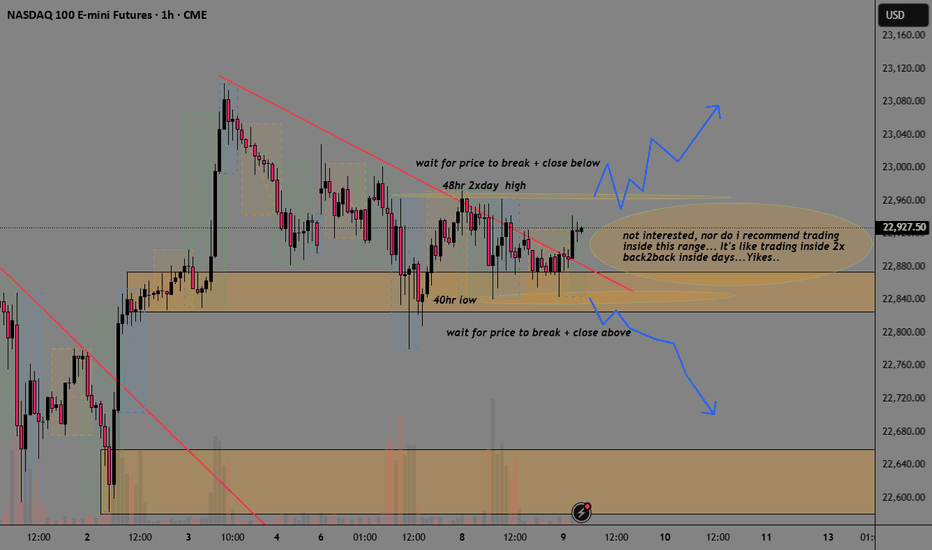

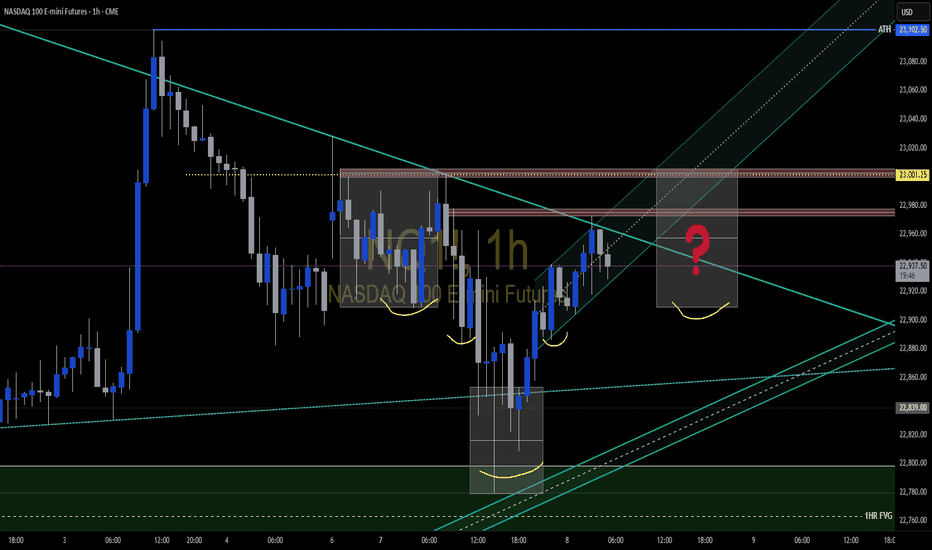

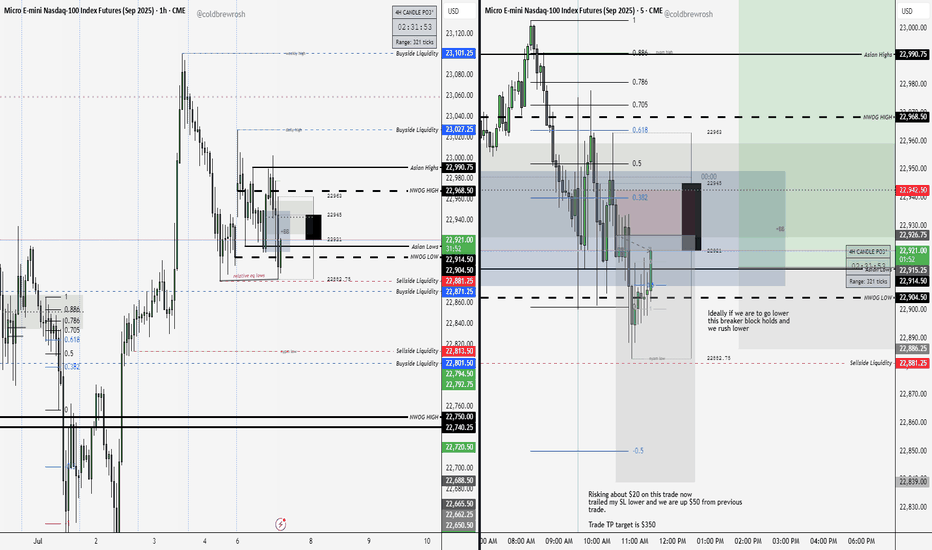

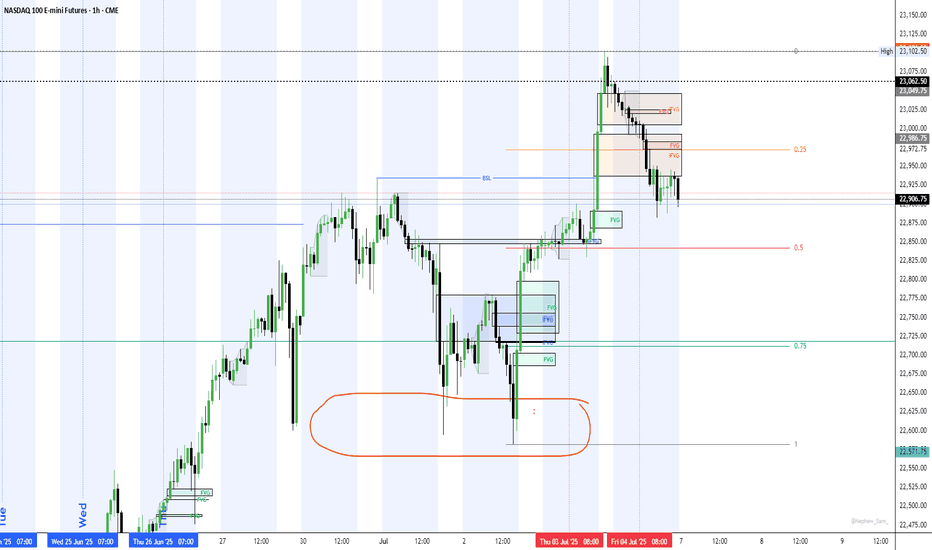

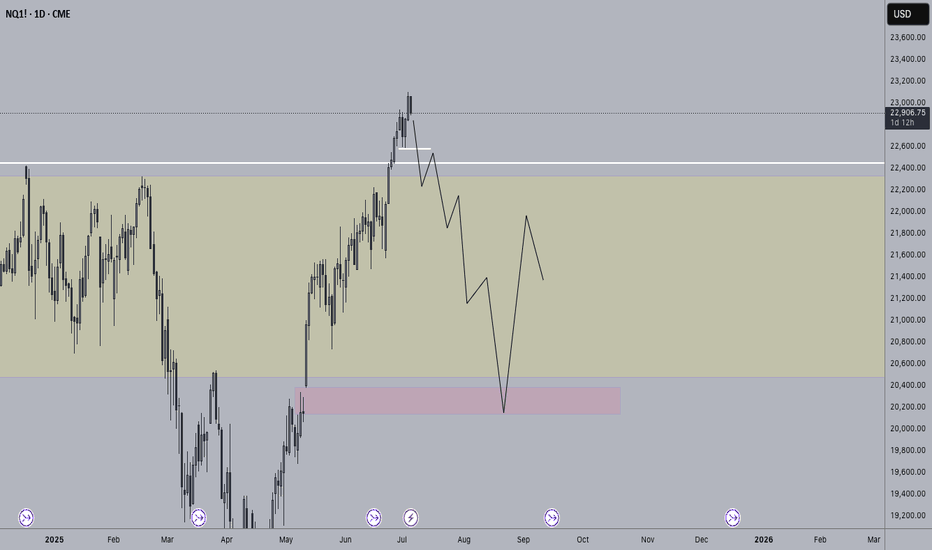

NQ Analysis ICT Liquidity Search Break-Out TradePrice is expected to open not just 1, but inside 2 previous days.

We have 2 options:

1) ICT silver bullet up my bum trader strategy traders are waiting

for liquidity search breaking highs or lows then reversing.

2) Break-out trades waiting for price to break and close above or below

24hour range and trade in direction of break-out.

UNF1! trade ideas

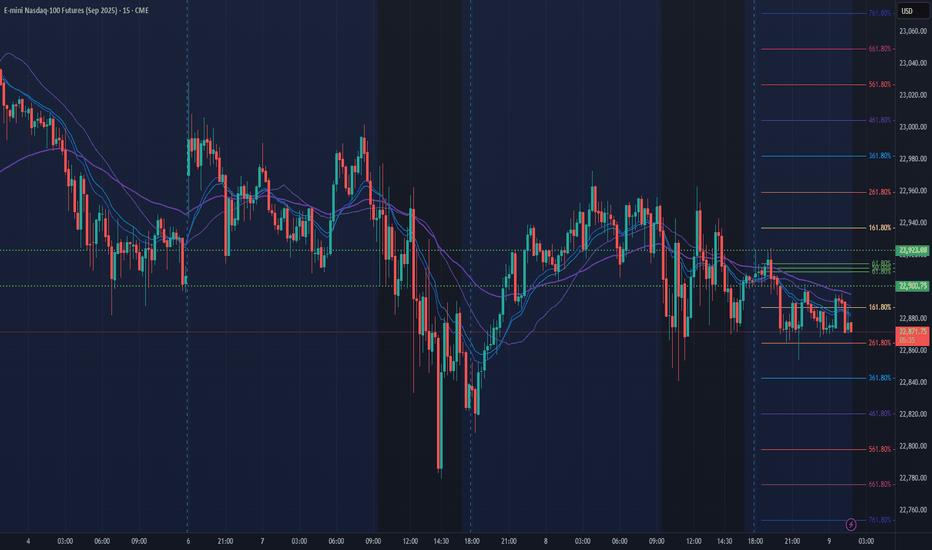

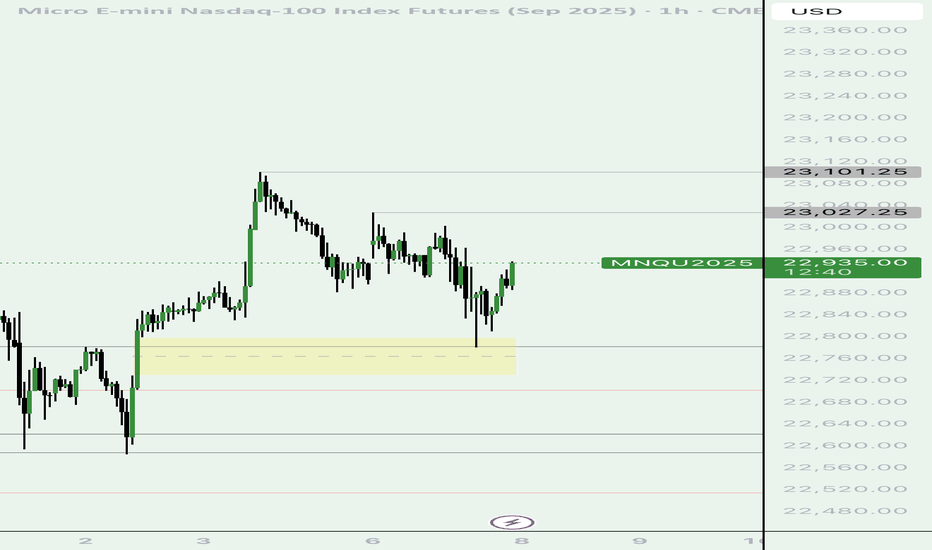

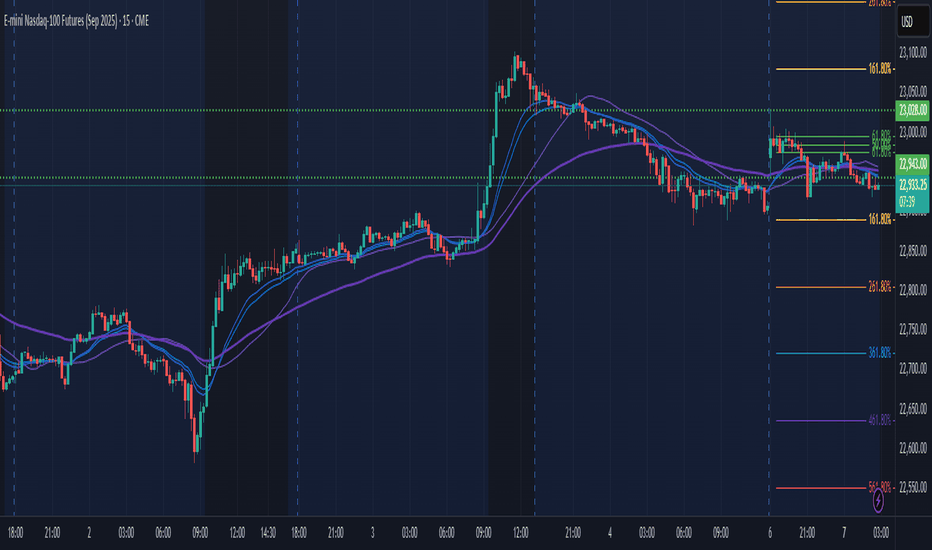

NQ Power Range Report with FIB Ext - 7/9/2025 SessionCME_MINI:NQU2025

- PR High: 22923.00

- PR Low: 22900.50

- NZ Spread: 50.5

Key scheduled economic events:

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:25 AM 7/9)

- Session Open ATR: 303.33

- Volume: 16K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

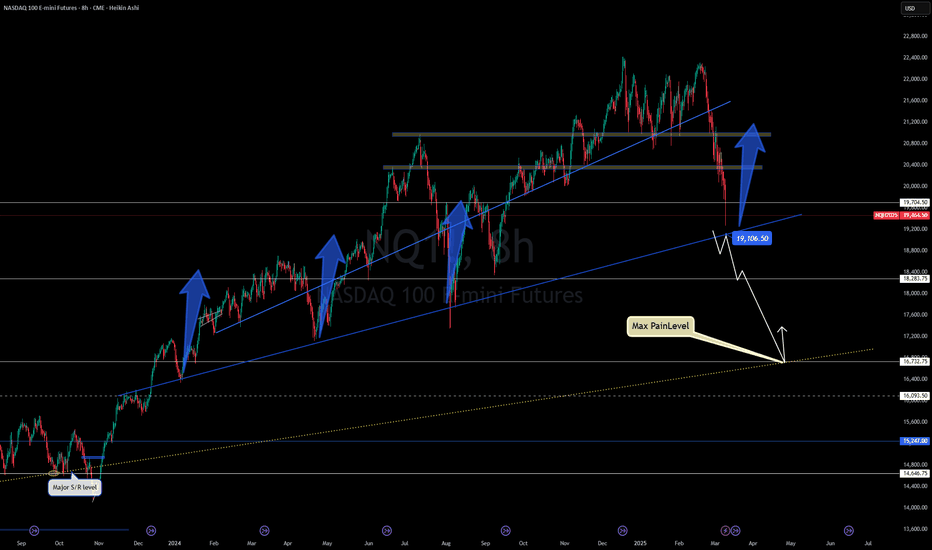

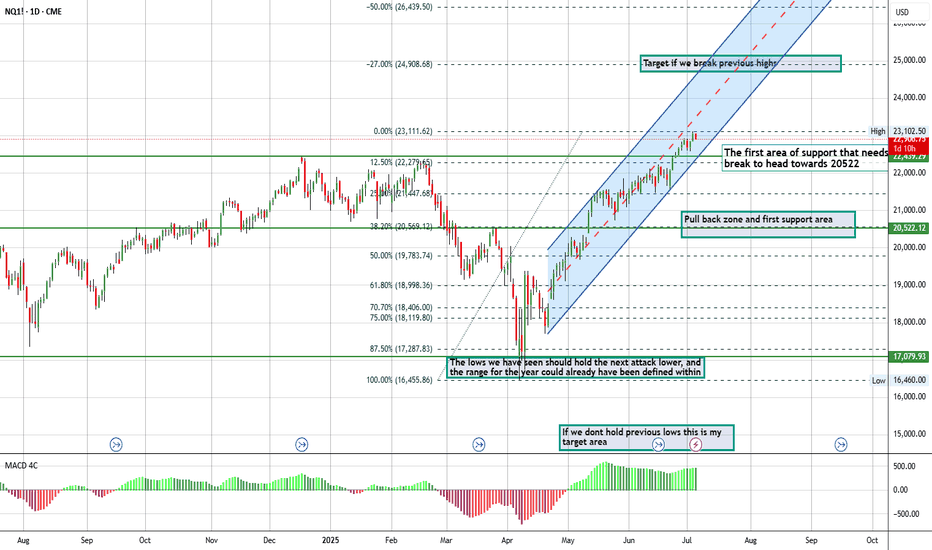

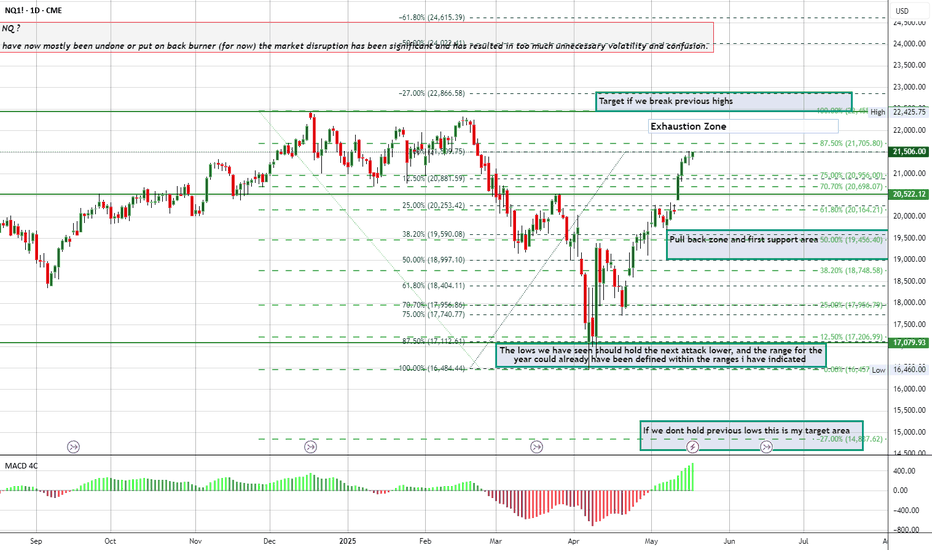

NASDAQ – Will It Hold or Collapse Further?📉🔥 NASDAQ Approaching Max Pain – Will It Hold or Collapse Further? 🚀⚠️

The NASDAQ 100 is hanging by a thread, as price approaches the key 19,106 support level. A breakdown from here could accelerate losses toward the 18,283 zone, and if things get worse, the dreaded 16,732 "Max Pain" level may be tested.

📊 Key Technical Levels:

📌 19,106 – First major support (bounce or breakdown zone).

📌 18,283 – Next key level if sellers take control.

📌 16,732 – The "Max Pain" zone, where long-term buyers may step in.

📌 15,347 – Ultimate demand zone if things spiral out of control.

🚨 Why Is Nasdaq Falling?

Tech stocks are getting destroyed, with Tesla leading the plunge.

Market panic over higher interest rates & economic uncertainty.

Bitcoin also struggling, highlighting broader risk-off sentiment.

💡 Will we see a relief rally from these levels, or is the bloodbath just getting started?

Drop your thoughts below!

One Love,

The FXPROFESSOR 💙

#Nasdaq #StockMarketCrash #TechStocks #Trading #MarketAnalysis

NQ Power Range Report with FIB Ext - 7/8/2025 SessionCME_MINI:NQU2025

- PR High: 22853.50

- PR Low: 22808.50

- NZ Spread: 100.5

No key scheduled economic events

Session Open Stats (As of 12:25 AM 7/8)

- Session Open ATR: 318.85

- Volume: 24K

- Open Int: 269K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

If we are still bullish futures look to expect these levels. If we are still trending bullish a return back to the old gap low found in the fib & the fvg within the 1hr time fractal .. with a continuation of higher futures - we can see the level delineating in gray lines are my upside targets to see want to reprice to in a order to continue higher.

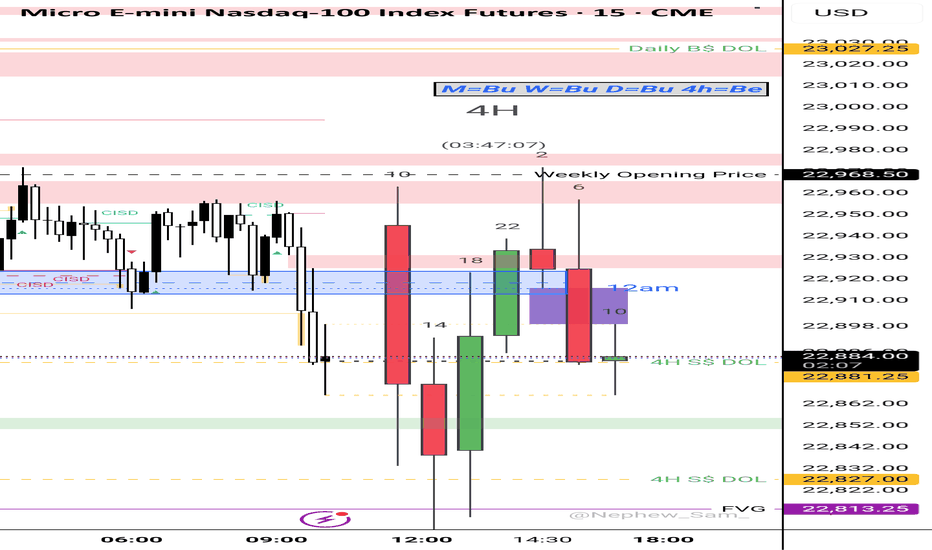

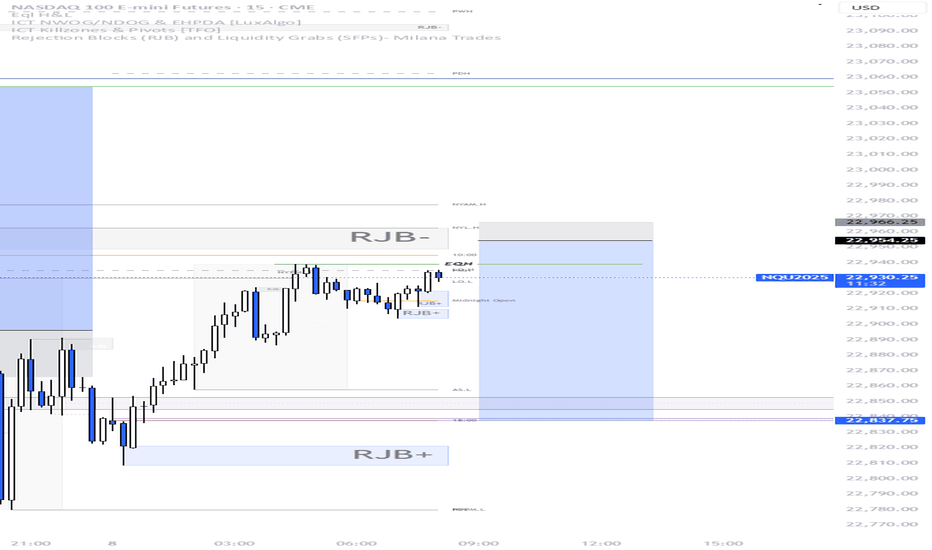

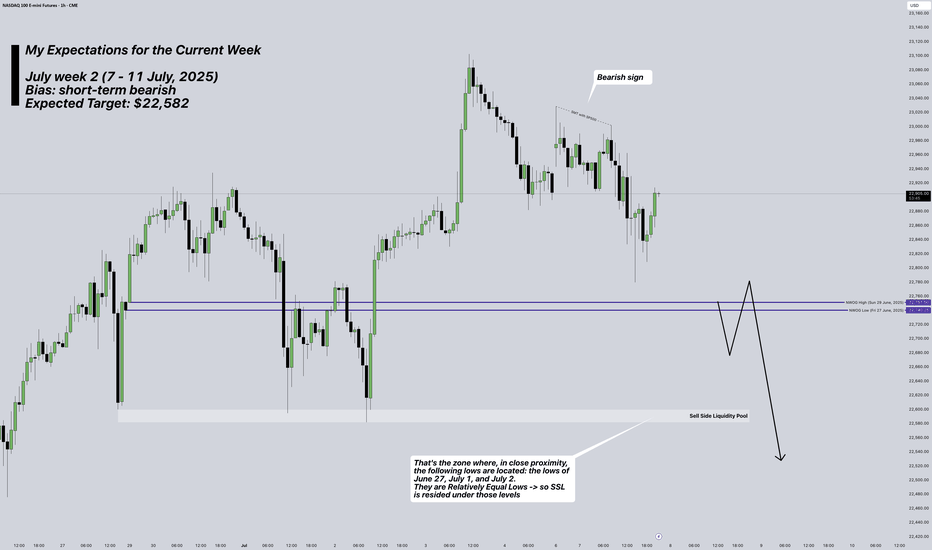

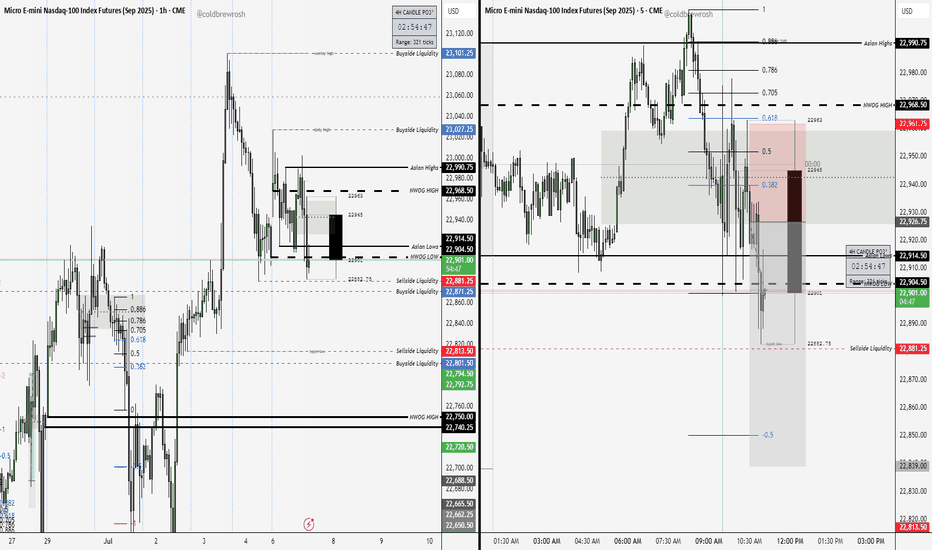

NASDAQ Futures: My Plan for current Week (7-11 July, 2025)Week: July 7–11, 2025

Instrument: NASDAQ Futures (NQ)

Trend: Overall, the market remains bullish, but for this week I anticipate a retracement targeting the $22,582 level.

Bias for the week: Bearish

Overview:

This week, I’m watching NQ for a potential move toward the $22,582 level. This expectation is based on how Thursday (July 3, 2025) played out—specifically the buy-side liquidity that was taken, and the clean sell-side liquidity pool left near $22,582.

I also find it notable how the NWOG (New Week Opening Gap) was opened and how price moved below it, which reinforces the short bias.

I would consider opening a short position once I see a confirmed 4H candle close below $22,760, otherwise no trades will be taken.

* Trade execution details will be published separately if my bias confirms.

* for more information -> review my notes on the chart

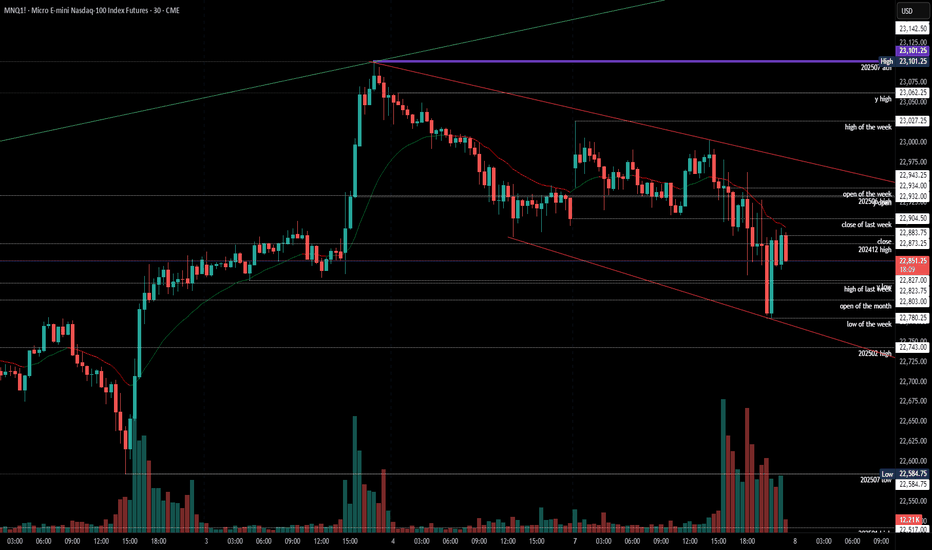

2025-07-07 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: Market is ignoring every risk under the sun because the US government is too incompetent to follow-through with their excrement show. Beyond me that we are staying up high. Got no better comment for you today.

current market cycle: bull trend

key levels: 22500 - 23100

bull case: As long as bulls stay comfortably above 22500, they are fine and sideways is a very bullish correction for them. Bears are certainly not doing much, so bulls buy every dip and the chances of a new ath are there since we are very close to it.

Invalidation is below 22500.

bear case: Bears are just not doing enough. Markets have every reason to sell hard but they don’t. Unless we see big 1h bear bars closing on their low with follow-through selling, we can not expect lower prices. We need gaps but all bears get are huge reversal bars. Below 22500 things would look better for them but for now it’s very unlikely. It’s certainly a start that we closed a 4h bar below the 4h 20ema and below last week’s close but unless we make lower lows, it does not mean much.

Invalidation is above 23100.

short term: Neutral.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Scalping both sides since we had many alternating bars and prominent tails.

NQ Range (07-02-25)NAZ will have to get some help with a Tweet or two in order to get above KL 22,881. This Post will have Monday close as end point. Look for the long weekend to use the Pop Trick into Monday and if not, we have a decent short developing. BTD/FOMO Forever, you don't even need much volume or fundamental/technical reasons.

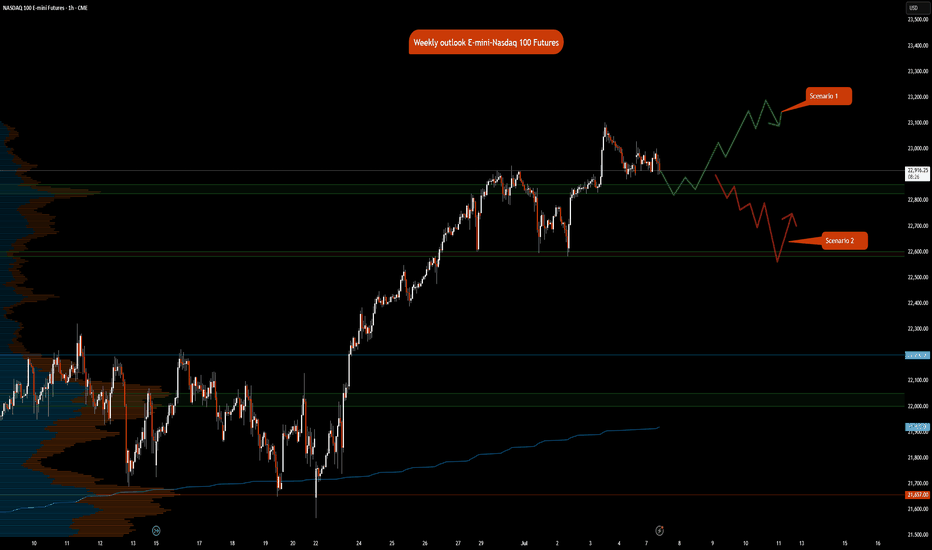

Weekly Market Outlook: E-mini Nasdaq 100 Futures NQCME_MINI:NQ1!

It’s a quiet week for US economic news. However, the RBA and RBNZ are scheduled to announce interest rate decisions.

As has been the theme this year, markets remain highly sensitive to headline news and associated risks.

US President Trump signed the One Big Beautiful Bill Act into law at the White House.

Treasury Secretary Bessent is currently giving an interview on CNBC as we write this outlook. Explanation of the near-term impact of Trump’s BBB Act, tariffs, and trade deals will be key to monitor, as this may be fuel for further movement. The US is set to announce more trade deals in the next 48 hours, while trading partners who did not reach a deal will revert to April 2nd tariff levels, with the tariffs to take effect on August 1st.

As many as 100 smaller countries will get a set tariff rate.

How does this all translate into price action and expectations for the market?

NQ and ES are currently trading near all-time highs. RTY has potential upside as it plays catch-up. With the BBB Act signed into law, many of the investment banks anticipate a near-term positive impact on GDP.

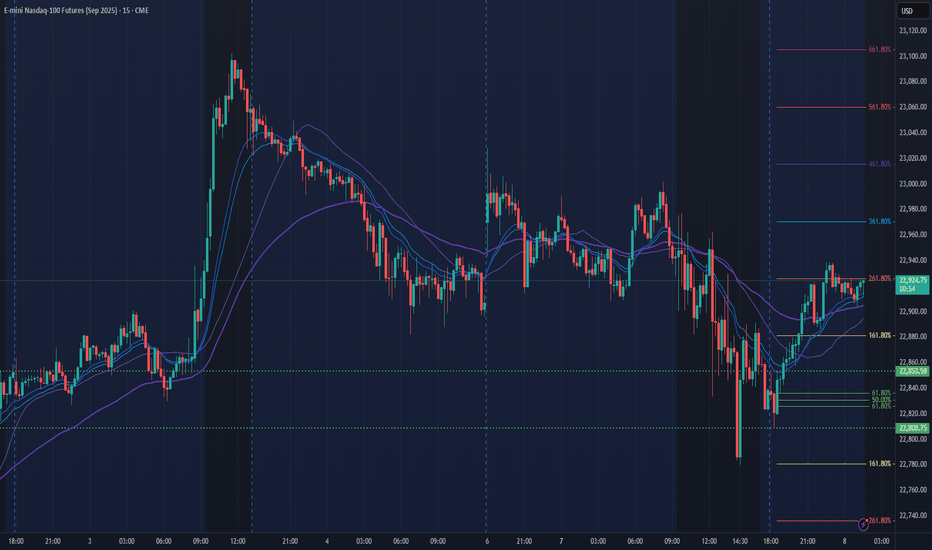

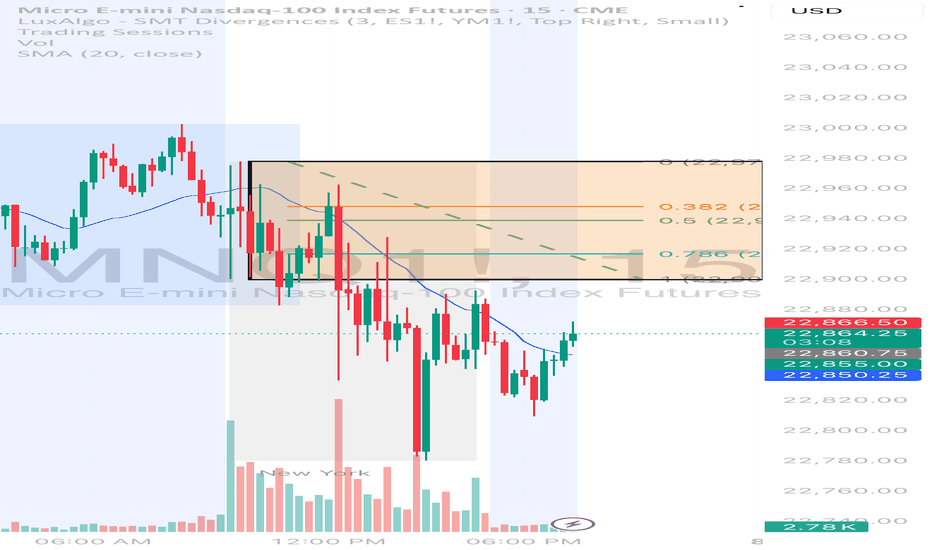

In NQ, we are looking at the following scenarios:

Key LIS zone: 22860.50 – 22825.50

Support Zone: 22600 – 22582.25

Key Support Zone: 22000 – 22050

Scenario 1: Hold above key LIS

In this scenario, we expect new ATHs and continuing price discovery higher.

Scenario 2: Hold below key LIS

In this scenario, we expect the price to re-test the support zone at 22600 – 22582.25 and consolidate to build value higher. A break below support may lead to further short opportunities to retest the 22000 level.

NQ Power Range Report with FIB Ext - 7/7/2025 SessionCME_MINI:NQU2025

- PR High: 23028.50

- PR Low: 22943.00

- NZ Spread: 191.25

No key scheduled economic events

First full trading day following long holiday weekend

Session Open Stats (As of 12:45 AM 7/7)

- Session Open ATR: 323.71

- Volume: 33K

- Open Int: 271K

- Trend Grade: Neutral

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

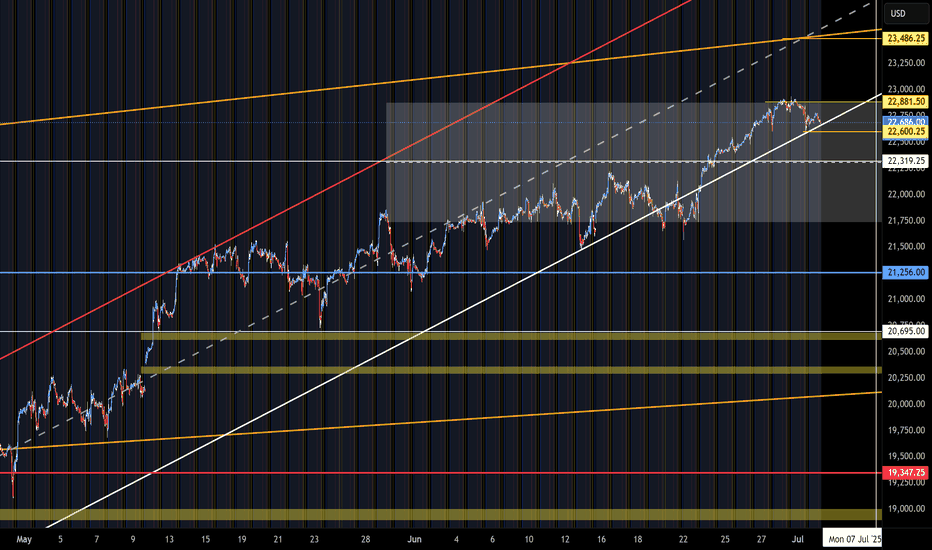

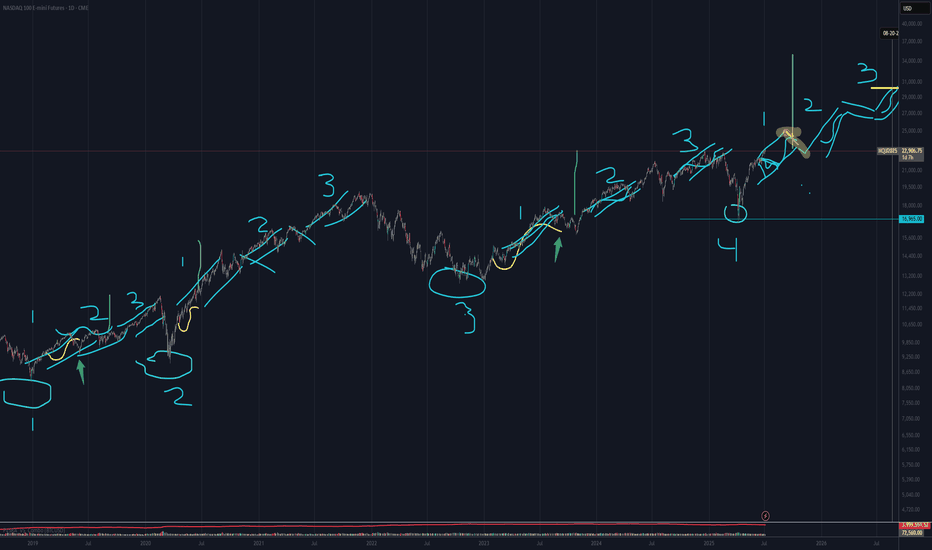

NASDAQ / $NQ!! Projecting the Next CycleIf history rhymes, we should see:

A 6–7 000‑point gentle climb (blue “2”) off the 17 000 springboard into ~23–24 000.

Followed by a sharper 8 000‑point blow‑off (blue “3”) into the low‑30 000s.

Of course, any big exogenous shock (geopolitics, Fed surprise) can alter the timing—but structurally the chart wants to repeat its 1→2→3 cycle into 2026.

NQ 100 E mini

🧠 NASDAQ 100 (NQ) Weekly Outlook – July 8–12, 2025

📍Liquidity Sweep Before Expansion?

After the rejection near 23,100, NQ appears to be entering a rebalancing phase, with potential downside liquidity grabs before any continuation to the upside.

📊 Key Technical Levels:

🔸 High: 23,102.50 → Major buy-side liquidity zone.

🔸 Equal Lows: 22,675 – 22,725 → Potential draw on liquidity.

🔸 0.75–1.00 retracement zone (from the recent bullish leg) overlaps with a clear demand area.

🔸 Multiple open Fair Value Gaps (FVGs) remain above and below current price.

📈 Primary Scenario:

✅ Bullish bias, after a potential liquidity sweep below the Equal Lows.

🔻 A downside sweep into the 22,675–22,725 zone would open up opportunities to go long on bullish confirmation, targeting:

22,975 (FVG fill)

23,050 (intermediate resistance)

23,102+ (liquidity above previous high)

⚠️ Alternate Scenario:

If the market fails to sweep the lows and begins pushing higher early in the week, I’ll look for breakout-retest setups above 22,975 to participate in continuation plays.

🎯 Weekly Game Plan:

Plan A: Wait for a liquidity sweep below the equal lows, then look for a bullish reaction and structure shift to go long.

Plan B: In the absence of a sweep, only consider longs above 22,975 after confirmation of strength.

📌 This outlook is based on price action, market structure, liquidity zones, and FVG analysis. Not financial advice.

July 7 - 11: Buy Stock Indices DIPs! Watch For Gold, Oil FVGs!In this Weekly Market Forecast, we will analyze the S&P 500, NASDAQ, DOW JONES, Gold and Silver futures, for the week of July 7 - 11th.

Stock Indices are strong, so dip opportunities should present themselves next week.

Gold is bullish-neutral. Could see strength enter this market as July 9th approaches.

Silver is bullish. No reason to short it.

Oil is in a Monthly +FVG. If the FVG fails, it will confirm bearishness. Couple that with the fundamentals, I am watching for that confirmations to sell US Oil.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.