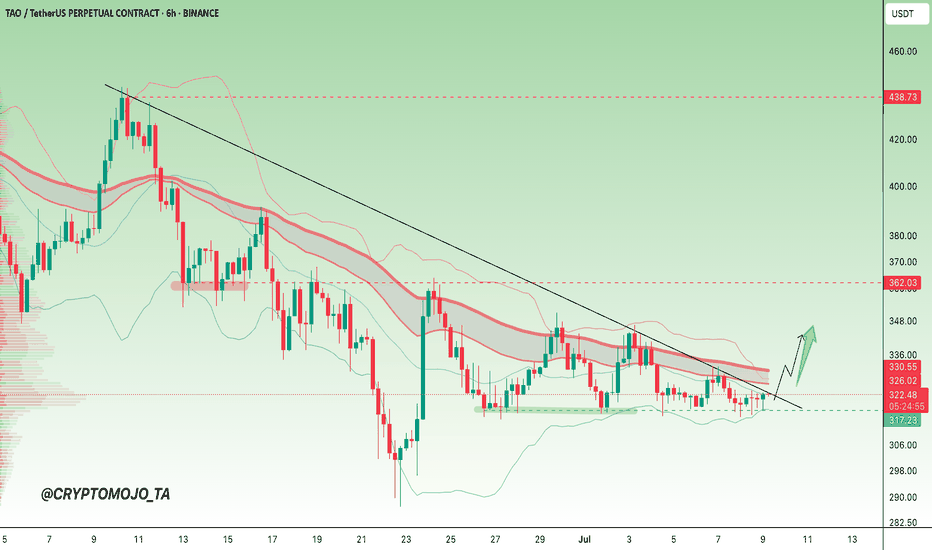

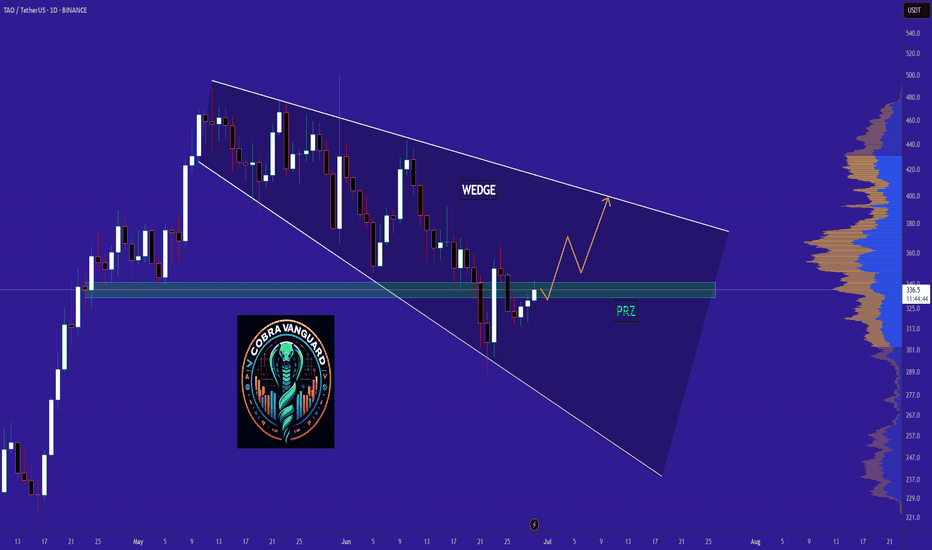

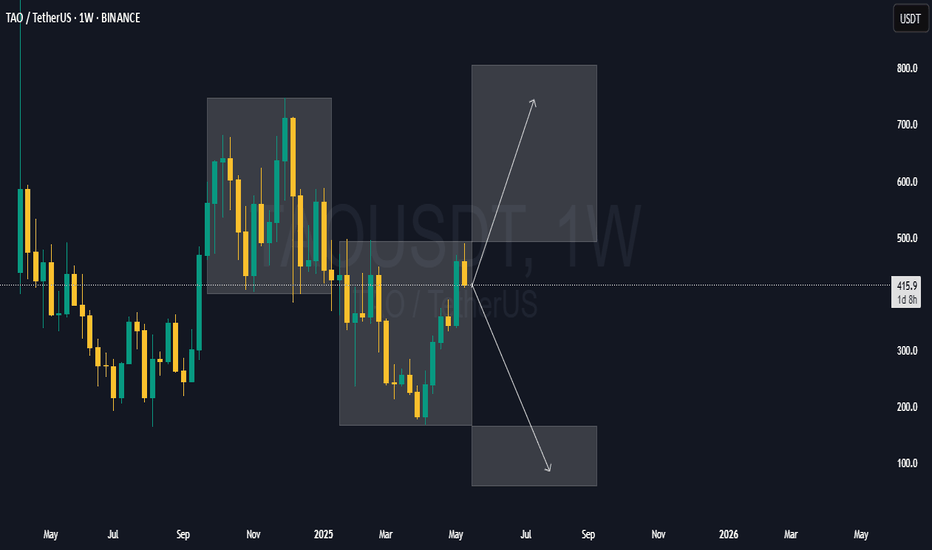

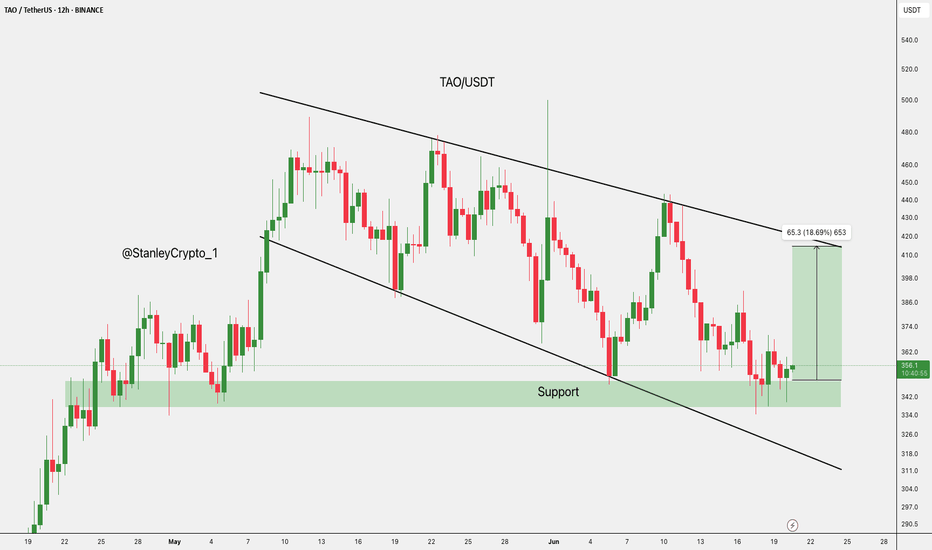

Rising Pressure on $TAO, Is the Trendline About to Crack?GETTEX:TAO is gearing up for a breakout 🔥

After weeks of consolidation, RNDR is now moving within a rising structure and pushing against a key descending trendline from the previous highs.

🔍 What the chart shows:

Descending Trendline Resistance: Price has tested this trendline multiple times, a breakout would signal strength.

Higher Lows: Buyers are consistently stepping in early, showing increasing demand.

Tight Price Action: Price is getting squeezed, indicating an explosive move could be near.

Volume: Slight rise in volume suggests growing momentum.

🎯 Trade Setup Idea:

Entry: Break and retest above $330

Stop-loss: Below $310

Target 1: $380

Target 2: $440

A breakout above the trendline could trigger a strong upside move.

DYOR. NFA

GETTEX:TAO BINANCE:TAOUSD BINANCE:TAOUSDT

TAOUSDT trade ideas

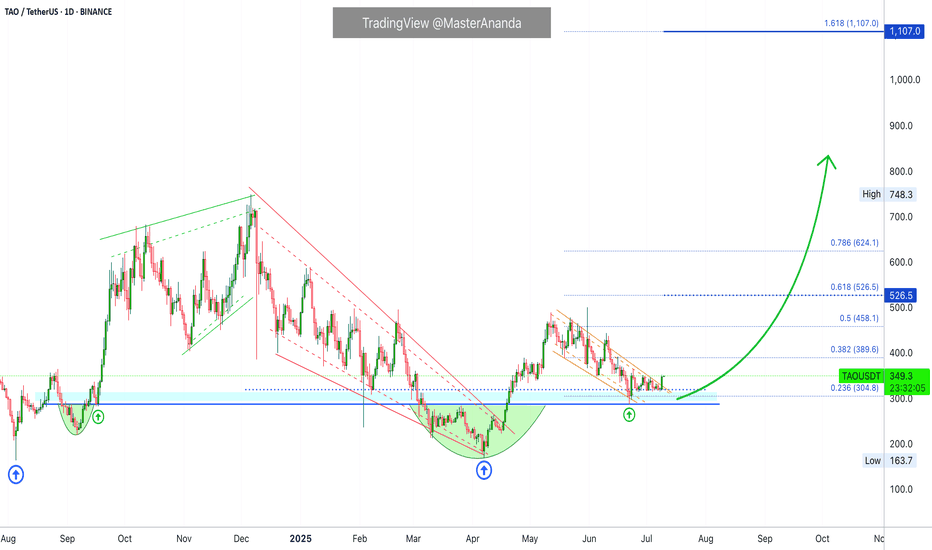

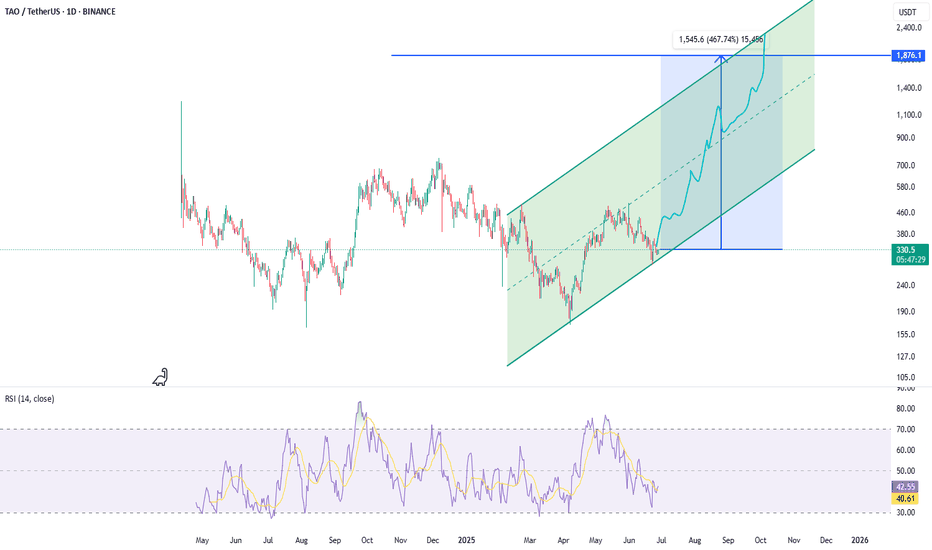

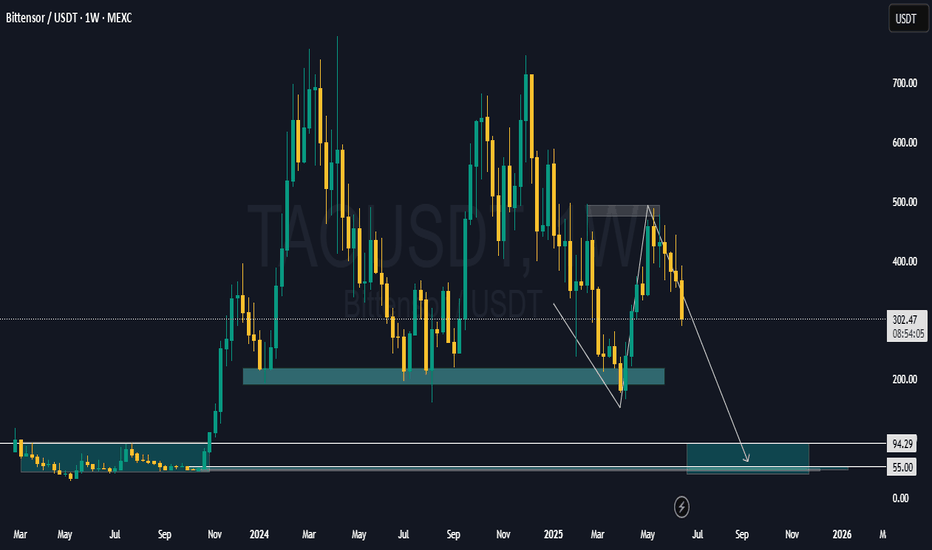

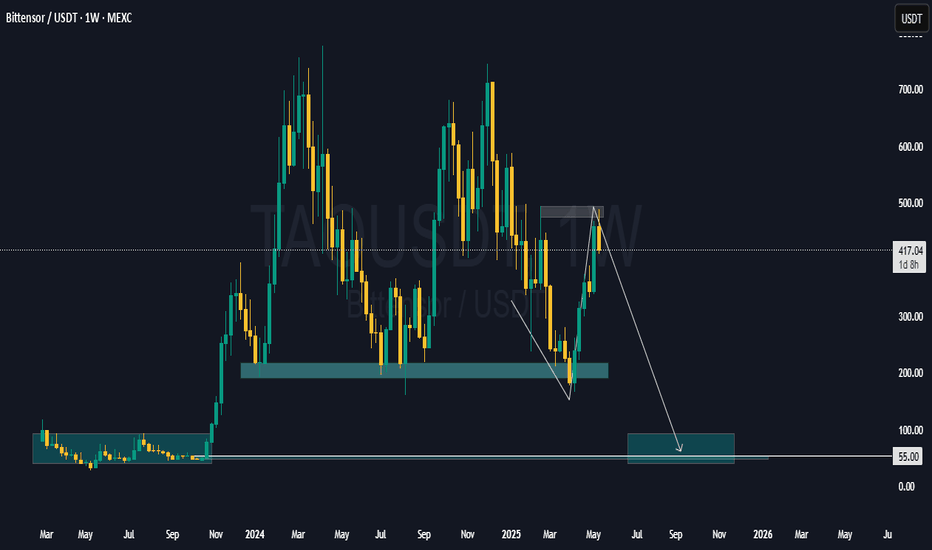

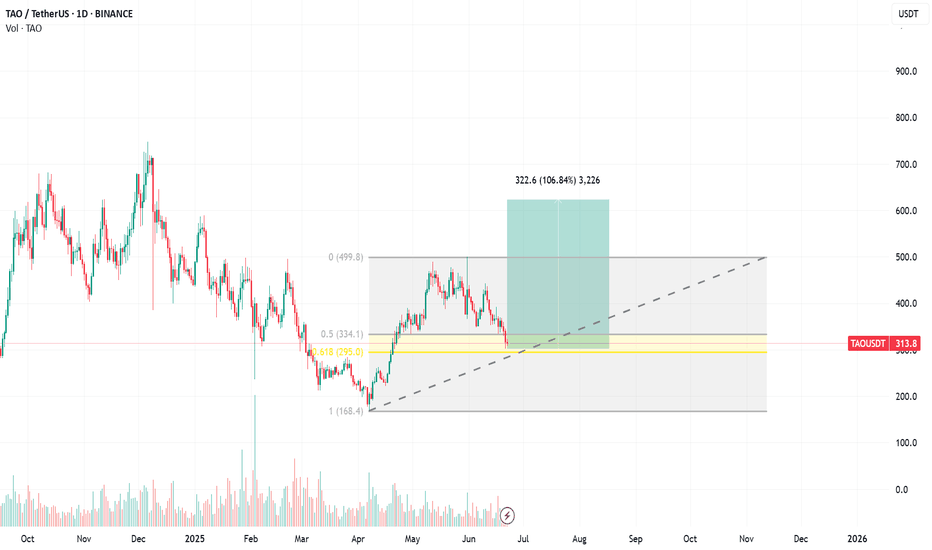

Bittensor Goes Bullish · $1,107 Price Target Within 6 MonthsHere is a very interesting piece of information. The same 22-June low worked as support back in September 2024. Needless to say, the test of this level propelled a major bullish phase. Conditions are similar now, not the same but similar. Bittensor is stronger now compared to late 2024, so we can expect the bullish wave that follows also to be stronger and thus a $1,107 price target mid- to long-term. Within 3 to 6 months.

Today we have a bullish breakout from the current structure with confirmation of long-term support and the higher low. TAOUSDT is now entering a new wave of growth. This is a long-term event, this wave should last all through 2025 and possibly beyond.

You can find additional details on the chart.

Leave a comment if you have any questions. Follow if you enjoy the content and would like to see more.

Namaste.

TAO - Bullish Channel - Easy 5-10x🧠 Bittensor ( LSE:TAO ): The AI Infrastructure Play Hiding in Plain Sight

In a crypto market crowded with overhyped narratives and underdelivered roadmaps, Bittensor ( LSE:TAO ) stands out as one of the most structurally sound, undervalued, and long-term scalable tokens in the entire AI x crypto sector. Despite a current market cap of ~$3B, the upside potential remains largely untapped.

🔍 TL;DR: Why Bittensor Could 5–10x From Here

Real utility in the AI stack: decentralized machine learning marketplace, not vaporware

$3B market cap is tiny compared to the trillions flowing into AI infrastructure

Network effects + crypto incentives = exponential flywheel

Tokenomics favor scarcity and network value accrual

Could be the “Nvidia of decentralized AI”

⚙️ What is Bittensor?

Bittensor is a decentralized network for machine intelligence. Instead of siloing AI development inside closed corporate labs (like OpenAI or Anthropic), Bittensor incentivizes open-source contributors to train and provide AI models to the network.

It’s a proof-of-intelligence protocol where miners contribute compute and models, and are rewarded in LSE:TAO tokens based on the quality and usefulness of their output.

Think of it as:

“A decentralized, crypto-native version of HuggingFace + OpenAI + AWS rolled into one trustless protocol.”

🧠 The LSE:TAO Bull Case

1. Massive Market Tailwinds

The AI industry will exceed $1.8 trillion by 2030 (PwC, Bloomberg estimates)

Current AI infra is centralized and bottlenecked (e.g., API limits from OpenAI, model censorship, GPU shortages)

Bittensor taps into the open-access, decentralized future of AI, where censorship resistance and incentive alignment matter

Even a 0.1% capture of AI infrastructure spend = $1.8B/year in value flowing through TAO.

2. Superior Token Design

LSE:TAO is the fuel for both training and inference — all compute value flows through it

Scarcity baked in: 21 million max supply (same as Bitcoin)

Inflation rewards productive nodes, meaning value is tied directly to performance and adoption

Validators and miners stake TAO — creating constant buy pressure from participants who need skin in the game

TAO is not a meme — it’s an incentive layer for decentralized intelligence.

3. Network Effects Just Beginning

TAO ranks and rewards subnetworks based on model performance, sparking competition

As more builders contribute models, the value and intelligence of the network improves

Early movers get rewarded heavily (like Bitcoin in 2011 or Ethereum miners in 2016)

Low retail awareness right now = asymmetry for early investors

4. $3B Market Cap Is Misleadingly Small

For context:

Chainlink ( BIST:LINK ) = $11B cap with no real network effect

Arweave = ~$2.5B for decentralized storage

OpenAI (private) = $80B+ valuation

Nvidia = $3T+ valuation with GPU dominance

TAO offers something none of them do: a decentralized, monetizable brain — and it’s only just starting to scale.

A move to $15–$30B (5–10x from here) is conservative if Bittensor becomes the de facto decentralized AI coordination layer.

5. The Right Narrative at the Right Time

AI + crypto is the most investable narrative of this cycle

TAO is the only AI token with real compute and learning on-chain

VCs and institutions are increasingly looking for AI token exposure — and TAO is one of the few with a credible moat

🏁 Final Thoughts

If you're looking for a conviction trade that combines crypto-native scarcity, real-world AI utility, and explosive upside in a still-underappreciated niche, Bittensor is that play.

It’s not just another token riding the AI hype. It’s an ecosystem building the future of decentralized intelligence — with a token that rewards performance, scales with adoption, and is designed to accrue real value.

In a world where data is the new oil, Bittensor is building the decentralized refinery.

Disclosure: As always, do your own research. But in a space full of noise, LSE:TAO is one of the few tokens that could genuinely outperform 5–10x from here — and still have room to run.

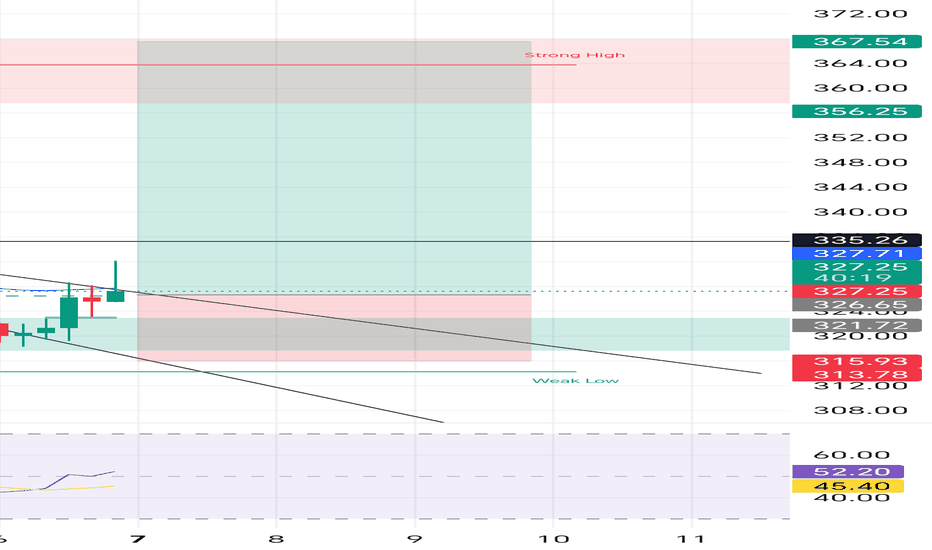

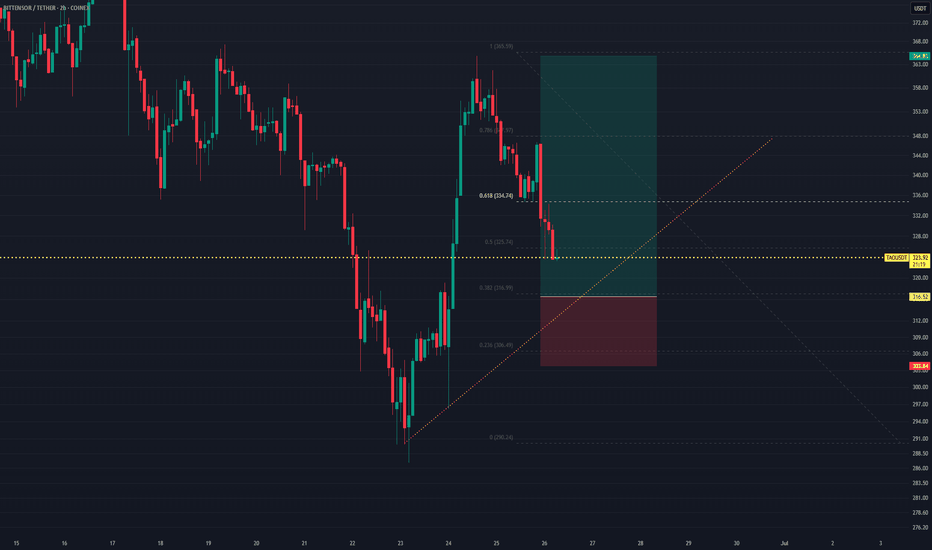

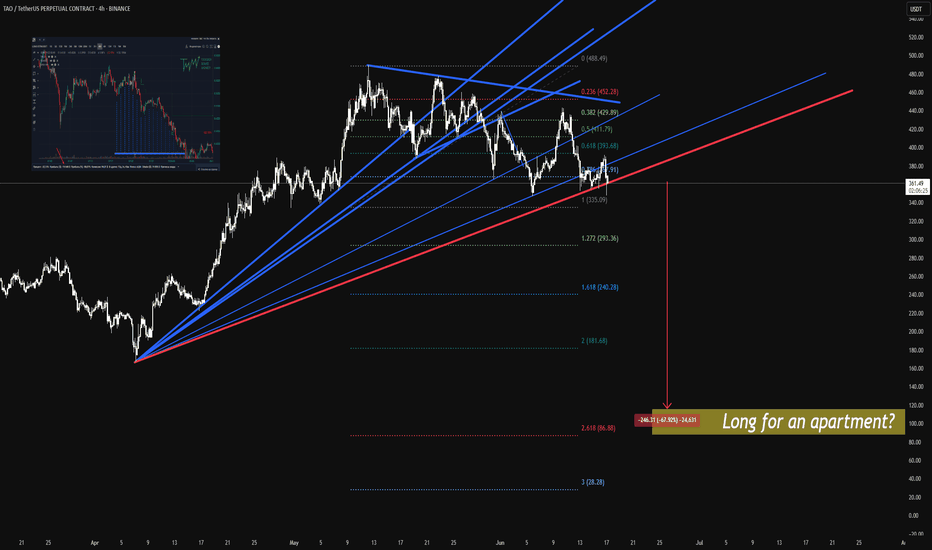

TAOUSDT Long Setup from Fibonacci 0.382 and Trendline ConfluenceTAOUSDT has retraced into a strong confluence zone combining the 0.382 Fibonacci retracement level ($316.99) and a long-term ascending trendline. This area is often considered a high-probability bounce zone in bullish market structures.

A long position was entered at $316.52, anticipating a continuation of the uptrend toward the previous swing high near $364.83.

The setup offers a high reward-to-risk ratio, with a tight invalidation level below recent structural support and Fibonacci level.

🧩 Trade Parameters:

- Entry: $316.52

- Stop Loss: $303.84

- Take Profit: $364.83

- Risk: $12.68

- Reward: $48.31

- Risk:Reward Ratio: 1 : 3.81

✅ Bias:

Bullish continuation after a healthy correction

🔄 Confirmation:

Strong price reaction or bullish candle from the 0.382 Fib and trendline support

❌ Invalidation:

Clean break below $303.84 (structural and Fib support)

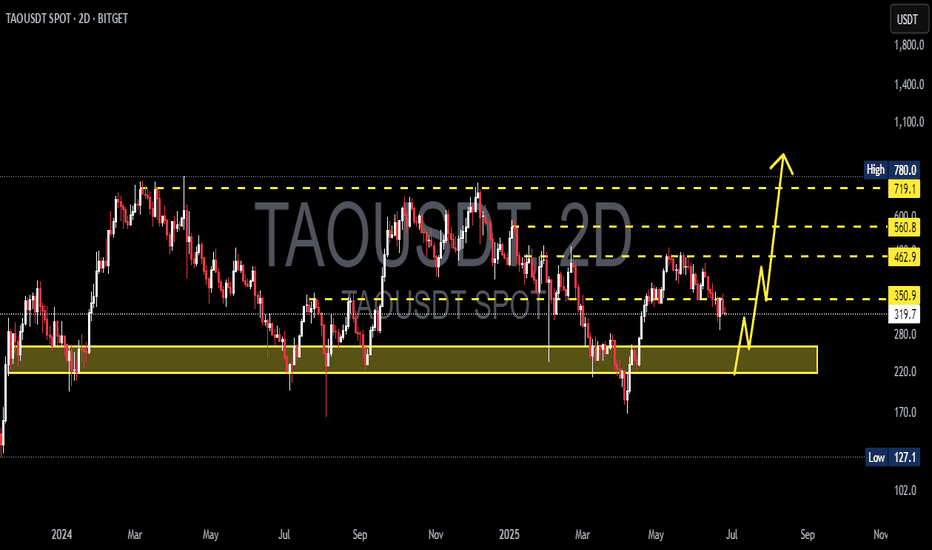

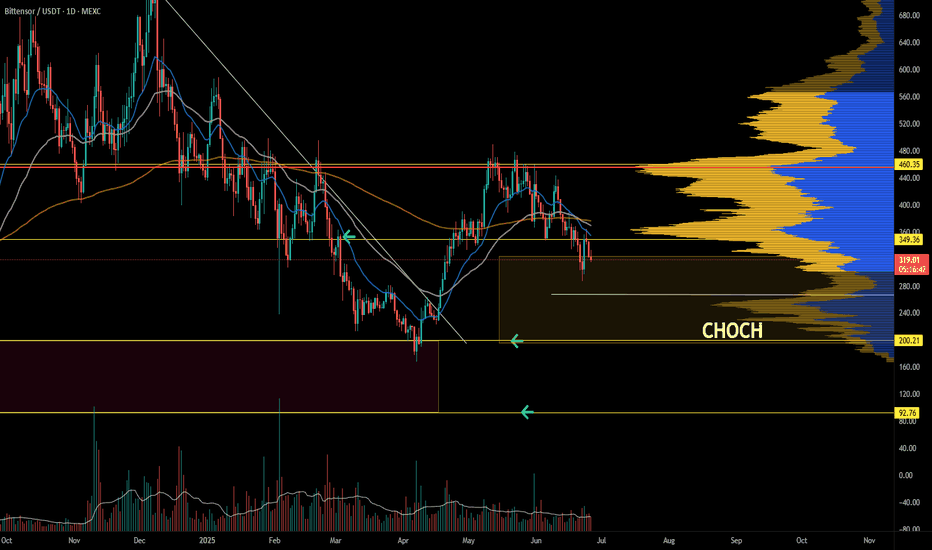

TAO/USDT Potential Reversal Zone – Major Bounce OpportunityTAO/USDT is currently testing a critical support zone (highlighted in yellow) between $220 – $280, which has historically acted as a strong accumulation area. The price has shown multiple reactions from this region throughout 2024 and 2025, signaling that bulls may be preparing for a reversal.

🔍 Key Technical Levels:

Major Support Zone: $220 – $280

Immediate Resistance Levels:

$350.9

$462.9

$560.8

$600

$719.1

Long-Term Resistance: $780 (local high)

🔄 Scenario: If TAO successfully holds this support zone, a bullish reversal could be triggered with a potential rally toward the $350 level first. A break and retest above this could open the door for a sustained move towards $560 and beyond. The bullish projection is illustrated with the yellow arrow path, showing a potential multi-stage rally through key Fibonacci and structural levels.

📉 Invalidation: A confirmed break below $220 would invalidate this bullish setup and could push TAO toward lower lows, potentially retesting $170 or even $127 support levels.

📌 Summary: TAO is approaching a historically strong support base. If the structure holds and volume supports the reversal, we could see a powerful leg up toward $560 and possibly $719 in the medium term. Risk management is essential, especially with volatility around macroeconomic events and Bitcoin price movements.

TAO looking for a bullish confirmation. TAO retracing for a confirmation low is bullish. The real concern is that this turns into a dead cat bounce and the price makes a LL. As long as the price stays above the previous low, as momentum and trend oscillators get oversold, the structure is intact.

Full TA: Link in the BIO

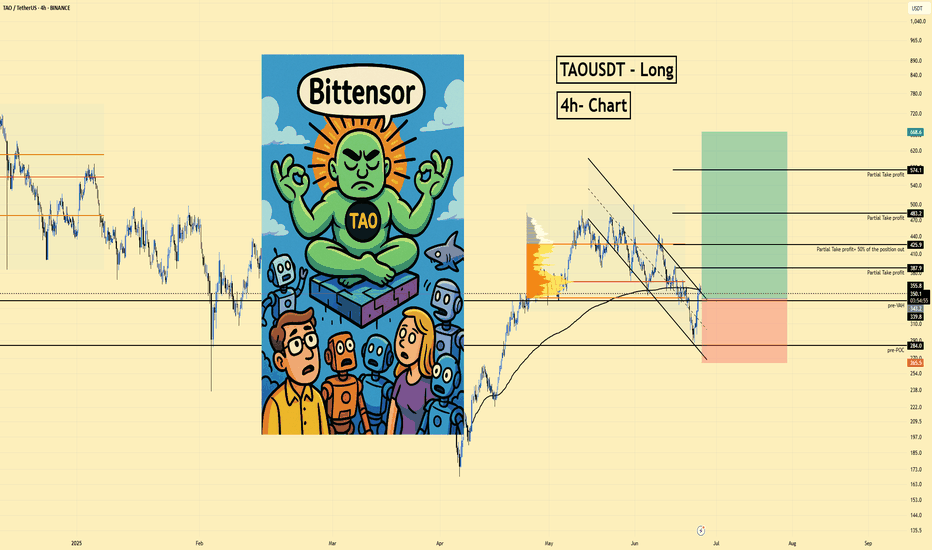

TAO/USDT | Long | DeAI Infrastructure Play | (June 23, 2025)TAO/USDT | Direction: Long | Key Reason: DeAI Infrastructure Play & Technical Recovery | (June 23, 2025)

1️⃣ Insight Summary

TAO has been in a downward channel, but it's now approaching a key zone of interest where support, volume, and structural value overlap. With fundamentals in decentralized AI, it could present a high-upside swing opportunity if the trend flips.

2️⃣ Trade Parameters

Bias: Long

Entry: Around 343.00

Stop Loss: Below 265.00 (previous point of control & structural low)

Take Profit 1: 387.00

Take Profit 2: 425.00

Take Profit 3: 483.00

Extended Targets: 574.00 / 668.00

3️⃣ Key Notes

✅ Fundamentals remain intact – Despite recent price correction, Bittensor’s core value proposition as a decentralized AI marketplace remains.

✅ Layer-1 infrastructure – Built specifically for AI model training, compute exchange, and monetization—all backed by its native blockchain.

✅ Strong community – Active developers, validators, and AI miners; over 75% sentiment bullish across social platforms.

✅ Institutional interest – DCG invested $100M in TAO, launching “Yuma” as an ecosystem builder on top.

❌ Risk alert – Past security issues ($8M exploit), and leadership clarity is limited (no public founder presence).

⚠️ Technical caution – Price is still under pressure; a clean flip of VWAP and volume zones into support is key before full confirmation.

4️⃣ Follow-up Note

I’ll monitor how TAO reacts to the value area low and VWAP. If price confirms a base above $387 with sustained buying, we’ll reassess for a move toward $574 and beyond.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

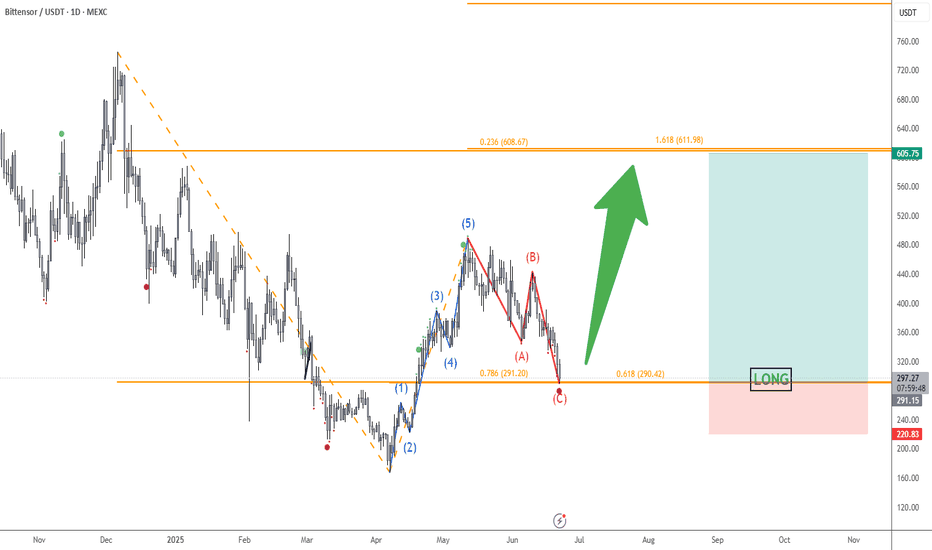

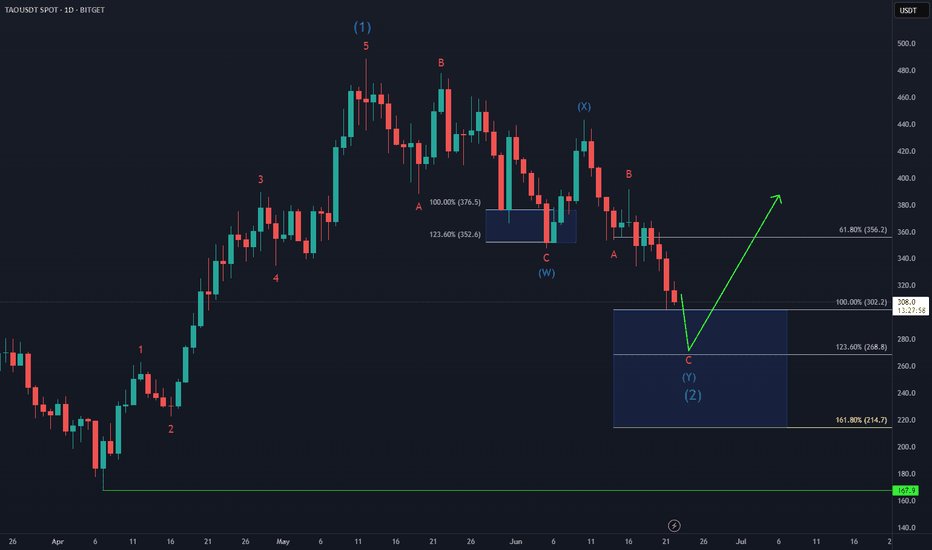

TAO the beginning of an epic BULLRUN!🚀 LONG on LSE:TAO – Perfect Confluence Setup

TAO has just completed a textbook ABC corrective wave, retracing precisely to the 0.618 Fibonacci level of the April–May bullish 5-wave structure.

What makes this setup even more compelling:

✅ That 0.618 retracement also converges with the 0.786 Fibo of the larger corrective move that started back in December ‘24.

✅ We’re likely at the start of wave 3 of a higher time frame impulsive structure — the most explosive leg.

🎯 Target: $605 — the 1.618 Fibo extension of the recent ABC correction, which aligns with the 0.236 retracement of the macro move from December.

📉 Stop Loss: $220 — placed below wave 2 for structural invalidation.

📊 Risk/Reward Ratio: ~4.5R — excellent setup.

I love it when the Fibs align. 🔥

Fingers crossed for liftoff!

Bittensor Step-by-Step Process🧠 BINANCE:TAOUSD has entered the #BlueBox buying area at $302–$214, where the bottoming process is expected to begin. This zone aligns with the typical equal legs fib cluster setup is a high-probability region for bulls to step in.

Now it’s all about strategy:

🔹 Aggressive bulls might start scaling in here

🔹 Conservative traders may wait for reversal confirmation — like a break of internal trendlines or bullish divergence on lower timeframes

Either way, the groundwork for the next rally could be forming.

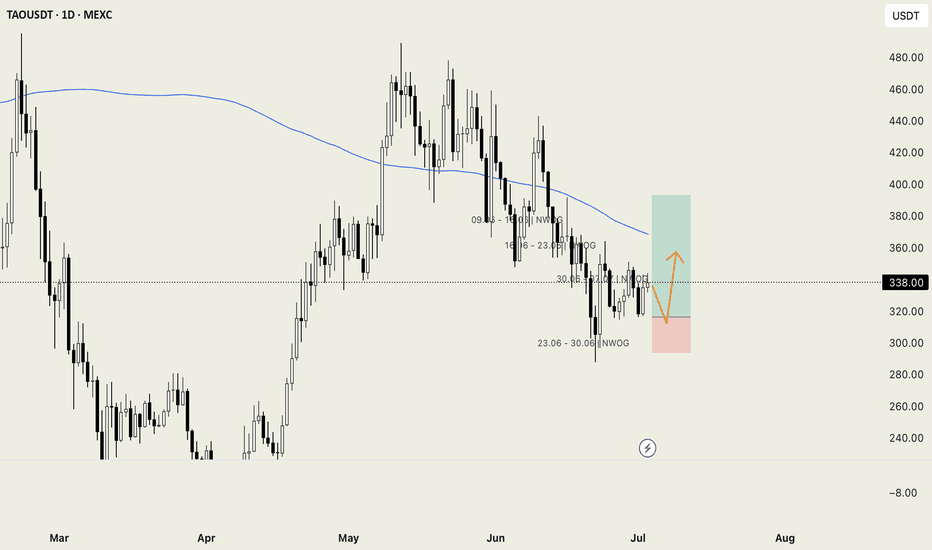

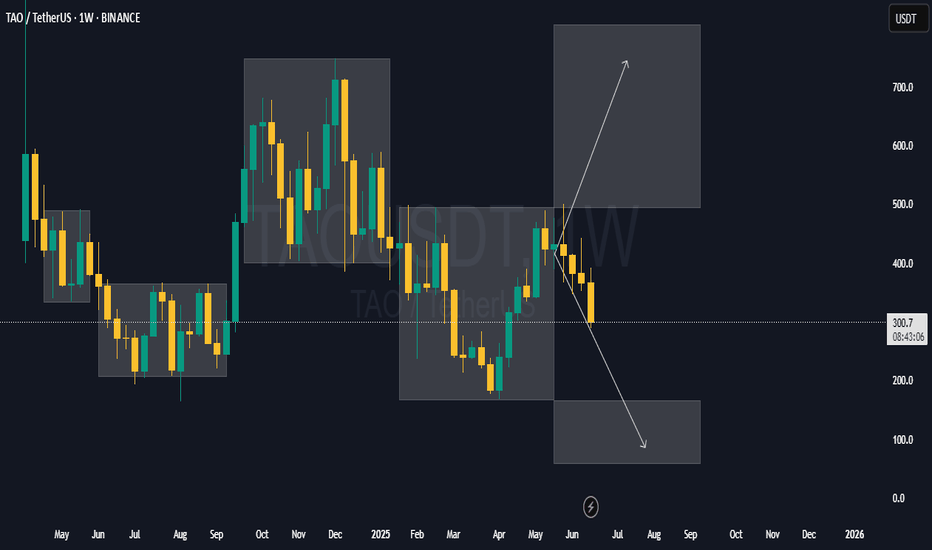

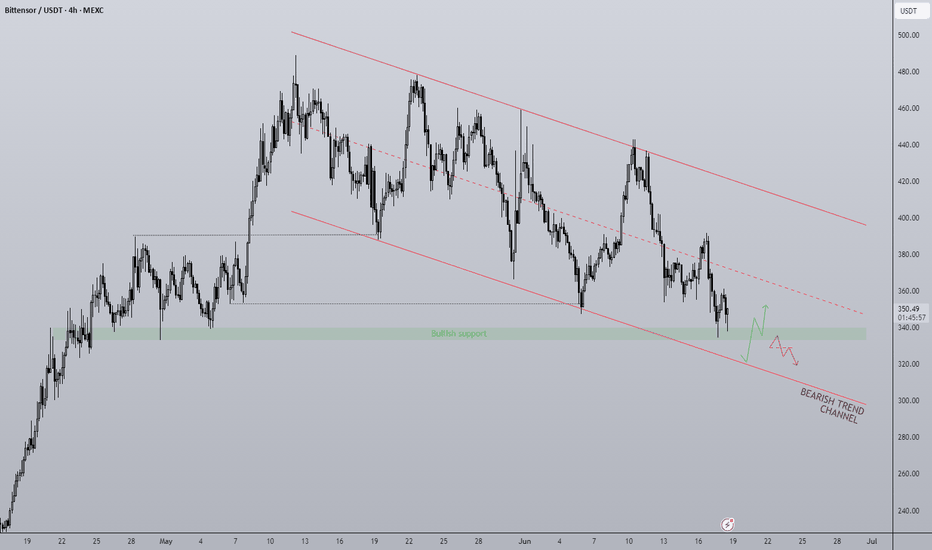

TAO 4H - Downtrend bottom? Altcoins have certainly taken a backseat to BTC this cycle with Bitcoin dominance holding around 65%. Despite this, there are still some good setups in altcoins presenting themselves each day, one of which is TAO on the 4H.

To me it looks to be in a clear downtrend respecting the upper and lower limits while reacting off of support levels on the way down. As it stands price has reached a key S/R level that has proven to be support in the past and is in conjunction with the lower end of the trend channel.

With FOMC only hours away and TAO being at such a critical level this would be an interesting place to do business. A good reaction off the level would kickstart a move towards the trends upper limits. A loss of this level and it's very possible what has been support can turn into resistance.

To me the R:R here is good for a long position, the threat to the trade is bearish reaction to FOMC, escalation geo-politically which effects risk-on assets and therefor overalls TA.