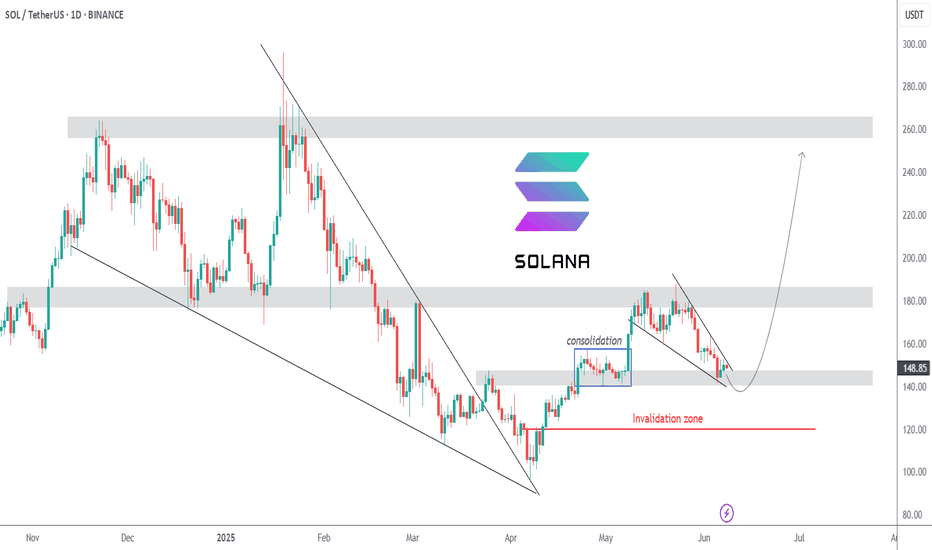

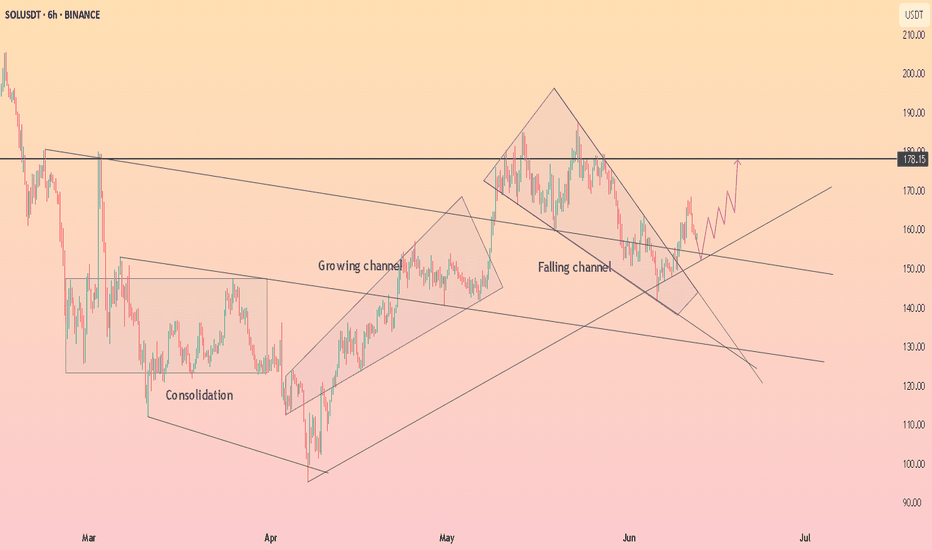

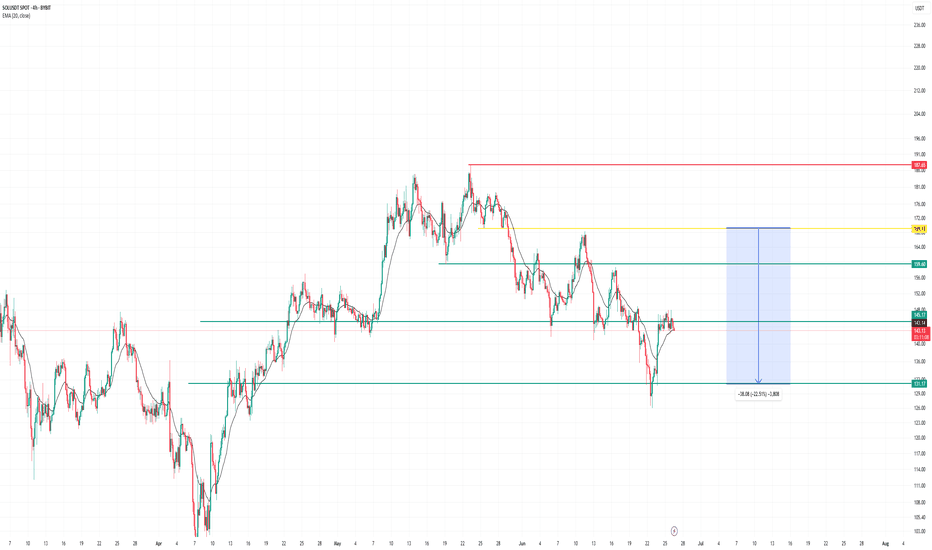

SOLUSDT | The Final Liquidity Hunt | $250 is the Next StopSOLUSDT is currently in an uptrend after recently breaking out of its extended downtrend to $95 which took out millions of long positions. Now, we are seeing yet another extended downtrend on the lower time frame, but the overall direction is still up.

Last week, price action printed two very bullish pinbars at the $155 level which could have been considered support, where price was consolidating around late April. High leverage traders entered here and eventually got liquidated last Friday.

Following the liquidity hunt, price reversed quickly, but not strong enough to reclaim the $155 zone. Many of those who were liquidated likely re-entered on this fast move, thinking that the liquidity hunt is over and price cannot move lower.

I am anticipating one FINAL move down to $140 before the uptrend resumes. This will be the move that takes out the dumb money and where smart money will take their positions. The alternative is that the liquidity hunt never happens, and price breaks out of the falling wedge to resume its uptrend.

What about macro and micro factors?

⚖️ Ripple vs SEC Case

On 8th May, both parties agreed to settle, which ignited a massive market-wide rally. Unfortunately, their filings were rejected due to a procedural issue. The next deadline for refiling is on 16th June. Once accepted, we can expect another massive rally.

🤝 US-China Trade Talks

This week, US and China will meet at the negotiation table again. On 12th May, US & China reached a deal in Geneva and sent markets on another rally. IF (big if) they come to another deal this time, we can expect another rally.

✂️ Fed Rate Cut Expectations

The Fed talked about cutting interest rates in late 2025. They are currently in a "wait and see" stance however, due to uncertainties. Eventually we will see a rate cut, and I believe this would be a "buy the rumor, sell the news" event. Markets will price in the anticipated rate cut before it happens later this year.

Our first price target is $250.

SOLUSDT.3S trade ideas

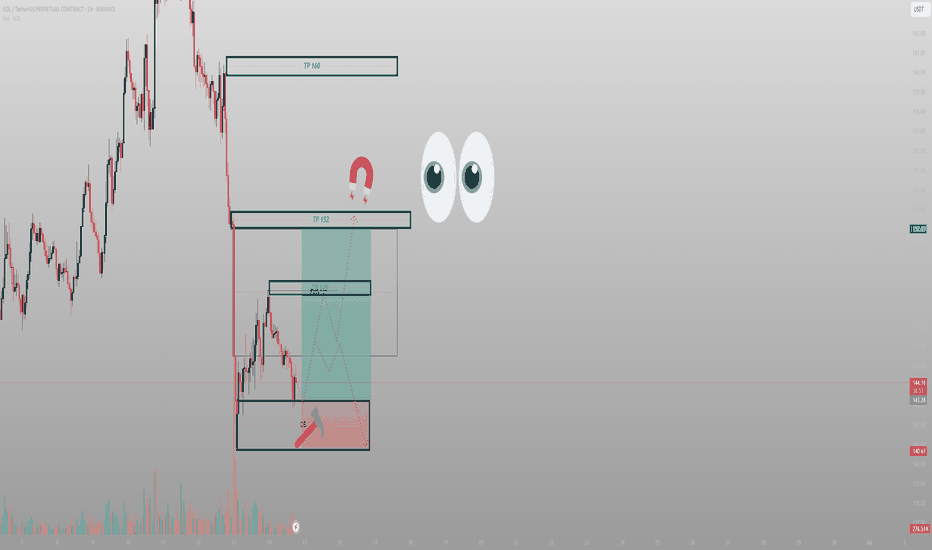

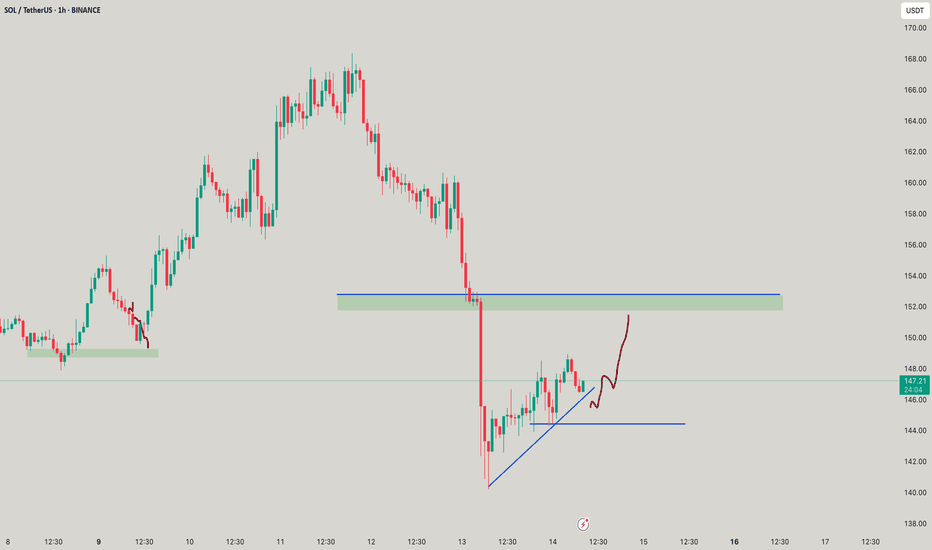

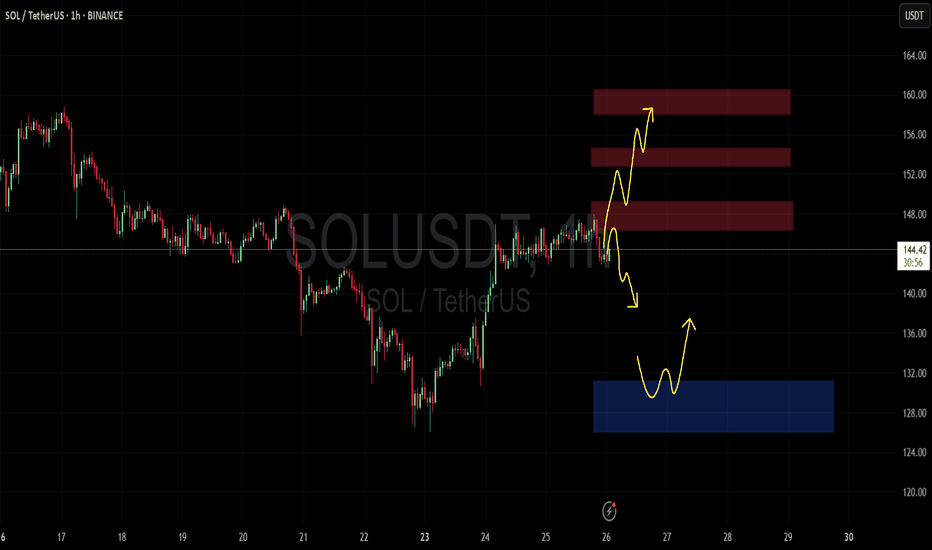

They saw a crash. I saw where the next rally beginsThis isn’t chaos. It’s sequence. SOL sold off into a well-defined 1H OB, paired with a high-volume low. Price didn’t break. It anchored.

The setup:

After an aggressive dump, price settled into an Order Block between 140–143. This isn’t weakness. It’s rebalancing. Right above? A perfect FVG at 149 and inefficiency zones that align with liquidity draws at 152 and 160.

Volume is telling — it spiked into the OB, not on exit. That’s how Smart Money positions.

Expectation:

Accumulation near the OB → quick reversal → reclaim 145

From there, watch price reprice through:

TP1: 149 (FVG reclaim)

TP2: 152 (full inefficiency fill)

TP3: 160 (external liquidity sweep)

Any deeper dip below 140 becomes a deviation — not a breakdown — unless structure is violated with follow-through.

Execution:

Entry: 141–143 zone

SL: Below 139.8

TP1: 149

TP2: 152

Final: 160

This is engineered — not emotional.

Final thought:

“You don’t need to predict the bottom. You just need to know where price is built to return.”

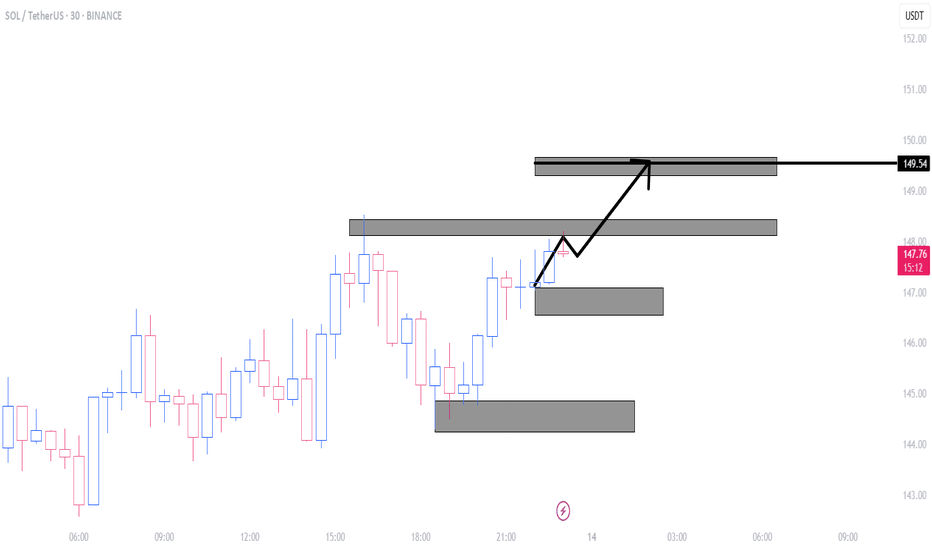

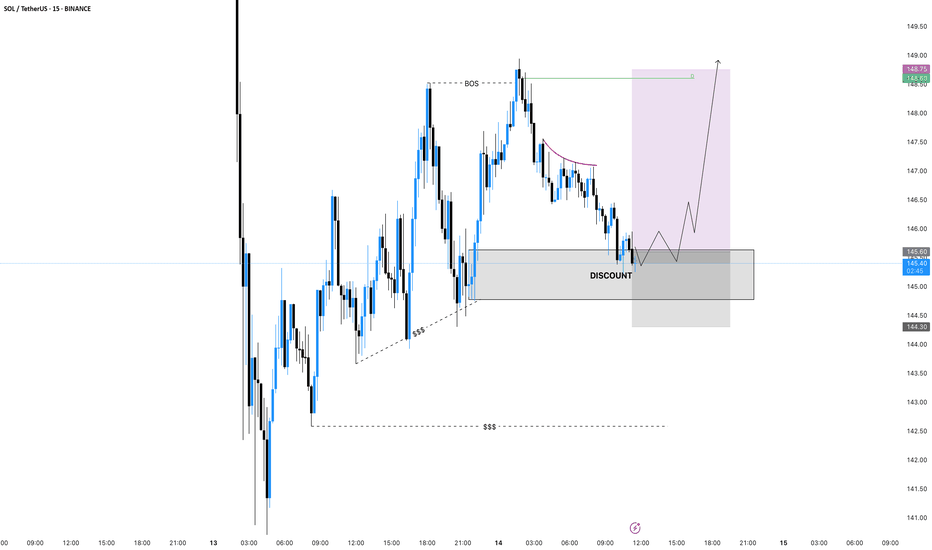

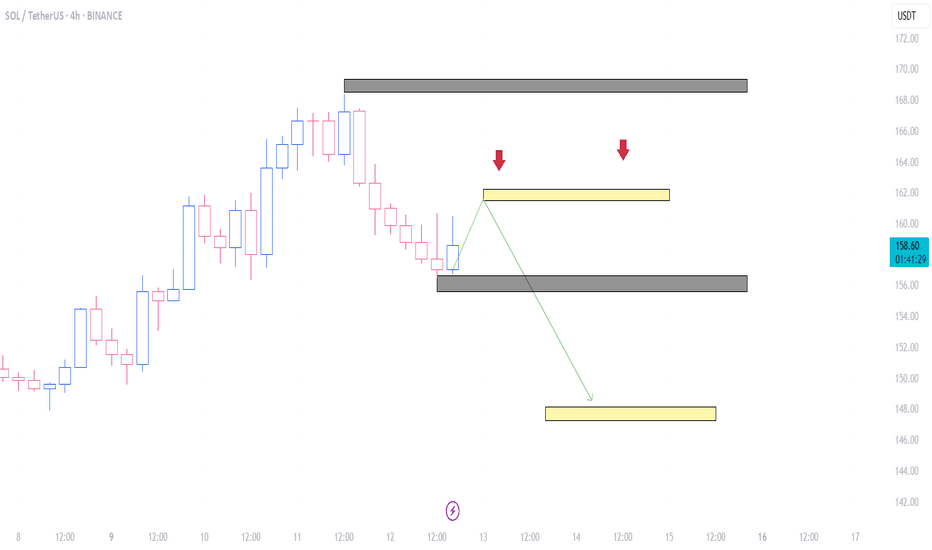

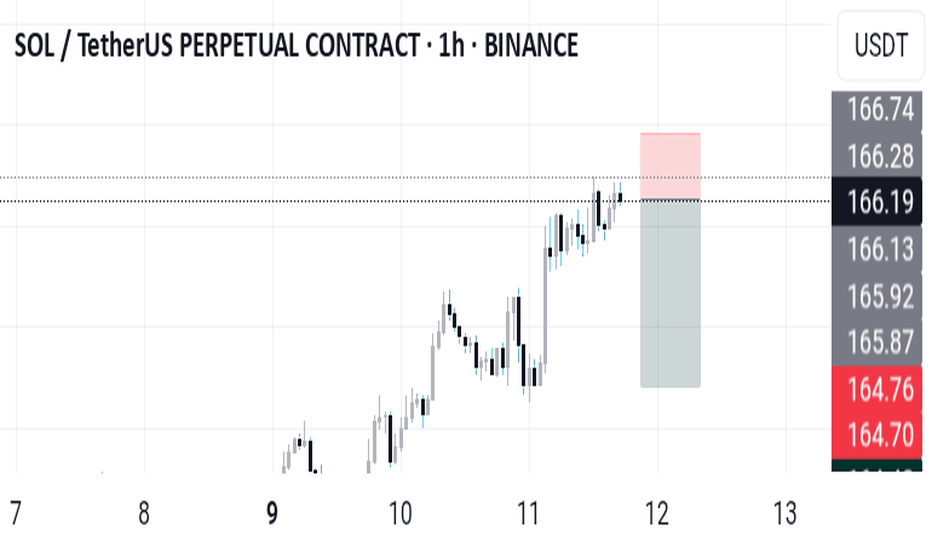

SOLUSDT // 15M // LONGPrice tapped into a previous support zone which is now acting as support & resistance flip, showing early signs of a bullish structure shift.

Just below, a clearly defined Bullish Order Block between ~151.00 and 152.20 is providing institutional demand, which strengthens this zone further.

The current entry sits slightly above this confluence, giving a high-probability long setup.

📈 Expected Price Path: Anticipating a possible liquidity grab, internal pullback inside the grey box, followed by continuation toward target liquidity around 156.00+.

🔹 Entry: 153.23 (Market Execution)

🎯 Take Profit (TP): 156.02

🛑 Stop Loss (SL): 152.22

📊 Risk-Reward Ratio (RRR): ~1:2.53

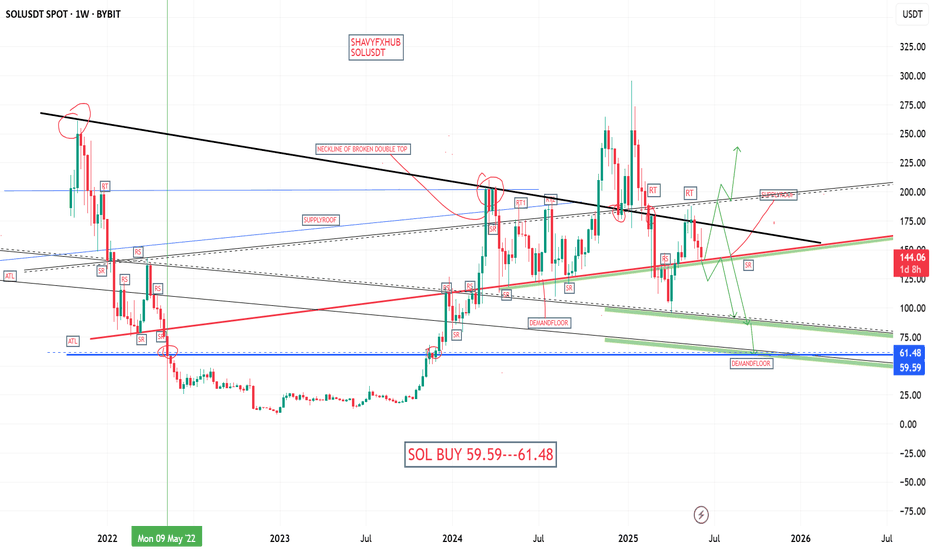

SOLANA SOLANA weekly chart shows lack of interest on the crypto project, with price resting on weekly demand floor awaiting a clear directional bias. If they break and close off that level then solusdt will be trading below 100$ and it will call for bearish reinforcement attracting quick take profit booking from bears.

place your buy order on demand floor @59.59-61

Risk management is key and critical for long term traders

GOODLUCK ON FREE CHART IDEA

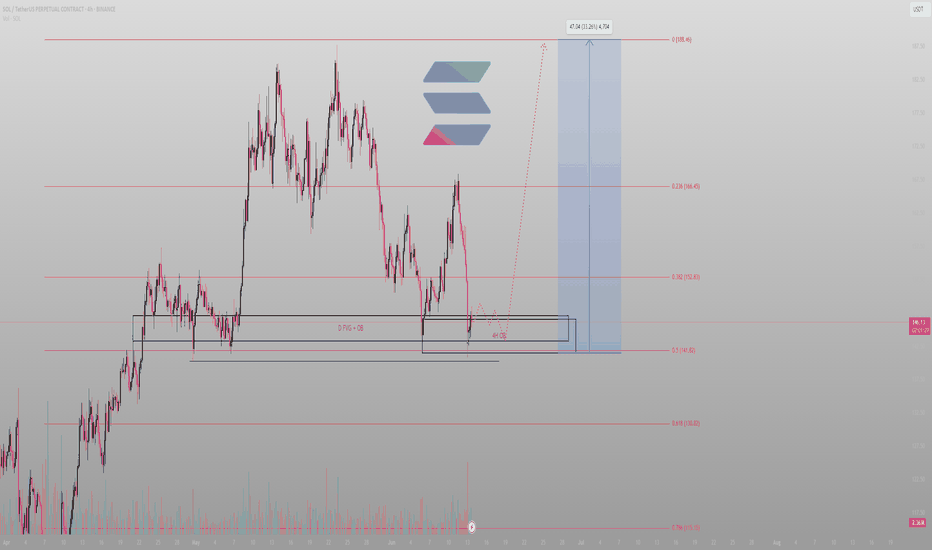

Price returned. I was already waitingThis wasn’t a pullback — it was a reset. And Smart Money doesn’t chase price. It sets traps. This is one of them.

Breakdown:

SOL delivered into a confluence zone where multiple models align:

Daily FVG overlaps perfectly with a 4H Order Block

0.5 fib retracement (141.82) tagging the midpoint of the prior expansion leg

Volatility spike? Engineered. Not reactive.

Retail is shaken. I’m composed. This is the zone you mark before price even gets there — because when it does, you don’t hesitate.

Trade logic:

Entry: 141.8–146.0 (inside D FVG + 4H OB)

SL: Below the 0.618 fib / 130.8 invalidation

TP1: 152.8 (0.382)

TP2: 166.4 (0.236)

Final draw: 188.4 — full inefficiency fill and premium rebalance

This isn’t about hitting every level. It’s about understanding why these levels matter. Structure tells the story. The fib just refines the sentence.

Final words:

“Smart Money doesn’t trade the reaction. It trades the setup that creates it.”

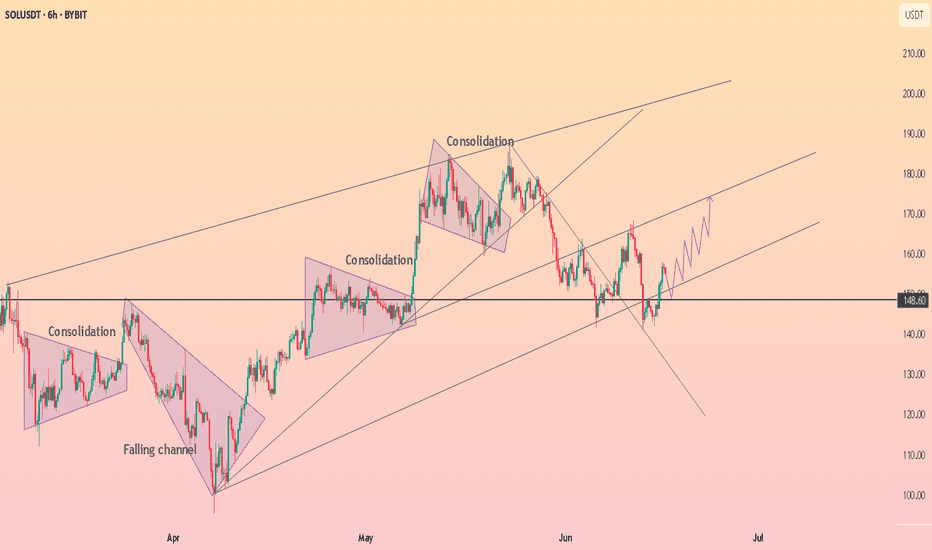

SOL/USDT (Daily Chart), ProjectionsTechnical Analysis – SOL/USDT (Daily Chart)

Projection Pattern: Higher Highs (HH) and Higher Lows (HL)

Indicators: RSI Divergence, Alligator, Support/Resistance Levels

Solana (SOL) is currently in the early phase of a bullish structure, characterized by a Higher High (HH) and Higher Low (HL) sequence. This indicates a potential trend reversal from the previous bearish cycle to a bullish trend.

Key Observations:

HH-HL Structure:

The market printed a Higher High followed by a Higher Low, indicating buyers are gradually gaining control. The current price action suggests a probable continuation to the upside if the next impulse breaks above recent highs.

Buy Stop:

A breakout trade is anticipated if SOL breaks above the Buy Stop level (approximately $156–158), aligned with Alligator indicator resistance and horizontal resistance.

Stop Loss:

Positioned just below the HL zone near $144, offering protection if the bullish breakout fails.

Take Profit (TP1):

The first target is projected near $187.71, which aligns with a historical resistance zone and the next significant swing high.

Indicators:

RSI (Relative Strength Index):

The RSI is currently at 38.05, recovering from a previously oversold region. There are several bullish divergences marked earlier in the year, which preceded major upswings. The latest bullish setup may follow suit if the RSI continues upward.

Alligator Indicator:

The Alligator lines are converging, suggesting a potential breakout phase as market momentum consolidates. A clear expansion of the green (lips), red (teeth), and blue (jaw) lines will confirm trend direction.

Conclusion:

The chart sets up a bullish continuation scenario, contingent on a breakout above the buy stop zone (~$158). If confirmed, the price may rally toward the $187 level. However, a close below $144 would invalidate this setup, suggesting a reevaluation of market sentiment.

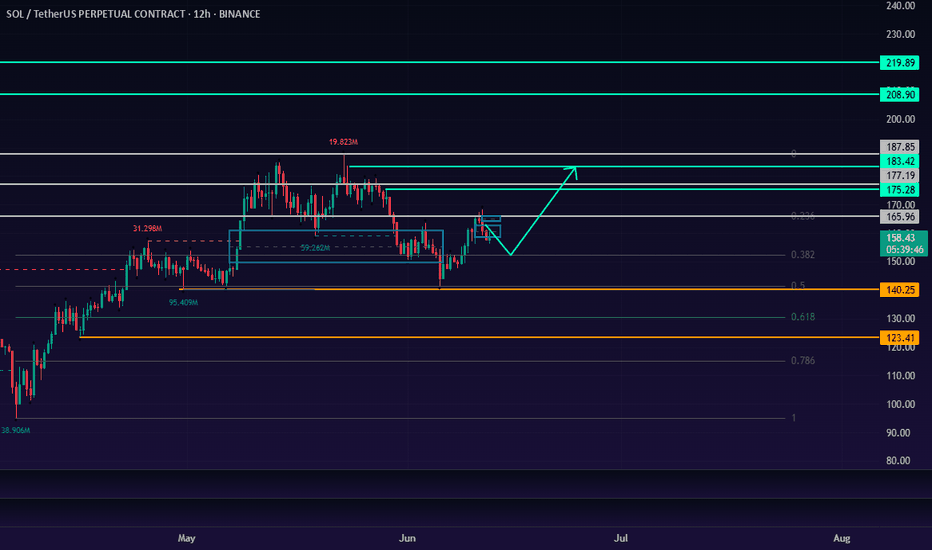

SOL 1D. Price Action Suggests a Bullish Move. 12/06/25BINANCE:SOLUSDT

The current price action looks bullish, and it's likely we’ll see a push toward the $170–$180 range without major pullbacks. I’ve outlined a potential path on the chart reflecting short-term expectations.

However, if the broader market experiences a correction, there's no reason we couldn't see a retracement to the 0.5–0.618 Fibonacci levels. For that reason, it's wise to have limit orders set just in case.

Entry Points (EP):

• Market

• $140.25

• $123.41

Take Profit (TP):

• $175.28

• $183.42

• $208.90

⚠️ This is not financial advice. Just my personal outlook based on current structure.

Please do your own research and remember: your decisions are your responsibility.

Stick to your risk management plan, and never risk more than 2% of your portfolio per trade.

Wishing everyone green candles and solid gains!

DYOR.

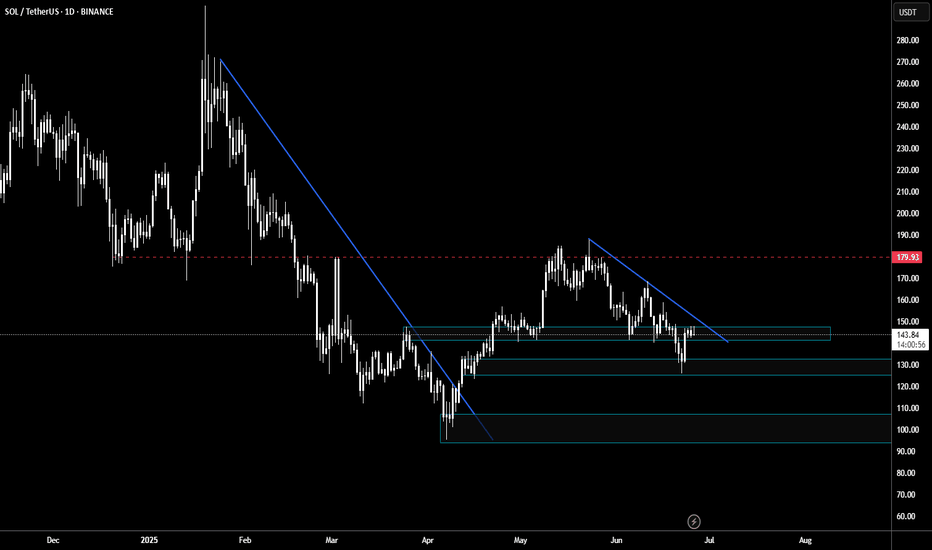

$SOL - Ready for a STRONG Comeback to $300!Throughout 2024 Solana has been moving within the Massive Ascending Channel . It does these days too.

Recently, back in March 2025, there was a fake breakdown of the channel's ascending support. It ended up with a strong pullback above the line. Moreover, the descending trend line that was initially formed in February 2024 was also broken upwards.

Signs of strong bullish volumes.

At the moment the price is consolidating above the EMA500 of 1D chart (EMA70 of 1W) , just as it did back in November 2023 before the famous x7 rally from $30 to $210.

Breakout of the 0.382 lvl by Fibo will mark the beginning of a new rally upwards. Target for this upward movement on CRYPTOCAP:SOL is $320 , must be reached in 2025.

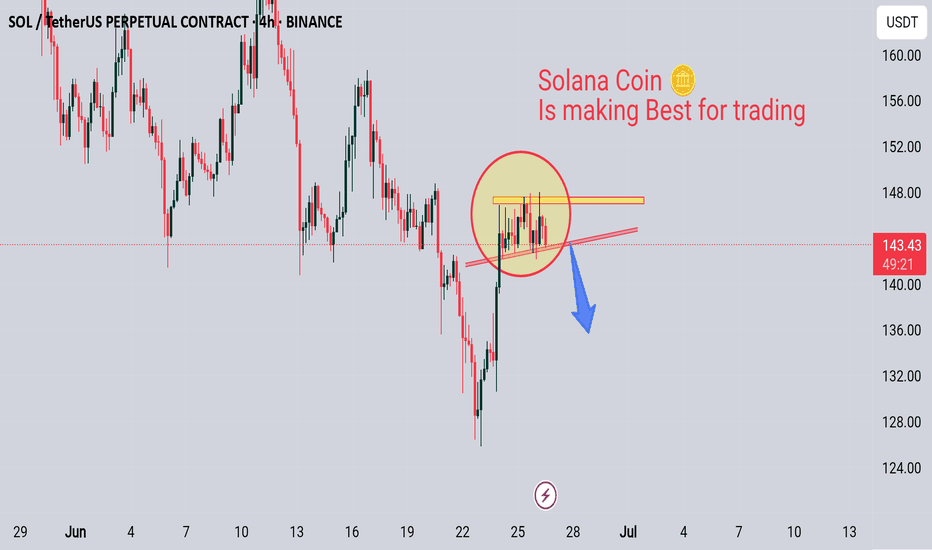

#SOL/USDTSOLANA →

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 142, acting as strong support from which the price can rebound.

Entry price: 144

First target: 146

Second target: 149

Third target: 152

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

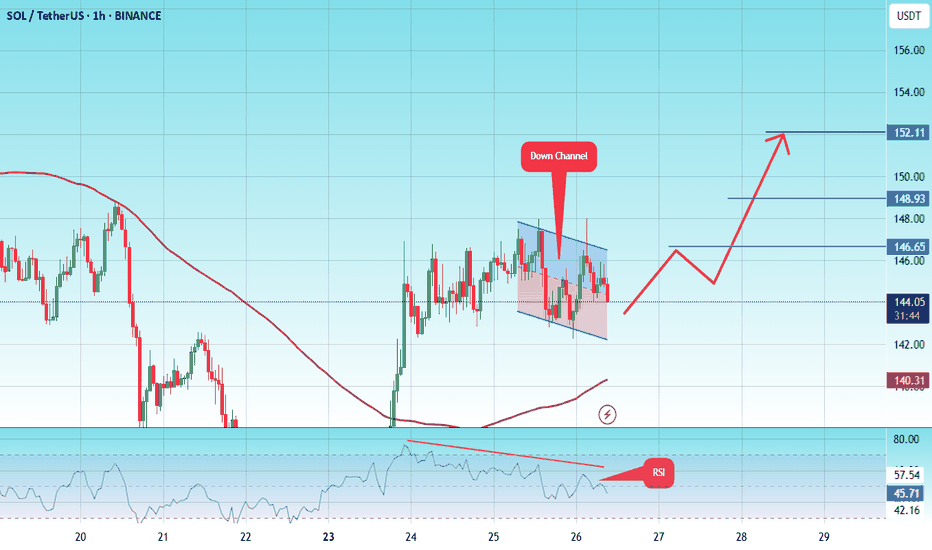

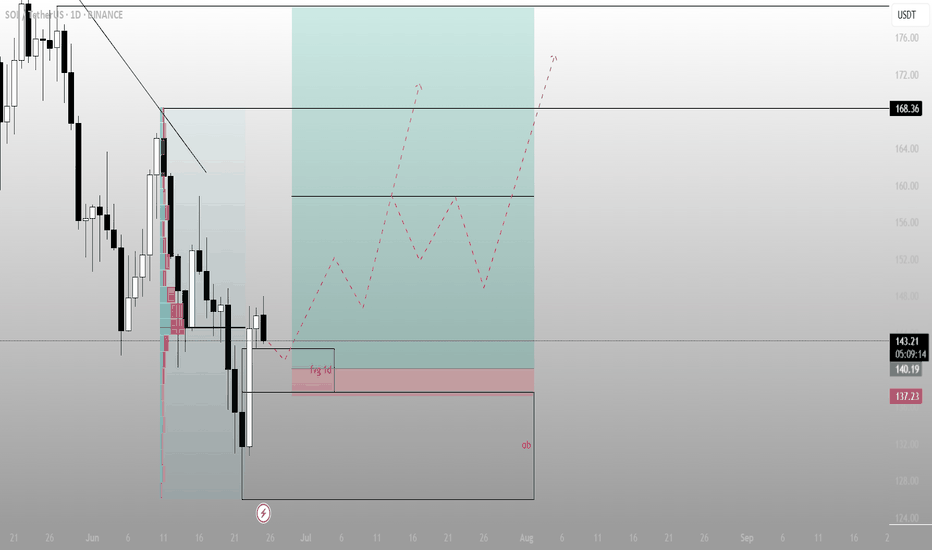

Most see rejection. I see a launchpadWhat looks like a failed breakout is actually SOL setting up for a higher timeframe reversal, right at a refined zone of inefficiency and Smart Money interest. The narrative isn’t over — it’s just beginning.

Technical Breakdown:

Current Price: ~$143.30

Context:

Price tagged the Fair Value Gap (FVG) on the daily and showed reaction — a sign of algorithmic awareness

Volume profile suggests thin liquidity above, ripe for expansion if momentum kicks in

Key Levels:

FVG (1D) zone: just under current price (~140.19)

Order Block (OB): ultimate demand zone near 137.23 — strong structural support

Downtrend Line: recently broken, retest in motion

Major Upside Target: 168.36 — a clean liquidity magnet

Strategic Thesis:

Price dipped into FVG but held above the OB — a classic Smart Money accumulation setup

The dashed projection shows potential higher lows forming, giving fuel for a push through prior highs

FVG + OB form the discount zone, where risk/reward is maximized before the next impulse move

Execution Plan:

Entry zone: $140.00–137.50

→ Expect small shakeouts before confirmation

Invalidation: Daily close below $136 kills the bullish case

Target:

Primary: $168.36

Stretch Goal: $172–176 if momentum is sustained into August