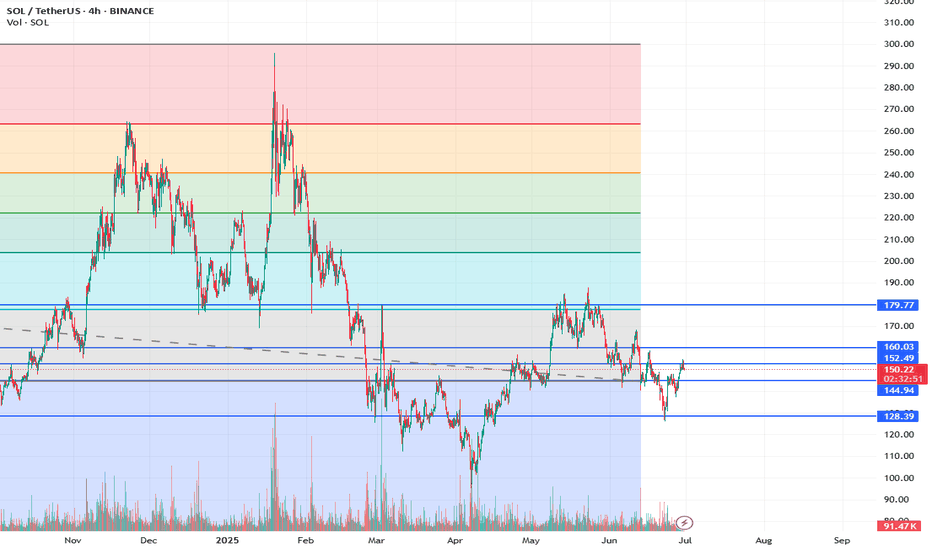

Analisis SOLANA🔍 SOL/USDT Technical Analysis (4H)

📆 June 30, 2025

📈 Binance | 4-Hour Chart

📊 Current Context:

Solana (SOL) is currently trading around $150, consolidating within a sideways range after a prolonged corrective phase. Price action has reacted several times around key horizontal resistance levels and Fibonacci retracements, indicating a strong battle between buyers and sellers at this zone.

📍 Key Technical Levels:

$144.94: Critical support level that has served as a base multiple times since May.

$152.49 – $160.03: Immediate resistance zone. Price has been rejected here several times and is currently retesting from below.

$179.77: Major resistance ahead, aligning with the 200-day moving average and a strong psychological barrier.

$128.39: Key lower support in case of a bearish breakdown.

📐 Additional Technical Insights:

Price action is developing within an emerging bullish channel since the May lows.

Fibonacci extensions project a potential target around $300 if SOL can break and hold above $180, a move that would likely require strong volume and external catalysts (such as the already-approved SOL ETF).

Volume remains steady, with no signs of capitulation or clear institutional accumulation in this timeframe yet.

📌 Conclusion:

SOL is showing accumulation patterns, pressing against increasingly tight resistance zones. A confirmed breakout above $160 could open the door to the $180–$190 range, a key technical target supported by confluences such as the 200-SMA, prior structure, and psychological relevance.

Meanwhile, $145 and $128 remain critical support levels to watch in case of bearish rejection. The upcoming launch of the SOL ETF could act as a major catalyst, but the market is still waiting for a technical confirmation.

SOLUST trade ideas

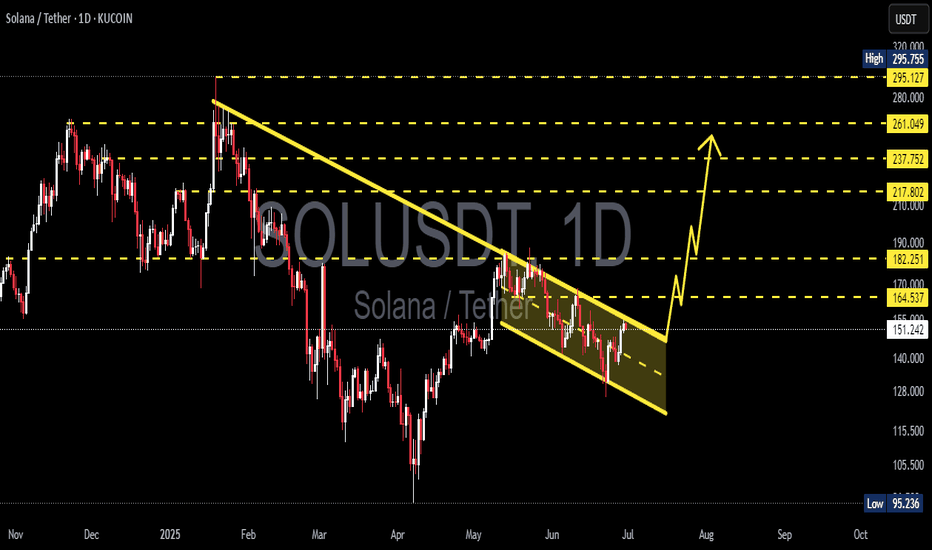

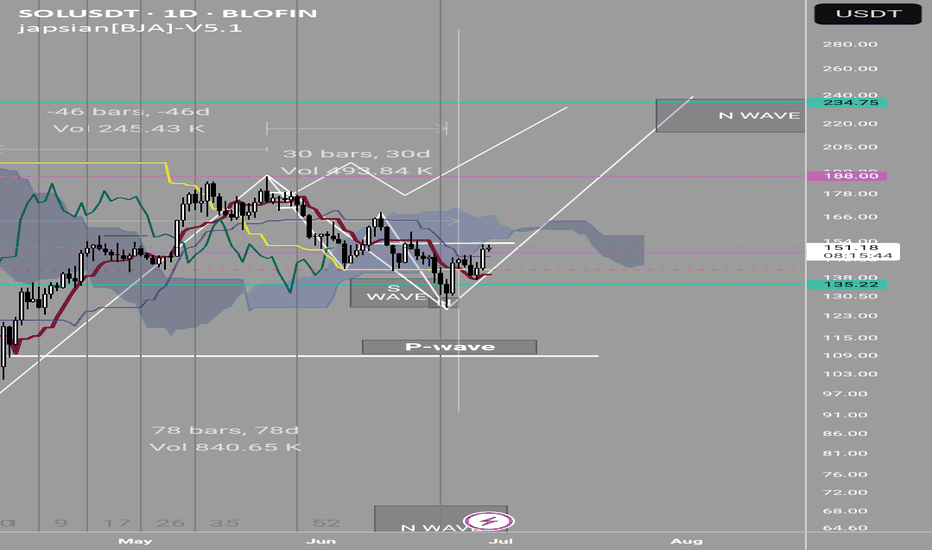

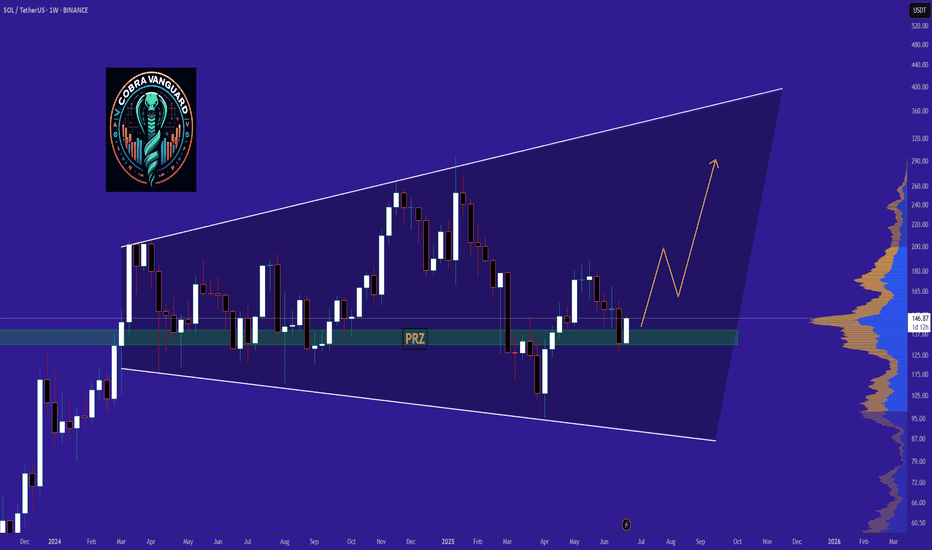

Is SOLANA SOL Ready for a Breakout? Bounce from Falling Channel?

🔍 Chart Pattern and Price Structure Analysis

This chart illustrates a well-formed descending channel (parallel falling channel) that has been developing since mid-January 2025. Currently, the price is approaching the upper boundary of this channel — a key decision area.

🟡 Technical Pattern

Descending Channel: This pattern is characterized by a series of lower highs and lower lows, representing a medium-term bearish trend.

The price is now testing the upper resistance of this channel, a crucial point that could either trigger a breakout or result in another rejection.

📈 Bullish Scenario

If the price successfully breaks out above the upper trendline (around $152–$154), several resistance targets come into play:

1. $164.5 — A minor horizontal resistance and key psychological level.

2. $182.2 — A strong historical resistance zone.

3. $210–$217.8 — A previous consolidation/resistance zone.

4. $237.7, then $261–$280 — Key bullish targets if momentum sustains.

5. Ultimate target near $295.1–$295.7 if broader market sentiment remains strong.

📌 Bullish Confirmation:

Valid daily candle breakout above the channel.

Strong breakout volume.

Successful retest of the breakout area as new support.

📉 Bearish Scenario

If the price fails to break above the channel and gets rejected, we may see a continuation of the downtrend with potential moves to these support levels:

1. $140–$138 — Current minor support zone.

2. $128 — Recent consolidation support.

3. $115.5 — Major support from April.

4. $95.2 — The lowest support zone on the chart.

📌 Bearish Confirmation:

Strong rejection candle (e.g., bearish engulfing) from upper channel.

Weak breakout attempt with declining volume.

Break below the lower channel support or creation of a new lower low.

📊 Conclusion

The current setup is a classic descending channel, indicating a strong mid-term bearish structure.

Price is now at a make-or-break zone — a breakout could signal a trend reversal, while a rejection could extend the current downtrend.

Traders should wait for a confirmed breakout or clear rejection before entering a position.

#SOLUSDT #Solana #CryptoAnalysis #TechnicalAnalysis #DescendingChannel #BreakoutAlert #CryptoTrading #BullishScenario #BearishScenario #Altcoins #CryptoTA

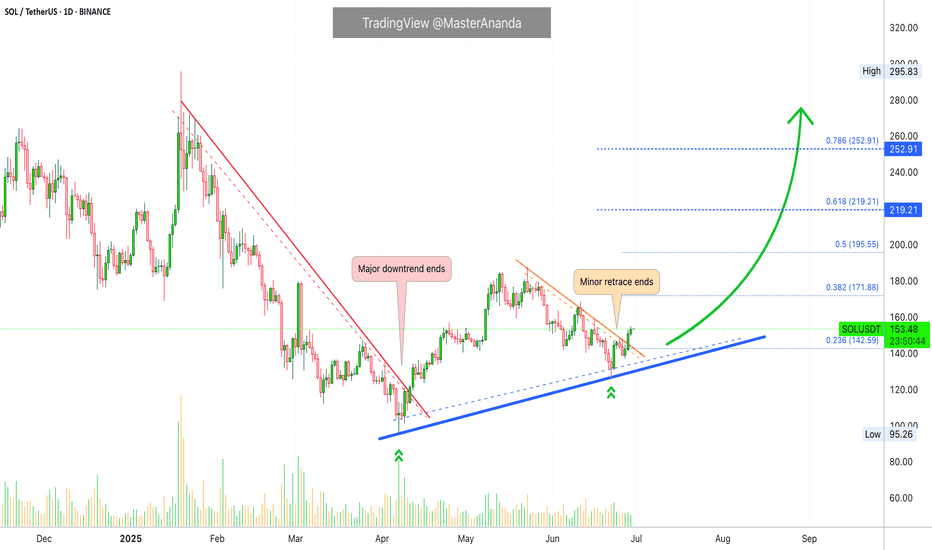

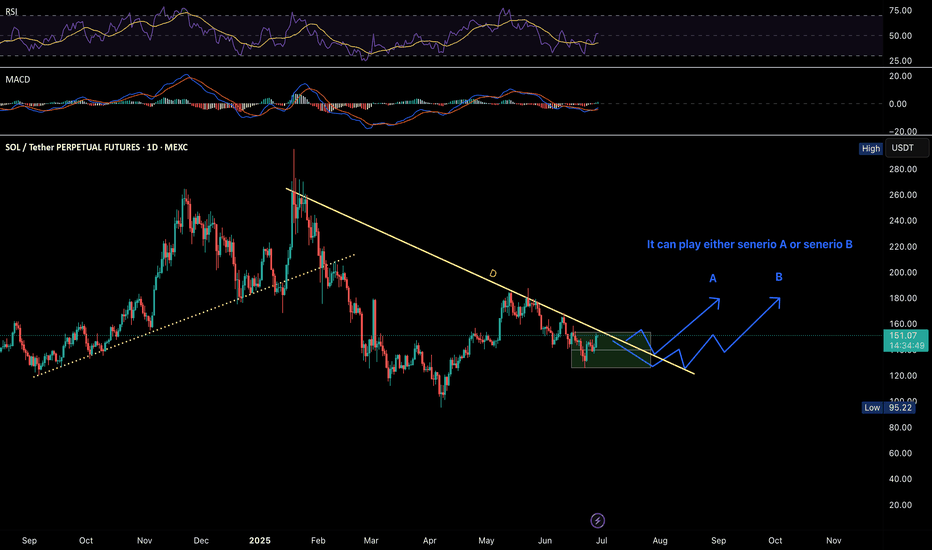

$420 Solana Within 2 Months —TargetsSolana is on a path to a hit a price target of $420 mid-term, within 1-3 months. This is the continuation of the uptrend that started in early April with the end of the previous correction and a more than a year long strong low.

This is not for the faint of heart. Solana is preparing for something massive, even scary but positive. $600+ is also possible but we are going step by step and $420 is the first step.

Immediately when prices start to rise Solana is likely to find resistance around $220 and $253.

The last high, January 2025, would be the minimum on this bullish wave. This would be price tag of $296.

The end of the retrace happened 22-June. This means that the market is already bullish for an entire week. Bitcoin is about to produce the best possible weekly close. As Bitcoin is ultra-bullish above $106,000/$107,000, the altcoins can continue to recover and will aim higher trying to catch up. Of course, no altcoin can catch up to Bitcoin but invariably the entire market will grow.

The wait is over, we are bullish now. Timing is great.

Bullish momentum will grow for weeks and then a major force will permeate the market, something not seen in many years. I hope you are prepared.

Namaste.

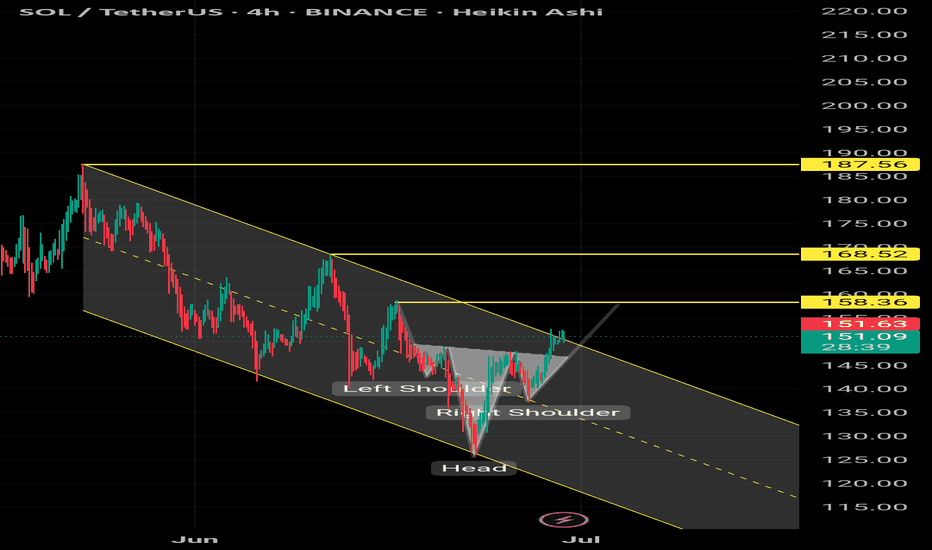

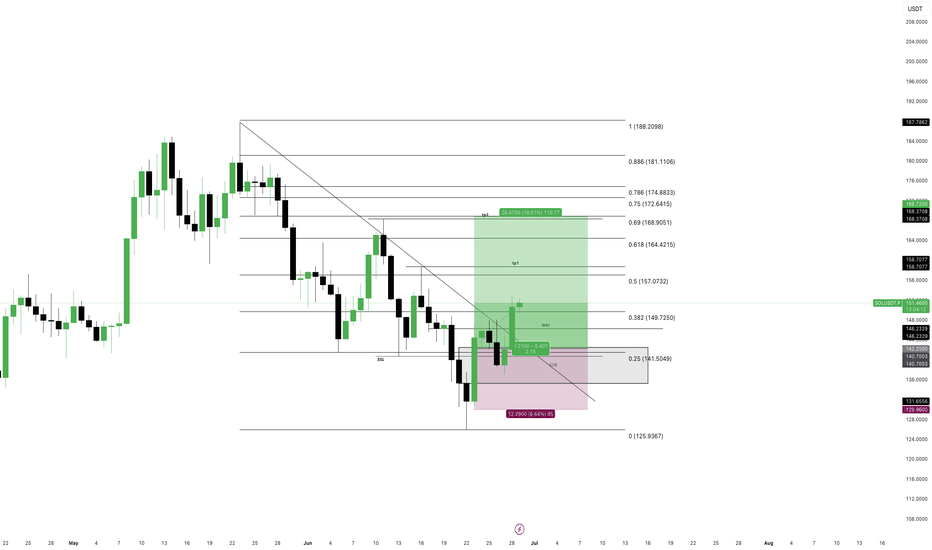

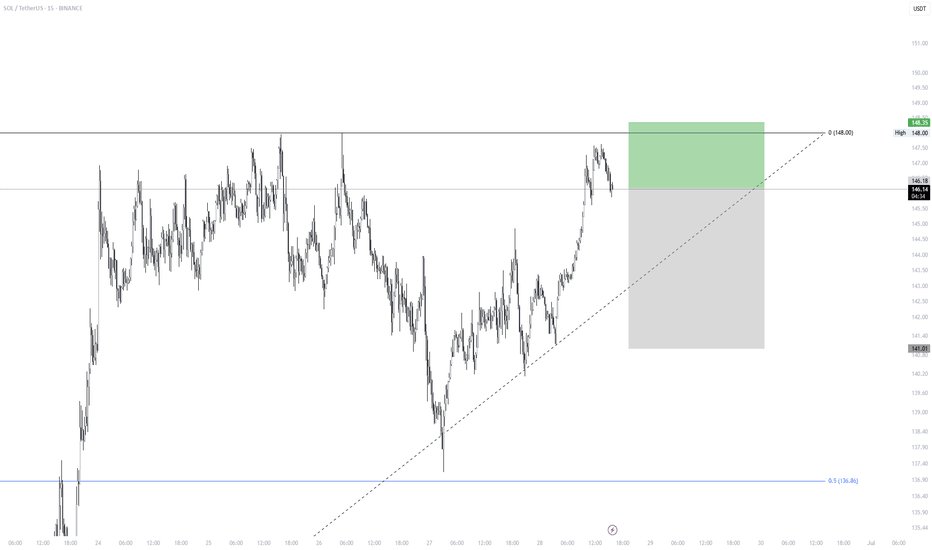

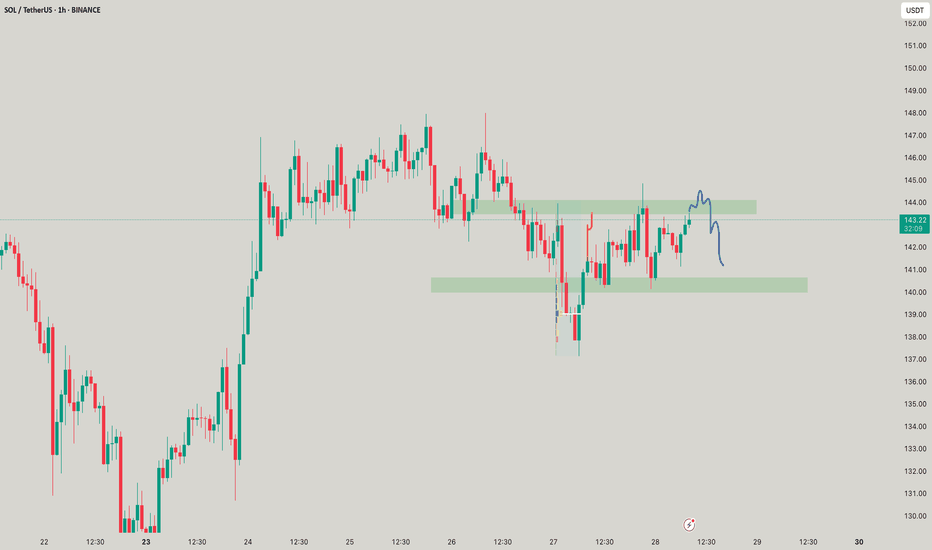

sol usdt pattern identified inverse head and shoulders with chan🧠 Technical Analysis (SOL/USDT – 4H Timeframe)

🔍 Pattern Identified: Inverse Head & Shoulders

Left Shoulder: Around $137

Head: Dipped to ~$126

Right Shoulder: Formed around $135

Neckline Breakout: Successfully broken near $148–$150 zone

This classic bullish reversal pattern indicates a potential trend shift from bearish to bullish.

📈 Trend & Channel

The price was previously trading inside a descending parallel channel (marked in yellow).

The breakout from the upper channel boundary confirms strength and momentum shift.

🚀 Price Targets (Resistance Levels Ahead):

$158.36 – First resistance level (short-term target)

$168.52 – Mid-level resistance (medium-term)

$187.56 – Key resistance (long-term target area)

✅ Bullish Confirmation:

Breakout with volume from both descending channel and head & shoulders neckline

Price holding above neckline now acting as support

⚠️ Risk Note:

A retest of the breakout zone ($148–$150) can occur before moving higher

Invalid if SOL drops back below neckline and fails to hold above $145 support zone

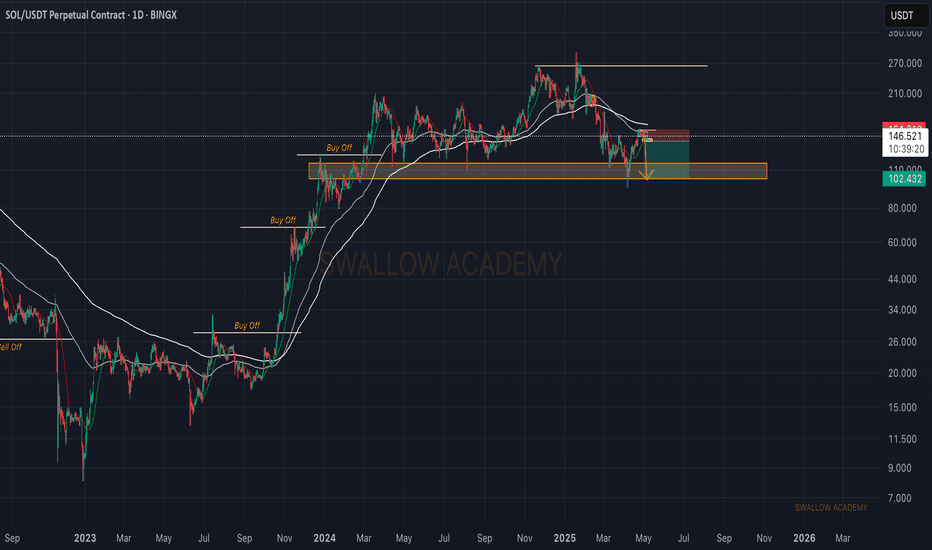

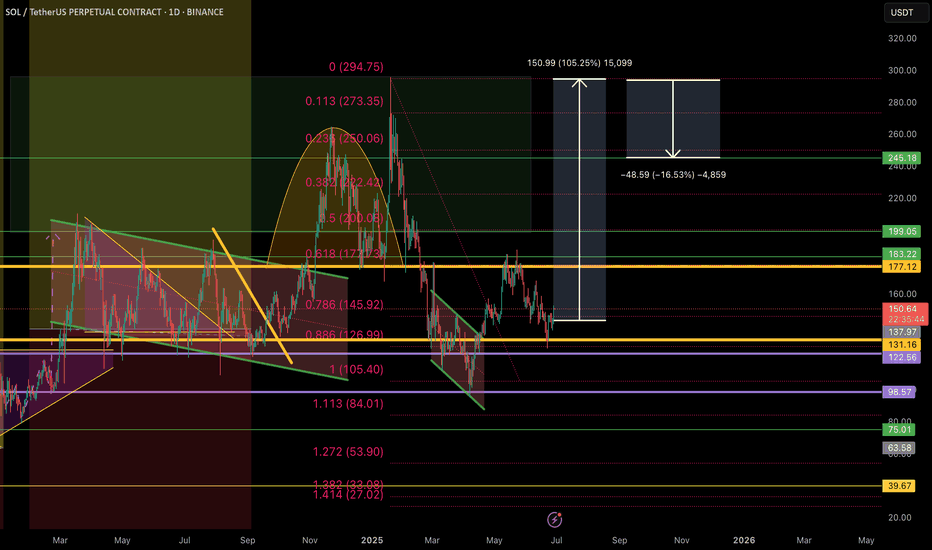

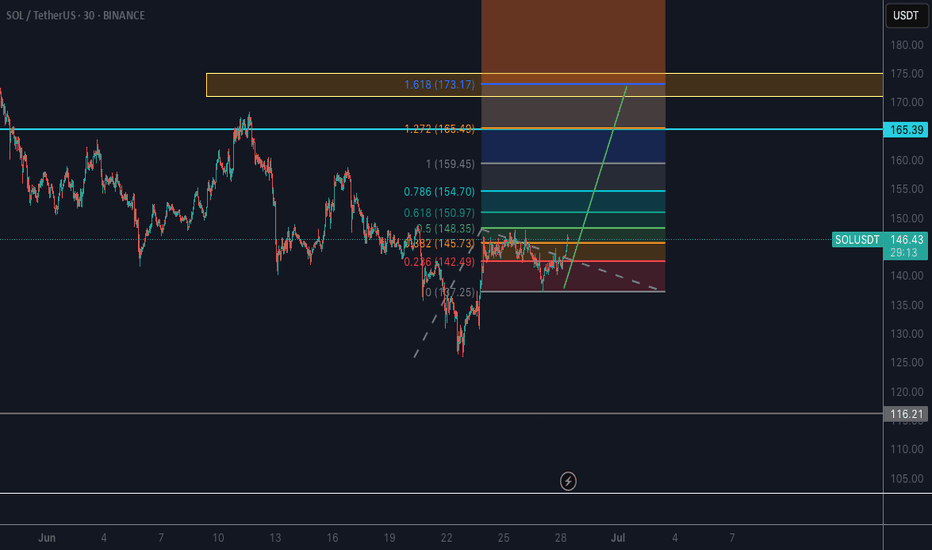

SOL Fractal long-term set up: 100% upside📈 SOL/USDT Long-Term Setup: Potential for 100%+ Upside or 16% Downside

This chart presents a Fibonacci-based technical outlook on Solana (SOL/USDT) on the daily timeframe.

🔍 Key Highlights:

Current price: $150.65

Major resistance zones: $177.12, $183.22, and $199.05

Fibonacci retracement levels (from $294.75 high):

0.618 at $171.32

0.5 at $200.08

0.382 at $222.42

Strong support at $137.97, $131.16, and $122.56

Downside risk to $126.99 (0.886 Fib) or even $105.40 (1 Fib)

Bullish target: $301.64 (+105.25%)

Bearish scenario: $126.99 or lower (-16.53%)

📊 The chart includes harmonic structures and descending/ascending channels suggesting consolidation, but the current structure could pivot into a bullish continuation if key resistances are broken.

🎯 Risk-to-Reward Ratio Favorable for Bulls: The setup offers a potential 105% upside against a 16% downside, making it attractive for medium- to long-term traders.

⚠️ As always, manage your risk appropriately and consider macroeconomic factors.

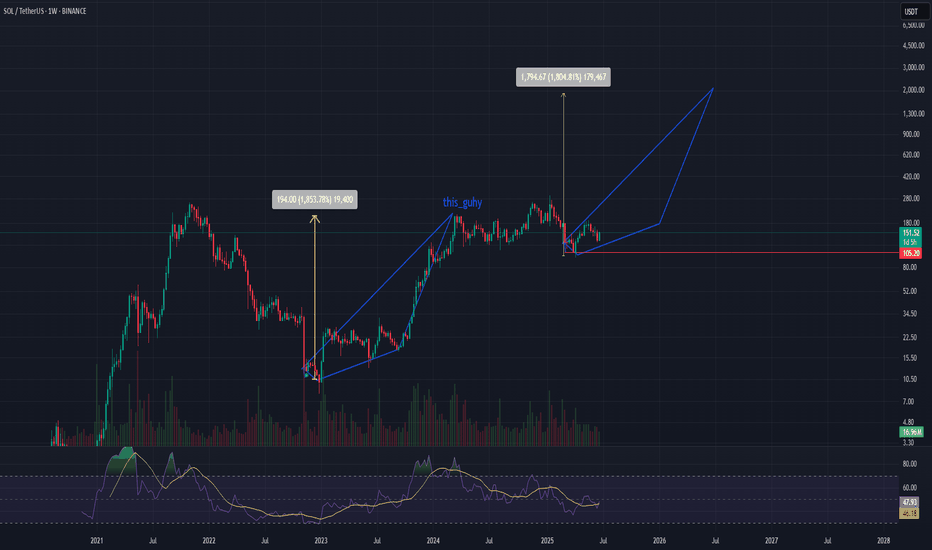

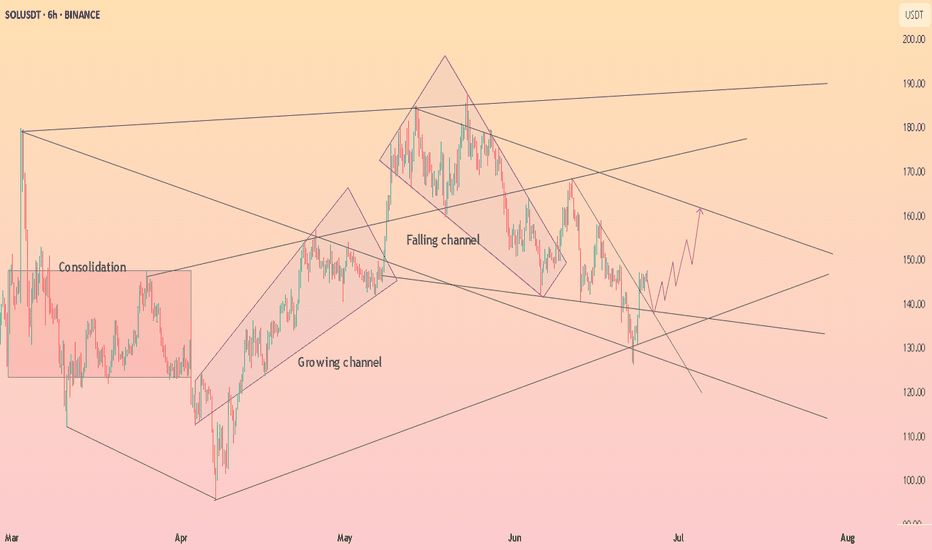

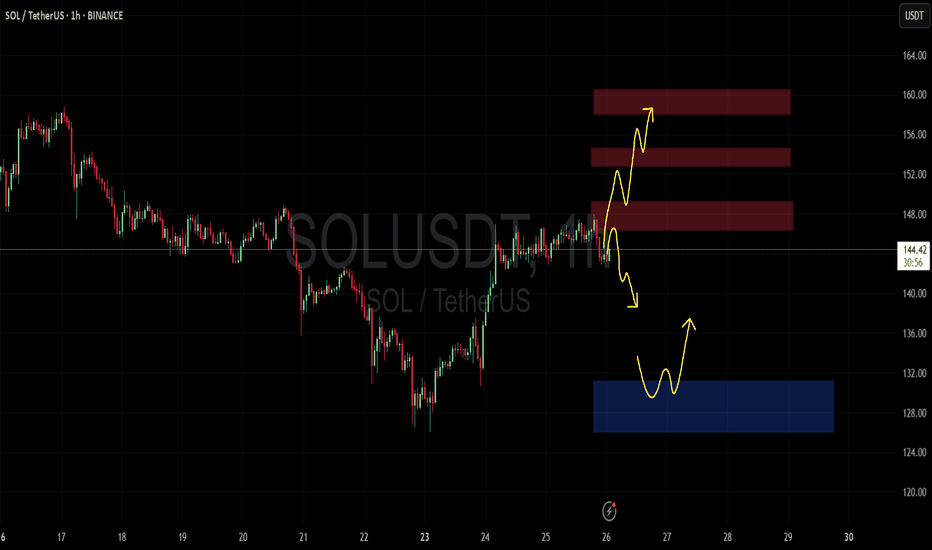

solana crazy ideaWell, I made this silly little chart for myself. I kind of expect it to follow the pattern of some bots running on Solana, at least within the range I’ve marked. But hey, it’s a bull market, and sometimes even random drawings by amateurs like me end up working out!

That said, I'm keeping my target modest — not expecting anything crazy. Stop loss depends on how Bitcoin behaves, and honestly, I wouldn’t recommend anyone follow what I’m doing. This is not investment advice, just a ridiculous idea I had.

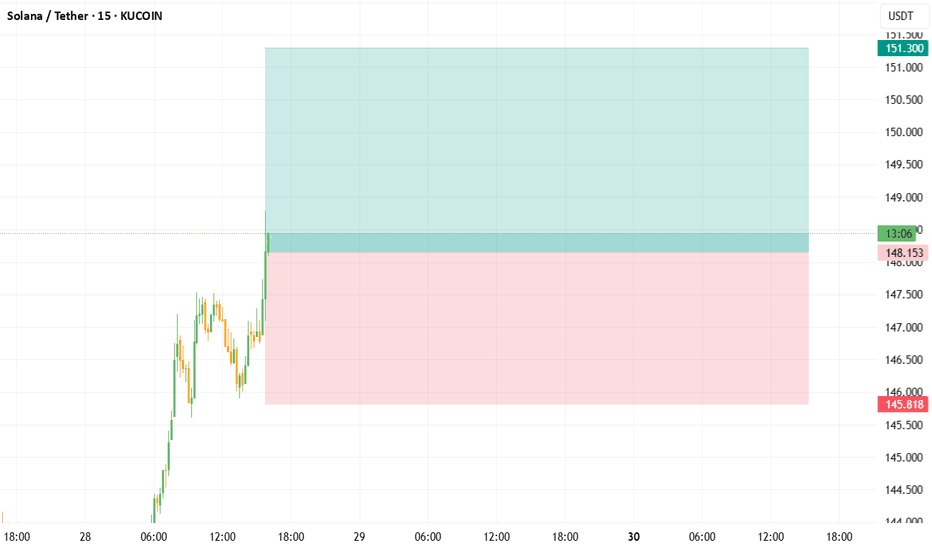

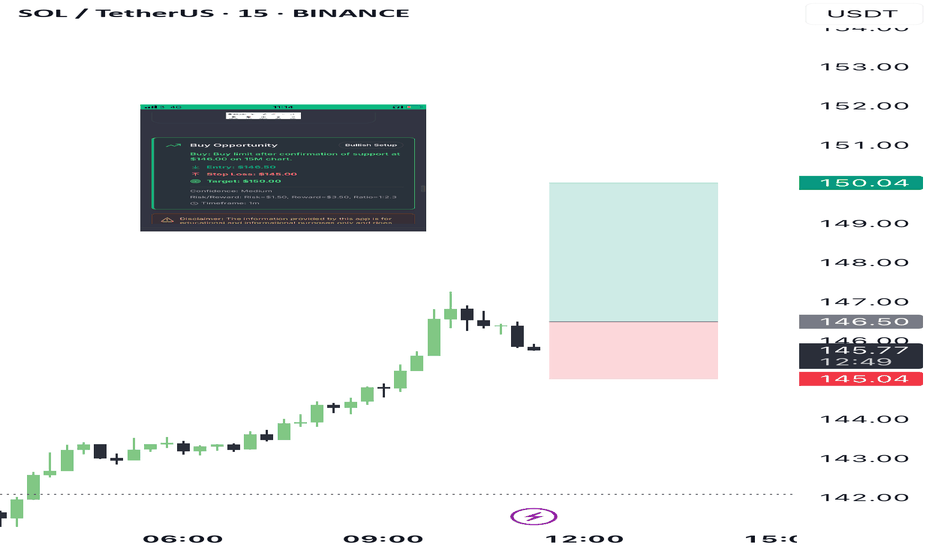

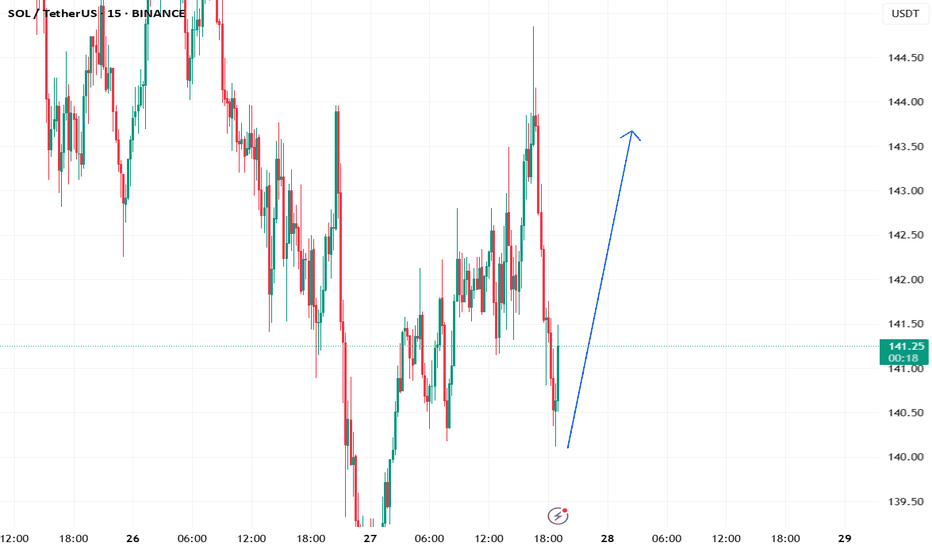

SOL/USDT Short Setup – Targeting Range LowContext:

Price just rejected off local range high near $148 — a key resistance that has held several times historically. We’re seeing initial signs of weakness after a strong rally, with price failing to hold above resistance and beginning to break minor structure.

Setup Details:

Entry: ~$146.20

Stop Loss: ~$148.35 (above recent high)

Target: ~$141.00 (range low + demand pocket)

Risk/Reward: ~2.38R

Trade Idea:

This is a classic range play — short from top of the range, targeting the base. Momentum is fading near resistance and we have a clean invalidation just above. Price structure suggests lower highs are forming, and any further weakness should push us back into the mid-to-lower part of the range.

Buy limit 146.60 TiqGPT buy signalAnalyzing the SOL/USDT across multiple timeframes, we observe a consistent upward momentum, particularly evident in the shorter timeframes (1H, 15M, 5M, and 1M). The 1D and 4H charts show a recent recovery from a downward trend, indicating a potential shift in market sentiment or a retracement phase.

1D Chart: The daily chart shows a series of bearish and bullish candles with recent bullish activity suggesting a potential reversal or pullback from previous lows.

4H Chart: This timeframe shows more granularity in the recovery, highlighting a resistance-turned-support level around $142, which has been retested and held as support.

1H Chart: A strong bullish impulse is visible, breaking past previous minor highs, suggesting an increase in buying pressure.

15M Chart: This chart shows a continuation of the bullish momentum with higher highs and higher lows, a classic sign of an uptrend.

5M and 1M Charts: Both these timeframes show detailed price action within the bullish trend, with the 5M chart beginning to form a pullback.

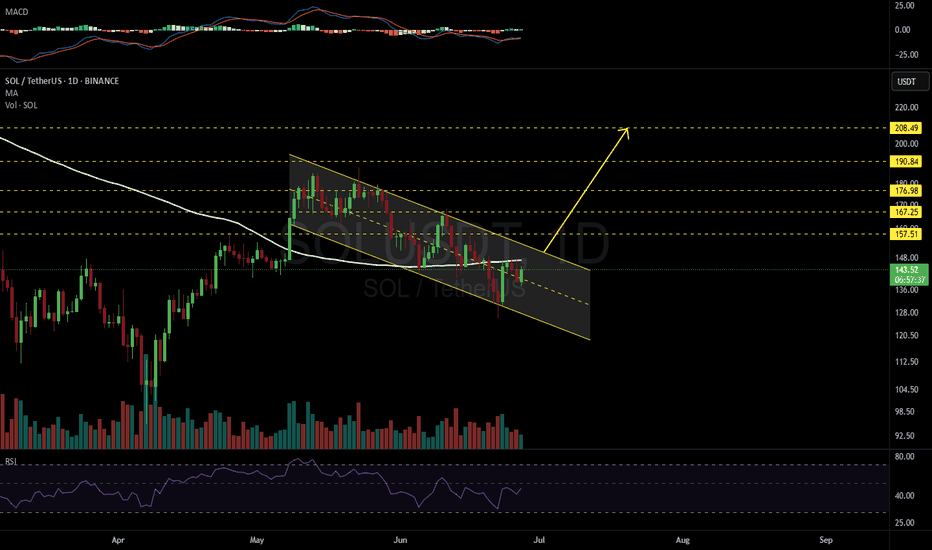

SOLUSDT 1D📈 #SOL – Bullish Flag Setup on Daily

Solana has formed a bullish flag on the daily chart — a continuation pattern that often leads to strong breakouts.

Currently, the price is trading above the midline of the flag and testing the daily MA100 as dynamic resistance.

🚀 If #SOL breaks above the MA100 and the upper boundary of the flag, the next targets are:

🎯 $157.51

🎯 $167.25

🎯 $176.98

🎯 $190.84

🎯 $208.49

📌 Watch for:

Breakout confirmation with strong volume

Retest of breakout zone for safer entries

⚠️ Risk Reminder:

Always use a tight stop-loss and apply solid risk management to protect your capital.

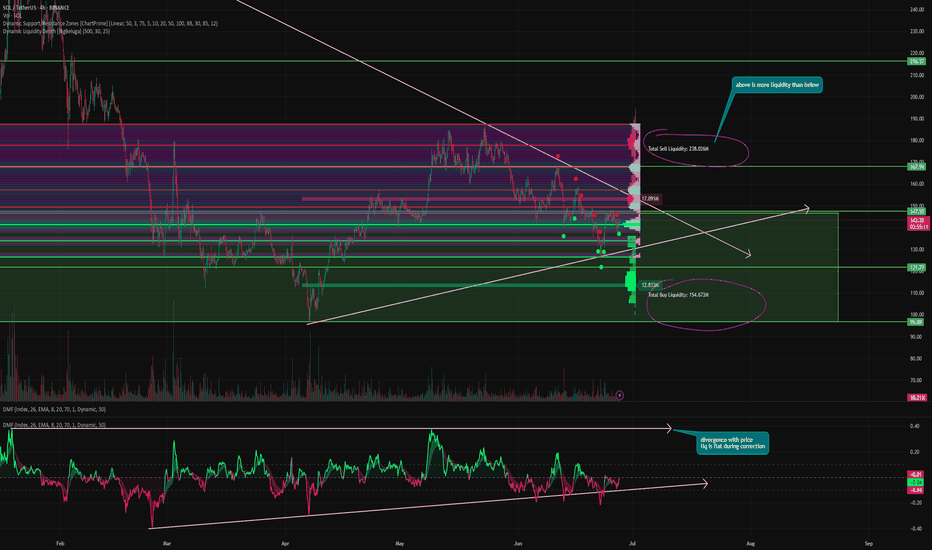

SOL is missing only one thing for the price to explode⚡️ Hello everyone! I decided to update my idea a little and take a closer look at the 4-hour timeframe on SOL.

After closing the gap from below, the price is now trying to consolidate at key levels of 141-150. If it fails, the nearest strong support is at 133.

📈 At the same time, the price has entered the buying range. This is a signal for position traders to accumulate positions.

⚙️ Metrics and indicators:

Money Flow - divergence with price. While the price fell from 300 to 140, liquidity remained virtually unchanged and is in a neutral zone.

Liquidity Depth - there is increasing liquidity at the top. On the daily timeframe, there is already an almost 5-6 times overweight in shorts. On the 4-hour timeframe, it is currently almost x2. And as we know, the price moves from one liquidity zone to another.

📌 Conclusion:

SOL continues to see liquidity inflows and huge demand. However, there is still one catalyst missing for a powerful price breakout: an ETF on SOL.

Institutional inflows into SOL are precisely the factor that could be the key piece of the puzzle for the next leg of the trend.

Have a great weekend, everyone!