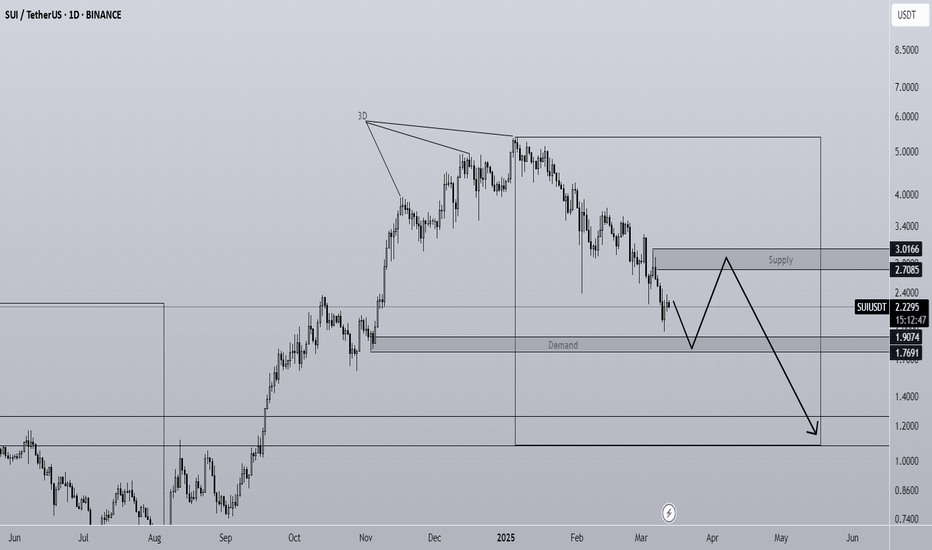

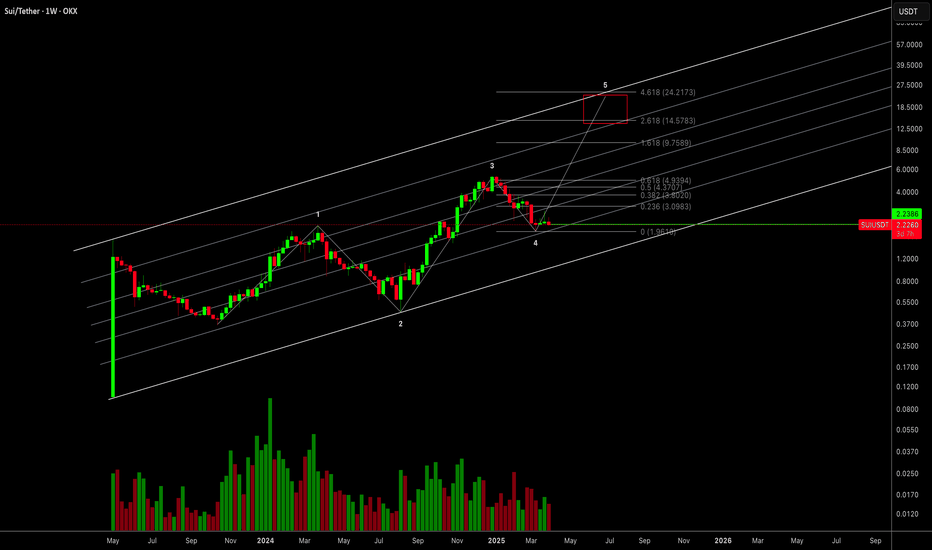

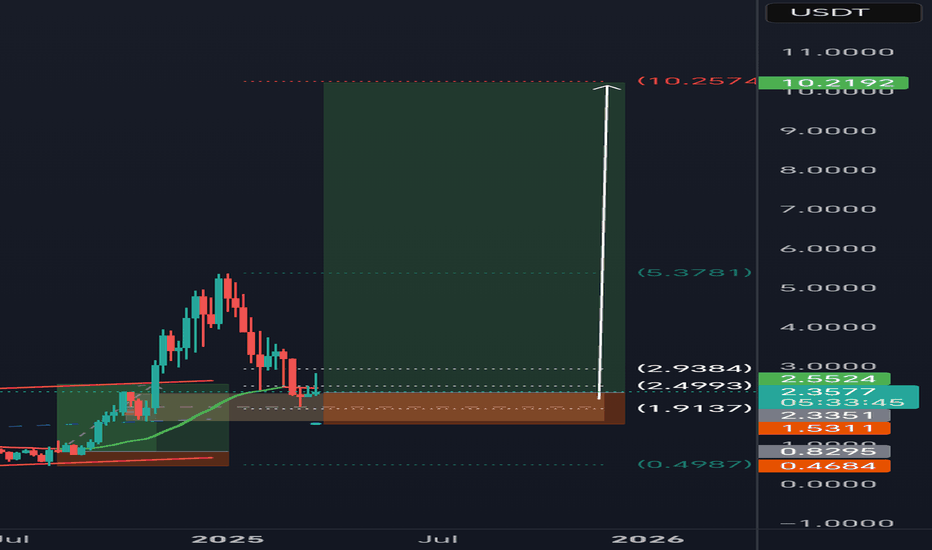

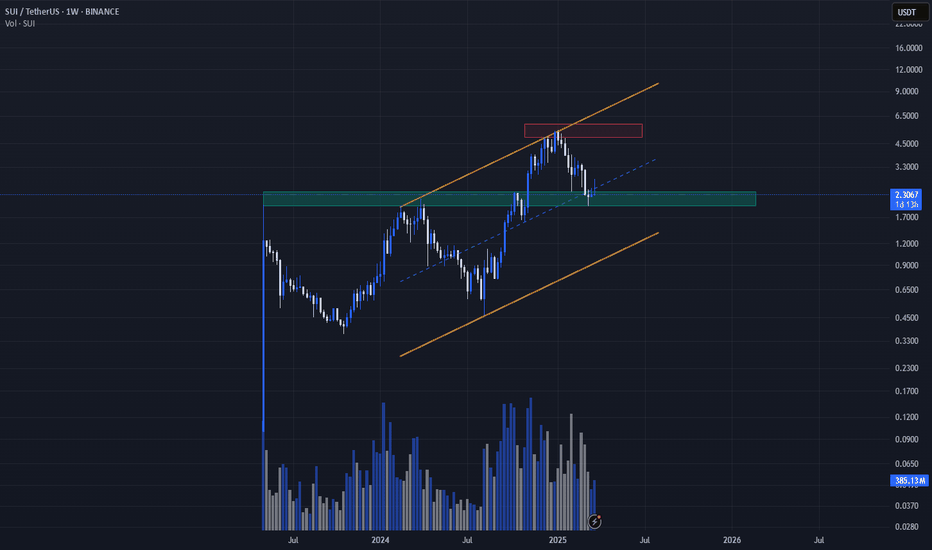

SUI is expected to have a 50% pump ahead (1D)SUI, after completing the 3D pattern at its price peak, has entered a corrective phase.

It is now approaching a high-potential zone, which is the origin of a strong move with significant buy orders. We are looking for buy/long positions in the demand zone.

The target could be the supply zone.

A daily candle closing below the invalidation level will invalidate our bullish outlook.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

SUIUST trade ideas

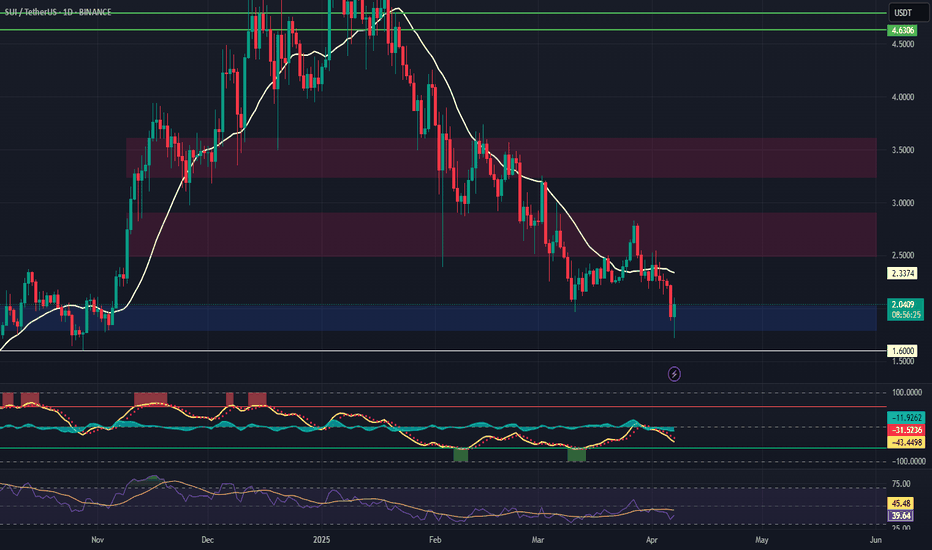

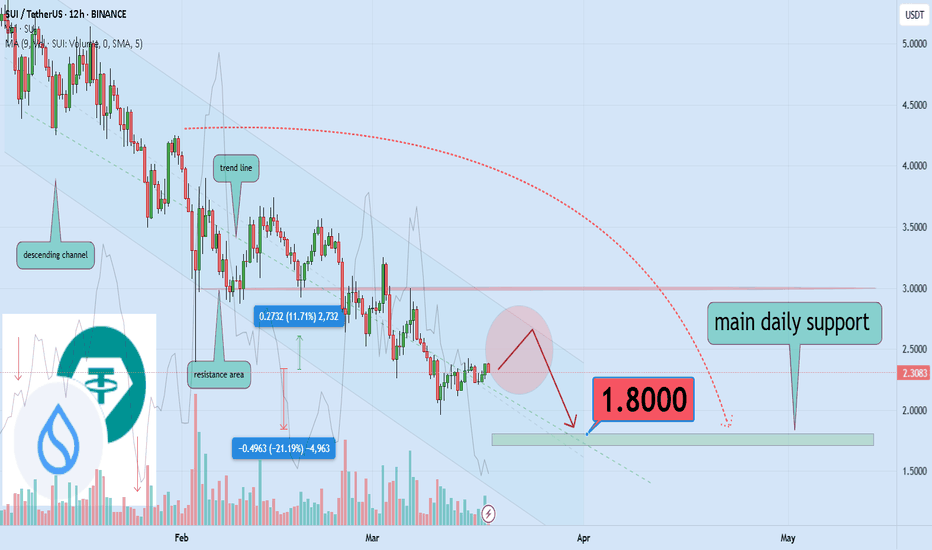

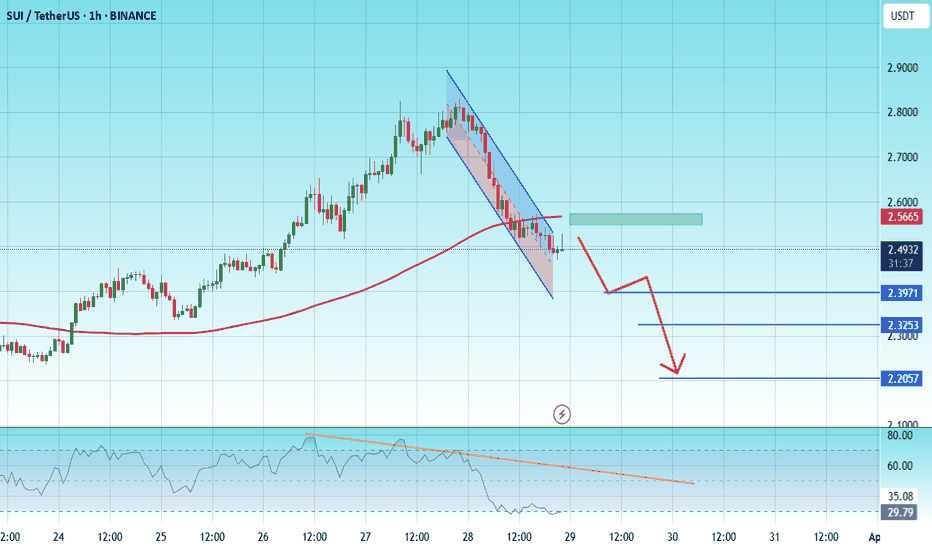

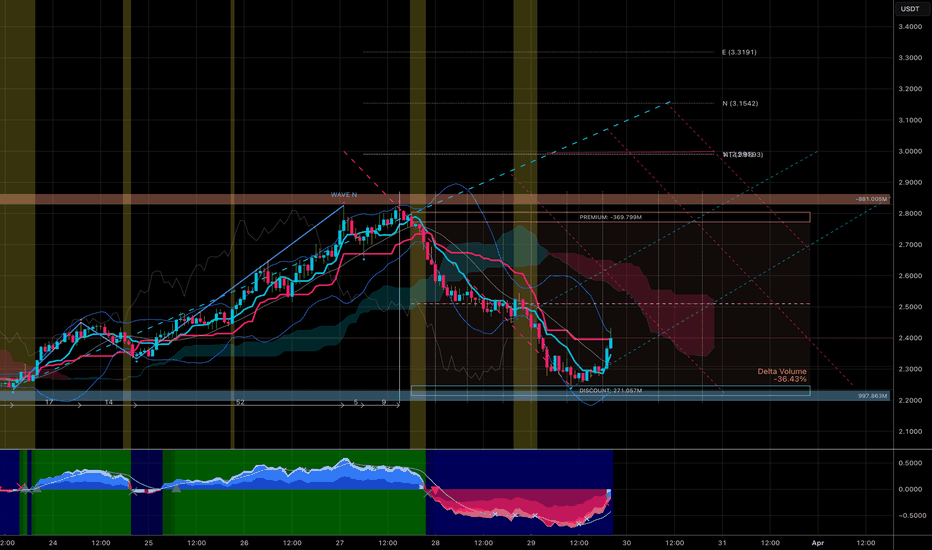

Will SUI break $2 support and drop 20% to $1.80?Hello and greetings to all the crypto enthusiasts, ✌

let’s dive into a full analysis of the upcoming price potential for SUI 🔍📈.

SUI is currently trading within a downward channel, signaling a potential continuation of its bearish trend. A decline of at least 20% appears likely, with the primary target set at $1.80, provided that the critical psychological support at $2 is decisively broken. If this key level fails to hold, increased selling pressure could drive the price lower, reinforcing the downtrend.📚🙌

🧨 Our team's main opinion is: 🧨

SUI is stuck in a downtrend, and if it breaks below the key $2 support, we could see at least a 20% drop, with $1.80 as the main target.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

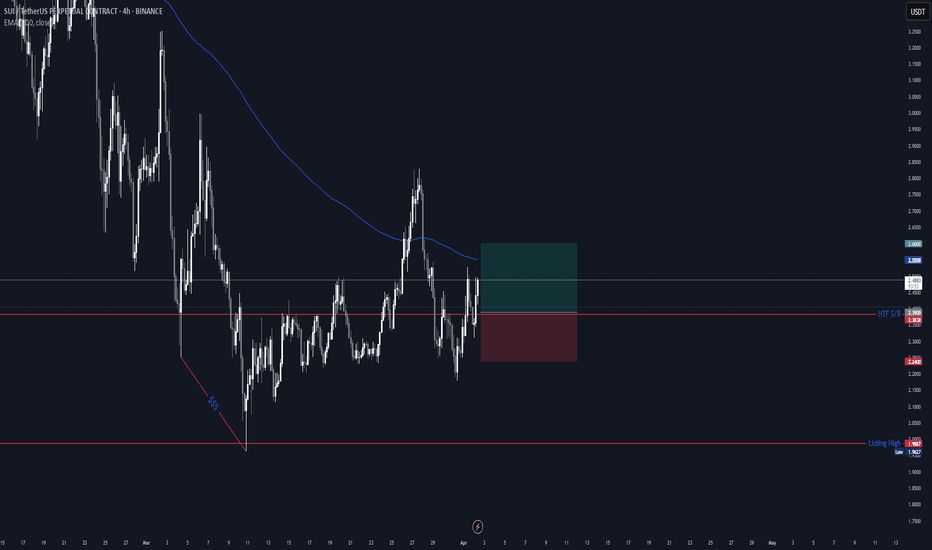

SUI-USDT Analysis: Watching Key Support at $1.75Hello Traders,

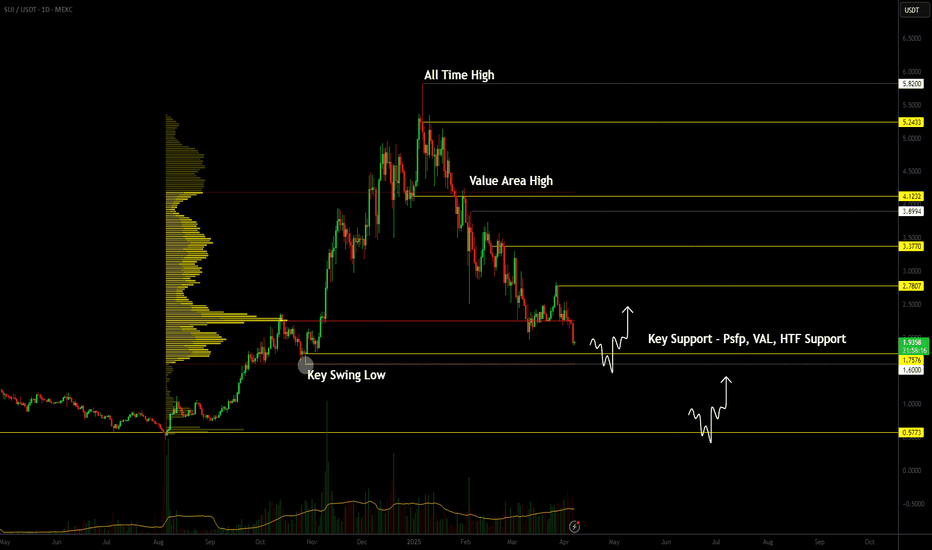

The price of SUI-USDT has been locked in a consistent downtrend, marked by a series of lower highs and lower lows. However, the asset is now testing a critical support level that could determine whether we see a relief bounce or a continuation of the decline.

Key Highlights:

• Price is approaching $1.75, a major support zone with confluence from the Value Area Low (VAL), HTF support, and a possible Swing Failure Pattern (SFP).

• If this level holds, there’s potential for a relief rally up to $2.78 over the coming days.

• A break below $1.75 opens the door to a deeper pullback toward $0.57, the next significant support.

SUI is currently sitting at support, and while it’s possible to see short-term candle closes above this region, confirmation is still needed before any strong bullish bias can be adopted. This is a level where patience and discipline will pay off — entering prematurely could result in getting trapped in a deeper leg down.

Overall, the market structure remains bearish. Unless the pattern of lower highs and lower lows is broken, momentum will continue to favor the downside. Holding $1.75 is crucial for any chance at a rotation higher.

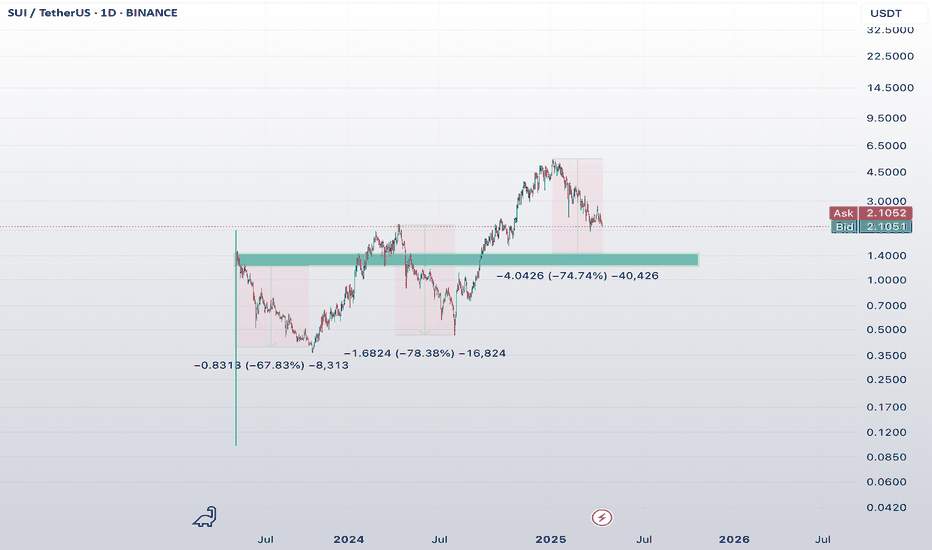

SUI is approaching a key support zone...

The price has already dropped by -74% from the top — and if it reaches the $1.00–$1.40 area, it could be a potential entry signal, just like it was before after a ~70% correction.

🔁 History doesn’t repeat, but it often rhymes.

An interesting level to watch — no need to rush, just be ready.

⚠️ Risk management is everything.

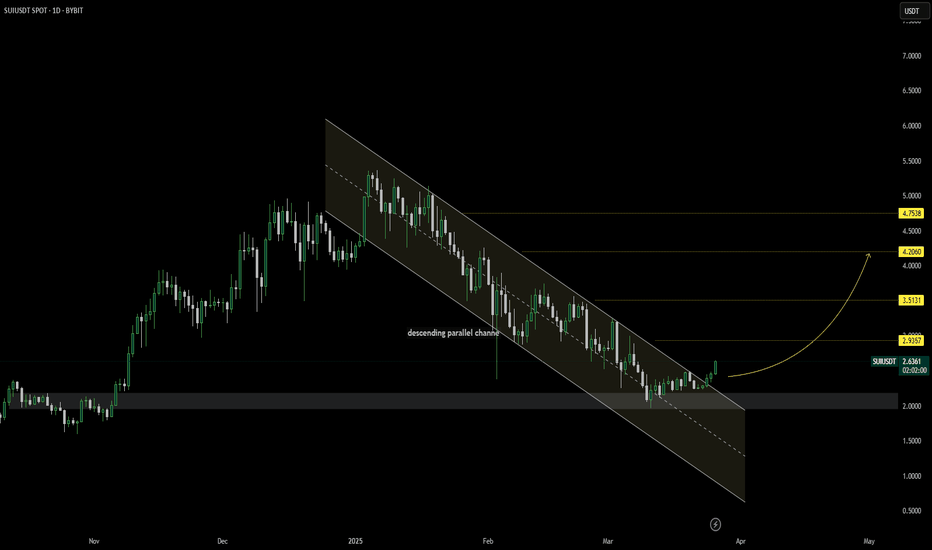

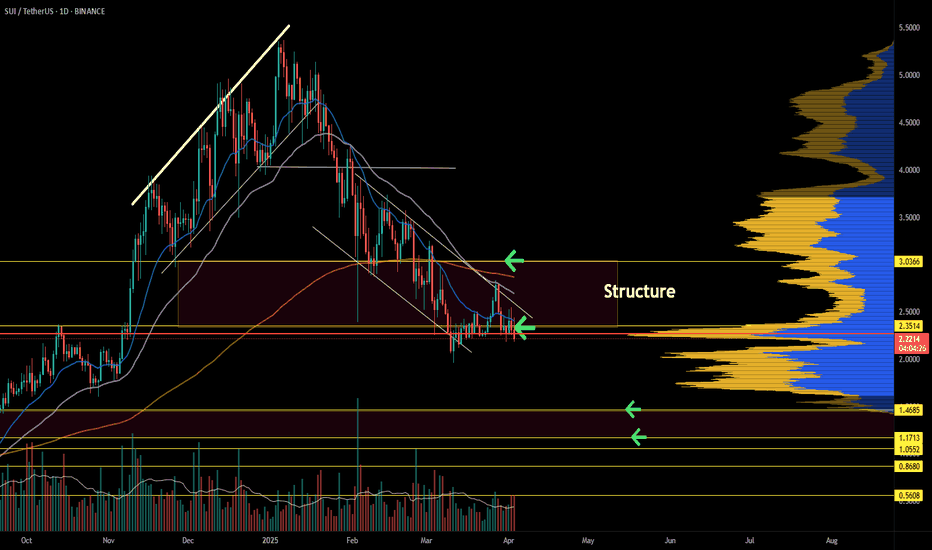

SUI/USDT Is a Trend Reversal on the Horizon?1D CHART of SUI on USDT market pair. indicates a potential trend reversal following a prolonged downtrend within a descending parallel channel. The price has consistently formed lower highs and lower lows, indicating strong bearish momentum. However, a recent breakout from the channel suggests a possible shift towards bullish price action.

A critical support zone around $2.00 has shown significance, as buyers have stepped in to defend this level, preventing further declines.

This breakout signals a potential trend change, with the price now targeting key resistance levels at $2.9357, $3.5131, and $4.2060. In an extended bullish scenario, the price could reach as high as $4.7538.

#SUI/USDT#SUI

The price is moving in a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a breakout.

We have a support area at the lower boundary of the channel at 2.17.

Entry price: 2.24

First target: 2.27

Second target: 2.32

Third target: 2.38

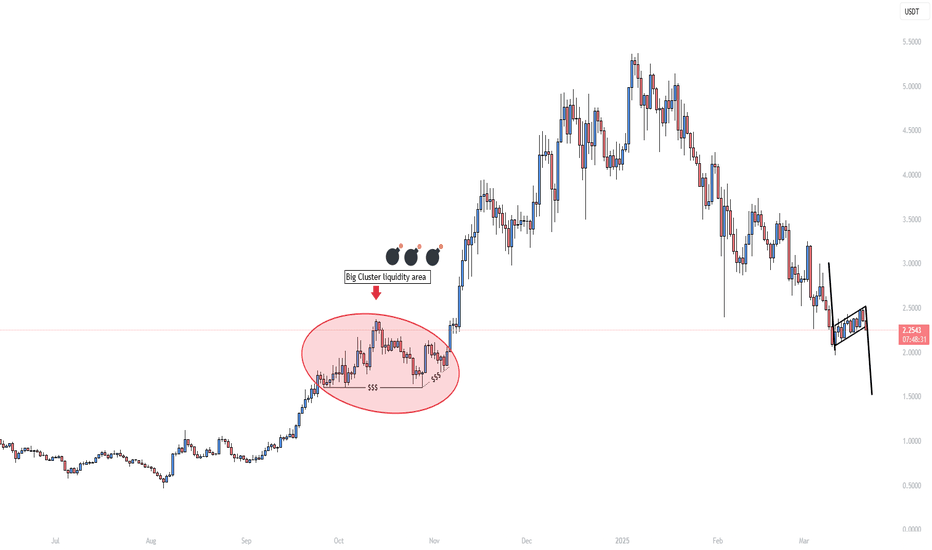

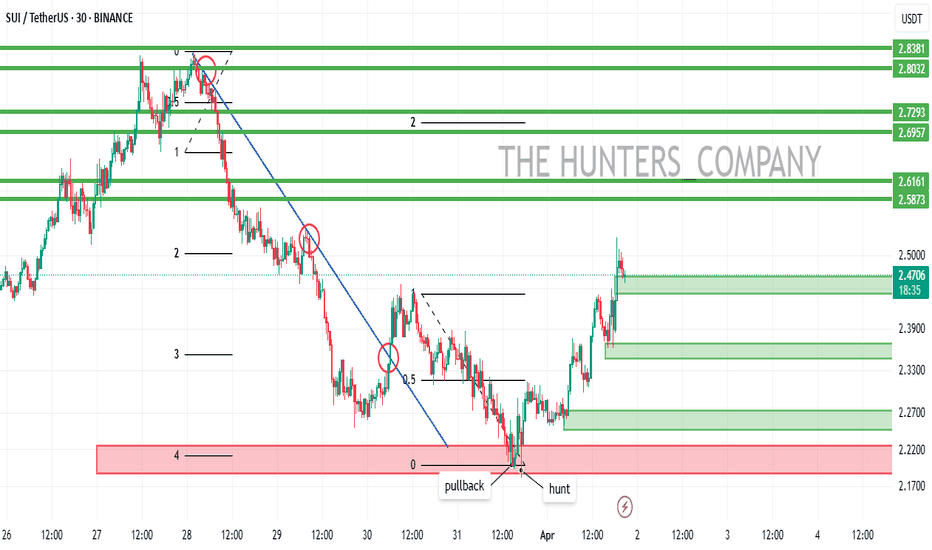

Sui Bear Flag !! Big Cluster liquidity area

Bearish Continuation Trade Idea - Potential Breakdown from Bear Flag

📉 Market Outlook:

The price has been in a strong downtrend, forming a bear flag after an impulsive move downward. This pattern is typically a continuation signal, suggesting further downside if the price breaks below the flag structure.

📍 Key Observations:

1️⃣ Big Cluster Liquidity Area: The highlighted zone marks an area where the price previously accumulated/distributed liquidity before a strong breakout. Now that the price has fallen below this region, it is acting as a major resistance.

2️⃣ Bear Flag Formation: After a steep decline, the price is moving inside a narrow ascending channel, which often acts as a bearish continuation pattern.

3️⃣ Potential Breakdown: A clear break below the lower boundary of the flag could confirm the next leg down.

🔴 Trade Plan (Short Setup):

Entry Trigger: Wait for a confirmed breakdown below the bear flag's lower boundary, ideally with a strong bearish candle close.

Stop Loss: Place above the recent swing high inside the flag to limit risk.

Take Profit Targets:

First target: Recent swing low

Second target: Major support zone with historical liquidity

⚠️ Risk Management:

Position sizing should align with your risk tolerance.

Beware of false breakouts; a confirmed breakdown with strong momentum is preferred.

Monitor macroeconomic events that might cause volatility.

📌 Conclusion:

The overall trend remains bearish, and the formation of a bear flag suggests further downside if confirmed. If the price breaks lower with conviction, sellers may push it toward key support levels.

🔔 Disclaimer: This is NOT financial advice. Always conduct your own analysis and manage risk accordingly.

Would love to hear your thoughts—drop a comment below! 🚀🔥

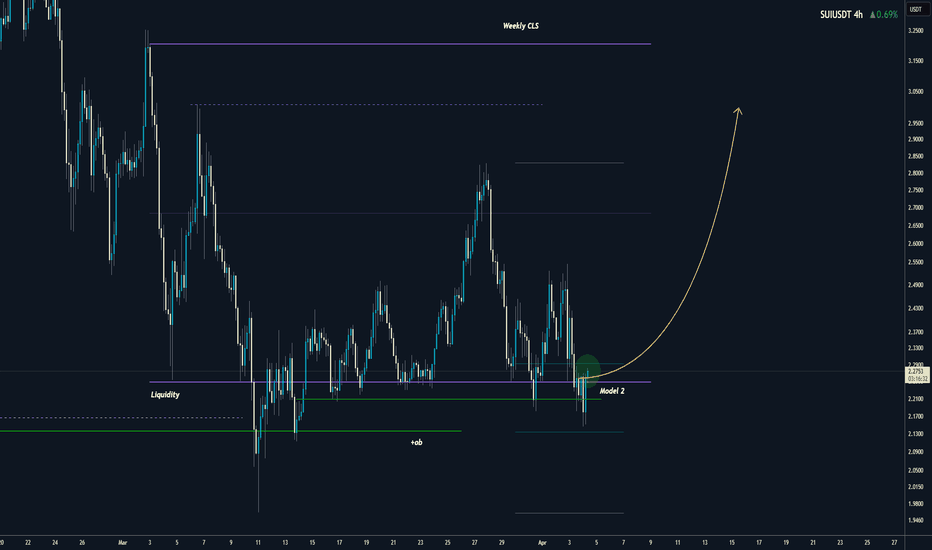

SUIUSD I Weekly CLS, Key level - OB I Model 2, Multiple targetsHey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

David Perk ⚔

SUI ready to provide structure? Be prepared for downside.SUI is at a good level, to get some support. There are further levels to get support below. However, a pivot structure can be built here. Momentum has room to get further oversold, but some downsides could still happen. DCA is the best strategy.

Full TA: Link in the BIO

#SUIusdtThe period of growth and show-off of this coin is over. Coins that are not American and try to attach themselves to America are not worth investing in.

And any coin that starts negotiating with Trump to enter the American market will soon disappear.

And experience has proven that any coin that gets close to Trump is doomed to pay him a ransom for growth and will disappear when he finishes paying the ransom.

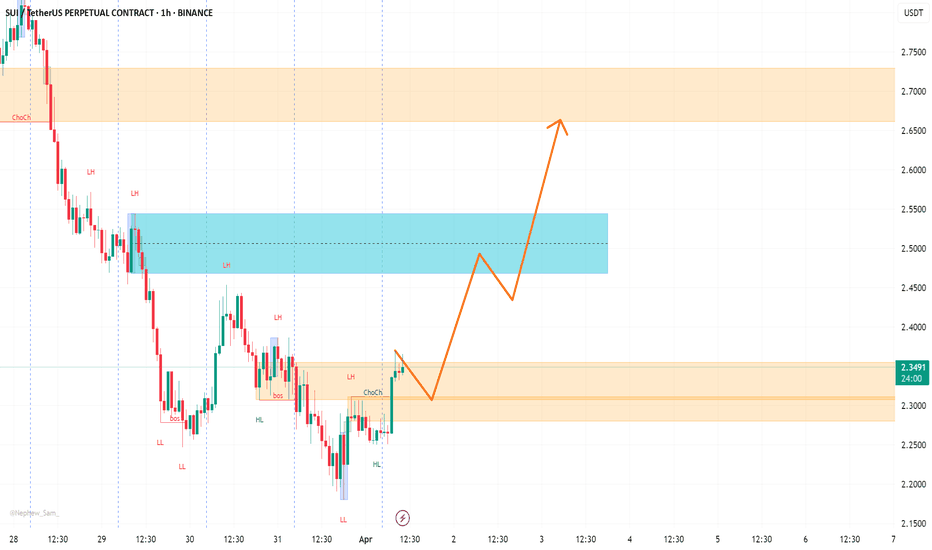

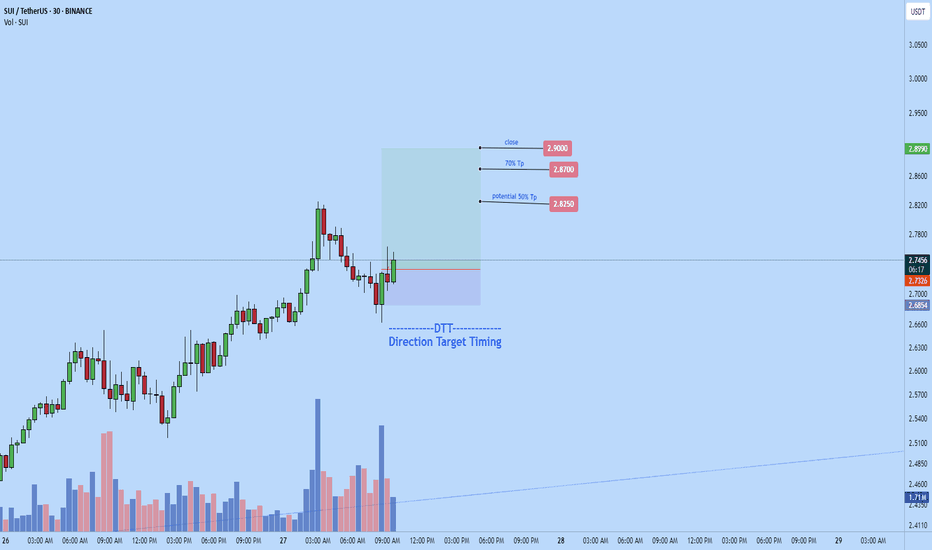

sui usdt ready to lead ALTS?Looking to long SUI as close to 2.4 as possible

Reclaimed key support level after forming A&E pattern

Above 50 level on both 4h and 12h rsi

Was the fastest horse of the market when the market started its trend in 2024. Should lead again

Broke out of the trendline after the fakeout. Usually fakeout --> retest support --> real breakout occurs

SUI/USDT:BUY LIMITHello friends

Due to the heavy price drop, it can be seen that the buyers have supported the price well at the specified support and by hitting higher ceilings and floors, they are giving us a sign that they have good strength. Now we can buy in steps with capital and risk management and move to the specified targets.

Don't forget to save profit on each target.

*Trade safely with us*

SuiUsdt Trade setup 12-15% upside ??recent impluse momentum with a formation of HL on 1h could be a sign of trend change

trade entry at2.300 to 2.350 demand zone further up at 2.5 can be the potential pullback area and could then face resistance at 2.65

and considering the down side risk at 2.200 can be the stop loss as it is recent low that bulls will try to defend

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 2.55.

Entry price: 2.52

First target: 2.40

Second target: 2.32

Third target: 2.20

SUI ON BULLISH -> $10+ Important Note: Trading involves risk, and this analysis is based on the provided chart and description. Traders should conduct their own thorough research and analysis before making any trading decisions. Remember to confirm the timeframe and adjust the stop loss based on your own risk management strategy.

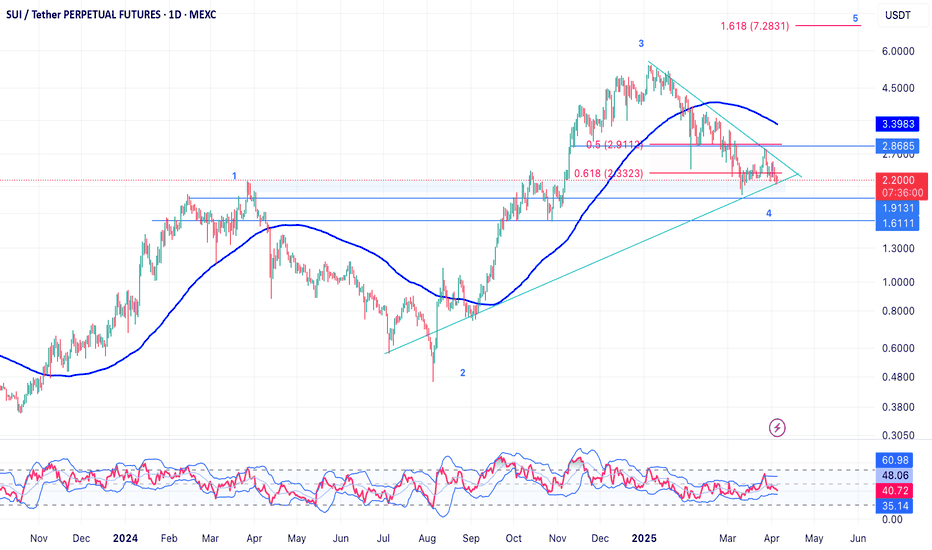

Buyers Regain Momentum After Big SelloffThe MEXC:SUIUSDT.P futures market is really heating up, as big exchange buyers at Binance, OKX, Coinbase and others regain momentum. Sui continues to be under-priced at the moment, but market sentiment has been very mixed, with TA showing both rising up-channel, as well as "death cross" crash potential. The current trend reversal may signal that momentum is on the taker side as investors gain interest seeing numbers, who may not have been active in Sui market have decided to get a piece of the action.

At this time 03:40 UTC I see futures market volume on the level of 500-600% or greater, above CEX spot market volumes. For example, Coinbase volume jumped from 4 to 6.77M in the last 60 minutes, while MEXC perpetuals have exploded from 36m to 59-60M in the last 45 minutes. All this is a good indicator especially considering we are outside normal workday hours. Perhaps traders around the world are taking notice of Sui as market volume increases.

Watch those volume levels closely for signs of reversal at major exchanges - Binance BINANCE:SUIUSD Coinbase COINBASE:SUIUSD OKX OKX:SUIUSD and other high volume markets - BB Squeeze indicator is quite effective here for the perceptive trader.

Stay tuned habibi

Sui Technical AnalyzeTrend: The price is forming an ascending channel (orange lines), which is generally a bullish sign.

Support: The green zone around 2.30 is a strong support level to keep an eye on.

Resistance: The resistance at 5.60–7.00 is a critical point. A breakout above this level could signal significant upside potential.

Volume: Volume is low and needs to pick up for a clear trend direction to emerge.

Price Action: Look for a retest of the green support. If it holds, the price may push upwards towards 5.60–7.00. Otherwise, a breakdown below 2.30 could indicate a reversal.