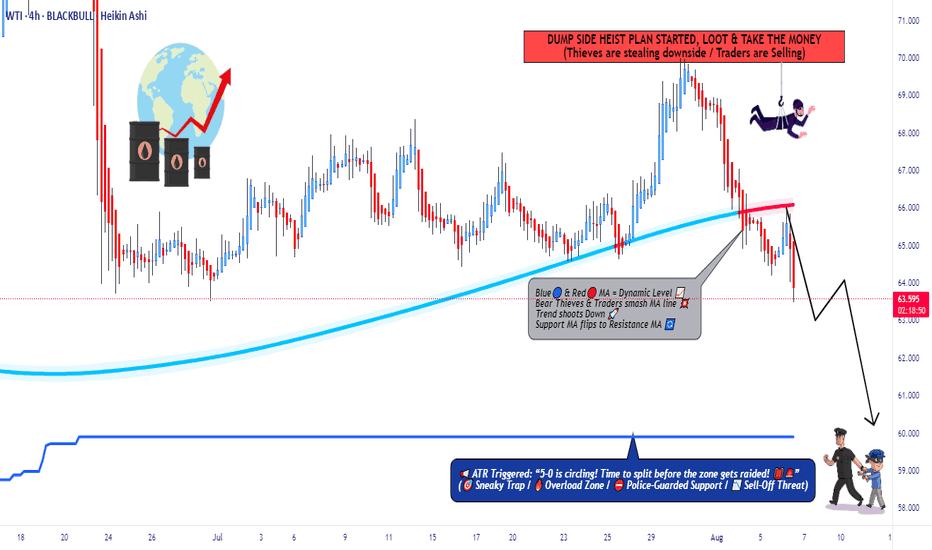

WTI Under Attack – Rob the Market with This Bear Setup🛢️💣 WTI Oil Short Raid: Bearish Heist Activated! 💣🛢️

📉 Thief Trader’s Limit-Layered Attack Plan 🔐

💥 Attention Market Robbers & Chart Breakers! 💥

We're about to break into the XTIUSD / US Oil Spot vault — Bearish style.

🚨 The Setup:

This ain’t your average breakout — we’re talking high-precision, multi-layered entries on a downside raid.

🧠 Thief Trader Strategy: Drop limit orders at key zones like trip wires. Let price walk into your trap.

🎯 Plan:

🧱 Entry: Any level after MA resistance confirmation.

Layer multiple limit orders — DCA-style — after trend shows weakness.

🛑 Stop Loss: 66.300 🔒

Protect your vault. Place SL just above major 4H rejection zone.

🎯 Target: 60.000 💰

Profit at exhaustion level. This is where bulls cry, and we cash out.

🧠 Robbery Logic Backed By:

COT Data 📊

Crude Oil Inventories 🛢️

Macro + Sentiment Flows 🌐

Technical MA Break + Retest Patterns 🎯

🔥 Why this isn’t a random short?

Because thieves do research — not guesswork.

Bulls have overextended. Oil’s price is reacting to strong supply pressure and weakening demand outlook.

⚠️ Risk Note:

No entry without trend confirmation.

No blind shots — place alerts and wait for the setup.

This is a sniper job, not a shotgun spray.

💬 Join the Robbery Crew

Smash that ❤️ & Boost if you're riding with the thieves!

Drop your charts, entries, or sniper shots in the comments 💬

We rob together. We win together.

🔔 Follow for more heist plans – next market break-in coming soon.

💰 Rob Smart. Trade Sharp. Exit Clean. 🏴☠️

SPOTCRUDE trade ideas

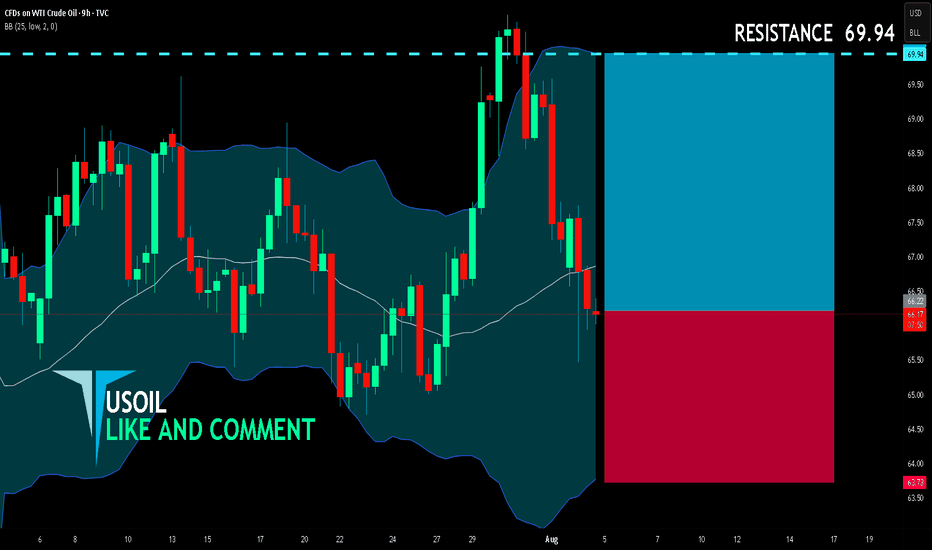

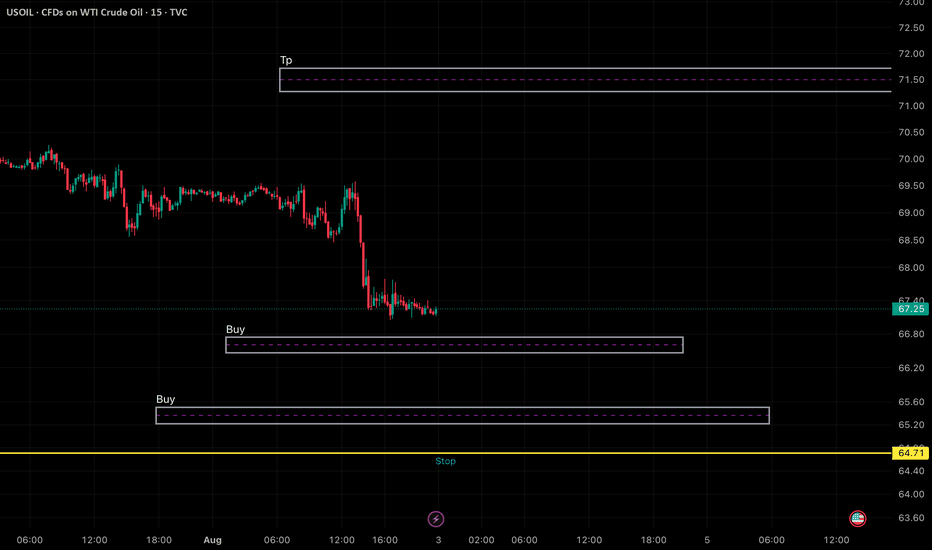

USOIL BULLISH BIAS RIGHT NOW| LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 66.22

Target Level: 69.94

Stop Loss: 63.73

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USOIL BEST PLACE TO BUY FROM|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 63.31

Target Level: 68.69

Stop Loss: 59.72

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

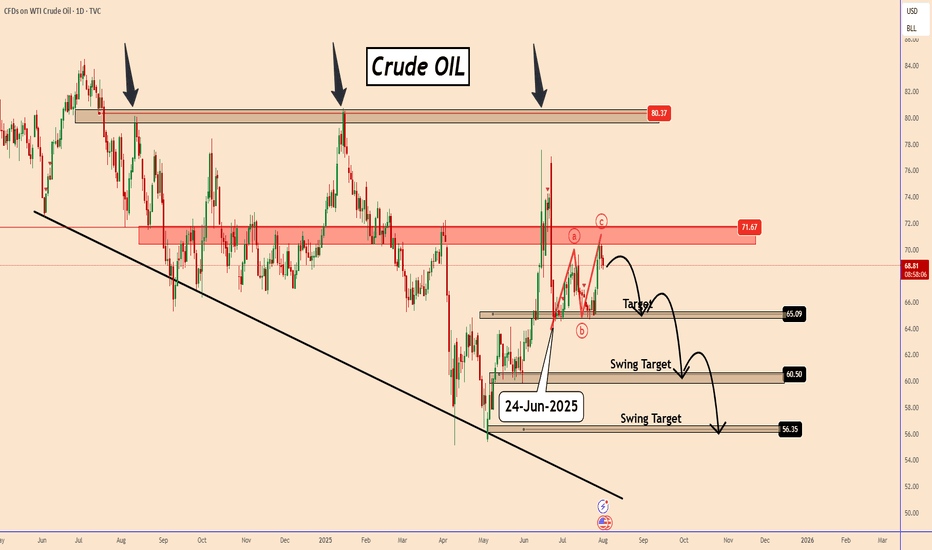

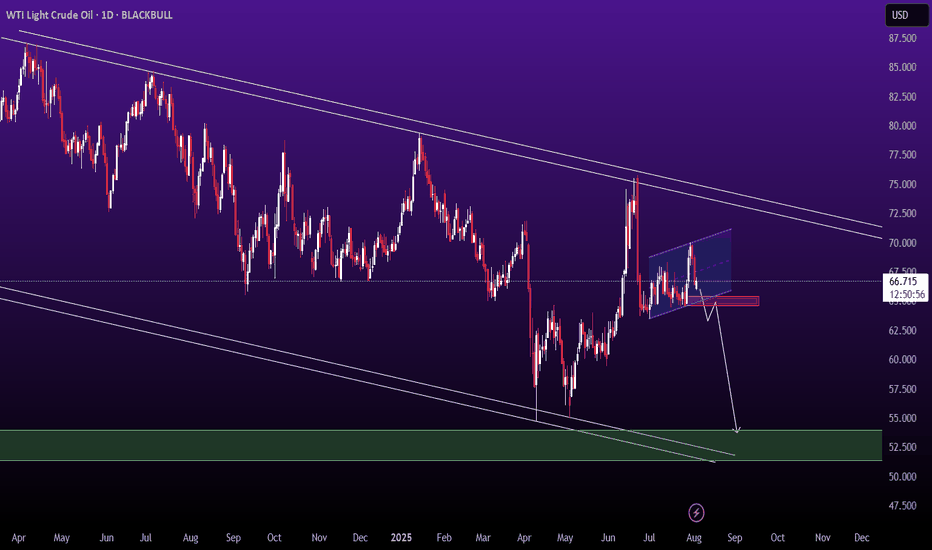

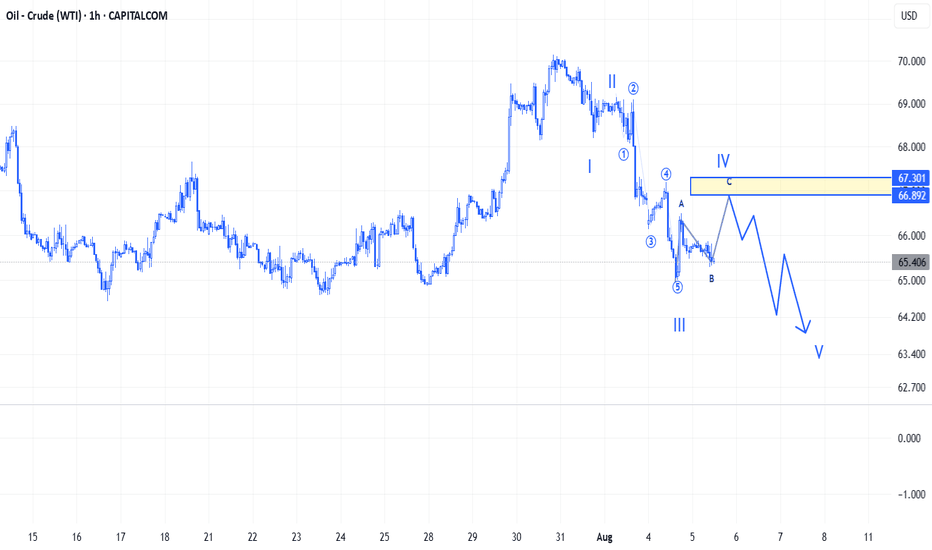

Oil Faces Bearish Turn After Speculative SpikeOil Faces Bearish Turn After Speculative Spike

Since June 24, 2024, when oil prices reached $64 entered a 38-day bullish correction. Based on the chart, this move appears to be forming an ABC corrective pattern, which may now be nearing completion.

From here, a renewed decline is likely, with potential downside targets at $65, $60, and $56.

Geopolitical Speculation Oil prices jumped in recent days following President Donald Trump's heightened rhetoric toward Russia. His announcement of a tighter deadline to end the war in Ukraine, along with tariff threats targeting countries trading Russian oil, stirred market reactions.

However, this rally seems driven more by speculation, and oil may soon resume the bearish movement again.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

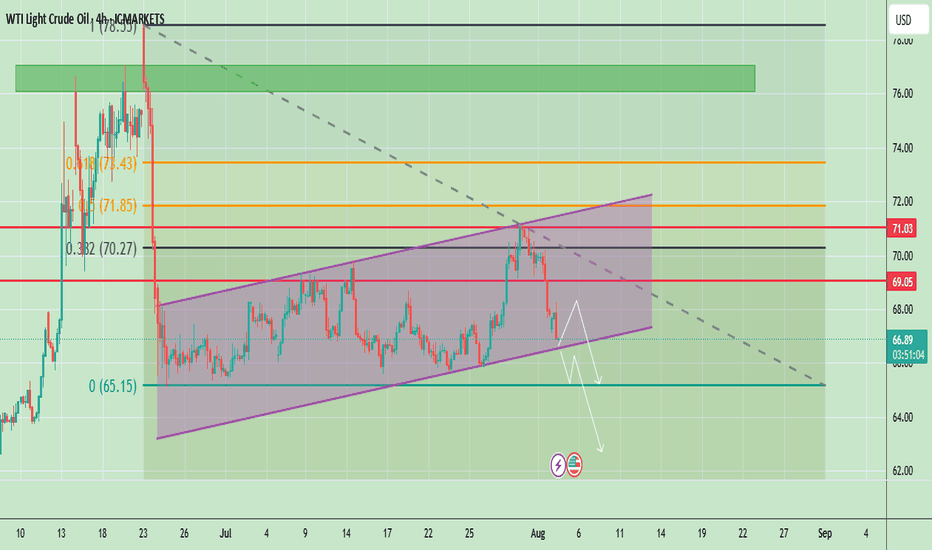

Oil at Key Support – Bounce or Breakdown?Crude oil is trading around $66.94, showing a bearish correction after failing to hold above $69.05. The chart shows price respecting an ascending channel but currently testing its lower boundary. The recent drop signals weakening bullish momentum, and a confirmed break below the channel could accelerate selling pressure toward lower levels.

📈 Potential Scenarios

- Bullish Rebound: If price holds above the channel support (~$66.00–$66.50) and breaks back above $69.05, it may target $71.03 and possibly $72.00.

- Bearish Breakdown: A confirmed close below $66.00 can accelerate the downside toward $65.00, with extended targets near $63.50–$62.00.

📊 Key Technical Highlights

- Price rejected from the channel top and is now testing lower support.

- Key resistance zones: $69.05 (immediate), $71.03 (major).

- Key support zones: $66.00 (channel), then $65.00–$63.50 (breakdown targets).

- Momentum indicators show weakening buying pressure, favoring cautious trading.

🔑 Key Levels to Watch

- Resistance: $69.05 → $71.03 → $72.00

- Support: $66.00 → $65.00 → $63.50

🧭 Trend Outlook

- A short-term relief bounce is possible, but failure to reclaim $69.05 keeps sellers in control.

- Breaking below the channel would shift the overall outlook to bearish for August.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

USOIL Sellers In Panic! BUY!

My dear subscribers,

USOIL looks like it will make a good move, and here are the details:

The market is trading on 63.34 pivot level.

Bias - Bullish

My Stop Loss - 63.05

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 63.89

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

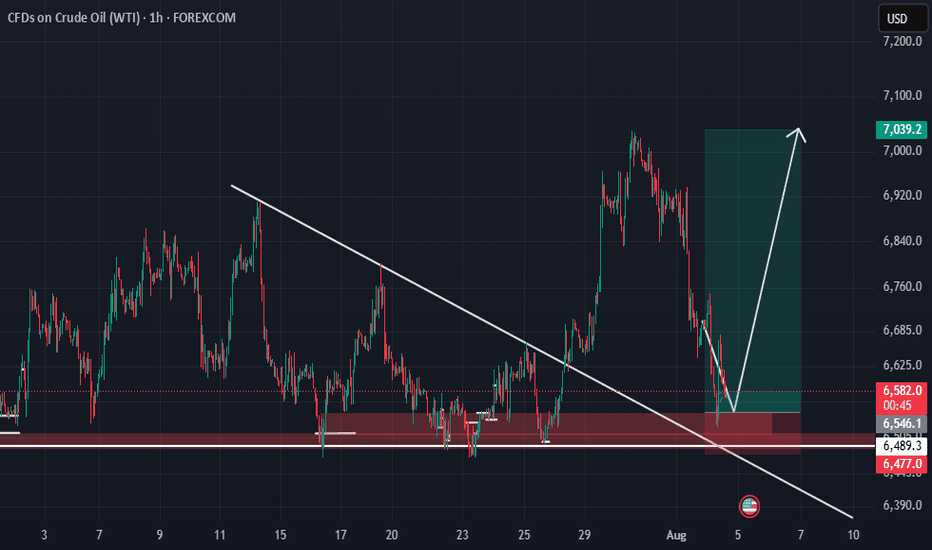

USOIL drops on rising supply and demand concernsUSOIL drops on rising supply and demand concerns

Oil prices fell Tuesday as OPEC+ planned a 547,000 bpd output increase for September, overshadowing potential Russian oil supply constraints from U.S. policies. Brent and WTI crude dropped to their lowest in a week, marking a fourth consecutive decline. OPEC+’s reversal of 2.5 million bpd cuts, combined with weak demand outlooks due to U.S. recession risks and China’s lack of new stimulus, pressured prices. Trump’s threatened 100% tariffs on Russian crude buyers like India, which imports 1.75 million bpd, heightened trade tensions but failed to lift oil prices. Analysts warn U.S. tariffs could further weaken global growth and fuel demand.

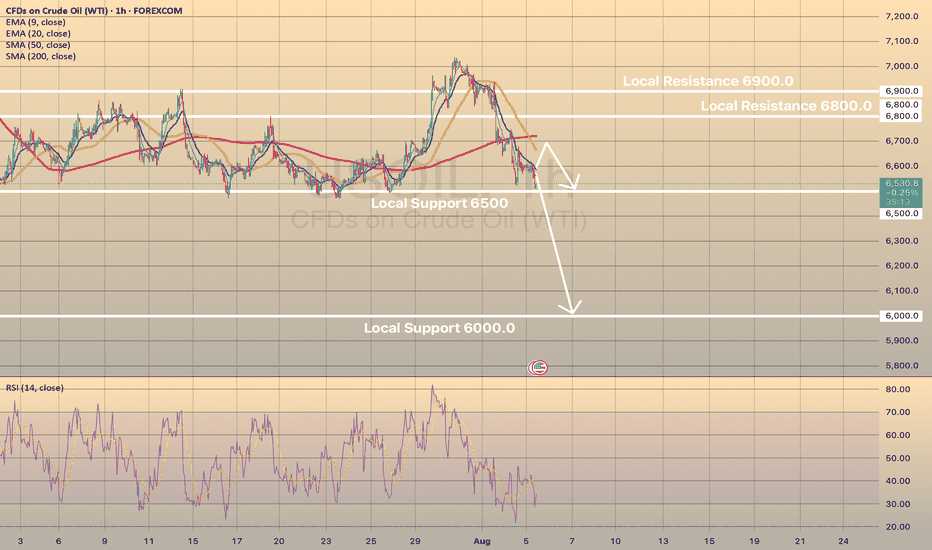

USOIL shows some in-moment strength on RSI on 1-h chart, the price may rebound towards sma200 at 6,700.00. However, in long-term perspective, low oil price is expected. Eventually, the price may decline towards level of 6,000.00.

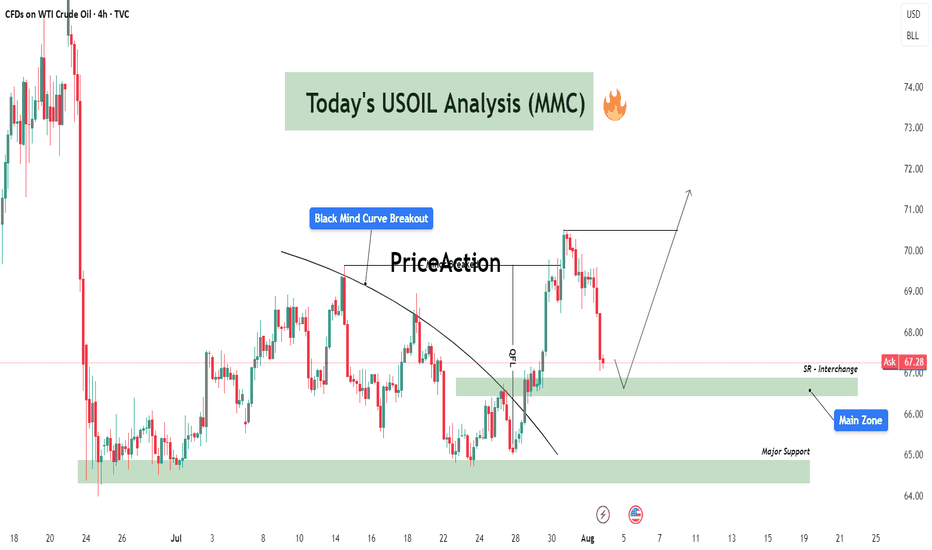

USOIL Technical Analysis – Black Mind Curve Breakout & Reversal🔍 Overall Market Context:

The current USOIL structure is a great example of market shift from compression to expansion, characterized by a breakout of the Black Mind Curve followed by a measured impulse move. This chart is not just reacting technically, but it reflects how institutional smart money manipulates curves, breaks minor structures, and then retests zones to refill orders before continuing directionally.

Let’s break the market psychology and price action phase by phase:

🔄 Phase 1: Black Mind Curve Breakout ✅

The Black Mind Curve represents long-standing supply pressure that had been capping price.

Its breakout marks a shift in market intention, often signaling the end of a distribution phase and beginning of a possible accumulation or re-accumulation.

Price broke above this curve cleanly with strong bullish candles, which also broke minor structure levels, confirming short-term bullish sentiment.

The breakout was also backed by momentum and volume as the market pushed 130+ pips upward—an aggressive impulse that trapped late sellers below.

📉 Phase 2: Retracement to Interchange Zones

Now, we’re in the retracement phase, where price is pulling back toward:

🔹 SR Interchange Zone ($66.80 - $67.30)

This zone was previous resistance, now flipping to support.

In MMC terms, this area is expected to serve as a refill zone where smart money will look to accumulate again after the breakout.

We are watching for confirmation candles or MMC-style reversal patterns here (e.g., inside bar breakouts, demand imbalances).

🔹 Main Zone ($65.80 - $66.50)

If the first zone fails, this is the next key demand base.

It holds historical value from previous accumulation phases (see July 10–25) and aligns with the origin of the last impulse.

Expect a sharper wick or deeper liquidity grab if price moves into this area.

📉 Phase 3: Final Defensive Zone – Major Support ($63.70 - $65.20)

This zone marks the last line of bullish defense.

A move here would mean the bullish structure is being reevaluated or absorbed by sellers.

However, if price hits this level, it could also attract significant institutional demand, setting up for a more powerful long-term leg up.

Reactions here are typically large and volatile, with a risk of fakeouts and fast reversals.

📈 Possible Scenarios (MMC Based Forecasting):

✅ Scenario 1 – Bullish Continuation (Primary Path)

Price finds support inside SR Interchange Zone.

Forms a base (MMC reversal structure) and pushes back to recent highs near $71.

Breakout above $71 opens room for next supply zones between $72.50 - $74.00.

⚠️ Scenario 2 – Deeper Liquidity Grab

Price breaks below SR Interchange and tests Main Zone for a deeper accumulation.

A wick or shakeout may happen before bullish continuation.

This trap zone could give the best R:R entry.

❌ Scenario 3 – Breakdown to Major Support

If both zones fail and bearish pressure sustains, price may revisit Major Support.

That would reset the bullish structure and require fresh MMC assessment.

🧠 MMC Logic at Work:

The curve break symbolizes the shift from supply dominance to a possible demand-led phase.

Minor structure breaks add fuel to trend shift and indicate participation from larger players.

Retracements are not weaknesses—they are refills for those who missed the move.

Smart money uses these zones and flips (SR interchanges) to hide in plain sight.

🎯 Key Takeaway for Traders:

This is a textbook MMC setup that combines:

Curve Breakout + Impulse

Zone Retest + Interchange Logic

Liquidity Engineering before Continuation

Traders should remain patient and observe reactions at each zone. Don’t chase—wait for the market to reveal its hand via MMC entry signals (break-of-structure, bullish engulfings, imbalance fills, etc.)

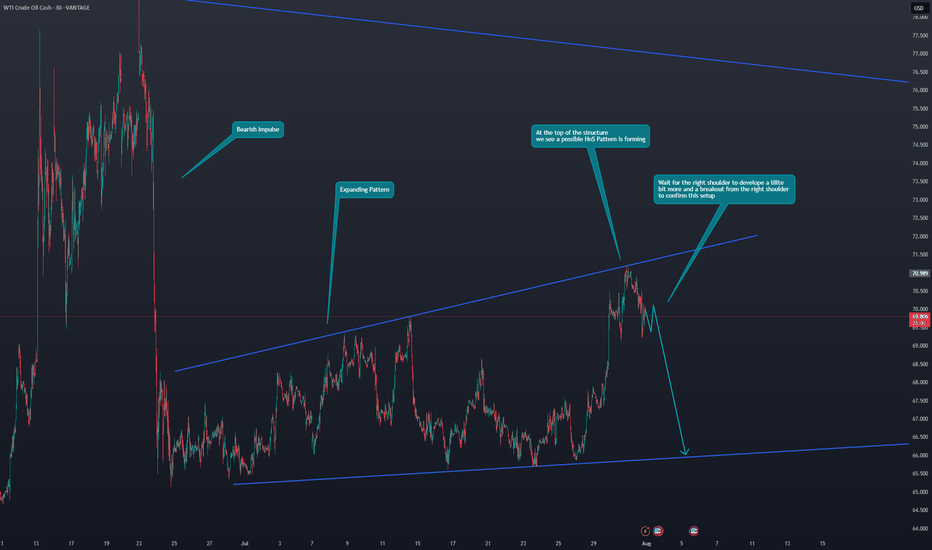

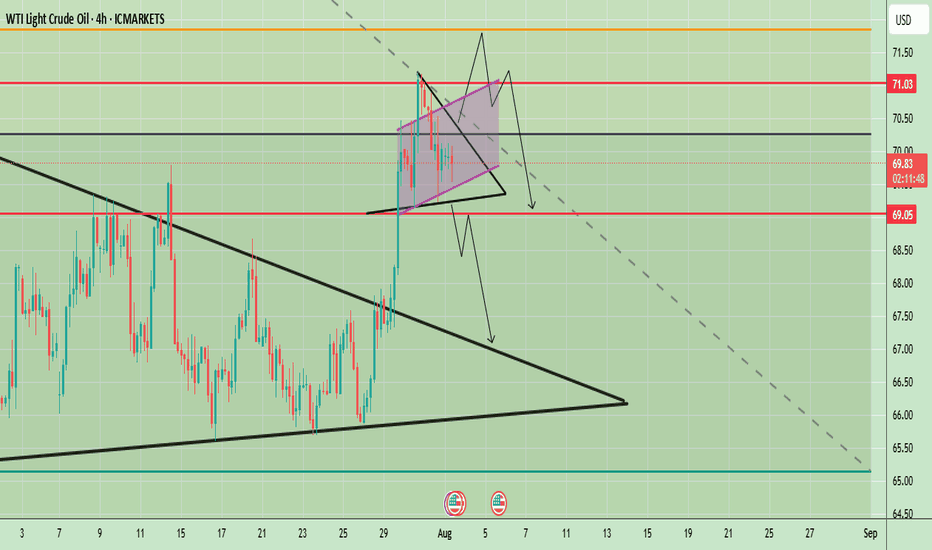

WTI Crude Oil Technical Outlook – Key Breakout or BreakdownWTI Crude Oil 4-hour chart suggests a potential inflection point after a strong bullish breakout from a larger symmetrical triangle pattern in late July. The price surged past key resistance levels and is now consolidating in a smaller symmetrical triangle formation just below the psychological $70 mark. This indicates a phase of indecision following a strong move, with market participants awaiting further confirmation.

Price is currently hovering around $69.82, with key levels marked at $71.03 (resistance) and $69.05 (support). The short-term price action within the tight triangle could determine the next move, with both bullish continuation and bearish reversal scenarios on the table.

Prices remain supported by supply concerns after Trump threatened to impose 100% secondary tariffs on buyers of Russian crude and warned China, a major oil consumer of severe penalties if it continues its purchases of Russian oil.

🔍 Potential Scenarios

- Bullish Breakout Scenario

If price breaks out of the smaller symmetrical triangle to the upside and clears the $70 resistance level with strong momentum, it may quickly test the $71.03 zone. A clean break above $71.03 would confirm the continuation of the previous uptrend, potentially opening room toward $72.50 and beyond in the medium term. The pattern would resemble a bullish pennant — a continuation pattern following the late July rally.

-Bearish Rejection and Breakdown

Conversely, a failure to sustain above $70 followed by a break below the lower boundary of the smaller triangle could lead to a sharper decline. The first critical level to watch would be $69.05; a break below this would likely invalidate the bullish setup and initiate a retest of the previously broken upper trendline of the larger triangle near $67.50. A further breakdown could lead price towards the larger support zone around $65–$66.

📈 Trend Outlook

- Short-Term: Neutral to Bullish — Consolidation in a smaller symmetrical triangle suggests a pause before continuation. However, the structure is still technically bullish unless $69.05 is broken.

- Medium-Term: Bullish Bias — The breakout from the large symmetrical triangle in late July indicates a shift in market sentiment, favoring higher prices unless the price fails to hold above $67.50.

- Long-Term: Cautiously Bullish — As long as WTI holds above the $65–$66 structural support area, the longer-term outlook remains constructive.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

USOIL Bulls Seize a New OpportunityThe EIA crude oil inventory data is scheduled for release today and is expected to have a significant impact on USOIL prices. Based on the previously released API report, there’s a high probability that the EIA data will also be bullish.

From a technical perspective, USOIL is currently showing signs of a potential rebound. Therefore, for traders participating in USOIL today, it may be more favorable to adopt a bullish bias. If managed well around key support levels and timing, the setup could offer attractive profit opportunities.

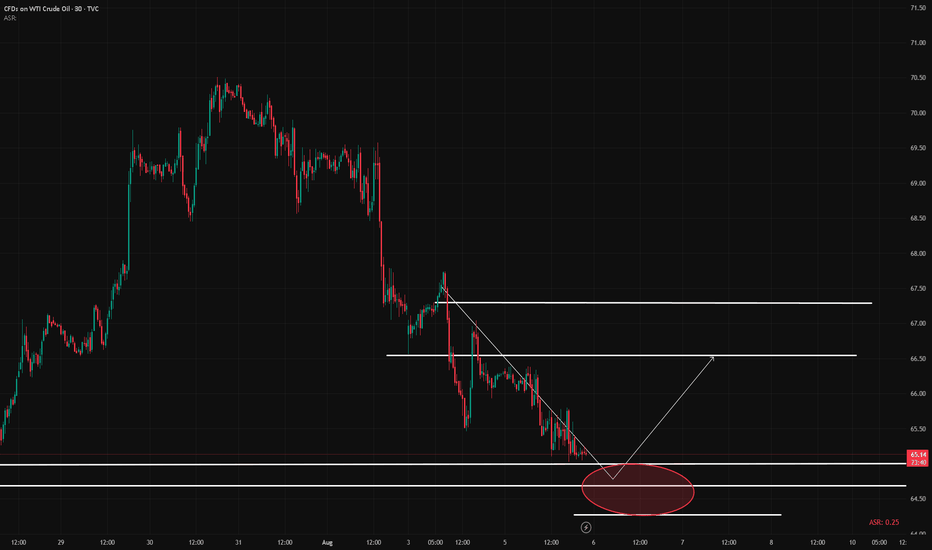

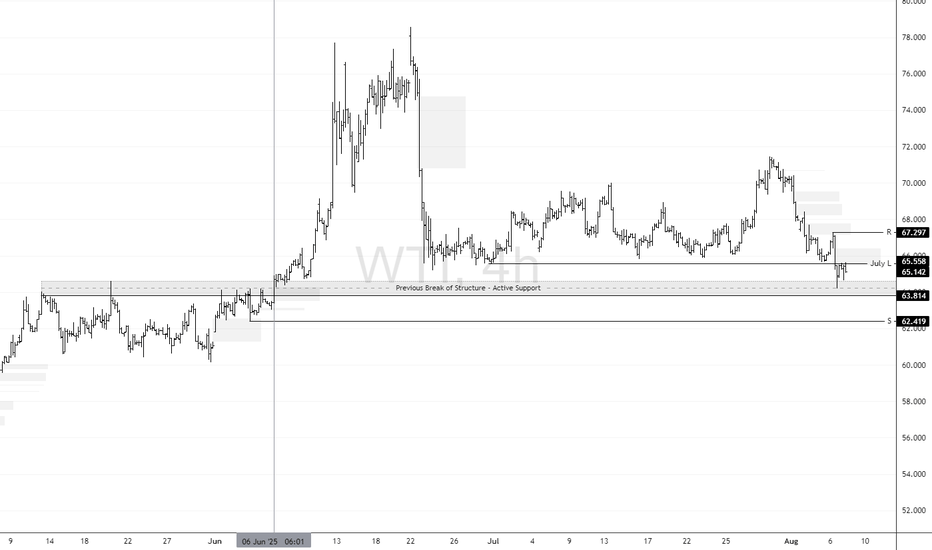

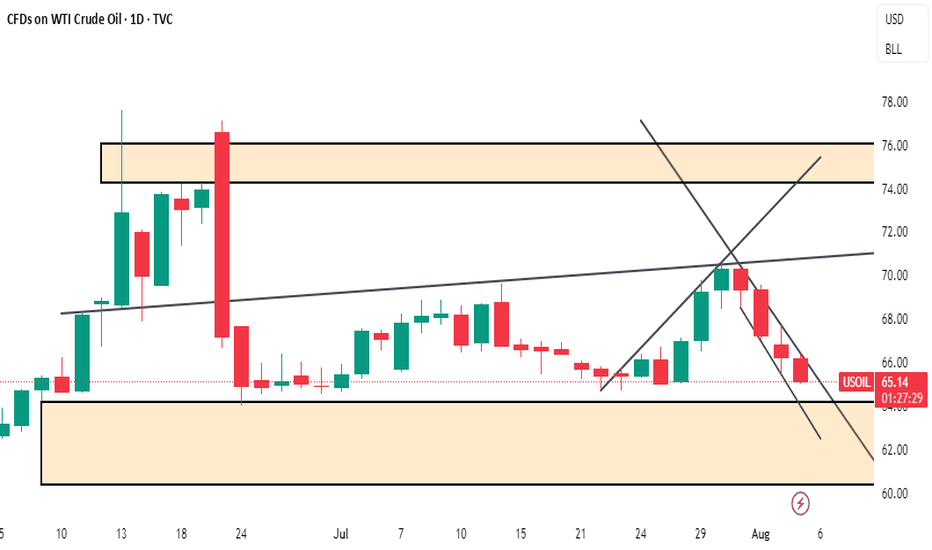

Oil Left Bulls Bruised and Bankrupt: A Silver Lining for RecoverFenzoFx—Crude Oil remains bearish, taking out bulls and breaking July's low this week—an unexpected move for the month. WTI Crude currently trades near $65.2, aligning with its prior market structure shift from bearish to bullish, marked by a bullish engulfing on June 6.

Forecast : Immediate resistance stands at July's low of $65.5. If price breaks above, Oil may begin to recover some losses. Technically, the next upside target is the order block at $67.29.

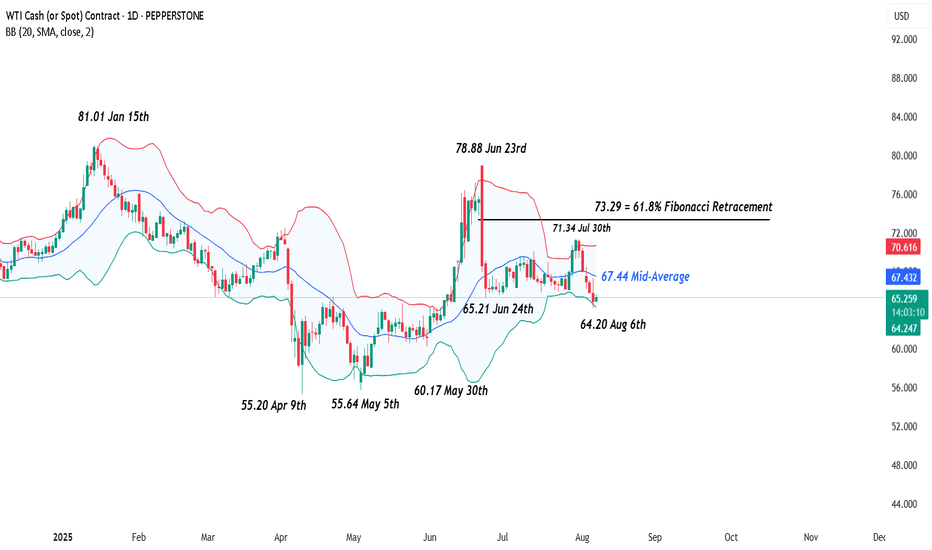

Could Oil (WTI) Be Breaking Out of its Range?Oil (WTI) has moved back to the forefront of traders thinking this week after OPEC+’s weekend decision to raise September production by circa 550k barrels per day. They also put traders on notice that all options remain open regarding further production increases to replace another output layer, amounting to 1.66 million barrels per day that has been offline since 2023. A decision on what comes next is due to take place at a meeting scheduled for September 7th.

Perhaps unsurprisingly, this potential for extra production (supply) being unleashed into the market later in the year has led to some downside pressure for Oil this week. This is because it comes at a time of uncertainty surrounding Oil demand due to possible weaknesses in the global economy, created by President Trump’s tariff policies. Oil (WTI) prices have fallen 4.8% from opening levels on Monday to post a new 1 month low at 64.20 yesterday, a level that it currently holding (more on this in technical update below).

Looking forward, one of the challenges traders are facing for where Oil moves next is President Trump’s August 8th deadline for Russia to end the war with Ukraine or face fresh sanctions on its energy exports. President Trump has also suggested he would increase tariffs on countries buying Oil from Russia, including China, although right now India is his initial focal point in this regard and yesterday, he doubled tariffs on Indian goods (25% to 50%) due to the country’s purchases of Russian Oil. These new tariffs are due to start in 3 weeks’ time.

With so much uncertainty surrounding Oil prices, including reports of a possible meeting between President Trump and President Putin being scheduled at some stage next week, it could be useful to be prepared for a potential increase in Oil (WTI) price volatility.

Technical Update: New Correction Lows Posted

Having seen the sharp sell-off in Oil between June 23rd and 24th 2025, a period of more balanced activity developed, as a reaction to over-extended downside conditions in price.

As the chart above shows, this resulted in a phase of sideways price activity between support marked by the 65.21 June 24th low, up to 71.34, which is equal to the July 30th failure high. However, price declines on Wednesday this week, have produced closes below 65.21, in the process of posting a new correction low at 64.20.

While communications between the US and Russia regarding the war in Ukraine are on-going, this type of break lower in the Oil price is no guarantee of future declines, so it could be helpful to assess what could be the potential support and resistance levels to focus on, just in case the outcome of these events lead to an increase in Oil price volatility.

Possible Next Support Levels:

As we have said above, the August 6th price weakness has seen a new correction low posted at 64.20, and this may now be viewed as the first support focus. Closes below 64.20 might then lead to a more extended decline in price.

Such moves would indicate the potential of further price weakness, with the next support possibly marked by the May 30th session low at 60.17, perhaps further towards 55.64 (May 5th low), if this level in turn gives way.

Potential Resistance Levels:

On the topside, within a period of price weakness, it can be the declining Bollinger mid-average that reflects the first possible resistance, and for Oil this currently stands at 67.44. Closing breaks above 67.44, if seen, could prompt further attempts to develop price strength to test higher resistance levels.

The first possible level would appear to be marked by 71.34, which is the July 30th session high. If this level was broken on a closing basis, it might then lead to tests of 73.29, which is equal to the 61.8% Fibonacci retracement of the June 23rd to June 24th sell-off.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

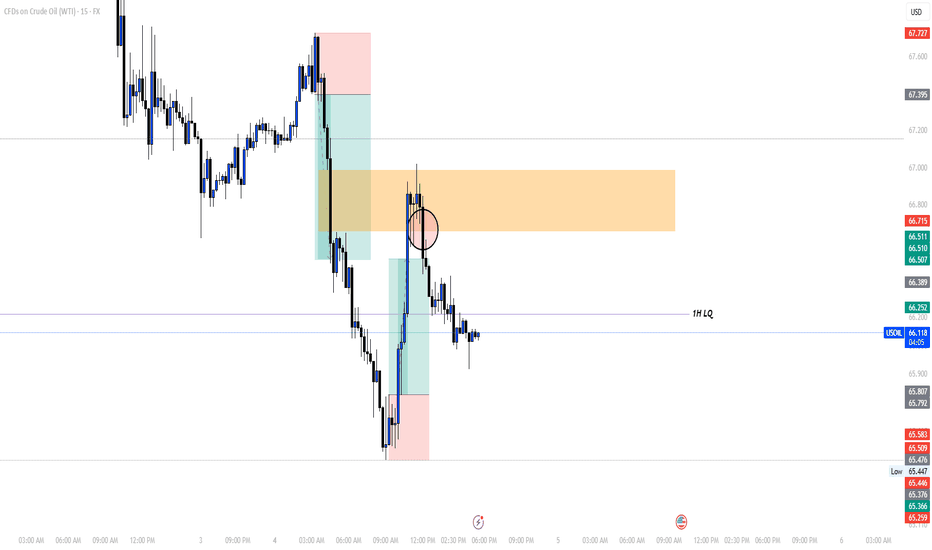

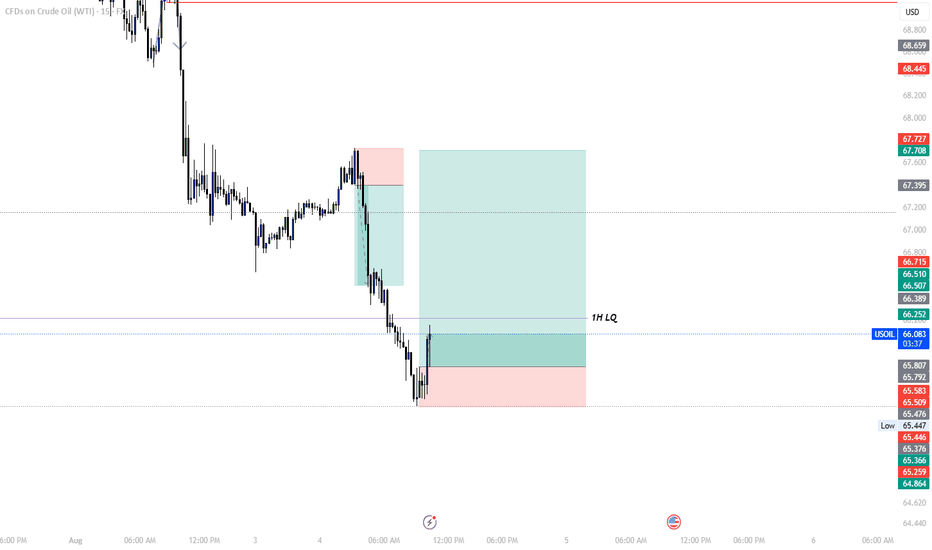

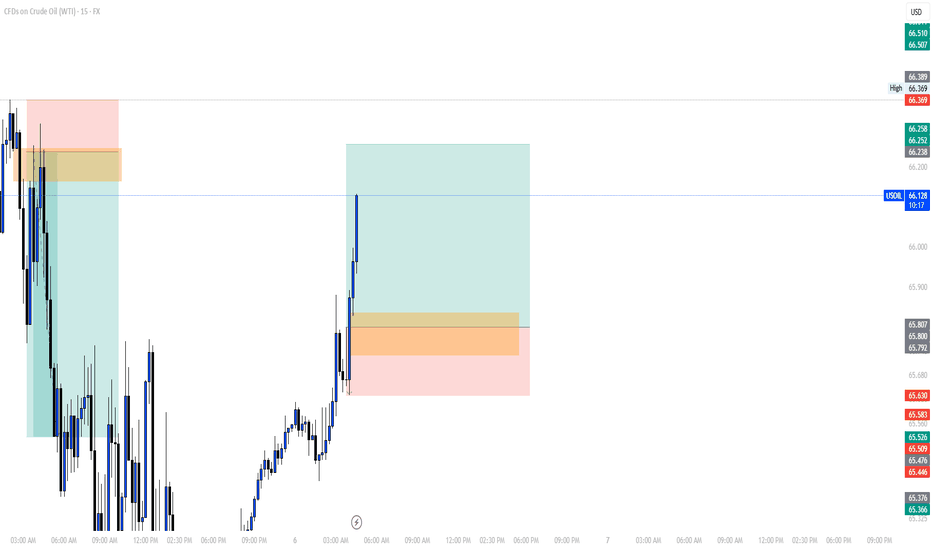

BUY USOILI'm sharing with you our trade today on OIL.

The reason we're buying is because yesterday the market grabbed the LQ now it is reversing to climb higher to fill all of the FVG we got in the previous movement.

For a safe entry, wait for the price to come back to our entry poin at 65.800 since I myself am waiting for the price to come to our entry point.

Follow for more!

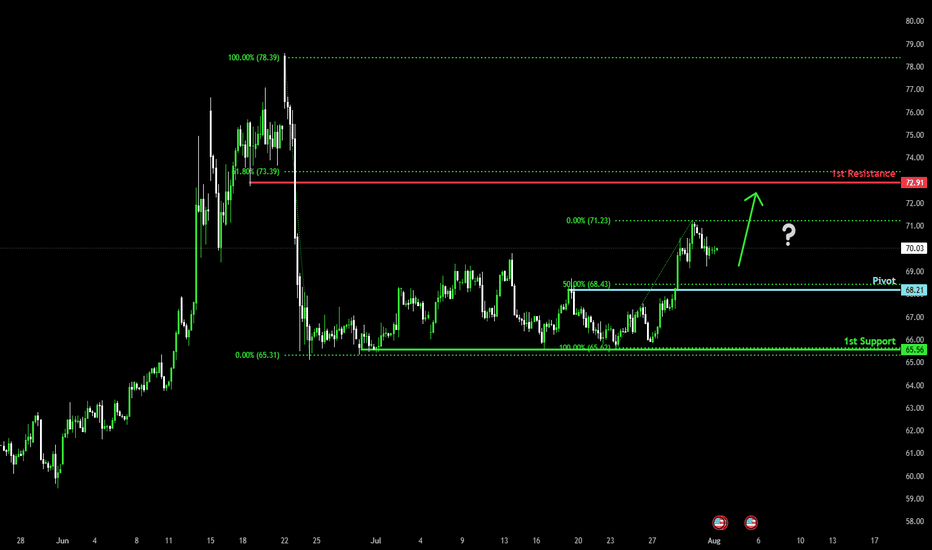

Falling towards 50% Fibonacci support?WTI Oil (XTI/USD) is falling towards the pivot, which has been identified as a pullback support and could bounce to the 1st resistance.

Pivot: 68.21

1st Support: 65.56

1st Resistance: 72.91

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.