SUSHIUSDT trade ideas

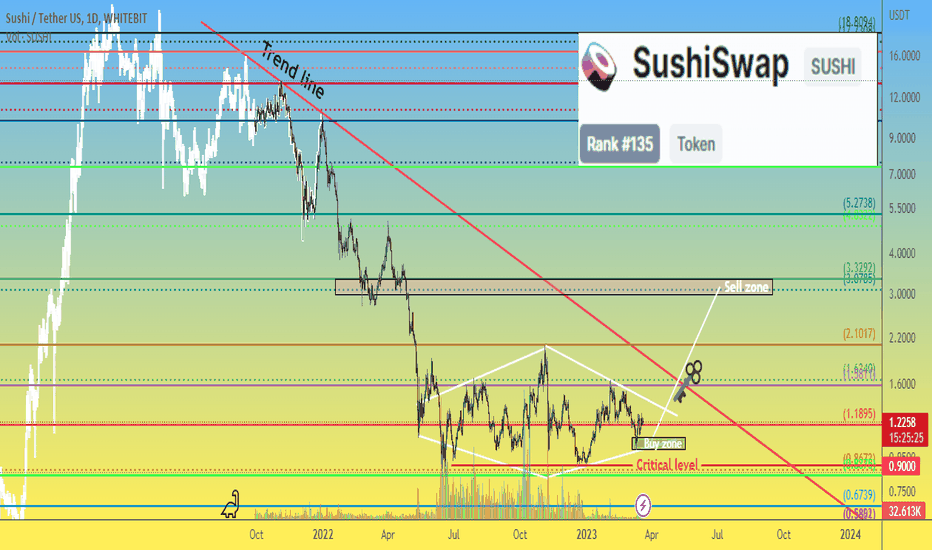

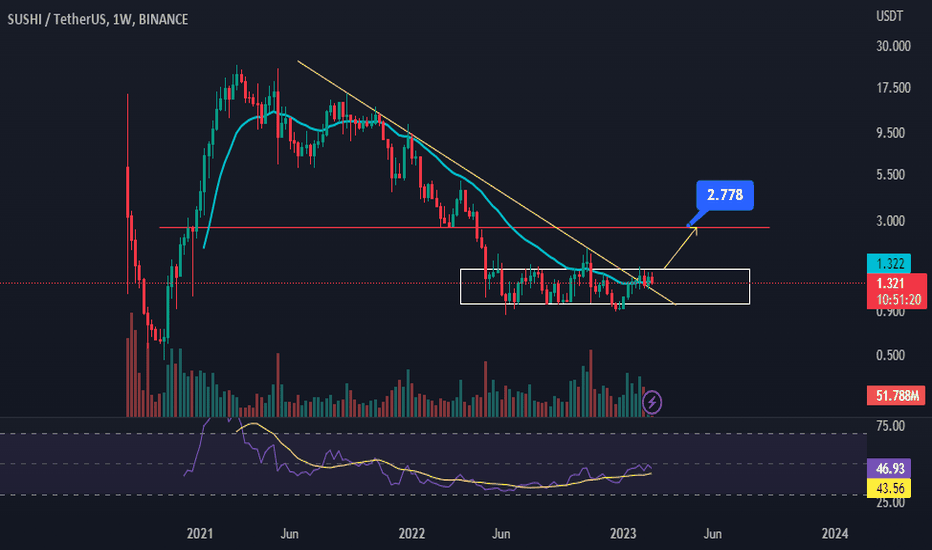

SUSHI price preparing for a rapid up move? Diamond on the chartFor almost a year, Sushi has been accumulating, most likely, a long position. Is there something "big" in the pipeline and soon everyone will see some news that will make everyone buy Sushi because the price will start to rise rapidly?)

If you try hard, you can see and draw the Diamond pattern on the chart , the target of developing such a pattern on the SushiUSDT chart is $3-3.30

The ideal buy price for Sushi is $1-1.10

The critical level is $0.90

The "key level" for the start of the growth trend is $1.60

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

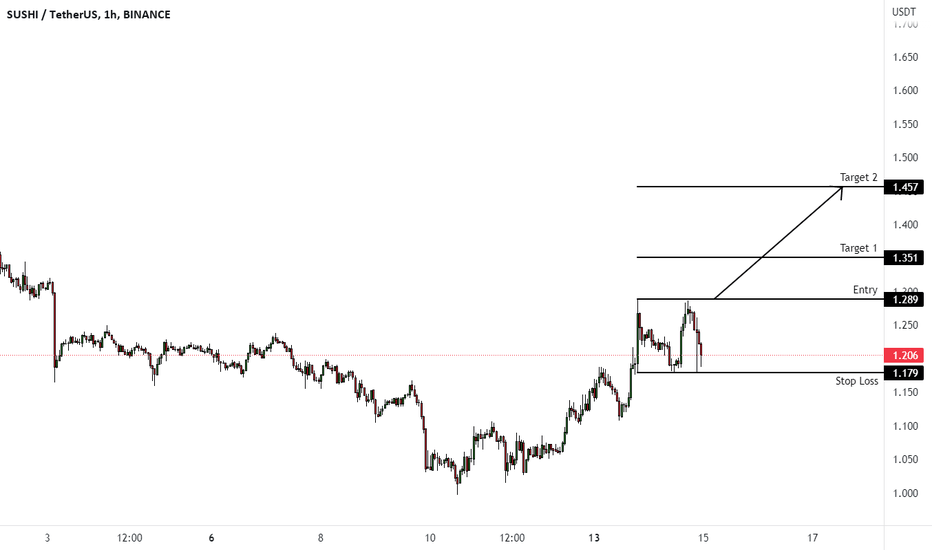

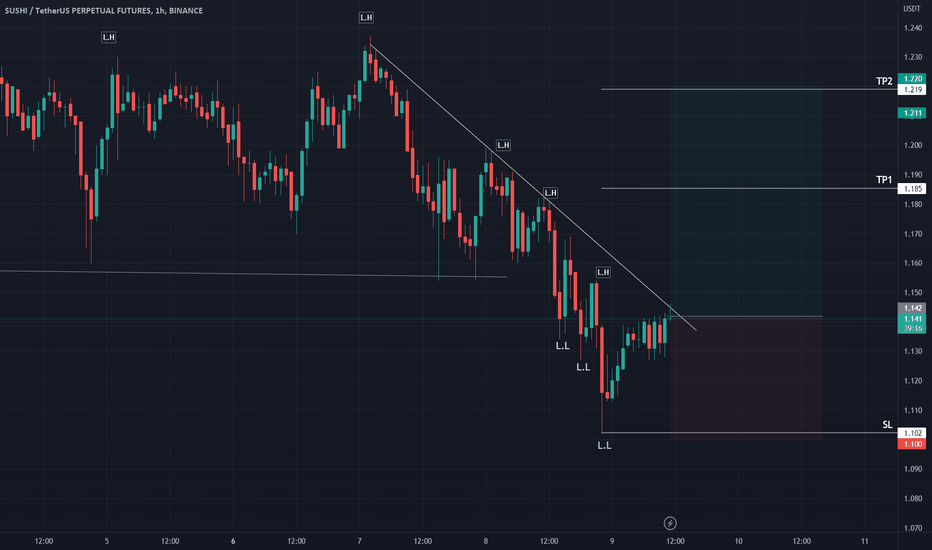

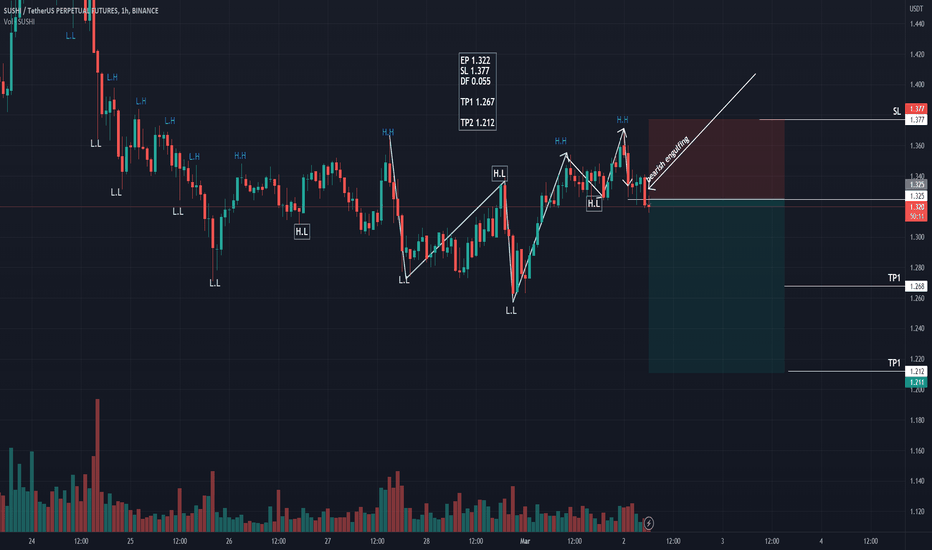

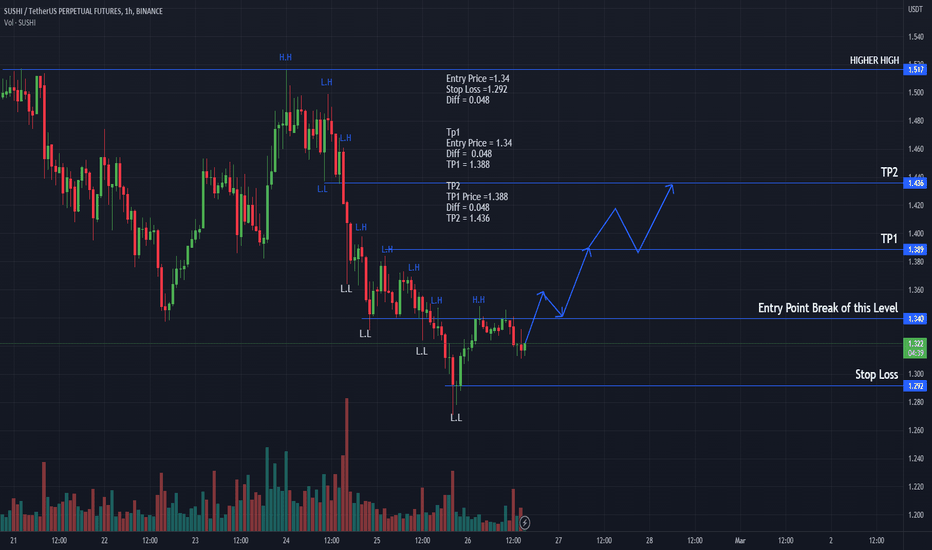

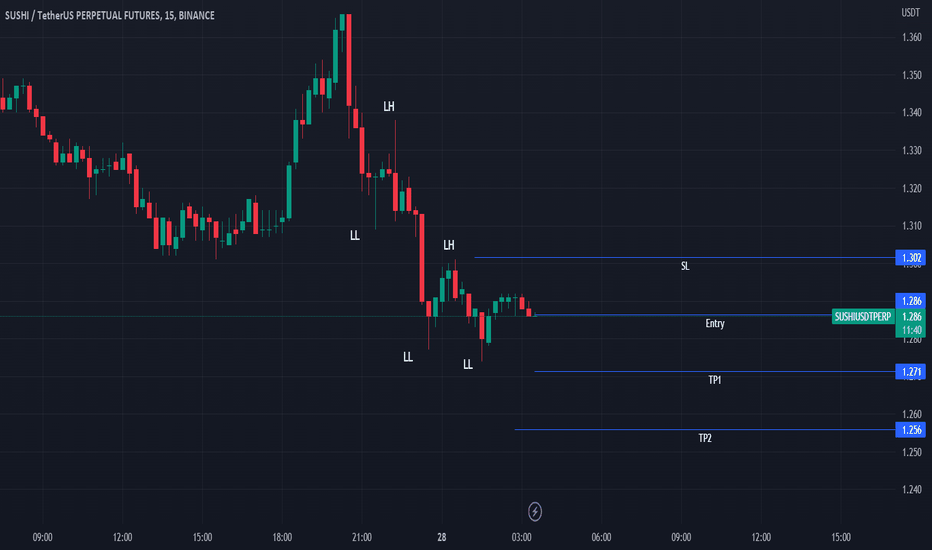

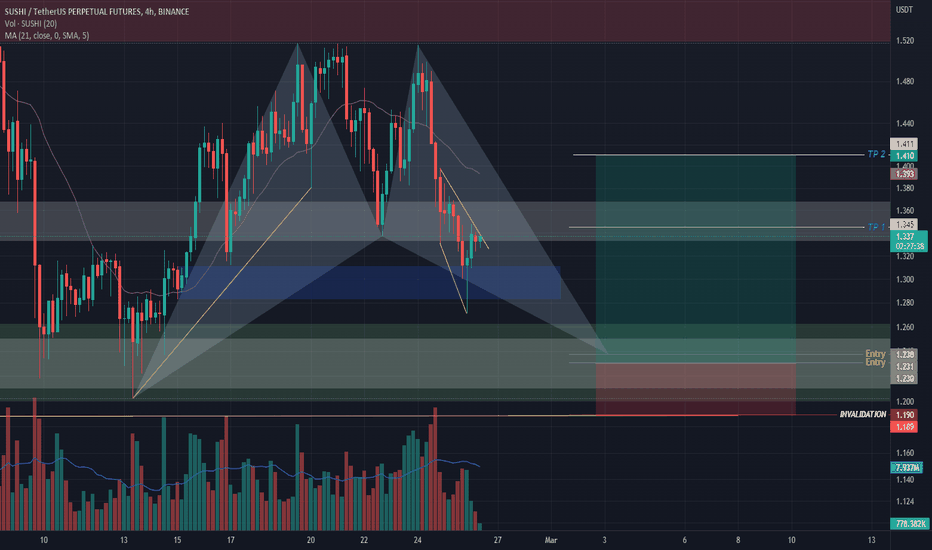

SUSHIUSDT (1H) - Bullish breakoutHi Traders

SUSHIUSDT (1H Timeframe)

The market is in an uptrend and we are waiting for an entry signal to go LONG above the 1.289 resistance level. Only the downward break of 1.179 would cancel the bullish scenario.

Trade details

Entry: 1.289

Stop loss: 1.179

Take profit 1: 1.351

Take profit 2: 1.457

Score: 7

Strategy: Bullish breakout

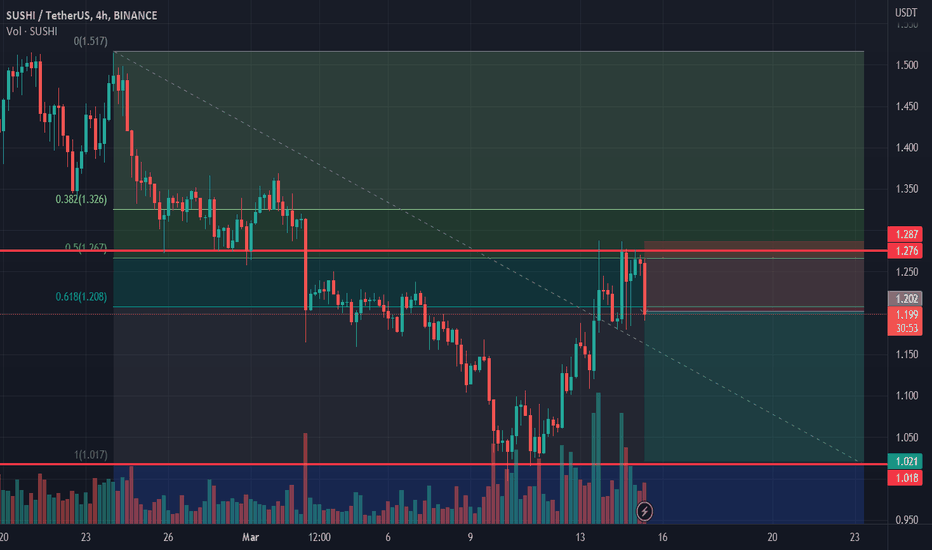

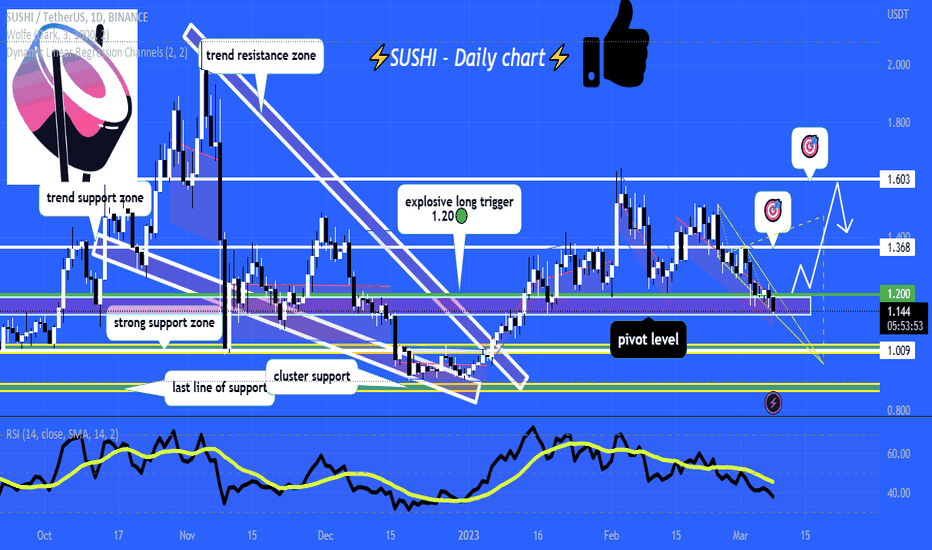

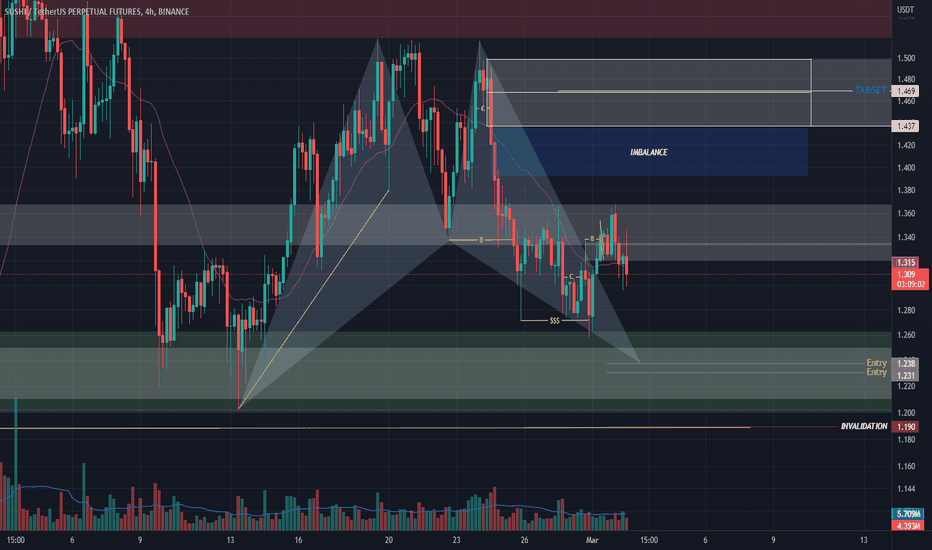

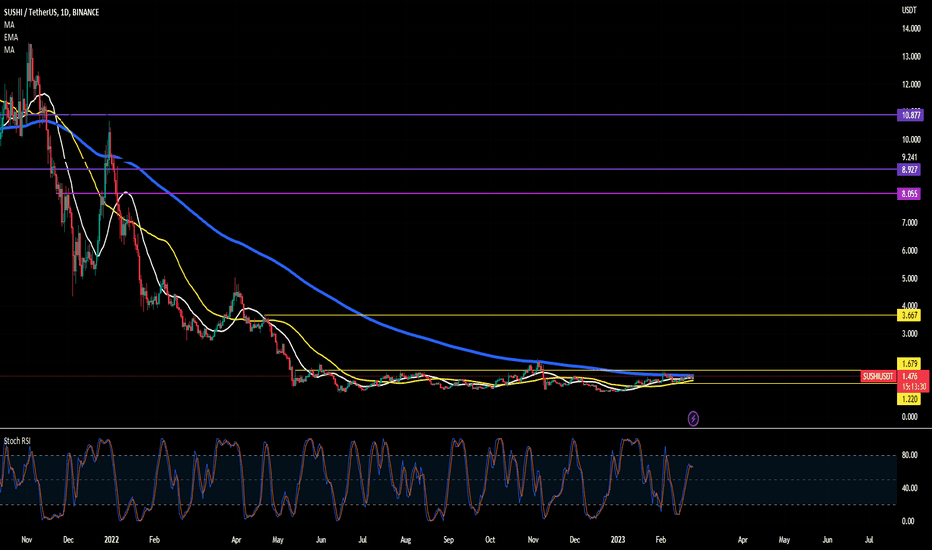

SUSHI ROADMAP UPDATEHi, dear traders. how are you ? Today we have a viewpoint to SELL/BUY the SUSHI symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

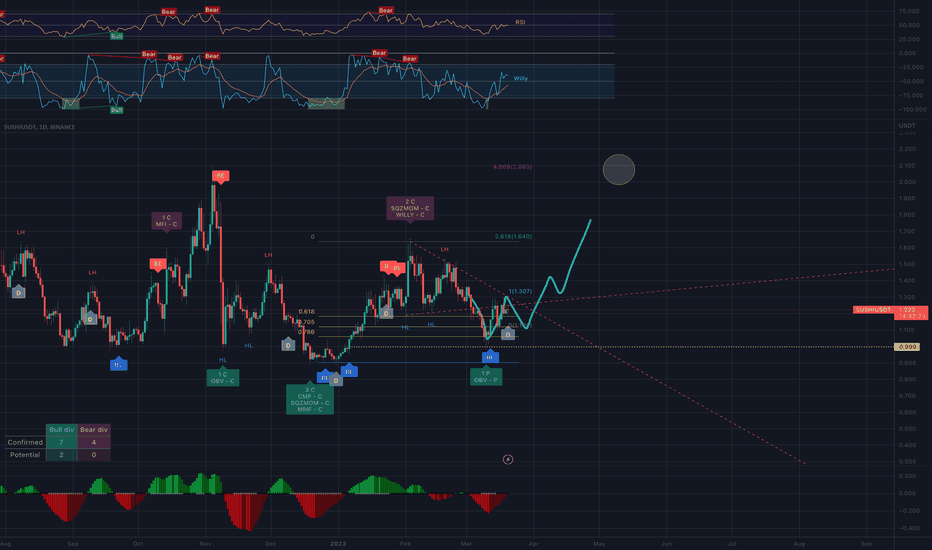

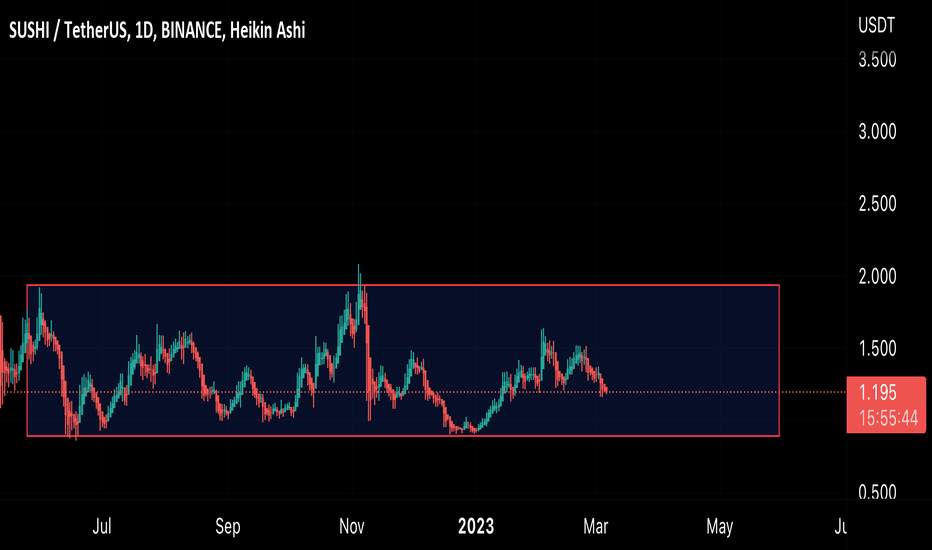

Sushi is ripe for a squeeze! Pt2Continuation of previous idea posted Aug 16, 2022

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

FED Macro Situation Consideration:

All TP's are drawn within the context of a return to FED neutral policy. I do not expect these levels to be reached before tightening is over.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

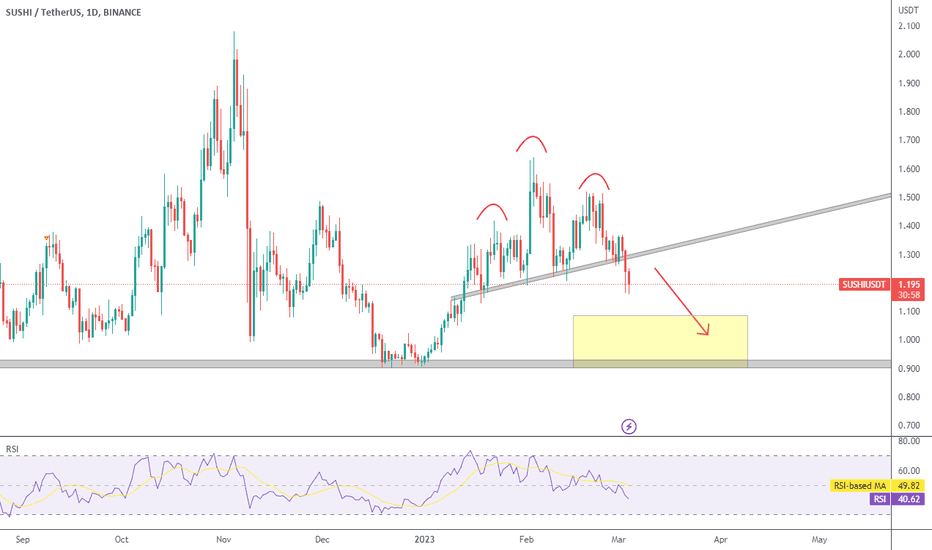

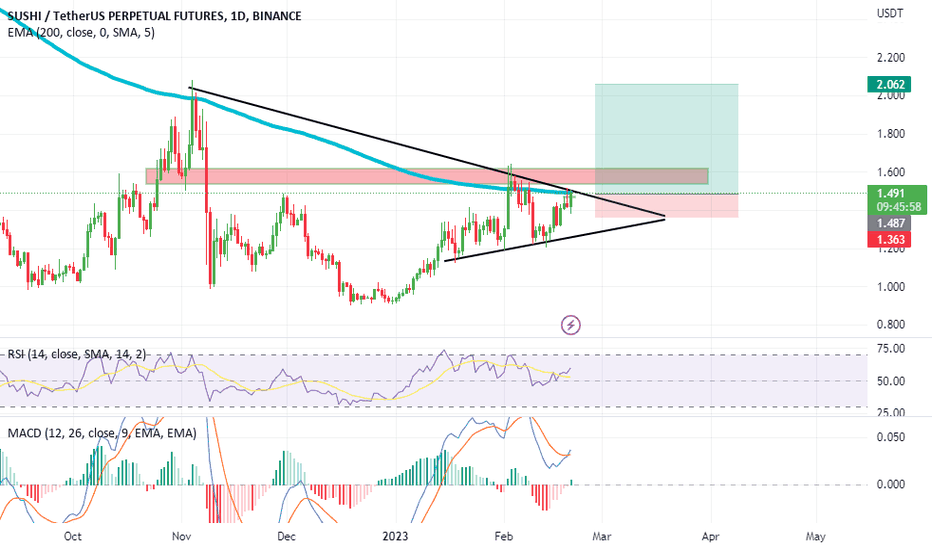

SUSHI - Due for a PAMPSushi has been trading sideways for almost a year now. It had quite a lot of bad news in 2022, but most of that seems to have been left behind. Despite the sideways price action throughout all of 2022, the RSI seems to be rising steadily now. It is still under the long term trendline in red, but is nearing the 50 SMA. I think it will soon break the 50 SMA and then punch through the horizontal resistance at about $2. Then the next challenge will be the long term trendline.