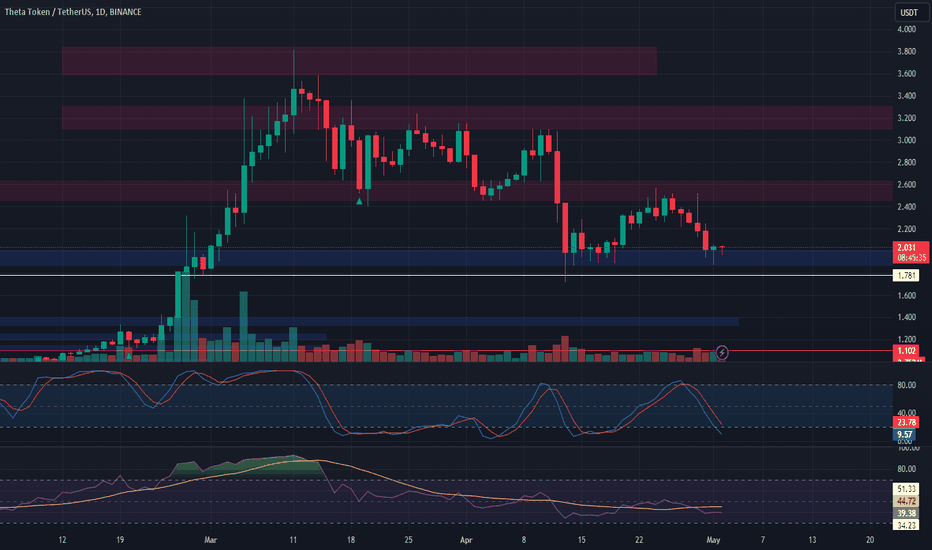

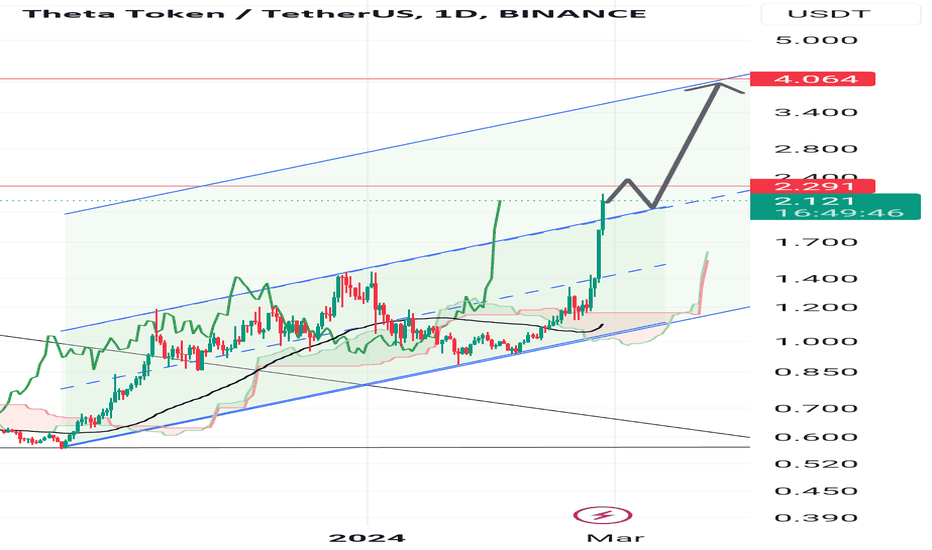

🚀 THETA Trading Plan 📈Entry Point:

Consider a long trade in THETA from the current support level, ranging between $1.88 - $2.00.

Trade Parameters:

Entry: $1.88 - $2.00.

Take Profit: $2.45 - $2.63 or $3.10 - $3.30.

Stop Loss: Just below $1.78.

Risk Management:

Implement a tight stop loss to mitigate potential losses.

📈 Trade Strategy Rationale:

Anticipate potential upward movement in THETA from the current support level.

📊🔍 Stay attentive to THETA's price action for trade adjustments! #THETATrading #CryptoAnalysis 🌐💰

THETAUSDT trade ideas

#THETA/USDT#THETA

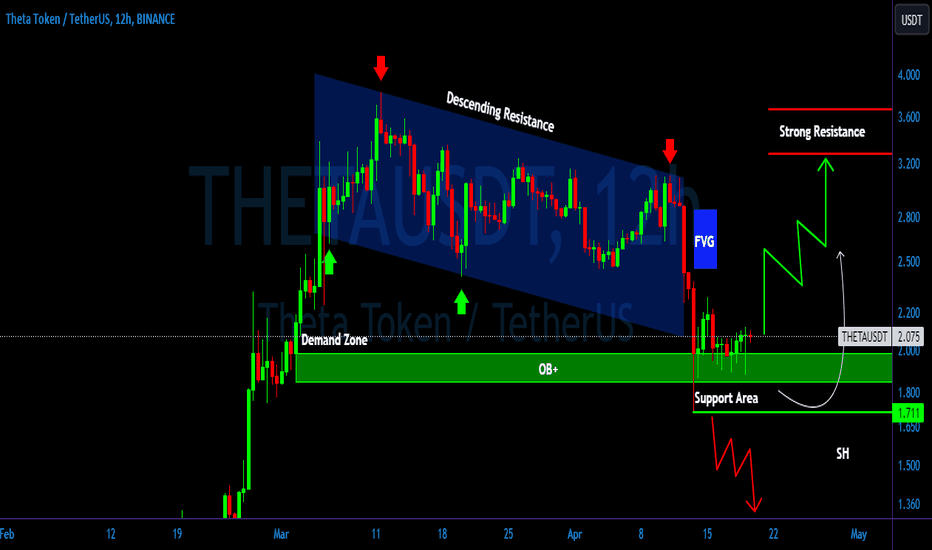

The price is moving in a triangle on a 12-hour frame, which it adheres to perfectly.

We have a major support area at the level of 0.1165.

We have a trend for stability above moving average 100.

We have a downtrend on the RSI indicator that supports the rise and is about to break higher

Entry price is 2.50

The first goal is 2.77

Second goal 3.14

Third goal 3.56

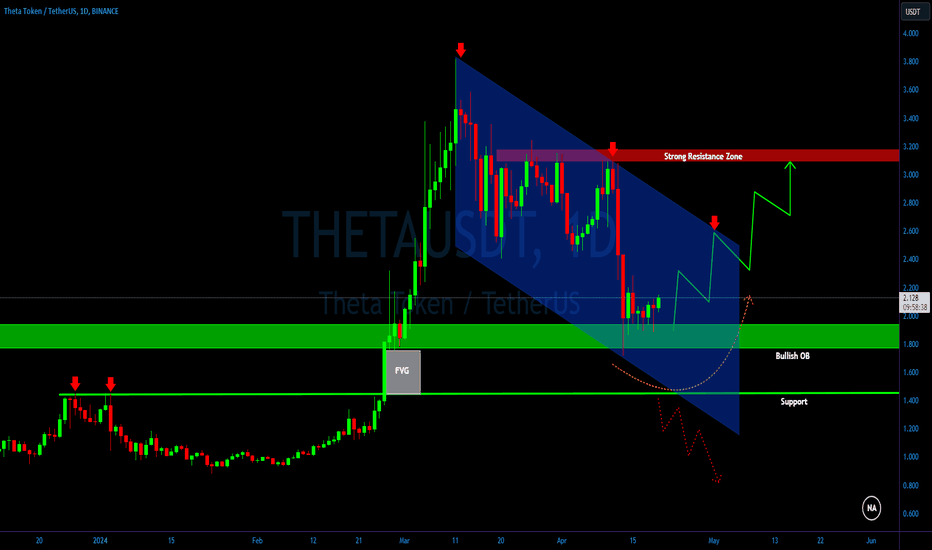

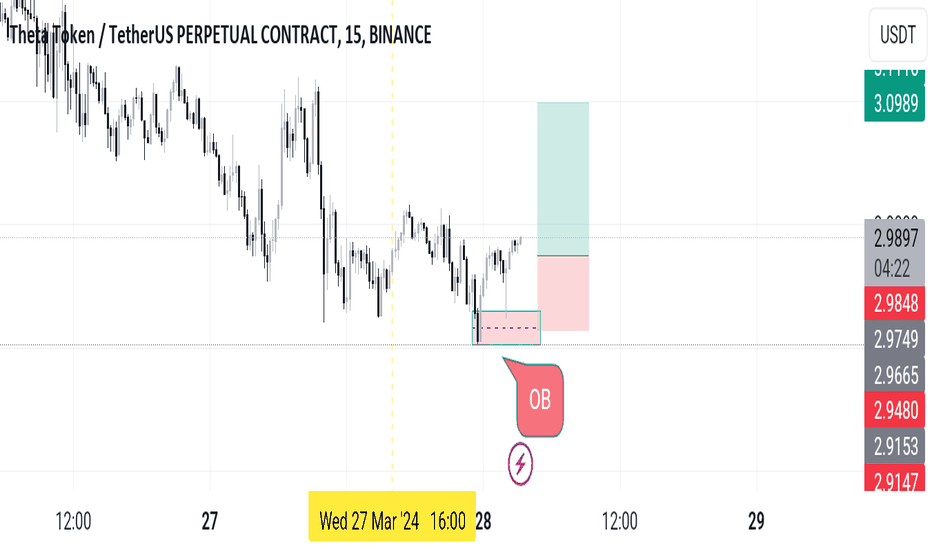

THETA/USDT should price hold momentum at OB? 🚀Theta Analysis💎 Paradisers, let’s explore the captivating movement of #THETAUSDT. Currently, it is assessing a bullish order block (OB) level—a zone of immense significance due to its juicy liquidity.

💎 Our observations reveal that #THETA dutifully adheres to a descending channel trajectory, respecting channel resistance on two occasions. Now, if the price successfully maintains momentum at the bullish OB level of $1.787, there exists a compelling probability that it will target levels above the major resistance.

💎 However, my friends, the markets are ever-changing. Should the price of MYX:THETA dip below this pivotal OB zone, our strategy must swiftly adapt. Brace yourselves! We anticipate a bullish rebound from the lower support level at $1.451. Failure to reclaim ground here could potentially lead to further declines. Stay vigilant, stay nimble, and let’s navigate these market fluctuations with grace and precision.

MyCryptoParadise

iFeel the success🌴

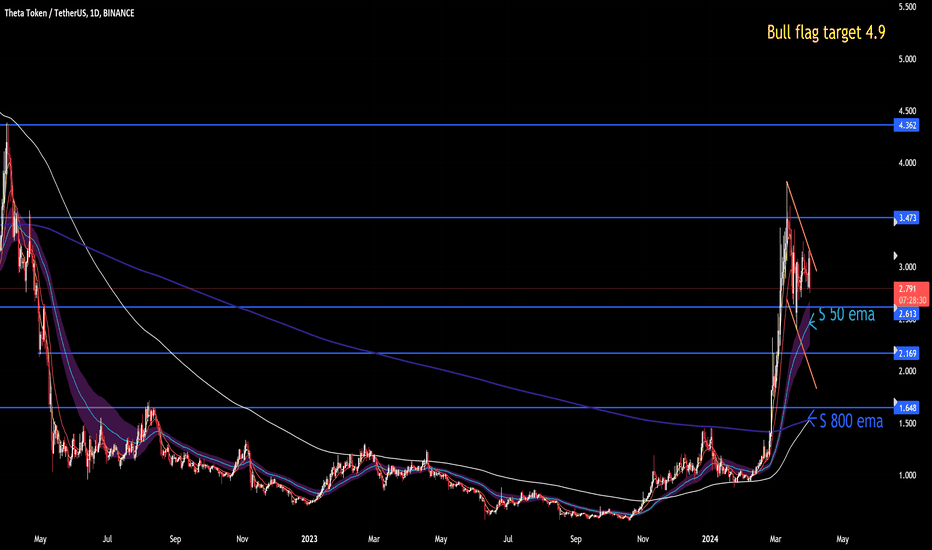

THETA/USDT Ready to Leave Accumulation Zone | 🚀Positive Sign💎Paradisers, #THETAUSDT is currently showcasing some interesting market movements. Positioned at a critical support level, THETA is experiencing notable accumulation, signaling potential bullish activity.

💎We remain hopeful that this accumulation at the support might catalyze a bounce, potentially initiating a renewed ascent. There's a strong chance that #ThetaToken could ascend toward our set target in the higher resistance zone, indicating a continuation of the upward trend.

💎However, If MYX:THETA struggles to sustain this support or fails to bounce effectively, it might point to a weakening in momentum. A drop below this support could mark a shift towards bearish territory.

💎It is vital to keep an eye on how #THETA interacts with this crucial support. Monitoring this closely will help us determine if the bullish trend will persist or if we should prepare for a possible bearish reversal. Stay focused and ready to adapt, Paradisers.

MyCryptoParadise

iFeel the success🌴

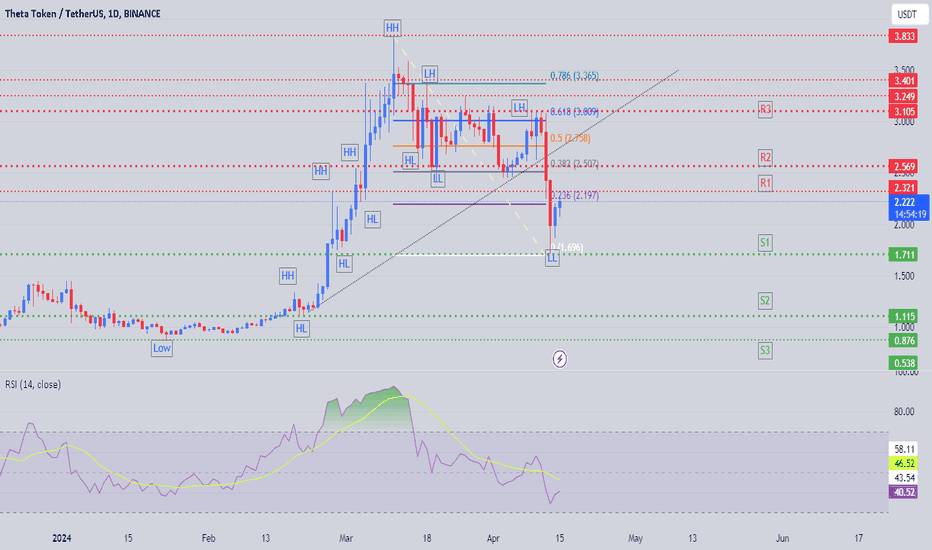

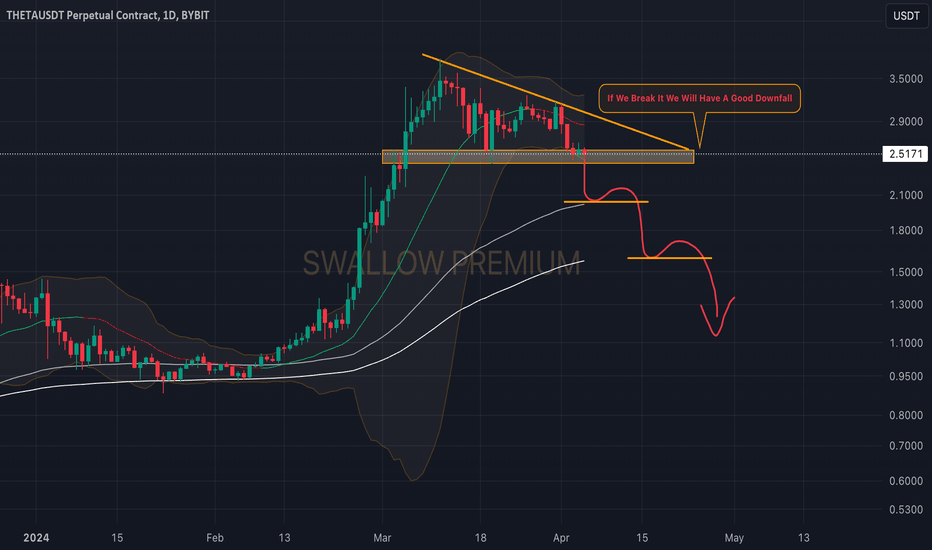

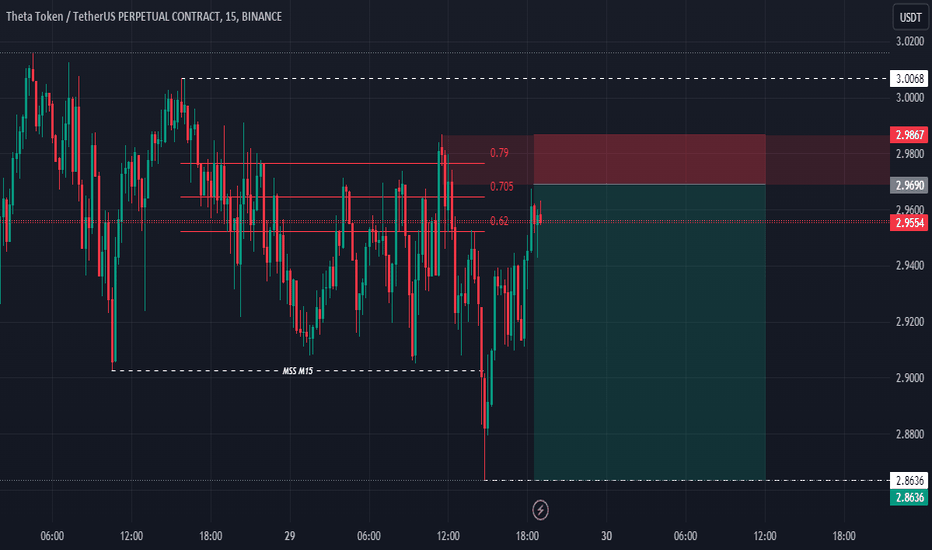

Theta-USDT - Recovering after CrashTheta has broken the trend and market structure.

As per Dow theory, It started making LH -LL and can expect another LL in couple of weeks.

Defined resistance and support in the chart.

I am expecting that Theta will back to 2.5 to 2.7 range, if it break than we can see that it will move to 3$ if not we can expect another pull back and find another LL..

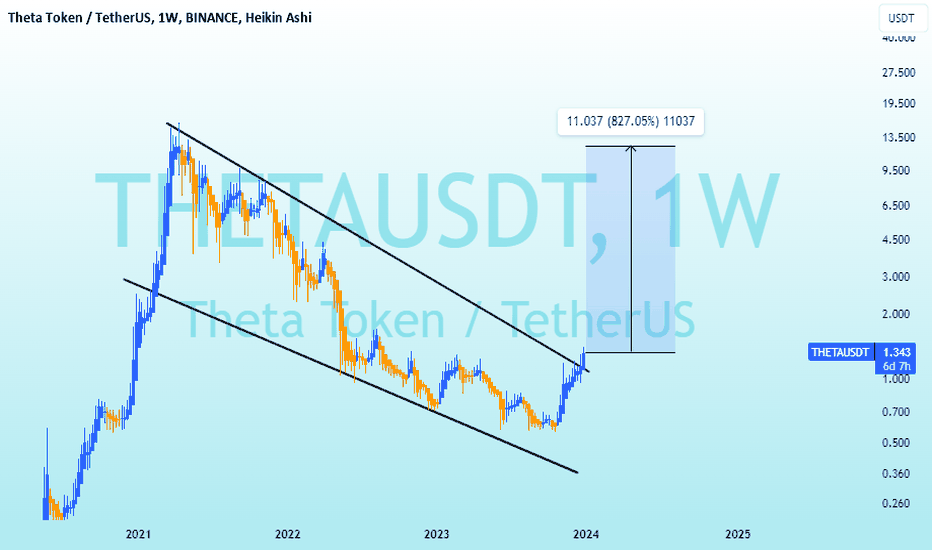

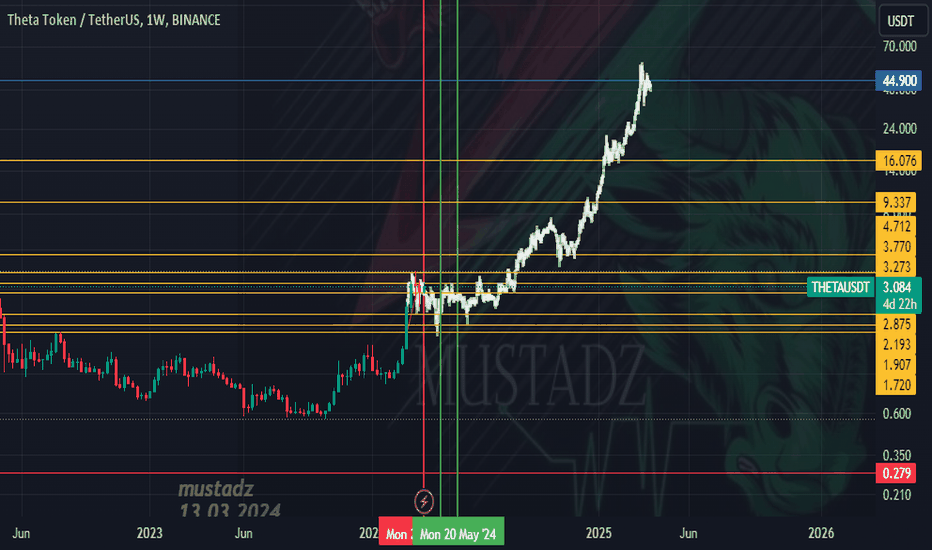

THETA LONG TERM BULLISH videoTHETAUSDT Market update

This is my current chart for THETA right now. Currently, I am using long timeframes here because this is a long term trade for me personally. I believe many of us are involved for the long term as well , not a quick money grab.

Technical Analysis POV:

We have been in a side trend ever since May 15,2022. Pumping hard and crashing hard. Thats what sidetrends are we go up and we go down until we enter a new trend. From the looks of the 2D chart, It looks like we should be attempting a breakout on the "#4?" in the chart. A breakout of the yellow trendline would lead us to a change of the sidetrend into an uptrend. I see low chances of ever reaching 0.7 again or lower, higher chances are we go up right now.

I also see a formation of an ascending triangle on the bottom of the chart, which could support my thesis of "this was the bottom". My target price for the long term right now is $3.81 which is more than 300% increase in price.

Fundamental Analysis POV

Fundamentally, THETA TFUEL has been cooking up A LOT . If you have been in twitter lately, you may know by now what THETA has been up to lately. New partnerships and projects joining THETA's ecosystem as well as more patents for THETAs technology .They just delivered a new roadmap as well and it looks very promising. With the support of ecosystem projects to go live with TNT20 tokens coming up on Q2 any time from April to June price action looks promising.

Overall, Q2 looks like a promising month for THETA TFUEL

THETHA long setupI suggest considering a potential long position entry with the idea of compression and liquidity collection from all levels above, targeting up to 3.8. At this level, participants with short positions using up to 3x leverage from the current global volume cluster are going to be liquidated.

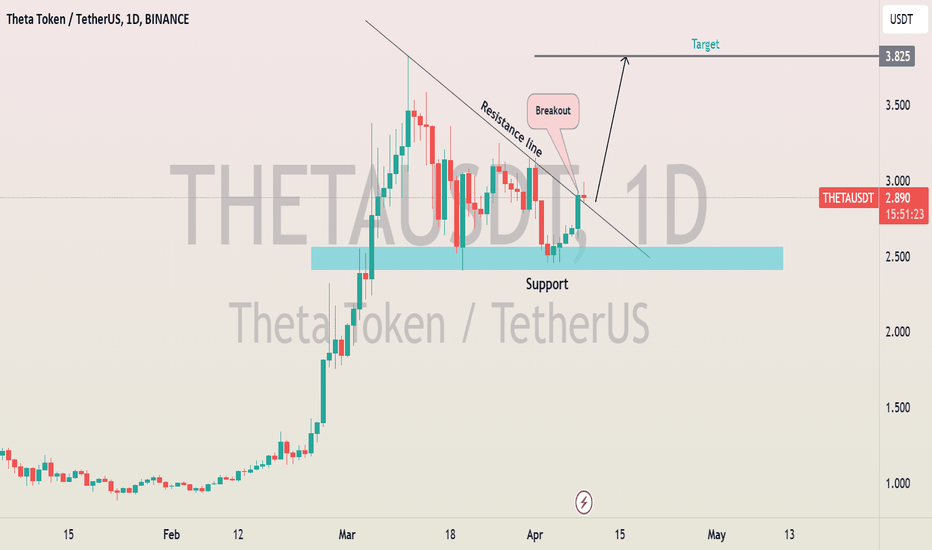

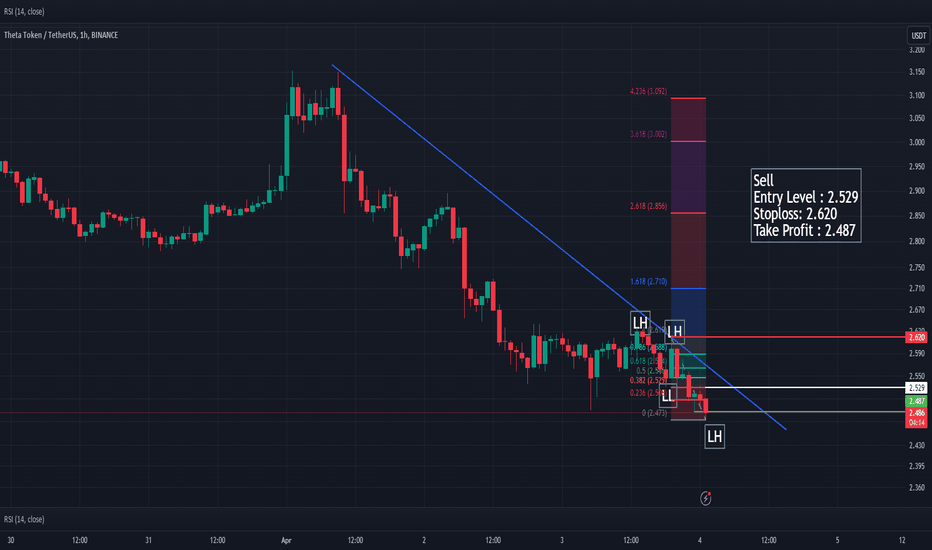

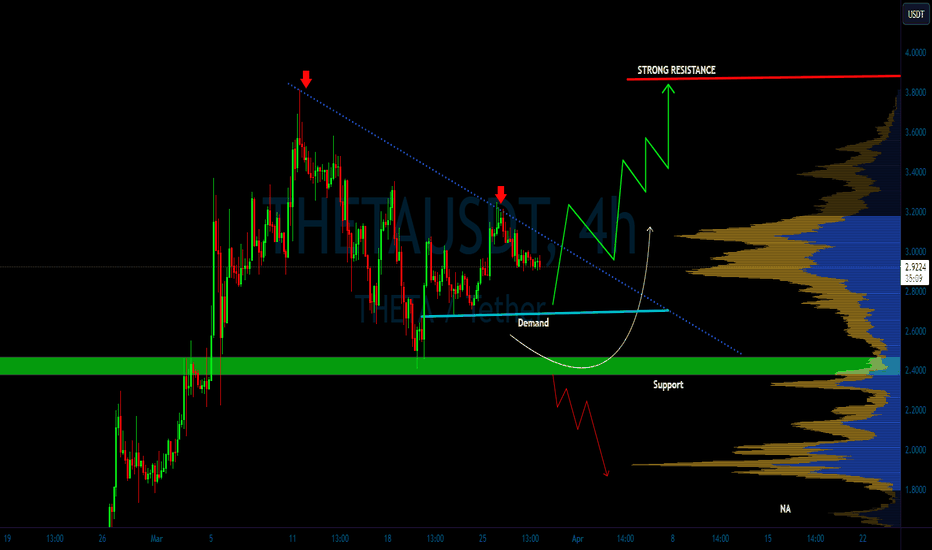

THETA/USDT: Important Bullish BreakoutFollowing a period of upward movement, the price experienced a downturn and stabilized around the 2.4 level.

Currently, a descending triangle shape has emerged, with the resistance of the pattern being breached. This development signals the dominance of the buyers, leading me to anticipate further upward movement.

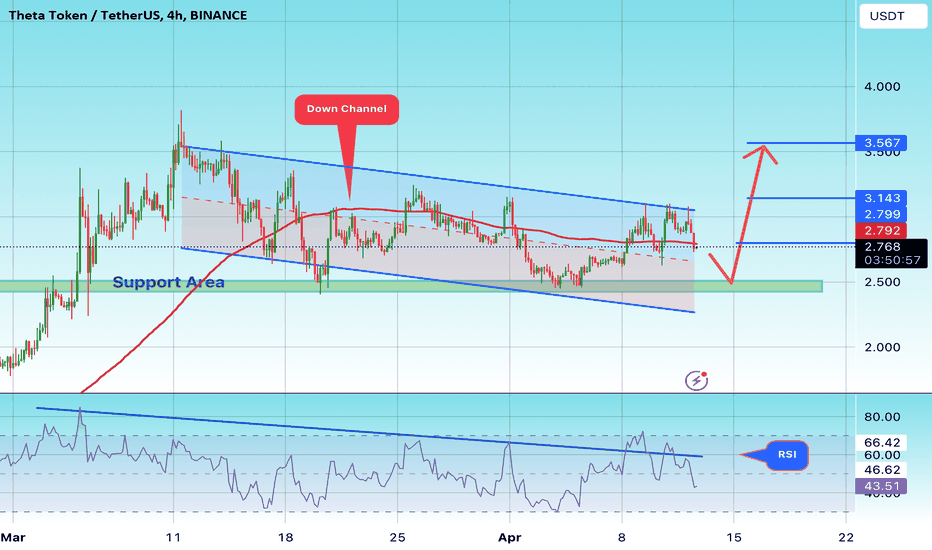

# THETA/USDT# THETA

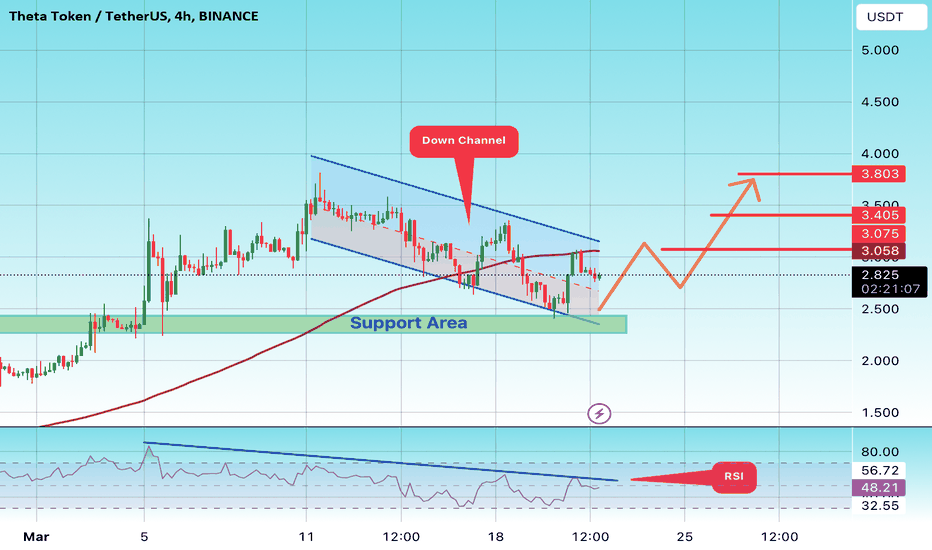

The price is moving in a downward channel on a 4-hour frame and we have a green support area at the 2.40 level

Now we have a breakout that is about to occur well after bouncing from the green zone

Our RSI indicator has a trend that is about to break to the upside

Entry price is 2.80

First goal 3.06

Second goal 3.40

Third goal 3.80

🛤️🔺 THETA Long Spot Trade Setup! 🔺🛤️

🛤️🔺 THETA Long Spot Trade Setup! 🔺🛤️

📊 Analysis:

Support Area: THETA is currently at a strong support zone, indicating a potential rebound.

Bullish Setup: Favorable setup for a long spot trade.

Upside Potential: Targets set at resistance levels above.

📈 Trade Plan:

Entry: Consider entering in the $2.50 - $2.70 support area.

Take Profit: Aim for profits at $3.00 - $3.30 or higher towards $3.60 - $3.80.

Stop Loss: Place stop loss just below $2.40 to manage risk.

💡 Note: Monitor price action closely for confirmation of the bounce from support and adjust strategy accordingly! Stay attentive to market movements. 🚀📈 #THETA #LongTrade 🛤️🔺

THETA/USDT VRVP & Bullish continuation from demand? 🚀THETA💎 Paradisers, direct your focus to #THETAUSDT as it currently charts a significant course in the market. Positioned within a demand zone at $2.6684, it's gearing up for another attempt to breach a formidable resistance level, hinting at a strong potential for a bullish movement.

💎 Delving into the #THETANETWORK market history, we observe its adherence to a descending channel pattern, culminating in a break and subsequent upward movement. Notably, the vrvp (volume-weighted relative strength) has shown significant momentum. If the price sustains its momentum at the demand level, we anticipate a bullish ride aiming to mitigate above the resistance.

💎 However, seasoned #THETA traders recognize that the path in crypto markets isn't always linear. If the anticipated breakout becomes a close call and deviates from expectations, be prepared to pivot toward a bullish resurgence from the support level of $2.3799. This strategic contingency planning is essential for navigating market fluctuations.

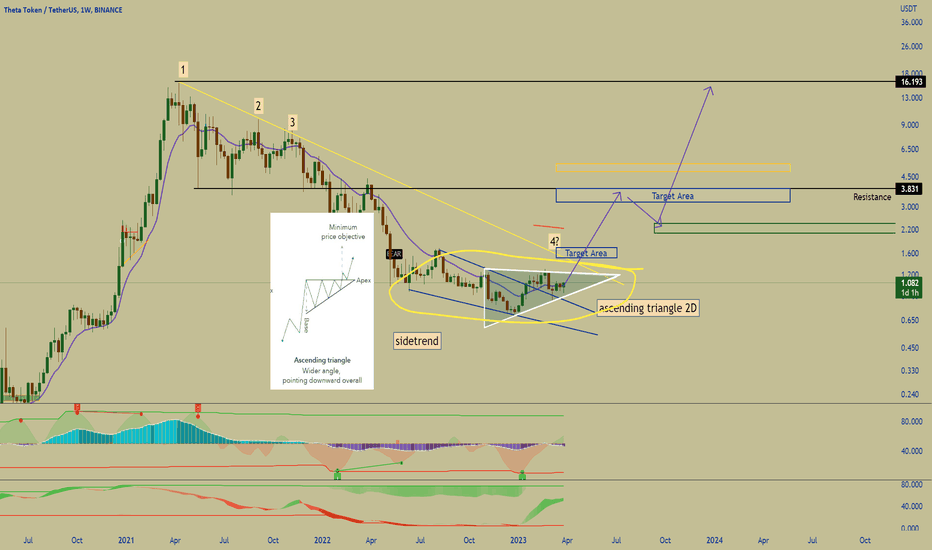

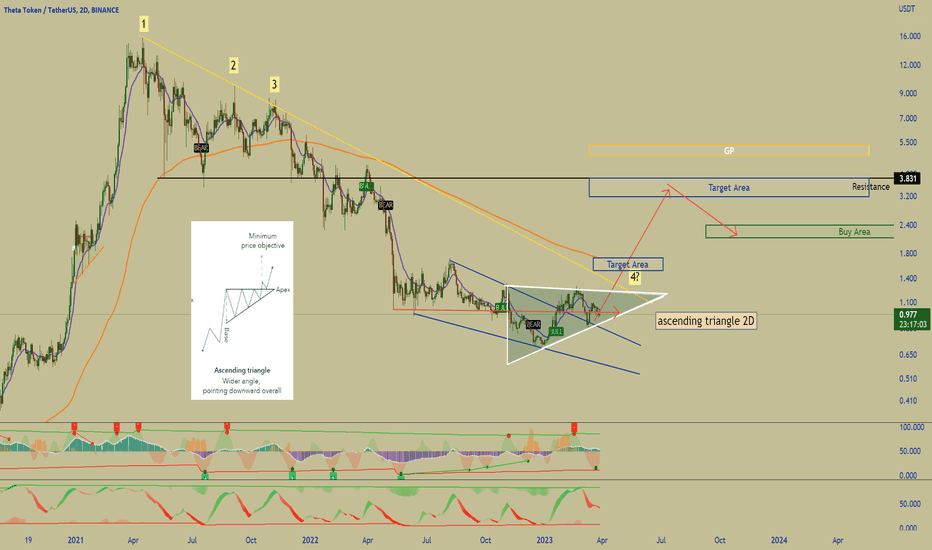

THETAUSDT Ascending triangle 2D chart This is my current chart for THETA right now. Currently, I am using long timeframes here because this is a long term trade for me personally. I believe many of us are involved for the long term as well , not a quick money grab.

Technical Analysis POV:

We have been in a side trend ever since May 15,2022. Pumping hard and crashing hard. Thats what sidetrends are we go up and we go down until we enter a new trend. From the looks of the 2D chart, It looks like we should be attempting a breakout on the "#4?" in the chart. A breakout of the yellow trendline would lead us to a change of the sidetrend into an uptrend. I see low chances of ever reaching 0.7 again or lower, higher chances are we go up right now.

I also see a formation of an ascending triangle on the bottom of the chart, which could support my thesis of "this was the bottom". My target price for the long term right now is $3.81 which is more than 300% increase in price.

Fundamental Analysis POV

Fundamentally, THETA TFUEL has been cooking up A LOT . If you have been in twitter lately, you may know by now what THETA has been up to lately. New partnerships and projects joining THETA's ecosystem as well as more patents for THETAs technology .They just delivered a new roadmap as well and it looks very promising. With the support of ecosystem projects to go live with TNT20 tokens coming up on Q2 any time from April to June price action looks promising.

Overall, Q2 looks like a promising month for THETA TFUEL