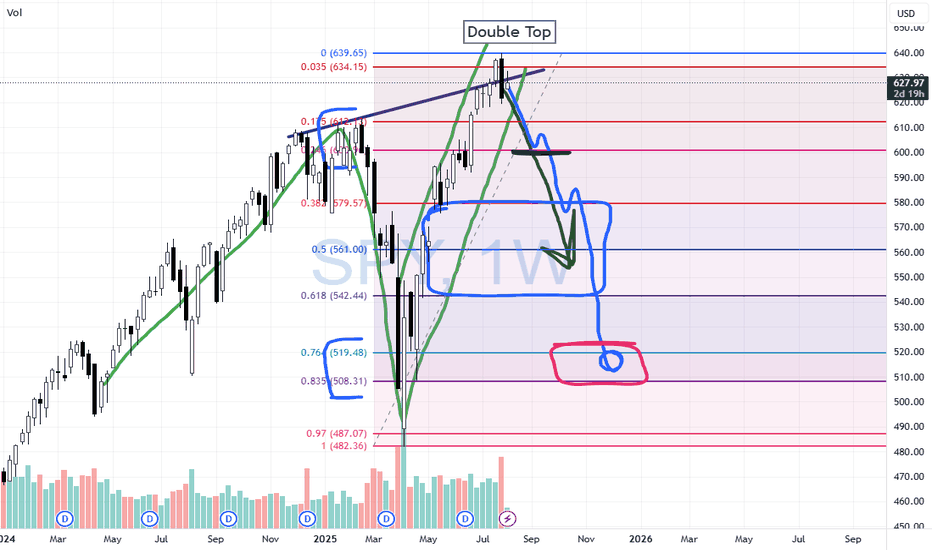

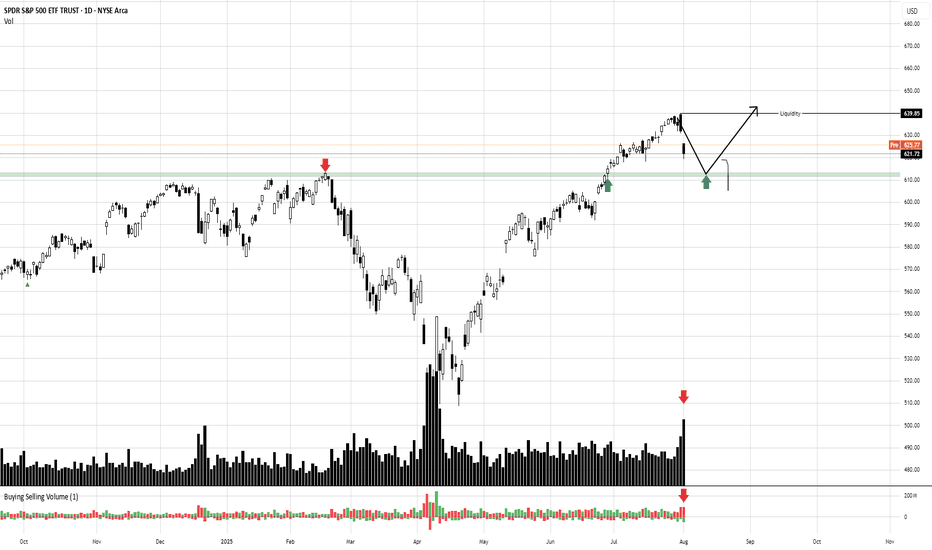

SpySo.... I'm looking for a rebound this week early on from Smallcaps, banks, and cyclical. All last week everything non tech sold off.. it all started with TVC:NYA hitting this monthly trendline

As you can see, this has been resistance for about 5yrs and every time it has tagged , a correction has followed. To make matters worse , July monthly candle finished with a gravestone doji reversal. Monthly grave stone reversal means that the trend has likely flipped and for the next few months at least until Oct things will flip bearish for all things non tech.

but right now for this week, I think all things non tech gets a big bounce at least early on

Why do I say a bounce is coming? Well the hourly technicals for things non tech went way oversold. On top of that look at the daily BBand on NYA and AMEX:IWM

With standing World war 3 or Powell firing you will get smoked if you short this. This is why my favorite longs early this week are Smallcaps and banks.

Focusing on big tech..

If you didn't know that this market runs on a tech bubble then last weeks divergence was your wake up call.

Neither, Dow,IWM or NYA made a new high but the QQQ and spy did.

With that being said you will only know if the spy has topped by keeping track of the NASDAQ..

Qqq

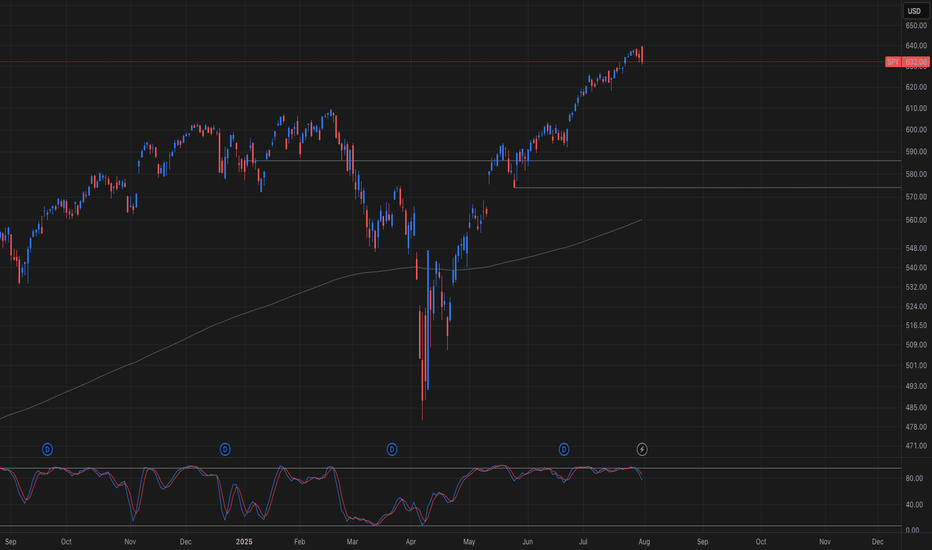

Over the next 2weeks I think Qqq will retest that breakout of 538-540 which is around the 50ma

This drop will bring spy down to 610 retest.

But first I think there is extremely high chance Qqq retest it's 20sma to the upside at 560 to the upside before heading down

I prefer the short up there at 560 but be aware that price could trade between 550-560 to form a H&S

In a move of extreme fawkery we could get a double top instead

But that will only come off Qqq breaks back over 565

Overall, I don't really like big tech long this week. You may have some making moves but it will be a spotty picture with some green and most red or choppy.

The break below the 20sma on Qqq and all tech indexes

AMEX:XLK

NASDAQ:SMH

AMEX:XLC

Means the trend has changed to bearish.. as a trader one of the rules that has helped me is

Swing the trend and scalp the counter trend..

If the market is bullish then you swing calls and scalp puts.

If the market is bearish , you swing puts and scalps calls.

As far as swinging puts this week, just keep your eye on the 20ma of your favorite index/Stock. Once price retest the 20ma , that is the best entry for the short IMO.

The weekly bearish engulfing means that's by WED-Thurs you should stop trading calls and look for market to roll over for more downside.

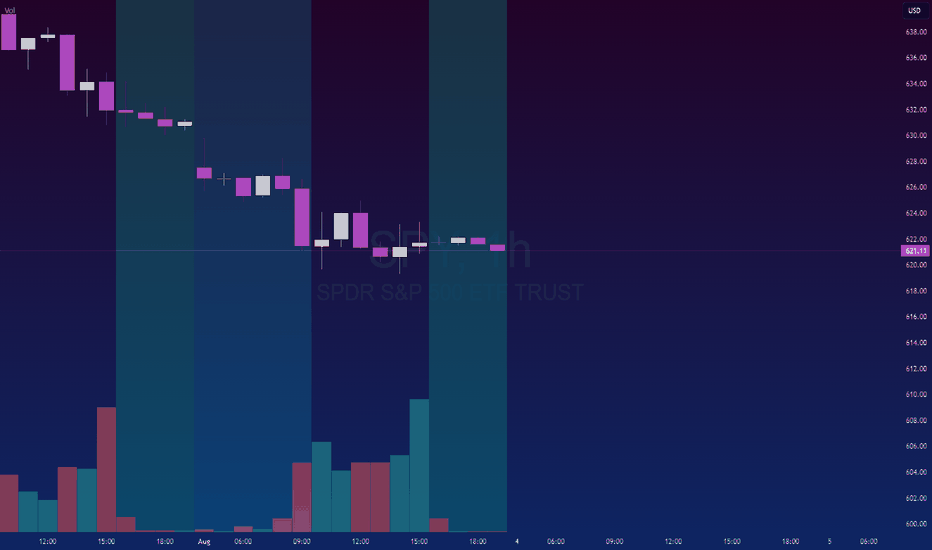

Spy

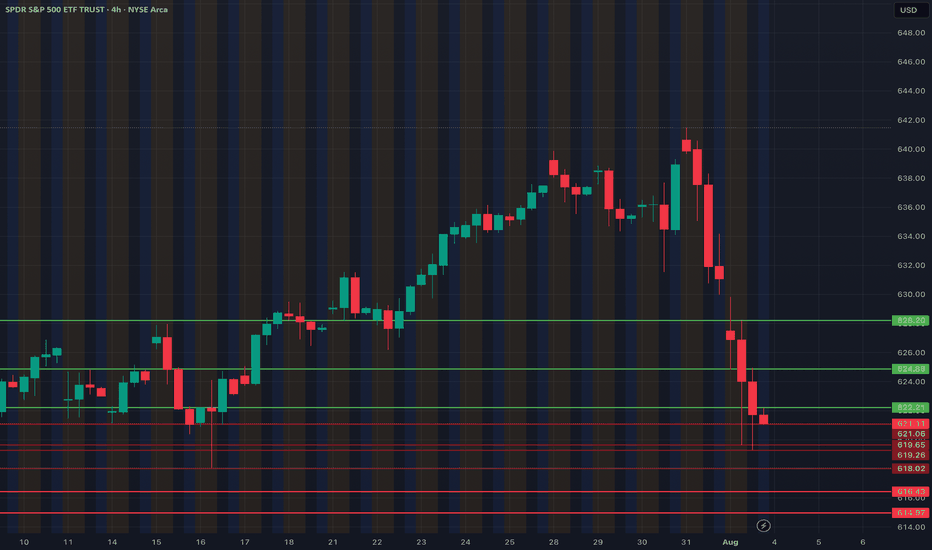

Hourly

As long as the market opens above 617, you want to scalp the long early in the week with your target of 626-628.

I don't know if they will close this gap or not, it will most likely depend on Qqq breaking above 560.

Below 617 and 610 comes.

If price pushes above 629 , I wouldn't chase calls here. That double bearish engulfing on daily Time frame is no joke, and price will likely no break above 640.

Trade idea of the week is

AMEX:IWM

200sma is at 216.50

Over 217.00 and I like calls to close gap at 219.40.

Price could push up to 20sma at 222 but from there I like the short back down targeting 210

SPY trade ideas

SPY/QQQ Plan Your Trade Update For 8-5This short video is to provide my followers with an update.

I'm still here. I'm still working on projects and new TV code. I have developed a couple of new strategies that I like and that seem to continue to perform.

Overall, I'm still doing my best to deliver superior analysis/results for my followers.

This video covers the SPY/QQQ, Gold/Silver, and BTCUSD (plus extras).

Hope you are all getting some great profits from these moves.

GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

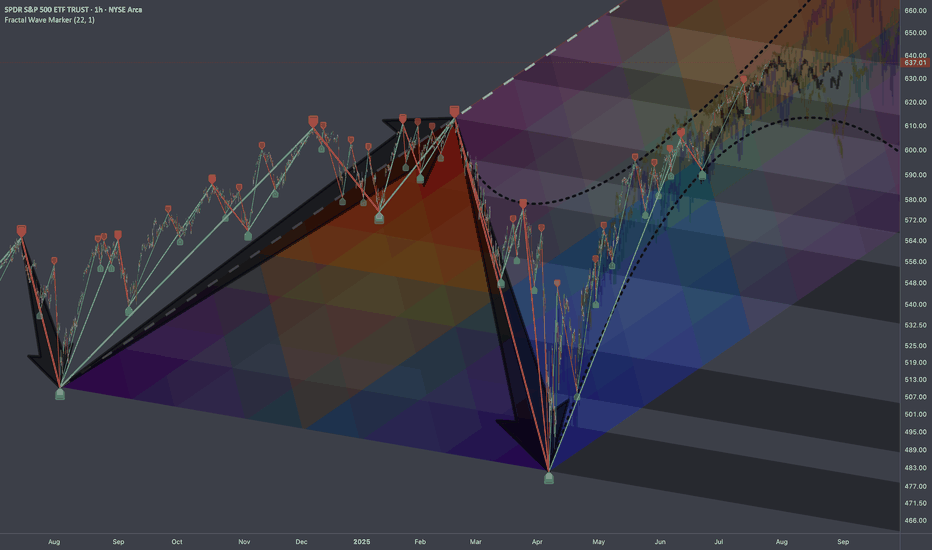

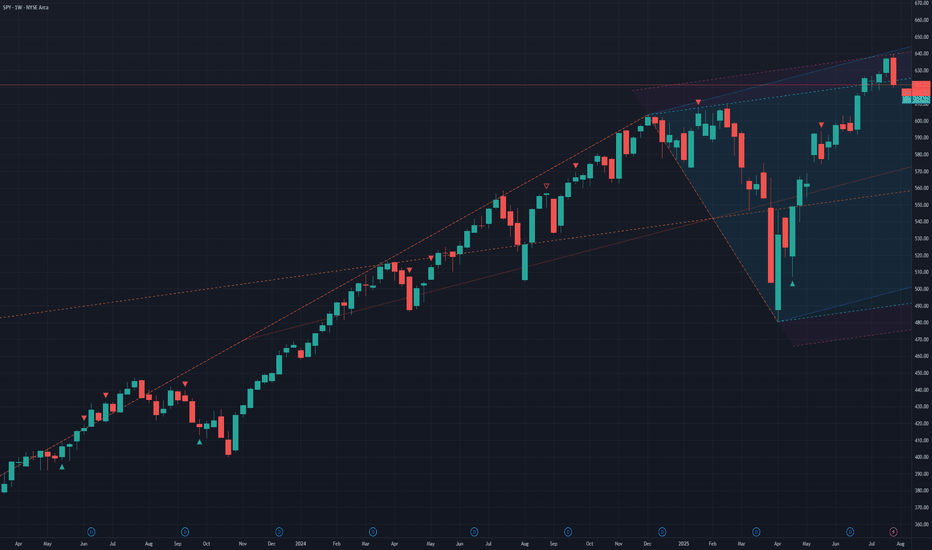

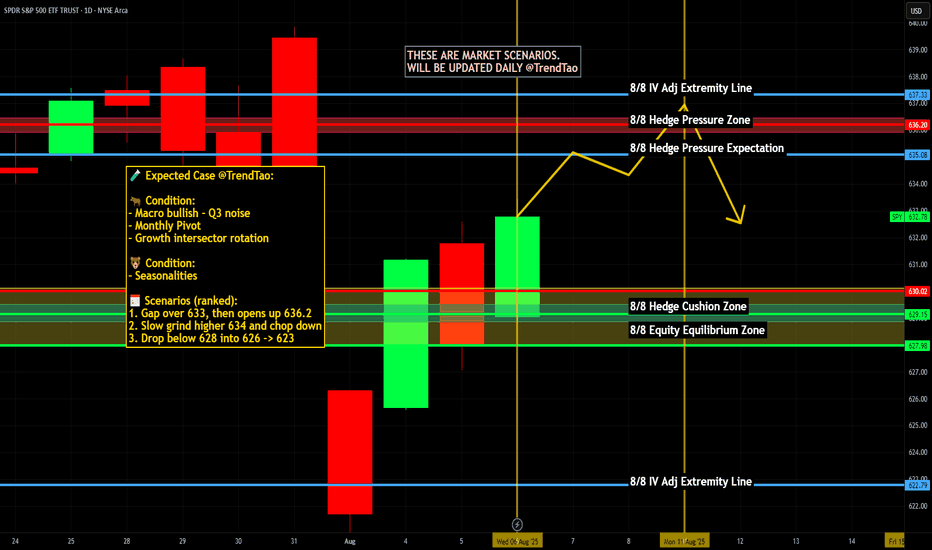

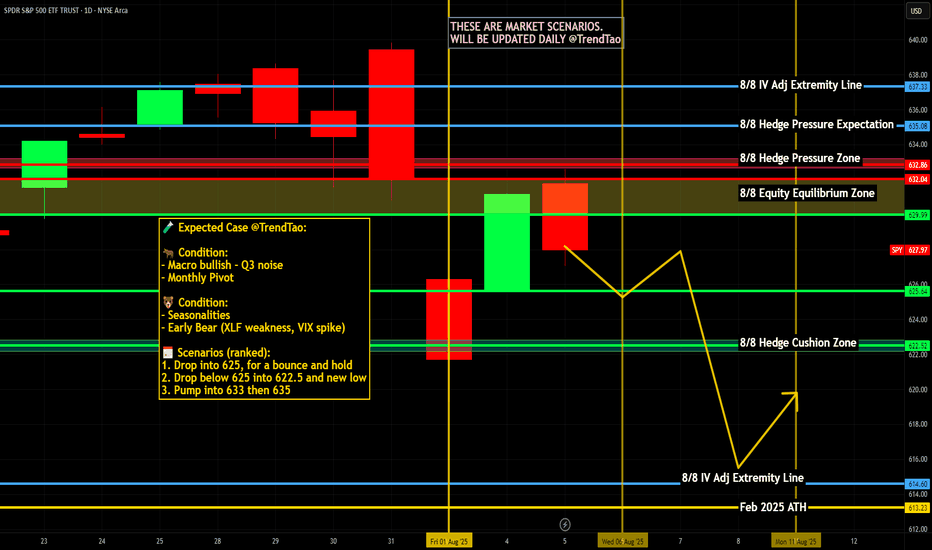

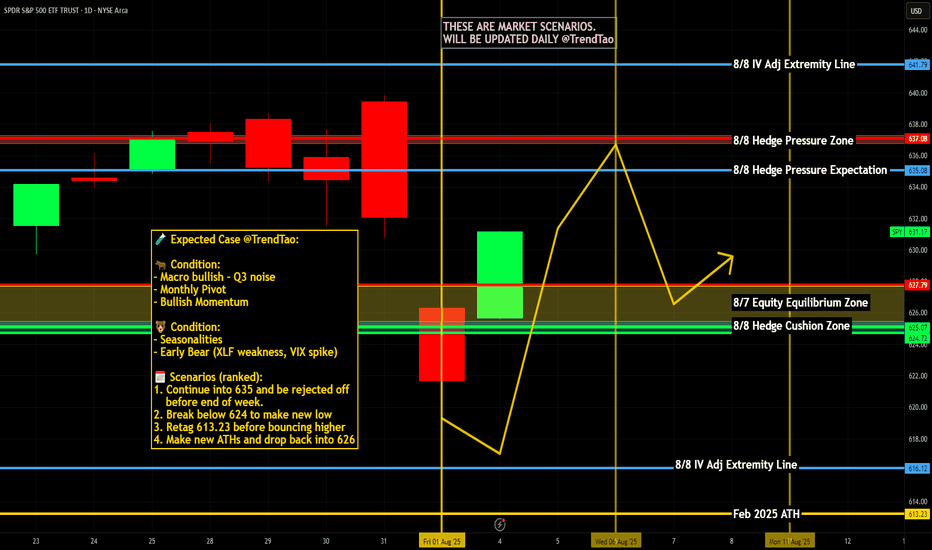

$SPY: Mapping Scenarios🏛️ Research Notes

Fractal Corridors

Shows recursive formations which indicates a full fractal cycle.

The angles of decline are parallel which is important for potential buildup.

To map a cycle we'd need to apply fib channel to the opposite direction In a way this should be sufficient to cover the scenarios of nearest future if we were to use bar patterns to validate a structure.

These are examples of historic progressions with similar growth patterns (composite sub-cycles):

This explains most elements present in interactive chart.

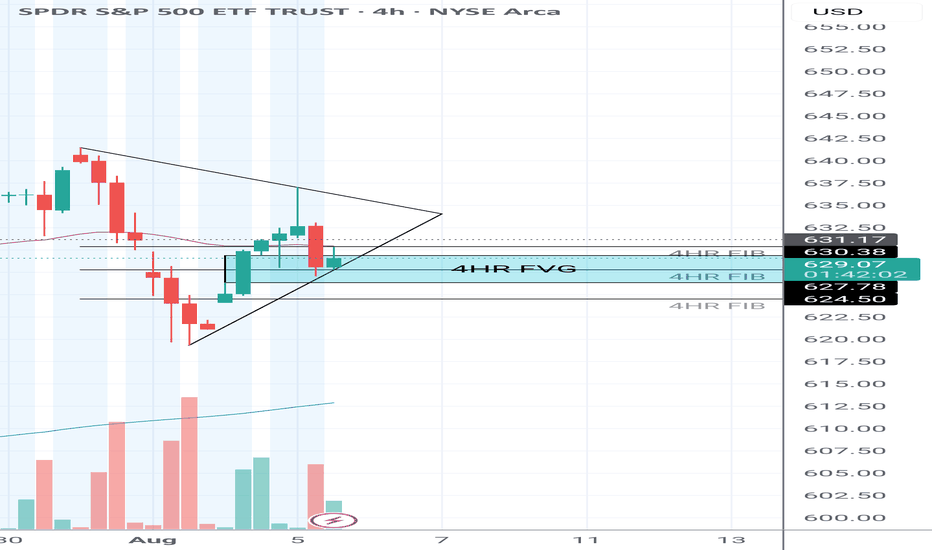

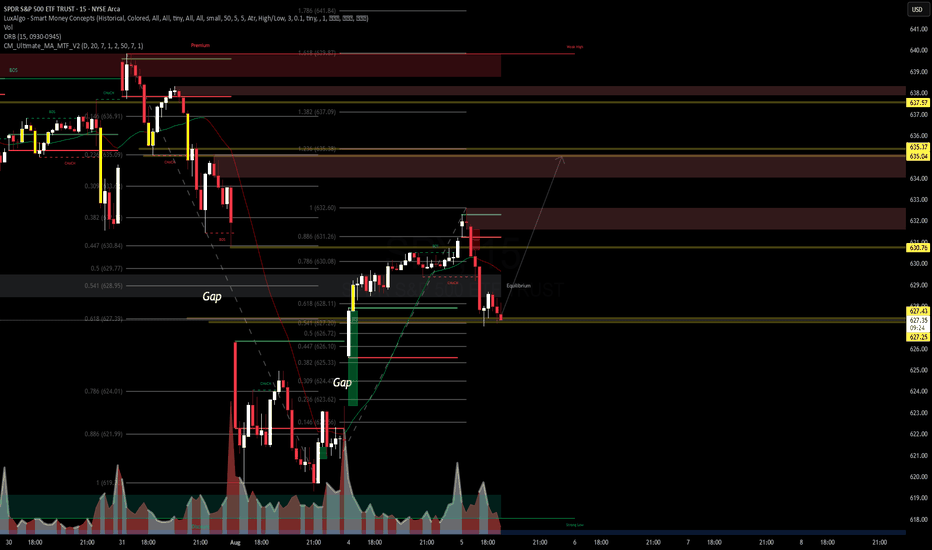

SPY – Bullish Recovery Faces Key Resistance. Aug. 5SPY – Bullish Recovery Faces Key Resistance 🚀

1H Technical Analysis & GEX Overview

SPY has staged a notable recovery from the recent pullback, breaking out of the descending channel and now pressing toward a key resistance cluster near 631–633. This zone aligns with the Highest Positive NETGEX and a 2nd Call Wall, making it a pivotal area to watch for continuation or rejection.

* Support Levels:

* 621–622 → Key structure support and HVL zone (08/04). Losing this could reopen downside toward 615 and 610.

* 615 / 610 → Next downside targets aligned with 2nd & 3rd Put Walls.

* Resistance Levels:

* 631–633 → GEX resistance & 2nd Call Wall; breakout here could fuel a run toward 640+.

GEX Insights

* Positive GEX builds above 628, signaling potential dealer hedging that could limit extreme upside but support gradual climbs.

* Negative GEX dominates under 621, suggesting increased downside momentum risk if price breaks support.

* Put positioning remains elevated at 81.3%, hinting at cautious sentiment but also squeeze potential if shorts get trapped.

Trade Scenarios

* Bullish Case:

* Break and close above 633 opens path to 640+.

* Options: Consider short-term Call spreads targeting 640 if breakout confirmed with strong volume.

* Bearish Case:

* Rejection from 631–633 and break below 621 could send SPY toward 615/610.

* Options: Put spreads targeting 615 with tight risk management.

15-Minute View (Intraday)

* Momentum is holding strong above VWAP, but intraday resistance at 631 is visible.

* A clear BOS above 631 with volume could trigger fast upside continuation intraday.

* Best scalp entries: pullbacks to 628–629 if defended as support.

Outlook

Bias leans cautiously bullish into the 631–633 test. Watch for confirmation on volume before chasing upside. If rejection occurs, expect choppy pullback toward 625–622 for a potential bounce.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always do your own research and manage your risk before trading.

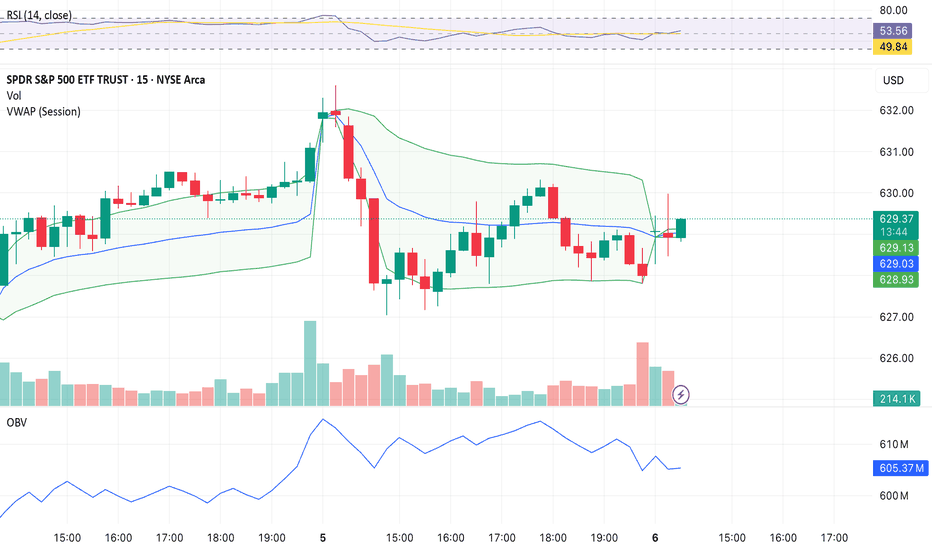

Options Trading for SPY - Bear Spread Oct 17I'm setting up a Bear Put Spread on AMEX:SPY with the following legs:

Buy 630 Put

Sell 620 Put

Expiration: October 18, 2025

Thesis: I'm expecting a bearish move or neutral-to-bearish consolidation over the coming weeks, likely driven by macroeconomic pressure and technical weakness around the 630 level.

Current Price: ~$629.50

Risk/Reward: Defined risk strategy with a maximum loss equal to the net debit paid.

Breakeven Point: $630 – net debit

Max Profit: If SPY closes below $620 at expiration

Max Loss: If SPY closes above $630 at expiration

Technical indicators include:

Price rejection around VWAP

Decreasing OBV during consolidation

RSI divergence suggesting weakening momentum

Watching for further confirmation on breakdown from current levels. Will monitor volume and macro news.

$UVXY Signaling Trouble — $SPY Could Drop 10%+ In this video, I discuss why August/September could bring serious downside for the market, despite my long-term bullish stance.

Right now, SPY is trading around $632, but I have a downside target of $573 in the short term. If we get volume beneath $573 — especially a break below the daily EMA — SPY could drop quickly, with a potential fall all the way to $480 in the coming weeks/months.

At the same time, UVXY is signaling a correction for the overall market after rallying from the low's of April. I have a target of $30 and when UVXY starts to move, it often reflects sharp market corrections — and the setup is beginning to mirror that now.

Despite this short-term bearish outlook, I want to make it clear: I am very bullish long term. Any 10–20% correction will be a major buying opportunity for me. I'm watching key levels closely and preparing to take advantage when the market overreacts.

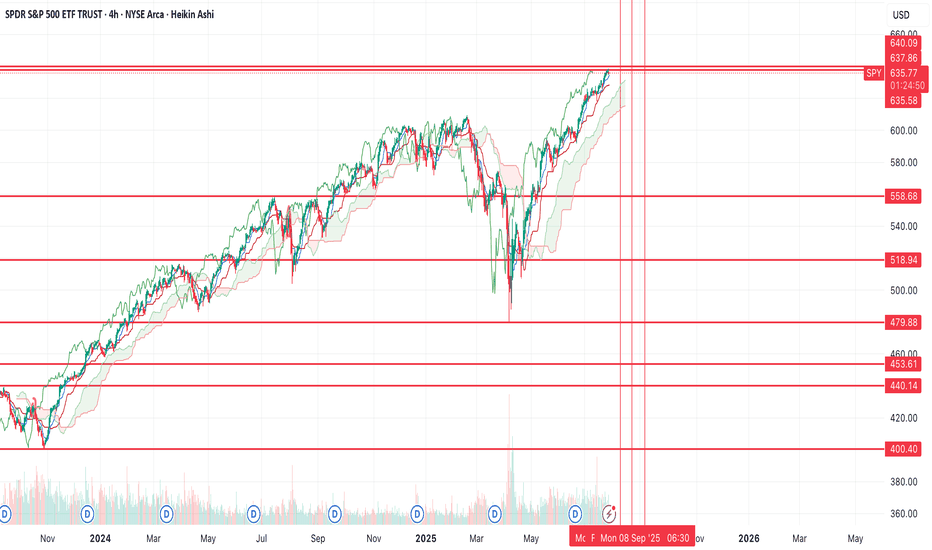

$SPY rolling over, potentially to new lows?While I was early to the idea (like usual), still don't think the thesis will be wrong. I still believe we're going to see a large move down from here.

Yesterday's price action made me pretty confident a top was in (TBD). We had positive news and the market couldn't rally on that positive news and we ended up closing at the lows -- indicating to me there's no more buyers.

Today we have treasuries, the dollar and volatility all rallying while equities selloff, a classic risk off signal. You also have crypto selling off too.

I think we see a large risk off move from here on out, the target is the $440 area (extreme down to $400), but if we find support at one of the other levels above that, there's potential for us to rally from there.

Will have to see how price action plays out over the coming weeks.

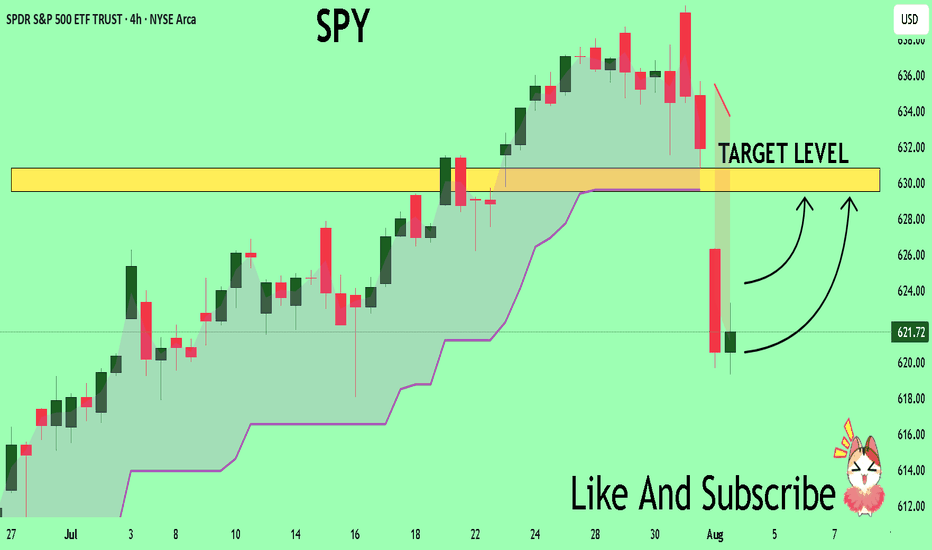

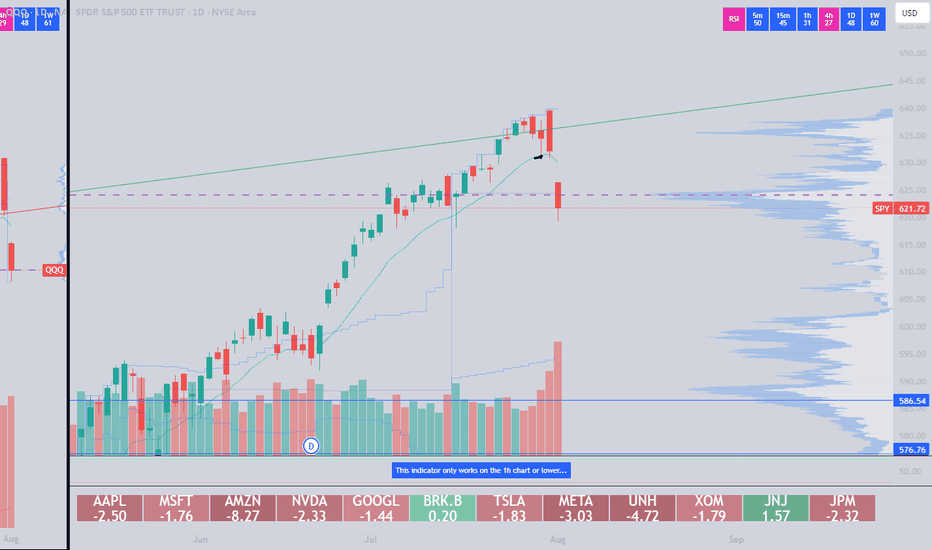

SPY Massive Long! BUY!

My dear subscribers,

My technical analysis for SPY is below:

The price is coiling around a solid key level - 621.72

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 629.55

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

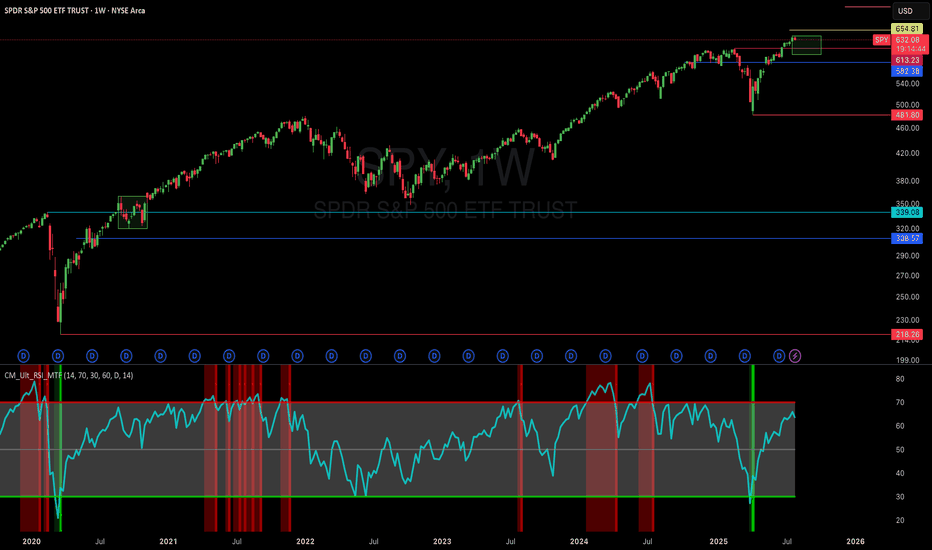

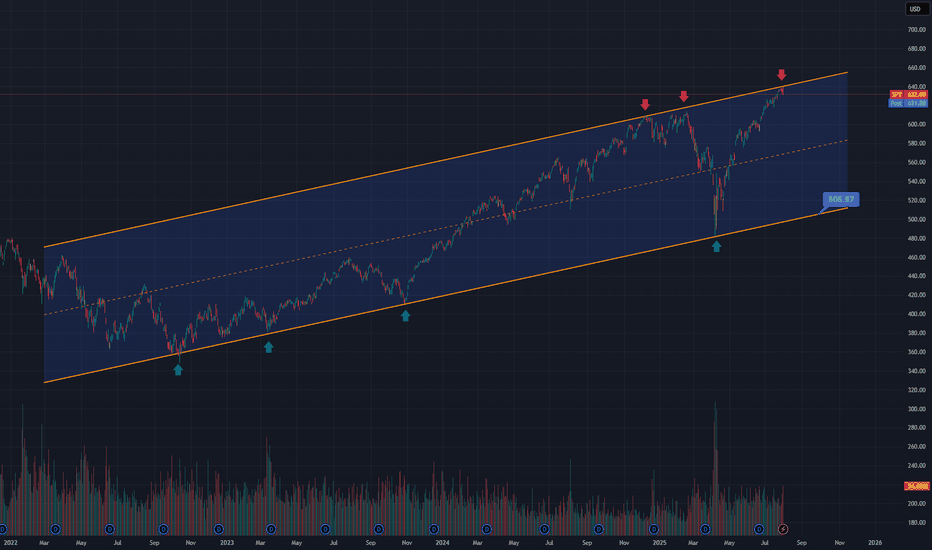

Next Leg down startingThe S&P 500 has been trading inside this rising channel for the last 3 and a half years. As you can see it has bounced off the bottom of the rising channel 4 different times and it is now back at the top of the channel. Price action gapped above the channel overnight but immediately sold off pre-market back inside the channel and completely reversed the move despite strong earnings from MSFT and META. This is very bearish and signals a move back down to the bottom of the channel once again and given that its already bounced off the bottom of the channel 4 different times, a 5th hit would have a high probability of breaking below the channel, which I would give a greater than 70% probability of playing out. If this happens, we will see much lower prices in this coming bear market.

A potential Swing Trade soon on SPY!?OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

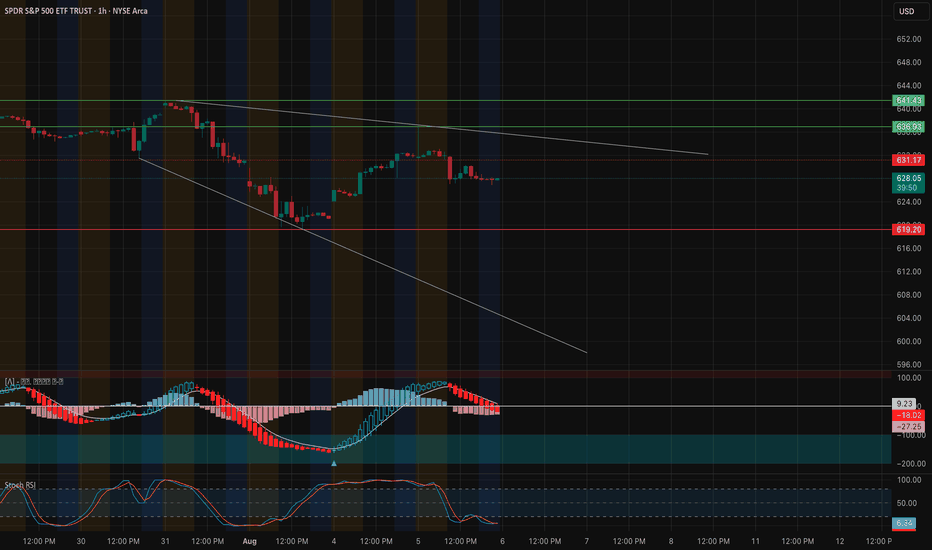

SPY Stuck Below Downtrend Resistance. TA for Aug. 6SPY Stuck Below Downtrend Resistance – Sellers Still Pressing

Market Structure (1H View)

* SPY continues to trade inside a descending channel, with repeated failures near the upper trendline around $641–$644.

* Recent price action shows a lower high rejection followed by consolidation under resistance, signaling a cautious market tone.

* The macro downtrend remains intact unless bulls can break and hold above the descending trendline.

Key Price Levels

* Immediate Resistance: $631 (local reaction high)

* Major Resistance: $641–$644 (trendline + prior supply zone)

* Support Zone: $619–$620 (key demand zone)

* Deeper Support: $603–$605 (previous low and psychological support)

Indicators

* MACD: Recently flipped bearish with red momentum bars increasing — suggests momentum is shifting back toward sellers.

* Stoch RSI: Oversold bounce attempt possible, but currently still near the lower range.

* Trendlines: Price remains capped under the descending resistance line.

Current Bias

SPY is struggling to sustain bullish momentum after the recent push into resistance. Sellers are defending the upper channel, keeping pressure on the downside toward $620.

Scenarios to Watch

🟢 Bullish Case:

* Break & close above $631 with follow-through volume → retest $641–$644.

* Needs strong buying interest to flip the macro trend bias.

🔴 Bearish Case:

* Failure to reclaim $631 + sustained weakness could send price back toward $620 support.

* If $620 breaks, risk increases for a sharper drop toward $603–$605.

Trade Ideas (Not Financial Advice)

* Short Bias: Look for rejection near $631 or the trendline; target $620, then $605 if breakdown accelerates.

* Long Setup: Only if price reclaims $631 convincingly and breaks the $641–$644 resistance zone.

📌 Final Thoughts

SPY remains bearish-biased inside a descending channel. Bulls need a decisive breakout above $641 to change sentiment; otherwise, sellers will continue targeting $620 and potentially lower.

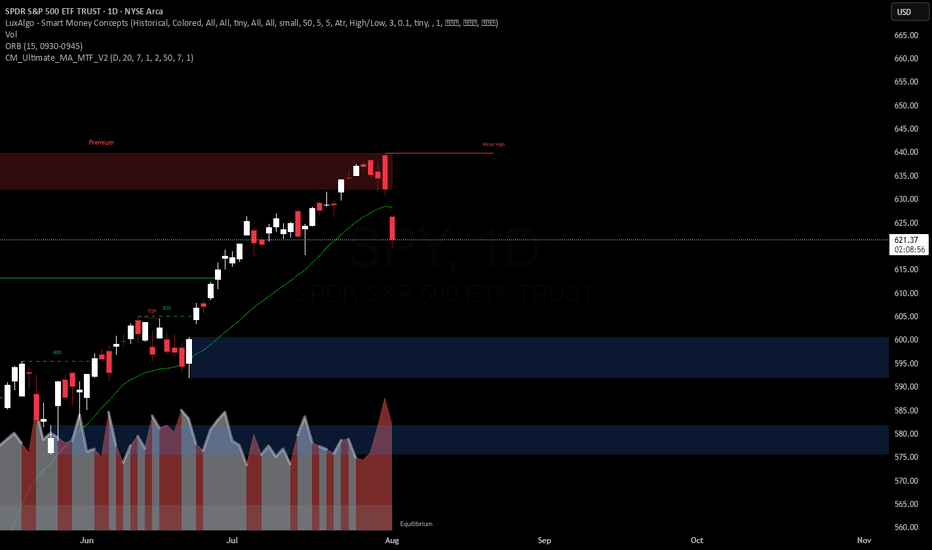

SPY: I think dollar milkshake is brewing, buying for long term📉 SPY Daily Breakdown – Aug 1, 2025 | VolanX Observations

🧠 Bot failed today, but the market taught more than any trade could have. Sitting out gave me the clarity to reassess structure and edge.

🔍 Market Structure Update:

Gap Down from Premium Zone: Today’s price action rejected the weak high and created a clean daily gap — signaling potential distribution at the top.

ORB (15-min) marked and ready: Likely to be retested on Monday. If price rallies into this zone and rejects, that’s where I’ll look for short entries.

Friday Bearish Close Rule: Statistically, when Friday closes red with strong momentum, Monday tends to follow — especially after a gap-down open.

🧭 Big Picture Outlook:

Liquidity Zones Below:

600 → First institutional reaction zone.

580 → Deeper demand and equilibrium area from previous consolidation.

Dollar Milkshake Brewing: Strong USD thesis could pressure equities short-term. This aligns with potential flow into defensives and out of high beta.

Long-Term Bias: Watching for deep discounts. If price moves into high-value demand zones, I’ll accumulate for the long haul — buying fear when it's priced in.

📌 What I’m Watching Next Week:

Monday open – will we see Gap & Go or a Gap Fill + Fade?

Reaction to ORB zone.

Volatility behavior and volume footprint in the first 90 minutes.

🔻 No trades today due to a bot error, but ironically, that gave me better vision. Sometimes, the best trades are the ones you don’t take.

VolanX Protocol engaged. Standing by.

Nightly $SPY / $SPX Scenarios for August 7, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 7, 2025 🔮

🌍 Market‑Moving News 🌍

📦 Major Tariffs Implemented Today

Sweeping tariffs ranging from 10% to over 40% officially took effect today on imports from numerous countries, significantly escalating global trade tensions. Markets are closely tracking initial reactions across affected sectors, especially pharmaceuticals and semiconductors.

💻 Semiconductor Tariff Shakes Tech Sector

President Trump introduced a substantial 100% tariff on semiconductor imports, with notable exemptions for U.S. investors such as Apple, Nvidia, and AMD. Apple shares surged 5.1% amid investor optimism, while broader tech stocks saw mixed reactions.

🚀 Firefly Aerospace IPO Debut

Firefly Aerospace launched its IPO today, pricing shares at $45. The stock began trading on Nasdaq under ticker "FLY," attracting significant attention due to its positioning in the space and defense technology sector.

📊 Key Data Releases & Events 📊

📅 Thursday, August 7, 2025:

8:30 AM ET – Initial Jobless Claims (week ending Aug 2)

Forecast: 221,000

Previous: 218,000

8:30 AM ET – U.S. Productivity (Q2)

Forecast: 1.9%

Previous: –1.5%

8:30 AM ET – U.S. Unit Labor Costs (Q2)

Forecast: 1.3%

Previous: 6.6%

10:00 AM ET – Wholesale Inventories (June)

Forecast: N/A

Previous: –0.3%

10:00 AM ET – Speech by Atlanta Fed President Raphael Bostic

Topic: Monetary policy outlook; market-sensitive for potential Fed signals.

3:00 PM ET – Consumer Credit (June)

Forecast: N/A

Previous: $5.1B

⚠️ Disclaimer:

This content is for educational and informational use only and is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #tech #earnings #IPO #Fed #tariffs #semiconductors

Nightly $SPY / $SPX Scenarios for August 6, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 6, 2025 🔮

🌍 Market‑Moving News 🌍

🪙 Citi Lifts Gold Price Forecast Amid Global Uncertainty

Citi raised its short-term gold outlook to $3,500/oz, citing surging safe-haven demand driven by trade instability, softening labor metrics, and heightened geopolitical risk. Risk premiums and volatility remain elevated.

📉 Equities Tumble as Risk Aversion Returns

U.S. stocks slipped on renewed caution—investors rotated into bonds and precious metals following weaker job indicators and escalating trade friction. The dollar and gold strengthened, while equity futures pulled back.

📊 Key Data Releases & Events 📊

📅 Wednesday, August 6:

No major U.S. economic data releases scheduled for today. Markets are closely monitoring corporate earnings reports and commentary from Fed officials, including San Francisco Fed President Mary Daly later in the day.

⚠️ Disclaimer:

This content is for educational and informational purposes only—it is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #trade #currency #gold #earnings

Nightly $SPY / $SPX Scenarios for August 5, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 5, 2025 🔮

🌍 Market‑Moving News 🌍

🔹 PBOC Moves Prompt FX Backlash

On August 5, 2019, China’s central bank allowed the yuan to depreciate over 2% to its lowest level since 2008. That same day, the U.S. Treasury officially designated China as a currency manipulator, citing the PBOC’s moves as retaliation for recent U.S. tariff actions. In response, China ordered state-owned enterprises to suspend purchases of U.S. agricultural goods—a significant blow to U.S. exporters.

🔹 EU Suspends Counter-Tariffs for Six Months

Following a negotiated framework with the U.S., the European Union suspended retaliatory tariffs on U.S. goods for six months. The move aims to de-escalate trade tensions while joint discussions continue.

🔹 Citi Raises Gold Price Outlook to $3,500/oz

Citi revised its short-term trading range for gold to $3,300–$3,600 per ounce, based on weakening U.S. labor data, rising inflation pressure from tariffs, and growing demand for safe-haven assets. Spot gold traded around $3,356 oz on Monday.

📊 Key Data Releases & Events 📊

📅 Tuesday, August 5:

8:30 AM ET – U.S. Trade Balance (June)

Expected to improve modestly to –$67.6 billion (from –$71.5B), reflecting tariff-influenced shifts in import/export volumes.

9:45 AM ET – S&P Global U.S. Final Services PMI & ISM Non-Manufacturing Index (July)

Key indicators of service-sector strength. Readings above 50 suggest expansion; below 50, contraction. Flash estimates forecast moderated growth in activity.

⚠️ Disclaimer:

This content is for educational and informational use only—not financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #trade #data #inflation #currency

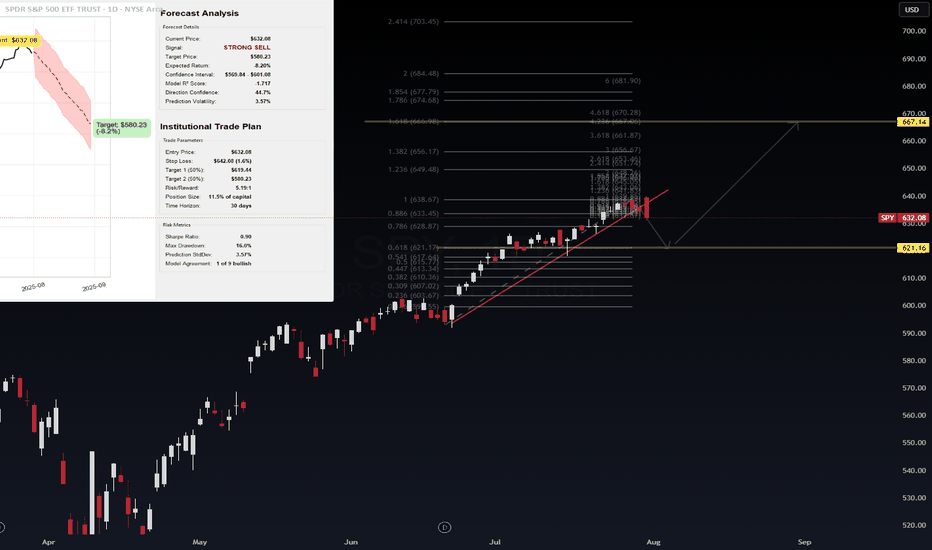

S&P 500 Futures – Trendline Breach + AI Forecast Signals Major C📉 S&P 500 Futures – Trendline Breach + AI Forecast Signals Major Correction

VolanX Risk Engine Flags High Probability Downside

🧠 Narrative:

Markets have enjoyed a powerful uptrend off the March lows, but the structure is showing signs of exhaustion.

The ascending trendline—untouched for over two months—has now been breached.

Fibonacci levels cluster below current price, with critical demand at:

6319.25 (immediate test zone)

6179.25 (0.618 retrace)

5964.75 (macro support / VolanX institutional target)

Meanwhile, VolanX Protocol's predictive engine has shifted to a "Strong Sell" with a projected correction path clearly outlined. The 30-day price forecast (shown in red) leans toward a mean reversion toward 5842.12 by late August.

📊 Institutional Trade Plan (VolanX DSS):

Entry Zone: 6360-6380 (Confirmed breakdown retest)

Target 1: 6179.25

Target 2: 5964.75

Final Target: 5842.12

Invalidation: Close above 6480 (new highs with strength)

🔎 Risk/Reward: 3.4+

📈 Trend Deviation: 7.4%

📉 Bearish Conviction: 84.1%

📌 Key Insights:

Breakdown below trendline confirms shift in control to bears

Institutional models anticipate volatility-led selloff

Major liquidity rests below 6200 and 5960 zones

This is not the time to chase highs—risk is asymmetric

🔮 VolanX Opinion:

“Volatility expansion is near. Institutional capital is likely rotating out of risk. The squeeze has passed; now the trapdoor may open.”

This is where preparation outperforms prediction. Execute with risk logic, not emotion.

📚 #SNP500 #ESFutures #SPX #MacroTrading #SmartMoney #InstitutionalFlow #TrendReversal #Volatility #LiquiditySweep #FibonacciLevels #VolanX #AITrading #EminiFutures #WaverVanir #QuantStrategy #TechnicalAnalysis #Forecast #TradingView