Geopolitics (Iran/Israel), 6 relevant risk barometersGeopolitics is in the spotlight this week, along with the FED's monetary policy decision. Geopolitical news is covered by the general media, so there's no need here to repeat information that's accessible to everyone. We therefore propose to review our selection of stock market barometers which, in our opinion, best measure the intensity of geopolitical risk.

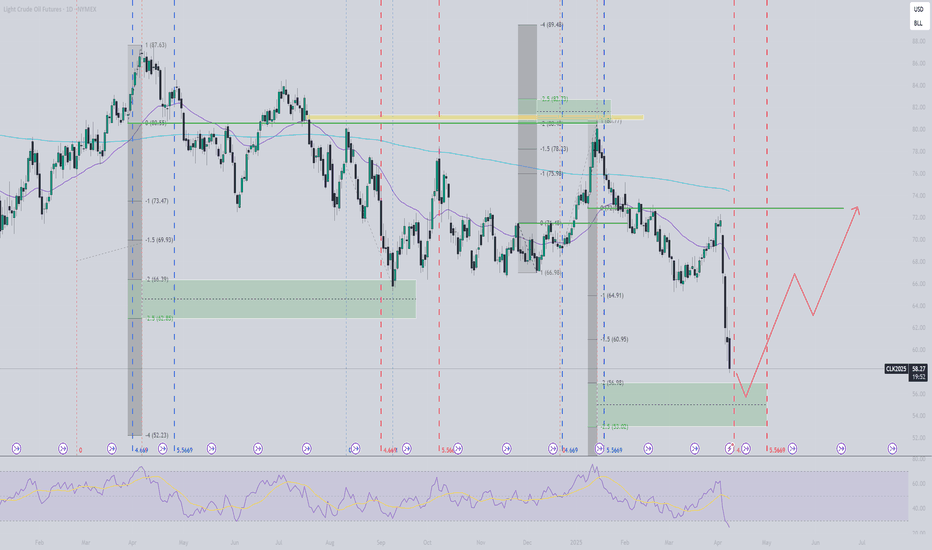

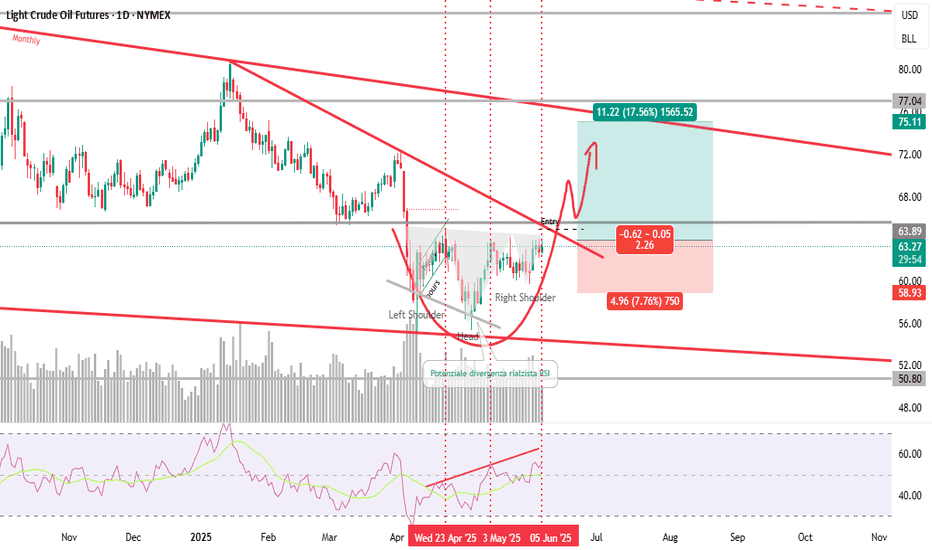

1) Oil and natural gas prices

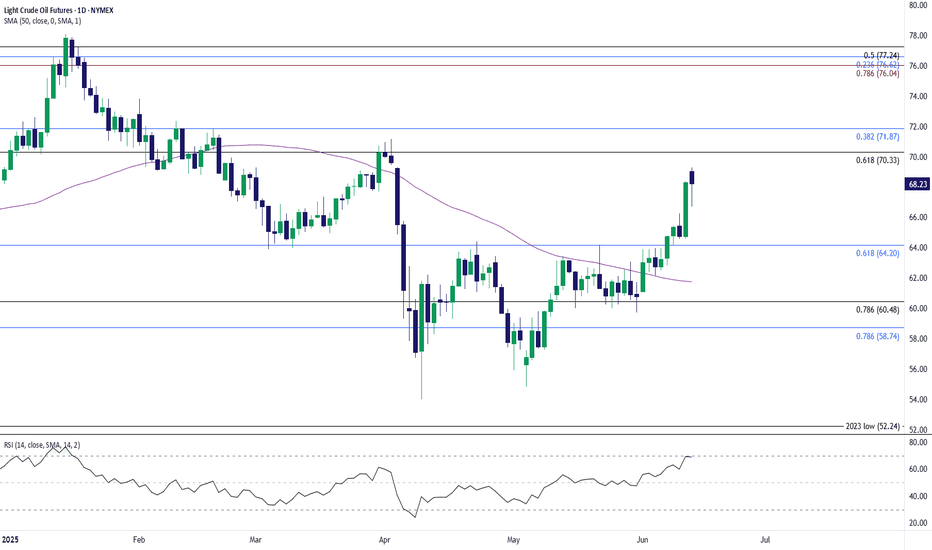

Naturally, oil price trends are the main barometer of the geopolitical risk of the current confrontation between Israel and Iran. Although Iran accounts for just 3% of the world's oil supply, the region itself represents 20%, and above all there is a risk of closure of the Strait of Hormuz, through which 25% of the world's oil supply passes. Technical analysis of the oil price is therefore the primary tool for measuring the intensity of current geopolitical tensions. The price of oil recently returned to the former technical support of $65, but there is no major bullish technical signal as long as the price of US crude oil remains below resistance at $80. We must therefore keep a close eye on the $80 threshold for US oil.

2) The trend of the S&P 500 index, the benchmark of Western finance

The equity market is the second barometer of geopolitical risk that we offer. The most important thing is to select the stock indices that best represent the perception of geopolitical tensions. We believe that the S&P 500 future contract does this job well, as it is the most widely traded stock market futures index in terms of volume by global high finance.

A few days ago, we published a detailed graphical analysis of the S&P500 index, which you can consult by clicking on the image below.

3) Trends on the main stock markets in the Near and Middle East

Equity markets in the Near and Middle East are excellent indicators of the current perception of geopolitical tensions between Iran and Israel. We suggest you take a look at the Saudi Arabian Stock Exchange (Tadawul), the region's largest in terms of market capitalization. Naturally, you should also follow the trend of the Tel Aviv Stock Exchange's flagship index, the TA 35, as well as that of the Egyptian stock market. These markets have the advantage of being open on Sundays, and are often a good early indicator of trends in Asia and Europe for Monday morning.

4) The trend of the US dollar (DXY) on the foreign exchange market (Forex) and of gold on the commodities market

On the floating foreign exchange market (FX), it is the US dollar that plays to the full its safe-haven aspect. In the event of geopolitical tensions spiraling out of control, it would make a strong bullish reversal. This week, however, the US dollar will be under the influence of the FED.

So it's best to trust gold's trend as a barometer of geopolitical risk. Geopolitics is not necessarily the dominant fundamental factor, but rather the dynamics of interest rates and the US dollar.

5) The TRUFLATION trend

If current geopolitical tensions were to become a major global shock, international trade would be disrupted, and transport difficulties would lead to a sharp rise in prices, particularly for raw materials and industrial goods. This potential price rise would then be rapidly reflected in TRUFLATION, the benchmark for real-time price dynamics in the USA.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

USOILN2025 trade ideas

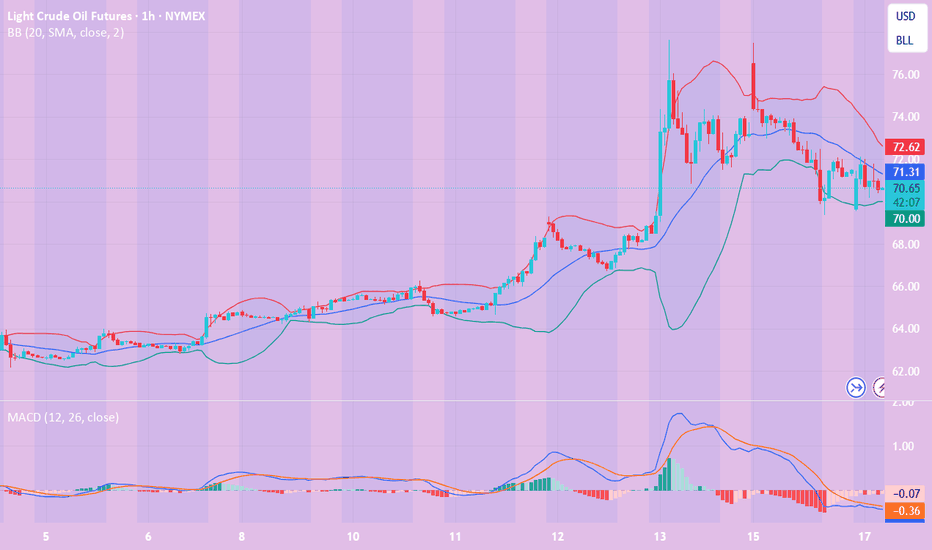

WTI(20250617)Today's AnalysisMarket news:

Revised version of the Republican tax cut bill in the US Senate: It is planned to raise the debt ceiling to 5 trillion, and the overall framework is consistent with the House version.

Technical analysis:

Today's buying and selling boundaries:

70.41

Support and resistance levels:

75.98

73.90

72.55

68.27

66.92

64.84

Trading strategy:

If the price breaks through 72.55, consider buying, and the first target price is 73.90

If the price breaks through 70.41, consider selling, and the first target price is 68.27

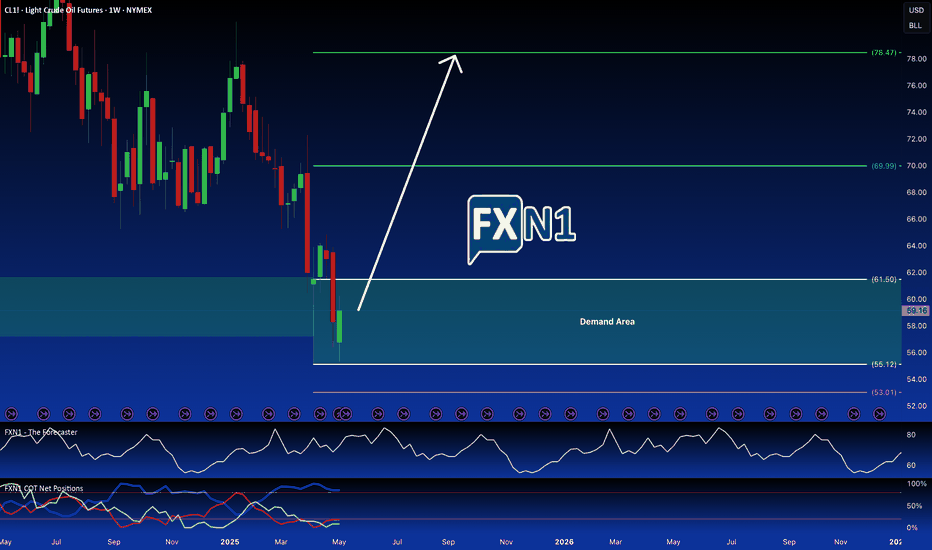

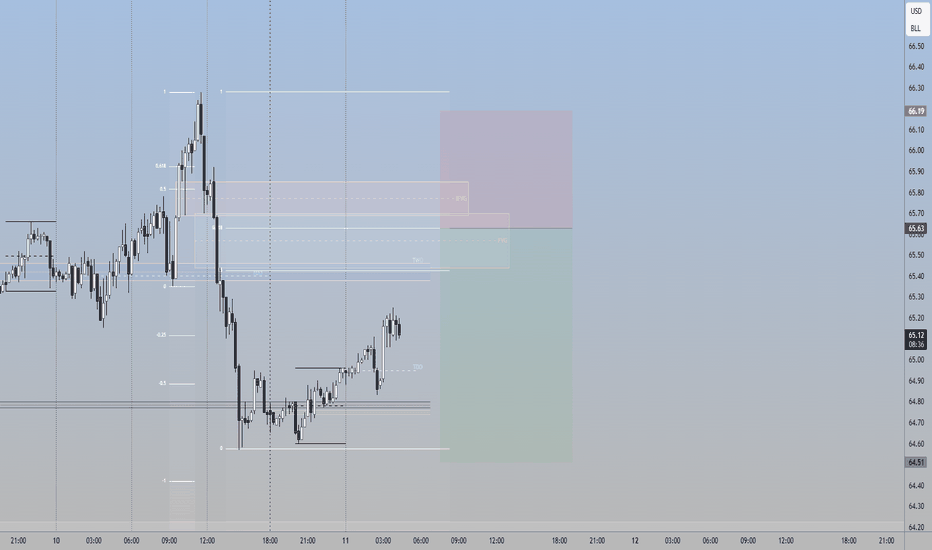

Oil Rebounds to $59 as US Inventories Drop – Reversal Ahead?After recent declines, crude oil futures (CL1!) staged a modest recovery during Thursday’s session, trading near $59.10 per barrel. The rebound comes as US crude inventories unexpectedly dropped, easing concerns about oversupply and providing a short-term lift to prices.

Key Drivers Behind the Rebound

US Inventory Drawdown – The latest EIA report showed a decline in crude stockpiles, signaling stronger demand and helping prices stabilize.

Technical Support Holds Firm – The bounce aligns with a critical daily demand zone, which previously acted as a strong support level on the weekly chart.

Market Sentiment Shifts – While retail traders remain bearish, commercial traders (often considered "smart money") are increasing long positions, hinting at a potential trend reversal.

Traders should watch for follow-through buying to confirm whether this is a short-term correction or the start of a larger reversal.

Bottom Line: Oil’s rebound is fueled by fundamentals (lower inventories) and technicals (strong demand zone). With commercial traders betting on higher prices, the stage may be set for a bullish reversal—if buyers sustain momentum.

✅ Please share your thoughts about CL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

WTI(20250616)Today's AnalysisMarket news:

Trump: The United States may still intervene in the Iran-Israel conflict. If Iran launches an attack on the United States, the United States will "fight back with all its strength on an unprecedented scale." Iran and Israel should reach an agreement.

Technical analysis:

Today's buying and selling boundaries:

71.11

Support and resistance levels:

78.59

75.79

73.98

68.24

66.43

63.64

Trading strategy:

If the price breaks through 73.98, consider buying in, the first target price is 75.79

If the price breaks through 71.11, consider selling in, the first target price is 68.24

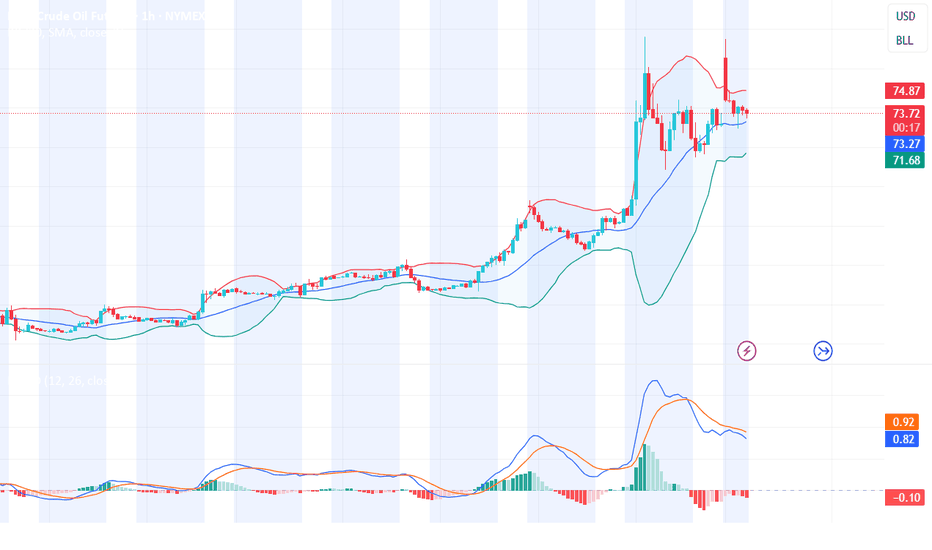

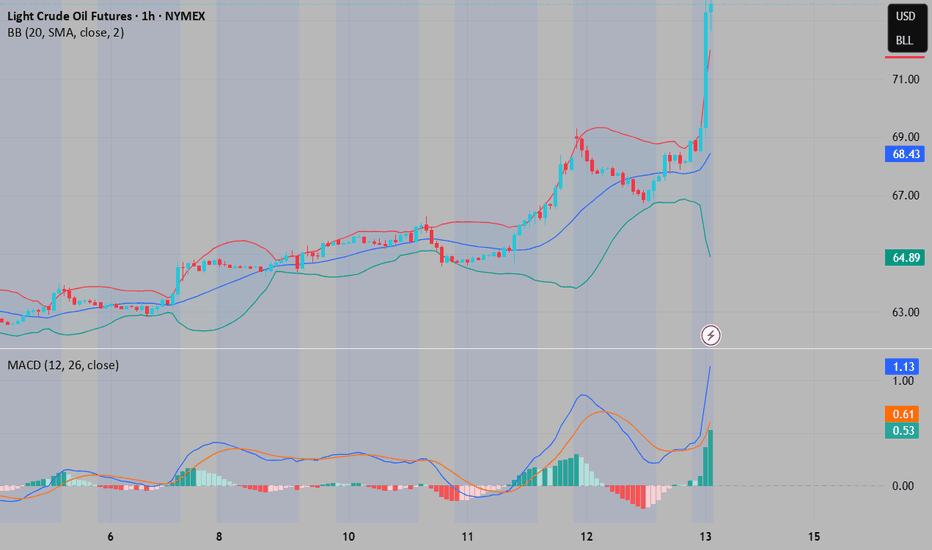

Crude Oil - we follow up with the momenetumCrude Oil Analysis: Why Prices Could Keep Rising Amid Israel-Iran Conflict? 🛢 🛢 🛢

📈 📈 📈The ongoing tensions between Israel and Iran have significantly intensified geopolitical risk in the Middle East—home to a third of the world’s oil supply. As hostilities escalate, crude oil prices are poised for continued upward momentum due to three key factors:

1️⃣ Supply Disruption Fears: The Strait of Hormuz, a critical chokepoint through which 20% of global oil flows, could be compromised if Iran retaliates or is targeted more directly. Any disruption—even speculative—typically sends prices higher.

2️⃣ Production Uncertainty: Iran, a major OPEC member, may face new sanctions or physical damage to infrastructure. In retaliation, Iran could also target regional energy infrastructure, including in the UAE or Saudi Arabia, shrinking global supply.

3️⃣ Market Sentiment and Risk Premiums: Investors tend to price in risk quickly. With oil markets already tight due to OPEC+ cuts and tepid U.S. production growth, heightened instability adds a strong speculative premium.

Bottom Line: Unless the Israel-Iran conflict de-escalates, crude oil has a strong bullish case. With limited spare capacity globally and increased geopolitical fragility, expect prices to remain elevated or climb further—especially if rhetoric turns into regional escalation. 💡 💡

📌 Trade plan

⬇️ Entry : On market open

✅Target : 79.00

❌SL: 64.00

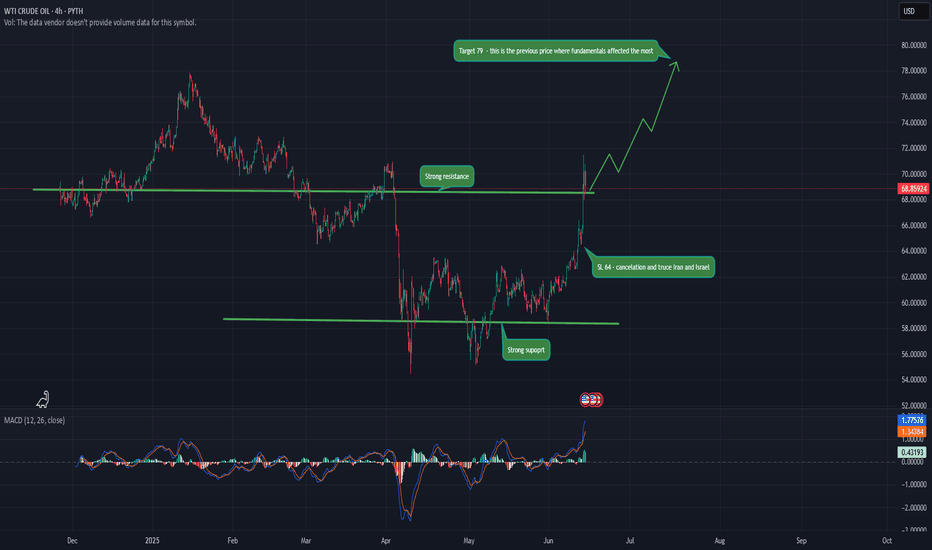

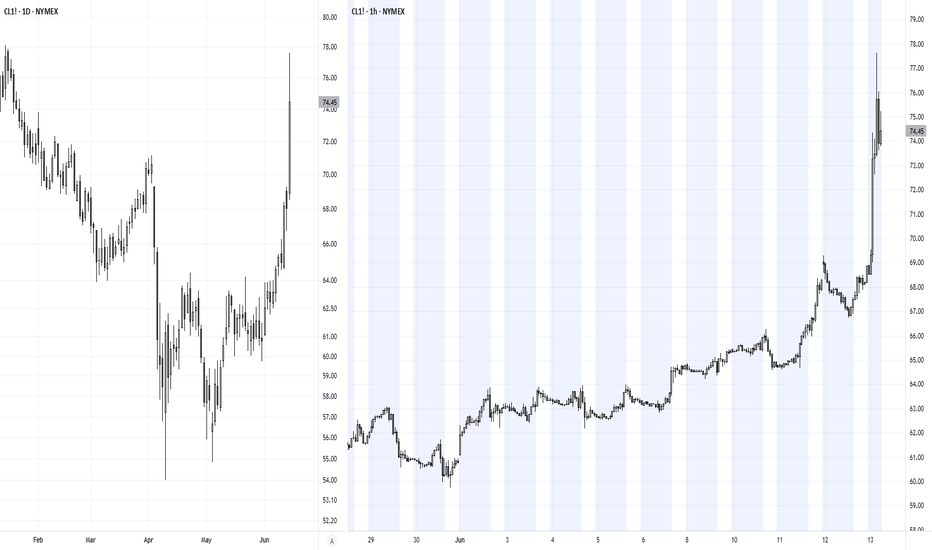

#202524 - priceactiontds - weekly update - wti crude oil futuresGood Day and I hope you are well.

comment: Good week for oil bulls but still a lower high below the April high 78.1. Now what? If this buying is the real thing and market is expecting higher prices for longer, the pullback will stay above 70. If bulls do that, we can expect at least a second leg up to retest 75+ or even 80+. We are seeing a full on war between Israel and Iran but you should not trade based on that. There are bulls who bought above 73 on Friday and lost Money so far.

current market cycle: trading range 54 - 78 on the weekly tf. Decent chance we are in a bull trend that could lead to 80/84 or higher.

key levels: 70 - 77

bull case: Bulls have all the arguments on their side. They now need to leave a big open gap to 69.3 and then we can do a measured move up. My lowest target for that is 80. Structure on the 1h chart is a textbook two-legged pullback and above 74.5 it’s a clear buy signal.

Invalidation is below 70.8 but can likely also be 70

bear case: Bears do not have much. They trapped late bulls on Friday and that’s a likely reason we sold off 677 ticks from the high. They need lower lows below 70.8 and close the gap to the Thursday high before the news-bomb hit. For that to happen they have to break 2 bull trend lines. I will not look for shorts on this tbh.

Invalidation is above 74.5

short term: Bullish. Maybe a bit more sideways but I have given two invalidation prices for bulls and couple of targets above. I don’t think looking for shorts makes any sense unless you are really good at scalping.

medium-long term - Update from 2025-06-15: Maybe we have seen the 2-year trading range coming to an end on Friday and we are in a new bull trend that could lead oil to 80 or higher. Right now it’s pure guesswork until we print higher highs above Friday’s 77.62. Oil above 80 is not something we have seen since end of 2023 so expect some ripples.

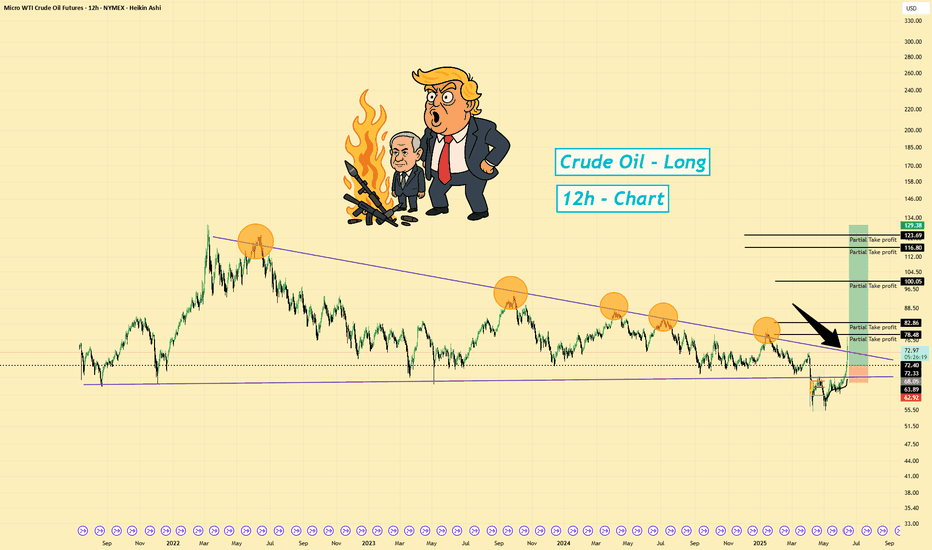

Oil | Long | Smart Money Accumulation | (June 2025)Oil | Long | Geopolitical Conflict & Smart Money Accumulation | (June 2025)

1️⃣ Short Insight Summary:

We're watching a long-term bullish setup in crude oil, driven by rising geopolitical tensions, smart money accumulation, and a potential reclaim of key levels from a historic triangle pattern.

2️⃣ Trade Parameters:

Bias: LongEntry: Watching for a reclaim of the $72 level (re-entry into triangle zone)Stop Loss: $62 (just below the recent liquidation zone)

TP1: $106

TP2: $116

TP3: $123

3️⃣ Key Notes:

This setup originates from a macro triangle structure formed since September 2012. Oil broke out post-2020 and surged, but recent volatility has shaken out many long positions—especially those from around $60.8. A reclaim of $72 would indicate a failed auction and potential continuation higher.

Geopolitical instability—particularly in the Middle East—continues to provide bullish tailwinds. JPMorgan has projected potential upside targets as high as $230 if tensions escalate.

The Volatility Index (VIX) is around 19, suggesting a calm market—often a precursor to strong directional moves. Smart money seems to be stepping in, accumulating positions during dips.

✅ This confluence makes oil a compelling candidate for macro upside, especially if global uncertainty deepens.

4️⃣ Optional Follow-up Note:

If the setup confirms, I’ll update this idea with revised targets and entry levels. Keep an eye on geopolitical developments—they’ll be key triggers.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

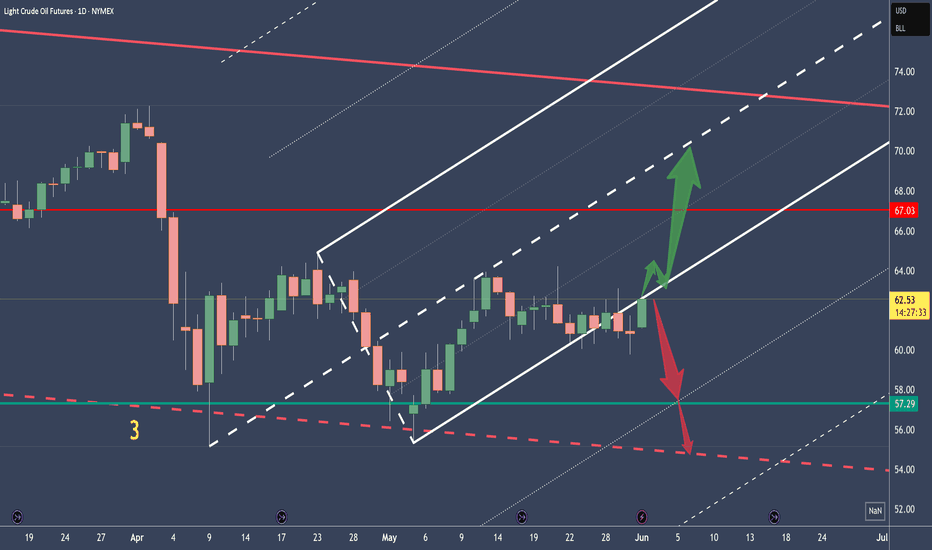

Crude Oil - Two Scenarios and about Brain PowerPrice retests the L-MLH.

VI. - Price breaks upward, target is the centerline

VII. - Price reverses again, then the target is the 1/4 line, with a subsequent extended target at the red centerline, and possibly even lower at the white dashed warning line.

On a personal note:

I was once again told that the price didn’t do what I had projected.

...yeah, really, that’s how it is §8-)

After over 30 years in the markets and hundreds of coaching sessions, I’m still amazed that people think you can predict price movements as if with a magic crystal ball.

The fact that this belief still persists (even though they don’t understand even the absolute basics of trading) deeply concerns me at the core of my trading soul.

Because this growing irrationality clearly indicates that far too little is being done in terms of education – or humanity might simply go extinct in the next 100 years due to rapidly declining intelligence!

...maybe I should just create a chart and apply a few median lines/forks?

Happy trading to all of you and I pray for those with lesser brain power.

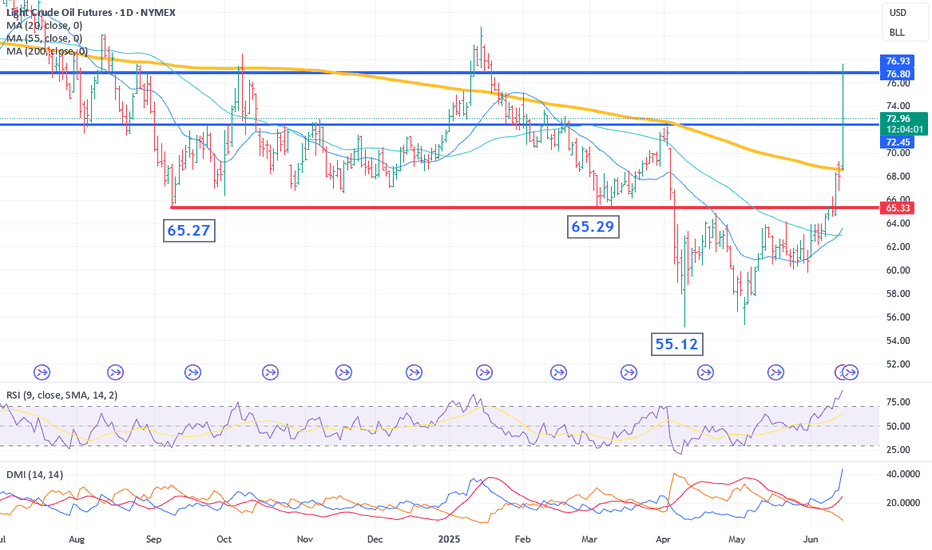

Oil Market on Edge Any disruption to Iranian oil supply could prompt OPEC to boost output quickly, says ING's Warren Patterson. But there's a limit to how much the cartel can buffer the market—especially if tensions escalate in the Persian Gulf, where most of OPEC's 5M bbl/day spare capacity sits.

🛢️ The Strait of Hormuz is critical—any supply shock here could trigger a global response to secure energy flows.

📈 Crude has spiked after the surprise attack, testing key resistance at $76.90–$80.77 (200-week MA). A break above? Eyes shift to $95. Support? Watch $68.58—200-day MA.

Volatility is back. Keep your eyes on the charts and the geopolitics. 🌍📊

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Chasing Oil Spikes? How Geopolitics Can Wreck SetupsOil prices surged over 12% in Asia on Middle East headlines, sparking a surge of volatility across safe-haven currencies and stock market futures during thin trade.

It felt like a good time to provide food for thought to newer traders looking to chase these moves, highlight the mockery geopolitics can make of technical analysis with recent examples, and provide a filter for when the waters may be safer to reenter.

Matt Simpson, Market Analyst at City Index and Forex.com

WTI(20250613)Today's AnalysisMarket news:

The number of initial jobless claims in the United States for the week ending June 7 was 248,000, higher than the expected 240,000, the highest since the week of October 5, 2024. The monthly rate of the core PPI in the United States in May was 0.1%, lower than the expected 0.30%. Traders once again fully priced in the Fed's two interest rate cuts this year.

Technical analysis:

Today's buying and selling boundaries:

66.96

Support and resistance levels:

69.10

68.30

67.78

66.13

65.61

64.81

Trading strategy:

If the price breaks through 67.78, consider buying in, and the first target price is 68.30

If the price breaks through 66.96, consider selling in, and the first target price is 66.13

Oil Price Approaches April HighThe price of oil may further retrace the decline from the April high ($71.16) as it continues to carve a series of higher highs and lows, and a move above 70 in the Relative Strength Index (RSI) is likely to be accompanied by a further advance in crude like the price action from earlier this year.

In turn, a break/close above the $70.30 (61.8% Fibonacci retracement) to $71.90 (38.2% Fibonacci retracement) zone may push the price of oil toward the February high ($73.84), with the next area of interest coming in around $76.00 (78.6% Fibonacci extension) to $77.20 (50% Fibonacci retracement).

At the same time, lack of momentum to test the April high ($71.16) may keep the RSI out of overbought territory but need a move below the $64.20 (61.8% Fibonacci retracement) to bring the monthly low ($61.06) on the radar.

--- Written by David Song, Senior Strategist at FOREX.com

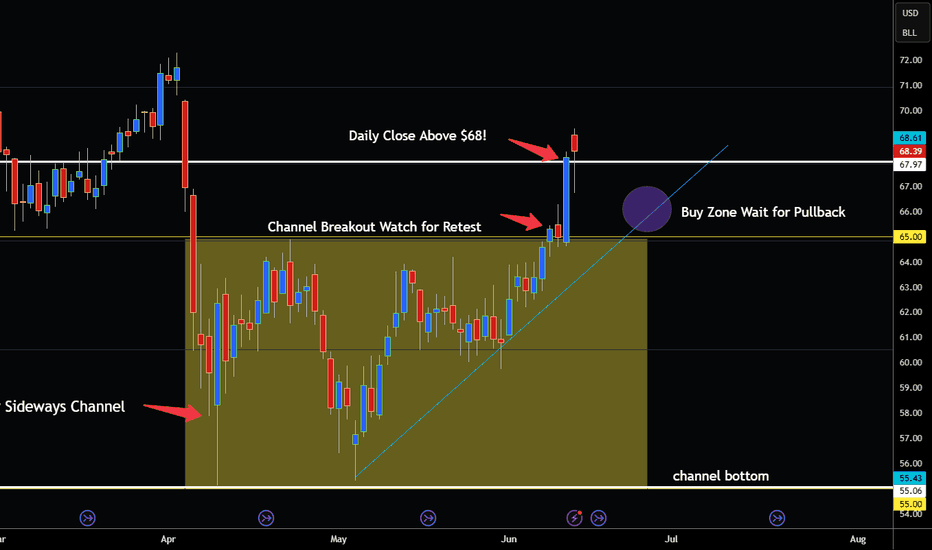

Crude Oil Breaks out of Channel More Upside Ahead?Hey traders so in continuation of the last post which was Can Crude Oil Close above $68?

The answer is YES that didn't take long. 😁

One rule to live by that I have learned as a trader is Always Expect the Unexpected in Trading!

So I bored out of my mind watching paint dry and then all of sudden Boom out of nowhere news that changes everything can happen in the blink of eye in these markets!

So what Happened Opec? Iraq? Inventory Reports?

Well truthfully it great to read to the news but I prefer to read the charts instead. The charts are already showing you that demand has increased so regardless of if you caught the news yesterday or not the charts have already told the story.

Ok so now what it has closed above $68 which a strong bullish candle on 06/11 so did we miss the move?

Not at all especially if this is the beginning of new trend so best way to trade the break out of a channel is watch for it to retest the breakout zone.

So the breakout zone on the charts was $65 but now at $68 so if we can get a retest of $65-66 I believe it would be a great place to buy back in this market.

Like I always say don't chase the market let it come to you. The party has already started but that doesn't mean you missed the party. We might get a second invitation at $65 or $66 so if trading this market place a buy order around there and stop loss somewhere below support and half way in the channel around $62-63 below to give the market room to breathe.

What if we don't get a retest?

Well thats how it is sometimes I would rather wait for the market to pullback then enter at the highest price of the move. I have missed moves sometimes because of this disicpline but sooner or later eventually the profit taking will bring it back down. Patience is key imo unless you don't mind buying at the high.

Also Seasonally Oil Prices normally get increased demand due to the summer driving season. I will say sometimes there are fake channel breakouts to watch out for but this one looks bullish imo.

Always use Risk Management!

(Just in case your wrong in your analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

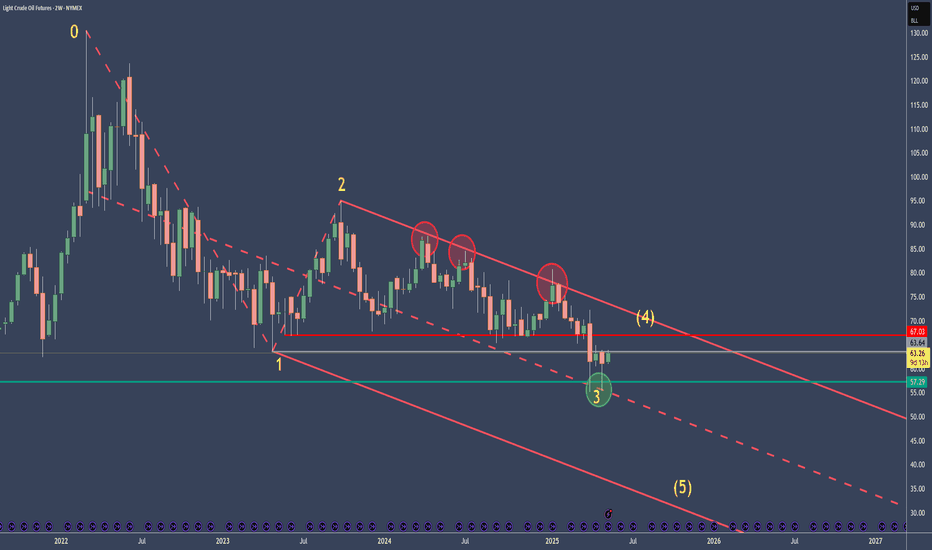

Crude Oil Going Higher - TA and fundamentals aligneThe 0-5 count is not over yet.

Sudo 4 and 5 are still lurking.

It's good to see how the Medianline-Set cought the Highs of the swings. Likewise we can see the subborn rejection at the Center-Line at P3.

I will not trade CL to the short side, until it's clear that P4 is engraved in this Chart. Until then, I maybe shoot for some intraday or dayli trades in Crude.

Economy Facts that support a rise, up to P4:

Crude oil refineries typically switch to producing more gasoline (fuel for cars) in the spring, particularly around March to April in the United States and other northern hemisphere countries.

Seasonal demand: Warmer months mean more driving and vacation travel, increasing gasoline demand.

Regulatory change: Refineries begin producing summer-grade gasoline, which has lower volatility and is required by environmental regulations (especially in the U.S. under EPA rules).

The switch to summer-grade gasoline must be completed by June 1st for retail and May 1st for terminals and pipelines in the U.S.

In Summary:

- Switch begins: March–April

- Completed by: May (terminals), June (retail)

- This seasonal shift is often called the "refinery maintenance season" or "spring blend switch."

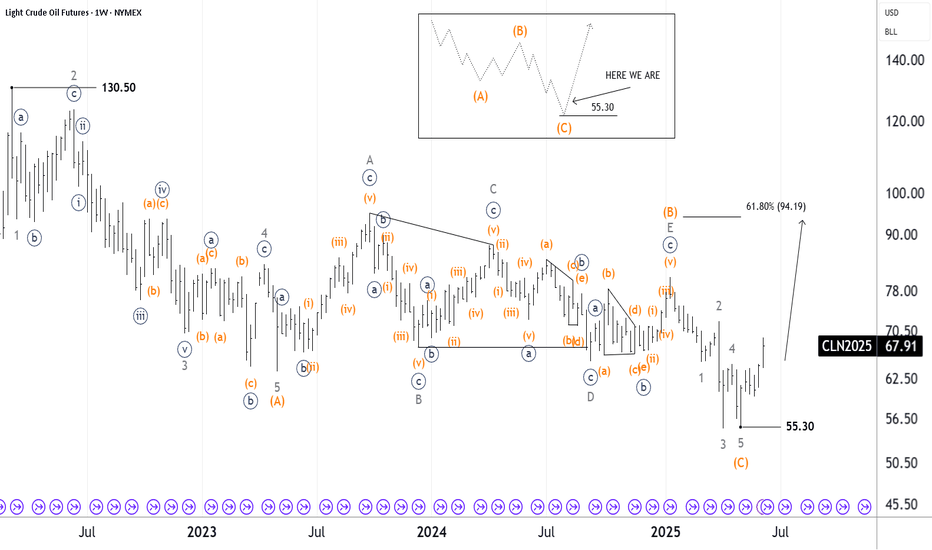

CRUDE OIL: 12 JUNE, 2025 - BOTTOM AND TAKE OFF!?Conclusion: The ABC)-orange correction may have just completed, and a five-wave is pushing much higher, targeting the nearest target at the high around 94.19 or 130.50.

Details: Since the high of 130.50, a decline with A,B,C)-orange has unfolded as a Zigzag. I counted a five-wave within the A)-orange, and a triangle within the B)-orange, and finally the C)-orange has completed as a five-wave. So, perhaps that ABC has ended with convincing evidence.

So crude oil is likely to rise in the medium term, even though the alternative scenarios with relatively high probability in another development also show increasing bullish weight. And it is aiming for the nearest target at 94.19. While price must always remain above 55.30 to keep the Bullish market view valid.

WTI(20250612)Today's AnalysisMarket news:

① The EU hopes that the trade negotiations will be extended beyond the suspension period set by Trump. ② Bessant: As long as "sincerity" is shown in the negotiations, the Trump administration is willing to extend the current 90-day tariff suspension period beyond July 9. ③ Trump will hold multiple bilateral talks during the G7 summit. ④ The total customs revenue of the United States in May reached a record high of US$23 billion, an increase of nearly four times year-on-year. ⑤ Lutnick: One deal after another will be reached.

Technical analysis:

Today's buying and selling boundaries:

66.02

Support and resistance levels:

69.56

68.23

67.38

64.66

63.80

62.47

Trading strategy:

If the price breaks through 67.38, consider buying in, and the first target price is 68.23

If the price breaks through 66.02, consider selling in, and the first target price is 64.66

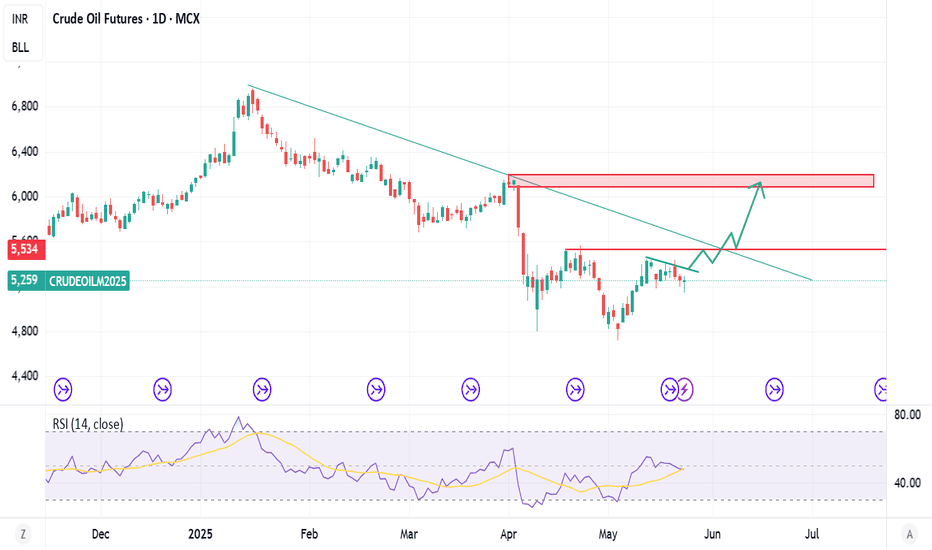

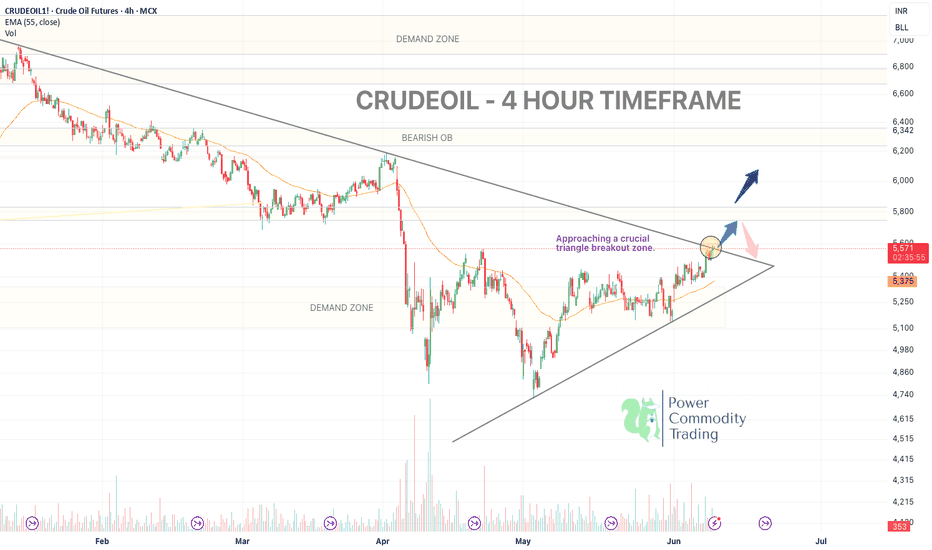

Crude Oil Triangle Breakout Near – Watch 5600 Zone Closely!🛢 CRUDEOIL – Weekly Outlook (4H Timeframe)

Published by: Shalvi Sharma (Power Commodity Trading)

Crude is trading around 5568 and approaching a crucial triangle breakout zone.

⚠️ Key Levels:

Breakout Resistance: 5600 – 5675

Bearish OB Zone: 5675 – 5800

Immediate Support: 5374 (EMA55)

Demand Zone: 5180 – 5270

🔍 Technical Outlook:

Price is compressing within a symmetrical triangle formation.

A breakout above 5600 with volume confirmation could push price towards the 5800 zone.

However, Bearish Order Block (OB) awaits near 5800 — this zone has historically rejected upside moves.

🎯 Possible Scenarios:

Bullish: Break & hold above 5600 → Upside targets: 5675 → 5740 → 5800

Bearish: Rejection at 5600 – 5675 → Downside pullback possible towards 5400 – 5374

📌 Wait for confirmation — breakout with volume will be the key driver.

Stay nimble and trade with defined risk.

#CrudeOil #MCXCrude #PowerOfCommodity #TriangleBreakout #TradingViewIndia #EnergyMarkets #TechnicalAnalysis

Comment below if you think it's bearish?

Chart Pattern Analysis Of CL1!

There are 4 candles close upon the neckline of a potential bullish triangle pattern,

It seems that another bull run will start here.

I am expecting an accelerate motive wave to touch or break up the nearest higher high at about 72USD.

On the other hand,

If K5 couldn’t close upon K4 to verify the strong bullish momentum,

It is also possible that a short-term consolidation will carry on from K3.

If the following candles successfully retest the downtrend line after a successful break up,

It is also a good place to buy it then.

Long-65.4/Stop-64.4/Target-72