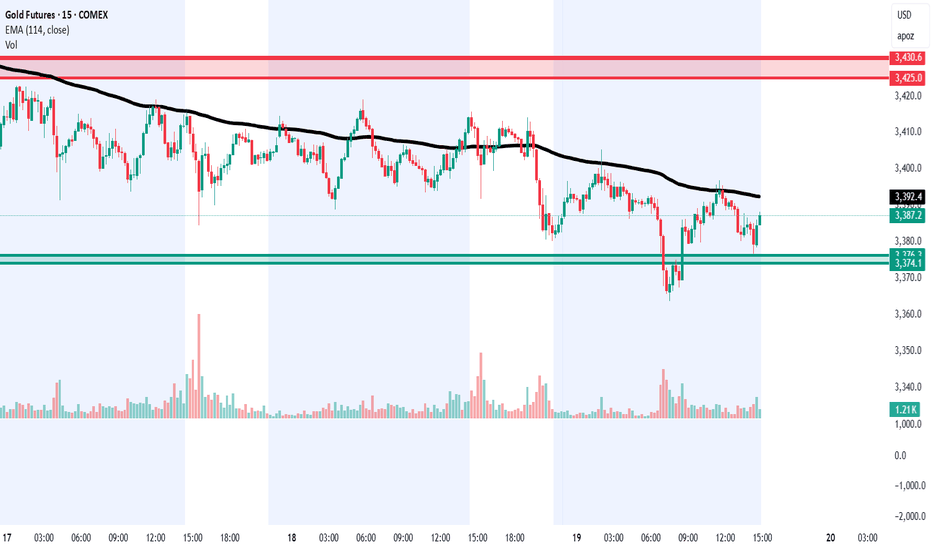

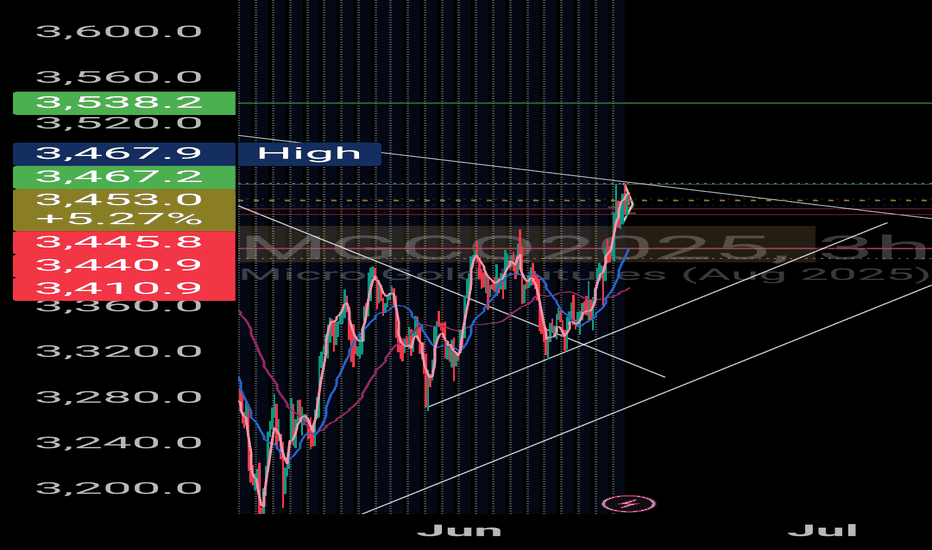

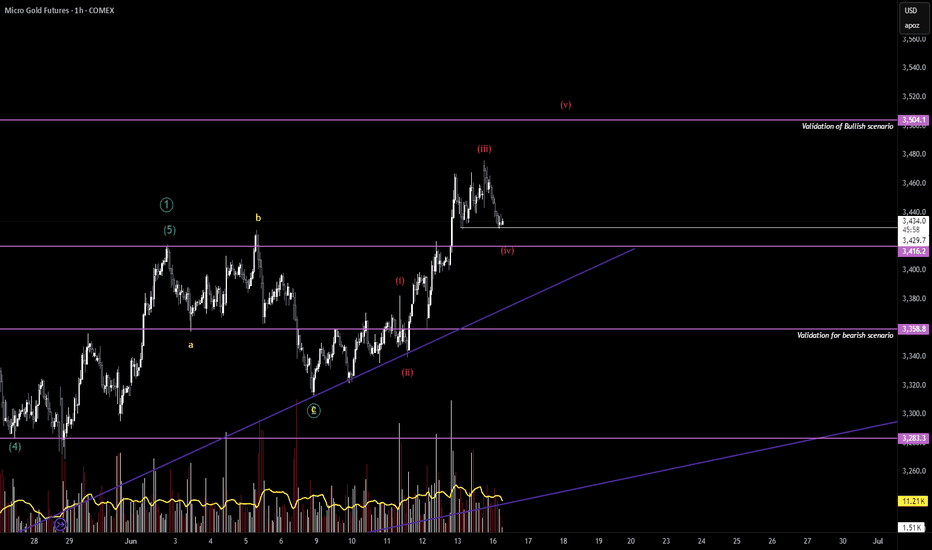

Waiting for Price to Hit the Green Zone for Long in GCAt the moment, I’m patiently waiting for price to pull into the green zone below. If price hits this area, I will look for a high-probability long trade, targeting the upper red zone for a very extended move.

However, my stop-loss will remain very tight — placed just below the green zone — because

Contract highlights

Related commodities

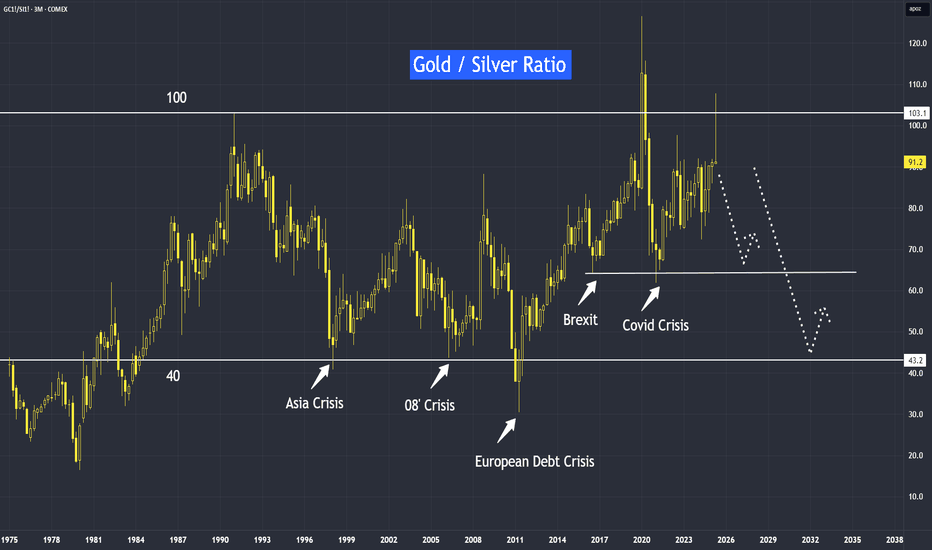

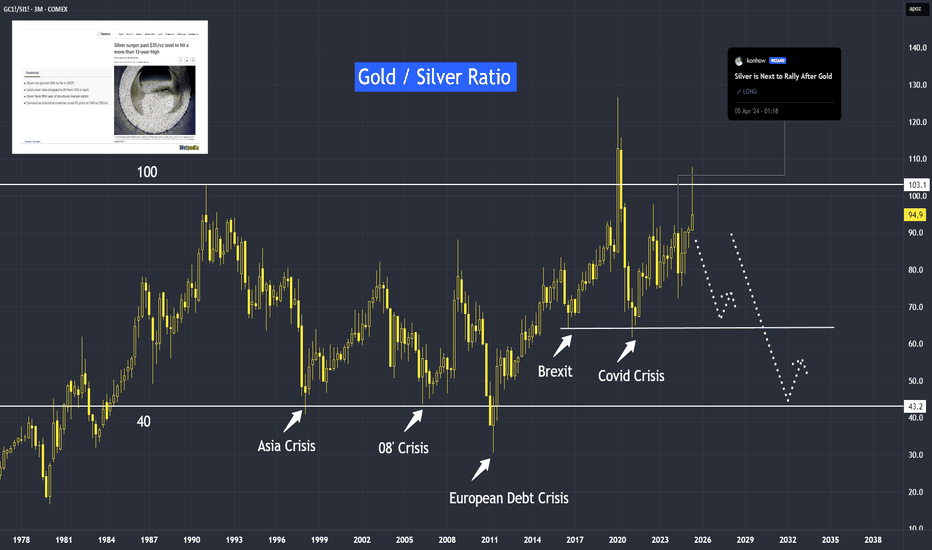

Gold Sliver Spread is Pointing Downward - Silver to TrendGold-silver ratio dropped from 107 to current 91. What does this mean? Does it indicate that silver is about to trend higher, or is it a sign that gold will continue its trend?

If you take the gold prices on 'Liberation Day' on 2nd April 2025 - Gold at $3,509 divided by Silver at $35 = 100.25

Today

What is Gold Silver Spread?What is gold silver spread? How to understand them to determine the market direction.

Reuters mentioned that the gold-silver ratio dropped from 105 to 94. What does this mean? Does it indicate that silver is about to trend higher, or is it a sign that gold will continue its trend?

Micro Silver Fut

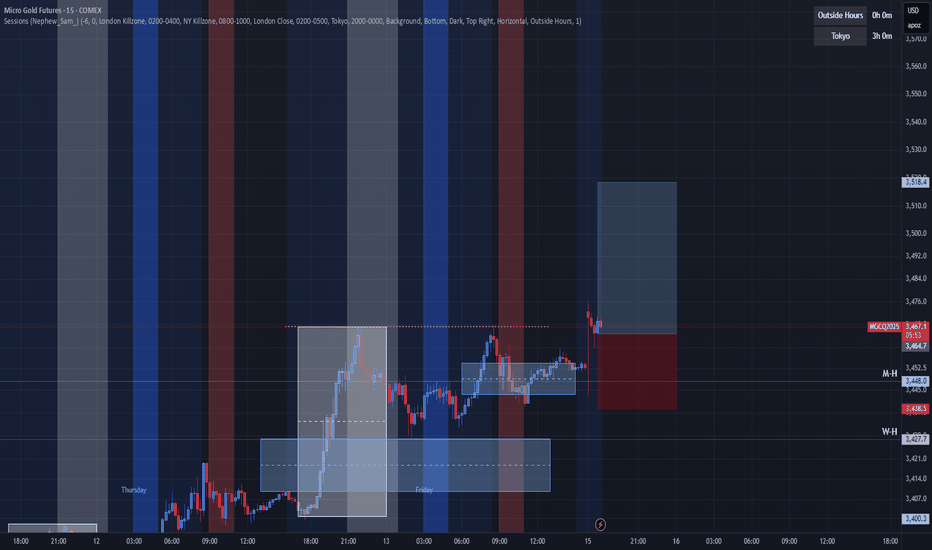

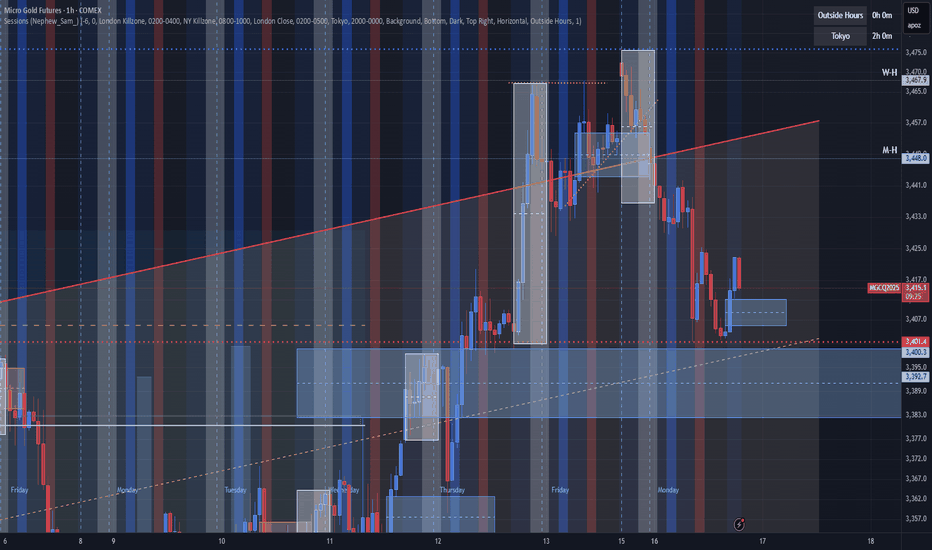

when price consolidates, its just setting upLooking for a bigger moving going into mid week. Tues spent the entire day consolidating. Now im thinking we getting ready for a bigger move. Just trying to be patient and wait for it. Price should give us some kinda sign on what it would like to do as we coming into the Asian Killzone.

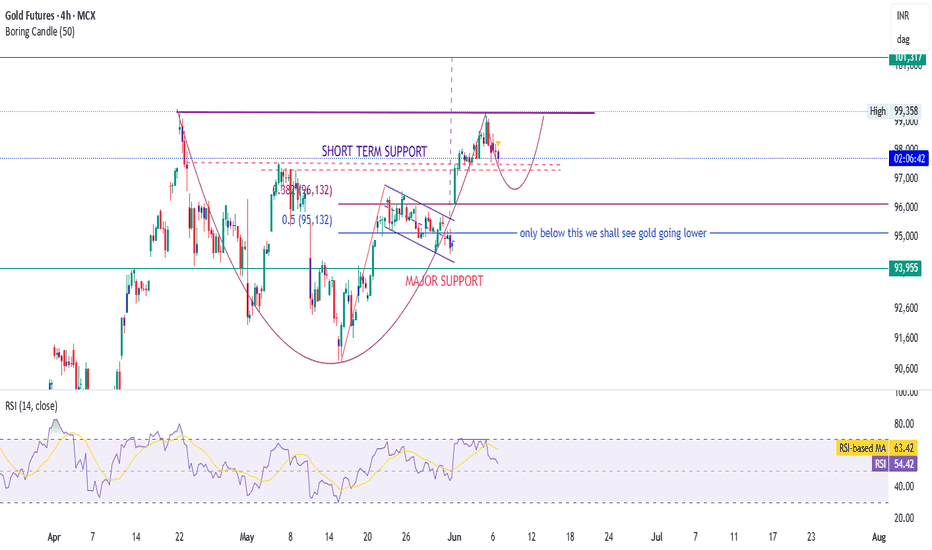

GOLD- WATCHING IT CLOSELY.🔍 Chart Analysis

🏗️ Structure & Patterns

A perfect Cup & Handle formation is visible.

Price has broken out above the neckline (~₹98,000) but is currently in a pullback phase, forming the handle.

A falling wedge breakout is also seen prior to the breakout — a bullish continuation pattern.

📐 Fibona

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 10 Baht Gold Futures is 52,580 THB / ThGB — it has risen 0.10% in the past 24 hours. Watch 10 Baht Gold Futures price in more detail on the chart.

The volume of 10 Baht Gold Futures is 269.00. Track more important stats on the 10 Baht Gold Futures chart.

The nearest expiration date for 10 Baht Gold Futures is Jun 27, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell 10 Baht Gold Futures before Jun 27, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For 10 Baht Gold Futures this number is 1.92 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for 10 Baht Gold Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for 10 Baht Gold Futures. Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of 10 Baht Gold Futures technicals for a more comprehensive analysis.