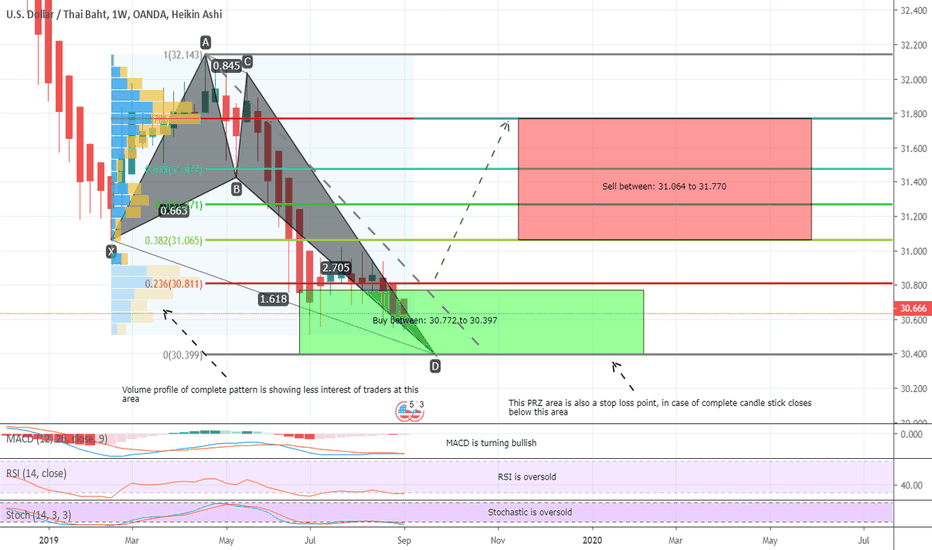

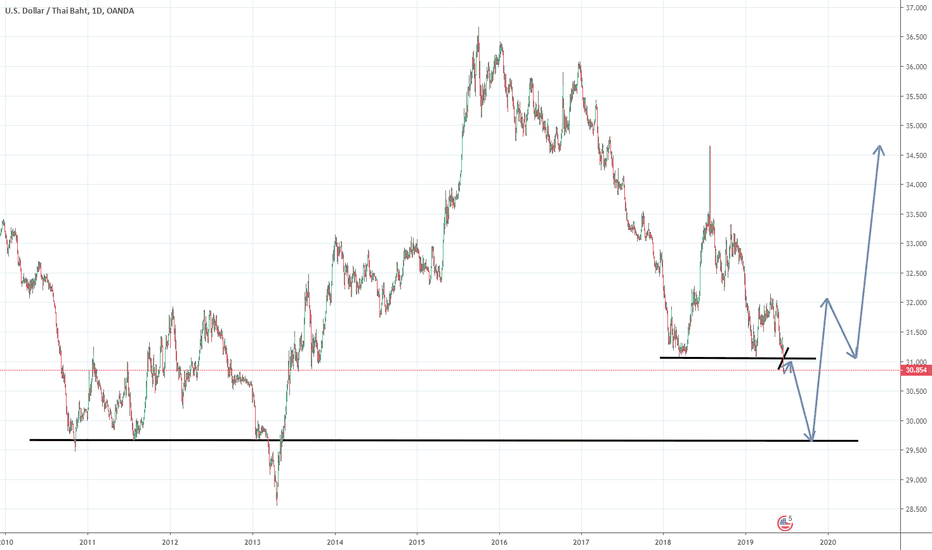

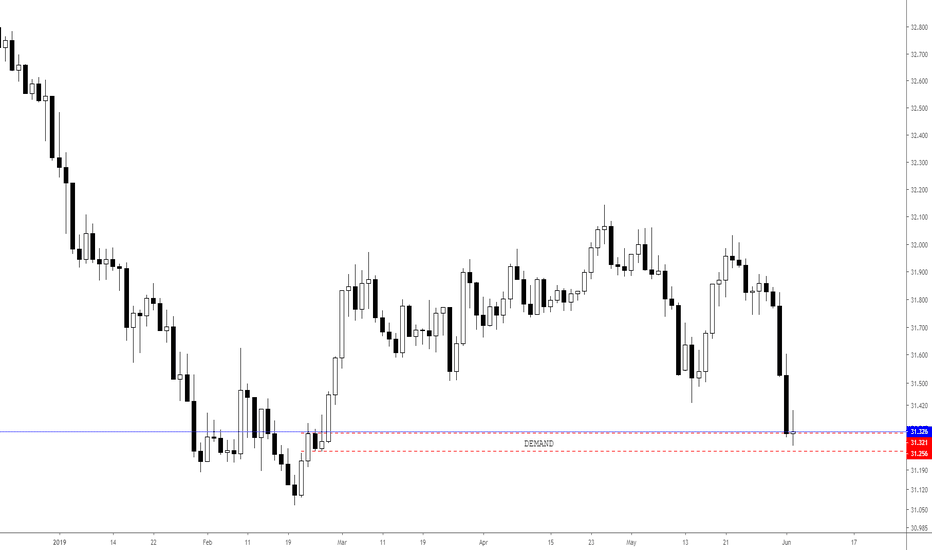

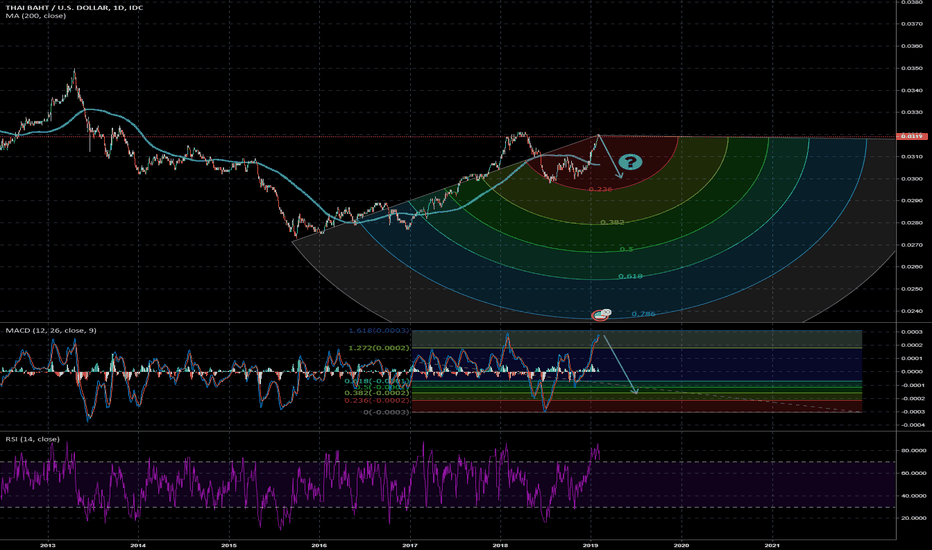

USDTHB fomred bullish butterfly | Upto 4.5% bull move.Priceline of US Dollar / Thai Baht forex pair has formed a bullish butterfly pattern and entered in potential reversal zone to hit the sell target soon insha Allah.

This PRZ area is also a stop loss point, in case of complete candle stick closes below this area.

MACD is turning bullish, it was strong bearish now turned weak bearish.

RSI is oversold.

Stochastic is oversold.

Volume profile of complete pattern is showing less interest of traders at this area.

I have used Fibonacci sequence to set the targets:

Buy between: 30.772 to 30.397

Sell between: 31.064 to 31.770

Enjoy your profits and regards,

Atif Akbar (moon333)

THBUSD trade ideas

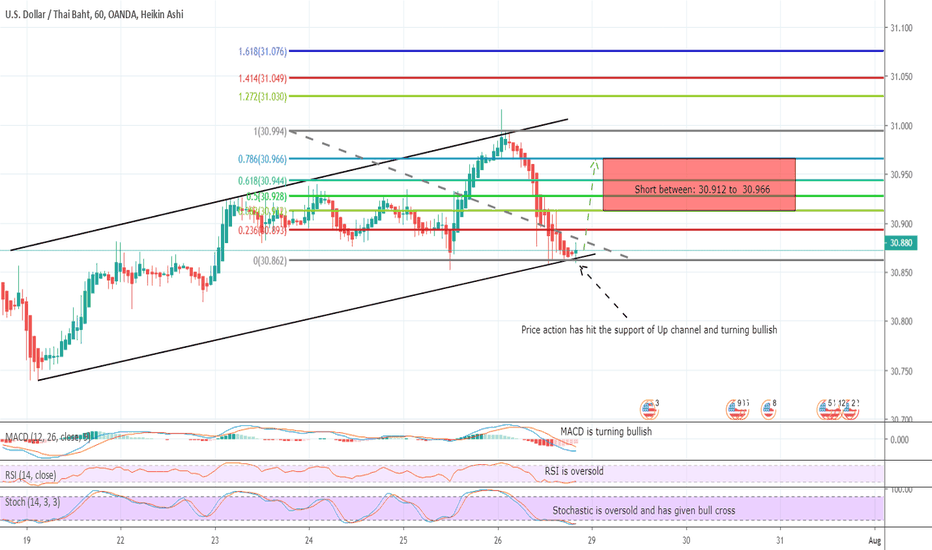

USDTHB hits the support of channel | a good long opportunityThe priceline of USDTHB is moving within an Up channel and hits at the channel's support.

The MACD is turning bullish.

RSI is oversold.

Stochastic is oversold and gave bull cross.

The sell targets are as below:

Short between: 30.912 to 30.966

Regards,

Atif Akbar (moon333)

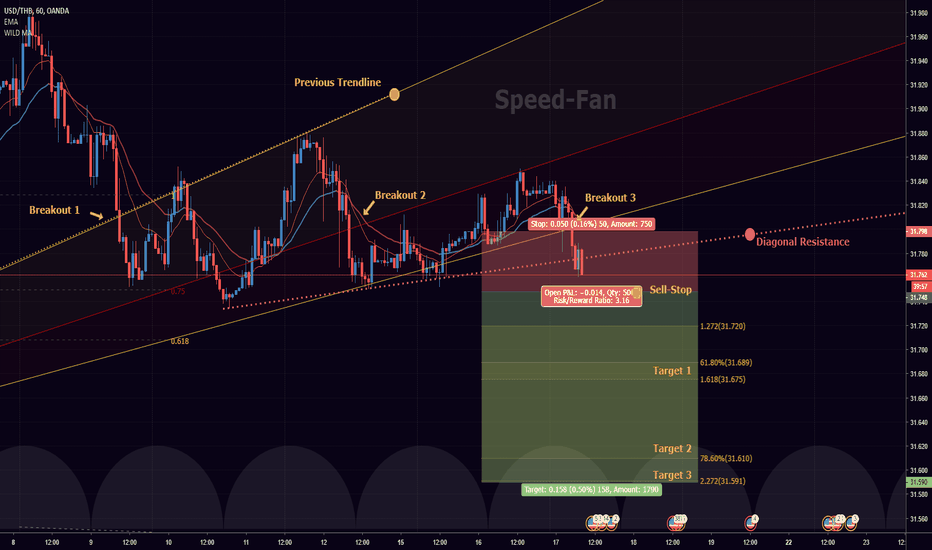

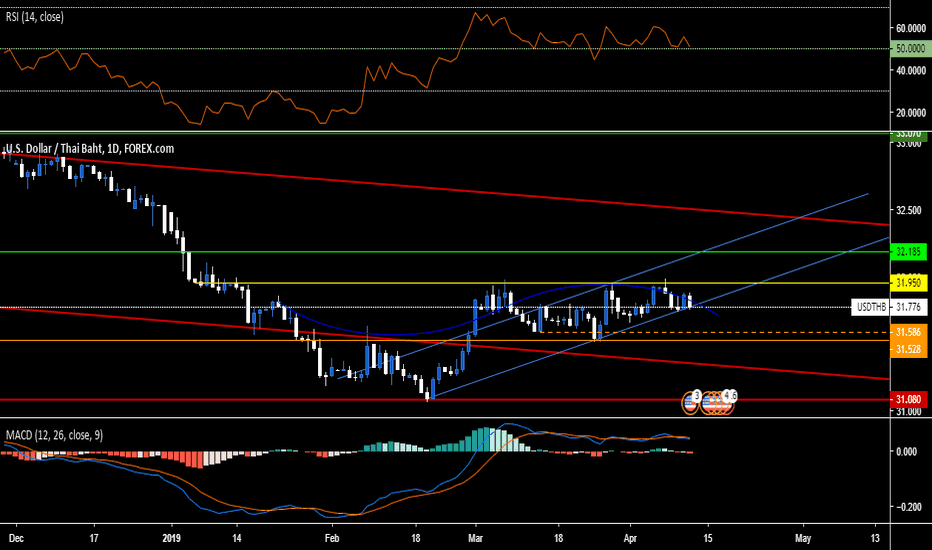

USD/THB: Swing-Setup! Very good chance to sell!Hey tradomaniacs,

welcome to another free signal!

-----------------------------

Type: Day-Swingtrade

Sell-Stop: 31,763

Stop-Loss: 31,798

Target 1: 31,688 - 31,677

Target 2: 31,610

Target 3: 31,590

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

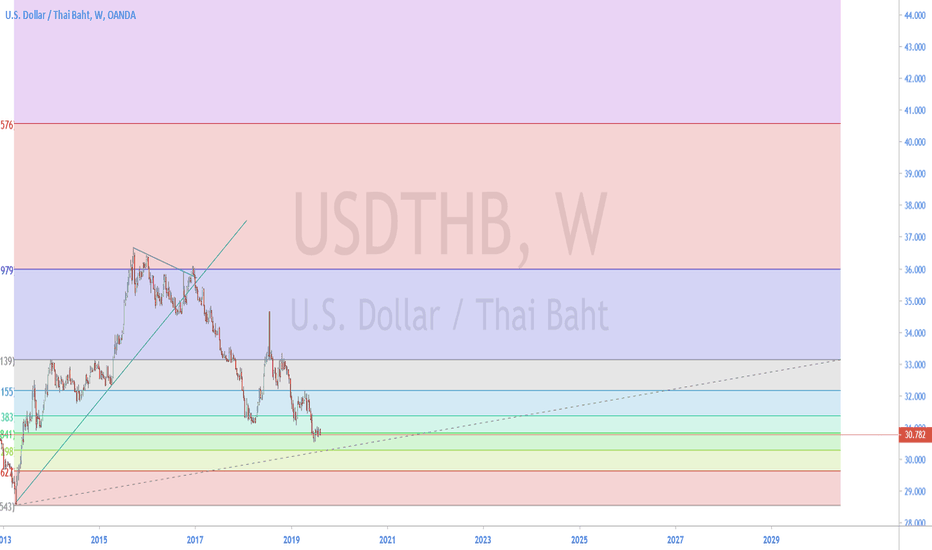

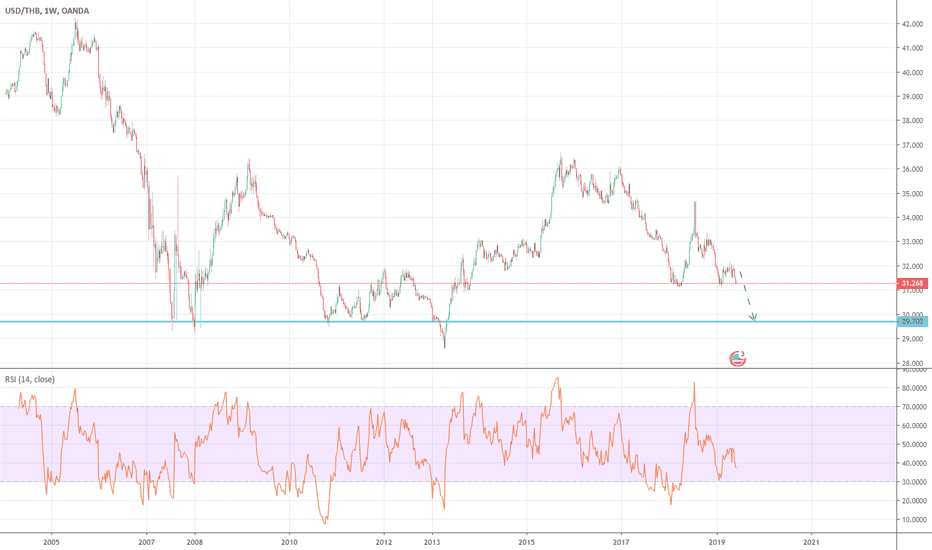

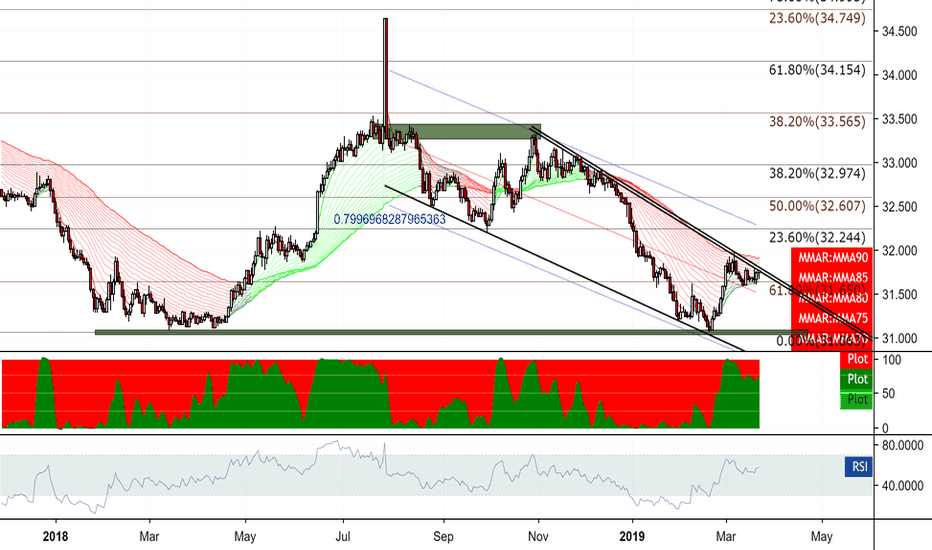

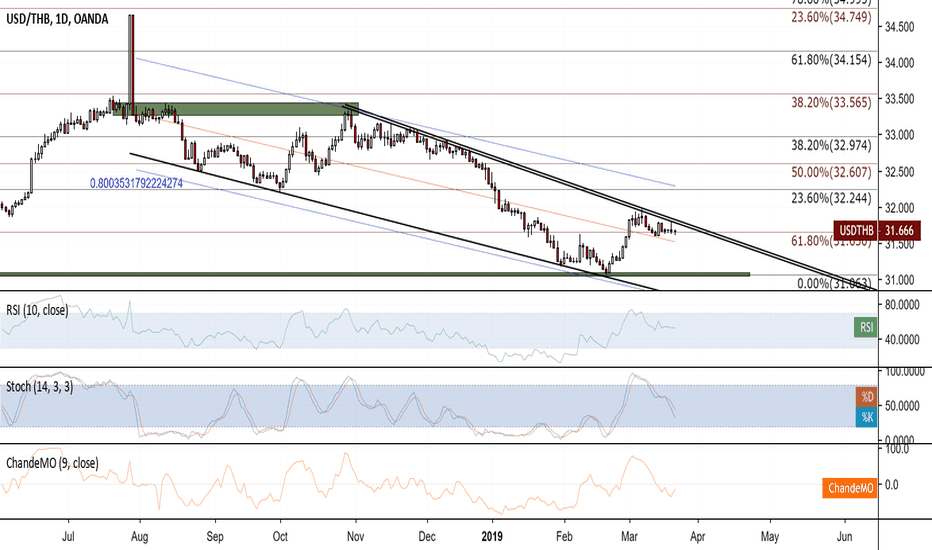

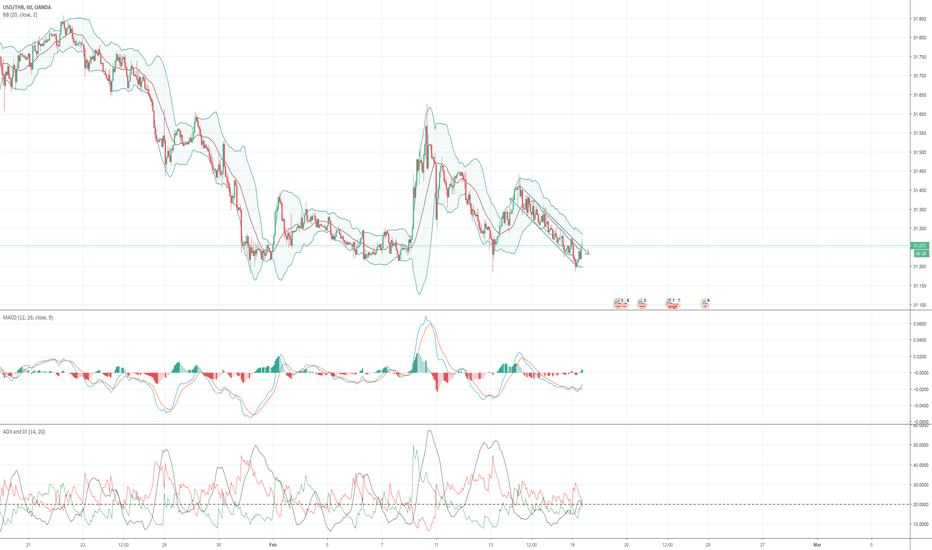

USDTHB Downward Trend Continues The Thai baht over the past week started out the week sideways, but like the Singapore dollar ended the week up. This pair is a bit more impacted recently from political risk surrounding its election and because of this we may see more volatility not related to technical or fundamental components. Nonetheless, its important to keep in mind the overall trend remains downward sloping and a continued weakening of the US dollar. Moreover, price action remained in theshort-term trend line resistance range at the week's end reinforcing the notion that linear downward resistance is difficult to break. Additionally, the technical picture for USDTHB over the next week looks like it could revert back to the mean where RSI points towards overbought and the bull bear indicator suggests USDTHB long is overcrowded. Meanwhile, exponential moving averages also suggest continuation of our downward trend. In sum, USDTHB is still short.

For more of my analysis, please check out www.anthonylaurence.wordpress.com

USDTHB Stalled Momentum, Still Trends DownOrdinary least squares method suggests we are still trending down in this pair even as many other Southeast Asian currencies are trending much further down such as USDSGD as can be seen here: In that respect, Thailand is an under-performer, but momentum has stalled even though some of the technicals are pointing towards a bit of an upward rebound. However, I am of the view that we still need to trend down a bit more before this sentiment can be achieved.

If you are interested in any more of my analysis that focuses on foreign exchange and equities, please check it out here anthonylaurence.wordpress.com

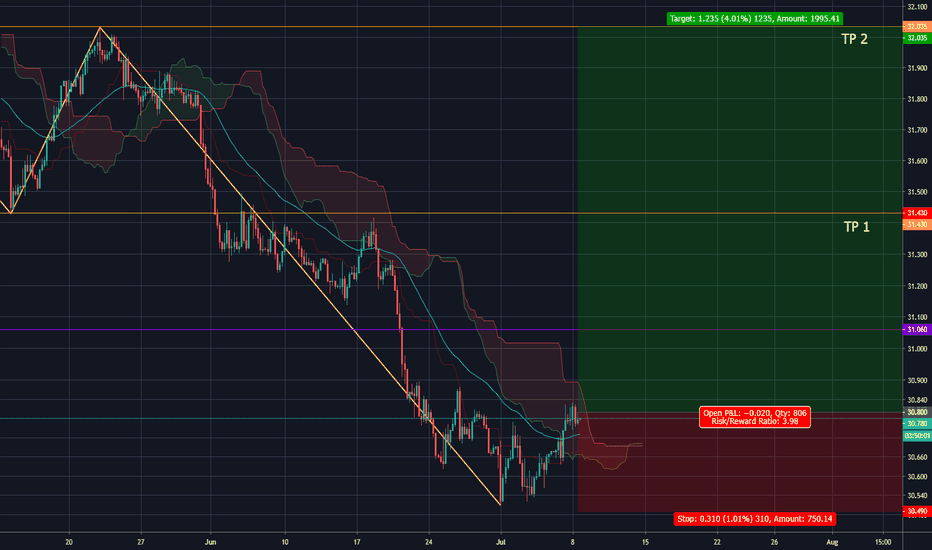

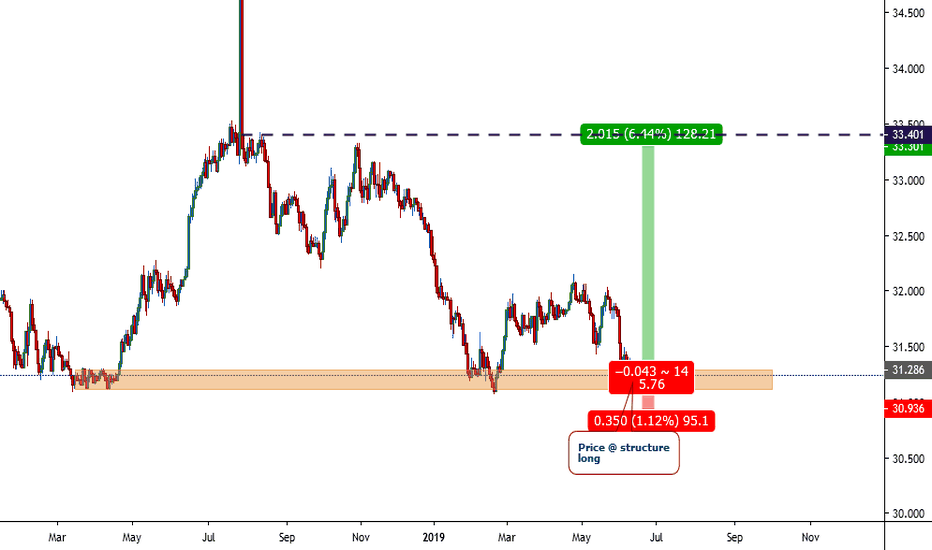

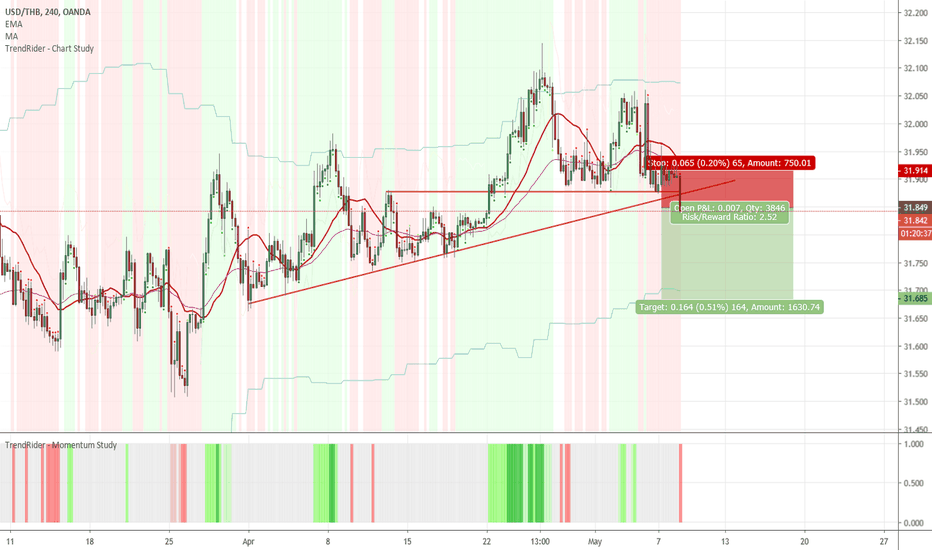

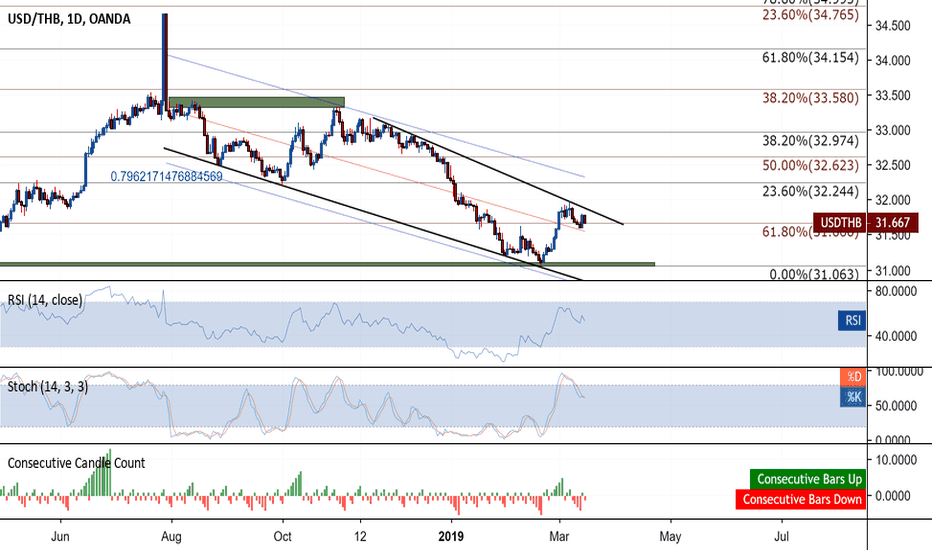

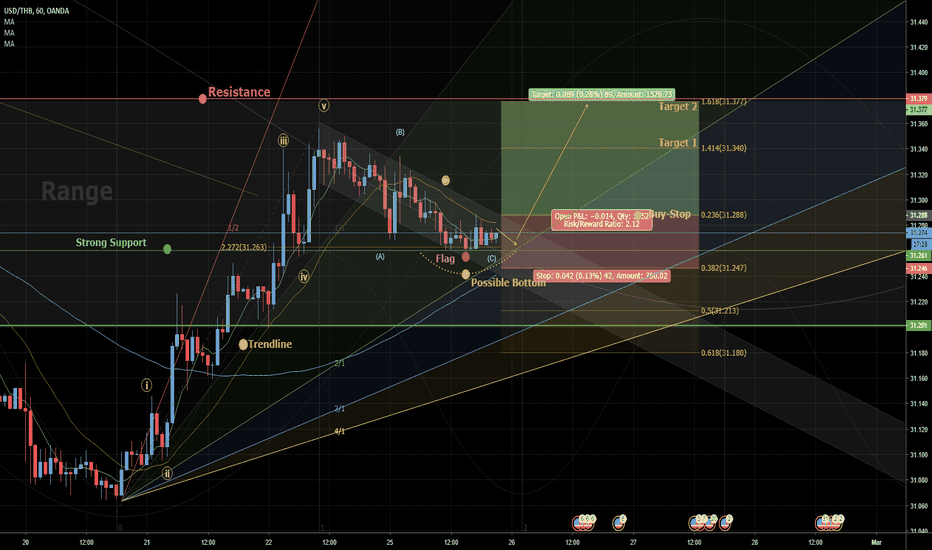

USD/THB: Swing-Setup!Nice OPPORTUNIY to buy the coming BREAKOUT!Hey tradomaniacs,

welcome to another free signal!

Important: Get ready for a pullback after Breakout! Don`t safe your profits too early!

-----------------------------

Type: Swingtrade

Buy-Stop: 31.288

Stop-Loss: 31.246

Target 1: 31.340

Target 2: 31.378

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

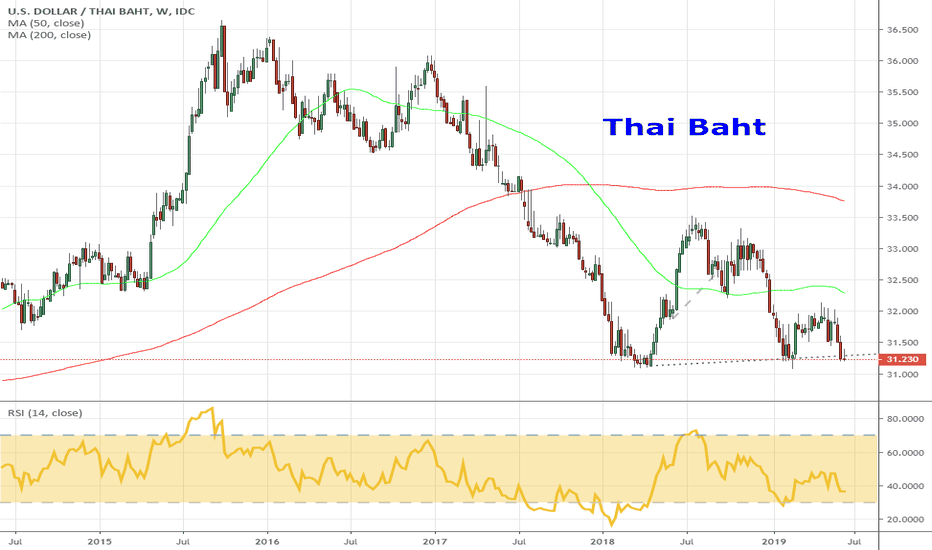

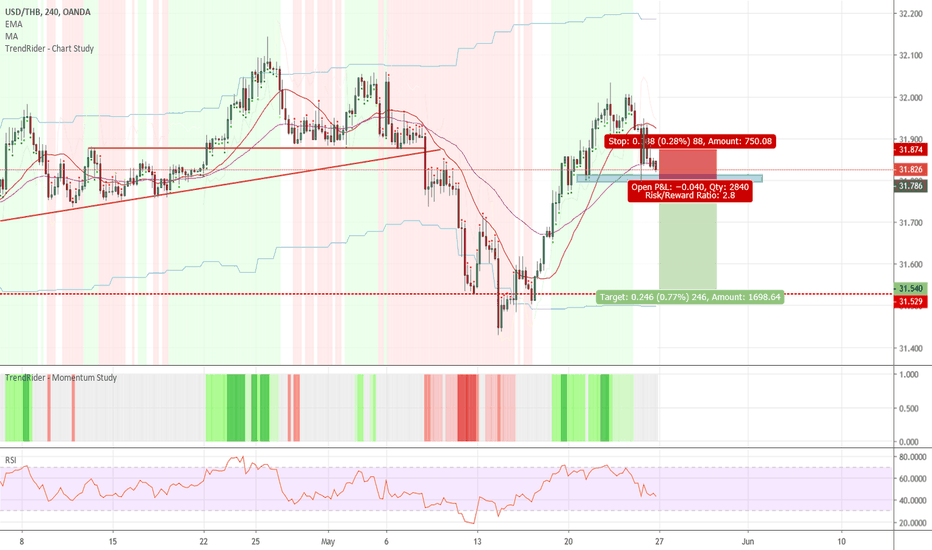

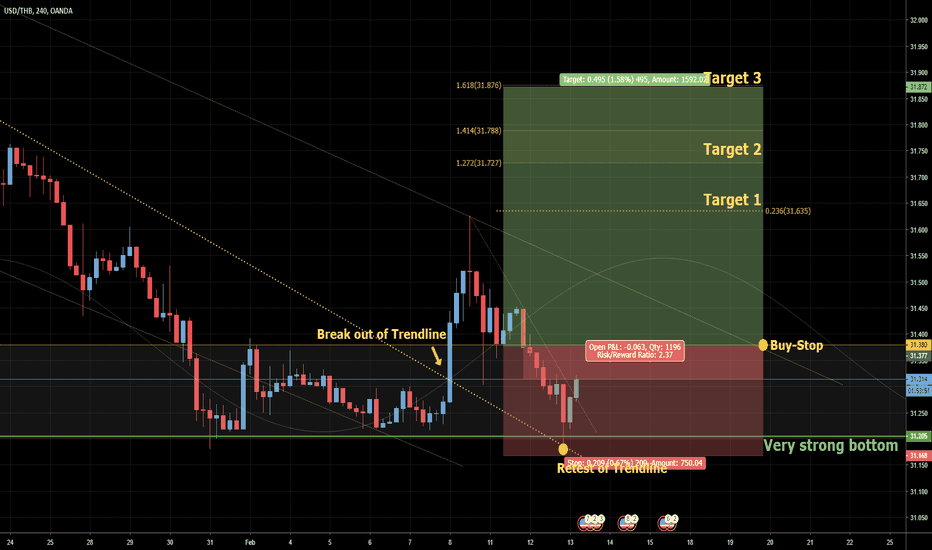

USD/THB: Swing-Setup! Trendchange chance!Hey tradomaniacs,

welcome to another free signal!

Important: Place a Buy-Stop and wait for the trigger!

-----------------------------

Type: Swingtrade

Buy-Stop: 31,380

Stop-Loss: 31,168

Target 1: 31,632

Target 2: 31,729

Targt 3: 131,872

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)