Solana at Key Resistance Level: $157 Break Could Lead to $174GUYS I WANNA CHAT WITH ALL OF U , IM HERE SINCE 2019 BUT NEED 5 BOOSTS , HELP ME PLZ XD!

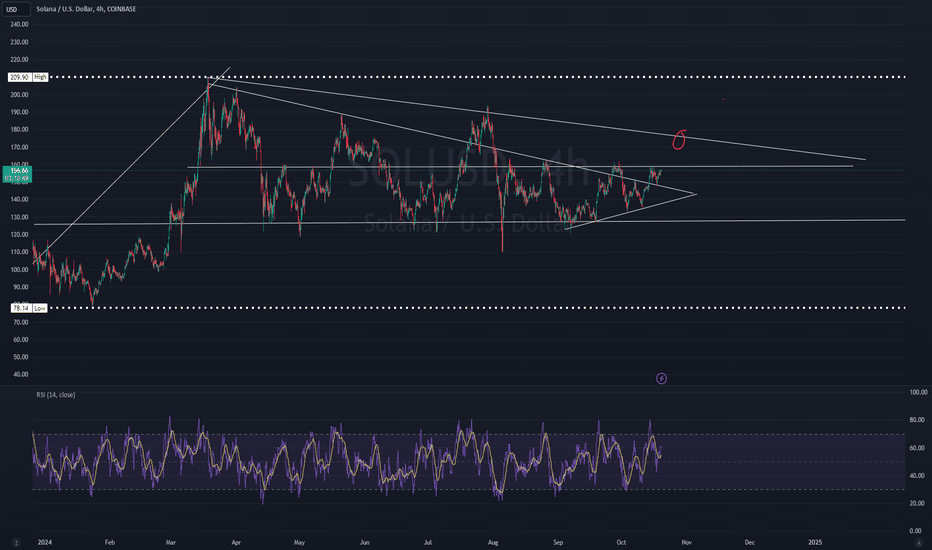

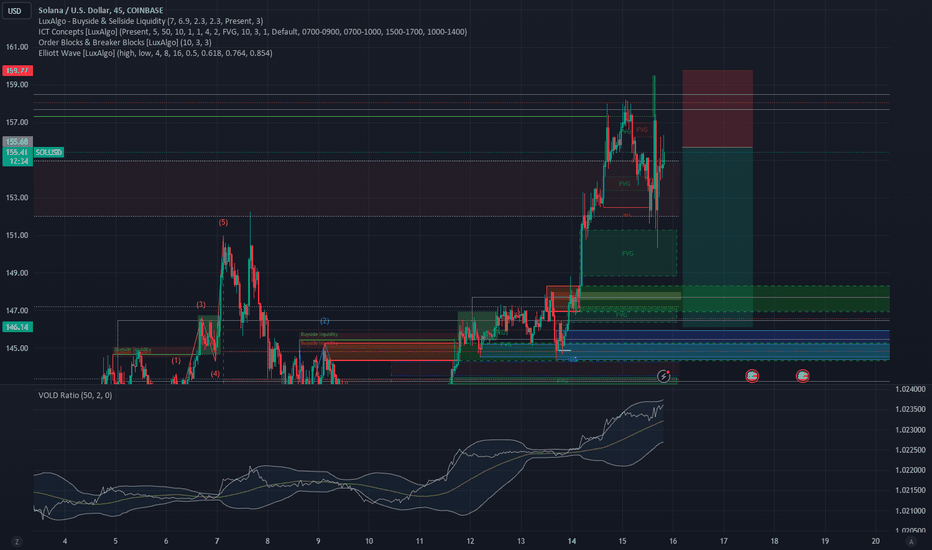

Solana (SOL) is currently trading at a crucial resistance level around $157. This zone has historically acted as a significant barrier for upward momentum. Should SOL manage to break and close above this resistance, we could see a potential rally towards the $174 level, as indicated in the chart analysis.

The price has been steadily climbing, and there are several technical factors to consider:

Momentum: Recent bullish momentum has brought Solana to test this level, with increased buying volume suggesting that traders are eyeing a potential breakout.

Resistance and Support: The $157 resistance level aligns with previous highs, making it a pivotal point to watch. A strong breakout above this level could trigger further bullish momentum, aiming for the $174 region, which represents the next significant resistance zone.

Indicators: Key technical indicators such as the RSI and MACD are showing signs of strength, but they remain in overbought territory, which signals caution. A clear break above $157, accompanied by volume, could invalidate these overbought signals and provide a clearer path to $174.

However, traders should be mindful of the risk of rejection at this resistance, which could lead to a pullback or consolidation before another attempt to break higher.

In conclusion, the $157 level is a critical zone to watch. If Solana breaks and sustains above it, we could see a swift move to $174. Keep an eye on volume and other key indicators to confirm the strength of any potential breakout.

SOLUSD.P trade ideas

The forecasting of SOLUSDThe forecasting of SOLUSD prices is a complex task that involves various factors, including market sentiment, economic indicators, technological developments, and regulatory changes. While there is no guaranteed method to predict future prices, several approaches can provide insights and potential trends:

Fundamental Analysis:

Project Development: Monitor the progress of Solana-based projects and their impact on the ecosystem.

Network Growth: Analyze the growth of the Solana network, including transaction volume, active addresses, and developer activity.

Economic Indicators: Consider macroeconomic factors like inflation, interest rates, and global market trends.

Regulatory Environment: Assess the impact of regulatory changes on the cryptocurrency market, particularly those affecting stablecoins.

Technical Analysis:

Chart Patterns: Identify patterns in historical price data, such as support and resistance levels, trend lines, and chart formations.

Indicators: Use technical indicators like moving averages, relative strength index (RSI), and Bollinger Bands to analyze price trends and potential momentum.

Sentiment Analysis: Gauge market sentiment by monitoring social media discussions, news articles, and investor sentiment surveys.

Machine Learning:

Predictive Models: Develop machine learning models that can analyze historical data and identify patterns to predict future price movements.

Data-Driven Insights: Utilize large datasets to uncover correlations and trends that may not be apparent through traditional analysis.

Expert Opinions:

Industry Insights: Seek insights from experts in the cryptocurrency and blockchain industries who can provide informed opinions and predictions.

Disclaimer:

Market Volatility: The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Past performance is not indicative of future results.

Risk Assessment: Investing in cryptocurrencies involves significant risks, including price volatility, market manipulation, and regulatory uncertainty.

Due Diligence: Conduct thorough research and consider your risk tolerance before making any investment decisions.

It's important to combine multiple approaches and consider the overall context to form a more informed perspective on SOLUSD price forecasting. Additionally, stay updated on the latest news and developments in the Solana ecosystem to make informed decisions.

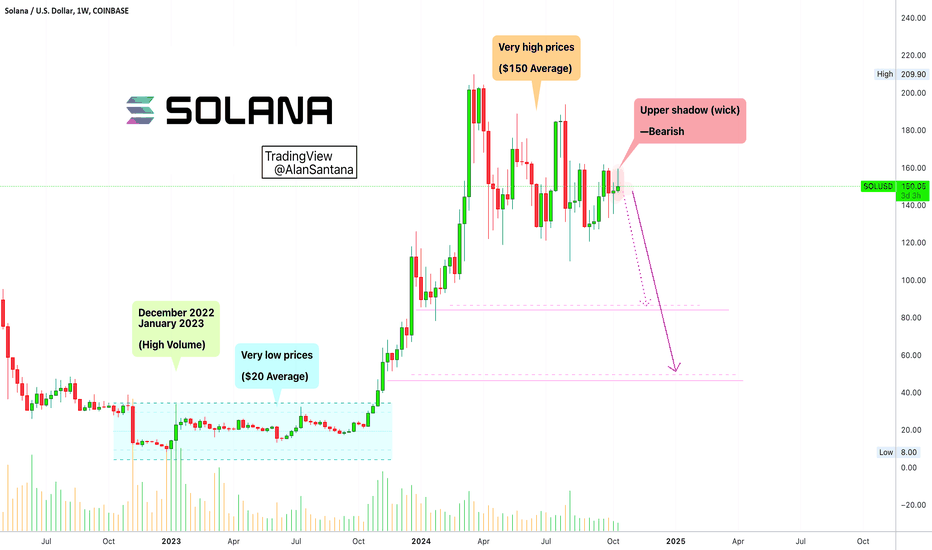

Solana Weekly Turns Bearish From Bullish: 2024 vs 2022The weekly candle for Solana is turning bearish, I shall explain.

This candle, which is marked on the chart and is also the current active session, started full green, as the week developed we can see a long upper wick. This is not what you want to see in a bullish continuation.

In a bullish continuation you want to see either the action happening at the top of the session always, or the session starting red, down, and then recovering and leaving a lower shadow/wick as it moves higher to close the week green.

If this pattern continues, the candle can turn red and thus a major bearish signal.

Taking into consideration the fact that it has now been 7 months of sideways action with bearish tendencies, this is super bad.

Either it breaks up or breaks down.

It can take a while, a long while, as we are seeing here, but two down-burst are already present in April and August. This week turning bearish would only strengthen the bearish bias and signal a new drop.

Now, here is the bad news. Since it has been consolidating for so long, the drop can be super strong.

If you get three weeks sideways, any drop or rise would only have three weeks of consolidation strength. If you get seven months sideways, whatever happens next is a major move...

If you read this through, follow up this trade-idea by reading the PEPEUSDT one that I will publish next. It will be the same dynamics, just so you can see how the entire market is one and how close we are getting to the next drop.

This is the data coming from the chart.

It was so easy to be bullish back in 2023 when prices were low. You can visit my profile and use the search filter and type SOLUSDT. Scroll all the way down until early to mid-2023. You will find dozens if not hundreds of bullish trade-ideas for Solana. Back in those days, it was very easy to be bullish and say, "Solana is going up!" Right now, it is very hard to do so, because the chart is pointing down not up.

Notice how in late December 2022/early January 2023 we have a major bullish signal in the form of super high volume. Then it is easy to say we will see growth because of the strongest buy volume and the low price on the chart.

Look at the chart now, where is the volume?

Where is the momentum?

Where is the excitement?

How high is Solana trading?

Once we hit bottom, there is no other place to go but up.

But once we are at the top, we can only fall down. There is nothing higher than the top.

From the bottom we grow.

From the top, we move back down in order to revisit our experiences, gain wisdom and strength, and then return back up.

Namaste.

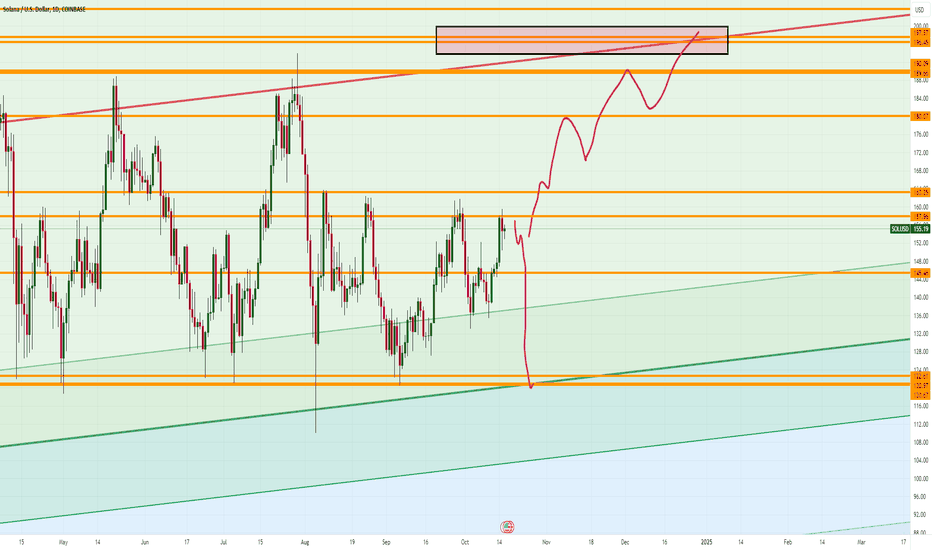

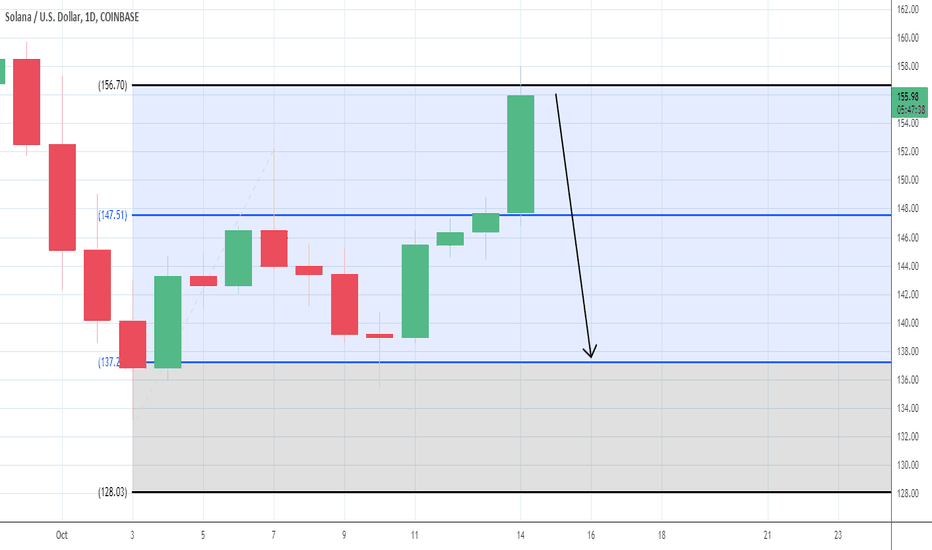

Solana’s Next Move: Will It Break 163 or Drop to 120? Find OutSolana is at a make-or-break moment. If it can push through 163.25, we could be looking at a run up to 189 and beyond—but if it stays under 157, things could get a little dicey, with a drop to 145 and maybe even all the way down to 120.97.

We’ll break down what to watch for and where the next moves might happen. Solana’s either gearing up for a moonshot, or it’s about to take a nap at 120. Either way, we’re here for it!

If this gave you some clarity (or at least a laugh), don’t forget to like, drop a comment, and hit follow for more updates. Because let’s face it—predicting crypto is like trying to guess when the Wi-Fi will suddenly stop working!

Happy Trading

Mindbloome Trader

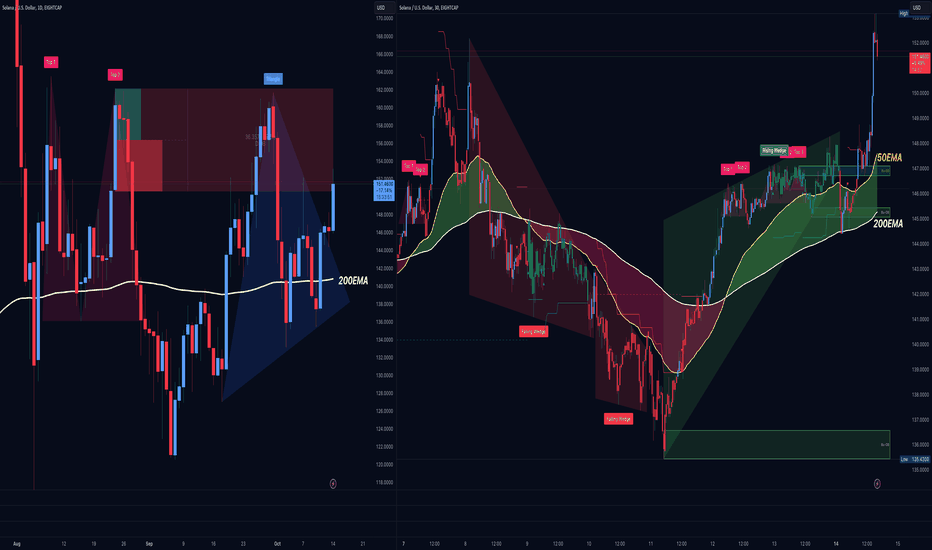

"Uptober" in the Crypto Market Has BegunAlongside BTC, SOL has also rebounded from recent price losses. Is now the time to go long and aim for new all-time highs? In our view: almost. The market remains tricky, and further setbacks are expected, though an overarching upward trend is emerging.

Currently, we see a short- to medium-term short setup for SOLUSD, as indicated in the chart. New opportunities for long entries could arise in the target zone area.

SOLANA SOLUSD Breaks-Out & Leads Cryptocurrency

It was not so long ago that Solana was priced below it's 200EMA on the daily chart.

This changed at the weekend when SOLUSD bullishly exited a Triangle pattern and during Monday Asian session has broken out and up over 4%.

Bitcoin in up about 2% in the Asian Monday session

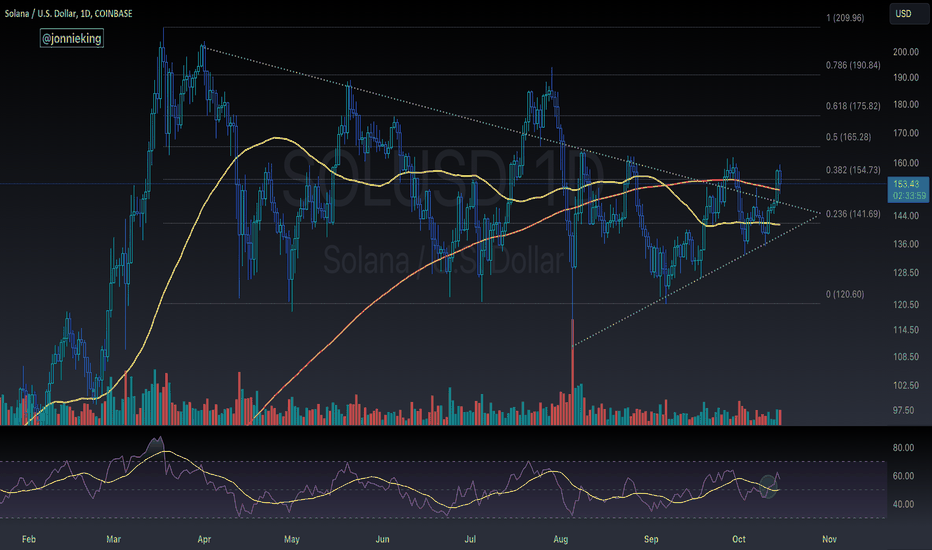

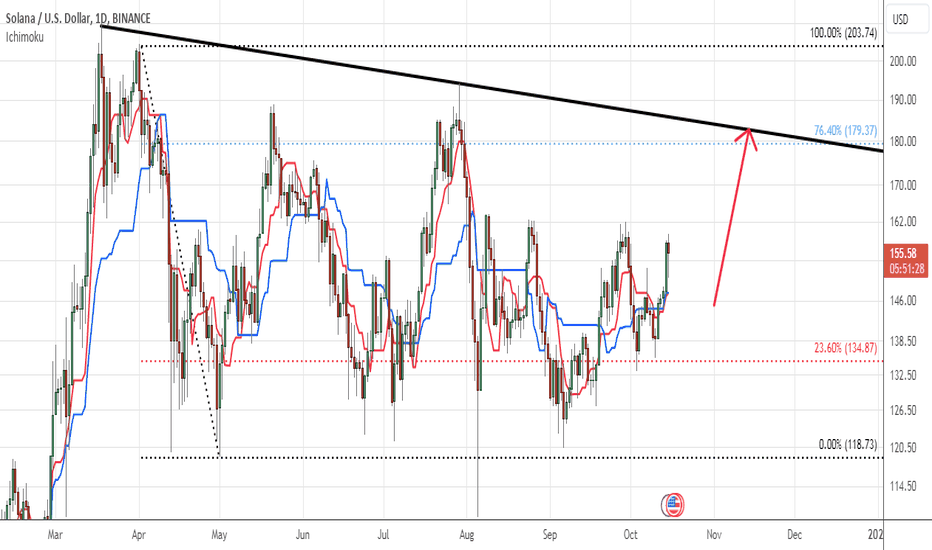

Is Solana (SOL) Ready To Continue Next Rally? Since April-2020 low, SOL:Binance made all time high of $267.52 in November-2021 as (I) impulse sequence. Currently, it favors upside in ((3)) of I after correction of (II) ended at $7.96 low in December-2022 low. It needs to break above November-2021 high to confirm the next bullish sequence.

Since April-2020 low, it placed I of (I) at $61.44 high, II at $19.04 low, III at $221.38 high, IV at $115.45 low & V at $267.52 high. After that it corrected lower in (II) as dip pullback in double correction at $7.96 low in December-2022. Within (II), it placed w at $75.34 low, x at $143.17 high & y at $7.96 low.

Above (II) low, it resumed higher in ((1)) of I, which ended at $210.03 high in March-2024. In ((1)), it placed (1) at $26.78 high, (2) at $12.82 low, (3) at $126.35 high, (4) at $78.87 low & finally (5) at $210.03 high as ((1)). It corrected in ((2)) as zigzag correction, which ended at $109.89 low. Within ((2)), it placed (A) at 118.89 low as 5 swings, (B) at $194.07 high as flat & (C) at $109.89 low as ((2)). The zigzag correction missed the extreme areas before turning higher.

Above ((2)) low, it placed (1) at $163.56 high & (2) at $120.40 low. It is choppy at the moment & need to break above (1) high to confirm the next move higher to be (3) to extend towards $174.84 – $208.07 area or higher levels as nest in (3). We like to buy the next pullback in 3, 7 or 11 swings, once it breaks above ((1)) high, confirming bullish sequence. Alternatively, if it breaks below $109.89 low, it can do double in ((2)) correction against December-2022 low before resume the trend.

SOL's End of Accumulation PhaseSolana keeps on failing to create a bearish momentum below the current range, after applying wave counts it is highly probable that the sideways move has come to an end and we are expecting a very impulsive move up for 3rd wave on the lower degree to proceed the higher degree 5 wave pattern

Solana Approaching Critical Support: Bullish Reversal or DeclineSolana has shown impressive resilience in the crypto market, benefiting from its high scalability and rapid transaction speeds. Now, the price is testing key support levels, which could define the next directional move.

Upside Potential: A bounce from the support around $143.04 could drive SOL higher toward $154.20. A break above this resistance could confirm a strong upward momentum, allowing SOL to push toward the $160 range.

Downside Risk: If SOL fails to hold the current support, a decline toward $138.53 and potentially $135.48 is possible, signaling more downside pressure in the near term.

This is a critical zone for SOL, with both bulls and bears closely monitoring price action for confirmation of the next move.

Happy Trading

Mindbloome Trader

Buy Opportunity on Solana (SOL) at $146 - Target $155Technical analysis suggests that Solana (SOL) is in a strong upward trend, with the price increasing by 6.1% in the last 24 hours, currently trading at $146.25. A buy is recommended at this level, aiming for the next resistance at $155. A stop-loss should be placed at $140 to protect against potential reversals.

This recommendation is supported by strong market momentum and Solana's growing role in decentralized finance (DeFi) and its scalable infrastructure.

SOLUSD Solana The wait is OVER.It is the time to buckle up!

Just like Jan-Sep 2023 Consolidation.

Massive move is in cards.

Targeting $420+, given COINBASE/SEC lawsuit is resolved favorably.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations