UNF1! trade ideas

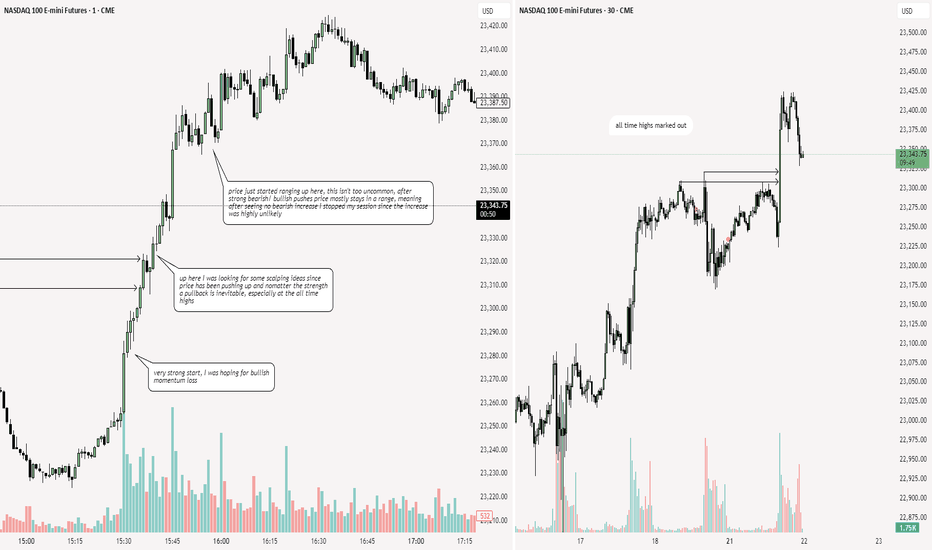

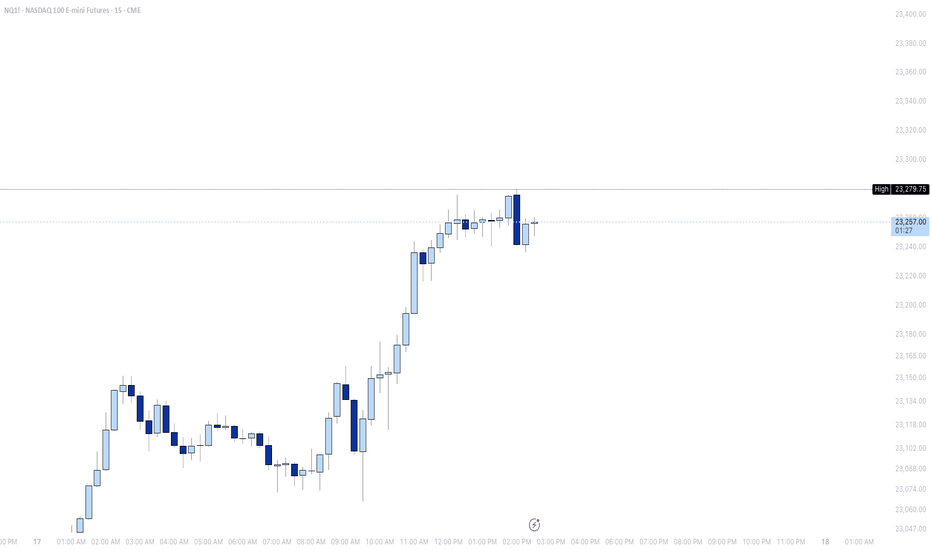

2025-07-21 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

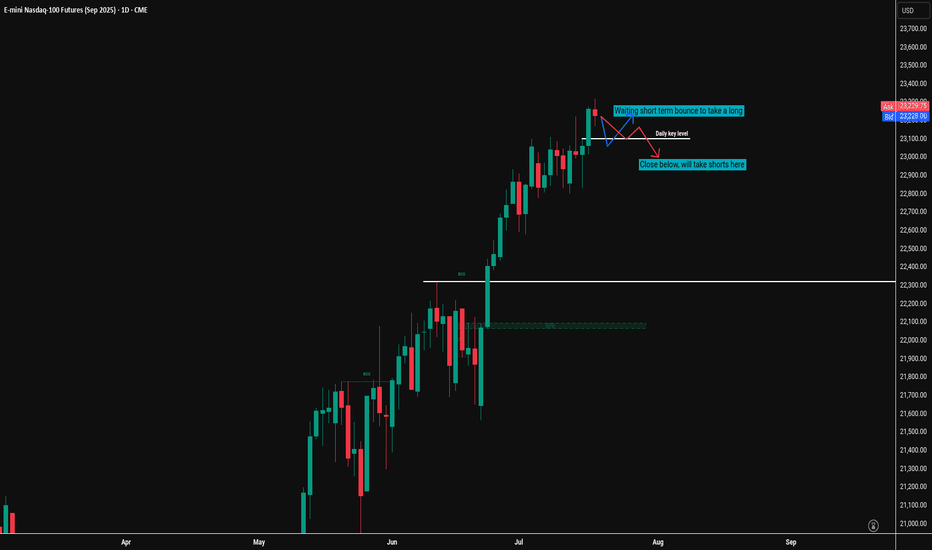

comment: Melt-up and bears failed to close below last weeks high, which means we are still max bullish. Until bears print below 23200, longs just make more sense than trying to look for shorts.

current market cycle: bull trend

key levels: 23000 - 23500

bull case: Bulls remain in full control until we get a daily close below 22700. First target for the bears is a lower low, which means getting below today’s spike 23225. That would be a start but likely means sideways rather than more selling. If we stay above 23200, we can continue to print many more new highs.

Invalidation is below 22700.

bear case: Bears obviously are not doing enough. They need to print 23200 and that would only be the first small start. It would open the possibility for a test of 23000 but since we are barely printing any red bars and have not broken any bull trend line so far, it’s stupid to look for shorts. Wait for much bigger selling pressure.

Invalidation is above 23500.

short term: Neutral but if anything I am looking for long scalps against support like the 1h 20ema.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Long US open. Just a quick melt-up but I missed it.

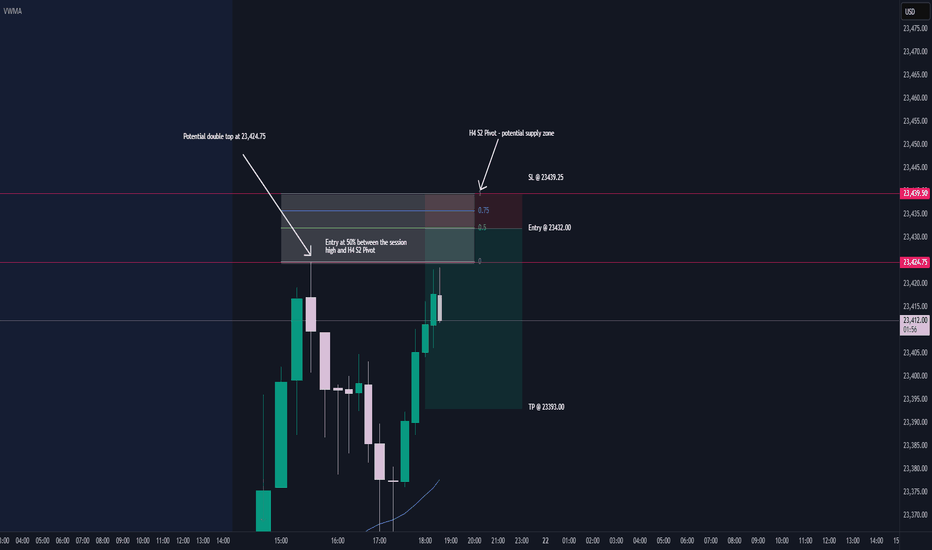

NQ Short Setup: Contrarian Trade into Supply ZoneDouble top forming near 23,424.75 with supply overhead at H4 S2 Pivot – 23,439.25.

🎯 Entry: 23,432.00 (mid-range)

📘 TP: 23,393.00

🔴 SL: 23,439.25

⚠️ Risky fade play against bullish earnings momentum and looming trade deal deadline.

— Tactical short. High risk, high tension. Stay sharp.

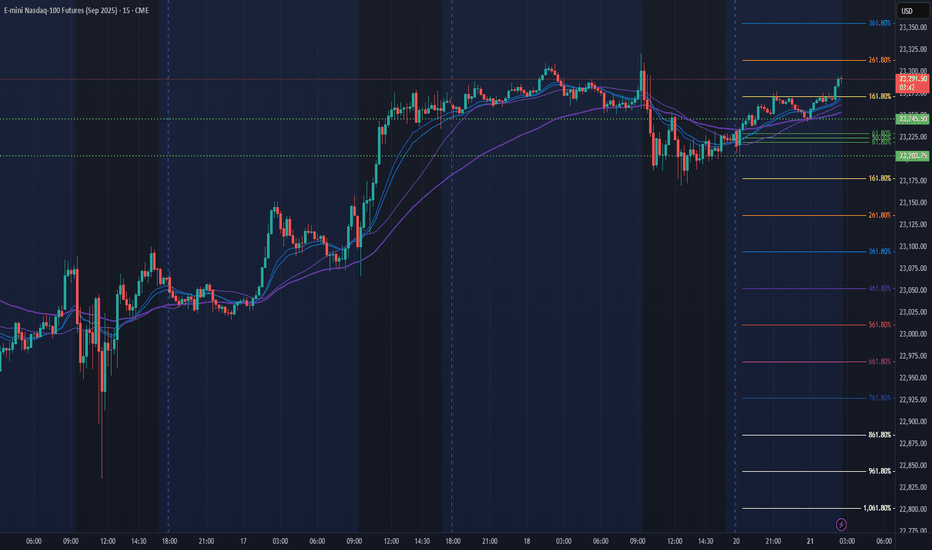

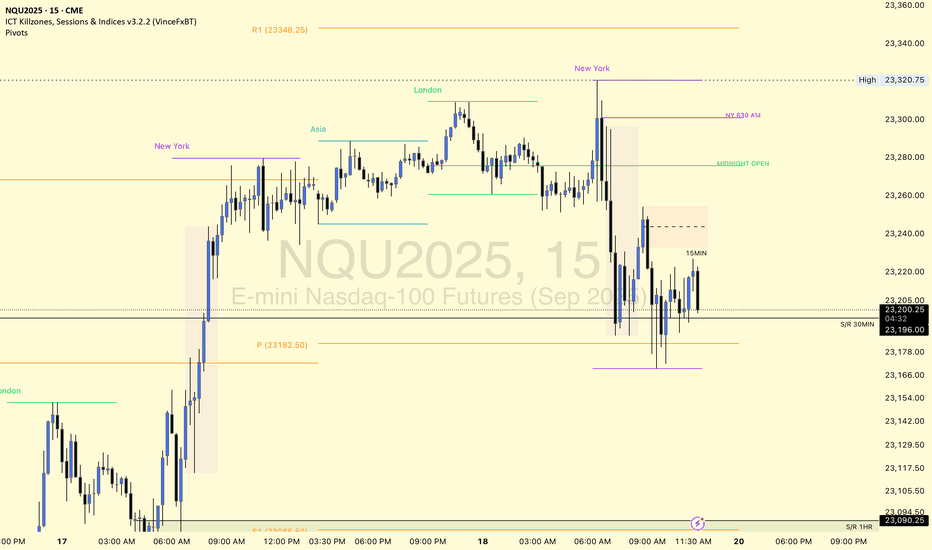

NQ Power Range Report with FIB Ext - 7/21/2025 SessionCME_MINI:NQU2025

- PR High: 23203.75

- PR Low: 23245.50

- NZ Spread: 93.25

No key scheduled economic events

In range to continue pushing ATH

Session Open Stats (As of 1:45 AM 7/21)

- Session Open ATR: 266.36

- Volume: 21K

- Open Int: 274K

- Trend Grade: Neutral

- From BA ATH: -0.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

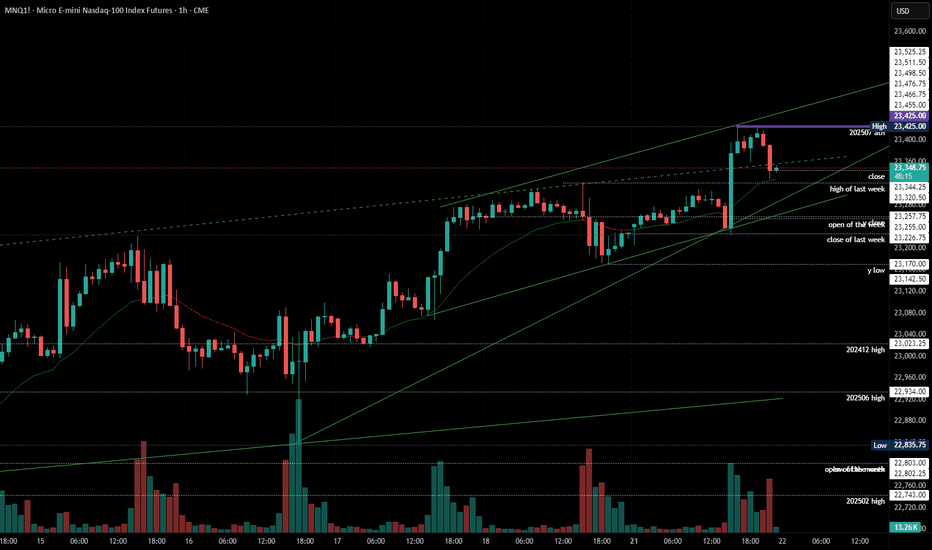

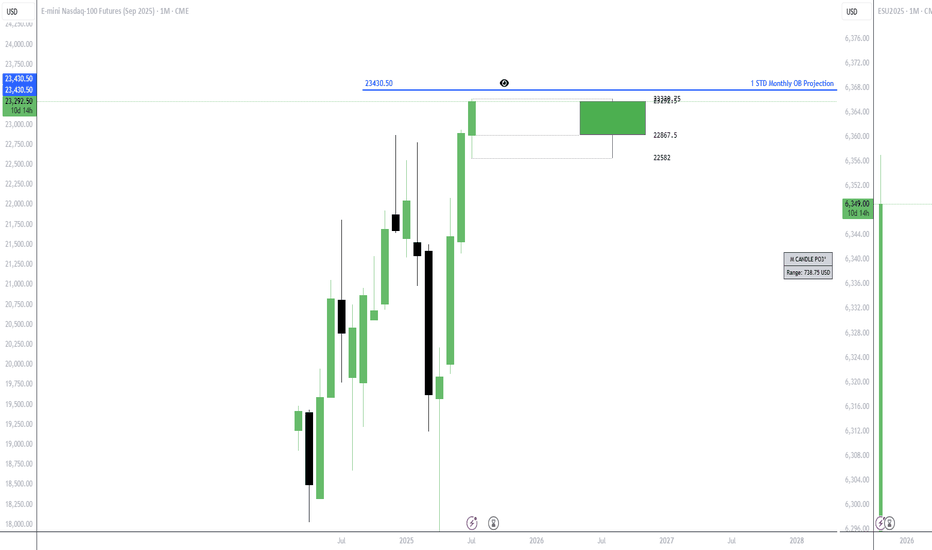

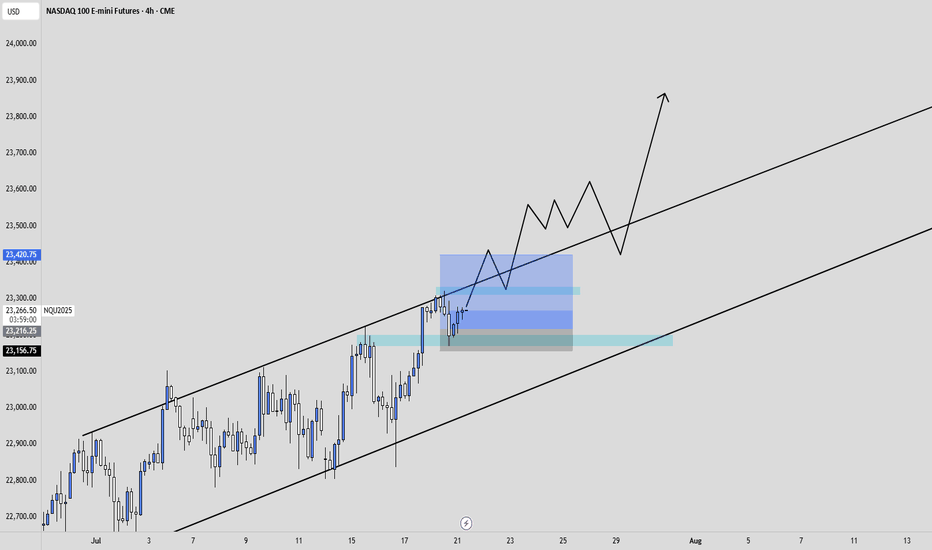

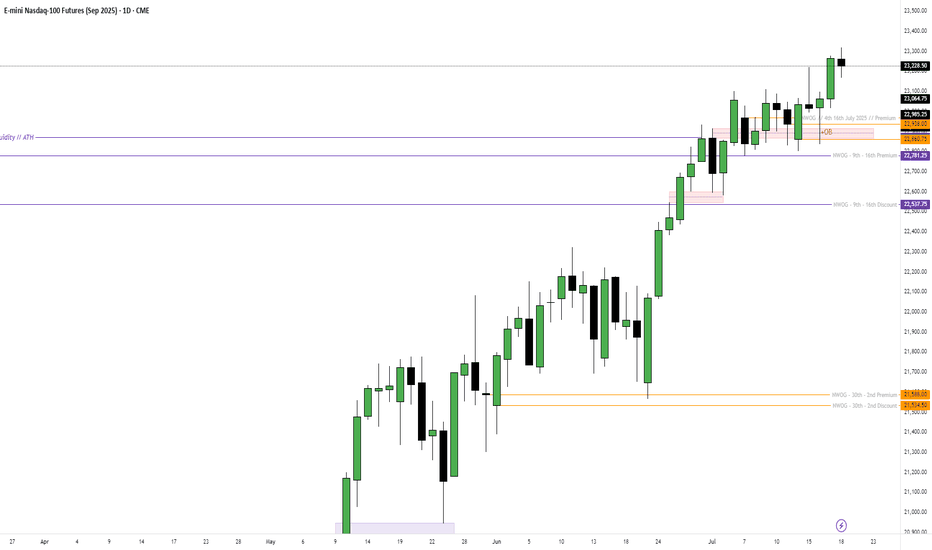

NQ Weekly Outlook & Game Plan 20/07/2025NQ Weekly Outlook & Game Plan

🧠 Fundamentals & Sentiment

Market Context:

NQ continues its bullish momentum, driven by institutional demand and a supportive U.S. policy environment.

📊 Technical Analysis:

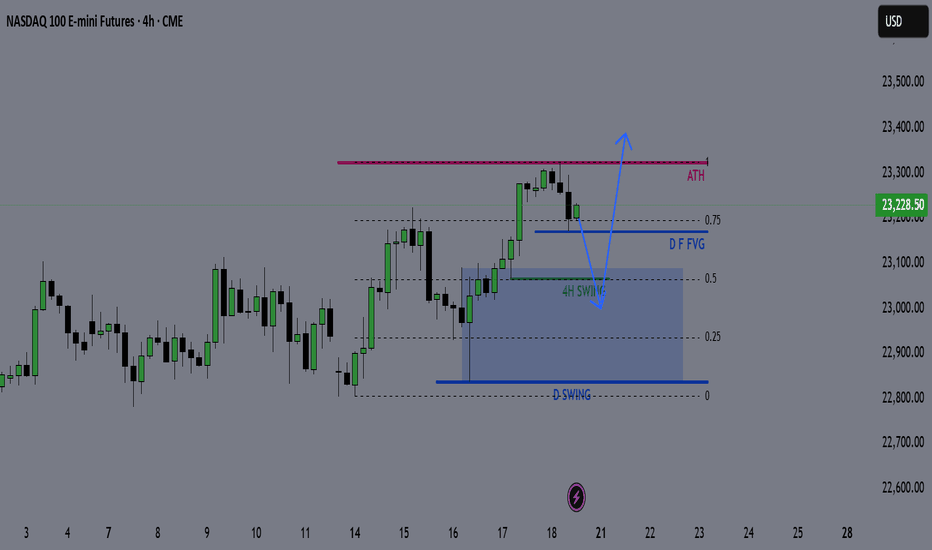

Price is currently in price discovery, and the weekly structure remains strongly bullish — so I prefer to follow the strength.

We might see a minor retracement before pushing further above the all-time high (ATH).

🎯 Game Plan:

I'm expecting a potential retracement to the 0.5 Fibonacci level, which is the discount zone in a bullish environment.

Interestingly, the 4H liquidity zone aligns perfectly with the 0.5 Fib level — this confluence suggests price may gather enough energy from there to make new highs.

✅ Follow for weekly recaps & actionable game plans.

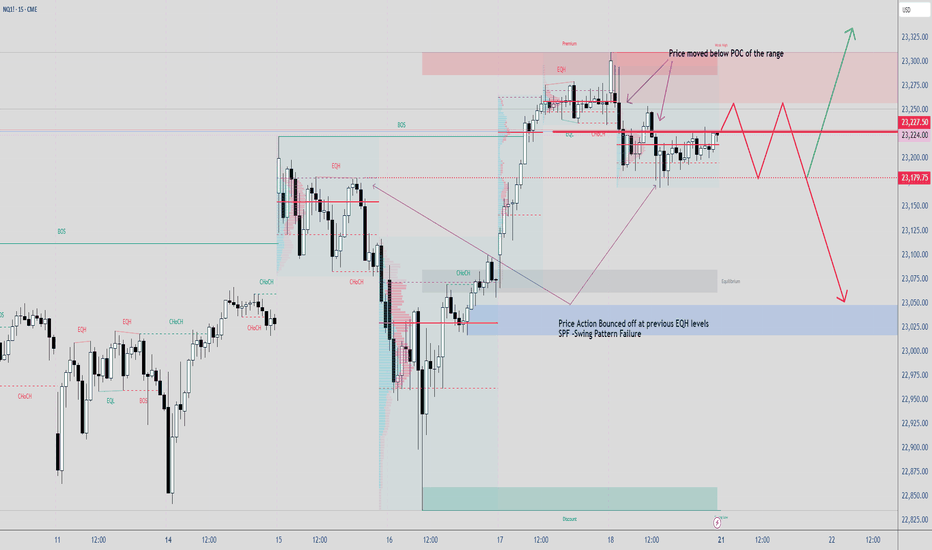

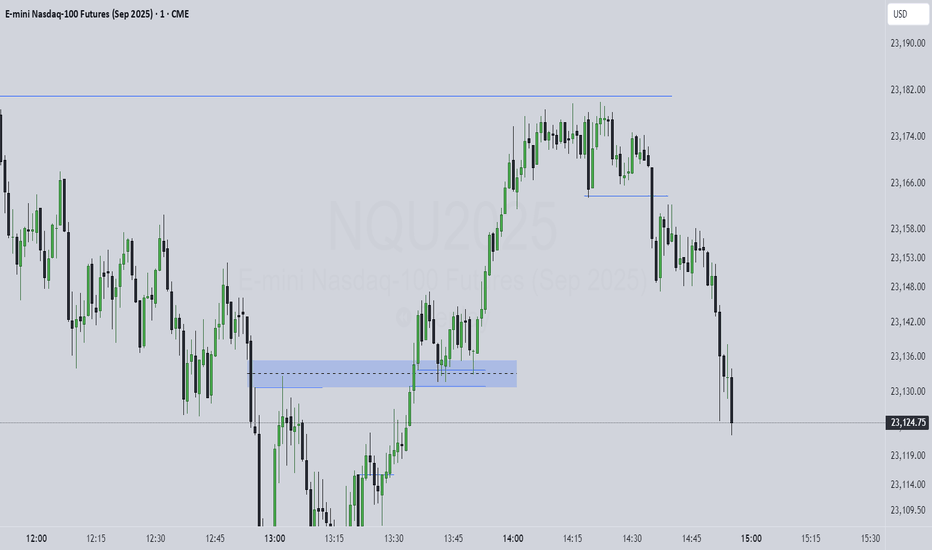

Using LuxAlgo SMC Free indicatorSometimes Indicators helps calculates the swing points without any effort especially during live trading.

POC is part of a tool called Volume Profile. In this case, Im using select Fixed Range VP to identify short term POC to see where PA can bounced from.

When markets moving sideways or in a Trading Range, PA tends to be choppy.

Nobody knows about the future, if they claimed to know, just run away. Here are some probabilities how PA would do next.

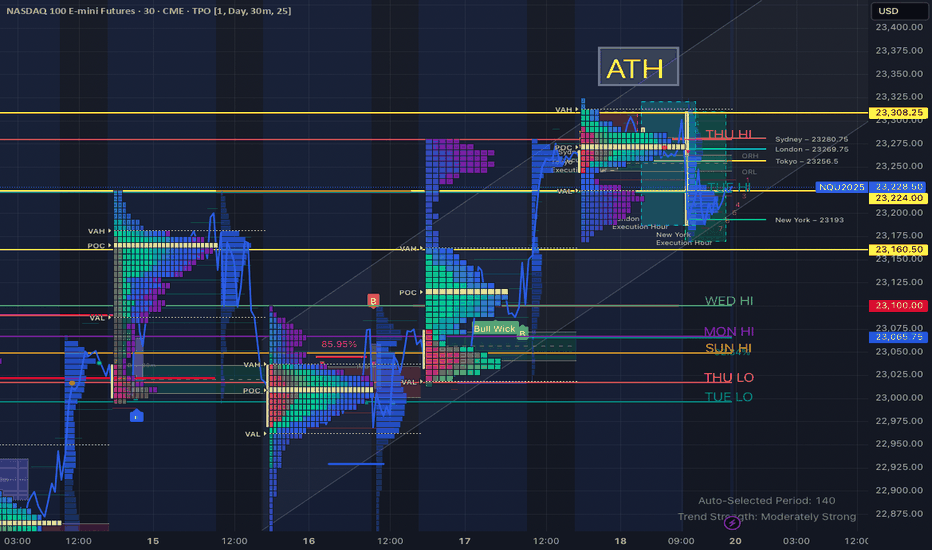

NQ2025 – Range Reclaim and ATH Test in Focus | TPO AnalysisDescription:

The Nasdaq-100 (NQ2025) is showing signs of strength after reclaiming a key value area around 23,224, with price now consolidating above the New York execution low (23,193) and the weekly value area low. Volume structure and price action suggest potential continuation toward the all-time high.

Key Technical Notes:

Range Reclaim: Price reclaimed a composite range zone (23,193–23,224), showing acceptance and strength during NY session.

All-Time High (ATH): 23,308.25 remains the upside magnet.

Initial Balance and ORL: Serving as confluence for bullish structure if retested.

TPO Structure: Value is shifting higher with poor high left above current range, increasing likelihood of continuation.

Primary Scenarios:

Bullish Continuation: Hold above 23,224–23,193 and rotate toward ATH.

Pullback Opportunity: Reclaim of NY low or session VWAP after sweep could offer long re-entry.

Rejection Scenario: Break back below 23,193 may shift control to sellers, targeting 23,160 and 23,065 support.

Support/Resistance Zones:

Resistance: 23,275 → 23,308.25 (ATH)

Support: 23,224 → 23,193 → 23,160

Lower Shelf Support: 23,100 → 23,065.75

This chart utilizes a blend of TPO analysis, intraday session levels, and volume-based structure to align setups with high-probability continuation or reversal zones.

📍#NQ #FuturesTrading #VolumeProfile #TPOAnalysis #DayTrading #TechnicalAnalysis #TradingStrategy

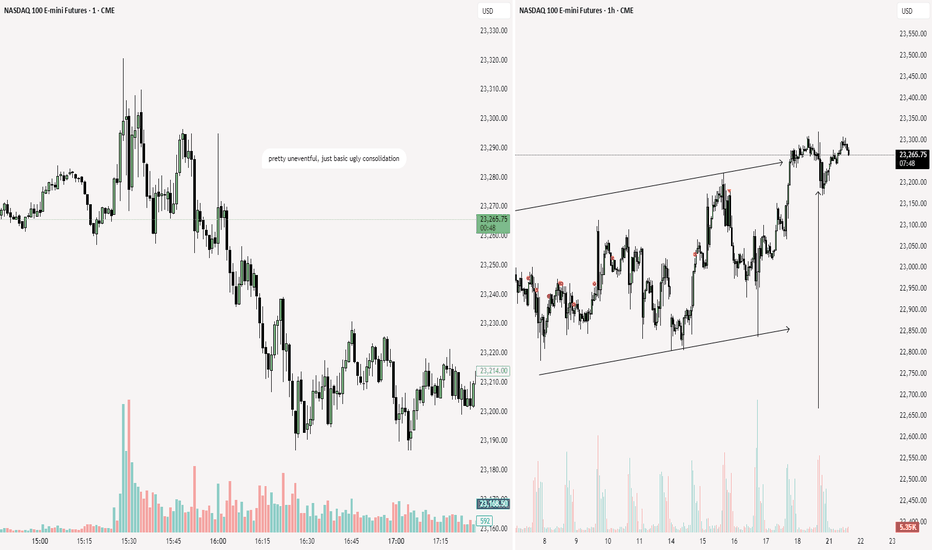

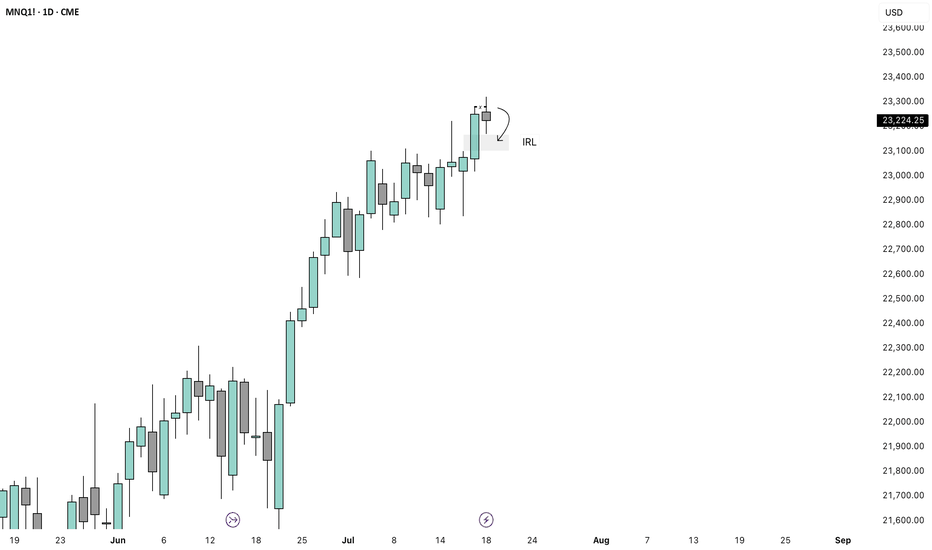

NASDAQ: Still Bullish! Look For Valid Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

NASDAQ (NQ1!) NAS100

The Stock Indices are strong, and showing no signs of selling off. Buy it until there is a bearish BOS.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

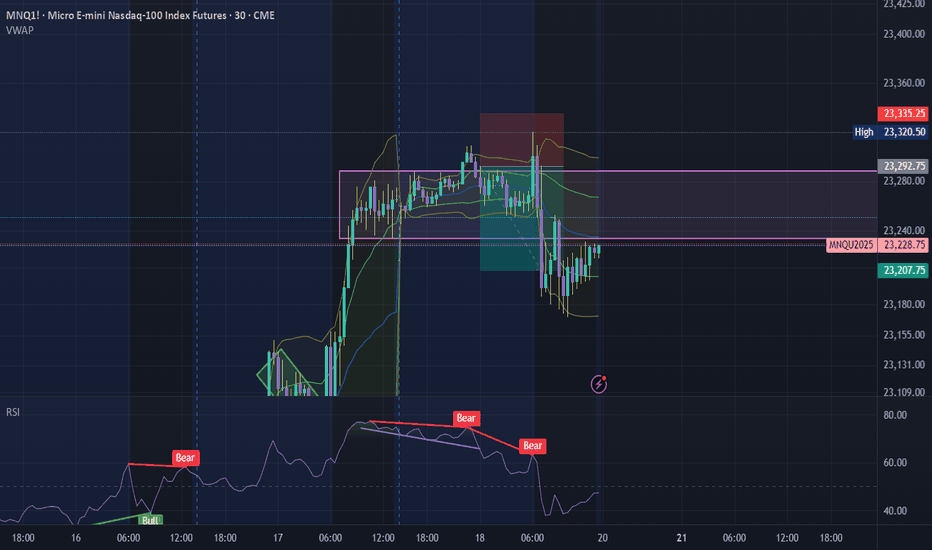

Bearish Divergence using RSIStarting to utilize RSI in confluence with market structure and FVG to create an entry and exit model. Higher highs of price action paired with lower highs of RSI values. Exit towards filling at least 50% of FVG. Don't be greedy, as price can use FVG as support/resistance.

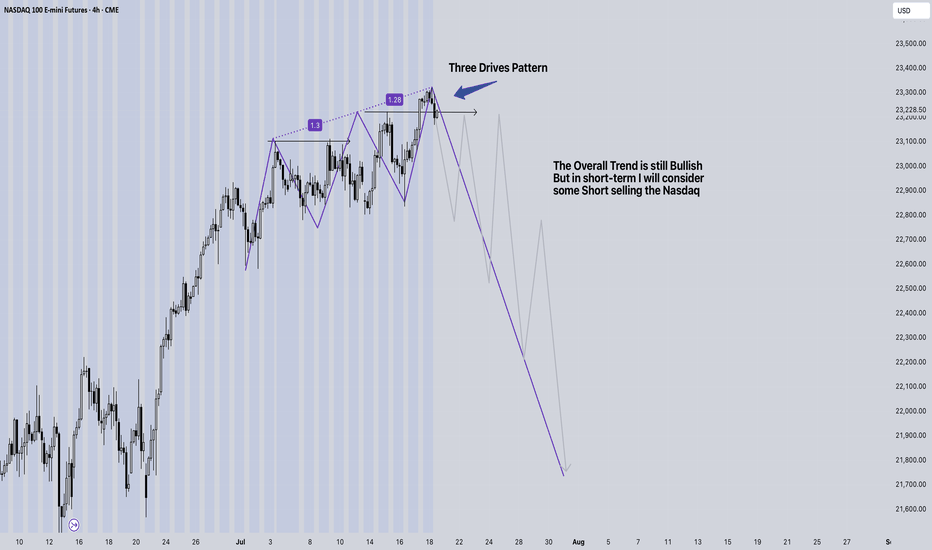

Nasdaq Short Cell or Sell !We Look for the ATM (All Time High) always, But markets Keep Making Higher Highs and New ATMs .

Keep in mind , Nobody Knows the Next Move Or if it goes Higher Or Lower.

We assume and try to Resume as Long As we Can !

The Market is somehow About Survival. If you Survive the next level to achieve is to keep your losses Small when you are wrong and let your profits run as long as they are valid Then you have entered the Realm of 10% profitable traders.

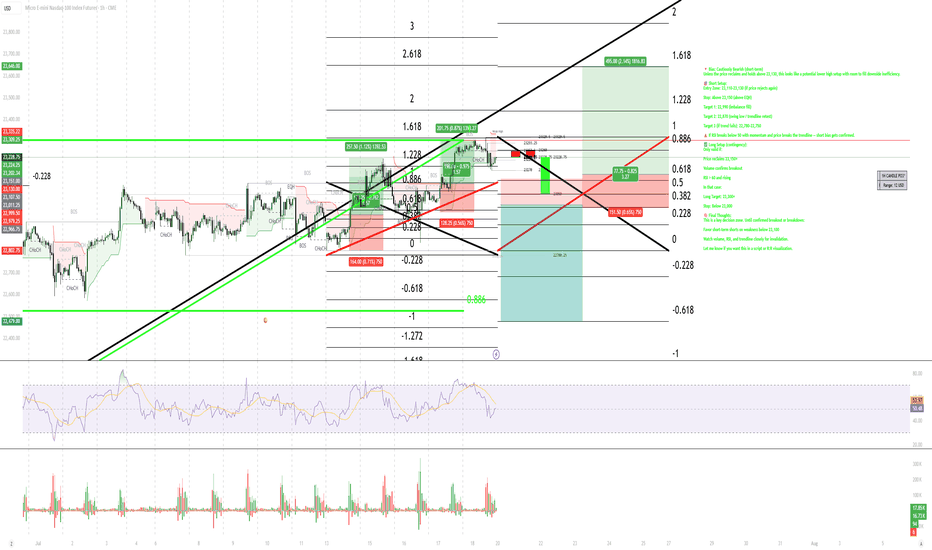

CHAT GPT TRADING This is a 1-hour chart of Micro E-mini Nasdaq-100 Futures (MNQ) with multiple tools active: structure annotations (CHoCH, BOS), SuperTrend, RSI, volume, and trendlines.

🧭 Overall Trend:

Primary Trend: Bullish (uptrend remains intact overall)

Recent Action: Consolidation under resistance (~23,120–23,130), with minor bearish market structure shifts (CHoCHs and BOS).

Key Support: Rising trendline + swing low around 22,870–22,900

RSI: Neutral (50 zone), slightly recovering from oversold dip.

📊 Structure Notes:

CHoCH (Change of Character) and BOS (Break of Structure) are noted frequently, with recent CHoCHs to the downside — showing potential early bearish pressure.

Market is hovering under a key resistance zone with a minor rejection candle and an open imbalance below (green zone).

✅ Suggested Approach:

🔻 Bias: Cautiously Bearish (short-term)

Unless the price reclaims and holds above 23,130, this looks like a potential lower high setup with room to fill downside inefficiency.

🎯 Short Setup:

Entry Zone: 23,110–23,130 (if price rejects again)

Stop: Above 23,150 (above EQH)

Target 1: 22,990 (imbalance fill)

Target 2: 22,870 (swing low / trendline retest)

Target 3 (if trend fails): 22,780–22,750

⚠️ If RSI breaks below 50 with momentum and price breaks the trendline — short bias gets confirmed.

✅ Long Setup (contingency):

Only valid if:

Price reclaims 23,150+

Volume confirms breakout

RSI > 60 and rising

In that case:

Long Target: 23,300+

Stop: Below 23,000

🧠 Final Thoughts:

This is a key decision zone. Until confirmed breakout or breakdown:

Favor short-term shorts on weakness below 23,100

Watch volume, RSI, and trendline closely for invalidation.

Let me know if you want this in a script or R:R visualization.

Ask ChatGPT

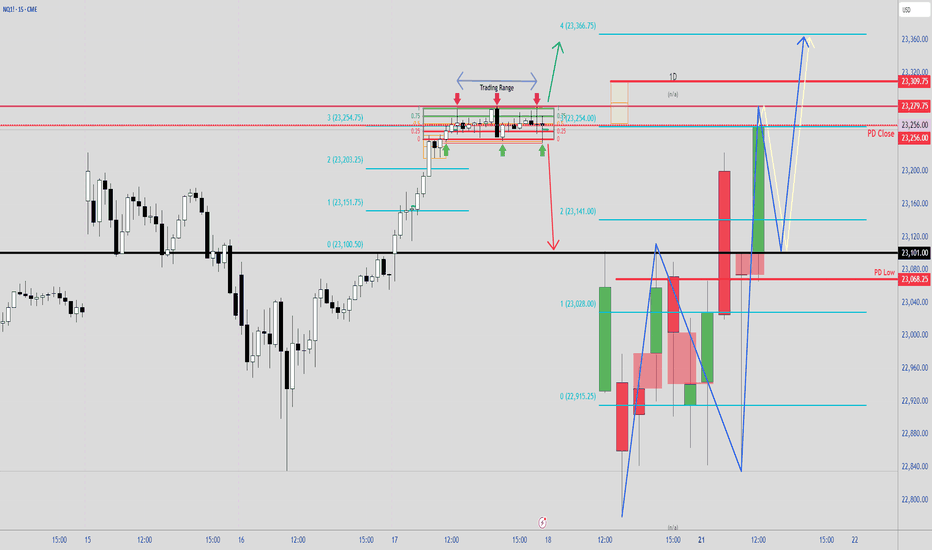

$NQ Supply and Demand Zones 7/18/25 This is for SEED_ALEXDRAYM_SHORTINTEREST2:NQ chart only, not as many supply zones with the limited timeframes I can use for TradingView free plan. This is my chart coming into next week.

However, we have so far found rejection from new ATH and making our way to retest the imbalances and previous resistance-now support levels of past supply zones.

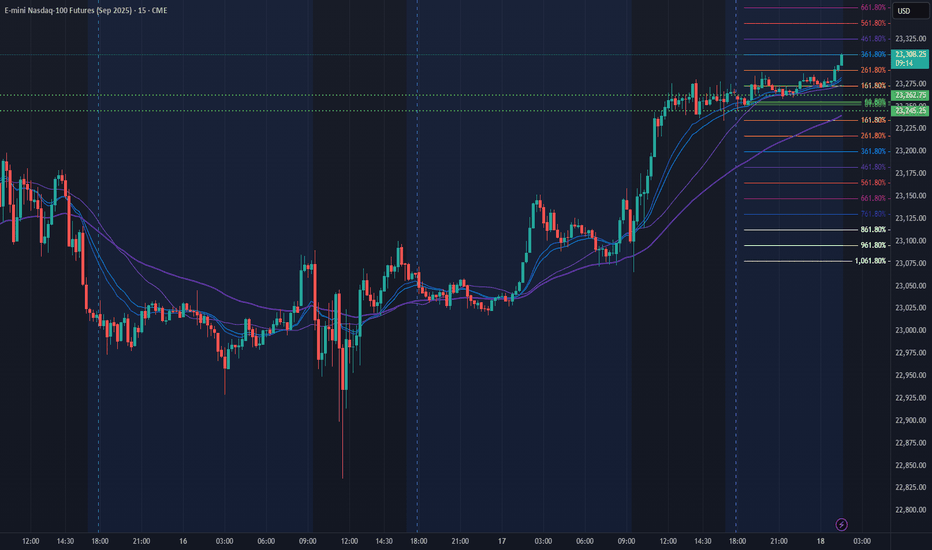

NQ Power Range Report with FIB Ext - 7/18/2025 SessionCME_MINI:NQU2025

- PR High: 23262.75

- PR Low: 23245.25

- NZ Spread: 39.0

No key scheduled economic events

Pushing ATH through overnight hours

Session Open Stats (As of 1:15 AM 7/18)

- Session Open ATR: 272.56

- Volume: 18K

- Open Int: 286K

- Trend Grade: Neutral

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone