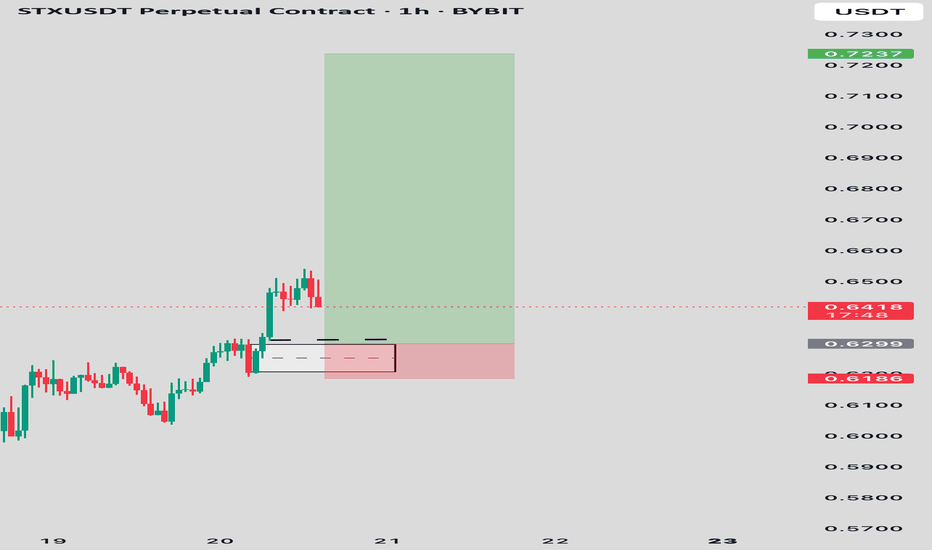

STXUSDT LONGPrice has broken out of a consolidation range and retested previous structure support at 0.6299. Bullish momentum followed with a clean engulfing candle on the 1H timeframe, confirming potential continuation.

Entry: $0.6299 (demand zone retest)

Stop Loss: $0.6186 (below demand)

Target: $0.6900 zone

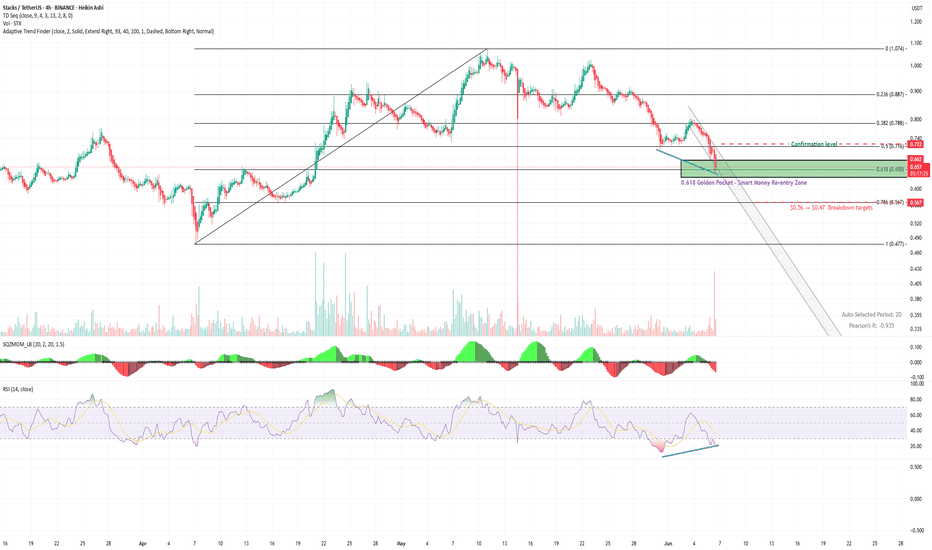

$STX / USDT (4H) – Golden pocket re-entryCOINBASE:STXUSD is testing the 0.618 Fib retracement ($0.65)

A zone where smart money often re-enters after corrections.

Confluence:

🔹 TD9 buy

🔹 RSI divergence

🔹 Fading momentum

🔹 Volume pickup near support = early demand?

Reclaim $0.72 could trigger a relief rally to $0.78–$0.80

Break $0.65 open

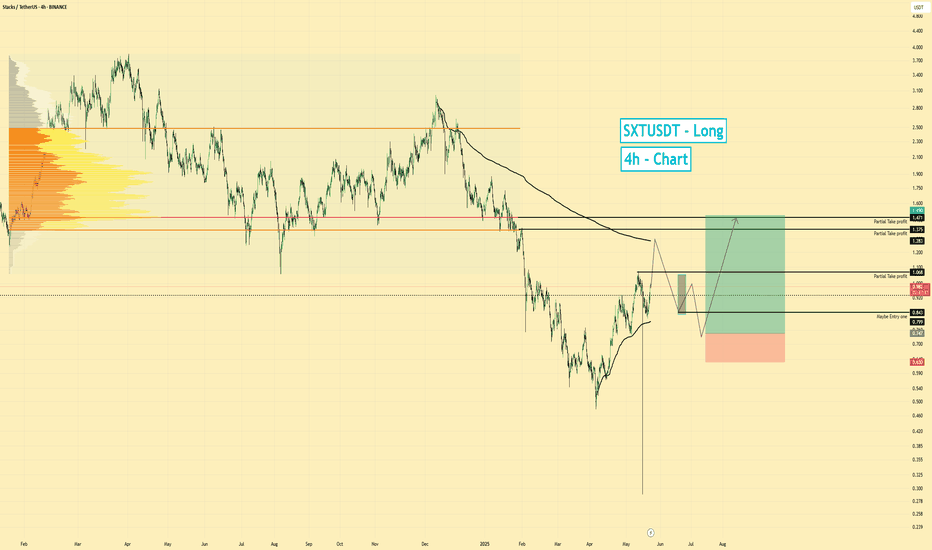

STX - LONG SET-UPBINANCE:STXUSDT

Green Zone (Demand Zone): 0.752 – 0.772

This is a bullish demand zone or entry zone where buyers previously stepped in.

Price may retest this zone before moving higher (as shown by the curved arrow).

Ideal area to deploy entries (25–50%) for a long position.

Acts as a support z

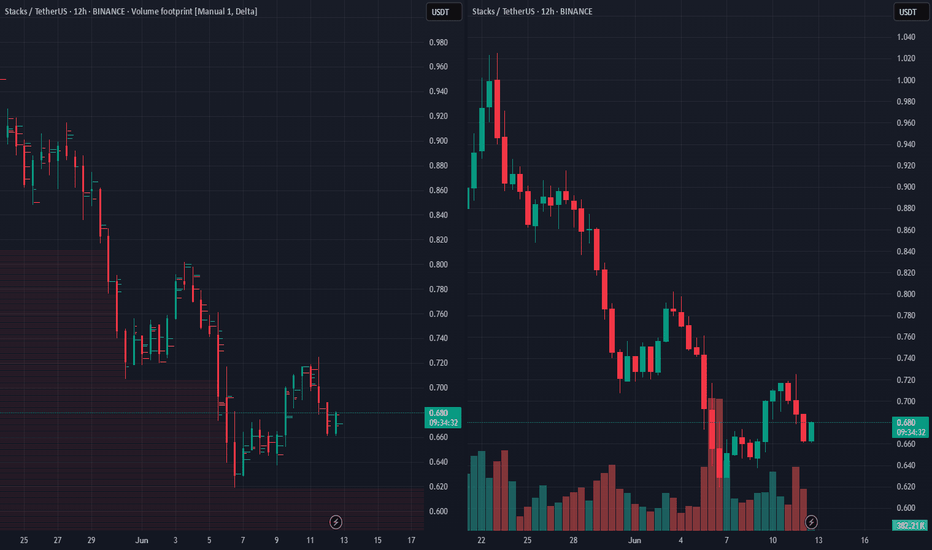

SXT | Long | At Reclaim VWAP | (May 22, 2025)SXT | Long | Reclaiming VWAP & Eyeing Resistance Zone | (May 22, 2025)

1️⃣ Quick Take: SXT is showing strength, climbing toward a key resistance area while holding bullish structure on higher timeframes. Liquidity remains on the bulls' side despite a brief corrective signal on the 30-min chart.

2️

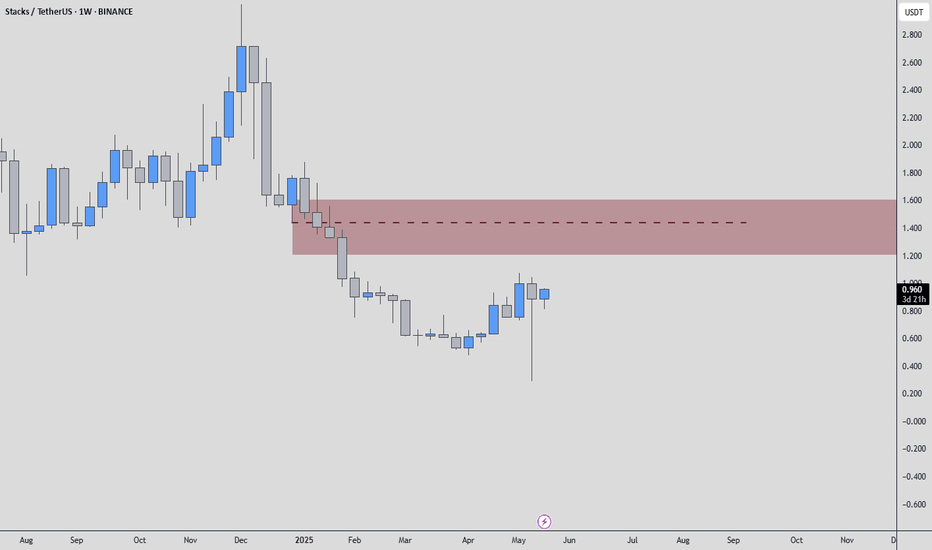

STXUSDT | Heavy Resistance AheadSTXUSDT is now approaching a critical resistance zone . This red box isn’t just any level — it’s where price has previously stalled or reversed .

I’m watching closely, but I won’t chase into strength blindly. Only if this level breaks with volume and flips to support will I consider a long setup

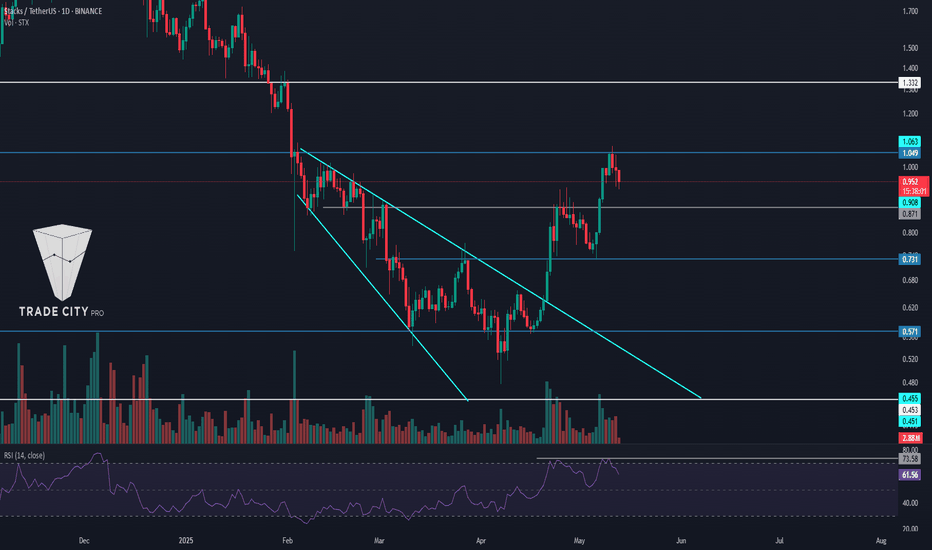

TradeCityPro | STX: Watching Triangle Breakout and RSI Reaction👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the STX coin, which belongs to the Stacks project—a Layer 2 solution for Bitcoin.

🔍 STX, with a market cap of $1.45 billion, is currently ranked 59 on CoinMarketCap.

🔄 In the previous analysis, I drew an expanding triangle and menti

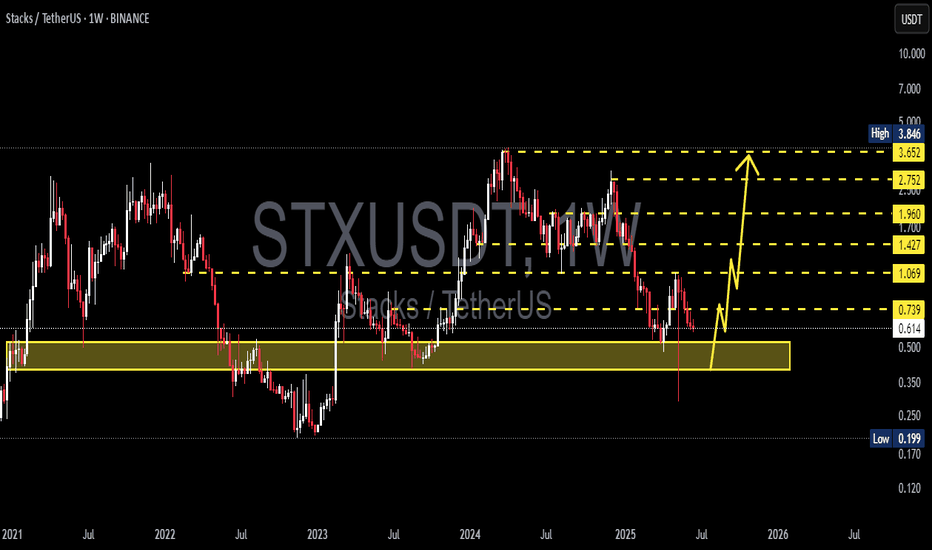

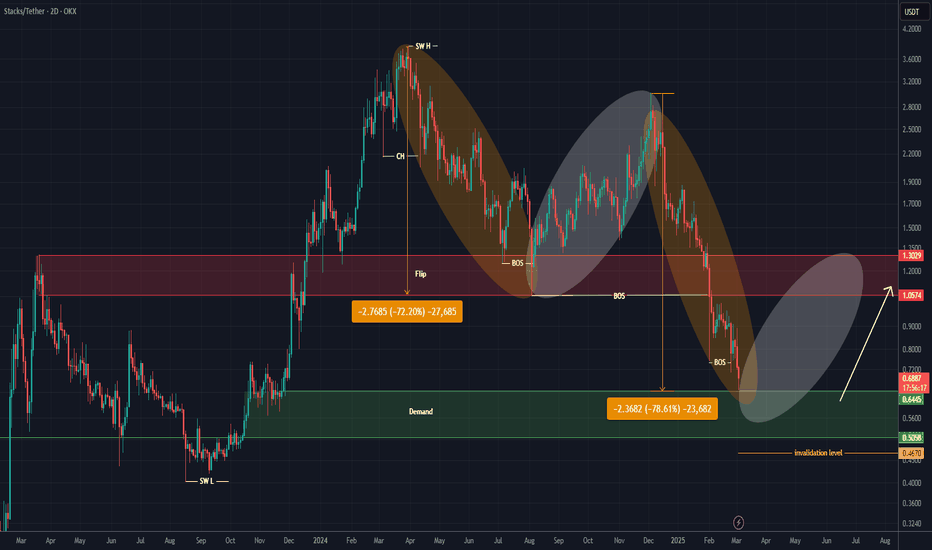

STX ANALYSIS (2D)The STX pair has reached a demand zone.

A price movement fractal seems to be repeating (highlighted by the orange and white boxes).

In the orange boxes, every time STX has dropped more than 72%, it has made a rebound move to the upside.

We are looking for buy/long positions around the demand zone

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where STXUSDT.P is featured.

Smart contracts: Make the smart decision

36 No. of Symbols

See all sparks