Could Solana face a 25% decline and hitting $145 target?Hello and greetings to all the crypto enthusiasts, ✌

In several of my previous analyses, I have accurately identified and hit all of the gain targets. In this analysis, I aim to provide you with a comprehensive overview of the future price potential for Solana , 📚🎇

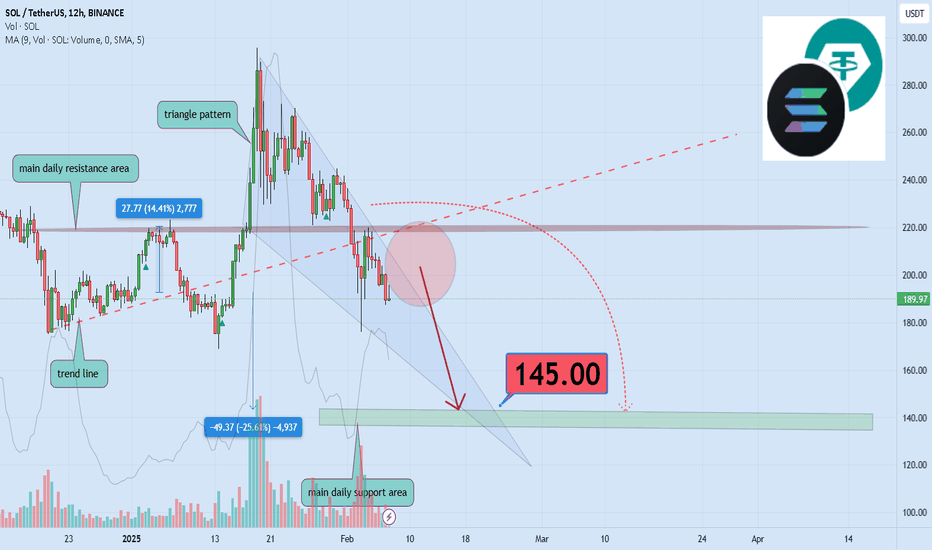

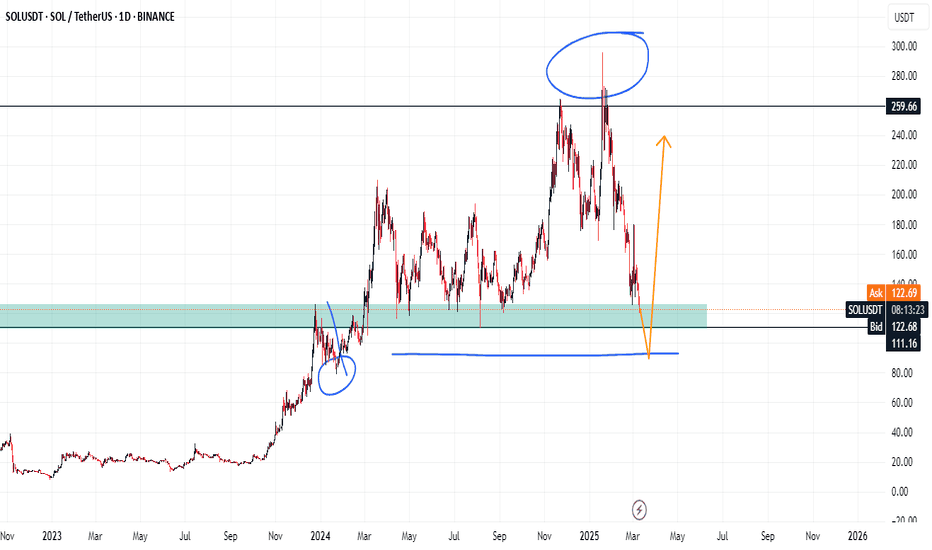

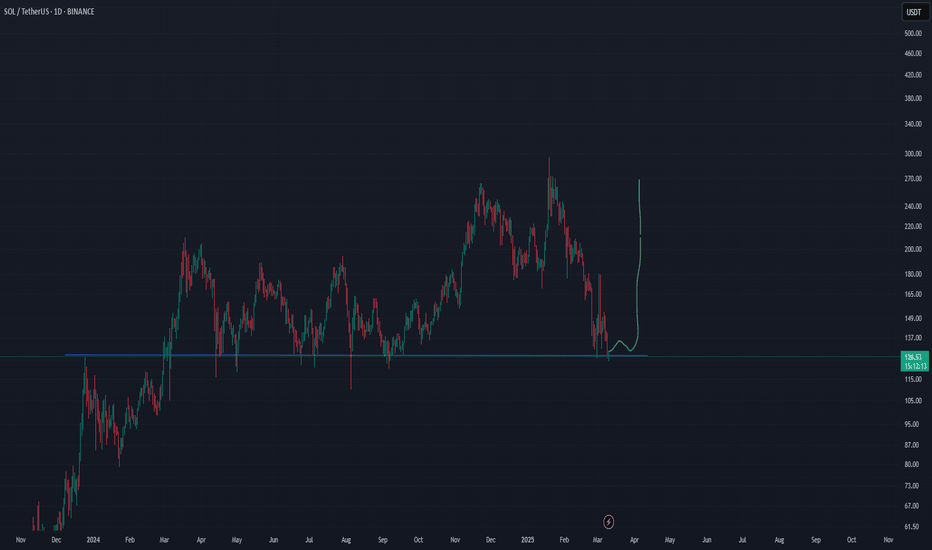

It is possible that we may observe brief upward price movements as part of a corrective phase before the broader downtrend resumes, yet there remains a strong likelihood of further downside for Solana from its current position. I foresee an additional 25% decline for this highly influential protocol, with a primary target price of $145. The current bearish trend is still intact, as the price has already lost several crucial support levels along the way. Should Solana fail to break through the upper boundary of the ongoing triangle pattern, we are likely to see continued downward momentum, ultimately reaching the target specified in this analysis. 📚💡

🧨 Our team's main opinion is: 🧨

Solana might see a brief upward movement before continuing its downtrend, with a potential 25% drop to $145 if it fails to break the triangle pattern, as the bearish cycle persists and key supports are lost.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

SOLUST trade ideas

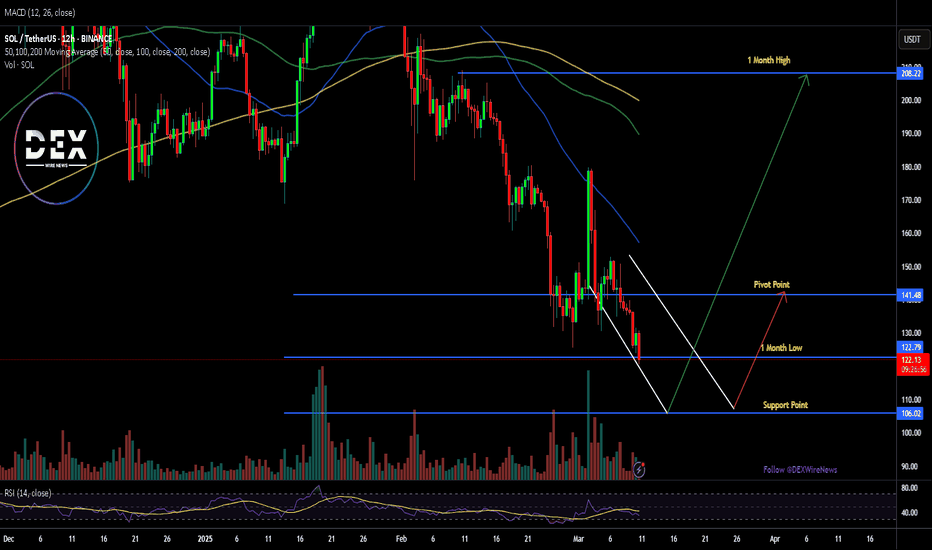

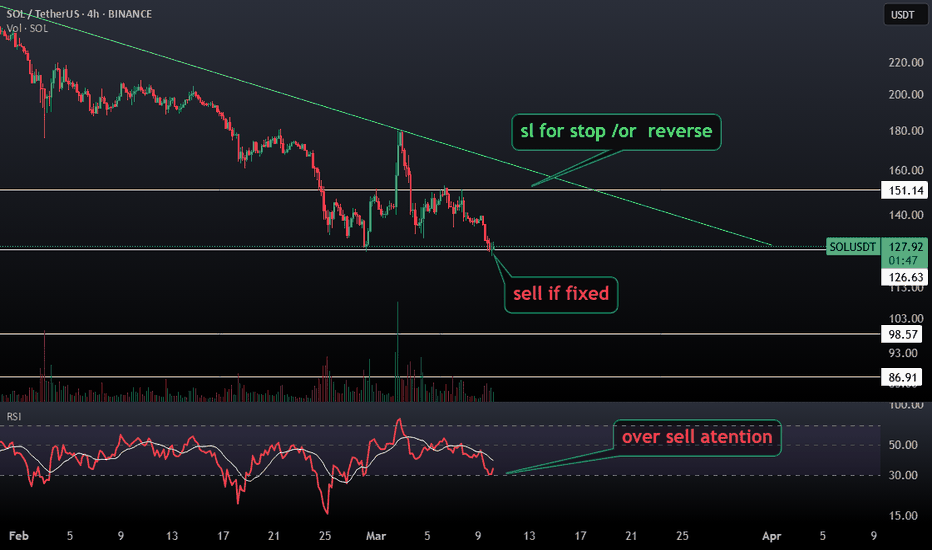

SOLUSDT at a Critical Decision Point – Reversal or Breakdown?Solana (SOL) has reached a **key support zone between $116 – $126**, a level that has held strong for the past year. This area will determine the next major move, with two possible scenarios in play:

📈 Bullish Scenario:

- If SOL holds and forms a reversal pattern, we could see a strong move toward $200 as bullish momentum builds.

- Confirmation of a bounce with increasing volume and bullish candlestick patterns (such as a double bottom or bullish engulfing) would provide an entry signal.

📉 Bearish Scenario:

- A break below $116 would indicate weakness, potentially leading to a retest of $100 or even $80 if selling pressure accelerates.

- A daily close below this support zone would confirm the breakdown and shift momentum to the downside.

🔹 My Bias:

I remain optimistic and will be looking for a reversal pattern within this key zone to enter a long trade with a target of $200.

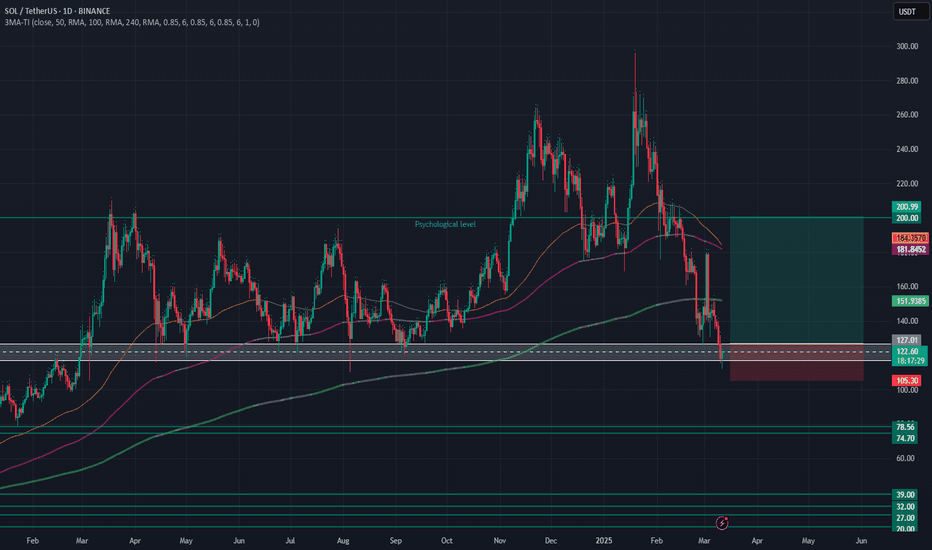

Solana: Time to Buy or More Pain Ahead?Solana has been in freefall since peaking at nearly $300 on January 19, 2025, dropping a staggering 61% to $115,47 in just 50 days, currently trading at around $119. A support zone for potential reversals.

The big question now: Is this the time to go long, or is more selling pressure ahead? Let’s break it down.

Key Support & Resistance Levels

Lost Key Level at $120

Solana lost the key support at $120, turning it into a resistance zone. For bulls to regain control, SOL must reclaim this level with confirmation and increased volume.

Next Key Lows to Watch

Below the current price, the next key liquidity zones are at $110 and $105, where buyers may step in.

Major Support Zone – $104 to $96

If selling continues, we have a strong support zone between $104.14 and $96.96, backed by multiple confluences:

Anchored VWAP Support: Taking the anchored VWAP from the 2023 lows at $8, we find it currently aligning near $100, a key psychological level.

Monthly Order Block: On the monthly timeframe, an order block sits right at $100 mark, reinforcing this level as strong support.

2024 Yearly Open: The yearly open from 2024 is at $101.72, adding another layer of confluence.

0.666 Fibonacci Retracement: Measuring from $8 to the all-time high of $295.83, the 0.666 Fib retracement is at $104.14, further strengthening this support zone.

Liquidity Pools: There's a lot of liquidity around the $100 area

Fib Speed Fan Support: The 0.7 Fib speed fan also aligns perfectly with this support zone.

Conclusion: The $104–$97 range becomes a high-probability long entry zone with minimal risk.

Long Trade Setup

Entry Zone: $118 – $97

Stop Loss: Below $95

Take Profit Target: $135

Average Entry: $105 (DCA)

Risk-to-Reward (R:R): a solid 3:1 or better

Strategy & Execution

With SOL already down over 60%, scaling into a long position makes sense. Here's how to do it the right way:

1️⃣ DCA Strategy – Instead of going all in, scale in gradually within the $118–$97 range for a better average entry.

2️⃣ Volume & Price Action – Watch for a spike in volume and bullish price action before adding to the position.

3️⃣ Psychological Level Play – There are likely many buy orders around $100, meaning a bounce before hitting lower support is possible.

Stay tuned for updates as this trade unfolds! 🚀

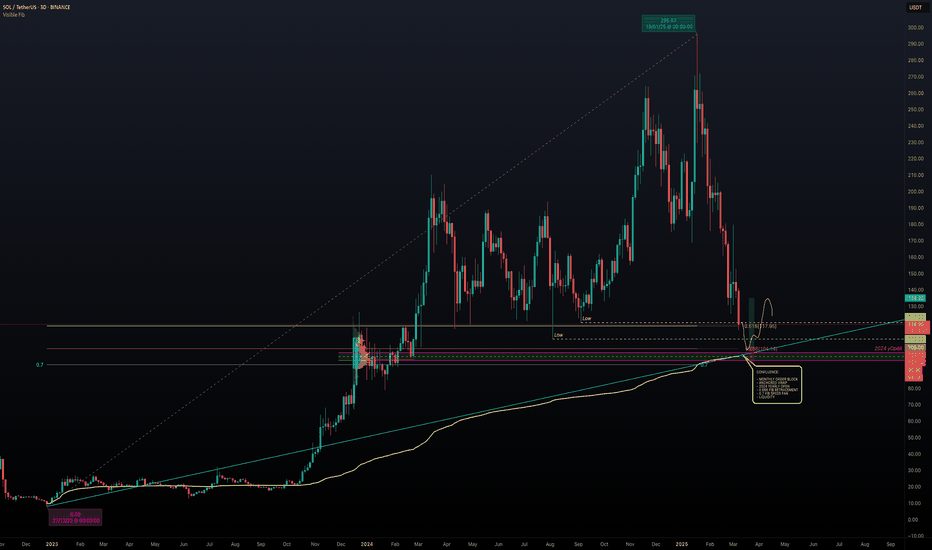

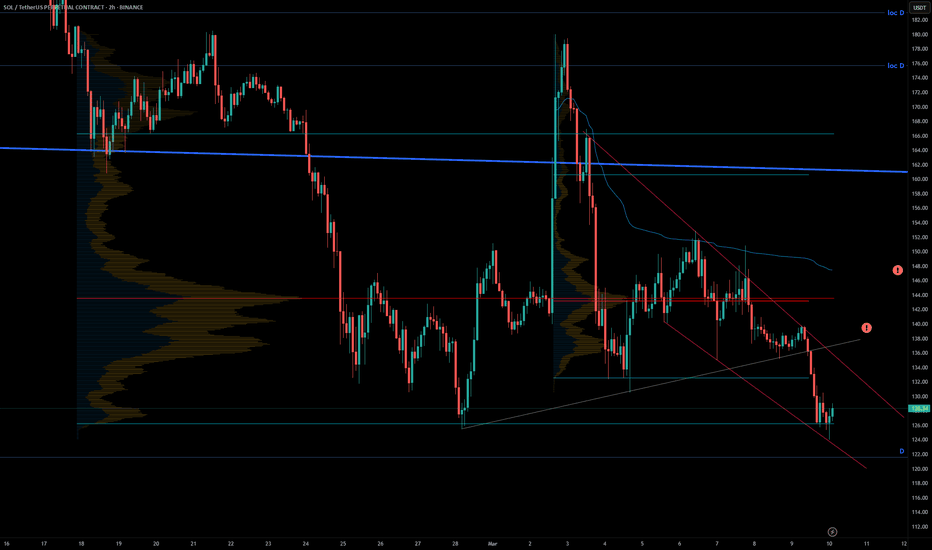

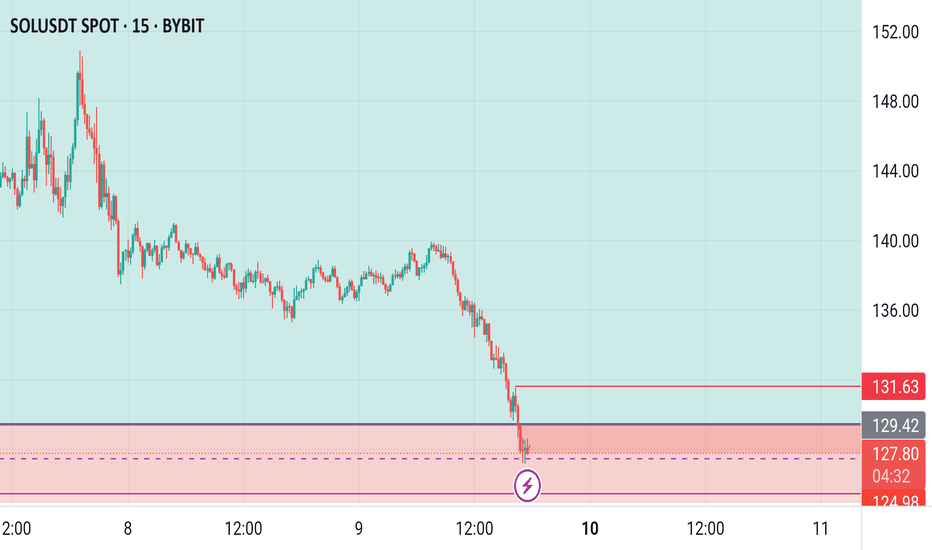

Solana’s Market Breakdown: Key Levels to WatchSolana has broken below $135 support, confirming a bearish shift in market structure. The next key level is $96.85, a high-timeframe monthly support that could provide a reaction.

If the Market Auction Theory plays out, a full rotation to $19 is possible, aligning with the Point of Control (POC) and value area low—a major confluence zone for accumulation.

Patience is key for traders and investors. Waiting for price to reach strong demand zones or show signs of a structural reclaim will provide better opportunities.

Breaking: Solana Tanking HardSolana often referred to as the Ethereum killer is tanking hard albeit Bitcoin also dipped to the $79k zone. Designed to facilitate decentralized app (DApp) creation, aiming to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of a blockchain, SOL has been building a scalable network with massive growth noticeable in its ecosystem.

With Selling pressure increasing, Solana could be on the brink of a massive selling spree with support pegged to the $110-100 pivot points.

However, should Solana bounced back and break pass the 78.6% Fibonacci retracement point, a trend reversal is inevitable. With the RSI at 35, a little shift to a 45 point in RSI could be all what Solana needs to catalysed a bullish breakout.

Solana Price Live Data

The live Solana price today is $124.43 USD with a 24-hour trading volume of $4,578,943,167 USD. Solana is down 6.54% in the last 24 hours, with a live market cap of $63,337,175,317 USD. It has a circulating supply of 509,018,387 SOL coins and the max. supply is not available.

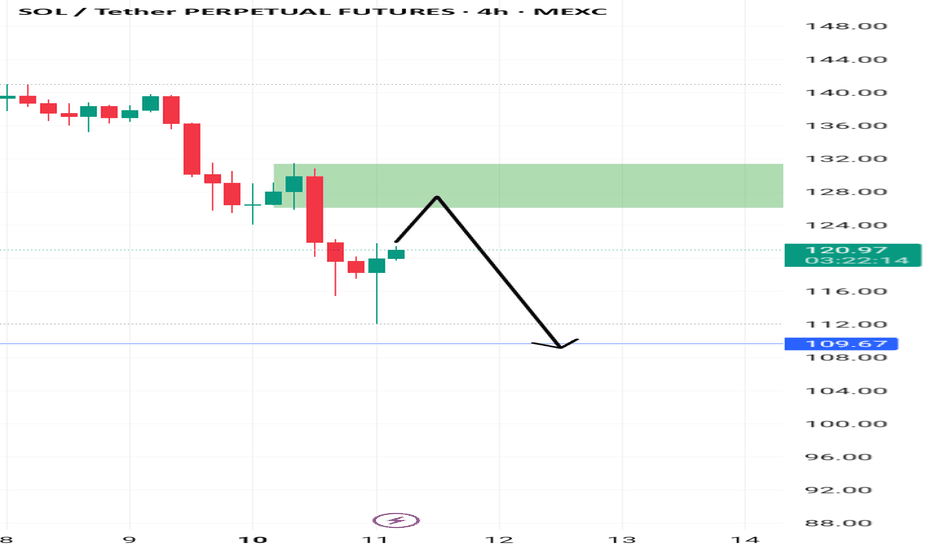

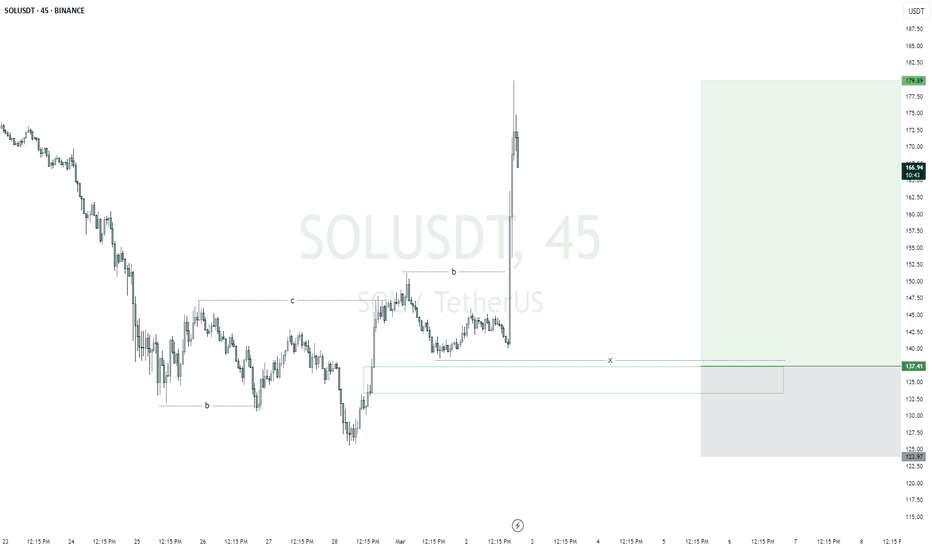

SOLUSDTmy entry on this trade idea is taken from a point of interest below an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $137.41

Take Profit; $179.89

Stop Loss; $123.97

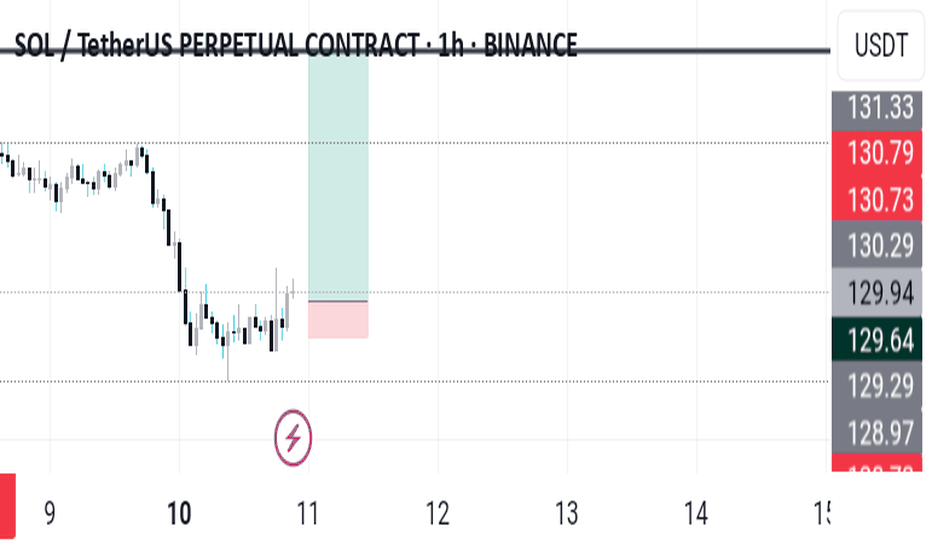

Trump Order Hits Crypto: $BTC Falls, $SOL Accumulates After news that Trump signed a strategic order for Bitcoin reserves, the US is not buying directly but using assets seized earlier.

The news hit the market hard. CRYPTOCAP:BTC dropped from 92k to 80k this morning.

After falling to 80k, strong buying returned—similar to the previous drop to 78k.

SOL might be accumulating between $120 and $130. This range could keep its base strong for the next wave.

SOL remains 1 of the few coins with a steady D1 uptrend, even during market consolidation from April-Oct. Large buy orders are concentrated in the $120-$130 range.

Whales and big players are betting:

• BTC at $80,000

• ETH at $2,000

• ETH at $120-$130

Most altcoins lack strong buying power. They may move sideways or drop as funds focus on US-based bluechips.

We’ll see how it plays out. If SOL can’t hold support, the market could face a broader decline.

#BTC #ETH #sol #MarketPullback #WhaleAccumulation

SOL - Some interesting POIsSOL is really hard to decide, what to do.

A Long from here or Daily R to gray TL could be plausible.

A Short from upper marked areas could be reasonable too.

Anchored VWAP (blue graph) is really good to have eyes on it (for Short).

Volume (2h, 4h and Daily) has bullish divergence.

(Long or Short with very low leverage)

I only watch it for now ...

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

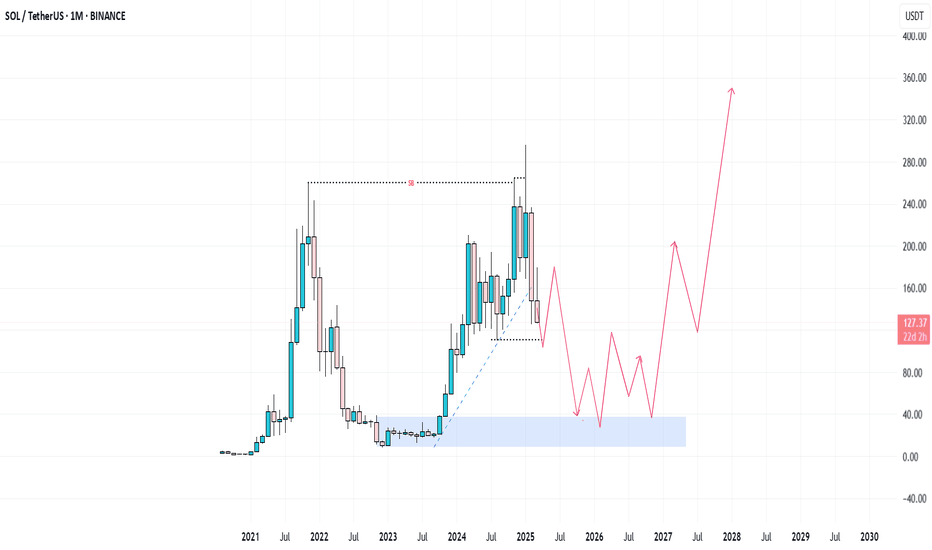

Long-term Solana (SOL) OutlookExpecting a further drop in price to a range of $10-$40 before a bull run to possibly another ATH. Sentiment and price pattern is similar across all major cryptocurrencies. HODLing would be extremely stressful during this bear run.

This is only my opinion and should not be taken as an investment advice. The market can of course, turn at any point in time.