UNFM2026 trade ideas

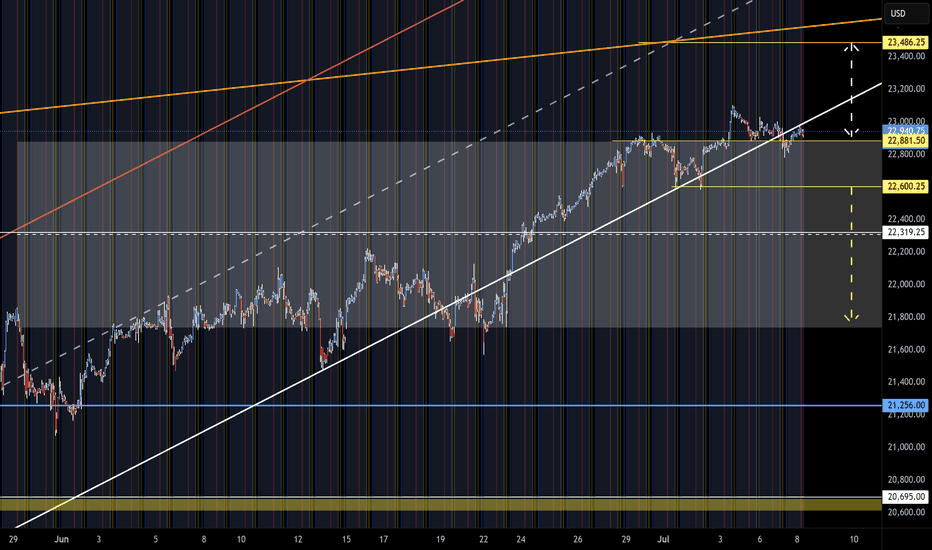

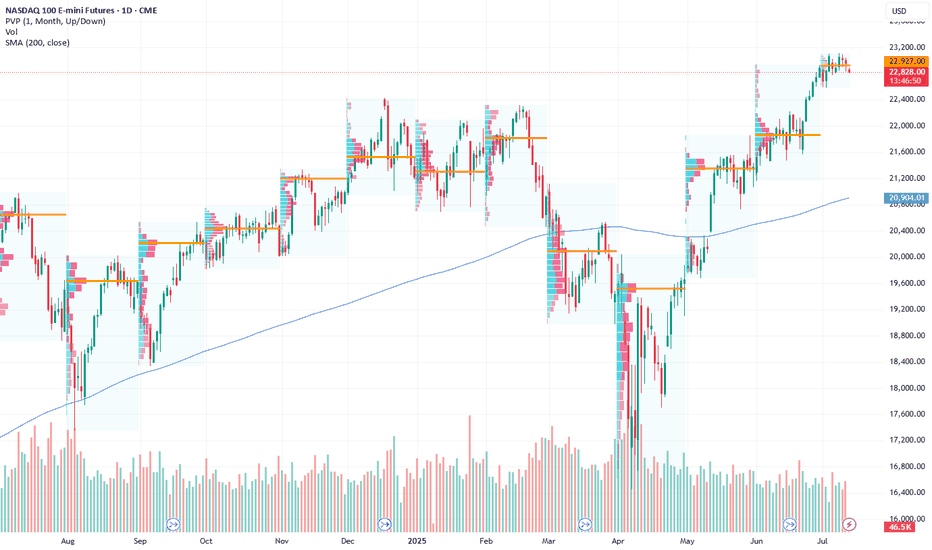

NQ Range (07-08-25)White arrow is stall/drop zone and yellow is strong short. The O/N continues to reset any drops that happen in most Reg Sessions. It appears to me that a weak/fake Euphoric Stage is being played out. The idea of chasing the NAZ (after the O/N redirect) is the game, no chase and the game will end. The O/N has been redirecting for about 2 years (can continue). Again, the recent 25% drop was erased with a Tweet & news release (10 min 2,000 point) move and a few O/N's. Just feels like a fake chase play since the pop of the bottom.

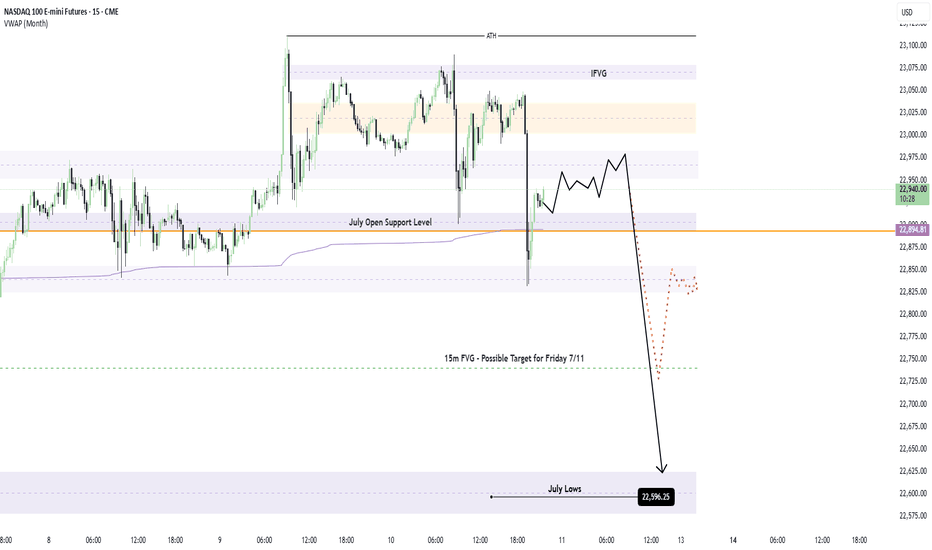

A Bearish July for Nasdaq?I hadn’t anticipated the -212 point move unfolding during the After Hours session—I'd mapped that reaction for the upcoming New York AM session open. That said, with momentum already in play, I’m maintaining my short bias. Price appears poised to revisit the July lows, with a high probability of trading through them and pressing further beneath the Monthly VWAP. I’m eyeing continuation to the downside as long as structure confirms the move.

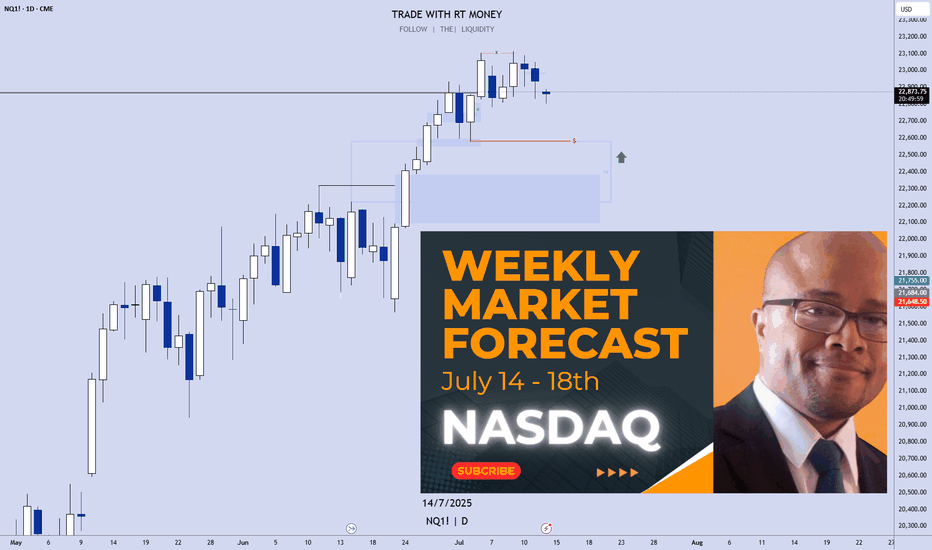

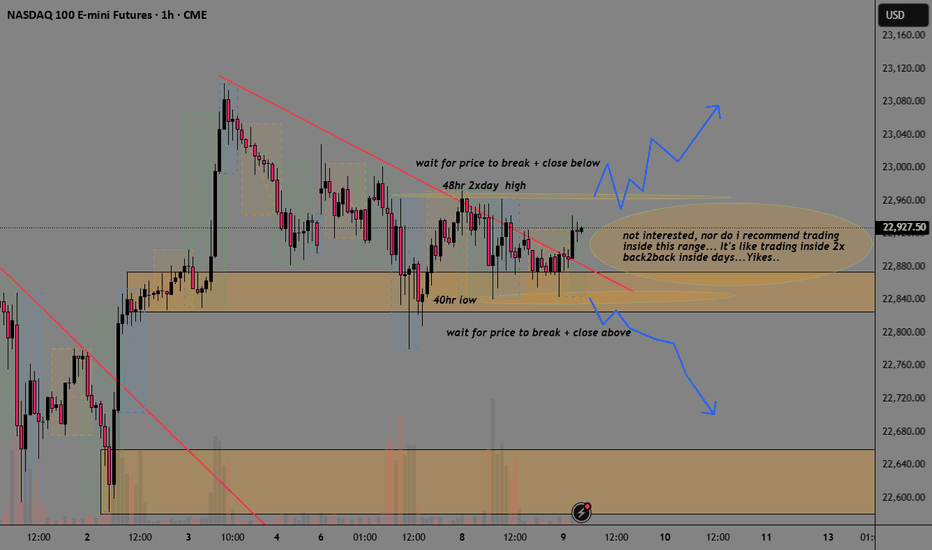

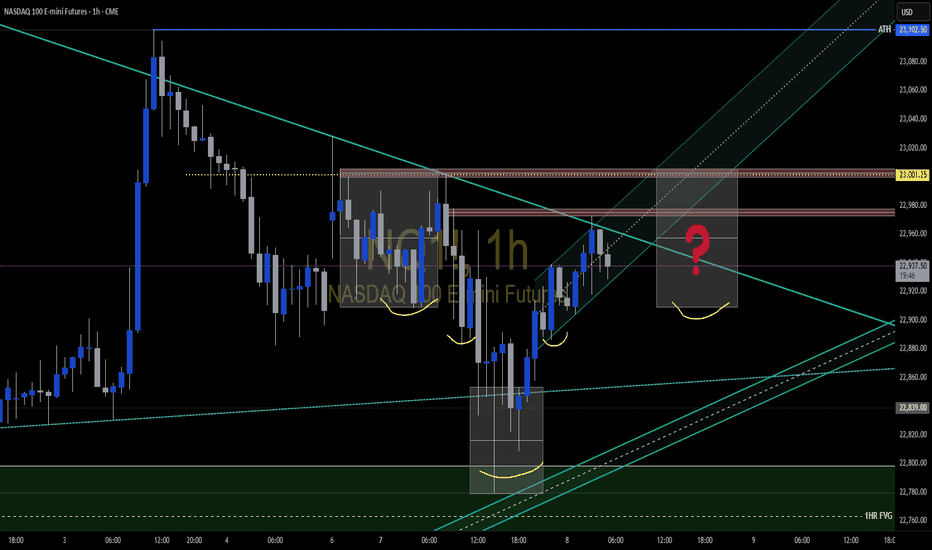

NASDAQ: Time For A Pullback?In this Weekly Market Forecast, we will analyze the NASDAQ for the week of July 14 - 18th.

The NASDAQ had a strong week, until Tariff Tensions Friday arrived.

This by itself doesn't mean we should start looking for sells. Just like the S&P 500, I'm expecting short term bearishness, as price goes from ERL to IRL.

With Tuesday CPI Data coming, this short term consolidation is to be expected until the news is announced.

Let the markets pick a direction, and flow with it.

Have a plan of action in place so you can react to the price action promptly!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

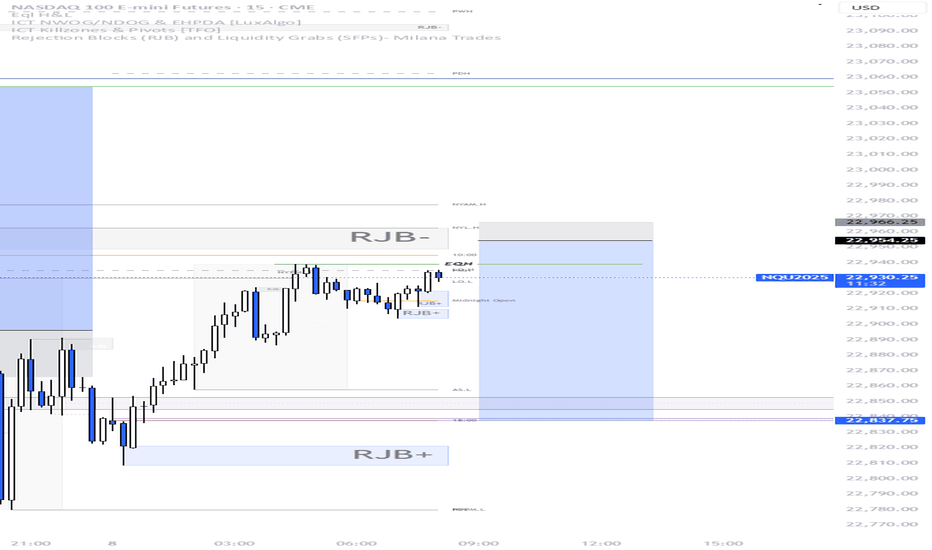

NQ Analysis ICT Liquidity Search Break-Out TradePrice is expected to open not just 1, but inside 2 previous days.

We have 2 options:

1) ICT silver bullet up my bum trader strategy traders are waiting

for liquidity search breaking highs or lows then reversing.

2) Break-out trades waiting for price to break and close above or below

24hour range and trade in direction of break-out.

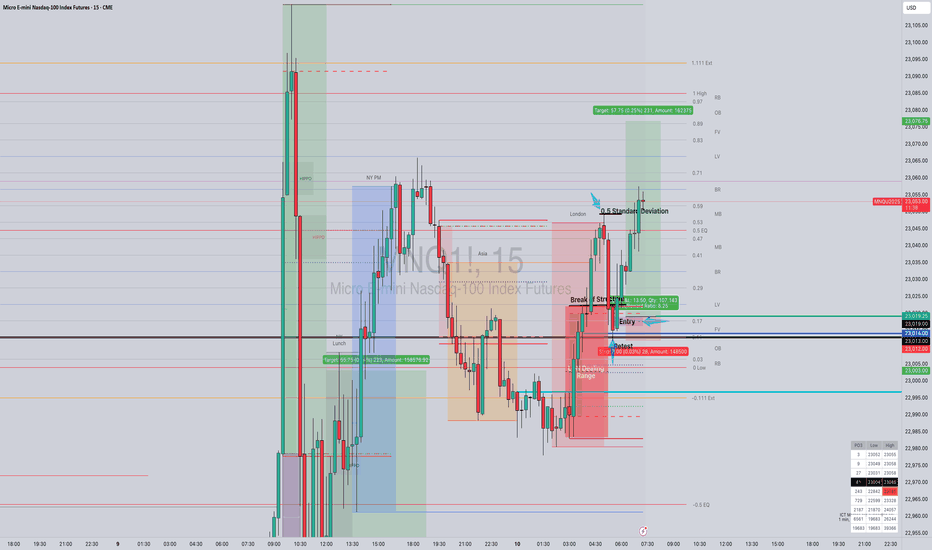

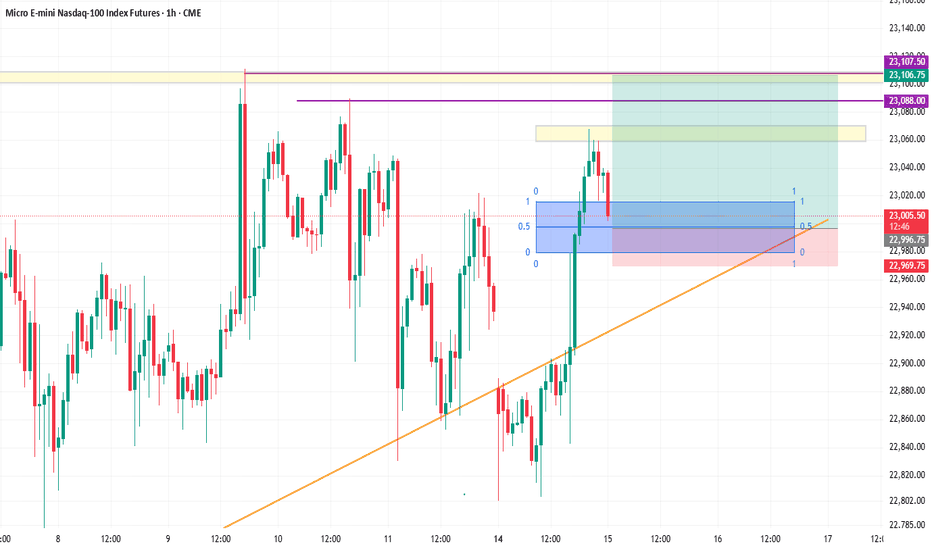

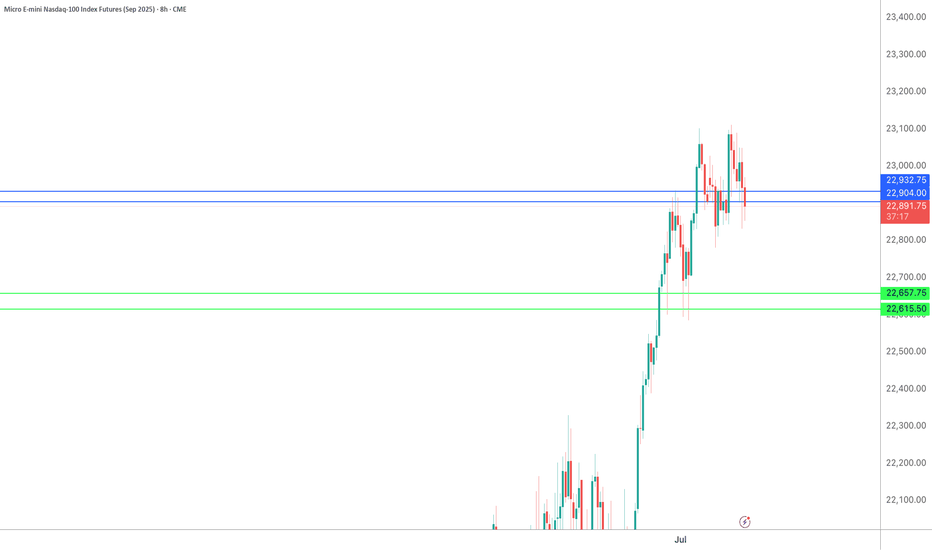

Trade Journal Entry MNQ1! – Micro E-mini Nasdaq-100 Futures

Trader: Lord MEDZ

Date: Thursday, July 10, 2025

Instrument: MNQ1! – Micro E-mini Nasdaq-100 Futures

Timeframe: 5-Minute Chart

Strategy: Master OD + IDR + DR Setup

Entry Model: Goldbach PO3 81 | M1 + FVG Confluence

🧠 Narrative & Trade Idea

This setup was based on the Master OD, Initial Dealing Range (IDR), and Dealing Range (DR) model, incorporating a Goldbach PO3 81 entry on the 1-minute chart with a confirmation retest.

London Dealing Range (LON DR) was established, followed by a Break of Structure (BoS) confirming bullish intent.

Price extended to 0.5 Standard Deviation, where profit-taking and a pullback were expected.

The pullback offered a retest of the DR high and tapped into a 1-minute Fair Value Gap (FVG) – key for PO3 81 entries.

Price also interacted with an Order Block (OB) confluence around 23,011.

Trade entry was executed cleanly with tight risk and high R:R logic.

📍 Execution Details

Entry: 23,019.00

Stop Loss: 23,011.00

Target: 23,077.00

Risk: 8.00 pts

Reward: 58.00 pts

Position Size: 12 contracts

Total Risk: $148.50

Total Reward Potential: $1,623.75

Risk/Reward Ratio: 1:8.22 ✅

🔍 Technical Confluences

✅ Clean Break of Structure from LON DR highs

✅ Retest of DR zone aligned with 1-min Fair Value Gap

✅ Price tapped into Order Block + PO3 81 criteria met

✅ Entry model: Precision M1 PO3 81 + 1m/5m alignment

✅ Target aligned with premium OB zone + 1.0 ext level

📈 Trade Outcome & Lessons

The execution respected both structure and order flow principles.

PO3 81 delivered textbook performance off the retest.

Strong emotional discipline shown by holding for full R:R.

Setup validated the predictive strength of the Master OD + IDR system with Goldbach’s entry logic.

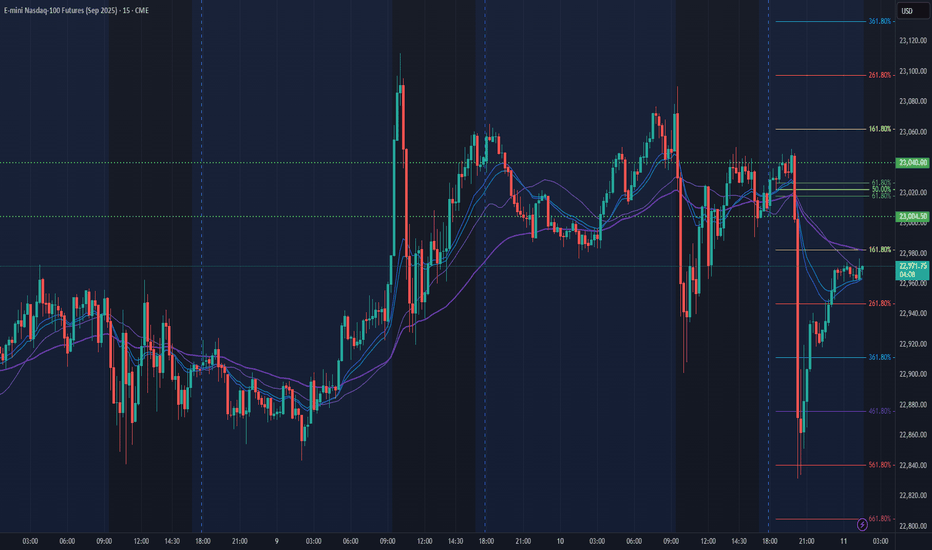

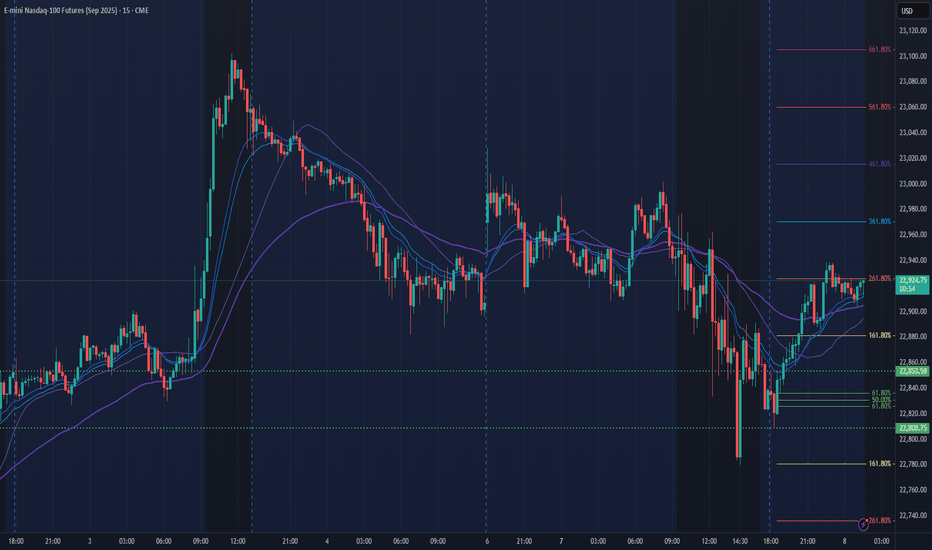

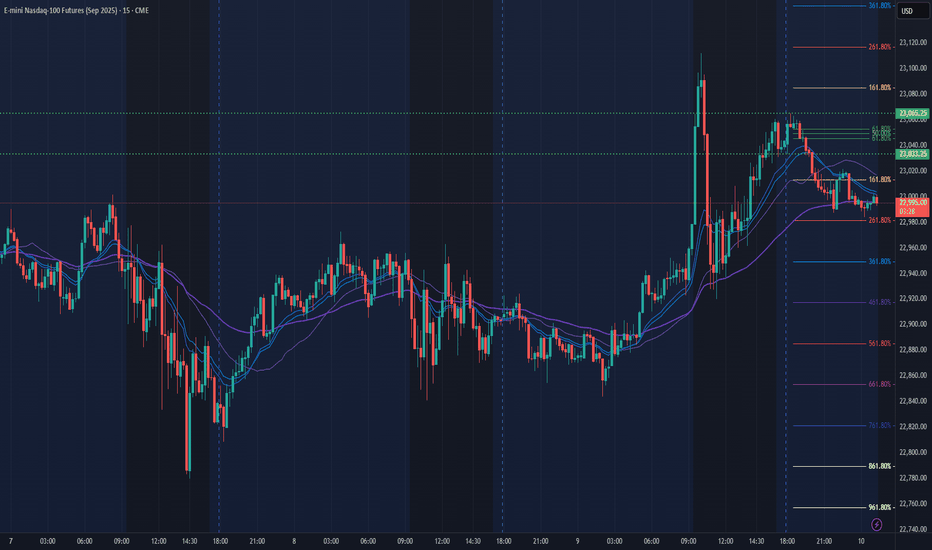

NQ Power Range Report with FIB Ext - 7/11/2025 SessionCME_MINI:NQU2025

- PR High: 23039.75

- PR Low: 23004.50

- NZ Spread: 78.75

No key scheduled economic events

High 200+ range volatility during Asian hours

Session Open Stats (As of 1:35 AM 7/11)

- Session Open ATR: 301.79

- Volume: 48K

- Open Int: 268K

- Trend Grade: Neutral

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

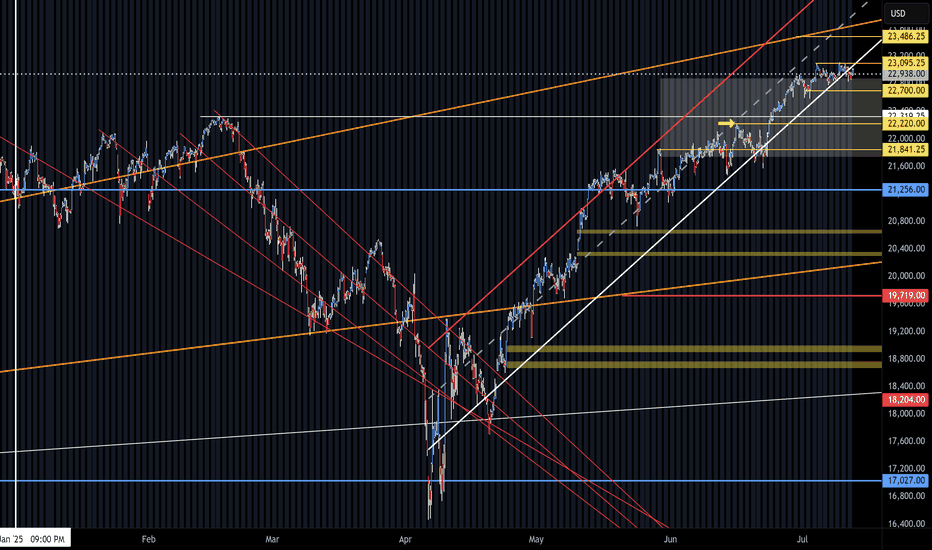

July 7 - 11: Buy Stock Indices DIPs! Watch For Gold, Oil FVGs!In this Weekly Market Forecast, we will analyze the S&P 500, NASDAQ, DOW JONES, Gold and Silver futures, for the week of July 7 - 11th.

Stock Indices are strong, so dip opportunities should present themselves next week.

Gold is bullish-neutral. Could see strength enter this market as July 9th approaches.

Silver is bullish. No reason to short it.

Oil is in a Monthly +FVG. If the FVG fails, it will confirm bearishness. Couple that with the fundamentals, I am watching for that confirmations to sell US Oil.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

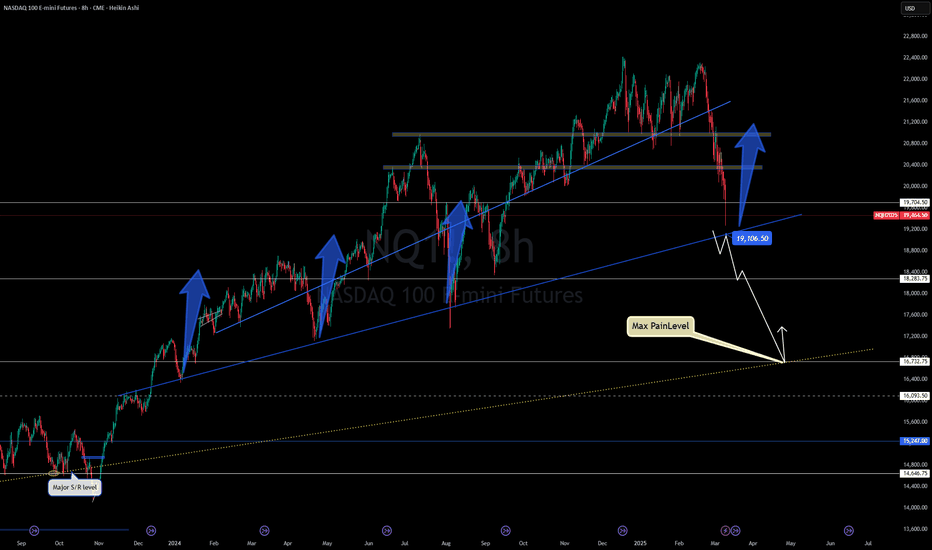

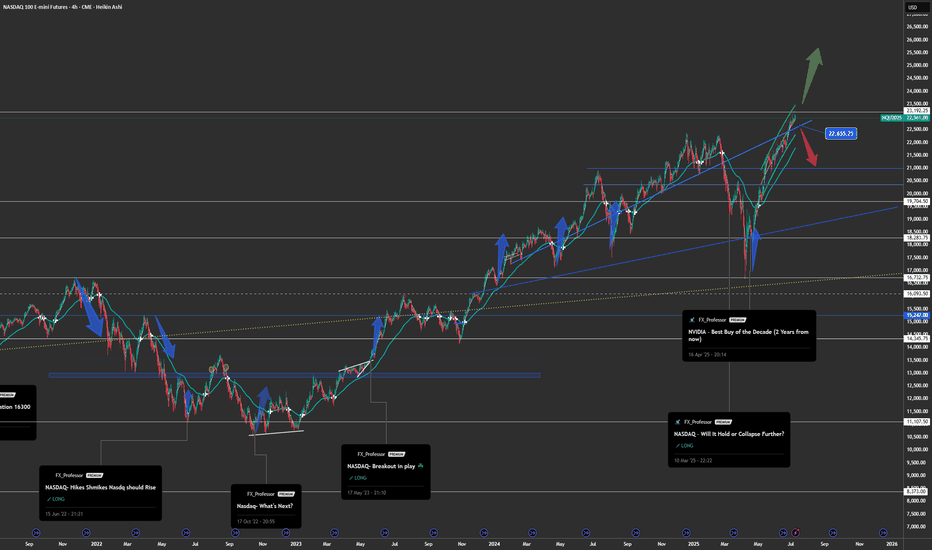

NASDAQ – Will It Hold or Collapse Further?📉🔥 NASDAQ Approaching Max Pain – Will It Hold or Collapse Further? 🚀⚠️

The NASDAQ 100 is hanging by a thread, as price approaches the key 19,106 support level. A breakdown from here could accelerate losses toward the 18,283 zone, and if things get worse, the dreaded 16,732 "Max Pain" level may be tested.

📊 Key Technical Levels:

📌 19,106 – First major support (bounce or breakdown zone).

📌 18,283 – Next key level if sellers take control.

📌 16,732 – The "Max Pain" zone, where long-term buyers may step in.

📌 15,347 – Ultimate demand zone if things spiral out of control.

🚨 Why Is Nasdaq Falling?

Tech stocks are getting destroyed, with Tesla leading the plunge.

Market panic over higher interest rates & economic uncertainty.

Bitcoin also struggling, highlighting broader risk-off sentiment.

💡 Will we see a relief rally from these levels, or is the bloodbath just getting started?

Drop your thoughts below!

One Love,

The FXPROFESSOR 💙

#Nasdaq #StockMarketCrash #TechStocks #Trading #MarketAnalysis

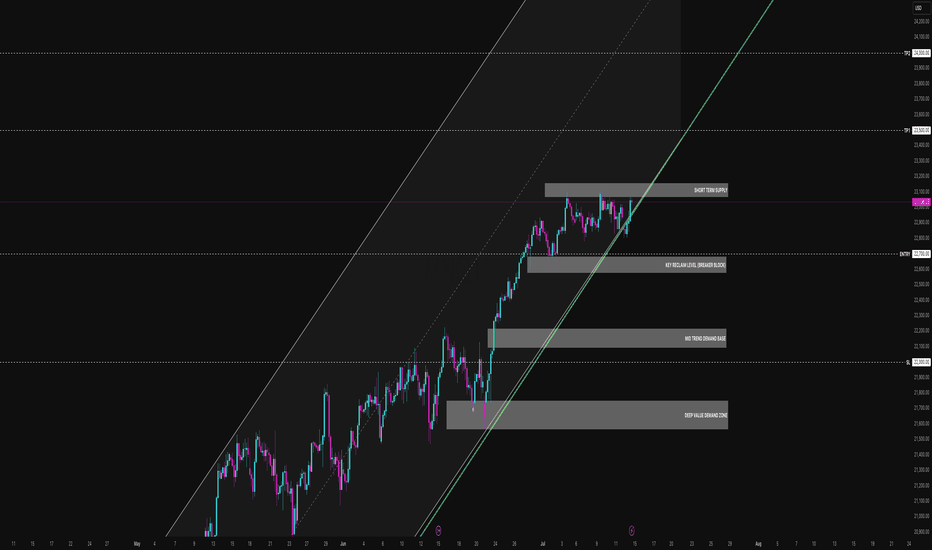

MNQ at the Supply Buffet. Will It Eat or SpitMNQ is hovering just under local highs after a textbook rally into a potential supply shelf. Price is compressing into a wedge between short-term resistance and dynamic trend line support. This is where the market reveals its hand either we break clean and run, or we roll over and unwind the entire move.

Here’s my full breakdown including swing entries, scalp options, confluence layers, and what I’m watching through the Tokyo, London, and NY sessions.

Primary trend: Bullish

Current condition: Compression under resistance (23,100 zone)

Market posture: Still within the ascending channel, but showing signs of indecision

We’re stacked on top of well-respected demand levels and riding a well-tested trend line. But price has now spent 5 sessions ranging just under short-term supply, and that opens up both breakout and breakdown scenarios depending on how it reacts in this key zone.

BULLISH SCENARIO — Trend Continuation

This play assumes the channel holds and buyers defend the 22,700 breaker block.

Primary Entry: 22,700 (Key reclaim level / breaker block)

Aggressive Entry: 22,950 (early reaction from structure front-run)

TP1: 23,500 (equal highs and channel extension)

TP2: 24,000 (clean trend extension target)

SL: 22,000 (below trend line and deep value failure)

Confluences:

Breaker block support from July 3 demand leg

Anchored VWAP from July 7 sits just above entry zone

Perfect alignment with channel midpoint and dynamic support

Buyers defended 22,700 multiple times during NY and London sessions

Macro still favouring tech risk-on

This is the continuation play. If 22,700 holds, I expect a swift push through supply with high reward potential.

BEARISH SCENARIO — Structural Breakdown

This play assumes the trend line and 22,700 level give way, confirming a change in structure.

Trigger: Clean 15m or 30m close below 22,700 and no buyer reclaim

Entry on Retest: 22,680–22,700 zone after breakdown

TP1: 22,200 (mid-trend demand base)

TP2: 21,900 (deep value demand zone)

SL: Above 22,800 (back inside structure = idea invalid)

Confluences:

Overhead supply has held 4+ sessions

Multiple liquidity sweeps above 23,100 with no follow-through

Momentum divergence + distribution signs on 5m-15m

London session often traps longs just before breakdowns

This isn’t about calling tops it’s about recognising when support fails. If 22,700 goes, the dominoes start falling.

Scalper Setup (Tokyo/London Focus)

For intraday traders hunting reactive entries with tight stops.

Short Idea:

Setup: Price sweeps into 23,090–23,130 zone during low liquidity (Tokyo/London premarket)

Trigger: Rejection wick or bearish engulfing on 5m–15m

TP: 22,950 or 22,700

SL: 23,150

Long Idea:

Setup: Quick drop into 22,950–22,900 front-run zone (pre-NY)

Trigger: Bullish engulfing or delta flip

TP: 23,100–23,200

SL: 22,850

Chart Structure Summary:

23,090–23,130 Short-Term Supply, Resistance shelf, range ceiling

22,700–22,750 Breaker Block Key structure to hold for bulls

22,200–22,400 Mid Demand Base, Trend structure, good R/R long

21,900–22,050 Deep Value Demand, Swing long zone, last line for bulls

Strategy Notes:

Use 15m for structure, 5m for entry, and 1H to confirm trend

Volume delta and order flow helps confirm traps/sweeps

Watch VWAP if price holds above, bias remains up

Don’t trade blindly into supply without confirmation let it reject or break

This isn’t just a supply test it’s a decision point for the next 300+ ticks.

The market is either:

Absorbing above demand and about to explode, or slowly distributing before a trend break.

As always don’t marry a bias. Let the levels do the talking. React, don’t predict. Let me know in the comments how you’re planning to play this.

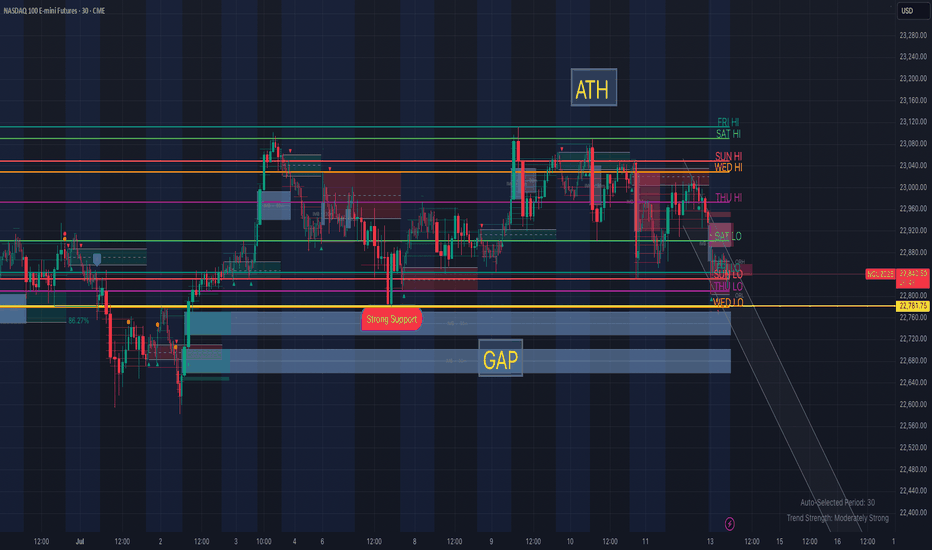

Eyes on the Gap – Discipline Over FOMO NQ📌 Waiting for High-Probability Levels to Engage

Right now, price has been stuck in a multi-week range, coiling just beneath major resistance and above strong demand. I’m not forcing trades — I’m waiting for price to reach the key gap zone and confirmed strong support near 22,781.75.

No reason to act until the market gives me a clear setup.

The real move will come from the edges — not the middle.

🔹 Support Confluence: Gap fill zone + Strong Support label

🔹 Range Context: Price capped under ATH & recycling between session highs/lows

🔹 Bias: Bullish only after sweep or confirmed hold of the lower zone

💬 Discipline is waiting when others get chopped up in the middle. Let the trap spring — then strike.

#PlaymakerTrading #GapZone #SmartMoneyLevels #NQFutures #MarketStructure #SupportAndResistance

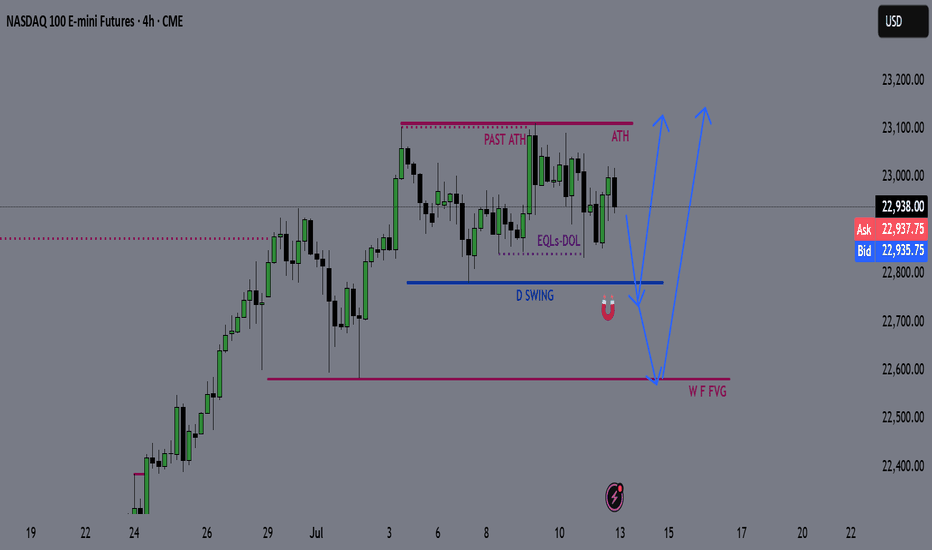

NQ Weekly Recap-Projection 13.07.2025NQ Weekly Recap + Outlook

1️⃣ Recap:

NQ made a new All-Time High, but the breakout ended up being a deviation. Price got rejected and started pulling back.

This signals potential weakness and suggests price may want to explore lower levels.

2️⃣ Bearish Scenario:

📍Target: Daily Swing low (Blue line)

📍Deeper target: Weekly Fair Value Gap (Purple zone)

I’ll look for LTF confirmations around these zones to position for potential longs.

3️⃣ Bullish Catalyst Watch:

There’s increasing speculation that Powell may resign this week.

If that happens, we could see:

✅ Strong bullish momentum

✅ Little to no retracement

✅ Immediate push into new ATHs

Weekly Plan Summary:

🔸 Scenario 1 - Pullback Continuation:

Look for reactive long setups at Daily Swing or W FFVG zone.

🔸 Scenario 2 - Powell Resignation:

Expect a breakout move with momentum — potentially no retrace.

Stay nimble. Trade what the chart confirms, not what the news promises.

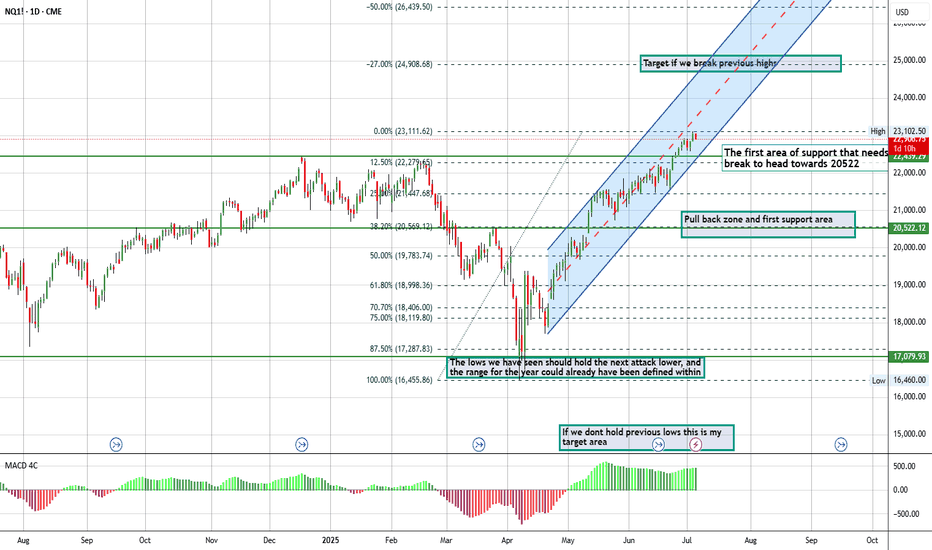

NASDAQ – Decision Point is Now: Breakout or Breakdown?📈🔍 NASDAQ at Key Inflection – Momentum or Meltdown? ⚠️💥

Hey Traders,

The NASDAQ 100 is now standing right at the make-or-break zone: 22,655. This level marks a critical retest of the recent breakout, and what happens here could define the next major move.

🔵 The Setup:

After a strong bounce and sharp rally from below 18K, we've climbed back into the tight ascending structure. But momentum is slowing…

This zone could produce either a bullish continuation to new highs — or a brutal rejection that unwinds the entire move.

📍 Structure Speaks:

Holding above 22,655 = likely continuation

Breakdown = deeper pullback toward 20,000 and lower channel support

Momentum names like NVIDIA are doing the heavy lifting again — but can they sustain the market alone?

📊 What I'm Watching:

Bullish path = measured target ~25,000+

Bearish path = test of the broader trendline near 20,000 or even the 18,200 region

Macro signals still mixed — stay nimble, not married to one bias

⚠️ Stay Sharp:

Just like in crypto, the Nasdaq can punish both bulls and bears when it enters chop mode. Structure and discipline remain your best defense.

I’ve updated the chart — fresh out the oven 🍞 — and more market ideas are following, including BTC, ETH, and BTC Dominance.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

NQ Power Range Report with FIB Ext - 7/8/2025 SessionCME_MINI:NQU2025

- PR High: 22853.50

- PR Low: 22808.50

- NZ Spread: 100.5

No key scheduled economic events

Session Open Stats (As of 12:25 AM 7/8)

- Session Open ATR: 318.85

- Volume: 24K

- Open Int: 269K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NASDAQ Futures: Consolidation Signals Potential Bearish Trend NeCurrent Price: 22959.0

Direction: SHORT

Targets:

- T1 = 22400

- T2 = 22200

Stop Levels:

- S1 = 23150

- S2 = 23320

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in NASDAQ Futures.

**Key Insights:**

NASDAQ Futures are currently consolidating after reaching new highs earlier this quarter. This period of range-bound activity is marked by a decreasing daily trading range, suggesting market indecision among investors. The emergence of lower highs and lower lows in recent sessions signals a potential bearish momentum in the near term, with key support levels being monitored closely.

Additionally, macroeconomic factors such as global geopolitical tensions and tariff developments are contributing to investor caution. Recent data highlights the sensitivity of this asset to broader market sentiment. A break below key support might further solidify bearish sentiment, creating downside momentum.

**Recent Performance:**

In recent weeks, NASDAQ Futures rallied to achieve an all-time high but have since moved into a phase of consolidation. Price action has narrowed considerably, with the daily range contracting to 158 points from 192 points, reflecting decreasing volatility. The consolidation reflects growing caution in the market amidst an environment of tightening economic conditions and continued uncertainty.

**Expert Analysis:**

Market analysts have pointed out that consolidation following a strong rally is not uncommon. However, technical indicators are showing early signs of weakness. NASDAQ Futures currently trade near critical support levels aligned with the 50-day simple moving average (SMA). A breakdown below these levels could trigger a more significant correction to the downside. Resistance at $23,200 remains strong, and the inability to breach this level confirms bearish sentiment. Furthermore, a lack of supportive macroeconomic catalysts could prolong this period of weak momentum or further amplify the downside risks.

**News Impact:**

Recent market news includes heightened geopolitical tensions and the continued ripple effects of economic tariffs. These developments have dampened sentiment across equity markets, contributing to heightened caution and consolidation trends. Investors should carefully analyze updates on these fronts, as any resolution or escalation has the potential to swing markets significantly.

**Trading Recommendation:**

Given the consolidation observed in the NASDAQ Futures and the emerging signs of bearish momentum, a short position with targets at $22,400 and $22,200 is recommended. This setup is aligned with technical indicators and key macroeconomic concerns currently influencing market dynamics. Stop levels are set at $23,150 and $23,320 to manage risk in case of unexpected bullish reversals.

NQ Power Range Report with FIB Ext - 7/10/2025 SessionNQ Power Range Report with FIB Ext - 7/10/2025 Session

CME_MINI:NQU2025

- PR High: 23065.25

- PR Low: 23033.25

- NZ Spread: 71.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

13:00 | 30-Year Bond Auction

Session Open Stats (As of 12:35 AM 7/10)

- Session Open ATR: 300.61

- Volume: 20K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

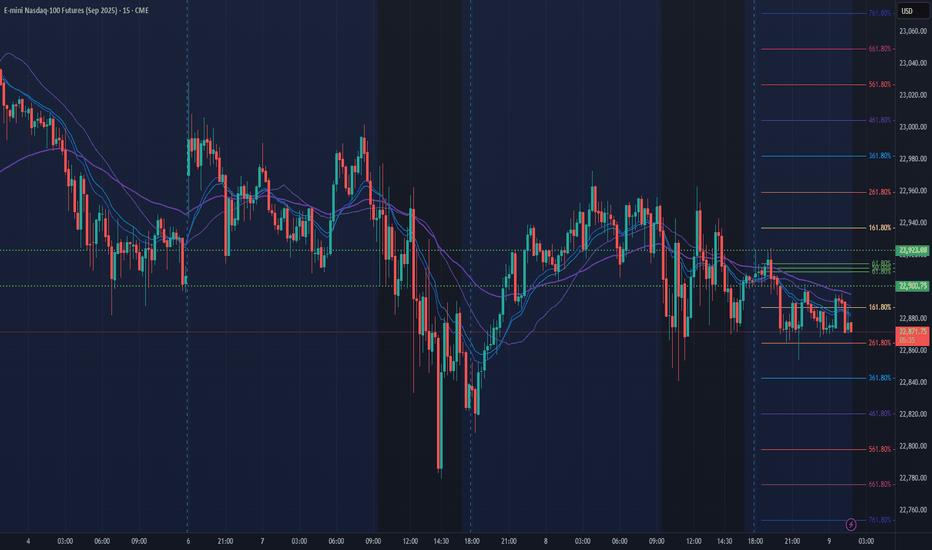

NQ Power Range Report with FIB Ext - 7/9/2025 SessionCME_MINI:NQU2025

- PR High: 22923.00

- PR Low: 22900.50

- NZ Spread: 50.5

Key scheduled economic events:

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:25 AM 7/9)

- Session Open ATR: 303.33

- Volume: 16K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone