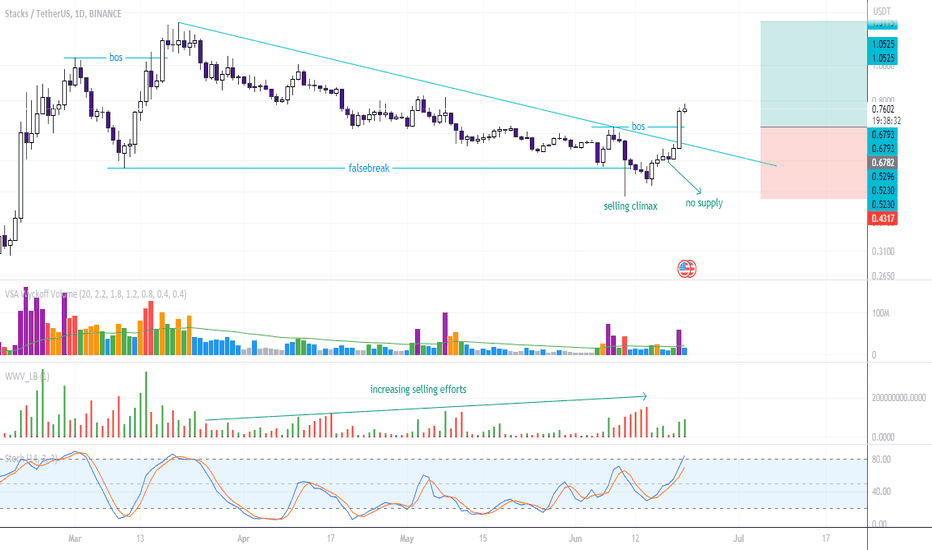

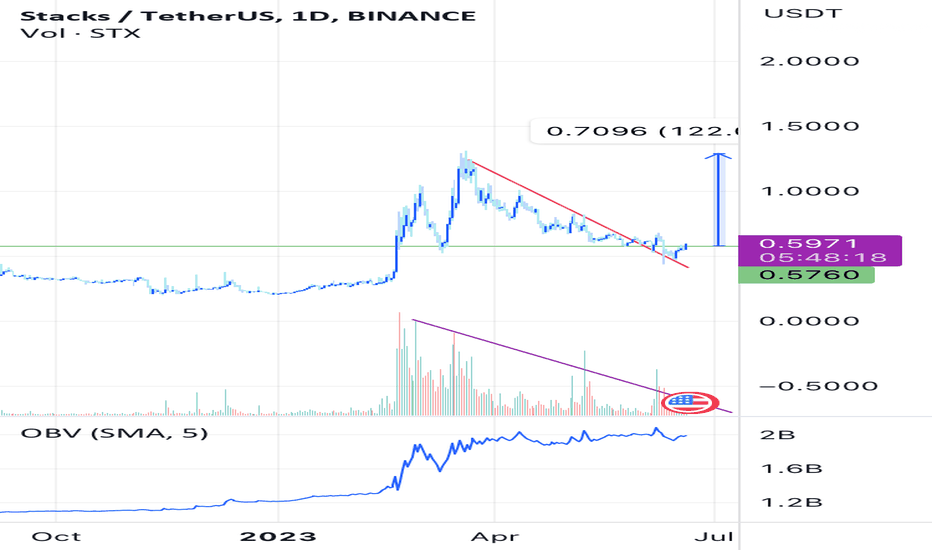

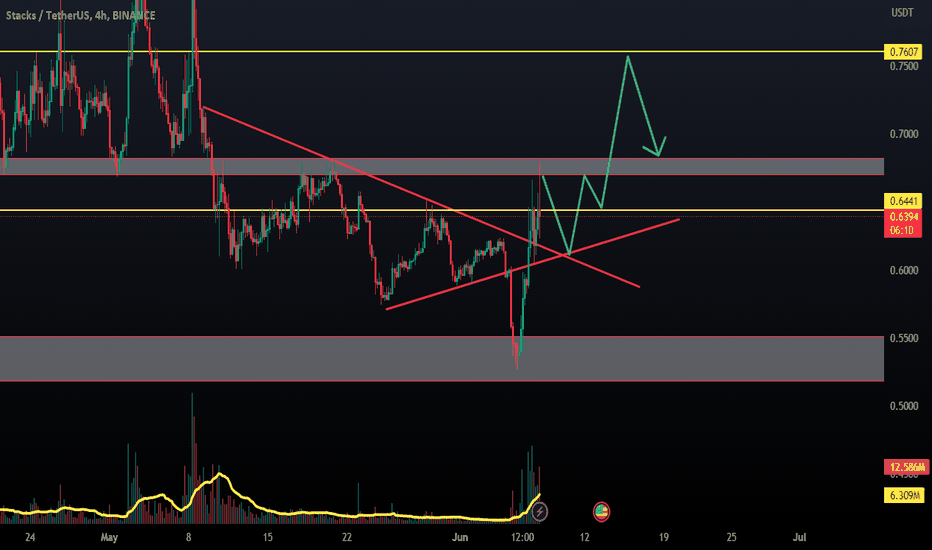

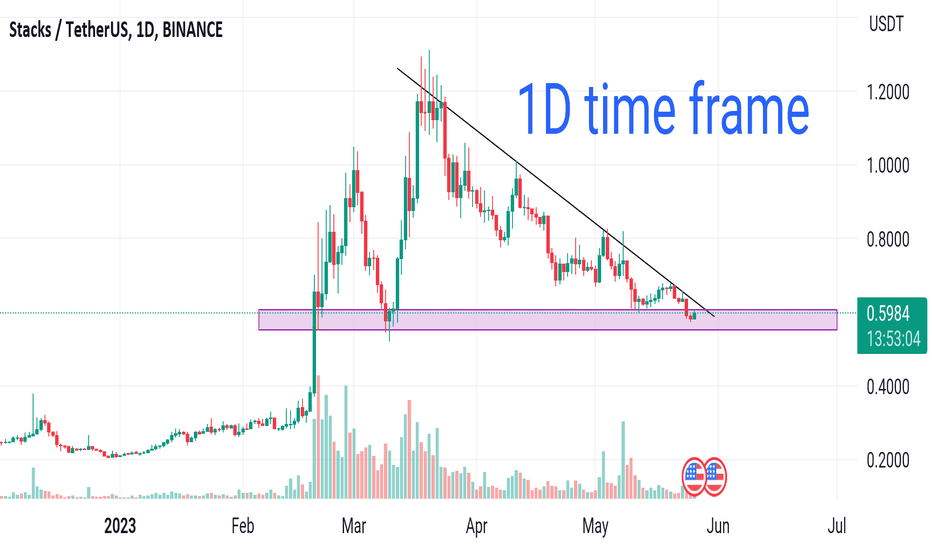

x2 - x4 chance with STXD1: stx main uptrend. During the downtrend starting from March 20 to June 10, the price moved down the channel with low volume and small amplitude.

The weis wave volume represents an ascending attempt by the sellers, but the price did not fall sharply when the price approached 0.5213. The candle on June 10 is a climax of selling and the candle on June 18 is a no supply -> selling pressure is exhausted.

On 20/06 there was a strong bullish candle + super high vol broke the downtrend structure -> the downtrend corrected and ended, stx returned to the uptrend.

setup: buy limit 0.6795, sl 0.435, tp1 1.3115, tp2 2.8

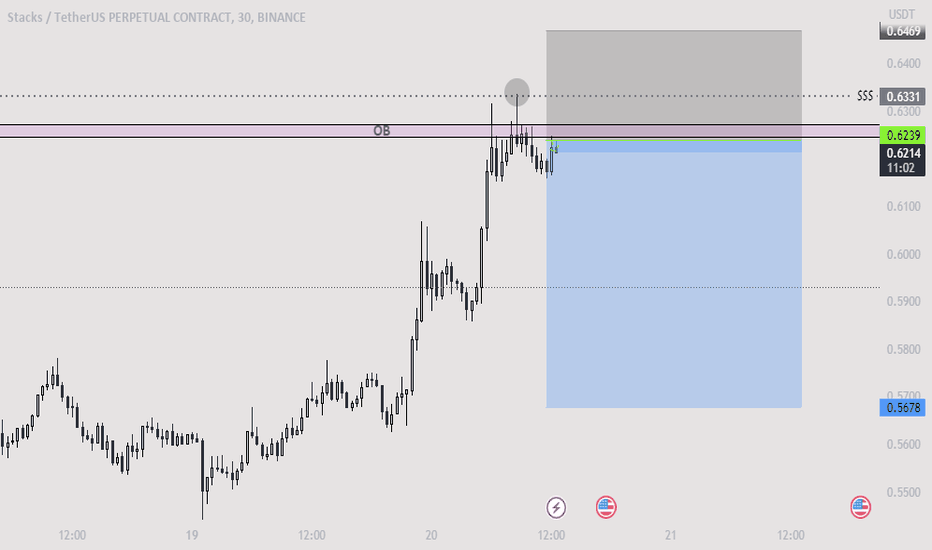

STXUSDT.P trade ideas

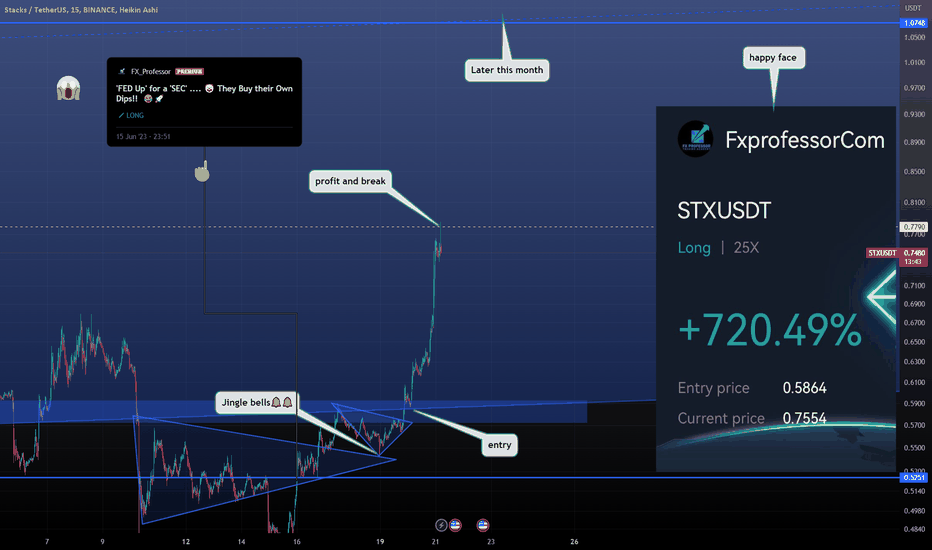

🔔 Jingle all the way, oh what fun it is to ride the STX train🚄🔔Merry Xmas to all SEC and Powell bears:

🔔reference:

🔔Dashing through the snow

In a one-horse open sleigh

O'er the fields we go

Laughing all the way

Bells on bobtails ring

Making spirits bright

What fun it is to ride and sing

A sleighing song tonight, oh!🔔

🔔Jingle bells, jingle bells

Jingle all the way

Oh, what fun it is to ride

In a one-horse open sleigh, hey!🔔

🔔🔔🔔MERRY XMAS JEROME, MERRY XMAS SEC!🔔🔔🔔 HAPPY NEW YEAR BEARS!!

The FXPROFESSOR 🎅

OH I FORGOT: STX IS A TRAIN 🚄🚄🚄🚄🚄🚄🚄🚄

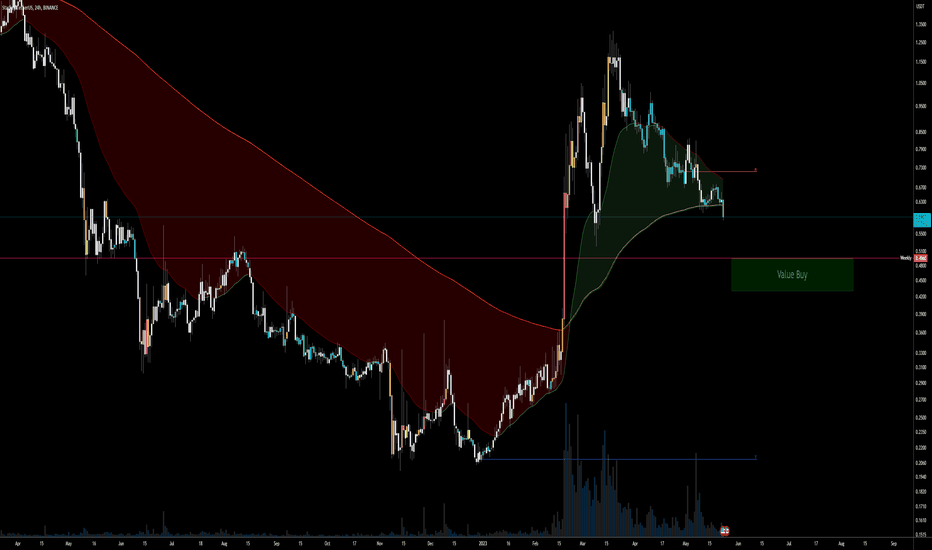

76% Profit?hello guys

i hope you all doing well

i think this setup will make a very good profit

but do you fundamental research before open any position

The information provided on this Page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. this page does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisio

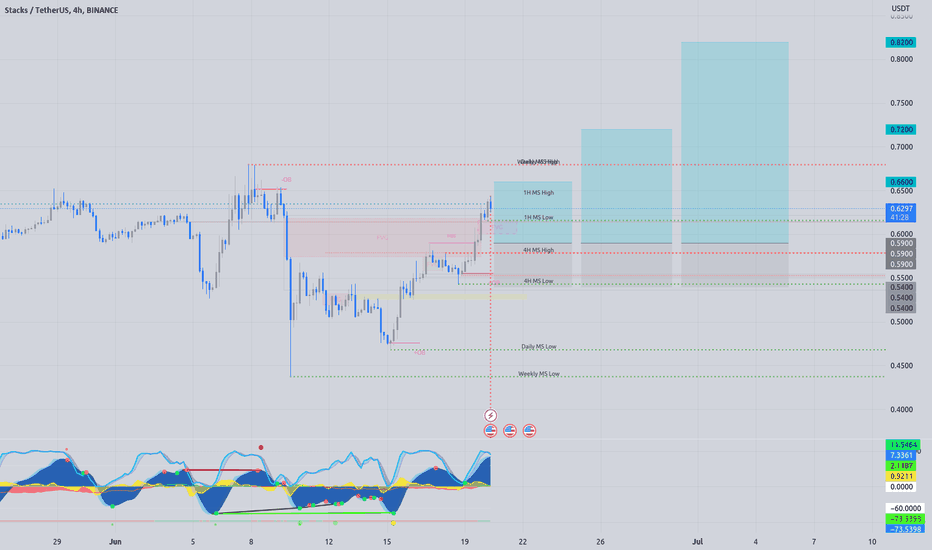

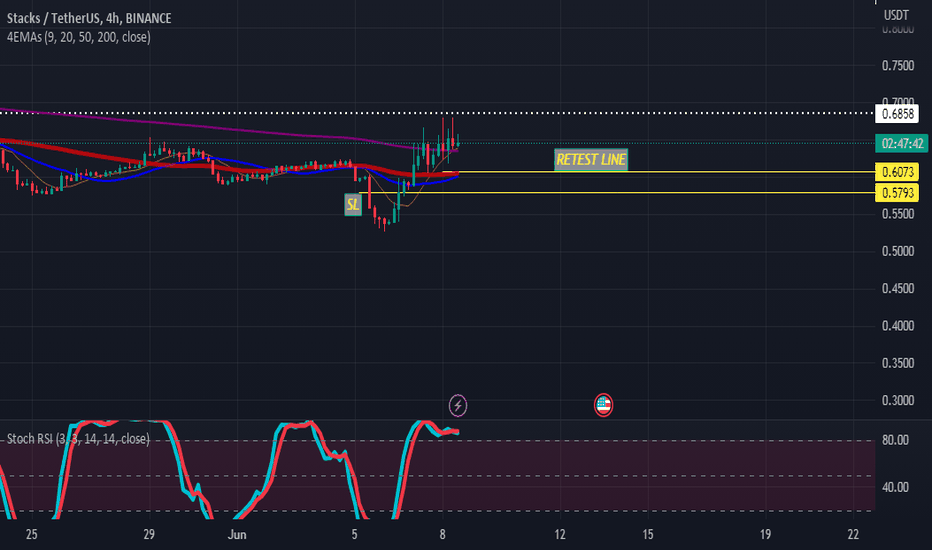

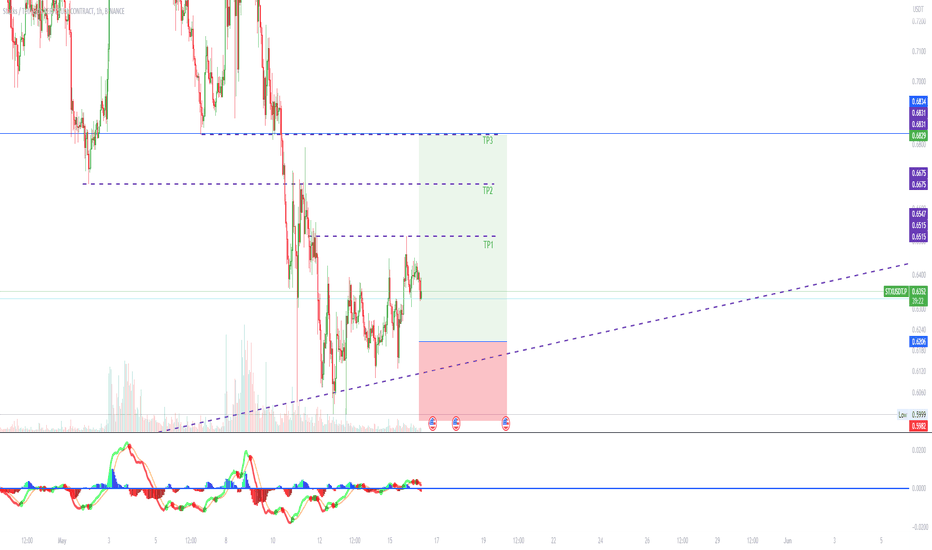

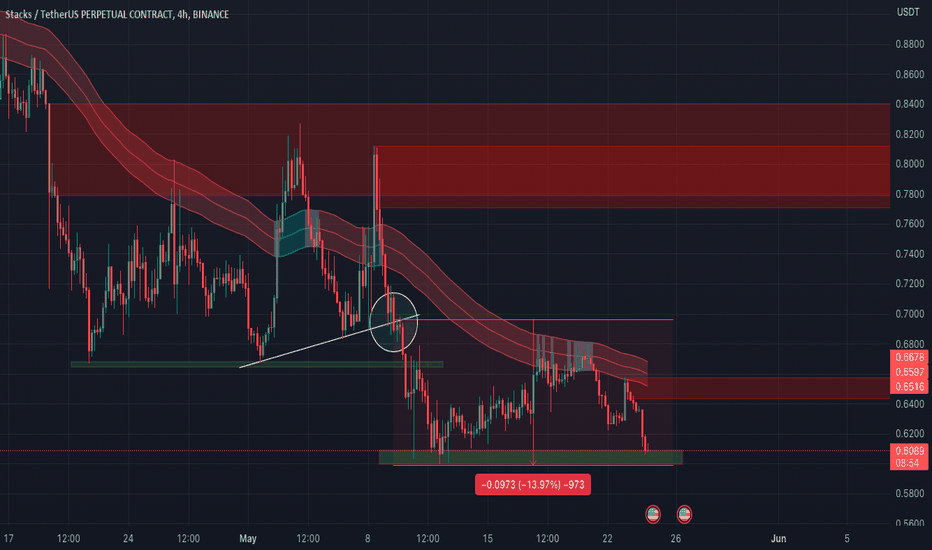

STX SHORT RETESTstx is looking strong despite current market sentiment. we tested resistance at ..67 cent.we are now retesting the 200 although stoch rsi are overbought so a continued retest to the 50 and 20 running in confluence is my expectation

if taking the long i would put a stop loss at either 57cent or if you want more exposer 52 cent is the swing low i am expecting the bounce at 60 cent i would enter the long there and target .84 cent we need to break through ..68 first

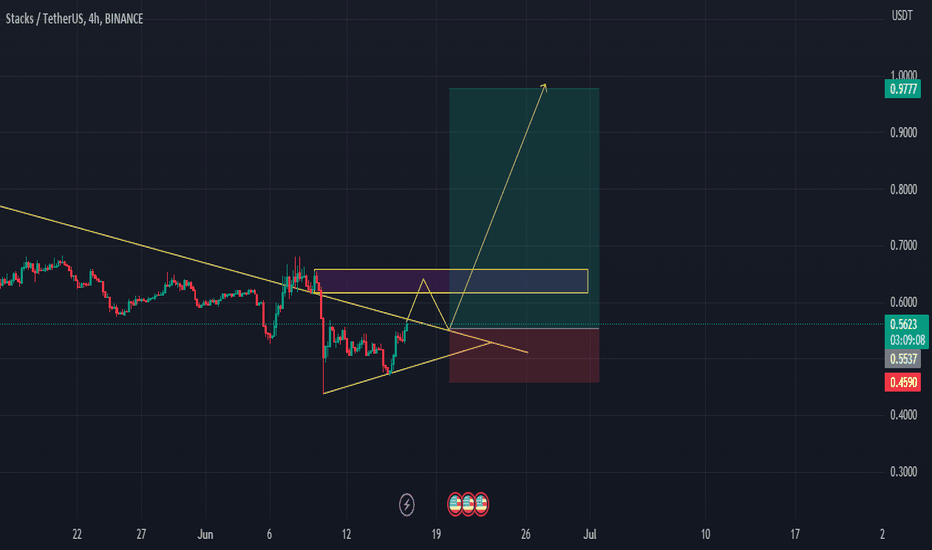

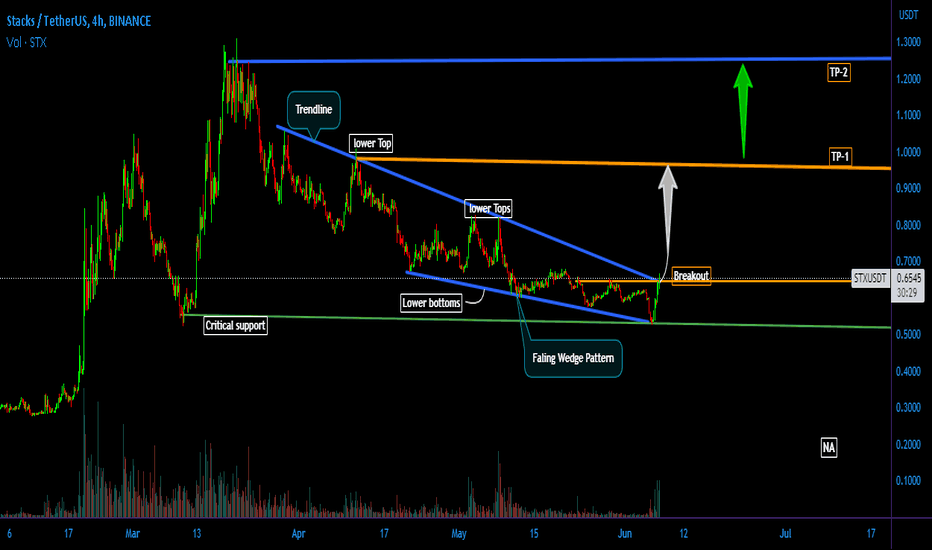

STXUSDT Signals Potential Bullish Breakout with Falling Wedge 💎 STXUSDT pair has formed a falling wedge pattern on the 4-hour timeframe, indicating a potential bullish reversal.

💎 As the trading volume gradually decline. This signifies reduced selling pressure and accumulation by buyers. An increase in volume during the breakout can further confirm the bullish outlook.

💎 If the breakout occurs above the upper trendline of the falling wedge, it could lead to a potential upward price movement.

Disclaimer: This is Not Financial Advice ❗️ Trade at Your Own Risk ⚠️

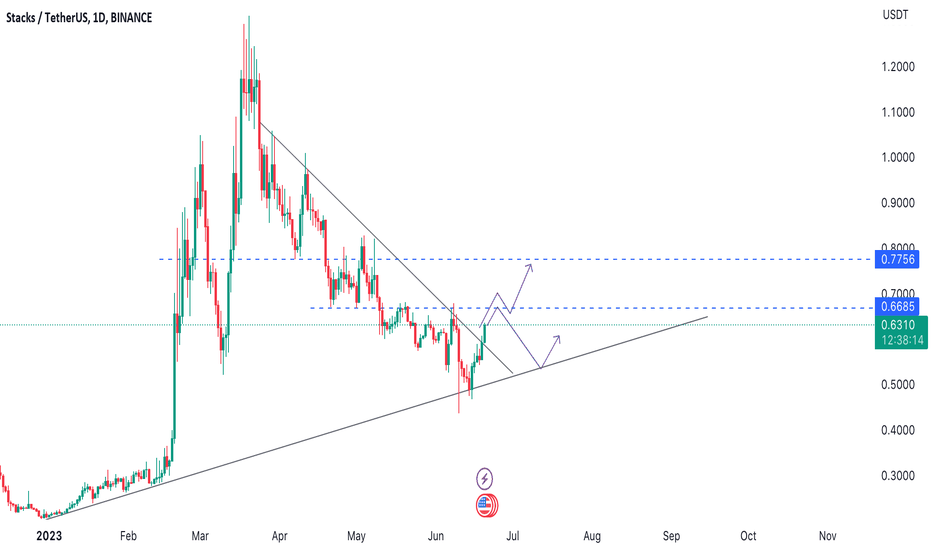

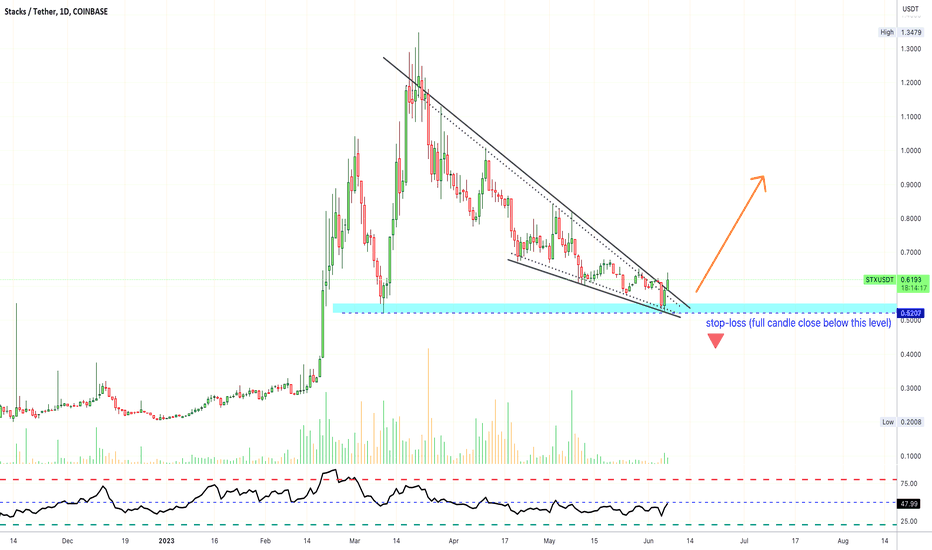

✴️ Stacks, Bullish Chart SetupStacks has been in a correction since late March, even though we had a strong market shakeout yesterday it looks good today.

STXUSDT Bullish Signals

We have a higher low this month vs 10-March.

We have a falling wedge pattern.

Bullish divergence with the RSI.

Volume breakout.

This chart looks like a great setup.

Low risk with a potential that can go beyond 80% in the short-term.

Wishing you a lovely Wednesday.

Namaste.

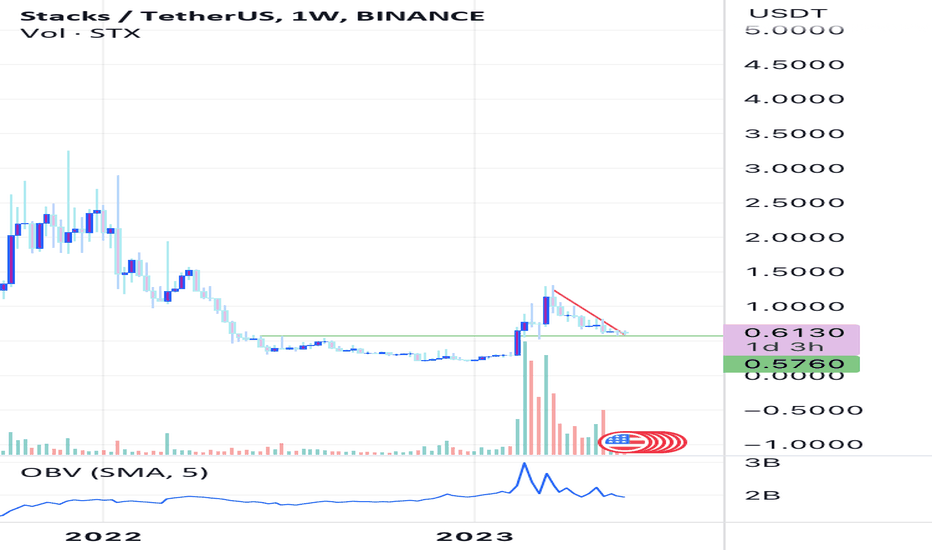

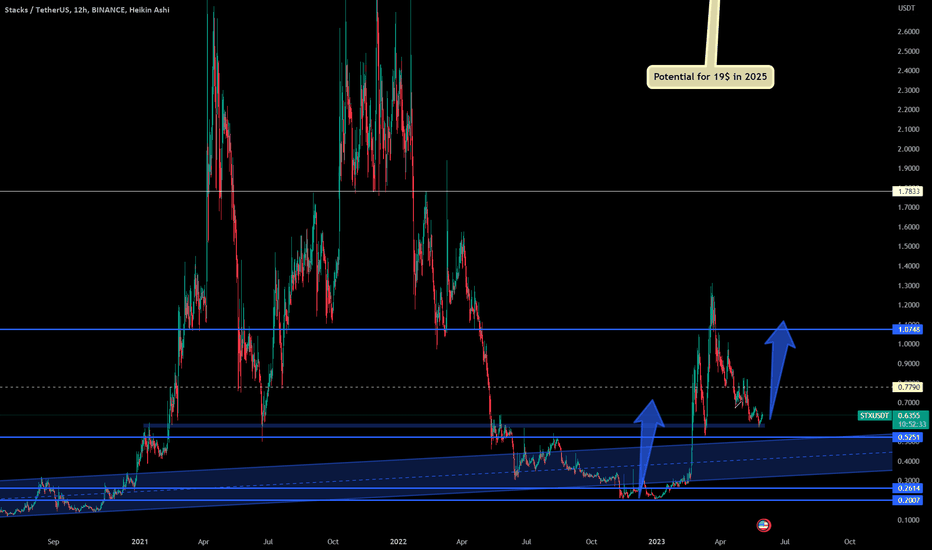

STACKS- Time to Un-stuck the Stacks 🥞🥞🥞Very volatile but that's not a bad thing (for me at least).

STACKS is very promising and i keep it in spot with patience.

CHART:

Between 0.52-0.63 lies great support.

TARGETS:

🥞0.779 Interim resistance/target

🥞1.07 Target 1

🥞1.78 main resistance/Target for 2023

🥞19$ is the potential i see for 2025-2027

One Love,

The FXPROFESSOR 🌅