GDF1! trade ideas

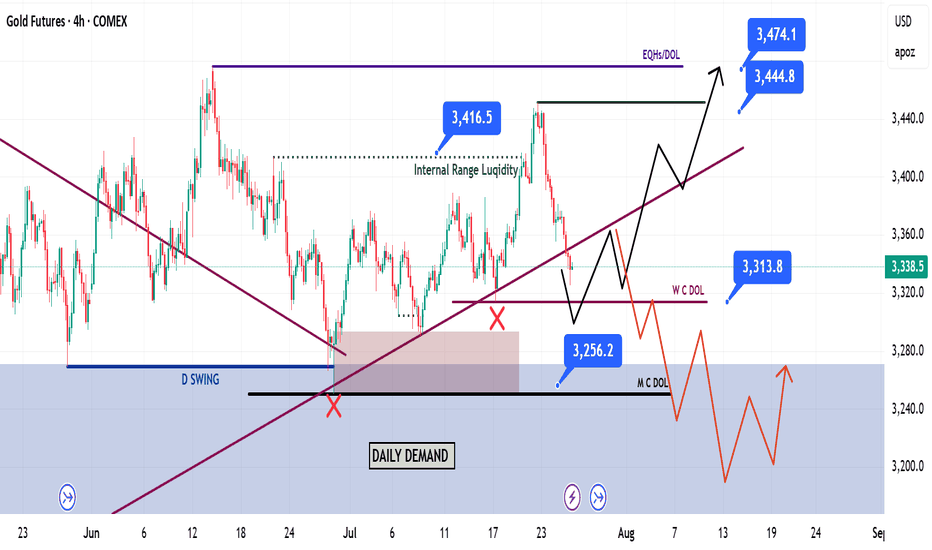

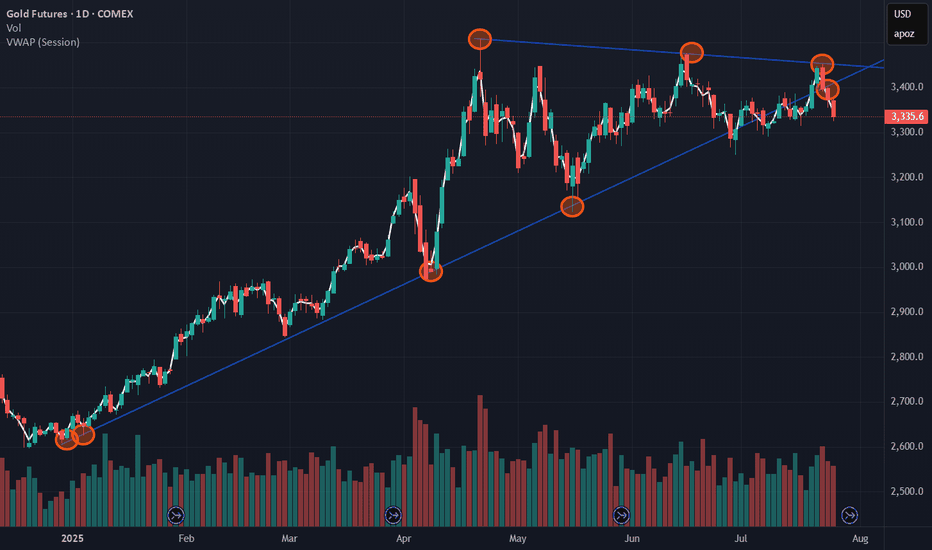

GOLD - GC Weekly Recap & Outlook | 27.07.2025🧾 Weekly Recap:

• Price tapped into the 1H Demand Zone (red box) and ran the 4H swing liquidity before bouncing to clear internal range liquidity.

• This move was followed by a retracement which led to a break of the bullish trendline.

This may signal the beginning of a broader accumulation phase. Expect choppy price action targeting internal liquidity both above and below, before a clear trend resumes.

📌 Technical Analysis:

Price has closed below the bullish trendline, leading to two possible scenarios:

1. Bullish scenario (black path):

– Price runs the W C DOL (3313$) →

– Finds rejection →

– Retests broken trendline →

– Breaks above the trendline →

– Continues toward 3444$ and potentially 3474$

2. Bearish scenario (orange path):

– Price runs W C DOL (3313$) →

– Rejects from the broken trendline →

– Fails to reclaim it →

– Continues downward to target M C DOL (3256$)

📈 Setup Trigger:

Wait for clear 1H–4H supply/demand zone creation and structure shift before initiating a trade.

🎯 Trade Management:

• Stoploss: Above/below relevant supply-demand zone

• Targets:

– Bullish: 3444$, 3474$

– Bearish: 3256$

🟡 If you liked the idea, feel free to drop a like & comment — and don’t forget to follow for more weekly updates.

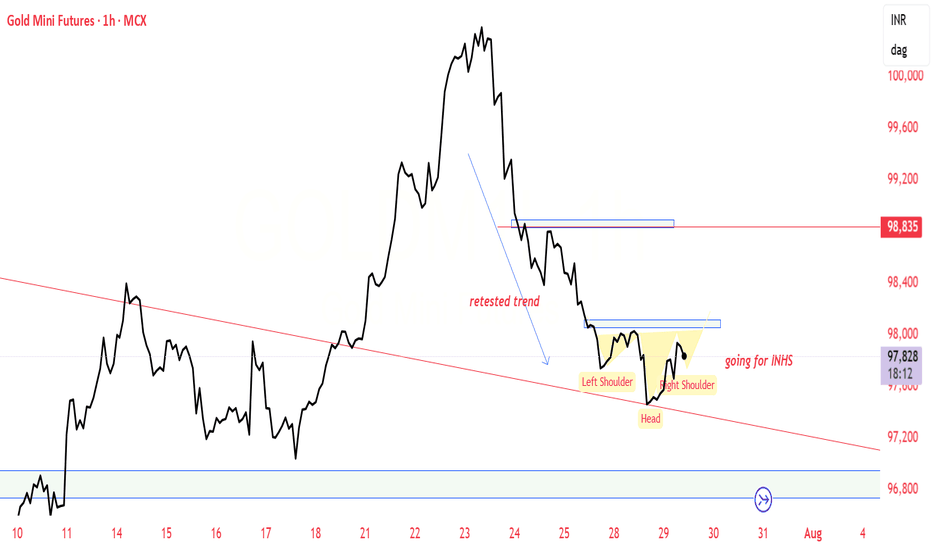

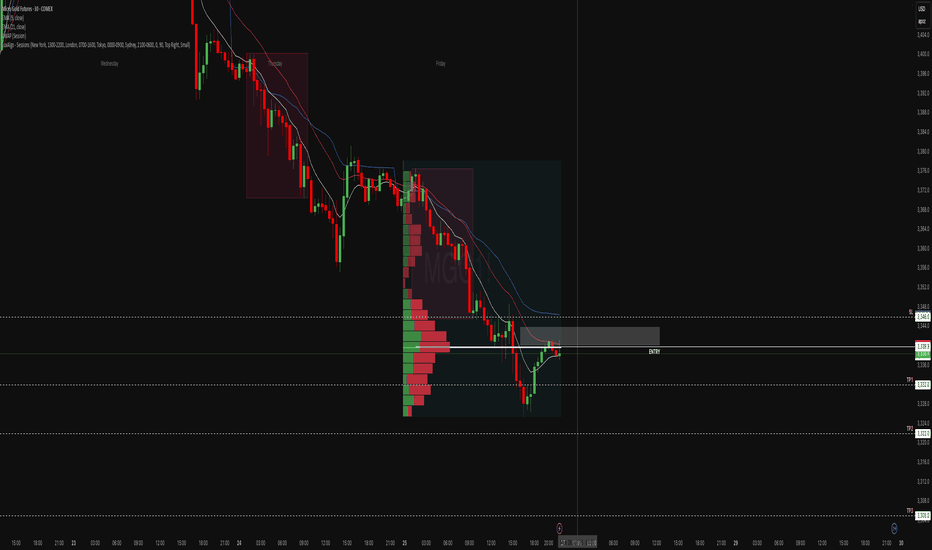

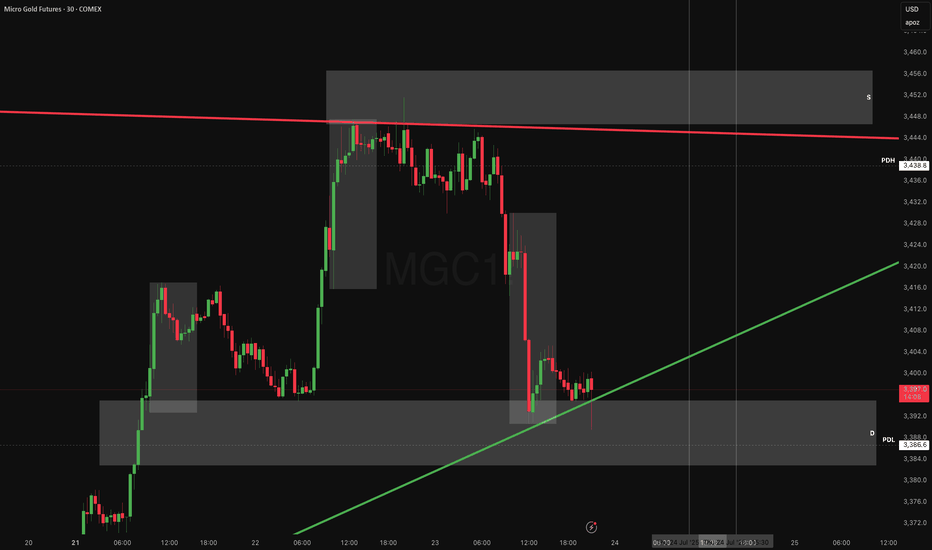

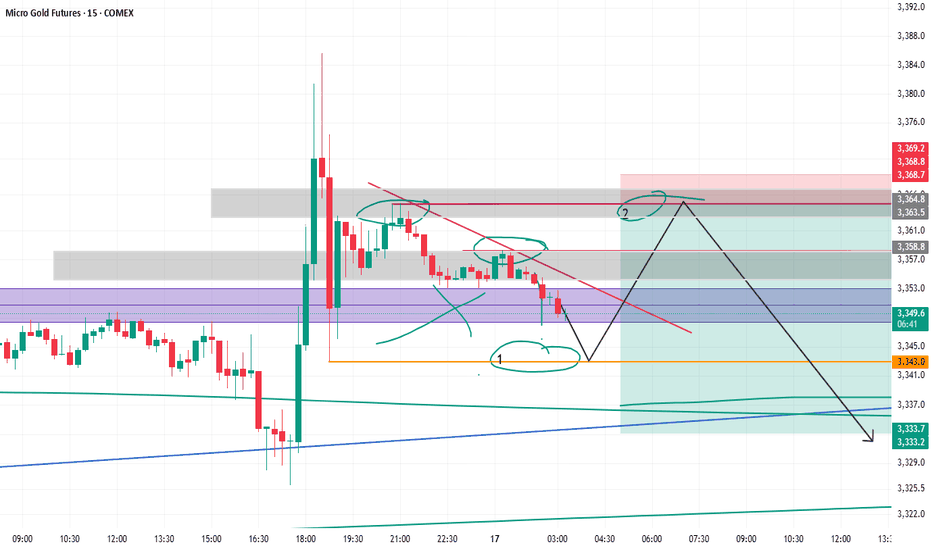

MGC Tokyo Fade: If It Rejects, It DiesThis one was a request from someone asking for a breakdown of MGC heading into the Tokyo session so here’s the full quant review.

After Friday’s clean liquidation, gold found temporary footing around 3330. But the bounce is stalling under VWAP (3344) and Friday’s POC both stacking resistance like a ceiling of bricks. EMAs are fanned and directional, suggesting sellers still control the structure.

VWAP + POC = kill zone for a potential Tokyo fade.

Quant Review:

- Friday Session POC: 3341.9 — currently acting as resistance

- VWAP (Session): 3344.6 — unclaimed on the bounce

- 9 & 21 EMAs: Bearishly stacked, aligned with VWAP

- Volume Profile: Value area is lower; price is rejecting acceptance higher

- Microstructure: Weak bounce into resistance without reclaim of structure

Trade Plan (Short Bias):

- Entry Zone: 3340–3344 (VWAP/POC cluster)

- Trigger: Bearish engulfing or LTF rejection off VWAP shelf

- TP1: 3332 (prior low)

- TP2: 3322 (thin node sweep)

- TP3: 3305 (session low extension)

- Stop Loss: Above 3346 (structure + shelf break)

- R:R: 1.5–5 depending on scaling

- Probability of rejection and drop to 3332: 65%

- Probability of full leg to 3322–3305: 30%

- Risk of breakout above VWAP: 5%

If I’m Wrong

The Sunday open is always a wildcard sometimes you get pure trend continuation, other times it’s total chop or liquidity grabs before the real move unfolds in London.

If price cleanly reclaims 3346, closes above with strength, and holds the short idea is off. At that point, I’d expect a sweep toward 3355–3360, potentially tagging the high-volume node from mid-Friday.

In that case: Flip bias to bullish retrace into early London.

Bonus:

If you ever want a quant-style breakdown or session analysis like this just reach out. We break it down with structure, stats, and setups.

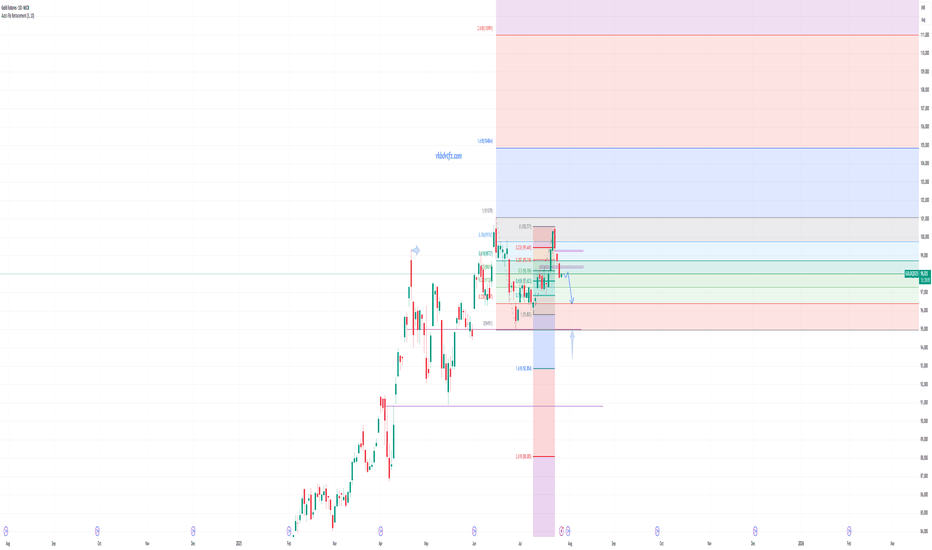

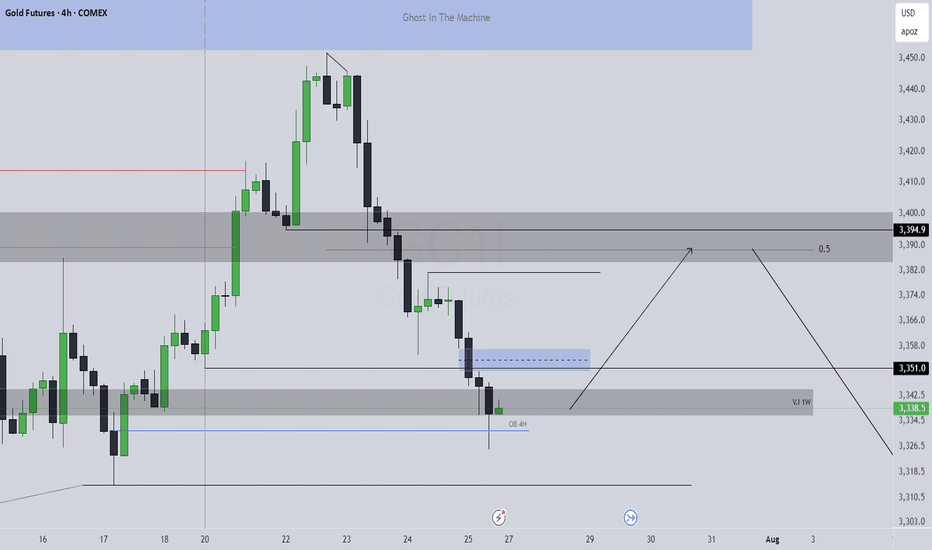

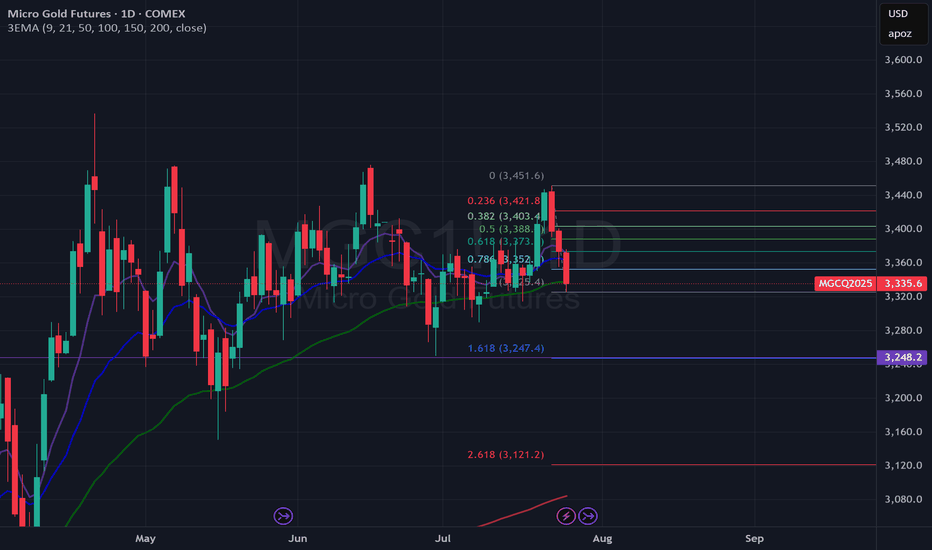

Near Term Bearish Development on Gold?The three bearish days in a row could be a potential near term bearish development on Gold. If a retest somewhere between 3370 and 3400 happens relatively soon and rejects it could potentially be in for a bearish extension. 3373 would be the 0.618 and 3388 would be the 0.5 retracement area. With a potential target down toward 3248 area

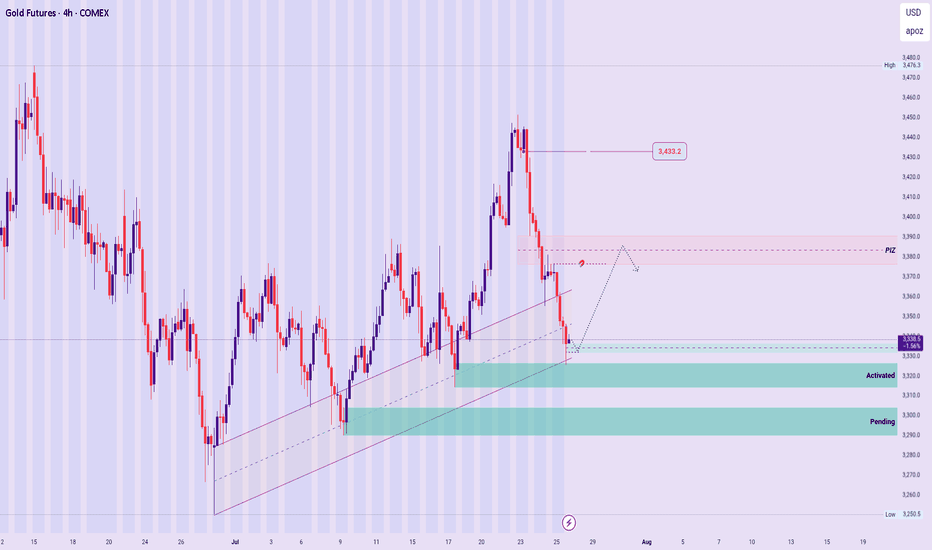

GOLD – New Week Technical Bias (Market Open)

Structural Outlook:

The broader bullish sequence remains valid, with no structural breach confirmed yet.

However, price is currently reacting at a sensitive level, warranting measured caution.

Zone Dynamics :

▪︎ A recently activated Rejection Zone is expected to support a gradual impulse toward the PIZ.

▪︎ From the PIZ, two scenarios unfold:

a. If it becomes a Price Base, we may see a continuation rally toward the 3433.2 region.

b. If the PIZ acts instead as a Price Cap, price may reject lower, targeting the pending Rejection Zone beneath or deeper, should the current zone fail to hold. Thereby presenting a Bearish structural formation.

Summary:

The directional bias remains bullish unless a clear Structure Breach (SB) occurs below key support levels.

Stay adaptive, and observe the PIZ reaction closely for directional confirmation.

🛑 Disclaimer:

This is not a trade signal. These are high-level technical insights meant for educational and analytical purposes. Always validate with your system and trade with discipline and risk awareness.

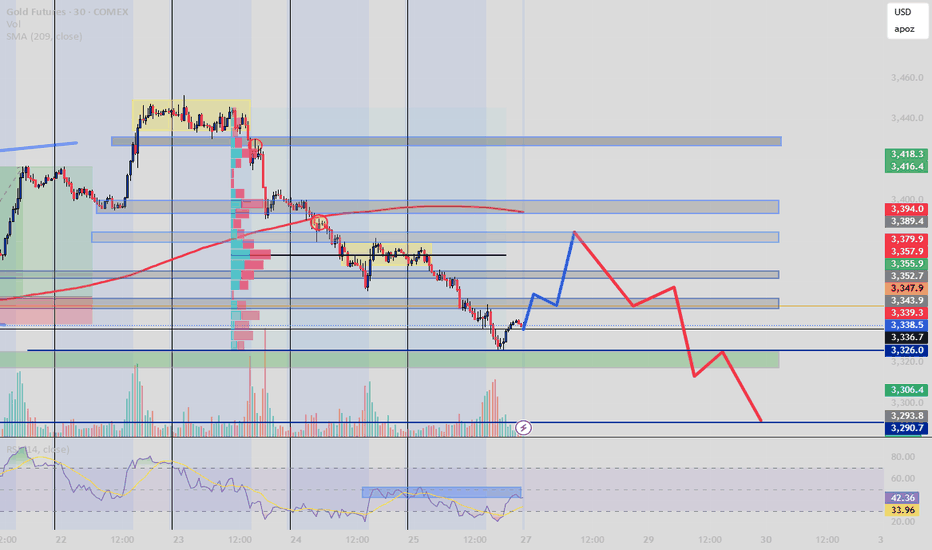

Gold Futures and the BOS Brearish Movement Steps In?After a clear break of structure and consistent rejection below the 209 EMA, price is retracing toward a key zone of confluence between 3347–3379.

This area aligns with:

Former demand turned supply (OB)

Volume cluster (high activity zone)

RSI hidden bearish divergence

Fair Value Gap (inefficiency fill target)

My expectation: a short-term bullish correction (blue) into that zone, followed by a high-probability sell-off (red) toward 3306–3290.

Bias : Bearish unless price reclaims 3394+

Strategy: Smart Money + Volume Profile + RSI Confirmation

Follow @GoldenZoneFX For more content and valuable insights.

Is GC1! GOLD At A Turning Point - Idea On Short DirectionProbably Gold is not going to be cheaper in the near future but we have seen some points that hold in the past break recently...

This is a view on the Gold chart that is explanatory by itself.

Probably tracing some support horizontally under the price at key level with the idea of, if it break follow the trend in short direction side...

Gold Buyers Barely Holding. Sellers Licking Their Lips.The move on gold over the last two sessions has been clean, aggressive, and very telling. Price rallied hard into a well-defined supply zone between 3452 and 3460, which has acted as a sell-side magnet for the past three rotations.

We got five separate stabs into that zone, all failing to close with strength above 3444, a key breakdown level from earlier structure. Every wick above that line was absorbed classic signs of exhaustion and seller control. That was our trigger. Once price failed to hold above 3440, the sellers unloaded. And they didn’t nibble they dumped.

What followed was a single-leg, high-momentum liquidation straight into demand at 3386–3392, wiping out all intraday longs and resetting the board. Price tagged the PDL (3386.6) to the tick, then bounced not with strength, but with stability. No strong reversal candle, no V-bottom just a hold. What that tells us is: the market’s not ready to trend yet. It’s testing intent.

Now we’re coiling between key structural levels:

- Support below: 3386 (PDL), backed by previous demand zone

- Resistance above: 3405–3410 (micro range breakdown) and 3440 (PDH)

We also have a rising trend line support running up from the July 21 low price is currently sitting right on it. That’s your structural “last chance” for bulls. Break that with volume, and the entire bullish thesis collapses short term.

My Bias Breakdown

Bullish: If we get a reclaim above 3410, then I’d target a move back to 3430, with extension toward 3444 (PDH rejection area). That’s the clean rotation if bulls can generate follow-through.

Bearish: If 3385 breaks on strong momentumbthat opens up 3355–3360, which was the last untested demand from the July 18–19 base.

Neutral (Reactive) right now. This is a trap-heavy zone. Volume is thinning out, the trendline is being tested, and both sides are probing. You don’t want to front-run here. This isn’t trend continuation yet it’s a chop filter before the next directional leg.

Key Contextual Notes

3455–3460 supply was the origin of the last two major reversals this isn’t a random level. Expect traps and stop hunts up there again if price rotates back.

3386–3392 demand has been respected across multiple sessions but it's getting tested more frequently, which means it's weakening. If it breaks clean, the unwind could accelerate.

This is a two-sided market right now. It’s not breakout season, it’s reactionary playbook time. Let the levels guide the setup, not emotion.

Trade Plan (for experienced hands only)

- Long bias: Only on 30m close above 3410 with decent volume target 3430–3444. Stop under 3385. Risk tight; momentum must confirm.

- Short bias: Rejection candle or sweep/failure at 3440–3445 OR breakdown and retest of 3385 target 3355. Invalidation on reclaim above 3410.

This is where traders get chopped to pieces, in the middle of a post-liquidation coil sitting between unfinished business above and fragile demand below. Don’t be that trader. This is where you observe, wait for intent, then strike. Trading is about timing, not guessing. Let the next move come to you. We’re ready either way.

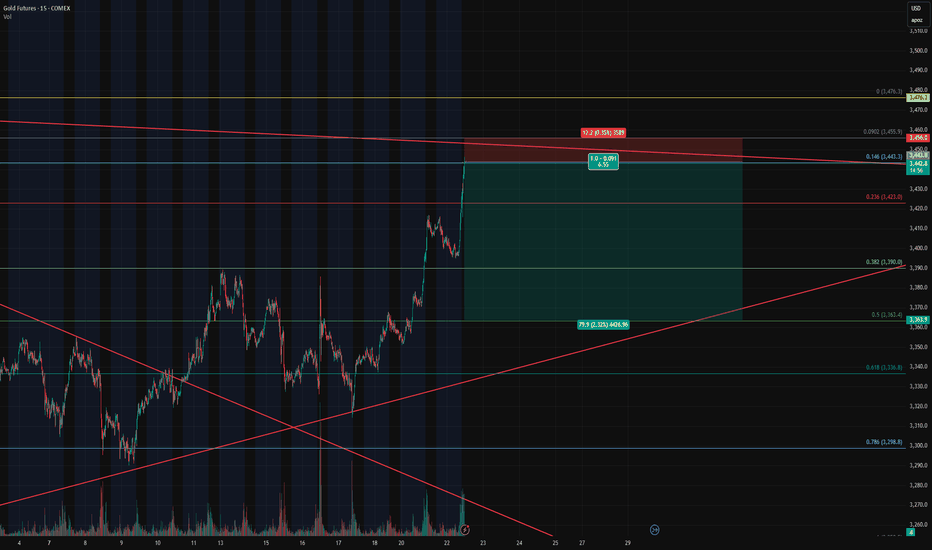

Gold Futures – Closing Longs and Flipping Short at Key Fib🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence

Instrument : Gold Futures – COMEX ( COMEX:GC1! )

Timeframe : 15-Minute

New Position : Short

Entry Zone : ~3442

Target : ~3362

Stop Loss : ~3458

Risk/Reward : Approx. 6.5+

Setup Type : Reversal from Overextension / Fib Resistance

💡 Trade Recap & Strategy Shift

We’ve officially closed both our recent long entry and our larger swing long position, locking in substantial profit on this move off the 0.618 retracement.

Now, we’re flipping short based on the following:

Price reached the 0.146 Fib extension from the previous retracement leg, a level often overlooked but powerful when confluence lines up.

Trendline resistance from the upper channel has been tagged.

Momentum is showing early signs of stalling after a strong vertical push — textbook overextension.

The rally into this level lacked divergence or structural buildup, increasing the chance of a snapback.

🛠️ Short Setup Details

Entry: 3442 (after signs of exhaustion near Fib confluence)

Target: 3362 (prior structure + 0.382 retracement)

Stop Loss: 3458 (just above high / resistance zone)

Risk/Reward: 6.5:1 — excellent profile for a countertrend play.

📌 Watch For

A break below 3390 will be key confirmation of momentum shifting back down.

Failure to hold 3442 on a retest will invalidate the short and re-open the door for a squeeze higher to 3476/3480.

With trend exhaustion in sight and high confluence resistance overhead, we’re taking the opportunity to pivot short — fully aware of the volatility this region can bring.

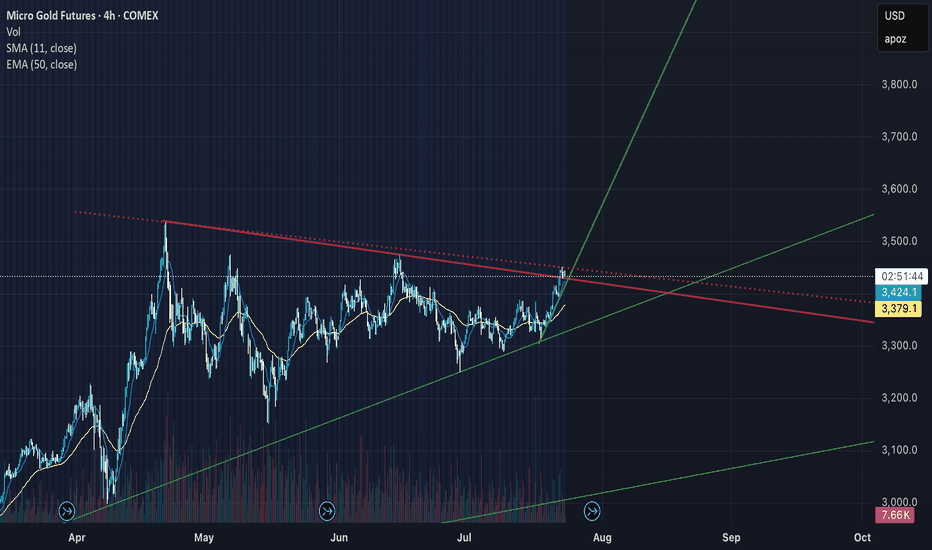

Gold to $3700 - $3800the price of gold has finally broken out of a long standing symmetrical triangle and an established 2 touch point trendline. It is currently consolidating above the broken trendline. If a 4H candle closes above the red dotted trend line we could see a massive pump up. If price closes below green upwards trendline then strategy is invalidated and reassessment needed. This is a long hold trade idea

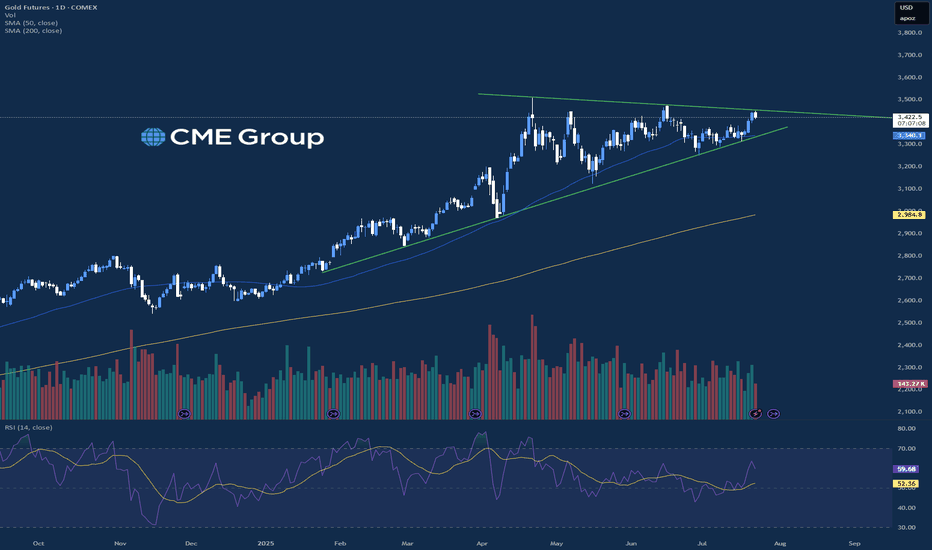

Precious Metals Pushing HigherMarkets were mixed across the board today with the precious metals leading the charge higher on the session. Gold, Silver, and Copper all traded higher again today with Copper being up near 1.5% and Gold and seeing slight gains. Copper and Silver are similar in the fact that they are more industrial metals and are affected by global manufacturing demand and overall costs more than Gold is. On July 8th, Copper saw a 13% move to the upside to a new all time high price, and Silver also made a new all time high today which brings a lot more attention to these markets.

Along with that, there is still significant tariff uncertainty that has been driving Copper and Silver higher relative to Gold. The Gold market is still moving higher overall but has stalled out slightly since the new all time high from April. Outside of the metals, there are critical earnings reports coming out tomorrow looking at Google and Tesla that may add significant volatility to the equity indices for the rest of the week.

If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

*CME Group futures are not suitable for all investors and involve the risk of loss. Copyright © 2023 CME Group Inc.

**All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

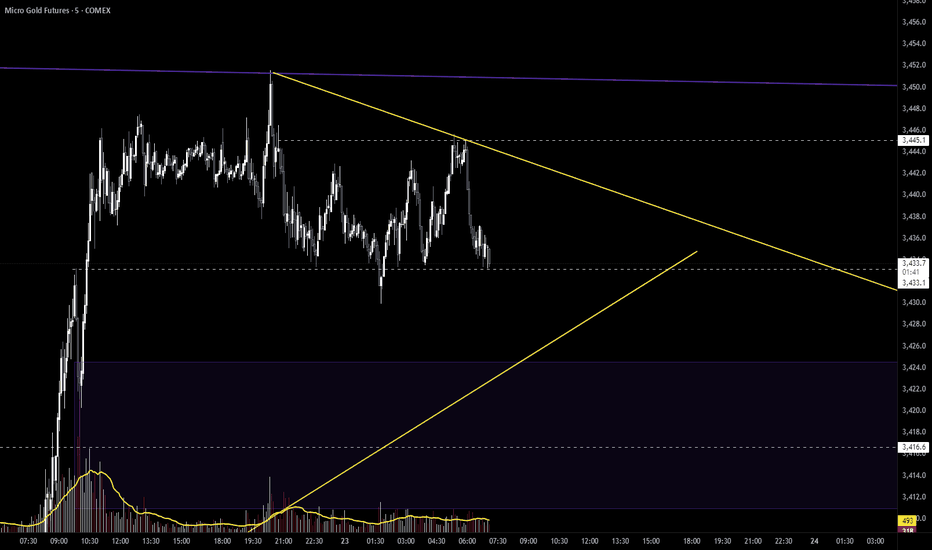

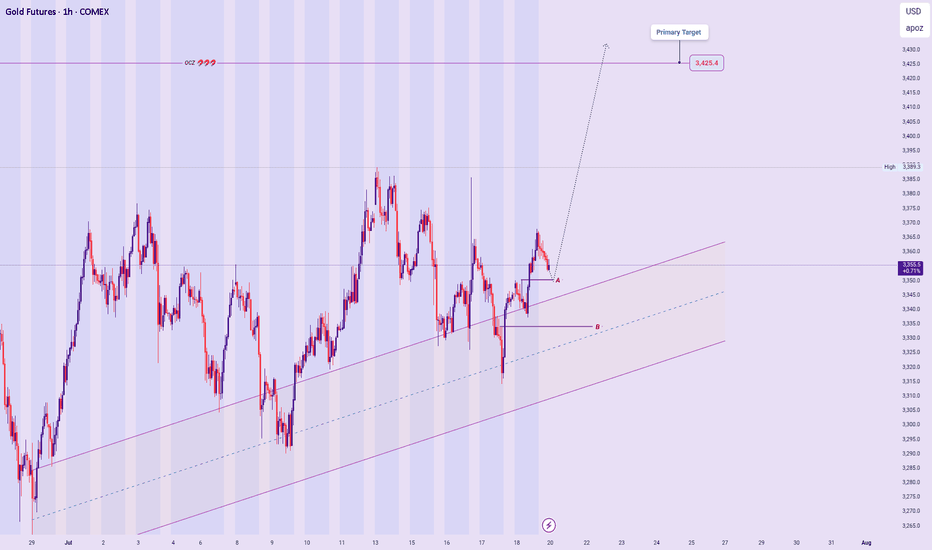

$GC / Gold Update - A New Entry - 7/23Hello fellow degenerates,

Our next target is above 3504 and we are currently in a quick ABC retracement.

- I am looking for an entry in the 3424.6-3411 range.

- This is a wave C so we could see an ABC or a ABCDE pattern forming.

- Levels to watch: 3433.1, 3424.6, 3416.6, 3408

$GLD / $GC – Gold Poised for Breakout as Hard Assets FlexAMEX:GLD / SET:GC – Gold Poised for Breakout as Hard Assets Flex

Gold is setting up for a major breakout, and the broader market is finally catching on to the hard asset trade. Whether it’s inflation ticking up or the never-ending government deficit spending, the market is starting to signal something big.

🔹 Macro Tailwinds:

Inflation pressures + record deficit = a perfect storm for gold.

The dollar is under pressure — metals ( AMEX:GLD , AMEX:SLV , SET:GC ) are responding.

This theme isn’t going away anytime soon.

🔹 Technical Setup:

AMEX:GLD and SET:GC (Gold Futures) are coiled tightly just under breakout levels.

Volume is steady, and momentum is building under the surface.

A move through current resistance could send this entire trade into overdrive.

🔹 My Positioning:

1️⃣ Options: Long AMEX:GLD calls with 1-month expiration — slow mover, but clean structure.

2️⃣ Futures: Trading SET:GC contracts on the breakout side.

3️⃣ Silver Exposure: Still holding partials in AMEX:SLV — it’s following gold’s lead but with more juice.

Why I’m Focused Here:

This is not a one-day theme — hard assets are becoming a rotation trade.

If this confirms, we could see multi-week upside in precious metals.

It’s rare to get clean technicals that align this well with macro.

Gold short Read this clearly, my confidence in this trade is 3 out of 10.

Use very small size on this trade, as iam not sure at all that this is even the right thing to do.

The chart is messy, and there is consolidation is going on.

if the price didnt make it to nr 1 circle, dont worry about it. The most important thing is the close below the FVG.

Also confirm on lower time frame to see how the price reacts to the entry levels. If anything is going to happen, is going to happen at those levels.

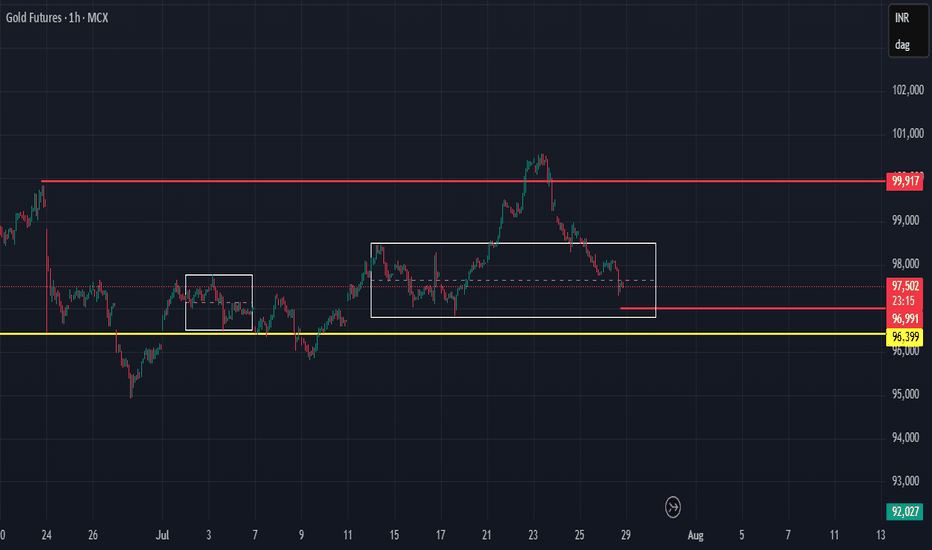

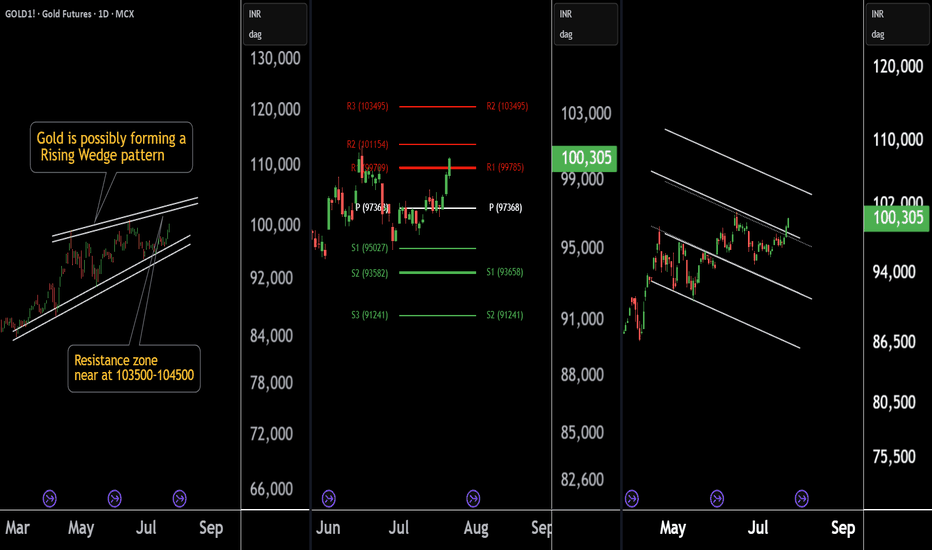

Gold at a Crossroad: Long or Short? Key Levels in FocusThere are three chart of Gold .

Gold1! is forming a Rising Wedge pattern, with resistance positioned between 103500-104000 levels.

Gold1! is facing Pivot Point resistance around the 103500 level, indicating potential supply pressure.

Gold1! is approaching the parallel channel resistance, and the upside move is nearly complete in percentage terms, with resistance around 103800-104000.

if this level sustain then we may see first of all higher prices then again fall in gold1!

Thank You !!

XAUUSD – New Week Technical Bias (Market Open)

Bias Overview:

Current outlook remains aligned with previous bullish analysis, supported by the broader Ascend Sequence on higher timeframes.

Price Expectations:

Anticipating a micro decline toward Price Zone A as a potential springboard for a bullish continuation.

While less likely, a deeper pullback into Price Zone B may occur before the rally unfolds — still within acceptable structure for HTF bullish intent.

Execution:

Will rely on micro-timeframe confirmations and reaction behavior within these zones to finalize entry decisions following market open.

Invalidation will be break and bearish structure below the ascending sequence Channel.

Summary:

Maintaining bullish bias while awaiting refined entry opportunities at defined price zones. Structural invalidation remains below key support and Sequence Line levels.

[b ]🔒 Disclaimer:

This analysis is for educational and strategic insight purposes only. It is not financial advice. Always manage your own risk and confirm with your personal trading plan before executing trades.

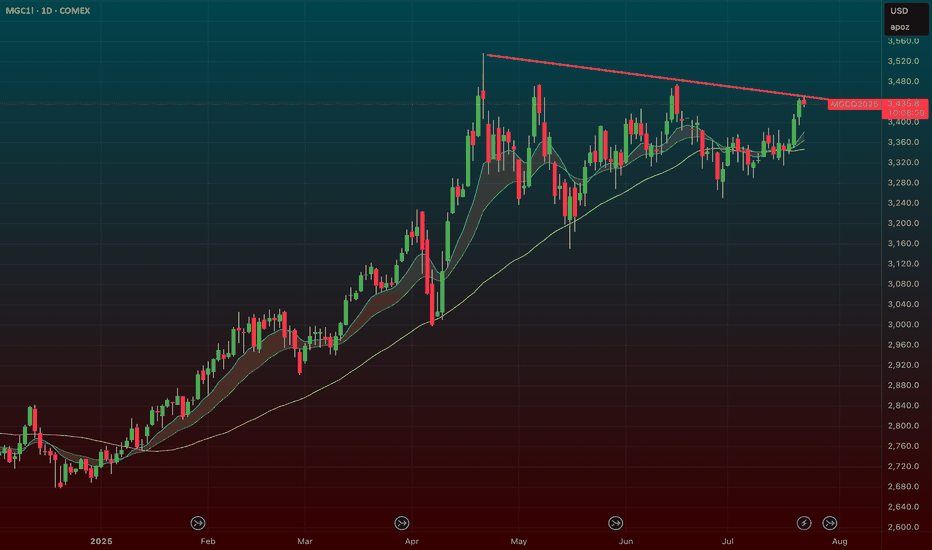

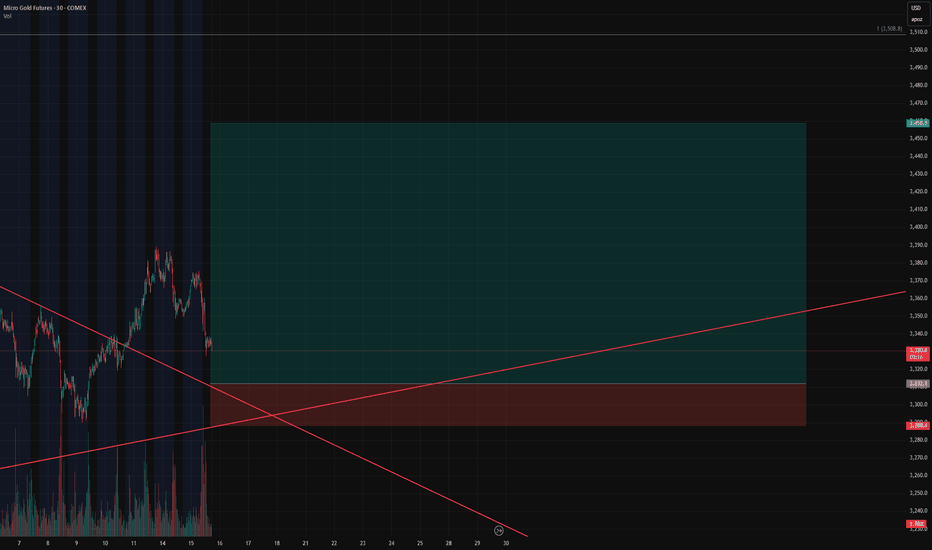

Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!🚨 Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!

We’re flipping the script on COMEX_MINI:MGC1! After a prolonged downtrend and textbook wedge compression, our breakout long is LIVE – but not without trapping the late shorts first.

💥 Entry: $3,312.1

🛑 Stop: $3,288.4

🎯 Target: $3,458.9

🧮 Risk/Reward: 6.19

Price just bounced at the retest of the wedge apex, and volume is confirming the move. If this holds, we’re riding momentum all the way up – and letting short pressure fuel the breakout.

📈 Trendline breached.

⏳ Time compression converging.

⚠️ If you’re still short, watch your stops!