SOLUSDT.3S trade ideas

Long trade

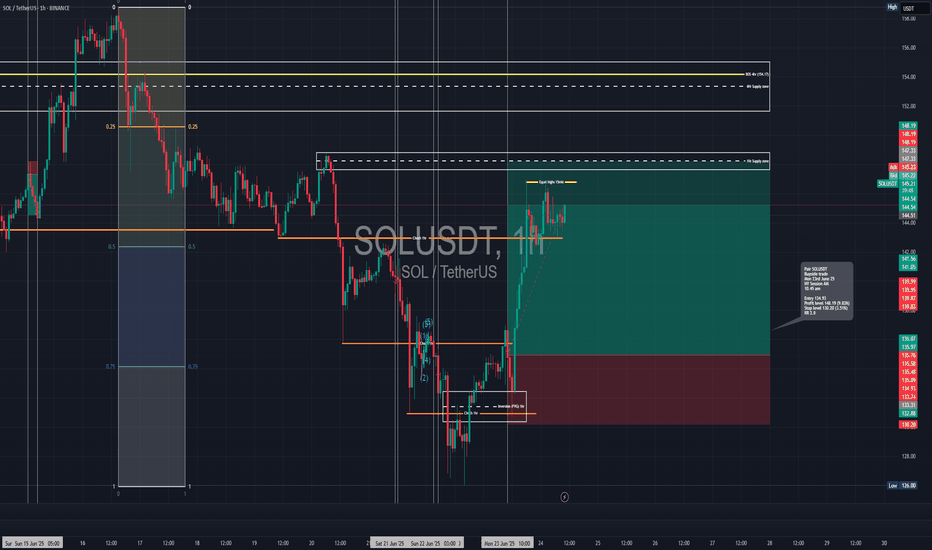

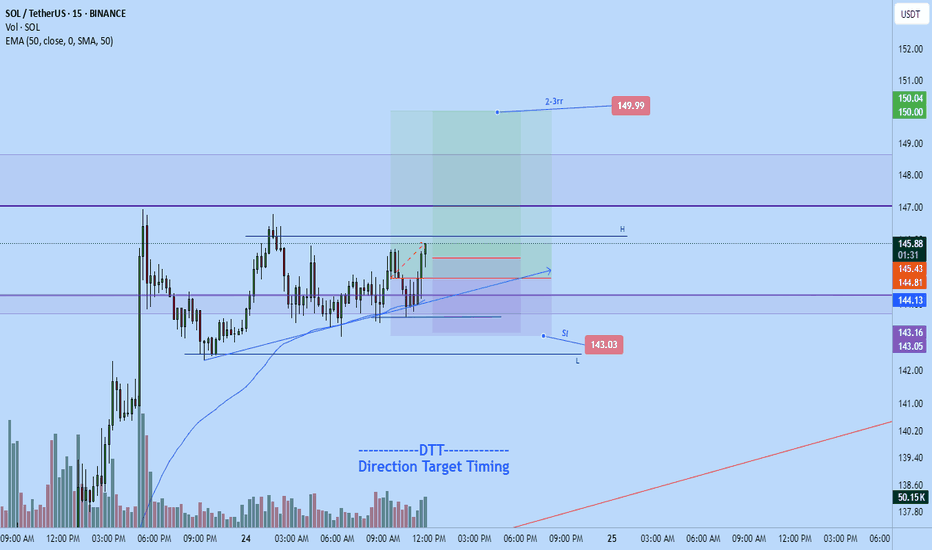

🟢 Trade Journal Entry – Buyside Trade

📍 Pair: SOLUSDT

📅 Date: Monday, June 23, 2025

🕒 Time: 10:45 AM (NY Session AM)

⏱ Time Frame: Not specified (assumed 4Hr or intraday swing)

📈 Direction: Buyside

📊 Trade Breakdown:

Metric Value

Entry Price 134.93

Profit Level 148.19 (+9.83%)

Stop Loss 130.20 (−3.51%)

Risk-Reward

Ratio 2.80 1

🧠 Context / Trade Notes:

Range Expansion Setup:

4H Demand Tap / Rejection:

Price respected a previously unmitigated bullish OB near $130 before printing consecutive higher lows.

Volume Increase + Session Alignment:

The NY session entry coincided with a volume surge and expansion candle, indicating breakout momentum.

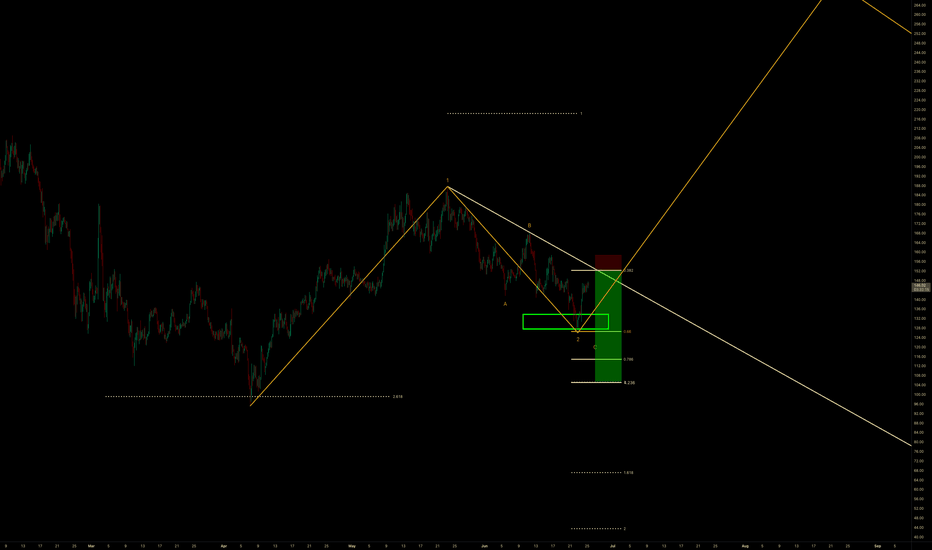

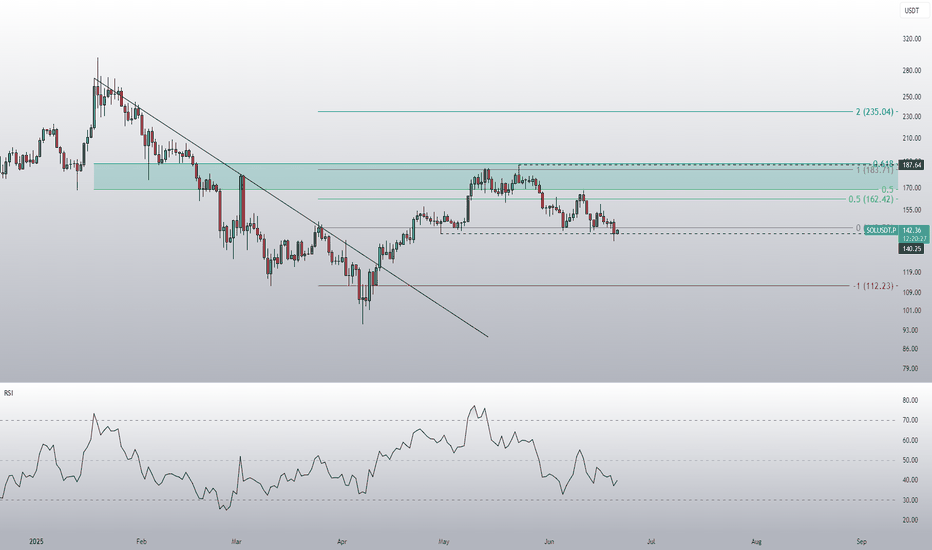

SOLUSDT | T.A.P.E. Method Breakdown: Has Solana Bottomed Or Not?Let’s walk through the T.A.P.E. Method I use to read every chart. This isn’t about price alone — it’s about structure, behavior, pressure, and clarity. Solana is at a critical decision point. I’ll explain what smart money is likely seeing, and how I’m approaching this chart with logic — not guesses.

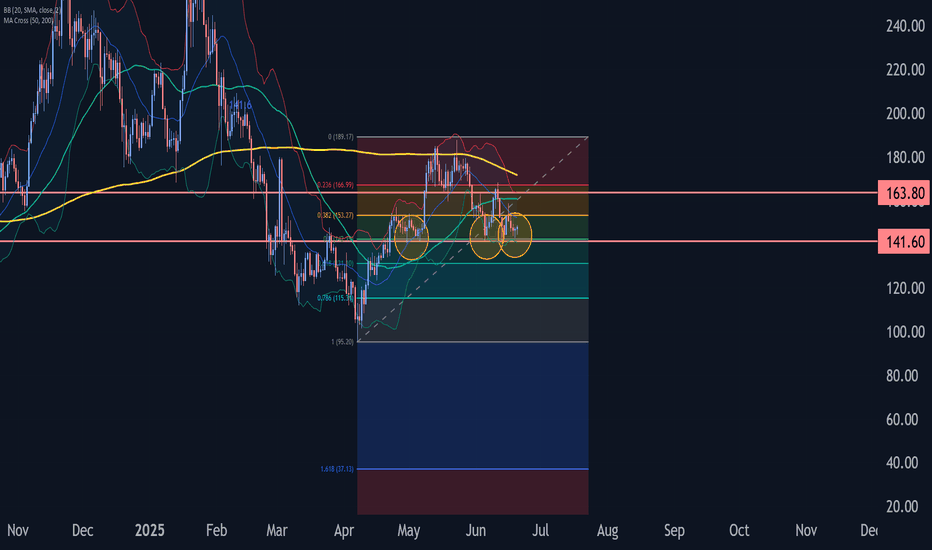

T — Territory (Know the Zone Before You Clone)

I started with the Fibonacci retracement from the all-time low to all-time high. It’s clear SOL is reacting near the golden pocket zone — a historically strong area for reversals.

We also saw strong support at the 2618 extension after the first major leg down. This alone gave an 87% rally. That’s how clean setups work — clarity beats complexity.

Market structure remains bullish on higher timeframes. Yes, we’ve had a wick below prior lows, but no clean break — structure still holds for now.

A — Activity (Price Behavior Over Indicators)

I don’t use RSI or crossovers. I look at behavior.

From the local low to the swing high, the retracement again held the 618 zone, showing buyer defense.

However, on a second leg down, SOL broke below the 2618 level — a key difference. This shift in behavior is what I’m watching closely. Price pushed past 236 on the retrace — that can hint at a stronger bullish leg forming.

But...

P — Pressure (Pain Points and Traps)

Here’s where most traders get caught.

Early longs that entered during the last local rally are underwater. Especially those who bought around the value area high — they are likely hoping to exit break-even, adding sell pressure.

This is classic: a liquidity zone stacked with pain.

That pressure zone sits just above the current range, near $153–$164. If we get a strong move into that zone without structure, I’ll be watching for short setups — not breakouts.

E — Execution (No Setup Is Complete Without a Plan)

Here’s how I’m structuring it:

No-trade zone: Where we are now. No edge here.

Short area 1: $153 — trendline + resistance

Short area 2: $164 — invalidation just above

Target: Sweep lows + retest $138/$128

Invalidation: Clean breakout above $164 with structure

Support zones to watch:

$138 (value area low)

$128 (786 Fib)

$122 (old structure pivot)

If price forms structure and pushes through the golden pocket cleanly, then I shift bias. But for now — pressure remains to the downside.

Summary & Context:

This T.A.P.E. breakdown keeps me from chasing noise and protects capital. Too many early longs, weak structure, and clean resistance zones make this a potential short setup — not a long.

If price flips those resistance zones into support with structure, I’ll adapt. Until then: Plan the move. Let the market prove.

Disclaimer:

This is not financial advice. All opinions are my own, based on chart behavior and analysis. Do your own research. This is a paper money breakdown shared for educational purposes only.

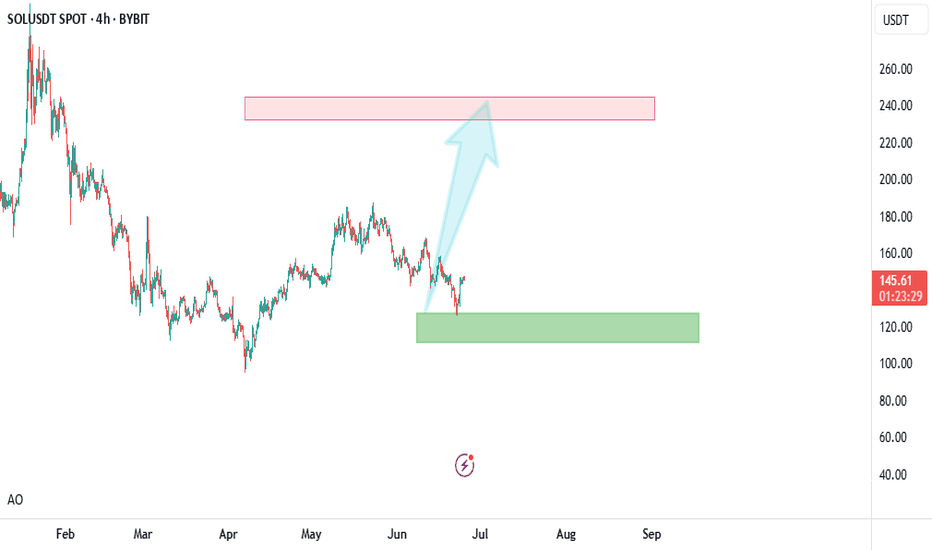

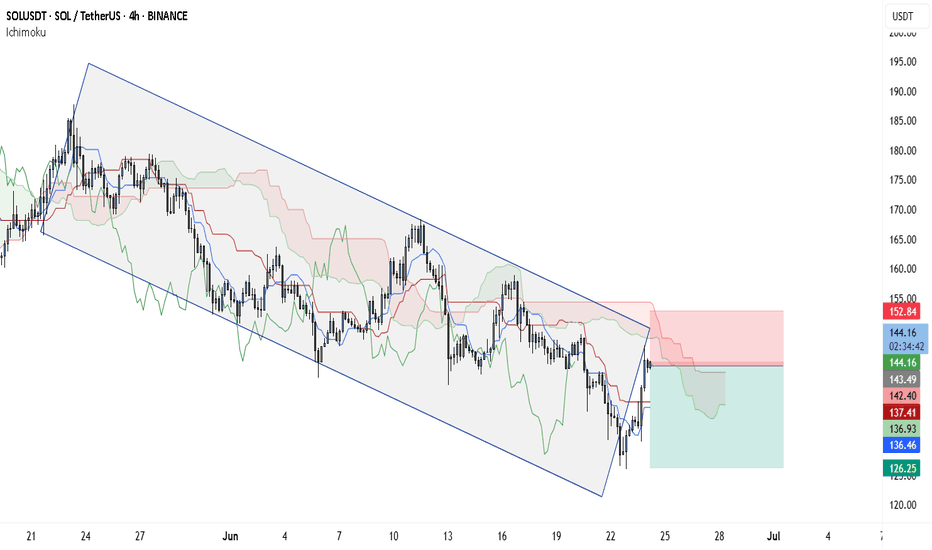

Bearish Breakdown Alert: SOL Eyes $136.46 — Is $126.25 Next?The current SOLUSDT 4-hour chart reflects a strong bearish trend structure, supported by the price consistently respecting a descending channel. This channel has been intact for several weeks, and recent price action shows Solana approaching the upper boundary of this channel once again. Historically, this has acted as a sell zone, and unless there is a confirmed breakout, it remains a high-probability short setup.

Adding to the bearish sentiment is the Ichimoku Cloud. Price is currently trading beneath the cloud, and the cloud itself is shaded red and expanding, signaling ongoing bearish pressure. The Tenkan-sen (conversion line) has just crossed slightly above the price, but the Kijun-sen (base line) sits just above current levels, offering resistance. Most importantly, the Chikou Span (lagging line) is still below both the price and the cloud, which reinforces the idea that momentum remains on the downside.

Within this structure, a clean trade setup emerges:

• Entry: Around $143.87 (Kijun-sen + upper channel area)

• Stop Loss: $152.84 (above the cloud + upper trendline)

• Take Profit 1: $136.46 (mid-channel + local support)

• Take Profit 2: $126.25 (channel bottom)

Given the overall confluence of the bearish channel and Ichimoku resistance, any rejection from the $143–$144 area would support continuation toward the lower bounds of the trend. As always, watch for a strong bearish candle or wick rejection before entering to improve timing.

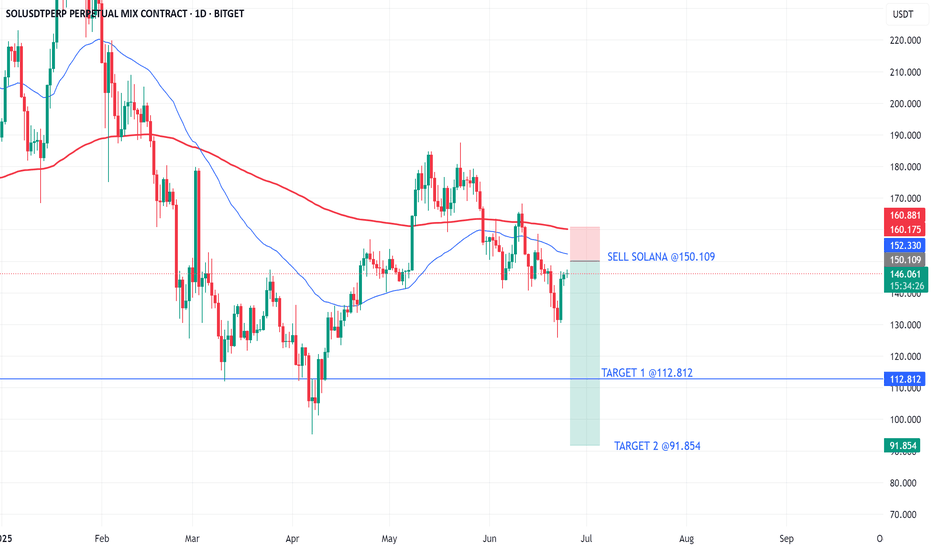

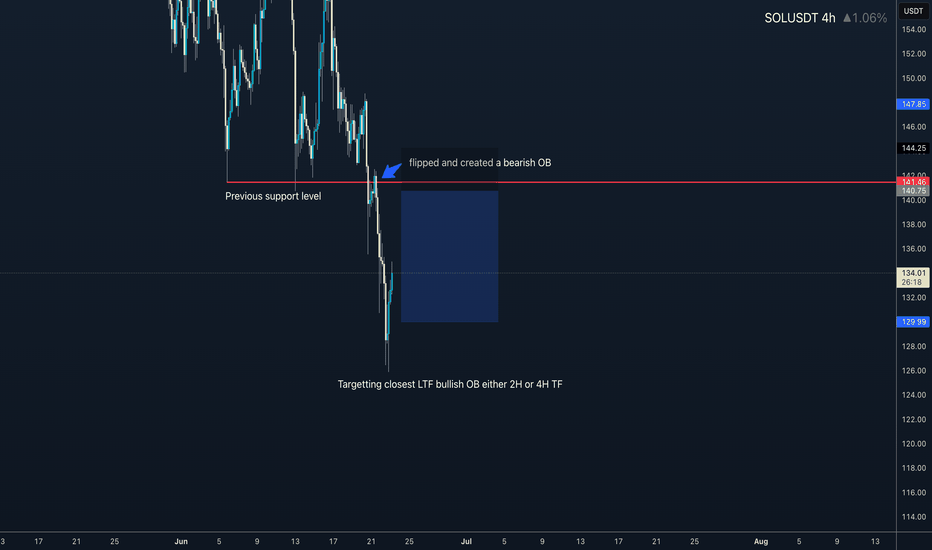

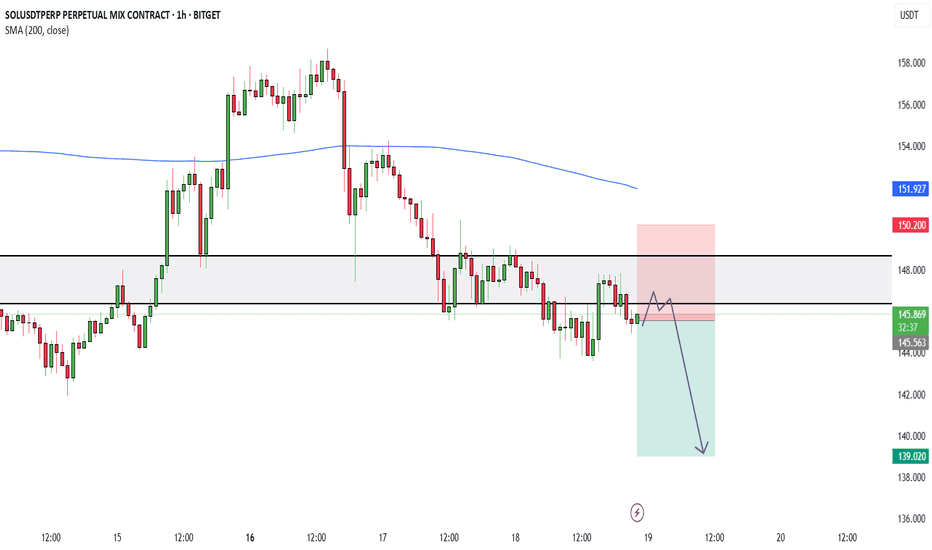

SOLANA SHORT We're going lowerFrom the chart is is clearly visible that we're going lower.

Solana has confirmed the move downside by closing couple HTF candles below the previous support hence gave the confirmation of bearish bias.

I've identified an area to SHORT as visible on the chart. Why? It is a zone where the PA filled the support and created a 4H bearish OB.

GOODLUCK and do not overtrade.

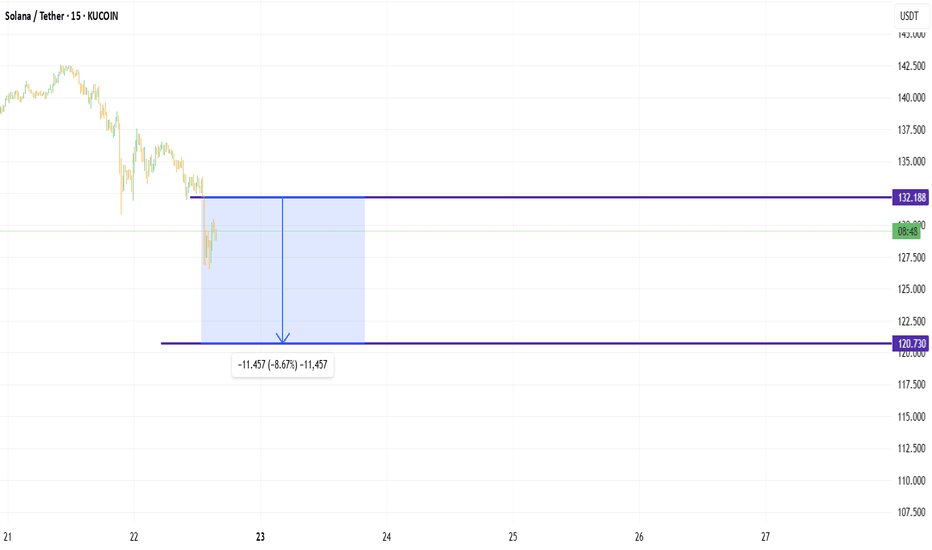

Sol at Risk: Key Support Break Could Trigger Drop to $97Sol is on the verge of breaking a critical support level. If this level fails, we could see a drop towards the $130–$125 range.

However, based on the full pattern length, Sol has the potential to fall as low as $97 — aligning with a possible double bottom formation.

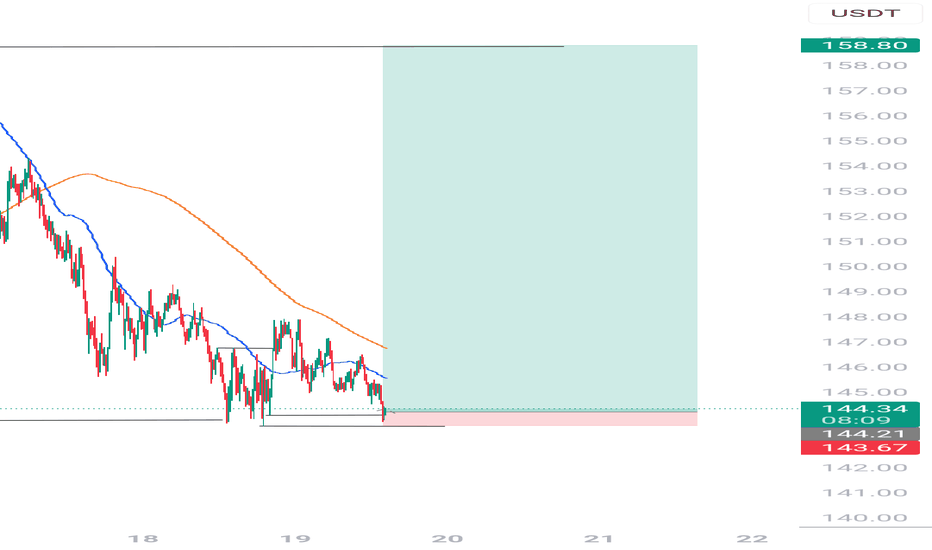

Solana Wave Analysis – 20 June 2025

- Solana reversed from support level 141.60

- Likely to rise to the resistance level 163.8

Solana cryptocurrency recently reversed up from the support area located between the strong support level 141.60 (which has been reversing the price from the end of April) and the lower daily Bollinger Band.

The upward reversal from this support zone continues the active intermediate impulse wave (3), which also started from this support area last week.

Solana can be expected to rise to the next resistance level 163.8 (which stopped the previous impulse wave B earlier in June).

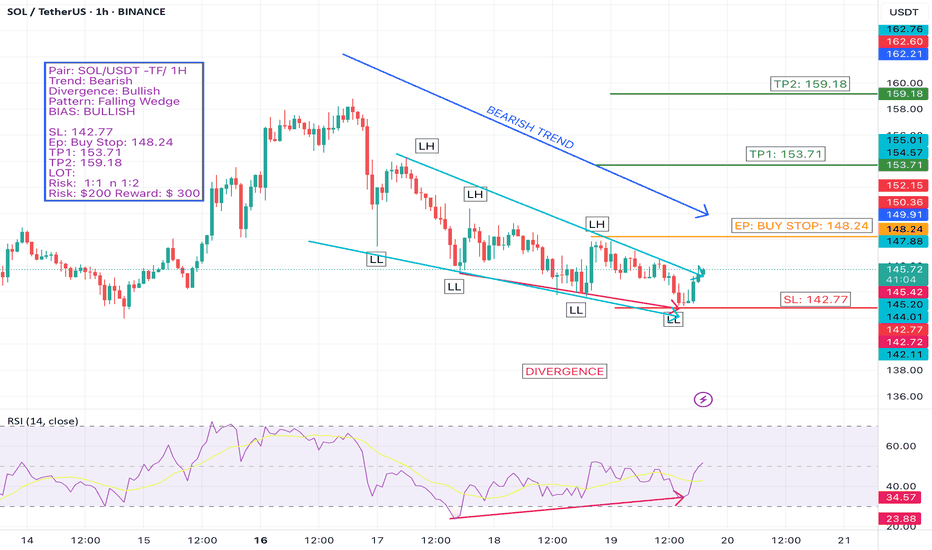

SOL/USDT – Bullish Reversal Setup (1H Timeframe)-wk9We are closely monitoring SOL/USDT on the 1-hour chart. Although the pair has been in a bearish trend, recent developments suggest a potential trend reversal.

A clear bullish divergence has formed, signaling underlying momentum shift. More importantly, a falling wedge—a classic bullish reversal pattern—has emerged. With this confluence of signals, we're now confident in a bullish breakout scenario.

🔹 Pair: SOL/USDT

🔹 Timeframe: 1H

🔹 Trend: Bearish (Bullish Reversal expected)

🔹 Pattern: Falling Wedge

🔹 Divergence: Bullish

🔹 Bias: Bullish

🔹 Entry (Buy Stop): 148.24

🔹 Stop Loss: 142.77

🔹 Take Profit 1: 153.71

🔹 Take Profit 2: 159.18

🔹 Risk/Reward: 1:1 and 1:2

🔹 Risk: $200

🔹 Potential Reward: $300

🎯 Strategy: Waiting for price to break last LH and trigger our buy stop level. Trade is structured with a calculated risk-to-reward profile.

📌 #SOLUSDT #CryptoTrading #FallingWedge #BullishReversal #Divergence #TechnicalAnalysis #PriceAction #AltcoinSetup #CryptoSignals #1HChart #BreakoutTrade #SmartMoney #RiskManagement #BullishSetup #SolanaAnalysis

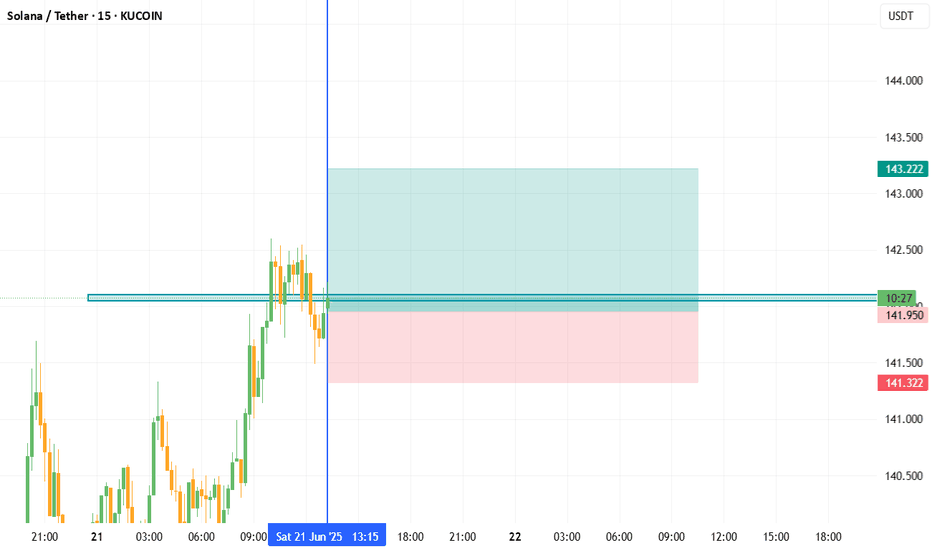

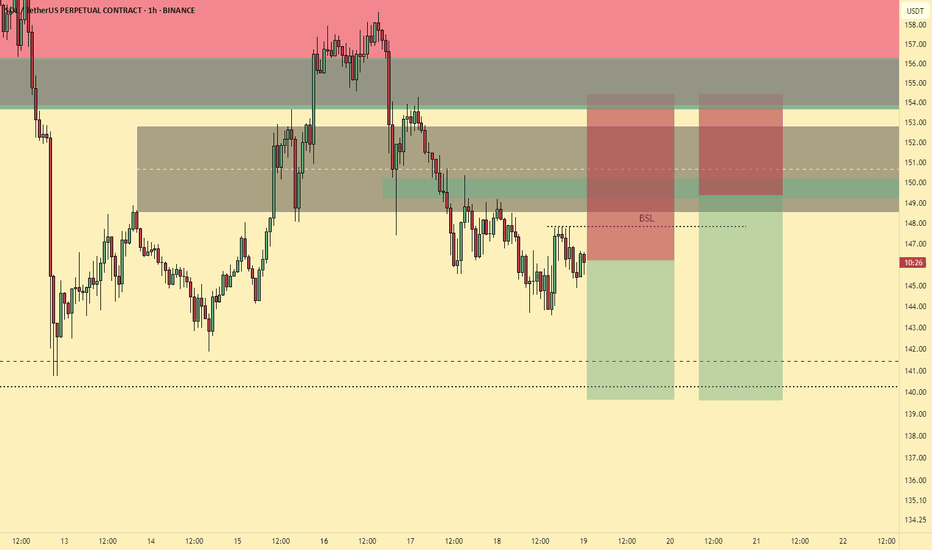

SOL: Short 19/06/25Trade Direction:

SOL Short - Hedge

Risk Management:

- Risk approx 0.5%

Reason for Entry:

- H1 supply zone at resistance

- H1 and M30 timeframes overbought

- M15 bearish divergence present

- Retracement into 0.718 Fibonacci level

- Weak lows beneath price drawing liquidity lower

- No breaker structure on higher timeframe; bearish grind continuing

- Trade set as a continuation with expectation of a lower high and further roll over

Additional Notes:

- Clear technical alignment for a short continuation trade

- Hedge against my FET Long

Solana scalp shortRecently opened a scalp short position on solana. The market structurally is at LL point in usual market continuation but we having a big sell off it seems so could push lower down to $144.35 area before we get a bounce. In the event though I get stop I"ll look for a re-entry as $144.35 is like area to get tested before any major upside.

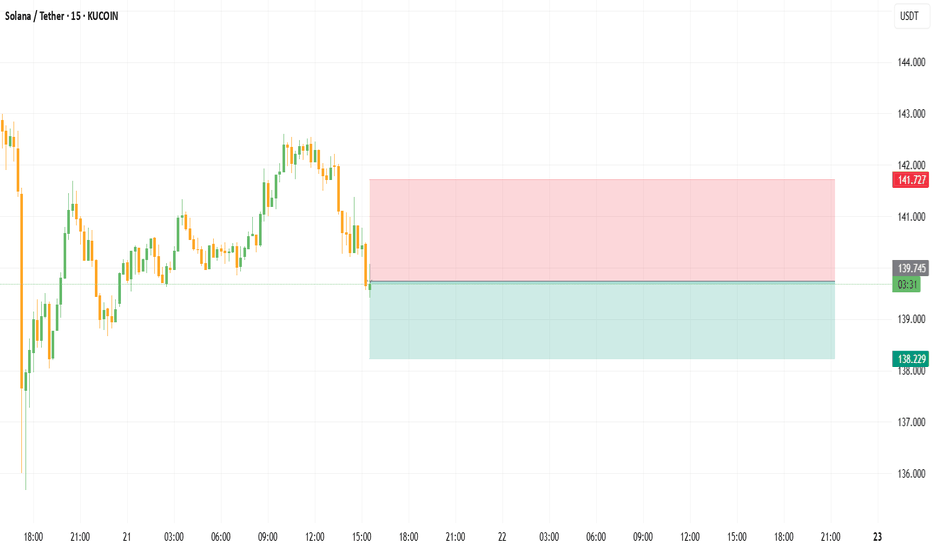

Short trade

Pair: SOLUSDT

Trade Type: Sell-side trade

Date: Sunday, 15th June 2025

Time: 1:00 AM

Session: Tokyo Session

Entry Timeframe: 15min TF

📍 Trade Details

Entry Price: 147.33

Profit Level: 144.54 (1.89%)

Stop Level: 148.19 (0.58%)

Risk-to-Reward Ratio (RR): 3.19

🧠 Context / Trade Notes

Trade executed during the Tokyo session, known for lower liquidity and often used to fade exaggerated price moves from the prior sessions. Price tapped into a minor supply zone formed during the late NY session, showing early signs of sell-side intent.

1Hr TF Overview