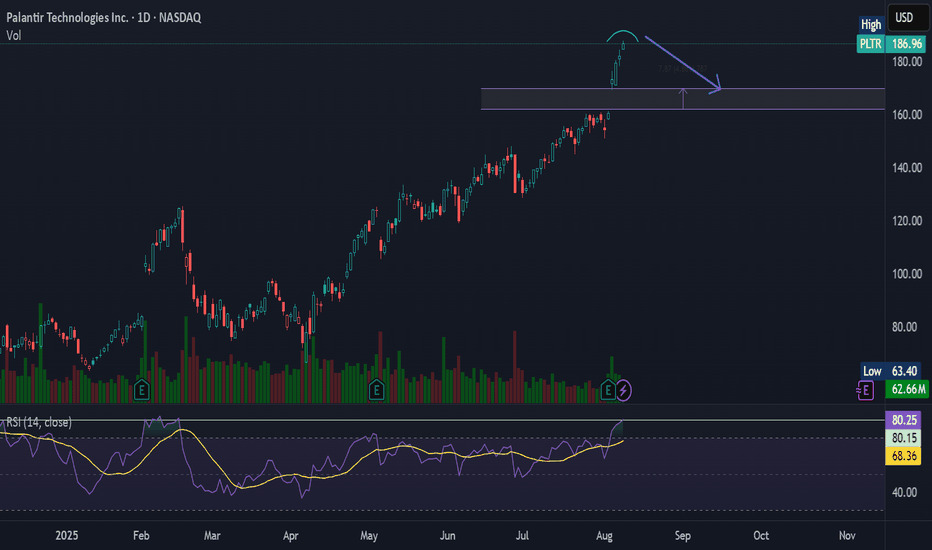

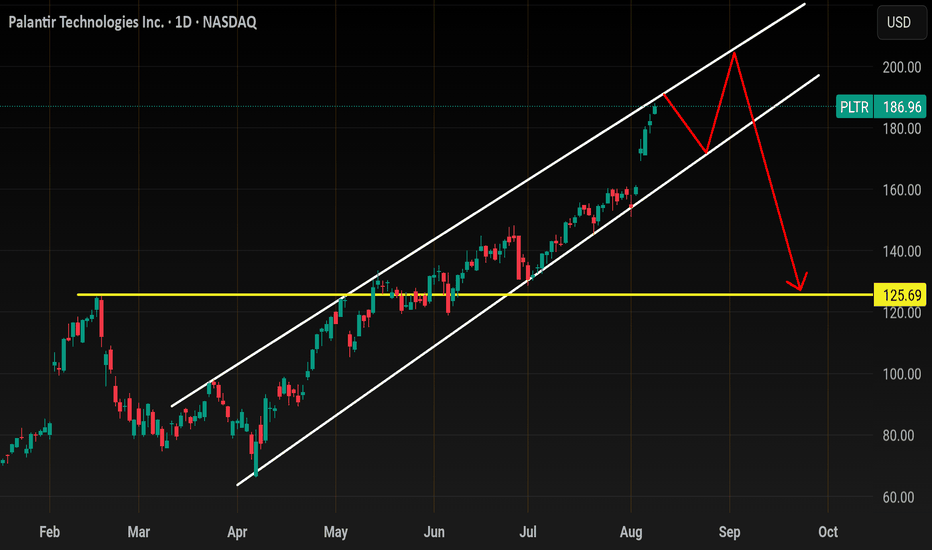

Short PLTR as it's time for a pullbackExtremely High Valuation: Palantir's stock has soared, and it's now trading at over 200 times its forward earnings. Such a high valuation can be hard to sustain, making the stock vulnerable to a correction.

The stock is up 28% in the last month. It is up close to 600% in the last year.

Even though

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.28 EUR

446.47 M EUR

2.77 B EUR

2.17 B

About Palantir Technologies Inc.

Sector

Industry

CEO

Alexander Caedmon Karp

Website

Headquarters

Denver

Founded

2003

FIGI

BBG00XJDTKD8

Palantir Technologies, Inc. engages in the business of building and deploying software platforms that serve as the central operating systems for its customers. It operates through the Commercial and Government segments. The Commercial segment focuses on customers working in non-government industries. The Government segment is involved in providing services to customers that are the United States government and non-United States government agencies. Its platforms are widely used in areas such as defense, intelligence, healthcare, energy, and financial services, supporting data integration, large-scale analytics, and operational decision-making. The company was founded by Alexander Ceadmon Karp, Peter Andreas Thiel, Stephen Cohen, Joseph Lonsdale, and Nathan Dale Gettings in 2003 and is headquartered in Denver, CO.

Related stocks

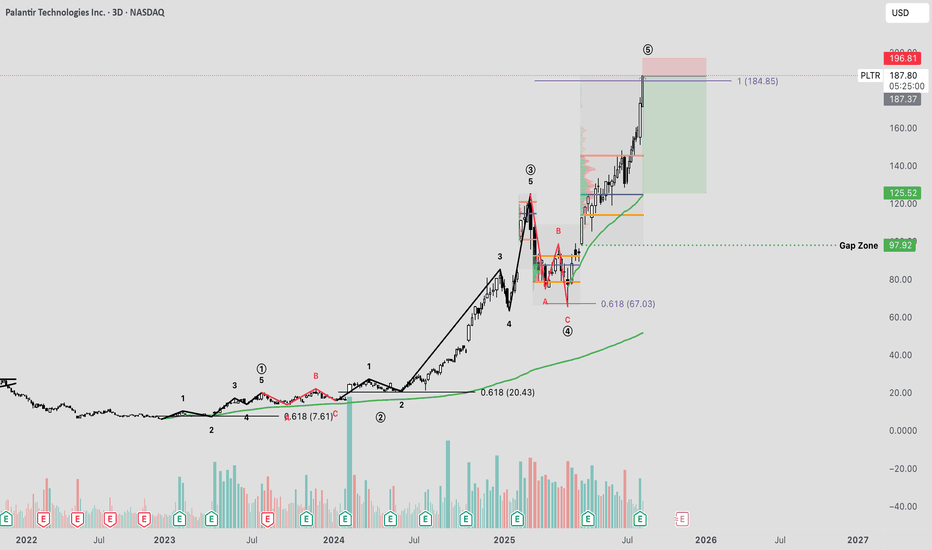

PLTR Elliot Wave Short Trade IdeaPalantir has experienced a remarkable rally since its April lows, surging to its current price levels. Throughout this uptrend, I’ve been analyzing the movement through the lens of Elliott Wave Theory. Given the stock’s relatively limited price history, the wave structure has been notably straightfo

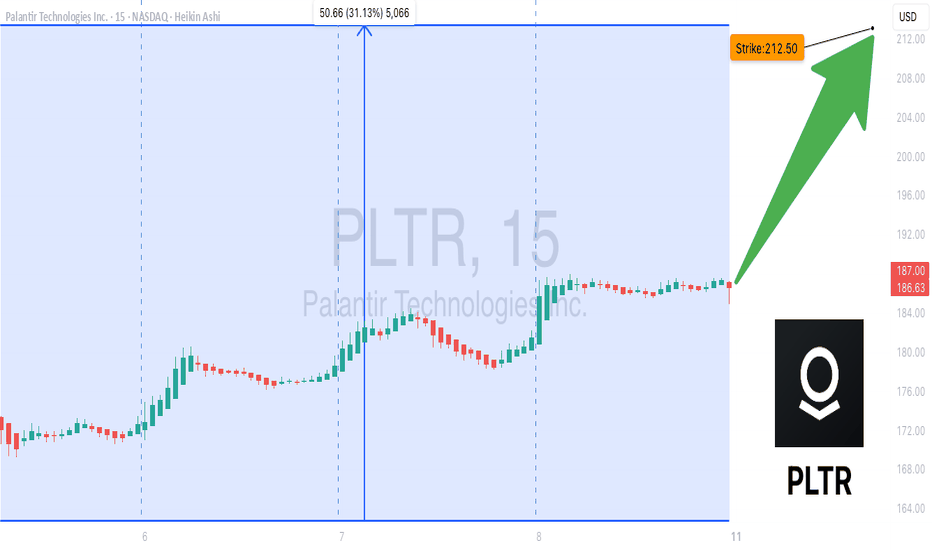

PLTR Bulls Unstoppable? Key Levels You Can’t Ignore! 🚀 PLTR Swing Trade Setup (2025-08-09) 🚀

**Bias:** 📈 **Cautious Bullish** — momentum strong, RSI hot, but volume light = high risk at highs.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:PLTR

* **Type:** CALL (LONG)

* **Strike:** \$212.50 (slightly OTM)

* **Entry:** \$0.85 (open)

* **Profit Target:**

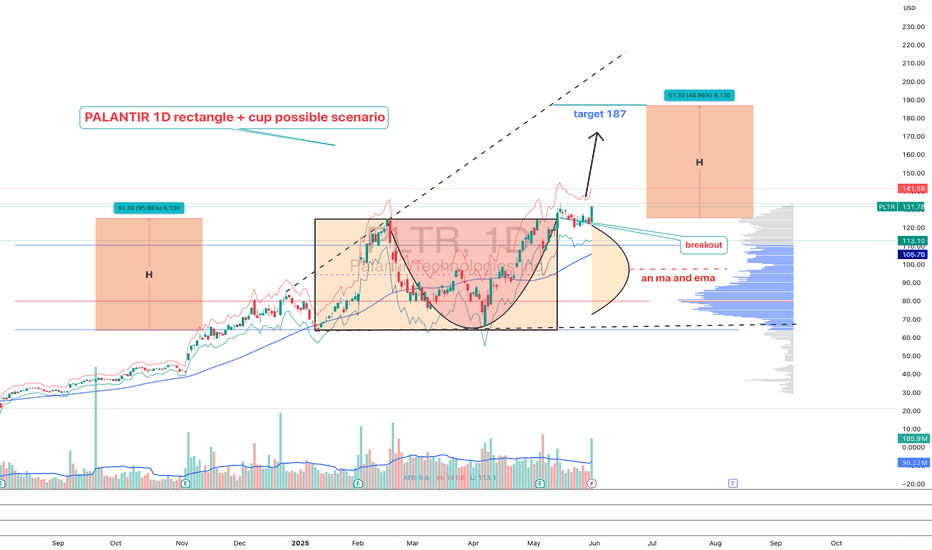

PLTR 1D — When the tea is brewed and the handle’s in placePalantir’s daily chart is shaping up a textbook cup with handle pattern — one of the most reliable continuation setups in technical analysis. The cup base was formed over several months and transitioned into a consolidation phase, building a rectangle structure where smart money likely accumulat

Palantir - The unstoppable company!💣Palantir ( NASDAQ:PLTR ) is just too strong:

🔎Analysis summary:

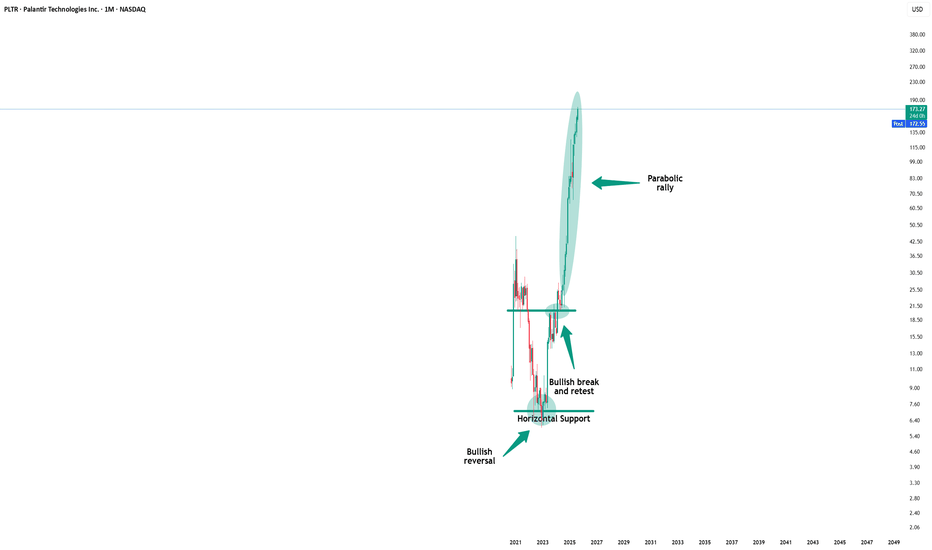

Since mid 2022, Palantir managed to rally more than 2.500%, creating new all time highs every single month. Eventually this rally will slow down, but before this happens, Palantir could rally another +100%. This is a classic exa

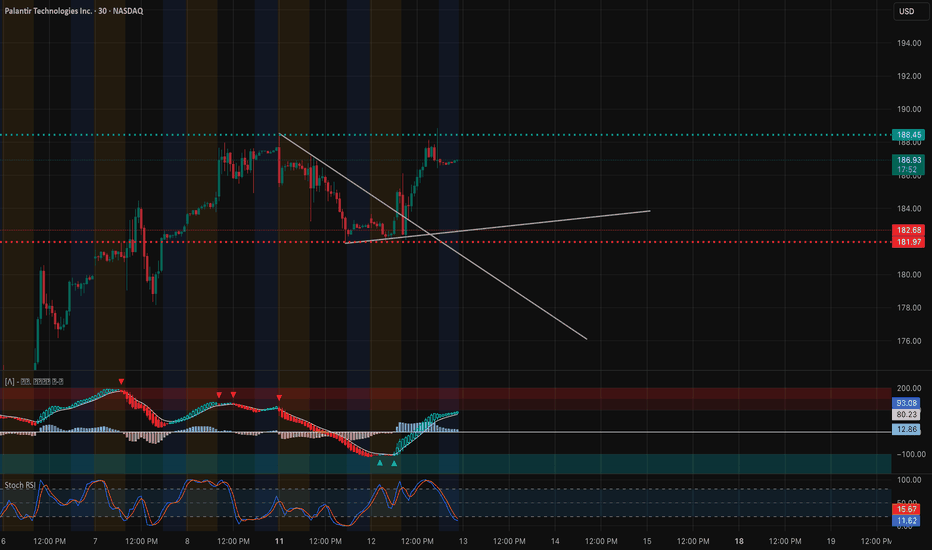

PLTR – TA + GEX Confluence for August 13, 202530-Minute Price Action

PLTR broke out of a short-term downtrend channel and is now testing the $188.45 resistance zone.

* Resistance: $188.45 – key breakout level; aligns with recent highs before pullbacks.

* Support: $182.68 – breakout retest level; $181.97 – secondary support.

* Indicators:

*

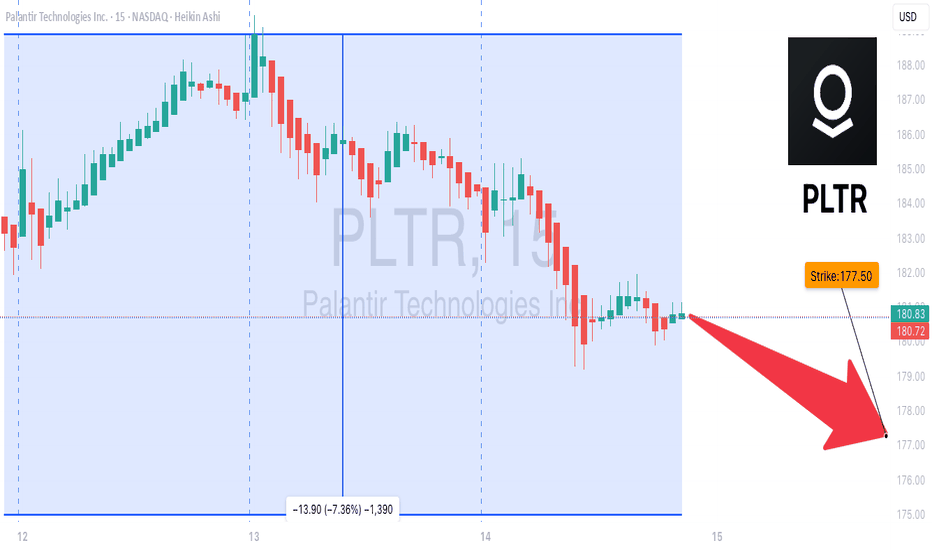

PLTR Gamma Risk High – Is This the Perfect Time for Puts? 📉 PLTR One-Day Put Play – Failed Breakout Turns Bearish

**Sentiment:** 🔻 *Bearish to Neutral*

* **Daily RSI:** 72.7 ⬇️ (falling from overbought)

* **Weekly RSI:** 83.0 ⬇️ (weakening momentum)

* **Volume:** 0.8× last week → low institutional conviction

* **C/P Ratio:** 1.05 (neutral flow)

* **Gamm

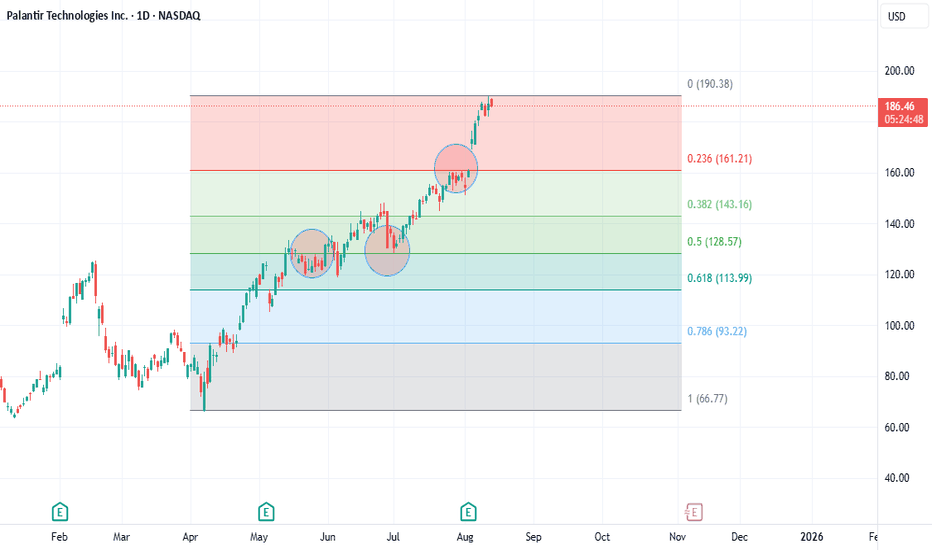

PLTR: The Top Is INPLTR has reached my top as stated in a previous post. This post is simply to show fib retracement levels to show how I came to this conclusion. As seen in the circles labeled, PLTR has given clues along the way by hitting these fib retracement, either as resistance or support. The next target for PL

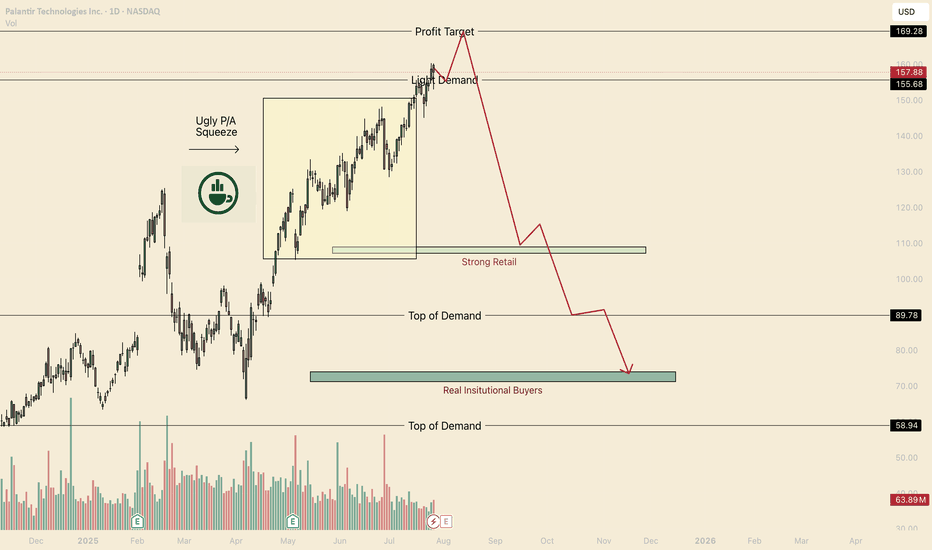

Hot Take, PLTR is a BubbleHello I am the Cafe Trader.

Price Action suggest we haven't had a proper buyer since $90.

Now I know that this can sound a bit off putting (especially if you bought above $90).

Even if this crashed, I am not suggesting you sell your long term position. I would instead look into hedging your posi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PTX is 156.06 EUR — it has decreased by −1.64% in the past 24 hours. Watch PALANTIR TECHNOLOGIES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange PALANTIR TECHNOLOGIES INC stocks are traded under the ticker PTX.

PTX stock has fallen by −0.18% compared to the previous week, the month change is a 20.95% rise, over the last year PALANTIR TECHNOLOGIES INC has showed a 455.27% increase.

We've gathered analysts' opinions on PALANTIR TECHNOLOGIES INC future price: according to them, PTX price has a max estimate of 180.28 EUR and a min estimate of 38.63 EUR. Watch PTX chart and read a more detailed PALANTIR TECHNOLOGIES INC stock forecast: see what analysts think of PALANTIR TECHNOLOGIES INC and suggest that you do with its stocks.

PTX stock is 0.95% volatile and has beta coefficient of 2.34. Track PALANTIR TECHNOLOGIES INC stock price on the chart and check out the list of the most volatile stocks — is PALANTIR TECHNOLOGIES INC there?

Today PALANTIR TECHNOLOGIES INC has the market capitalization of 375.48 B, it has increased by 17.28% over the last week.

Yes, you can track PALANTIR TECHNOLOGIES INC financials in yearly and quarterly reports right on TradingView.

PALANTIR TECHNOLOGIES INC is going to release the next earnings report on Nov 10, 2025. Keep track of upcoming events with our Earnings Calendar.

PTX earnings for the last quarter are 0.14 EUR per share, whereas the estimation was 0.12 EUR resulting in a 15.74% surprise. The estimated earnings for the next quarter are 0.14 EUR per share. See more details about PALANTIR TECHNOLOGIES INC earnings.

PALANTIR TECHNOLOGIES INC revenue for the last quarter amounts to 852.04 M EUR, despite the estimated figure of 796.02 M EUR. In the next quarter, revenue is expected to reach 932.52 M EUR.

PTX net income for the last quarter is 277.36 M EUR, while the quarter before that showed 197.84 M EUR of net income which accounts for 40.20% change. Track more PALANTIR TECHNOLOGIES INC financial stats to get the full picture.

No, PTX doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 15, 2025, the company has 3.94 K employees. See our rating of the largest employees — is PALANTIR TECHNOLOGIES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PALANTIR TECHNOLOGIES INC EBITDA is 507.47 M EUR, and current EBITDA margin is 11.93%. See more stats in PALANTIR TECHNOLOGIES INC financial statements.

Like other stocks, PTX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PALANTIR TECHNOLOGIES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PALANTIR TECHNOLOGIES INC technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PALANTIR TECHNOLOGIES INC stock shows the strong buy signal. See more of PALANTIR TECHNOLOGIES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.