SOLUST trade ideas

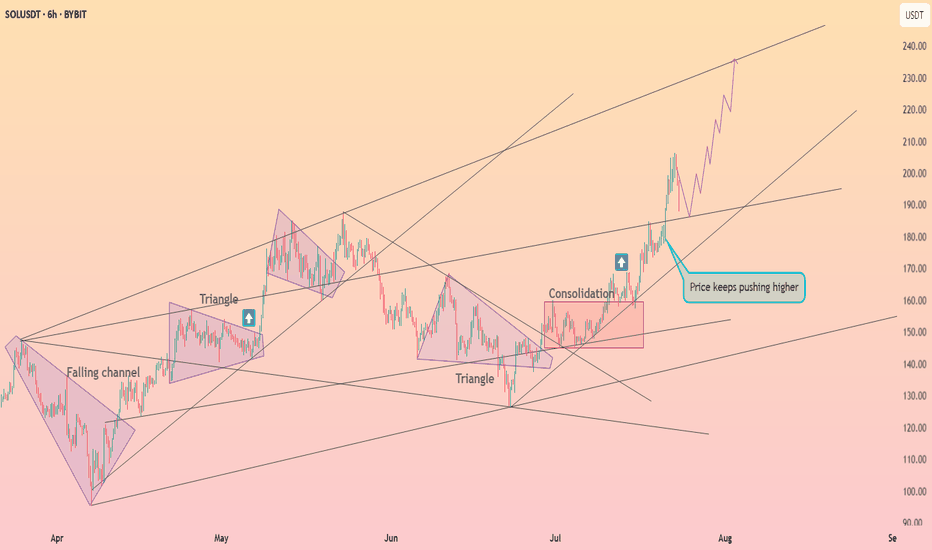

#SOL/USDT coin market structure analysis#SOL

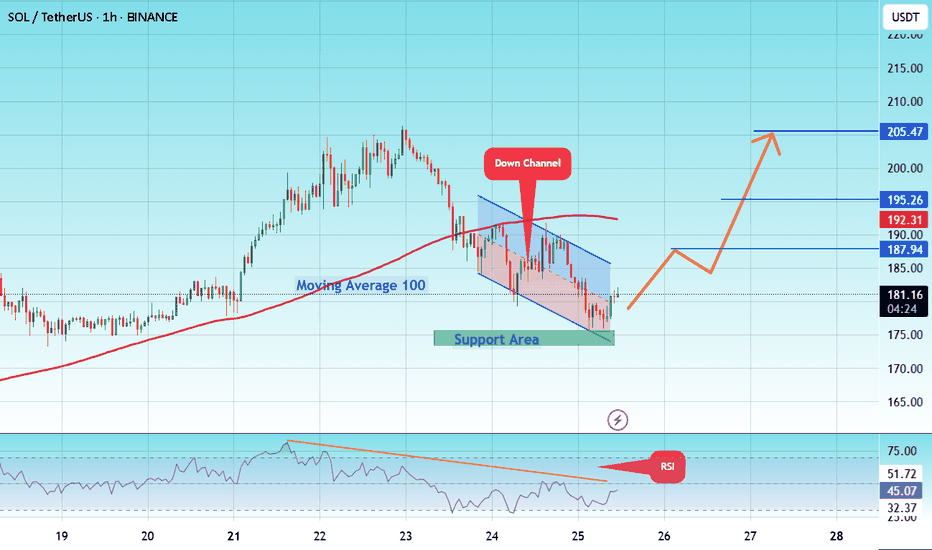

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 175, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 174.

Entry price: 181.

First target: 187.

Second target: 195.

Third target: 205.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

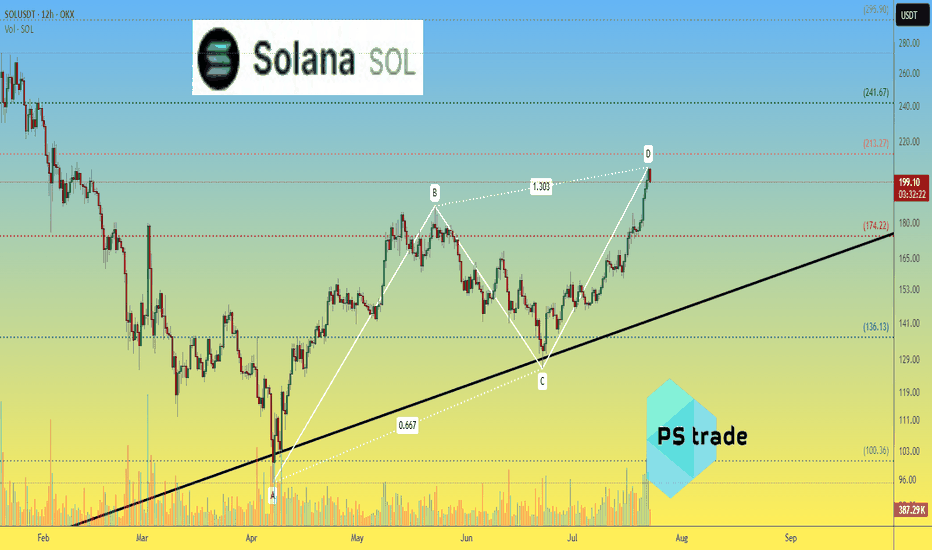

Solana SOLusdt: ABCD Completion & Reversal Candle Forming?The ABCD pattern on the 12H OKX:SOLUSDT chart is nearly complete near $213.

🔻 Current candle attempts to engulf the previous bearish one — an early reversal signal.

📊 Volume is declining after impulse — adding confluence.

📉 Correction targets:

$175 — Fibo 0.5 + support

$136 — consolidation area

$100 — start of CD move

❌ Breakout above $213 invalidates reversal scenario.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

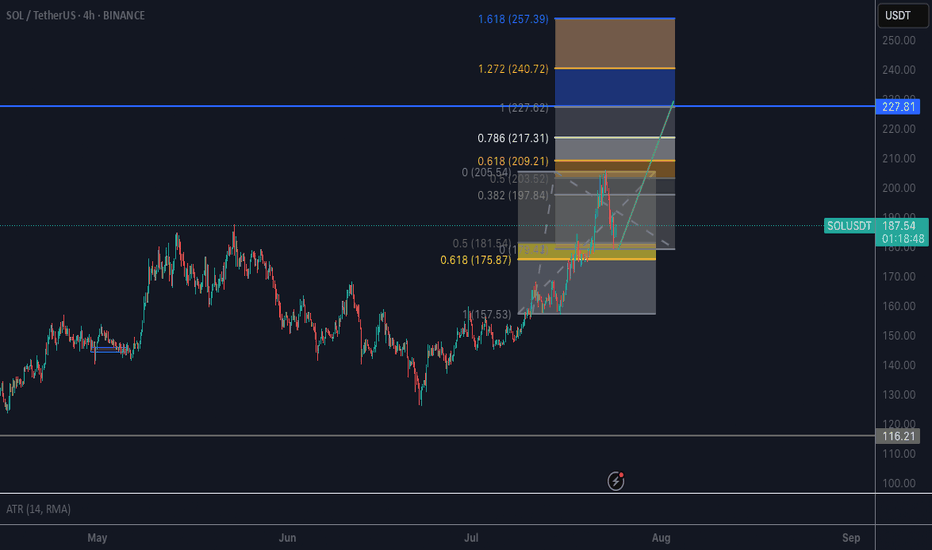

SOL long running - follow up on the Cup & Handle ideaPrice closed above both key levels I mentioned — 181 and the HTF S&R at 188 — with momentum and structure confirmation. That gave me enough conviction to enter a long.

🎯 Final TP aligns closely with the measured move target: 245.

📈 SL is already at breakeven after TP1 hit — risk-free from here.

Let’s see if SOL completes the full handle breakout.

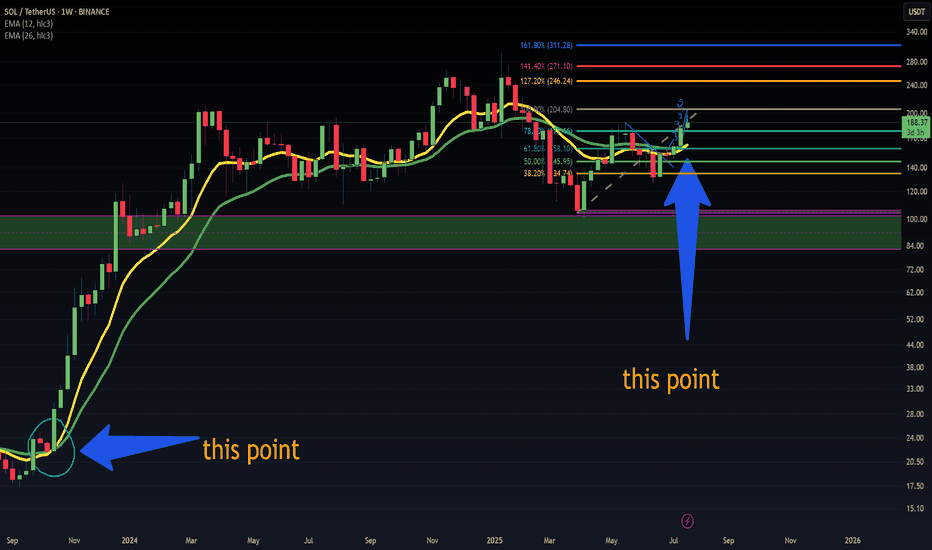

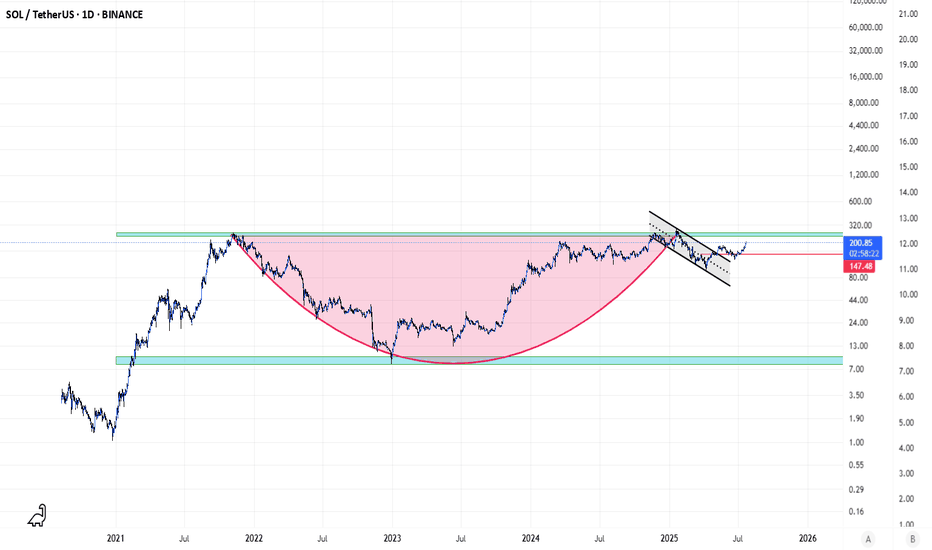

Solana is undervalued | New ATH coming very soon | $250++Solana is slowly but surely grinding up, following the altcoin king ETH. ETH is already near its 2024 highs of $4000. If SOL were to be in the same position as ETH in terms of price, we should be around $250.

In technical terms, SOL is showing huge bullish strength at the $180 resistance. In the last attempt in breaking above this level, it faced multiple rejections and consolidated before ultimately backing down. This time, there is little to no resistance.

The REX-Osprey SOL staking ETF continues to garner inflows, having only one outflow day since the launch date 2nd July. That's nearly $100 million net inflows and 11 inflow days out of 12 trading days. Imagine the demand the spot SOL ETF by big players such as VanEck, Grayscale and Fidelity will have once approved.

BTC dominance is breaking below 60%. Capital is flowing from BTC into ETH, and once ETH hits $4000, a good amount will flow from ETH to SOL as people look for better potential gains.

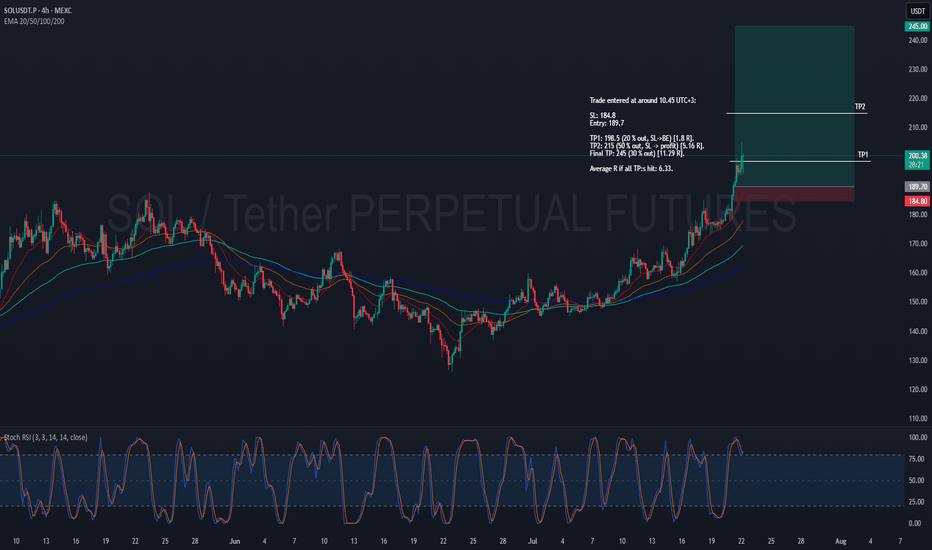

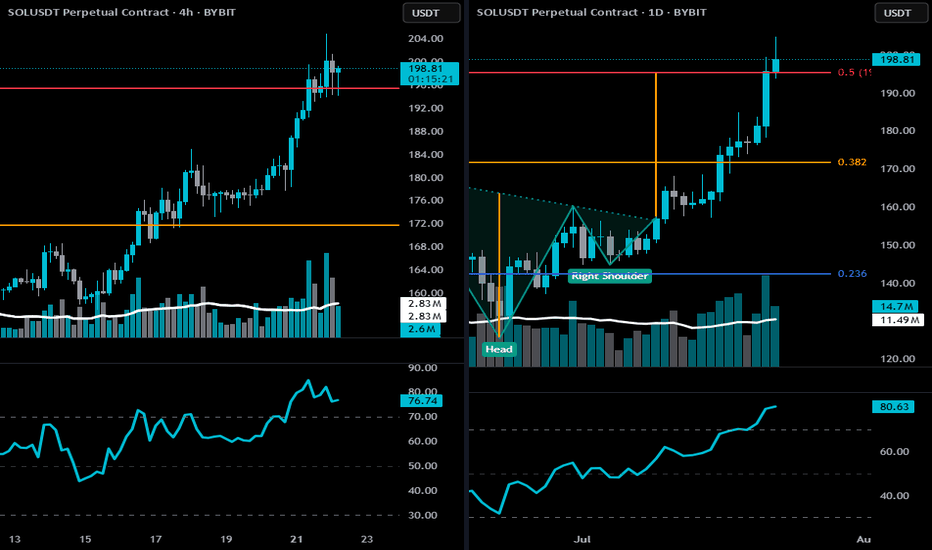

SOL CRUSHING-bearish risks developing🔻 4-Hour Bearish Thesis

🔸 Price Action Clues

SOL is currently stalling at the 0.5 Fibonacci retracement (~$198.18) of the full macro move — a classic profit-taking zone.

Multiple upper wicks and indecisive candles at resistance indicate supply absorption and buyer exhaustion.

After a steep rally, price is moving sideways in a rising wedge/flag, which is a bearish continuation pattern if broken downward.

🔸 Momentum + RSI

RSI at 76 is extended and flattening — often a zone where short-term pullbacks begin.

No confirmed bearish divergence yet, but momentum is weakening compared to earlier stages of the rally.

🔸 Volume Profile

Volume on recent pushes is lower than during breakout, suggesting diminishing bullish conviction.

Bearish if a breakdown below $194 occurs — that's the former breakout level and wedge support.

🧨 4H Breakdown Confirmation

Break below $194 (key short-term support) → opens downside targets:

🔻 $186–$182 (prior breakout base)

🔻 $171 (0.382 Fib retracement zone)

🔻 Daily Bearish Thesis

🔸 Price Action + Key Zone

Price is pressing against the neckline target ($198.18) of the inverse H&S pattern.

Stalling under the red resistance line and 0.5 Fib.

Recent candle closed with a small upper wick + reduced body size, hinting at hesitation after a parabolic run.

🔸 RSI Risk

RSI is at 80.41 — very overbought on daily.

While not immediately bearish on its own, this often precedes either:

Sharp correction, or

Prolonged consolidation

🔸 Fibonacci & Macro Resistance

$198–$200 is a confluence zone of:

0.5 Fib retracement

Previous structural resistance

Measured target of inverse H&S pattern ALREADY HIT.

This is not a great spot to initiate new longs — any weakness here invites a pullback.

⚠️ Invalidation of Bearish Thesis

A strong daily close above $200–$204, ideally with expanding volume, would invalidate the bearish outlook and shift momentum toward $219 (0.618 Fib).

🧠 Summary:

Yes, there is a short-to-mid-term bearish risk developing on both 4h and daily:

Overbought RSI

Stalling at major Fib resistance

Decreasing momentum

Vulnerable if $194–$195 breaks

Remember: this WILL MOST LIKELY BE A SHORT-SHORT pullback, not a confirmed trend reversal… yet. BUT I'VE INITIATED A STARTING POSITION!

THIS IS NOT FINANCIAL ADVICE. DrAnkin Smöökëē Whizkee. Edumacational Purpiz Only!

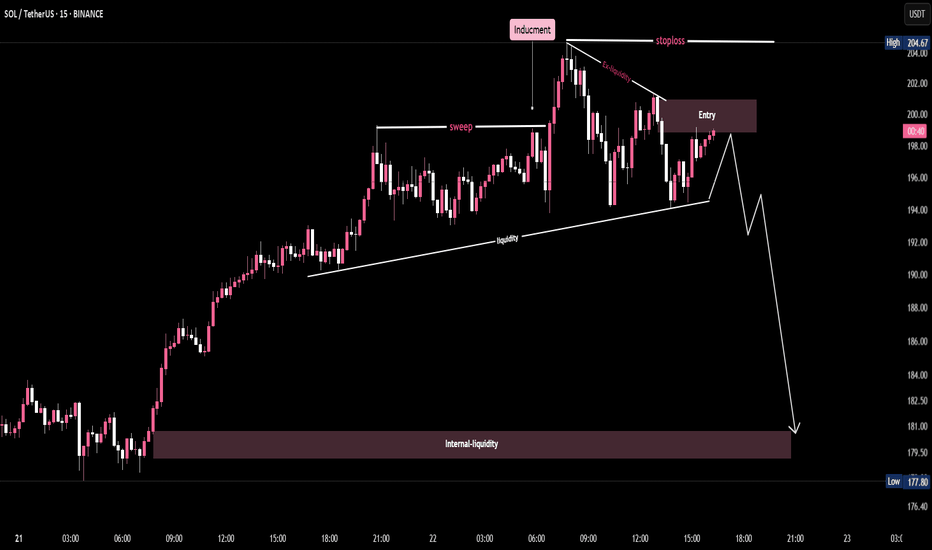

Bearish SMC Setup on SOL/USDT -15-Min chart🔑 Key Points from the Chart:

1.Inducement:

A price level engineered to trap breakout traders before reversing.

The chart shows a false breakout above the previous high, which induces buyers.

2.Sweep:

The market sweeps the prior highs (liquidity grab), enticing breakout traders.

Price shortly reverses after triggering stop orders above.

3.Ex-Liquidity (External Liquidity):

Refers to stop-loss clusters above the high.

This liquidity is taken out, leading to a reversal.

4.Entry Zone:

A supply zone where the price revisits after the sweep.

Ideal short entry indicated in the maroon box.

5.Stoploss:

Placed above the inducement high (post-sweep high).

Clearly labeled to show safe invalidation zone.

T6.rendline Liquidity:

Diagonal support connecting higher lows.

Acts as a trap—once broken, confirms bearish intent.

7.Internal Liquidity:

Major demand zone where price is expected to head next.

Target for the short setup, marked in a large maroon rectangle.

8.Projected Price Path:

White line showing expected bearish move.

Aims for internal liquidity zone below $181.

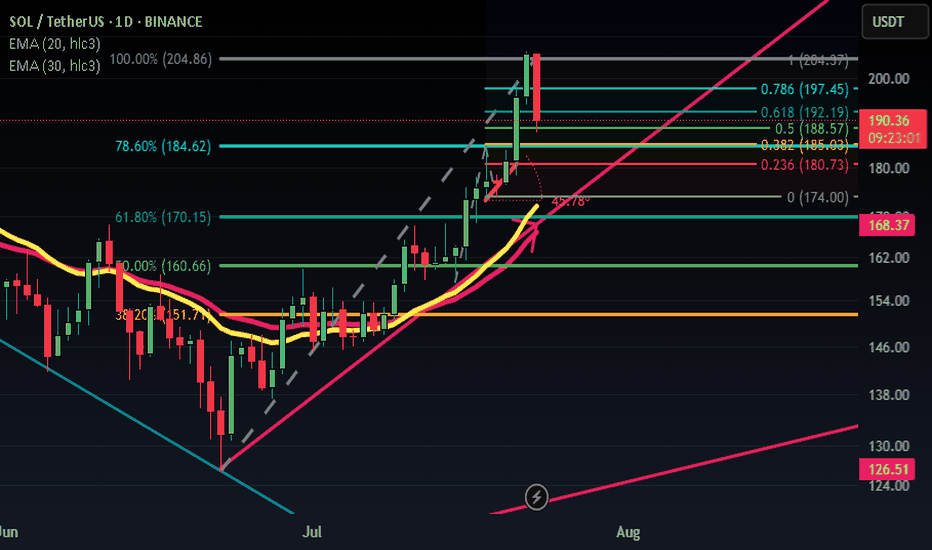

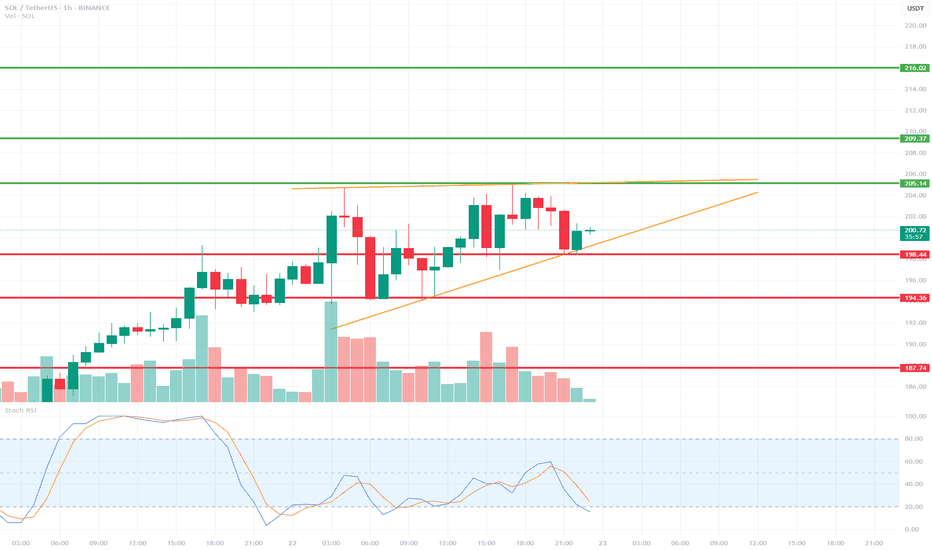

SOLUSDT 1H Short-Term🔍 Technical Structure:

Short-Term Trend:

SOL is currently in an uptrend, with local higher lows. This is evident from the orange uptrend line, which has been tested multiple times.

Local Resistance:

205.14 USDT – yellow line – a resistance level that the price has touched several times but failed to break (this could be a double-top formation).

Local Support:

198.48 USDT – the price is currently testing this level as support.

194.36 USDT – lower, more crucial support (stronger upon a trend breakout).

187.74 USDT – important support that would be tested in the event of a larger breakout.

📉 Oscillator – Stoch RSI:

The Stoch RSI is currently in oversold territory (below 20), suggesting the possibility of a local rebound.

However, there has been no upward crossover yet, so there is no strong buy signal.

🔊 Volume:

We are observing a decrease in volume during the current correction, suggesting that the declines are relatively weak – there is no strong supply impulse.

🧠 Short-term scenarios:

✅ Bullish scenario:

Price is rebounding from the trend line (orange) and the 198.48 USDT level.

A break of the 205.14 USDT resistance could open the way to:

209.37 USDT

216.02 USDT (next target)

❌ Bearish scenario:

A break of the trend line and the 198.48 USDT level with the 1-hour candle closing below.

Possible decline to:

194.36 USDT (first support)

and further to 187.74 USDT if selling pressure increases.

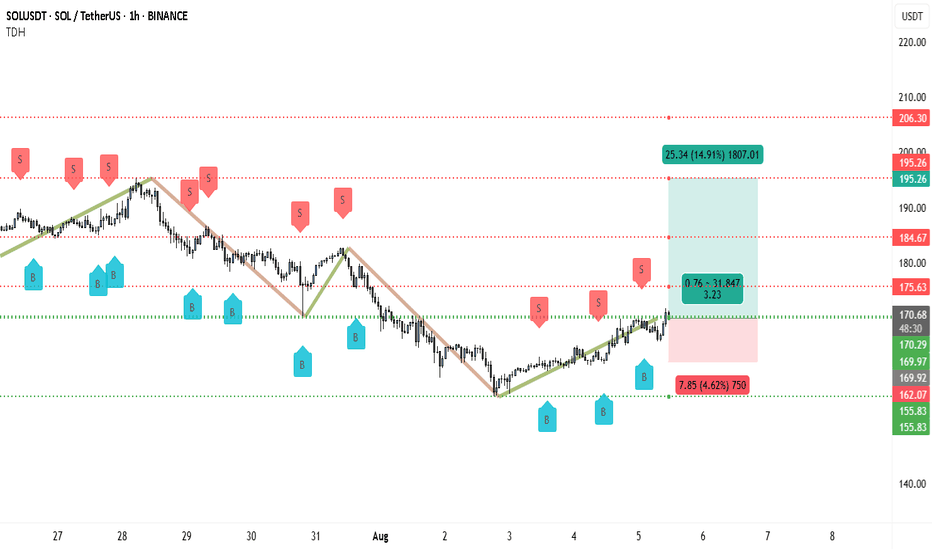

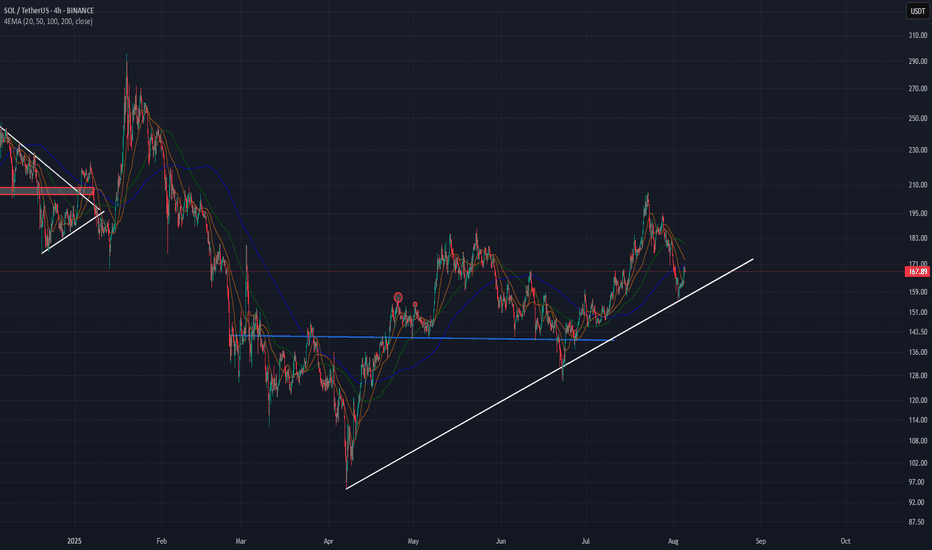

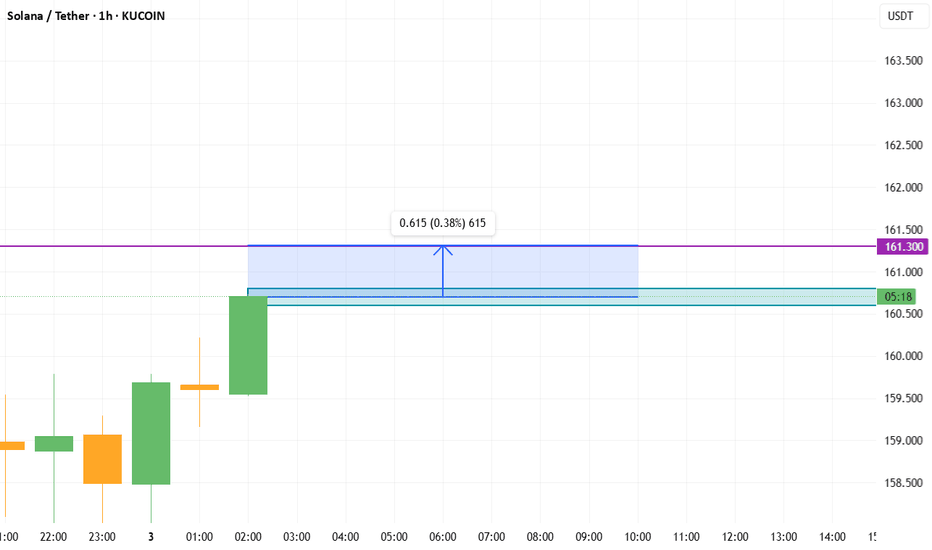

From $162 to $195 — Solana’s Next Big Move Could Be StartingSolana has recently rebounded from a strong demand zone around $162.07–$155.83 after an extended downtrend. This support has held multiple times over the past few sessions, showing that buyers are defending it aggressively. The “B” buy signals near these lows further support the case for an upward move.

Price has now broken above the $170.29–$169.97 resistance area, which has flipped into immediate support. Holding above this zone strengthens the probability of continuation toward the next key resistance levels.

The first resistance to watch is $175.63, followed by $184.67. If price sustains above these zones, the major bullish target lies near $195.26, aligning with the top of the projected profit zone in your chart.

From a structure perspective, the pattern suggests a potential short-term trend reversal, with higher lows forming since August 3. This change in market structure, combined with the break above the recent consolidation, indicates renewed bullish momentum.

Trading Setup

• Entry: Around $170.80–$171.00 (above breakout confirmation)

• Stop-loss: Below $169.90 or deeper at $162.00 for wider protection

• Take-profit 1: $175.63

• Take-profit 2: $184.67

• Final Target: $195.26

• Risk-Reward: Approximately 3.2:1

Risk Caution

Solana is known for sharp intraday swings. Traders should consider locking partial gains once the price moves 2–3% in their favor (about +3–5 USDT from entry) to protect capital while still holding for the larger target.

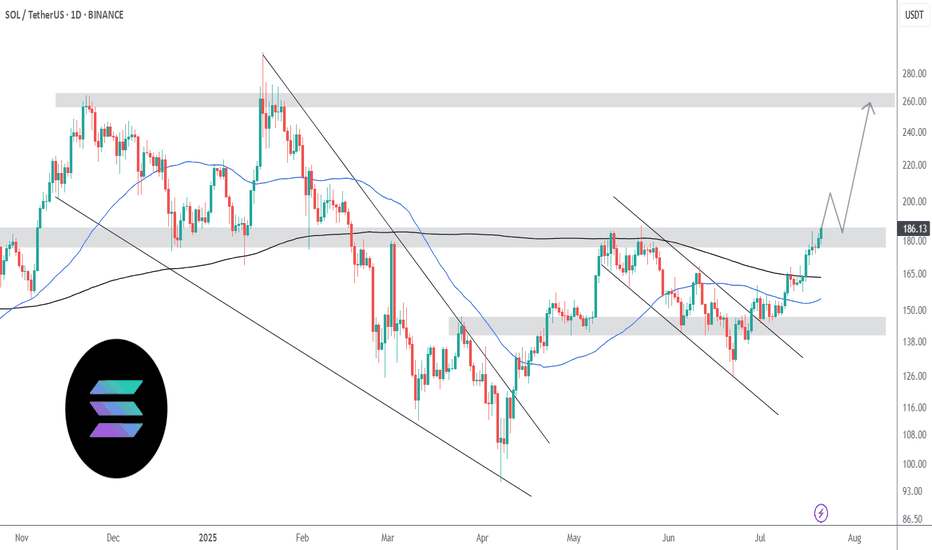

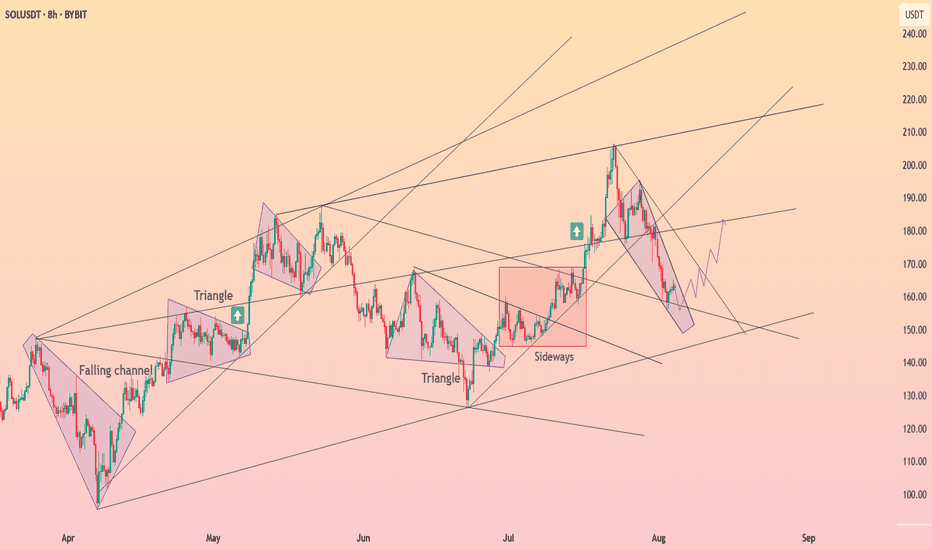

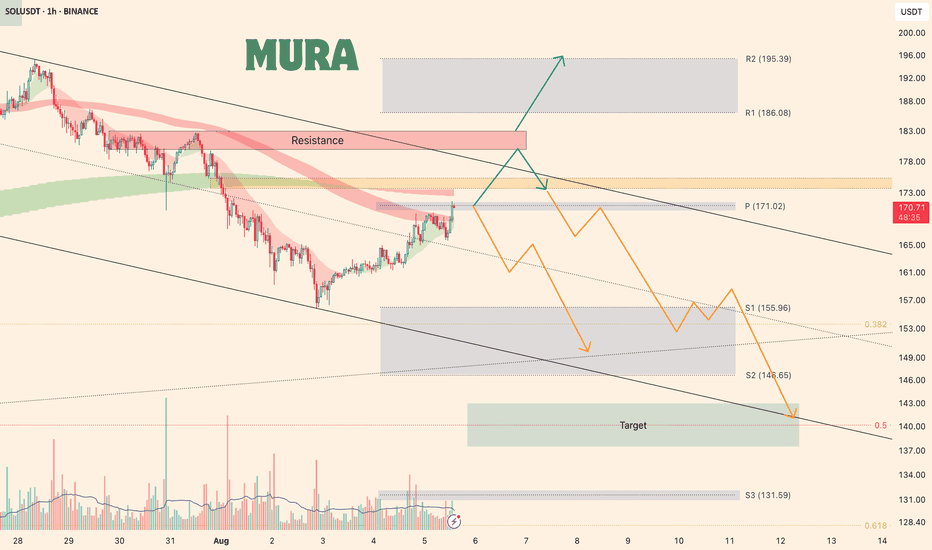

Weekly trading plan for SolanaPrice is currently testing the weekly pivot point, but significant resistance remains overhead. We could see a fake breakout of the descending channel before a true downside move materializes.

Key Levels & Scenarios:

Primary Target: $136-146 range

Bullish Invalidation: A confirmed break & hold above $182 would shift bias, opening path to $200

Until we clear $182 decisively, the structure remains bearish. Trade the ranges carefully.

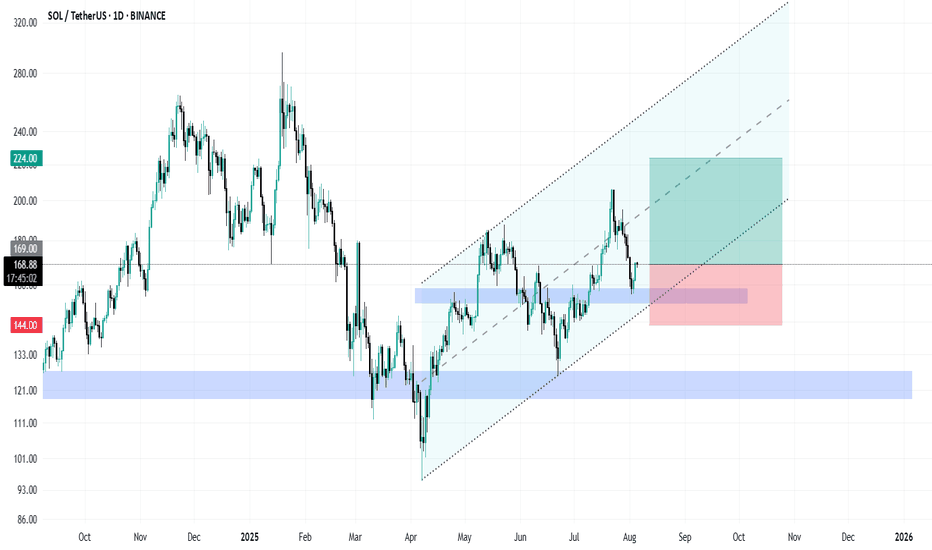

Solana Technical AnalysisBINANCE:SOLUSDT

Solana ( CRYPTOCAP:SOL ) Technical Analysis:

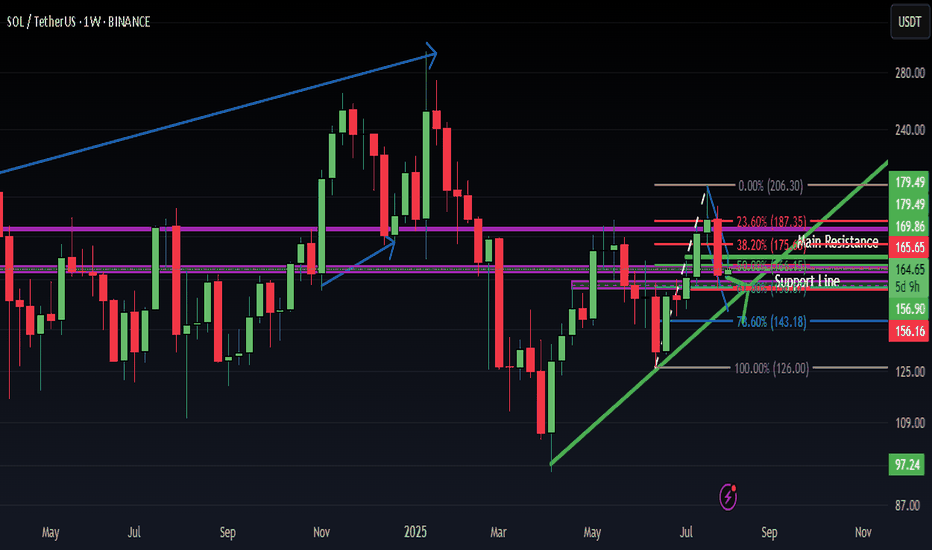

Last week, #Solana closed below its daily resistance level of $184.13 on Monday and subsequently declined by 13.44% over the next five days. The decline found support around the 200-day Exponential Moving Average (EMA) at $162.75 on Sunday. Notably, this EMA level aligns closely with the 61.8% Fibonacci retracement at $163.40, establishing a key support zone.

At the start of this week, SOL rebounded by 4.68% on Monday, and as of Tuesday, it is trading near $168.67.

If the 200-day EMA at $162.75 continues to hold as a support level, there is potential for SOL to extend its rally toward the daily resistance at $184.13.

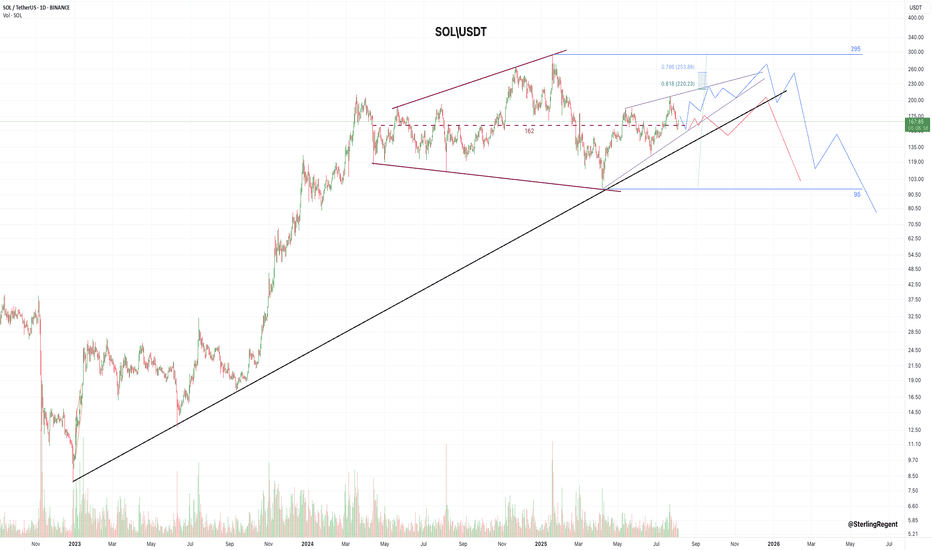

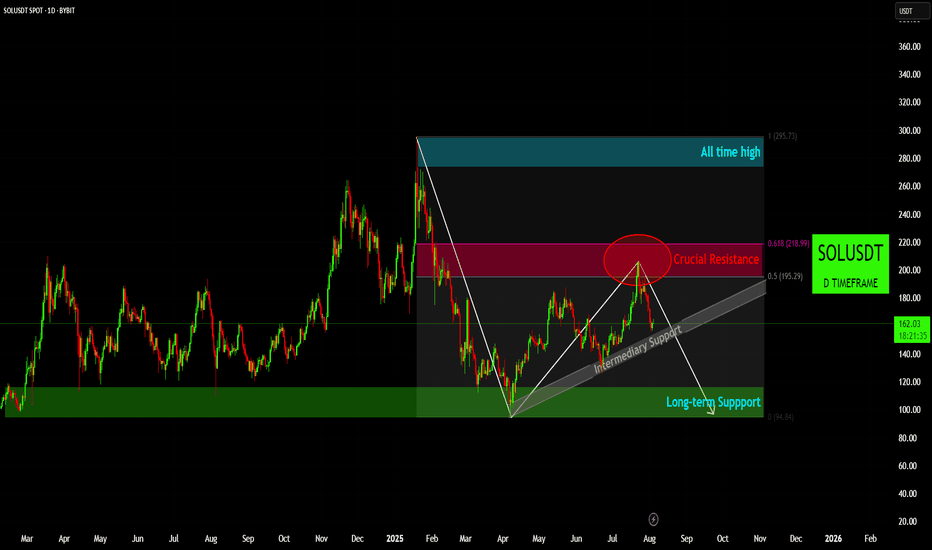

SOLUSDT: The Bears' Defense Holds Firm at the Golden Ratio. SOLUSDT: The Bears' Defense Holds Firm at the Golden Ratio. What's Next?

The Solana market has undergone a significant correction from its all-time highs, and the recent price action suggests the downtrend may not be over. The current structure is defined by a clear rejection from a formidable resistance zone, signaling that sellers remain in control for now.

The Bearish Rejection & Crucial Resistance 🔴🚨

Following the initial sharp decline, price made a notable attempt at a recovery, forming a rising intermediary support trendline. However, this recovery rally was decisively halted at a critical level—a confluence of a Crucial Resistance Zone and the 0.5 to 0.618 Fibonacci retracement levels. This red zone, from approximately $195 to $218, has proven to be a major supply area. The recent price action saw a strong rejection from this region, with the price now breaking below its intermediary support trendline.

The Breakdown of Intermediary Support 📉

The rising white trendline, which had provided support for several months, has been broken. This breakdown is a significant bearish signal, indicating a loss of momentum and a potential shift in the short-term trend from bullish to bearish. This event increases the probability of a move toward lower support levels.

The Ultimate Line in the Sand: Long-term Support 💪🟢

Should the current bearish momentum continue, the next major demand zone is the Long-term Support area, a wide green band from approximately $100 to $120. This region has historically served as a strong base of support and represents the last major line of defense for the bulls. A test of this zone would be a significant event, and a break below it could lead to further extended declines.

What to Watch For: The Path to Bullish Confirmation 🚀

For the sentiment to turn definitively bullish, Solana needs to demonstrate a new wave of buying power that is strong enough to overcome the current overhead resistance. The market must see a sustained break and close above the Crucial Resistance Zone ($195-$218), specifically above the 0.618 Fibonacci level. A successful push above this formidable barrier, especially with strong volume, would invalidate the current bearish outlook and signal a potential move toward new highs. Until then, the path of least resistance remains to the downside.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.