"THEUSDT: Bullish Momentum Building – Targeting $4.35 in 2 weeksAnalysis:

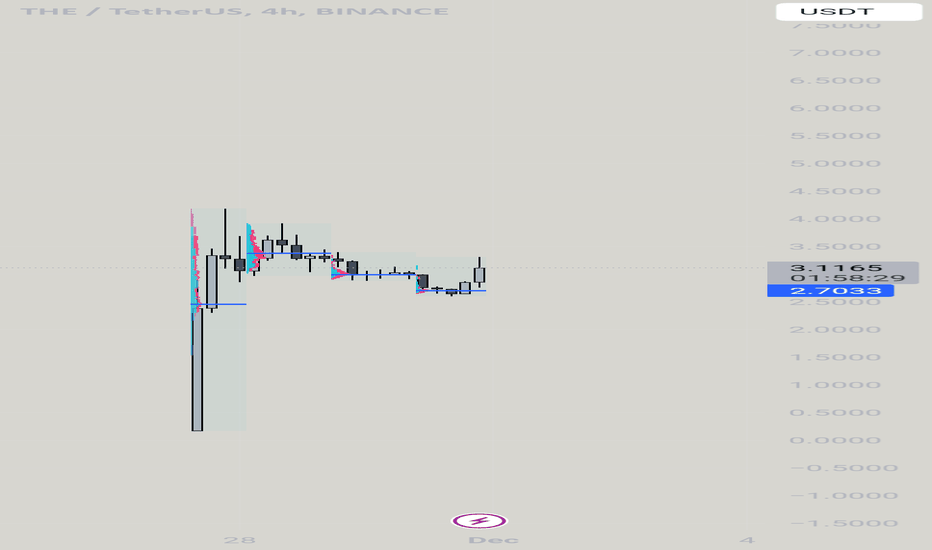

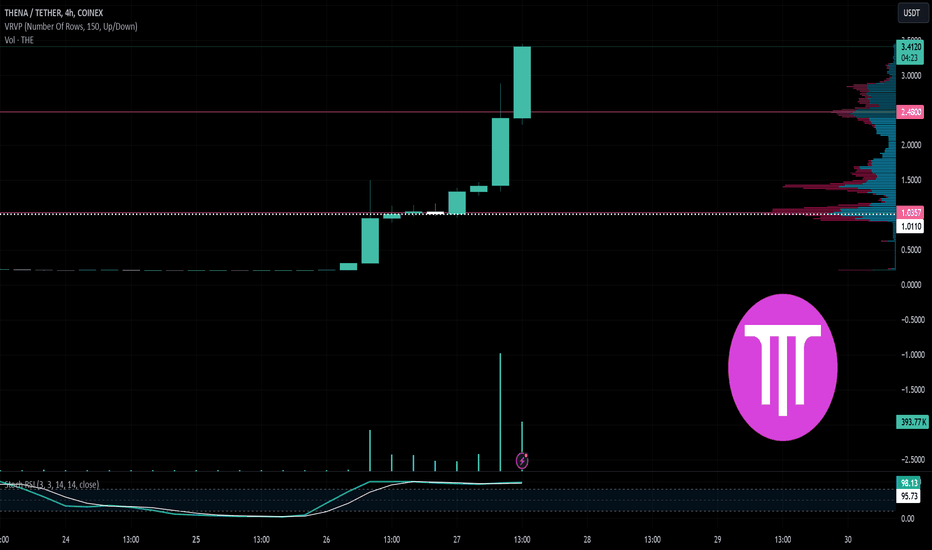

The current price action on the 4-hour chart of THE/USDT suggests strong potential for a bullish move toward $4.35 in the next two weeks. This analysis is supported by the visible TPO and volume profile structures:

1. TPO Support at $2.70:

The blue line marks a crucial level of TPO concentration at $2.70. This indicates a significant area where buying activity previously dominated, forming a strong base of support. The market has tested this level and rebounded, signaling that buyers are stepping in to protect it.

2. Low TPO Activity Above $3.10:

Above the current price at $3.11, TPO activity decreases significantly, indicating a low-resistance zone for upward movement. Such gaps in TPO profiles often act as vacuum zones, allowing price to rally quickly as supply is limited.

3. High TPO Levels at $4.35:

The $4.35 level coincides with a prior high-TPO concentration, making it a strong magnet for price action. Market participants often target such levels due to historical significance, creating a natural area for profit-taking.

4. Bullish Momentum:

The recent price action has broken through key resistance levels and is building momentum. The rejection of lower prices and steady higher lows indicate a shift in sentiment toward bullishness.

Projection:

Given the clear support at $2.70 and the low-resistance zone above $3.10, the price is likely to test and eventually reach $4.35 within the next two weeks. This upward trajectory aligns with the market structure, TPO analysis, and the presence of aggressive buyers in the current range.

Risk:

Monitor $2.70 support closely; a break below this level could invalidate the bullish thesis.

Watch for potential resistance around $3.80 as an intermediate level.

Stay updated as we track this move toward $4.35!

THEUSDT.P trade ideas

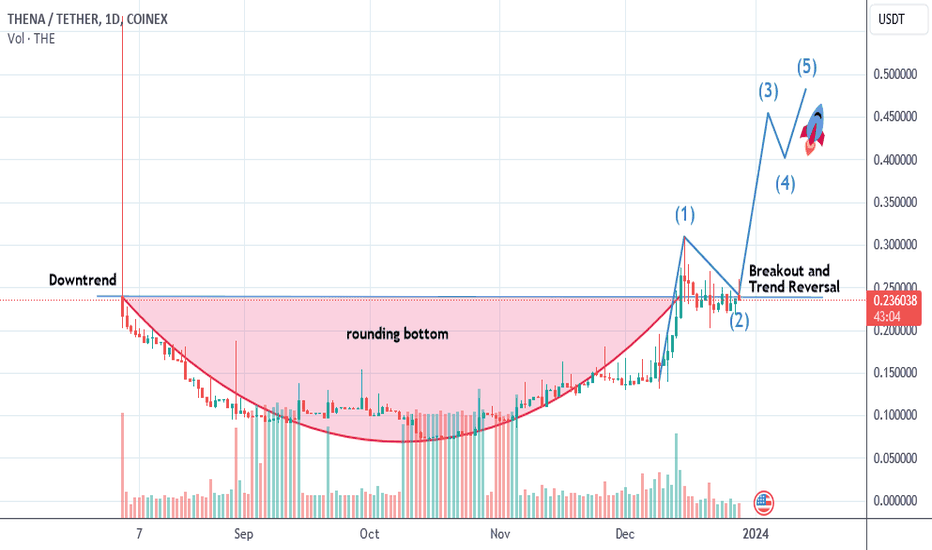

THENA COIN PRICE ANALYSIS AND NEXT POSSIBLE TRADE SETUP !!TSX:THE Coin Update!!

• currently Price holding golden Fib key level but i am not expecting bounce back from her... Still if its break trendline and you get confirmation for trade then use low fund and low leverage✅

• On the other hand i think pottential trade setup will be find when price at 2.30$-2.20$

Warning : That's just my analysis not a trade execution ... #DYOR Before follow me 🚨

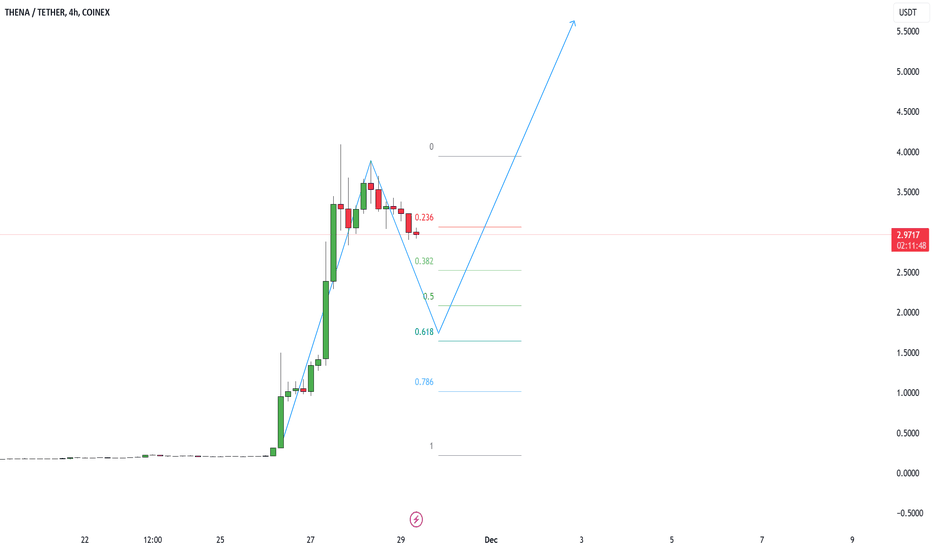

THE/USDT Analysis: Potential Correction with Key Fibonacci Buy THE/USDT Analysis

The price is currently at $2.9817 and is potentially heading towards key Fibonacci retracement levels for a correction.

Key Buy Zones

$1.7470

$1.0870

If the correction continues, the price is likely to drop to the mentioned support zones before resuming an upward trend.

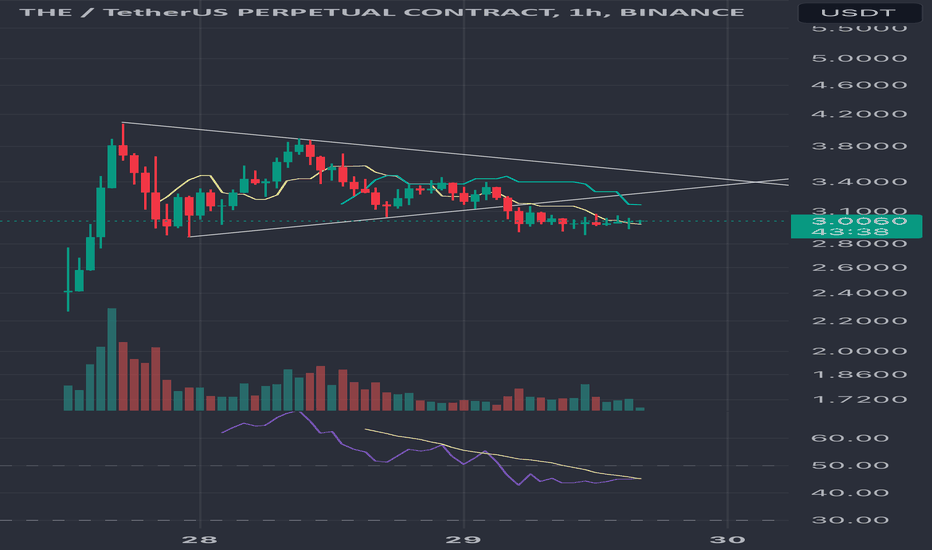

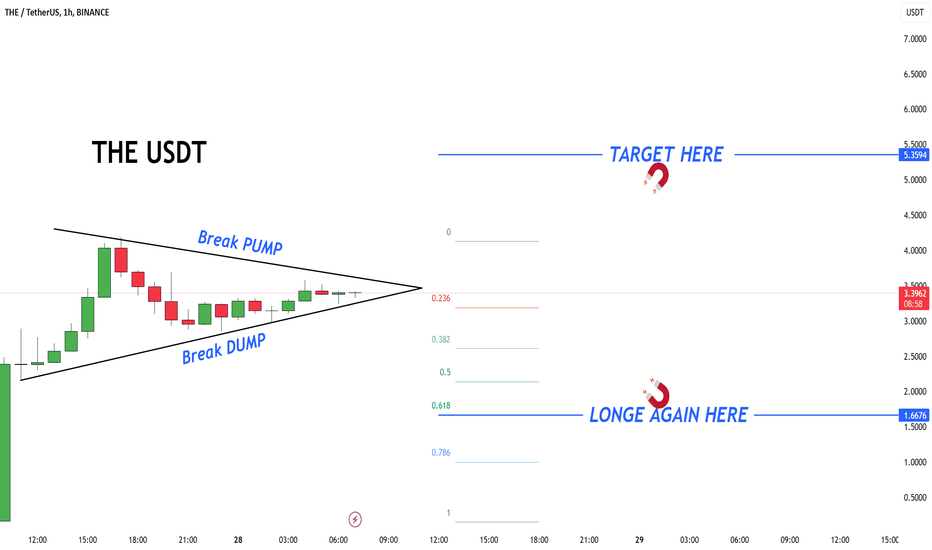

THE/USDT#THE/USDT

The $THE/USDT pair is trading within a symmetrical triangle pattern, indicating a balance between buyers and sellers before a potential breakout. If the price breaks above the triangle, the target is 5.3594 USDT. Conversely, if it breaks below, the price may drop to 1.6676 USDT. It is recommended to enter after a confirmed breakout with a tight stop-loss to manage risk effectively.

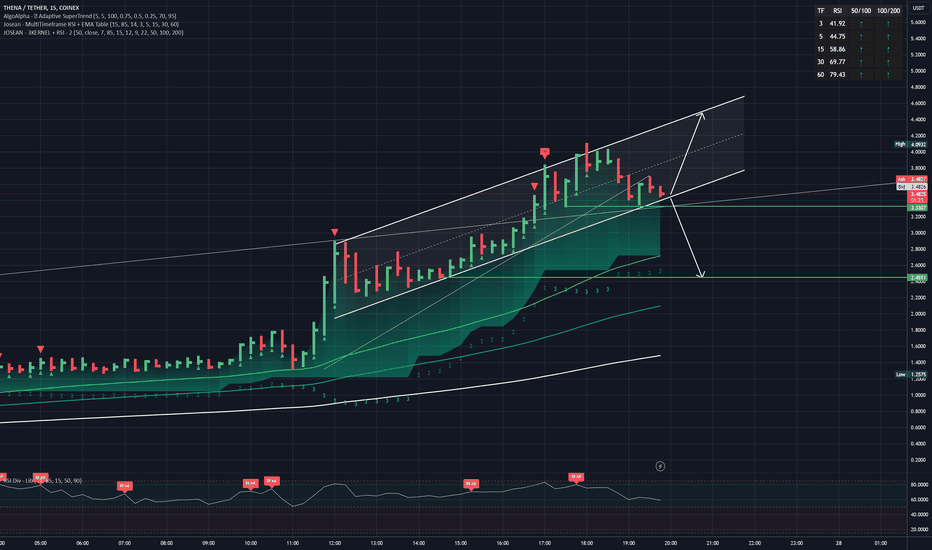

THENA-USDT 15min Great VOLATILITYTHENA-USDT -

First strategic tests with the bot, offered spectacular results of 20% profit with "ALL" trades in positive (24h).

We continue working on the small problems that have arisen, but for a diamond to become brilliant, the edges must be polished :)

Thank you!

_______________________________________________________

THENA-USDT 15min Great VOLATILITY

Its price has increased by +260% in just one day

The rise has been incredible throughout the day, but at some point it will be necessary to correct, so there is a great opportunity to go SHORT if the market allows it.

I was doing SHORTS with EMA CROSS: 1min - 3 min - 5min.

Another possibility is to wait for the falls to go LONG.

Whatever the case, this volatility allows us to position ourselves and seek profits in very short time frames.

Either of the 2 is good as long as you know how to catch waves.

Protect your investors with SL and have very good luck with your decisions.

__________________________________________________

Automated Cryptocurrency Trading Bots: All these strategic alternatives can be configured with TradeX BoT, since it will allow you to position in both directions without having to block any amount per position. It will only be necessary for the conditions to be met, either downward or upward, for the orders to be executed in one direction or another, taking the necessary deposits from your portfolio.

TradeX BoT (in development): Tool to automate trading strategies designed in TradingView. It works with both indicators and technical drawing tools: parallel channels, trend lines, supports, resistances... It allows you to easily establish SL (%), TP (%), SL Trailing... multiple strategies in different values, simultaneous BUY-SELL orders, conditional orders.

This tool is in the process of development and the BETA will soon be ready for testing.

FOLLOW ME and I will keep you informed of the progress we make.

I share with you my technical analysis assessments on certain values that I follow as part of the strategies I design for my portfolio, but I do not recommend anyone to operate based on these indicators. Inform yourself, educate yourself and build your own strategies when investing. I only hope that my comments help you on your own path :)

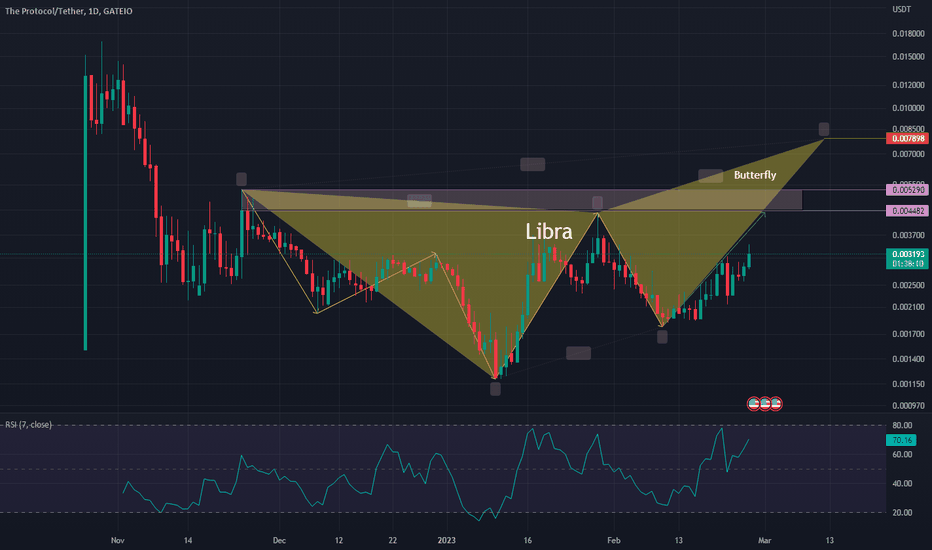

Thena | From Binance to the MoonCZ Joins Thena’s Party: Pumps, Pools, and Plenty of Liquidity

Thena serves as the primary liquidity layer and automated market maker on the BNB Chain. It leverages advanced AMM technology, deep liquidity, and smart routing to provide users with low slippage and high returns when exchanging cryptocurrencies. Thena is designed to onboard new protocols to the BNB Chain by facilitating a free market for THE emissions. Protocols can either bribe veTHE holders or acquire veTHE themselves to direct emissions to their pools, offering a flexible and efficient solution for scaling liquidity.

Thena features two types of liquidity pools for all trades, optimized through smart routing to ensure the best price execution. These composable and reliable AMMs make the platform attractive for protocols looking to integrate and build on Thena.

THE Token

THE is a BEP20 utility token powering the protocol, with emissions aimed at two core goals:

Liquidity Optimization: THE is distributed as farming rewards to incentivize deep liquidity, ensuring optimal trading conditions.

Decentralized Governance: THE holders can participate in governance decisions, steering the platform’s ongoing development. The ultimate vision is to achieve full decentralization.

Lets check Thena’s Market Performance so far

Current Price: $3.4, up by 222% in the past 24 hours.

All Time High: $3.23 (achieved on February 8, 2023), currently 2.7% below this peak.

Circulating Supply: 76.59 million tokens out of a maximum supply of 326.12 million.

24Hour Trading Volume: $837 million across 21 markets and 10 exchanges, with Binance being the most active for sure! and the Market Cap is $241 million

Thena’s listing on Binance has strengthened its position within the DeFi ecosystem, signaling strong growth potential. The token’s recent price surge and performance underscore the importance of community support, strategic partnerships, and innovation in a competitive market. The Binance listing has amplified its visibility, paving the way for increased adoption and marking the start of a promising upward trajectory.

its time to get in crypto gems