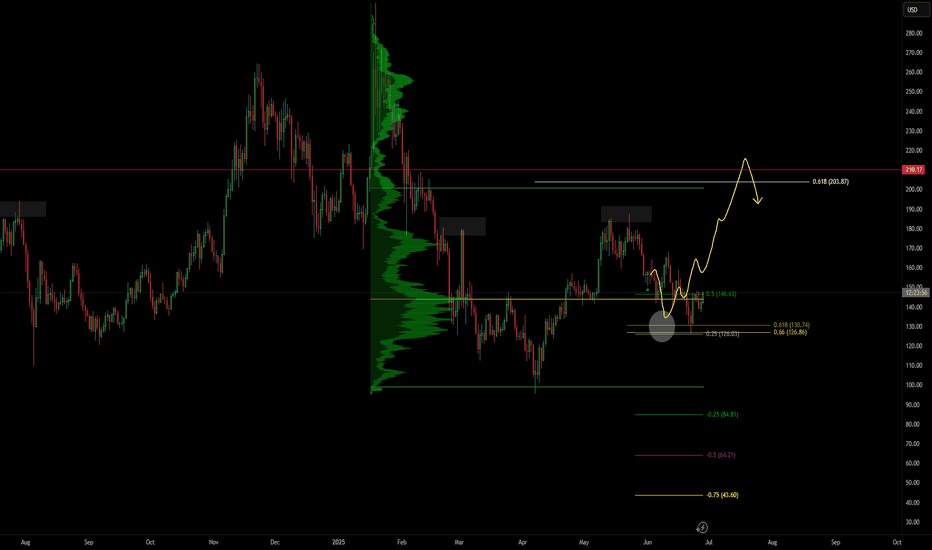

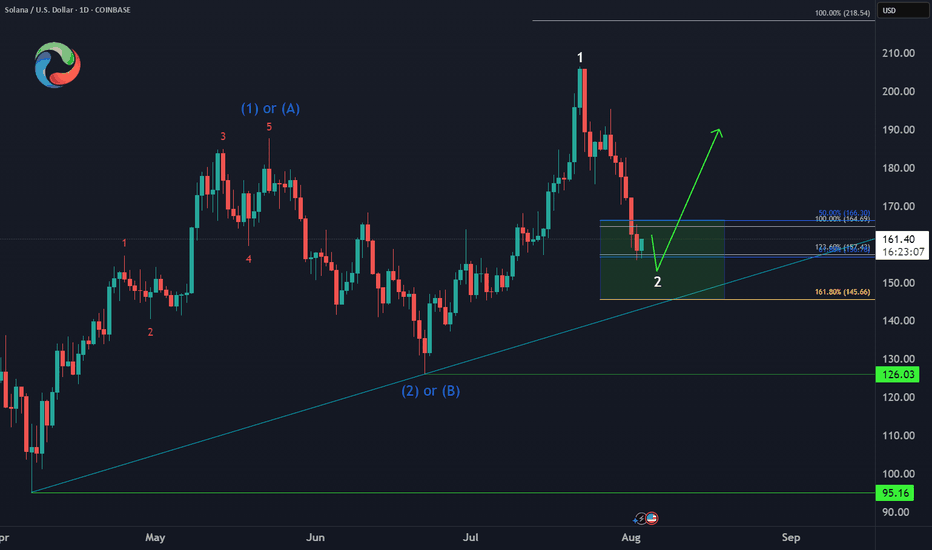

Solana coin Long setupIn this video I go through the current price action and talk about how the 126$ target level was recently reached for a clean long entry and on the daily timeframe we printed a higher low .

I expand on my thoughts for a continuation to the upside and to retest some higher levels of resistance 180$s and time will tell if we print a higher high at the 180$s before retesting the $200 zone .

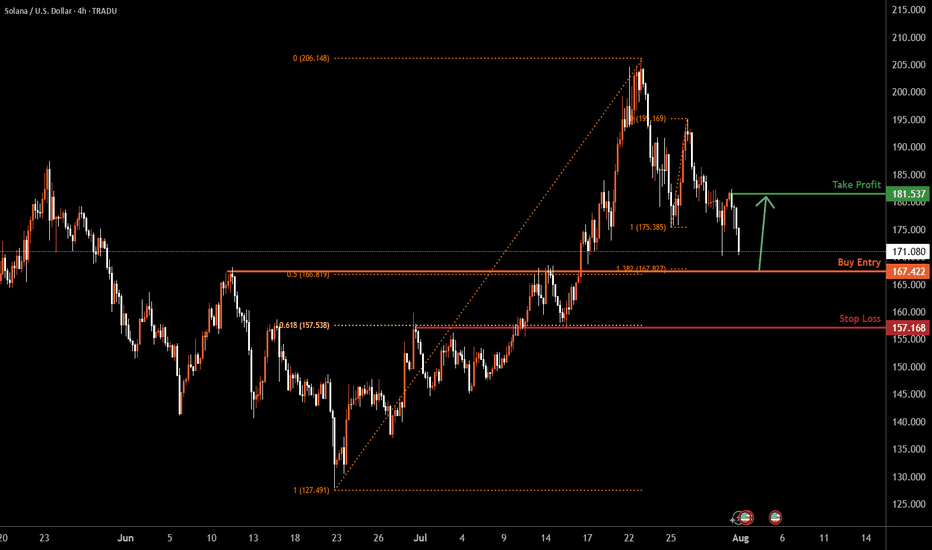

SOLUSD H4 | Bullish bounceBased on the H4 chart analysis, the price could fall to the buy entry, which acts as a pullback support that aligns with the 50% Fibonacci retracement and the 138.2% Fibonacci extension and could bounce to the upside.

Buy entry is at 167.42, which is a pullback support that aligns with the 50% Fibonacci retracement and the 138.2% Fibonacci extension.

Stop loss is at 157.16, which is an overlap support that aligns with the 61.8% Fibonacci retracement.

Take profit is at 181.53, which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

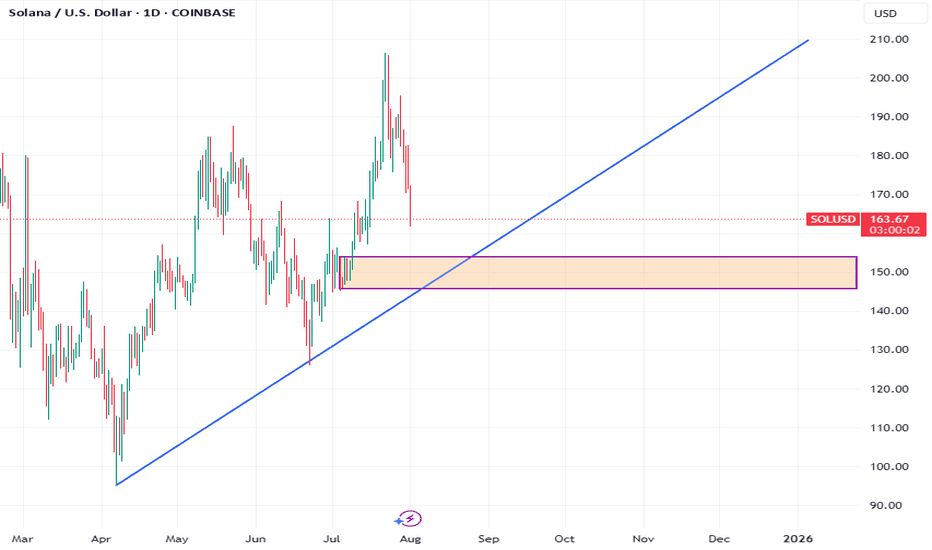

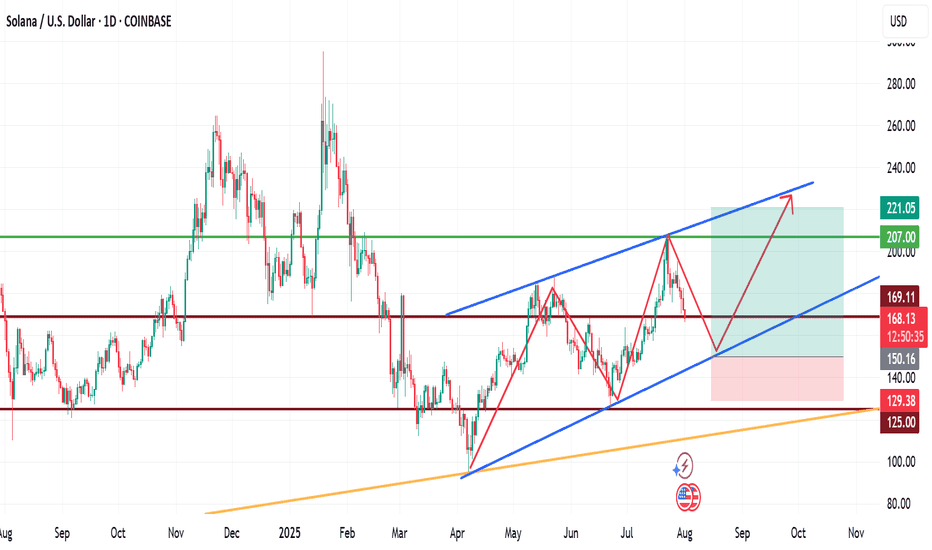

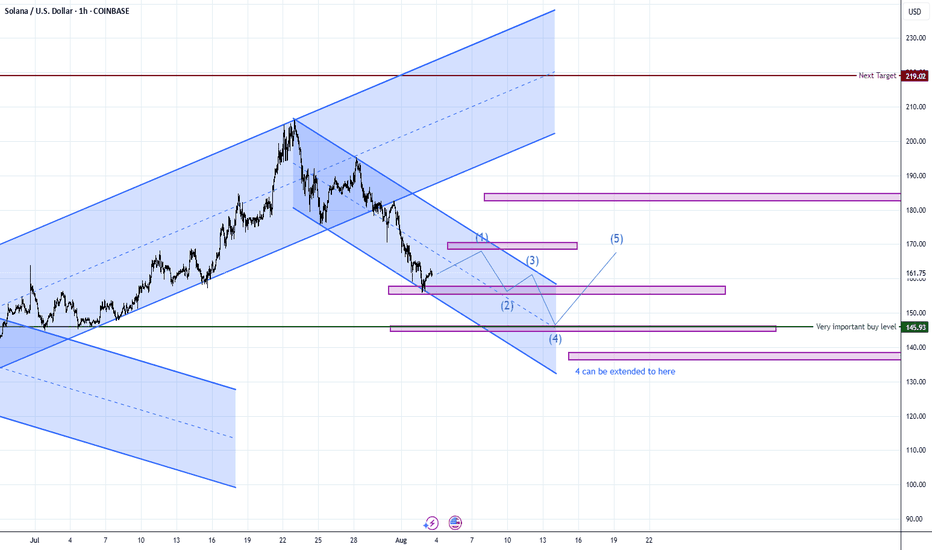

My View for SOLANA next moveMy View for SOLANA next move.

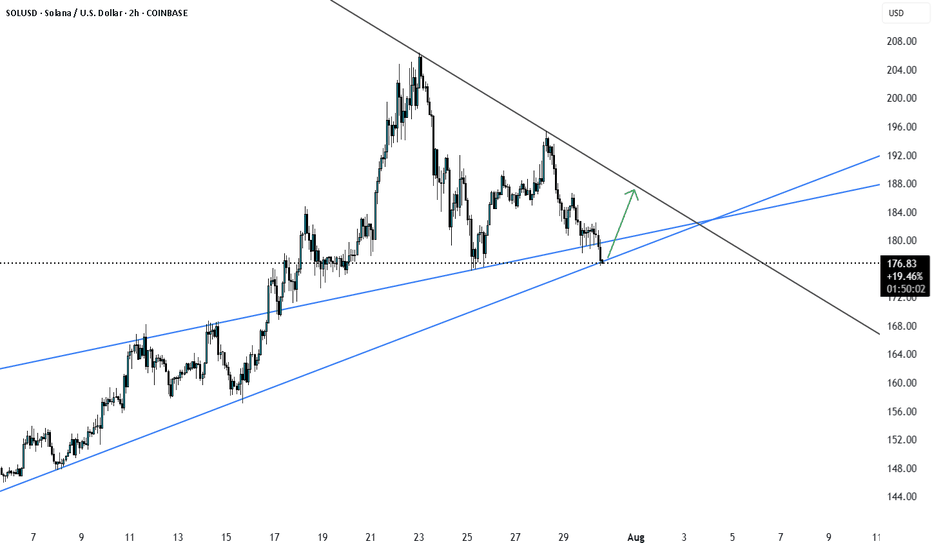

Technically, SOL has been trading within a channel for a while now, with the formation of HHs and HLs.

If fundamentals play out positively long to mid-term, we are likely to see SOLNA fall to $150 zone before another upward leg forms. This leg may rally to as high as $220.

Trade with care.

If you found this helpful, please connect with me.

Like, comment and share

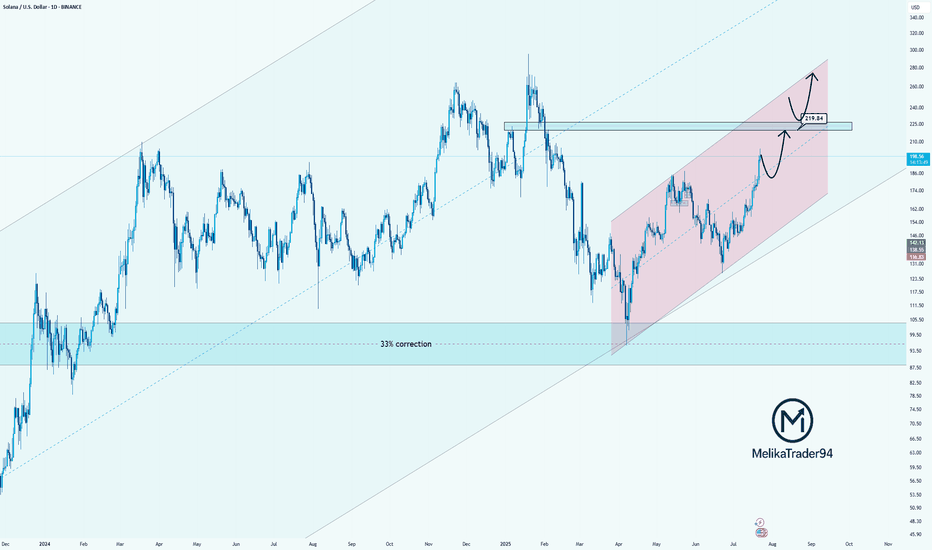

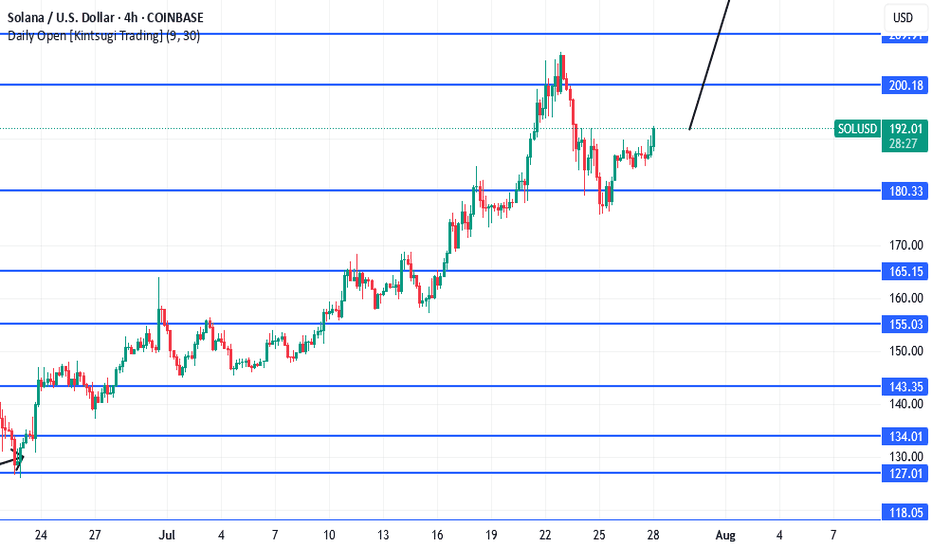

Solana Approaching Key Resistance: watch for $219Hello guys!

Solana has been trending strongly inside a rising parallel channel, recovering steadily after a significant 33% correction. The bullish momentum is clear, and the price is now approaching a key resistance zone near $219.84, which previously acted as a major turning point.

Here’s what I’m watching:

Strong uptrend within the pink channel shows controlled and healthy growth.

$219.84 is a critical decision zone. Price could:

React with a pullback before pushing higher,

Or break through it and flip the level into support for the next bullish leg.

The reaction in this zone will determine the next structure.

Whether we see a temporary correction or continuation to new highs.

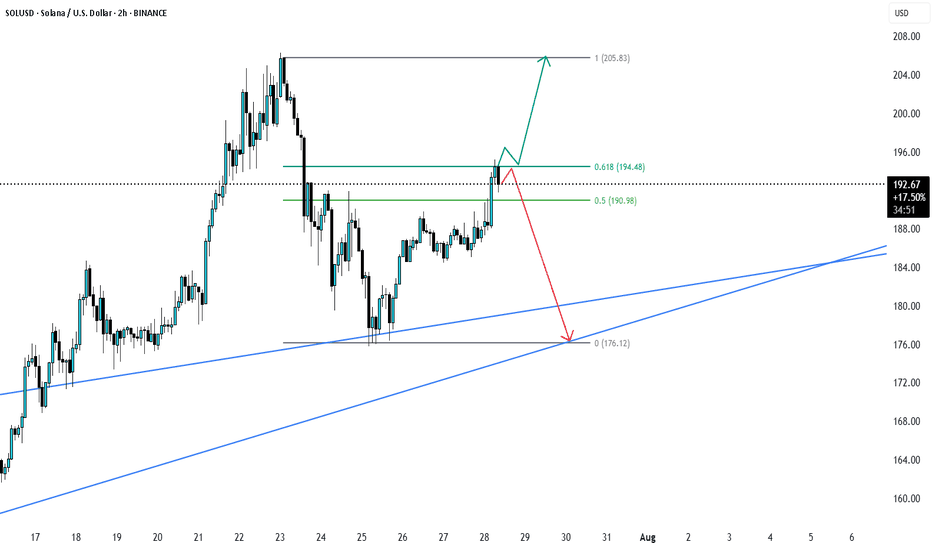

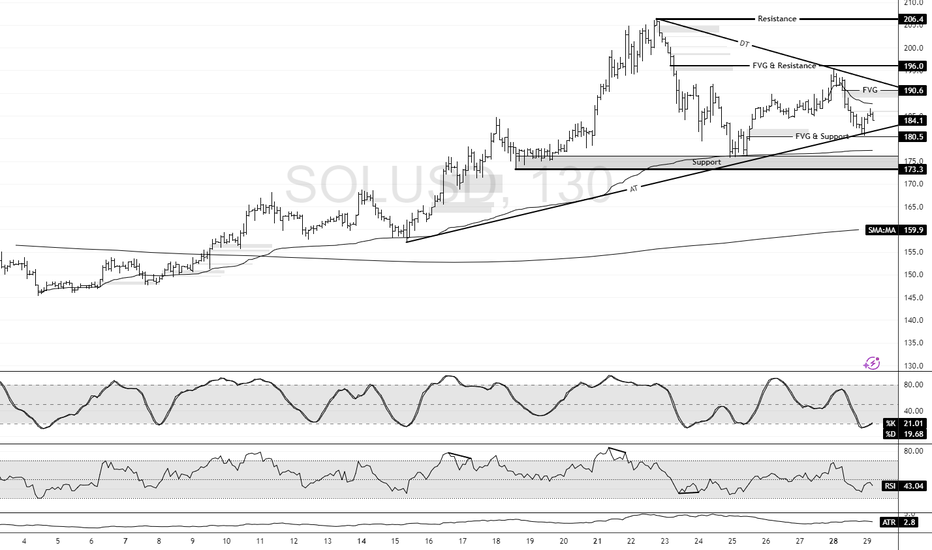

Solana Holds Firm Above VWAP and TrendlineFenzoFx—Solana remained above the ascending trendline and the monthly VWAP, currently trading sideways inside the wedge.

Critical support is at $173.3, and the market outlook remains bullish above this level. If this demand level holds, we expect Solana to resume its bullish trajectory and target the recent highs at $206.4.

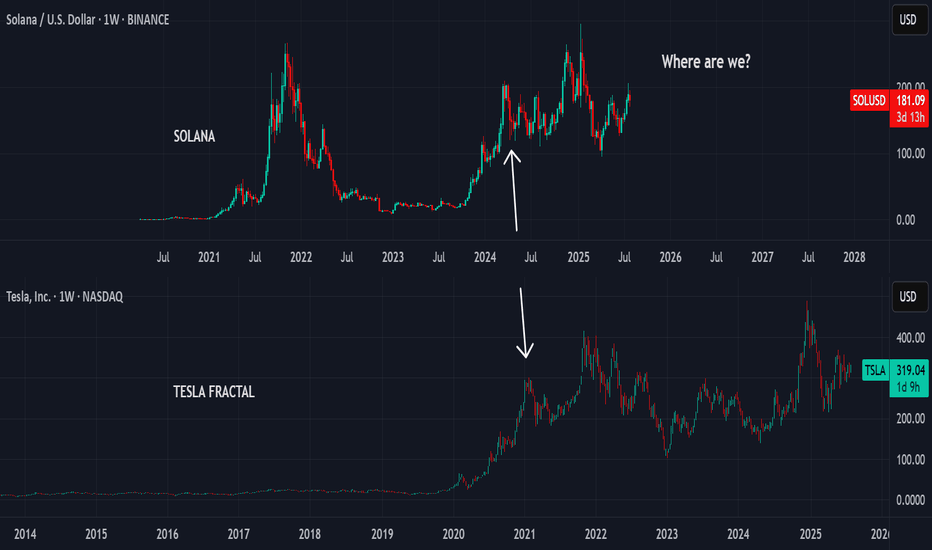

A PICTURE IS WORTH A THOUSAND WORDS.The two charts are only separated by name, both are working out a correlated fractal structure.

The exact position of Solana compared to the Tesla fractal is much elusive. Two possible considerations of current structure in Solana fit equally into the past trend already completed by Tesla

The two possible scenarios are indicated on the chart above,

1. If the 21st July 2025 top in Solana corresponds to the 4th April 2022 point on Tesla, the price action will favourably follow the white line.

2. If the 21st July 2025 top in Solana rather aligns with the 17th July 2022 point on Tesla, then price will likely make a minor correction and move higher as indicated by the gold line.

Please note, the year dates below the lines are not to be considered, the lines are just for illustrations only. Also note that the extent of corrections or expansions in fractals are not necessarily the same, they only share similar structural forms.

Trade safe, good luck

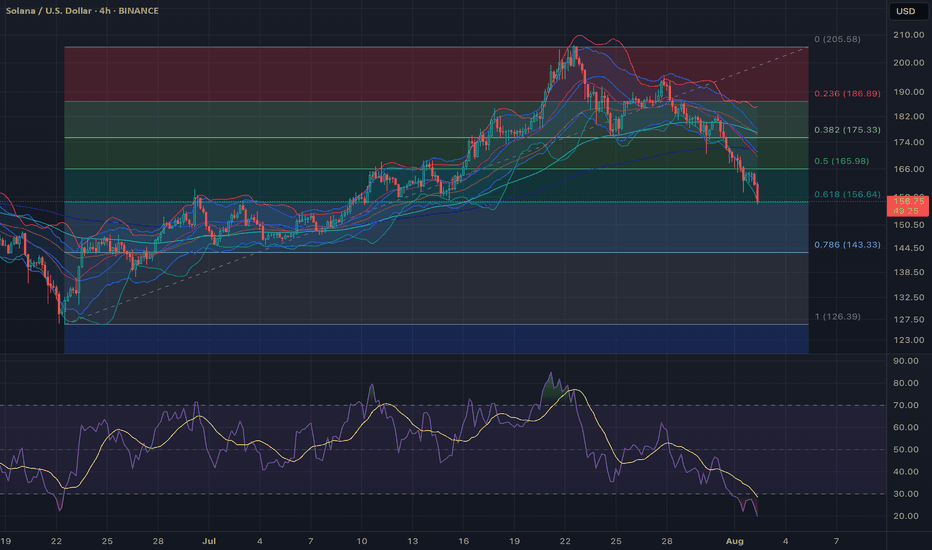

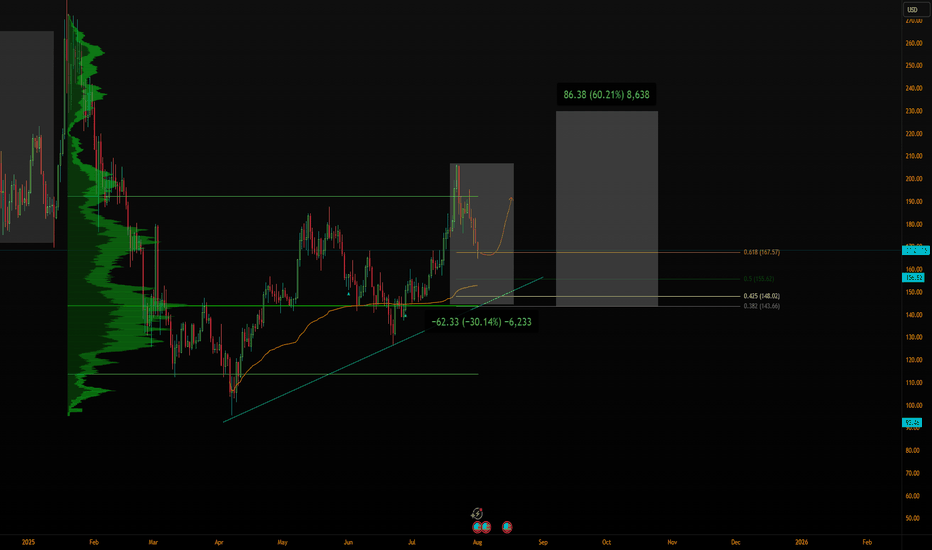

Still bullish in the higher time frames Solana has been struggling to break and stay above $170-200 zone this cycle.

It has been a very difficult asset to trade, however, I can see more bullish setups than bearish setups in higher timeframe charts.

Monthly:

1) July monthly candle closed above Fib 0.618 and formed higher high higher low.

2) RSI and MACD are still in the bull zone.

3) Stochastic are in the bear zone, but they are pointing to the upside.

Weekly:

1) EMA21 is still above EMA55.

2) The current weekly candle is forming bearing engulfing candle, however, there are two more days before it closes. It is still above EMA 21.

3) RSI orange line (RSI based moving average) is moving upwards and entering the bull zone.

4) MACD is about to enter the bull zone.

5) Stochastic hasn't reached overbought territory yet.

6) The set up of these three momentum indicators is very similar to the set up in Oct 23 before Solana started a massive bull trend. (see red vertical line)

Daily:

1) EMA21>EMA55>EMA200

2) As I said in the previous articles, EMA 55 and 200 don't cross easily. But when they do, the price often pulls back significantly before it starts to move in the direction of the trend.

3) Daily candle broke below EMA21, however, the price is reacting strongly to EMA55.

4) The price is still higher high higher low.

I will wait and see if the price is going to bounce off from $143 -157 region. (see blue rectangular block).

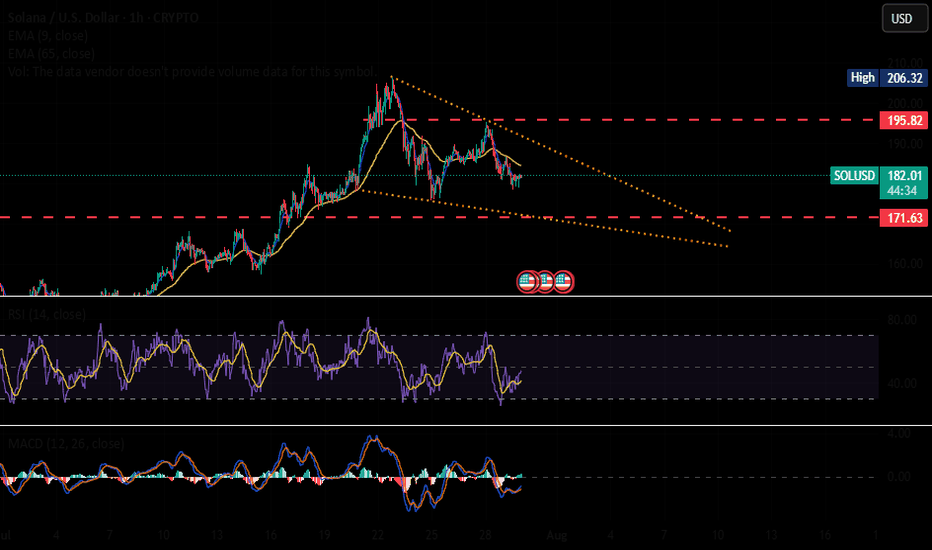

$SOL🚨 CRYPTOCAP:SOL Bullish Flag Forming 🚨

Solana is currently setting up a clean bullish flag pattern. We’re watching the $195 level closely a breakout above that zone could confirm a continuation to the upside.

However, confirmation is key we’ll need to see strong momentum and volume to validate the move.

👀 On the downside, there's liquidity building around $171. If price dips into that zone, we might see buyer activity spike possibly creating a new wave of volatility.

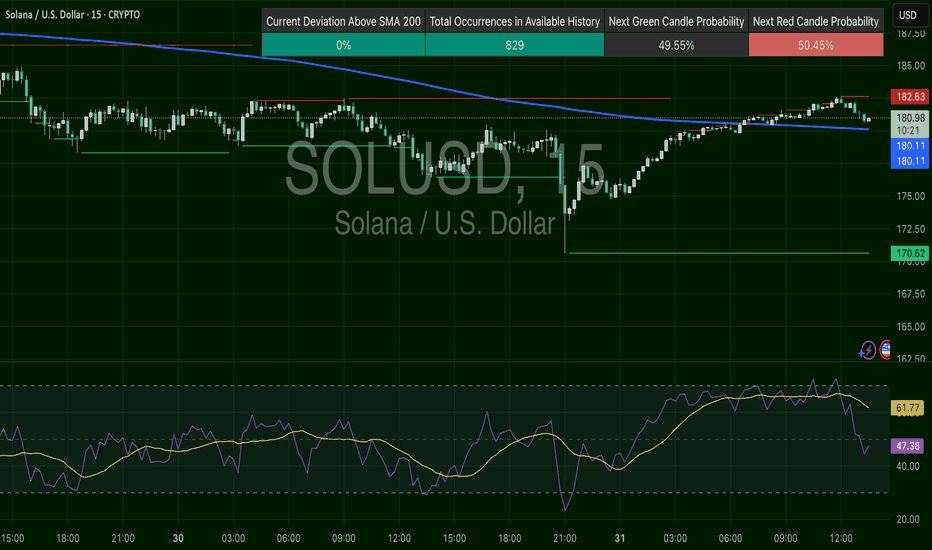

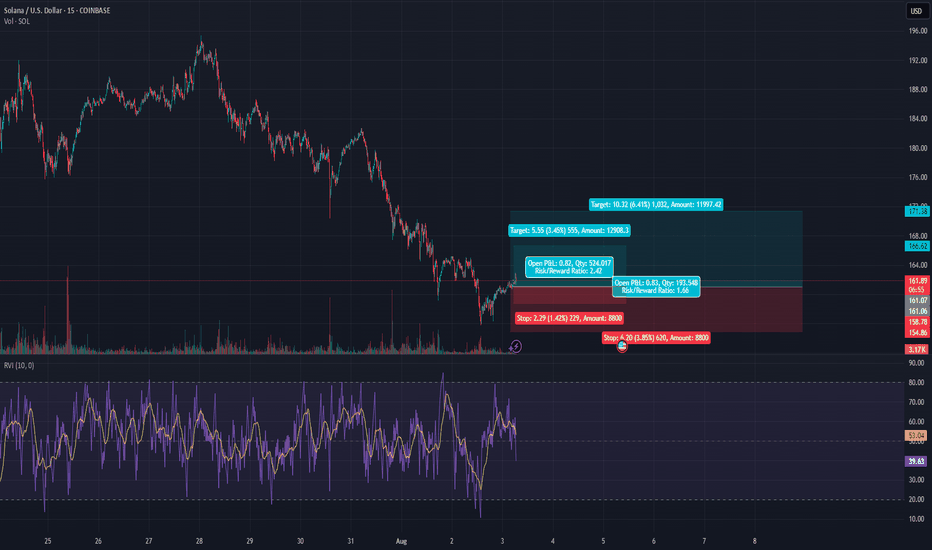

SOL 15m Ready to Rumble? Possible Double Setup!Two decent setups on Solana’s 15m, one bounce play off key support, the other a breakout rip targeting quant resistance.

Setup #1 — Mean Reversion Long:

• Entry: 161 to 162

• Stop: 158.78 (sits on quant S1 = 158.67)

• Target: 166.62

• R/R: 2.4x

This setup rides the bounce from support that matches pivot S1. Confirm with candle wick + volume punch.

Setup #2 — Breakout Continuation:

• Entry: Above 166.62

• Stop: 164 (tight) or 154.86 (sits above quant S2 = 153.41)

• Target 1: 171.38 (just under quant R1 = 172.46)

• Target 2: 180.99 (quant R2 if price rips)

• R/R: 1.6x to 3.4x

Break needs volume. R1 is the battlefield. If we nuke through, R2’s next.

Quant Levels to monitor:

• Support:

S1 = 158.67

S2 = 153.41

• Resistance:

R1 = 172.46

R2 = 180.99

R3 = 186.25

Daily ATR ~11 pts — volatility is favorable

Structure and confluence are clean. Execution depends on price confirmation.

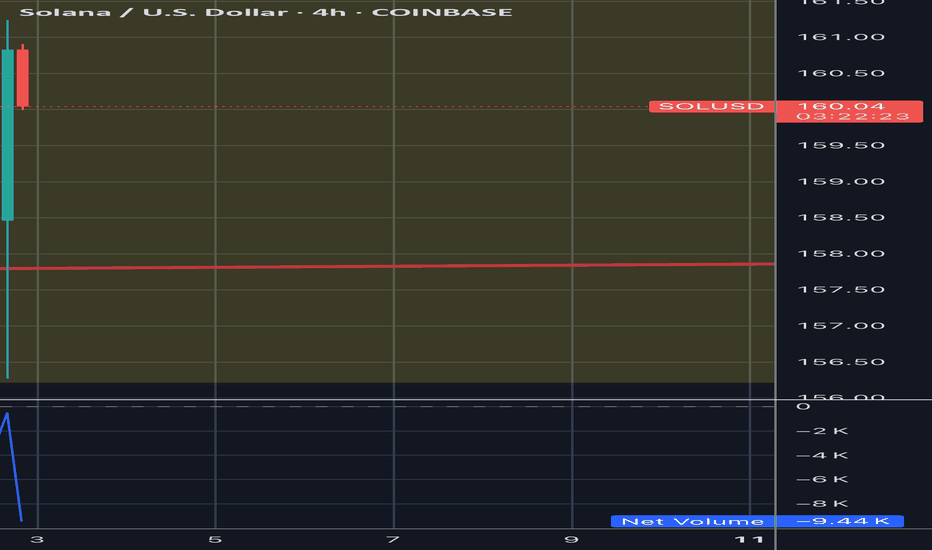

SOLUSD- Has a long-term sport between 155 and 158Technical Analysis by AI

💵 Current Price & Market Context

• SOL trading around $158–$160, down about 2–3% today, still down ~14% from last week’s top near $180+.

🧭 Trend & Momentum

• RSI near 41–47 → not oversold but on the lower side.

• MACD still leaning bearish. Momentum: neutral to slightly bullish across indicators.

🛠️ Support & Resistance

• Immediate support at $160, stronger support at $154.

• Resistance at $172–$176, bigger barrier around $180–$190.

📈 Pattern Behavior

• Still holding an ascending channel, currently sitting near the lower band.

• Failed breakout at $180–$190 means that’s a hard ceiling unless broader market turns bullish.

⸻

✅ Trade Thoughts Based on This

Aspect

Bias Neutral to bearish short-term

Entry Zone Valid? Yes, $156–158 is still solid

Key Level to Watch

$154 — if breaks, downside likely

Upside Potential Target $172–176 short term

Breakout Ceiling $180+ tough without volume/sentiment

⸻

🧭 What You Should Do Now

• You’re in near $156–158 → good spot as long as $154 holds

• If price dips to $154 and bounces: still valid

• If breaks $154: prepare to cut, next support is ~$145

• If price moves above $170: momentum could take it to $176+

• Don’t chase anything. Wait for volume or bounce from support

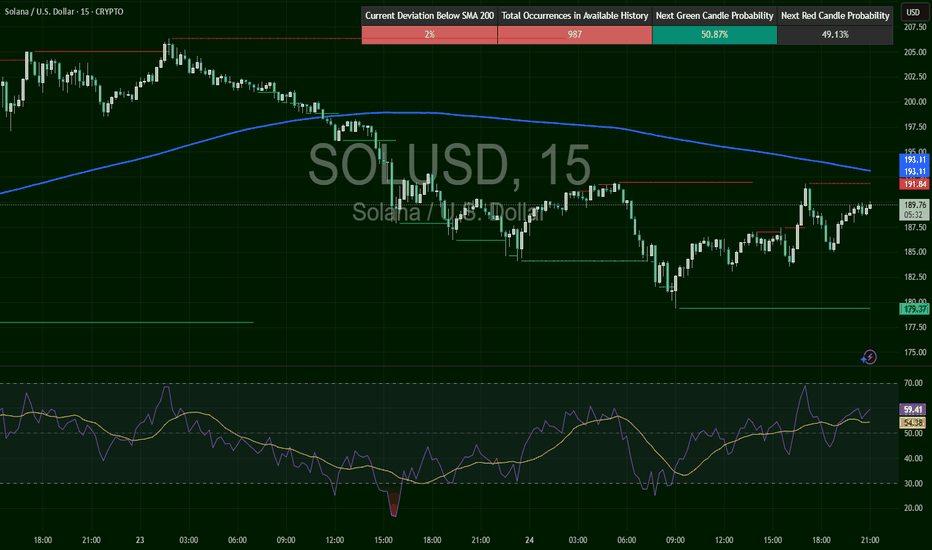

SOLUSD – Recovery Faces Wall at $193SOL broke below $198, hitting a low near $179, confirming the short trigger from the last setup. Since then, it’s building a grind-recovery, reclaiming $189 but stalling at a confluence zone ($191.84 resistance and SMA200 near $193.11). RSI at 59.41 still favors buyers — but SOL needs a clean break above $193+ to shift back into bullish territory.