NAS100 trade ideas

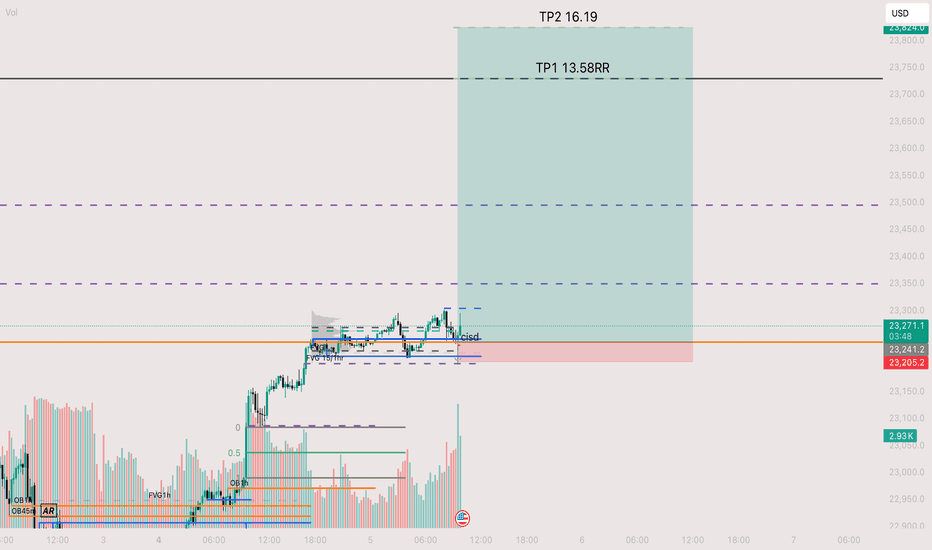

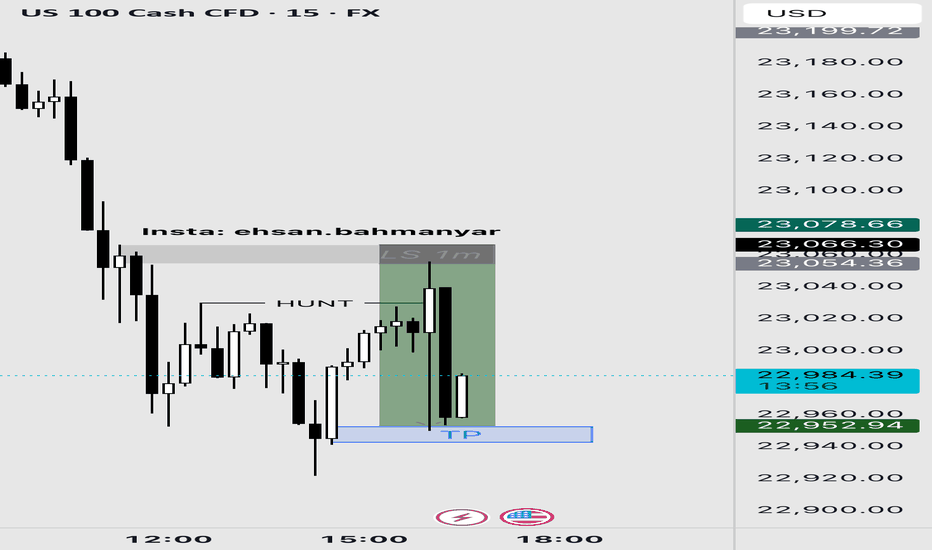

Long entry ON 1min off of daily bullish retracemen going into exMy overall bias is bullish and on the daily price was retracing into a high volume node which I then zoom into the 1min to find an entry. that entry was in a smaller time frame palace zone which price purge and heading upwards. Final TP is at 16.18rr due to me be trying to pass a phase in a prop firm. The real tp is like 40rr if I wasn't doing a challange

NAS100 (CASH100) Short - Double top 30minThe 15min head and shoulders setup got invalidated.

However, my double top variables are currently being met.

Still need confirmation before entering trade.

Risk/reward = 2.7

Entry price = 23 284

Stop loss price = 23 331

Take profit level 1 (50%) = 23 173

Take profit level 2 (50%) = 23 129

What does everyone thing the NASDAQ is going to do today?

NASDAQ (CASH100) SHORT - head and shoulders 15minPotential short on nas100 (cash100) with head and shoulders on the 15min.

Still waiting for confirmation on some of my variables before I enter.

Risk/reward = 3.3

Entry price = 23 262

Stop loss price = 23 287.3

Take profit level 1 (50%) = 23 184

Take profit level 2 (50%) = 23 153

What do you guys and girls think the nasdaq is going to do?

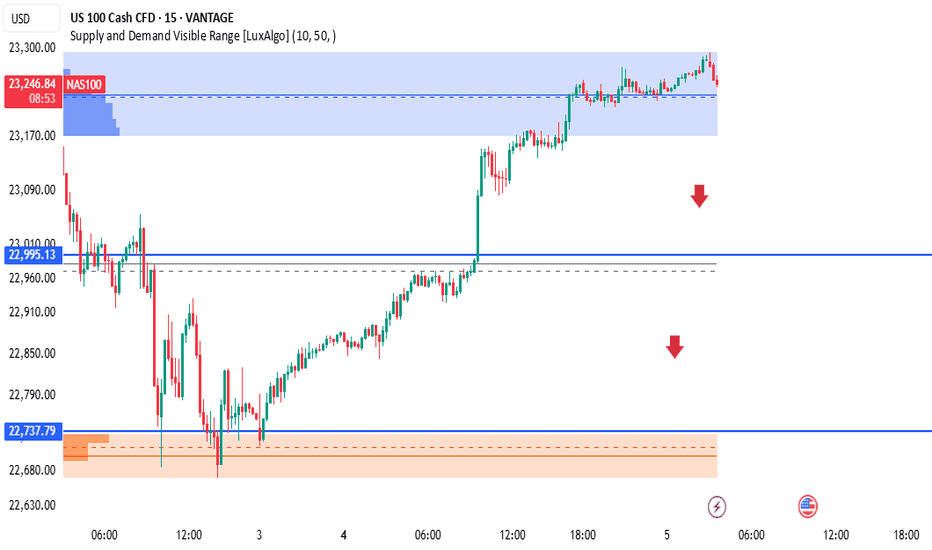

NAS100 – Supply Zone Rejection Trade IdeaPrice has entered a strong supply zone (highlighted in blue), where previous selling pressure originated. A sharp move up has now slowed within this zone, potentially signaling a distribution phase or exhaustion of bullish momentum.

🔰 Key Levels:

🟦 Supply Zone: 23,170 – 23,260

🔵 Mid Support: 22,995.13 (Potential retracement level)

🟧 Demand Zone: 22,680 – 22,750

🔽 Red arrows indicate potential downside targets.

🧠 Smart Money Perspective:

Price has filled the Fair Value Gap (FVG) and tapped into a low-volume node on the visible range volume profile.

Signs of liquidity sweep and exhaustion within the supply zone.

Possible short setup forming if price confirms a Change of Character (CHOCH) on LTF (e.g., break of short-term bullish structure).

💡 Trade Idea:

Short Entry: On confirmation inside supply zone

SL: Above 23,260

TP1: 22,995 (reaction level)

TP2: 22,737 (major demand zone)

Watch for a reaction at the 22,995 level; if price slices through, the next destination may be the orange demand block.

⚠️ Disclaimer:

This is for educational purposes only, not financial advice. Always use proper risk management.

🔖 Hashtags:

#NAS100 #SmartMoney #PriceAction #SupplyZone #OrderBlock #CHOCH #LuxAlgo #FrankFx14 #TradingView #US100

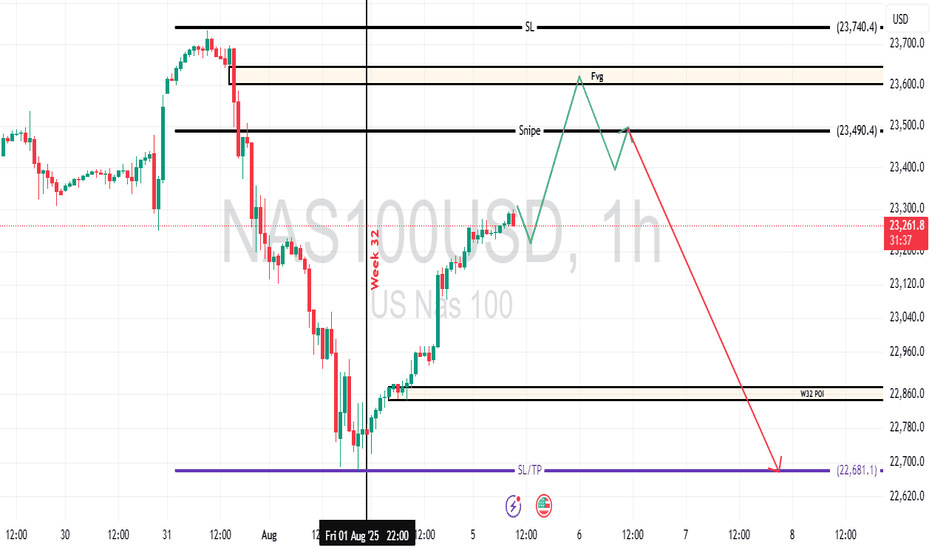

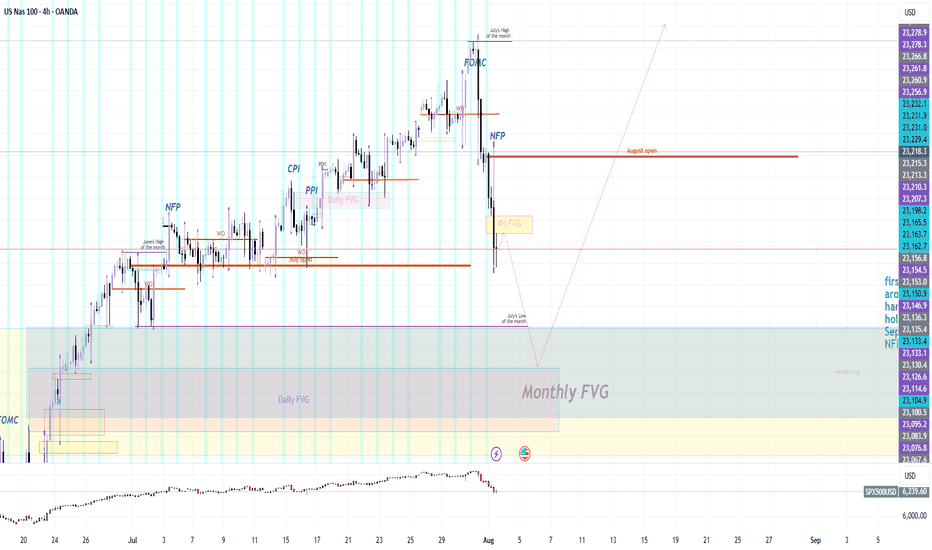

NASDAQ Week 32 OutlookOn the US Nas 100 1-hour chart, a bearish breakout from a symmetrical triangle suggests downward momentum. The Fair Value Gap at 23,500.0 is a pivotal level—watch for a breakout and retest here to confirm sell entries. Aim for the target at 22681.1, with a stop-loss at 23,740.4 to protect against adverse moves.

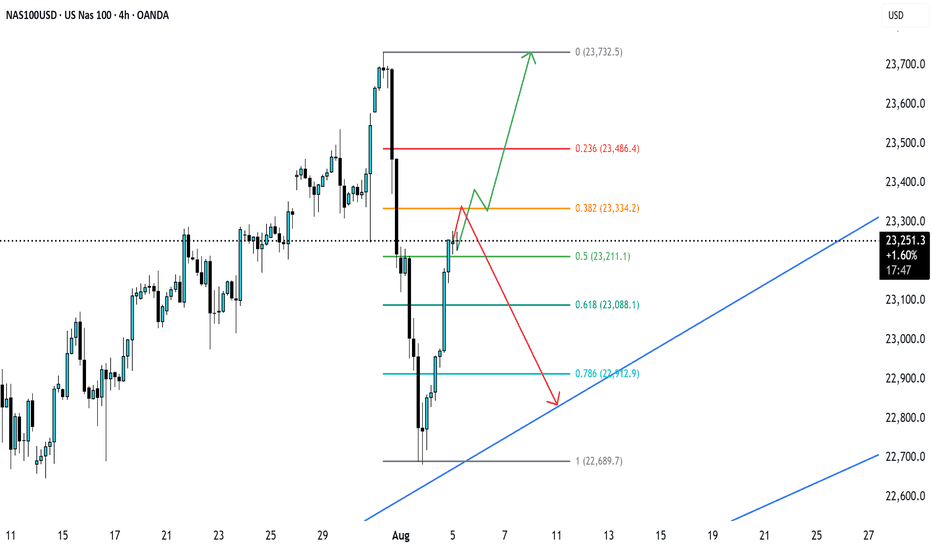

NAS100 at mjaor resistance area Fib 0.5Price has reached the 0.5–0.382 Fibonacci retracement zone of the recent swing. If the bears are strong, we may see a rejection toward the trendline support. However, if this resistance is broken, a bullish continuation is also possible. Let's see how it plays out.

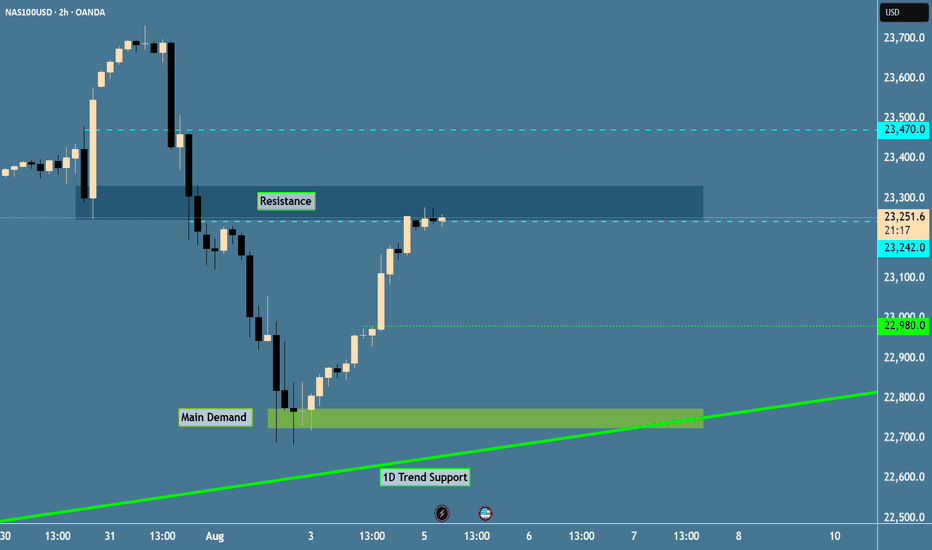

NAS100 - IMPORTANT UPDATEDear Friends in Trading,

How I see it,

Investors imposed a very strong recovery attempt.

Daily tweezer close.

As it stands, potential for a "BEARISH" sentiment is wavering.

1) Will price come all the way back to main demand for a second leg?

2) Will price only retrace back into discount for a higher right foot?

Keynote:

Investors show confidence/hopeful for a near term rate cut...

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

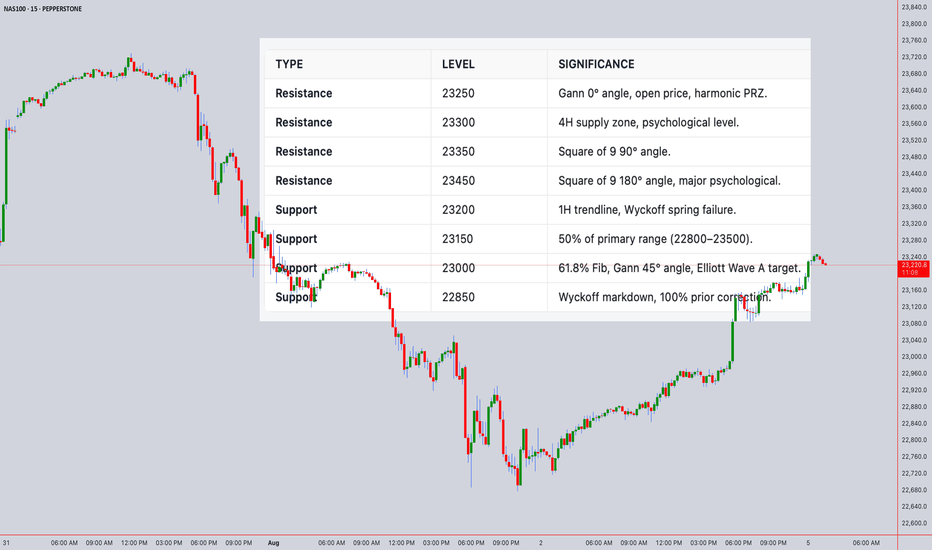

Technical Analysis Forecast for NAS100Open Price: 23242.3 (UTC+4)

1. Japanese Candlestick Analysis

4H/1H: Price opened at 23242.3 near resistance (23250–23300). Recent candles show bearish harami (4H) and dark cloud cover (1H), signaling rejection.

30M/15M: Gravestone doji at 23242.3 and three black crows indicate strong bearish momentum.

5M: Shooting star formation suggests exhaustion. Failure to close above 23250 confirms weakness.

Outlook: Bearish reversal likely if 23200 breaks.

2. Harmonic Patterns

4H/1H: Bearish Butterfly Pattern completing at 23242.3 (D-point).

PRZ: 23240–23250 (confluence of 127.2% XA and 161.8% BC).

Fibonacci Ratios: AB=CD symmetry (23240–23250).

30M: Bullish Crab forming at 23100, but secondary to larger bearish setup.

Outlook: High-probability short entry at 23240–23250 with target 23000.

3. Elliott Wave Theory

4H: Wave 5 of impulse cycle peaked at 23242.3.

Structure: Completed 5-wave sequence from 22800 → 23242.3.

Corrective Phase: ABC pullback targeting 23000 (Wave A) and 22850 (Wave C).

1H: Sub-wave (v) of 5 ending at 23242.3. RSI divergence confirms exhaustion.

Outlook: Bearish correction to 22850–23000 within 24 hours.

4. Wyckoff Theory

Phase: Distribution (after markup from 22800 → 23242.3).

Signs: High volume at 23242.3 (supply), upthrust above 23300 failed.

Schematic: Phase C (markdown) initiating.

1H/30M: Spring at 23200 failed to hold, indicating weak demand.

Outlook: Break below 23200 triggers markdown to 23000.

5. W.D. Gann Theory

Time Theory

24H Cycle: Key reversal windows:

UTC+4: 08:00–10:00 (resistance test), 14:00–16:00 (trend reversal).

Square of 9: 23242.3 aligns with 0° angle (resistance).

Square of 9

23242.3 → Resistance Angles:

0° (23250), 90° (23350), 180° (23450).

Support: 45° (23000), 315° (22850).

Price Forecast: Reversal at 23250 (0° angle).

Angle Theory

4H Chart: 1x1 Gann Angle (45°) from 22800 low at 23000. Price above angle = bullish, but overextended.

1H Chart: 2x1 Angle (63.75°) at 23242.3 acting as resistance.

Squaring of Price & Time

Price Range: 22800 → 23242.3 (442.3 points).

Time Squaring: 442.3 hours from 22800 low → 23250 resistance (442.3 points ≈ 442.3 hours).

Harmony: 23242.3 = Time Cycle Peak (24H from open).

Ranges in Harmony

Primary Range: 22800–23500 (700 points).

50% Retracement: 23150 (support).

61.8% Retracement: 23000 (critical support).

Secondary Range: 23000–23300 (300 points).

Key Levels: 23150 (50%), 23000 (61.8%).

Price & Time Forecasting

Price Targets:

Short-Term: 23000 (61.8% Fib, Gann 45° angle).

Extension: 22850 (100% of prior correction).

Time Targets:

First Reversal: 8–12 hours from open (UTC+4 12:00–16:00).

Second Reversal: 20–24 hours (UTC+4 00:00–04:00 next day).

Synthesized 24H Forecast

Bearish Scenario (High Probability)

Trigger: Break below 23200 (confirmed by 1H/30M close).

Targets:

T1: 23000 (61.8% Fib, Gann 45° angle).

T2: 22850 (Wyckoff markdown, Elliott Wave C).

Timeline:

8–12H: Drop to 23000 (UTC+4 12:00–16:00).

20–24H: Test 22850 (UTC+4 00:00–04:00 next day).

Confirmation: RSI <50 on 1H, volume spike >25% average.

Bullish Scenario (Low Probability)

Trigger: Sustained close above 23300 (Gann 0° angle).

Targets: 23350 (90° angle), 23450 (180° angle).

Timeline: 12–16 hours (if 23300 breaks).

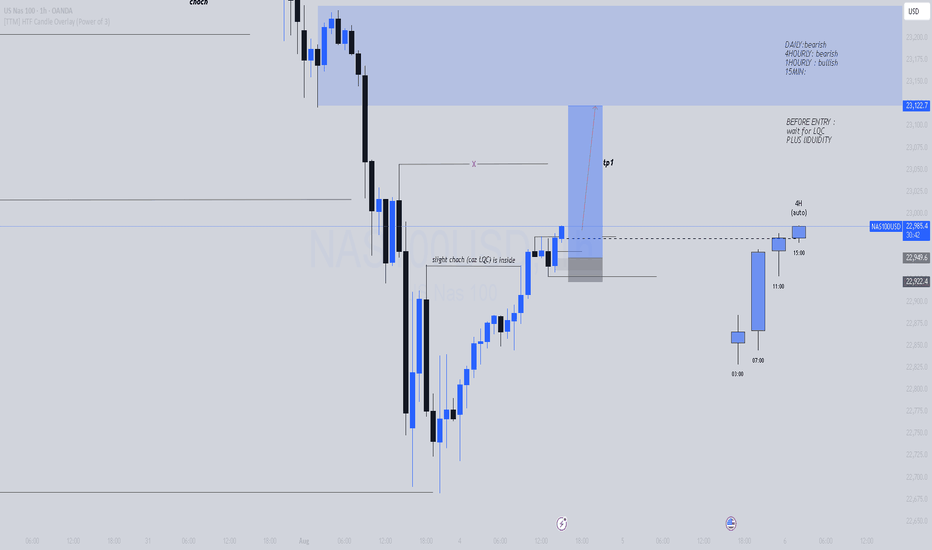

NAS100 | 1H Bullish Continuation Setup – Aug 4, 2025Here’s a complete **TradingView trade description** for your NAS100 setup based on the chart you shared — using Smart Money Concepts, market structure, and intraday context:

---

**NAS100 | 1H Bullish Continuation Setup – Aug 4, 2025**

### 🔹 Market Bias:

* **Daily**: Bearish

* **4H**: Bearish

* **1H**: Bullish structure forming

* **15min**: Bullish BOS + internal structure break

---

### 🧠 Trade Narrative (SMC-Based):

Price created a **liquidity sweep + slight CHoCH** on the 15min inside a discount zone. After the sweep, we saw strong bullish displacement on the 1H, shifting momentum temporarily back to buyers.

We've now returned to the **origin of the impulsive move (POI)** and are looking for **continuation into premium**, targeting the nearest inefficiency + supply zone above.

Entry taken from a refined OB with **Buy Limit at 22,949.6**, aligned with:

* Internal liquidity resting below

* 50% of the bullish candle

* Structure support formed after BOS

---

### 📌 Entry Criteria:

* **Buy Limit**: 22,949.6

* **SL**: Below recent low / zone invalidation (e.g., below 22,922.4)

* **TP1**: 23,056.6 (1H imbalance + prior S/R flip)

* **Extended TP**: 23,122.7 (origin of H4 supply zone)

* **RR**: \~3.2R to TP1

🛑 Before entry: Wait for **LQ grab + internal confirmation** (e.g., M5 rejection wick or engulfing).

---

### 🧩 Confluences:

* ✅ Internal liquidity sweep

* ✅ BOS + CHoCH (15M + 1H structure)

* ✅ Entry refined to OB with imbalance

* ✅ Targeting clean inefficiency + unmitigated supply

* ✅ Volume and momentum shift support continuation

---

**⚠️ Invalidation**: Clean break below 22,922.4 structure + bearish engulfing = setup no longer valid.

---

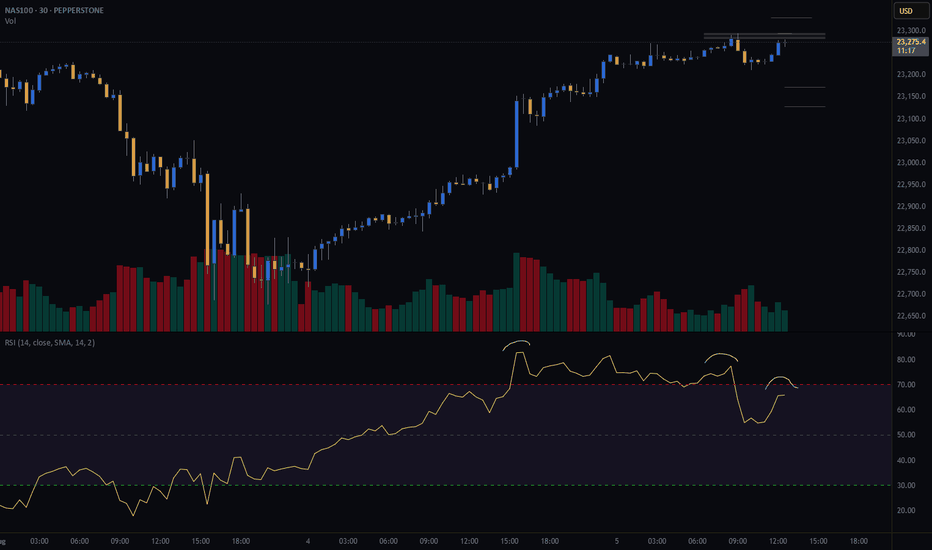

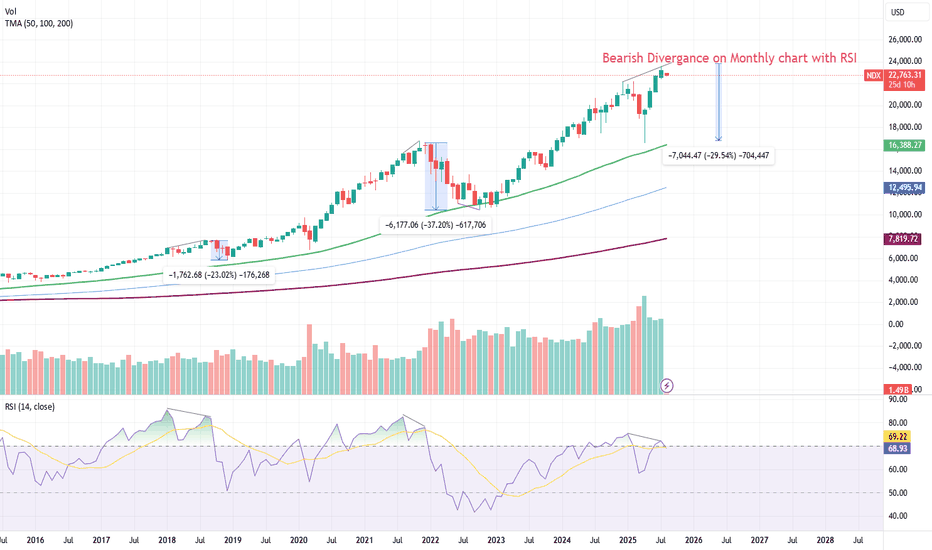

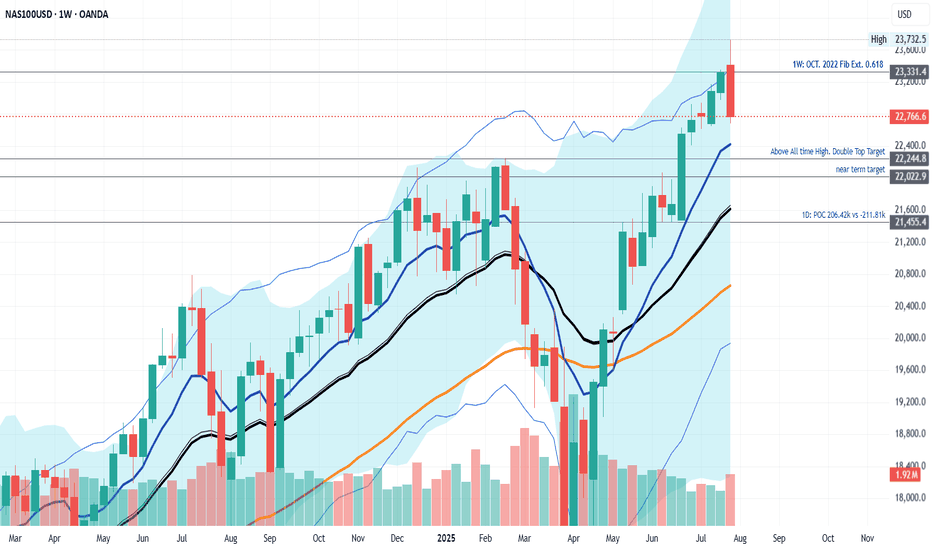

Nasdaq 100 Bearish Divergence Signals Potential 30% down ?Chart Analysis (Monthly):

The Nasdaq 100 (NDX) is showing a significant bearish divergence on the monthly chart with RSI, which historically has been a strong reversal signal. While the price has recently made a new high, the RSI has failed to confirm this move, forming lower highs. This divergence typically precedes major corrections in the index. Similar patters have been observed on S&P 500 and FANG+ Index.

Historical Context:

In past instances (highlighted on the chart), similar divergences led to substantial declines:

2018: ~23% drop

2022: ~37% drop

Currently, if history repeats, the NDX could potentially correct by ~30% from recent highs, bringing it closer to the 16,000–17,000 zone, aligning with the previous demand zone and the 100-month moving average.

Fundamental Backdrop – Tariff Issues:

Adding to the technical weakness, renewed concerns over U.S. trade tariffs under Trump's policy stance are resurfacing. Potential escalation in tariffs could weigh heavily on mega-cap tech stocks, which dominate NDX, impacting global supply chains and margins. Historically, tariff-related uncertainty has triggered volatility in growth-heavy sectors.

Watchlist Action:

Closely monitor upcoming U.S. trade policy announcements and tariff discussions.

Hedge long positions or consider selective short opportunities if bearish confirmation patterns appear on weekly/daily timeframes.

📌 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice.

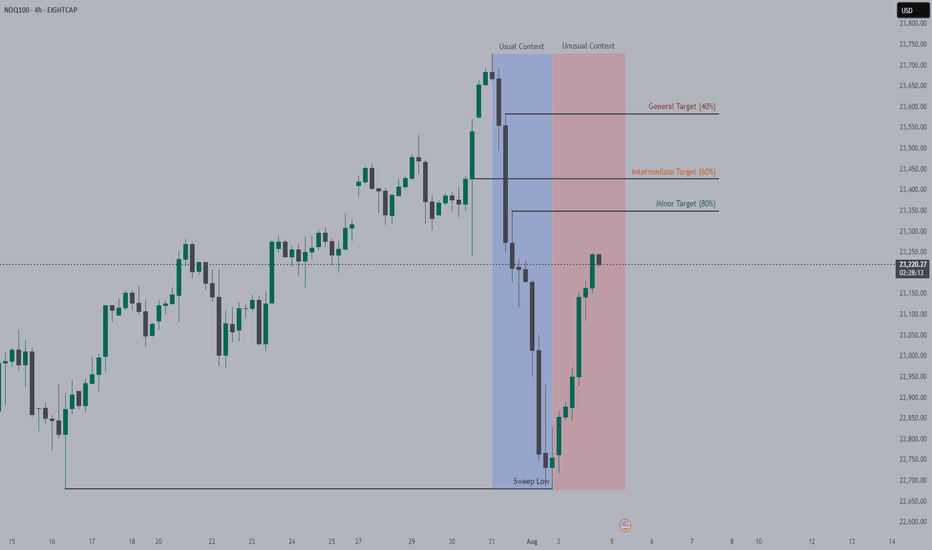

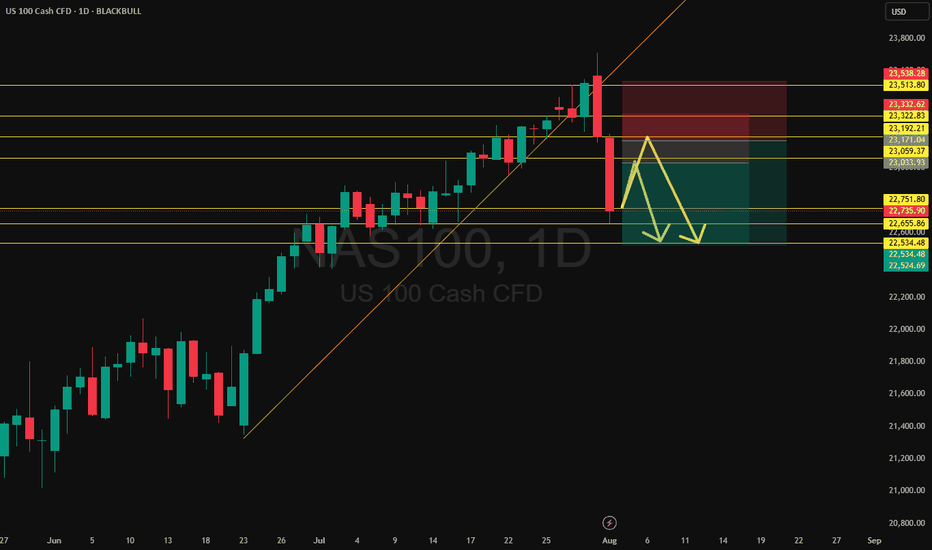

NAS100 Hits Monthly Level - Retrace or Reload?After a sharp leg down, NAS100 remains in a broader uptrend but is now reacting off a key monthly level. Expect a short-term retracement with the potential for a second leg lower. If bullish momentum returns, watch for an attempt to reclaim the level. Momentum is strong enough to challenge it again—traders should be ready for either a deep retrace or continuation move.

NAS100 - Potential Targets this WeekDear Friends in Trading,

How I see it,

(My week is building up; I'm using the DATA we have thus far)

Keynotes:

510k orders stacked at the current demand area.

If sellers push through Daily support decisively, it will become a strong resistance.

The real battlefield between sellers and buyer lies between 23250 - 23500.

Remember with stocks, Imbalances can remain unfilled for very long periods.

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

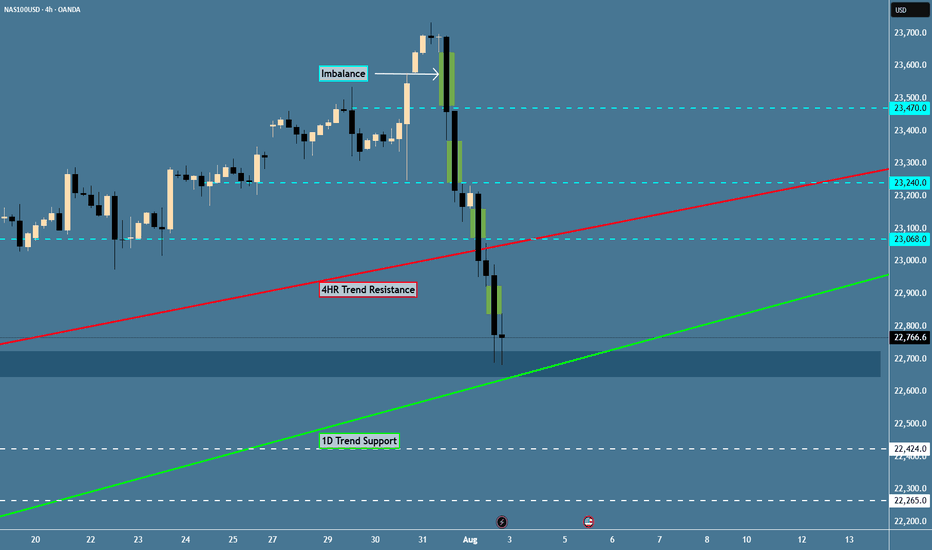

Sunday Premarket AnalysisWe will likely hit the 4H FVG not too far above where price left off on Friday.

Then head all the way down take July's low and hit the area below that

because there is a BIG FAT juicy MONTHLY, WEEKLY && DAILY FVG

sitting directly under the July monthly low. We will likely hit all three or maybe just 2

of these FVG's and then head up for super big push, bullish into at least the first week of September. Keep in mind Jackson Hole Symposium is mid month-ish also.

NAS100 Reversal Confirmed: Is the Rally Over?The NASDAQ 100 (NAS100) may have just hit its ceiling. In this video, I break down the technical evidence pointing to a confirmed reversal—including key candlestick formations and indicator signals that suggest the recent rally is losing steam.

The bearish engulfing candle on both the daily and weekly, along the monthly RSI divergence is signaling a deeper correction. Our initial target for this week is the previous high with a bounce for a much deeper correction which will be analyzed next week so stay tuned to all my updates and new publications. Thank you and have a great trading week. Cheers!!

NSDQ100 The Week Ahead Key Support and Resistance Levels

Resistance Level 1: 23050

Resistance Level 2: 43190

Resistance Level 3: 43430

Support Level 1: 22500

Support Level 2: 22333

Support Level 3: 22080

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

NAS100 - The Stench of Insider Trading on Colossal Scale!!Dear Friends in Trading,

How I see it,

This is just my observation on 12HR TF.

I need Monday's Pre-NYSE data to give a more detailed analysis on smaller TF.

The BEAR signal arrived, and what a monster it is!

Keynote:

Fundamentally something was very off, specifically regarding stocks.

Even though - yes, tariff uncertainty, massively overbought technically.

It had the aroma of serious insider trading profit taking pre-NFP!

I can't help but feel it was a massive exactly timed profit grab

Stocks hardly moved on the event itself...think about it

Also, I believe the labor figures was seriously cooked!!!

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

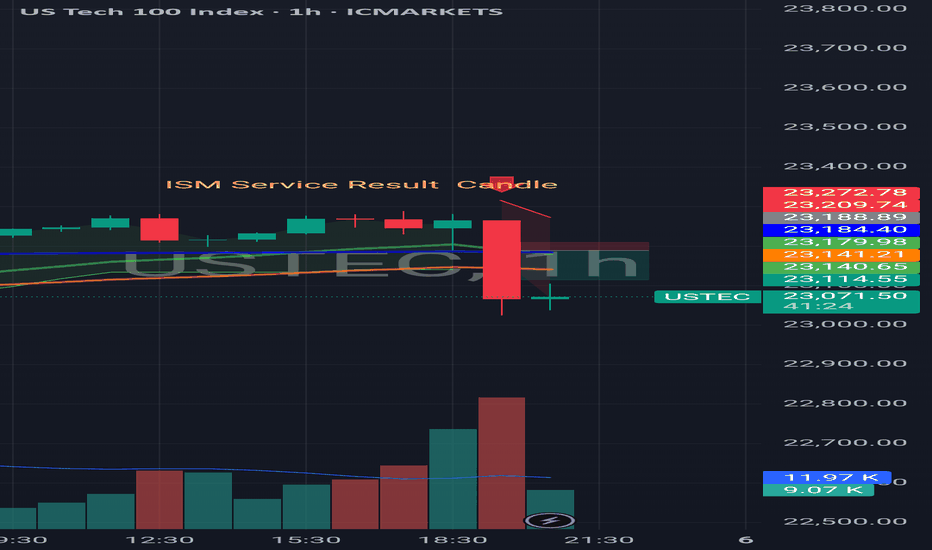

NAS100 – Sharp Breakdown After Tariffs & Jobs Data MissAfter a macro-driven selloff, NAS100 broke decisively below 23,025.0, taking out prior structure and confirming bearish pressure. The drop followed two key catalysts:

📉 Jobs Report Miss: Only 73K jobs added in July vs 200K+ expected — signals a slowing economy.

📛 Tariff Shock: President Trump imposed new tariffs on 90+ countries, up to 41%, rattling global sentiment.

Support at: 22,870.0 🔽 & 22,640.0

Resistance at: 23,025.0 🔼 & 23,200.0

🔎 Bias:

🔼 Bullish: Sustained strength above 22,870 with momentum could aim for 23,025 retest.

🔽 Bearish: Rejection below 23,025 or break under 22,870 opens space to 22,640 and possibly 22,518.

🎯 Let the dust settle – market could still be digesting the shock.

📛 Disclaimer: Not financial advice. Trade responsibly.

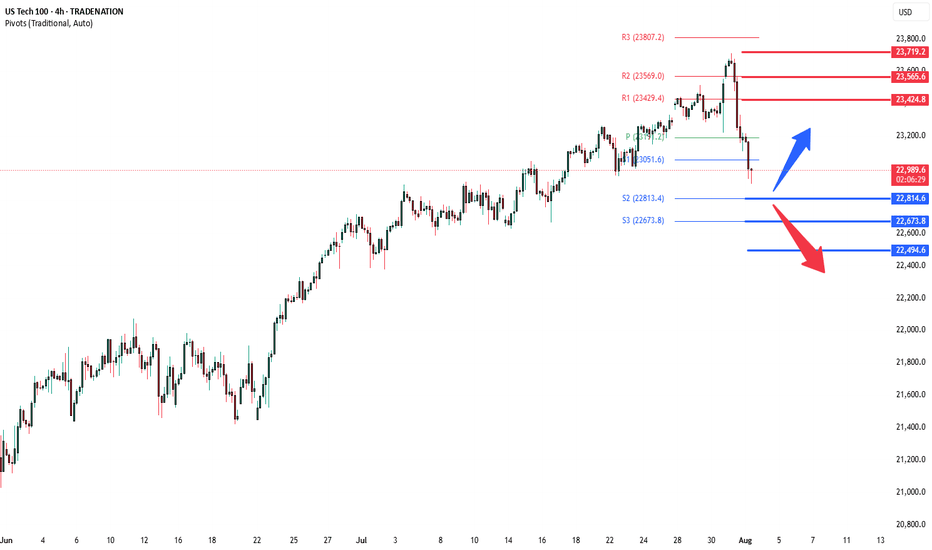

NSDQ100 ahead of US Employment data After the US close, Apple and Amazon posted mixed results:

Apple rose ~2% after-hours on a strong revenue beat ($94bn vs $89.3bn est.) and broad-based growth, especially in China — its first sales increase there in two years.

Amazon fell after projecting weaker Q3 operating profits ($15.5–$20.5bn vs $19.4bn est.) and showing slower cloud growth than competitors, raising concerns over its AI strategy.

These results pulled NASDAQ 100 futures down by -0.20%, as investors digested disappointing Amazon guidance despite Apple’s strength.

Additional Drivers:

US July Jobs Report due today may add volatility. Slower payroll growth (+75k est.) and a rise in the unemployment rate (to 4.2%) could support a dovish Fed narrative.

Trump’s Global Tariff Announcement added macro uncertainty, with sharp tariff hikes on countries with trade surpluses, including a 35% hit to Canada and 39% to Switzerland. This weighs on global trade sentiment.

Pharma Pressure: Trump is also targeting drugmakers on pricing. AstraZeneca hinted at unsustainability, suggesting regulatory risk may be rising for the sector.

Conclusion for NASDAQ 100 Trading:

The tech-heavy NASDAQ 100 faces near-term downside pressure, driven by Amazon’s weak outlook, broader macro headwinds from tariffs, and potential labor market softness. However, Apple's strong China rebound and stabilizing consumer trends (e.g., Target) offer some support. Expect choppy trade as markets await clarity from the jobs report and tariff policy impact.

Key Support and Resistance Levels

Resistance Level 1: 23424

Resistance Level 2: 23565

Resistance Level 3: 23720

Support Level 1: 22815

Support Level 2: 22673

Support Level 3: 22500

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

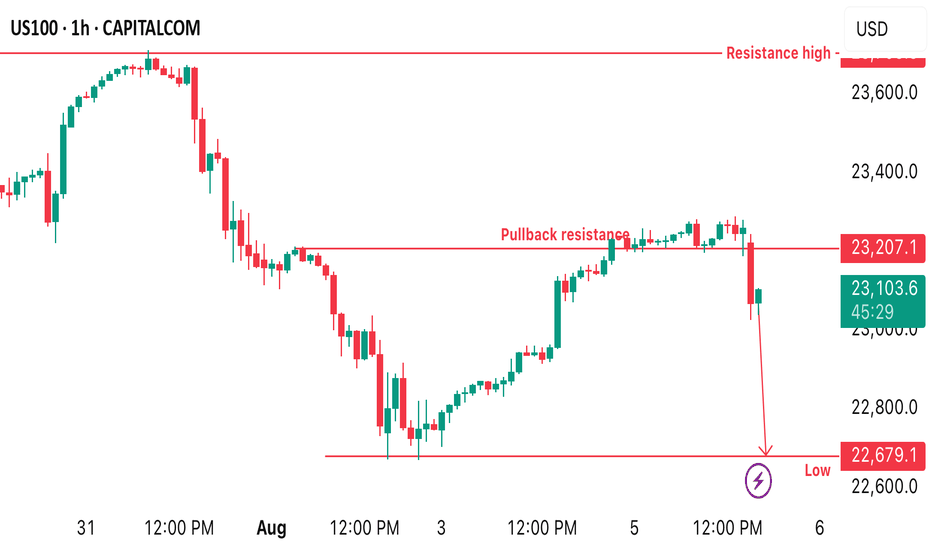

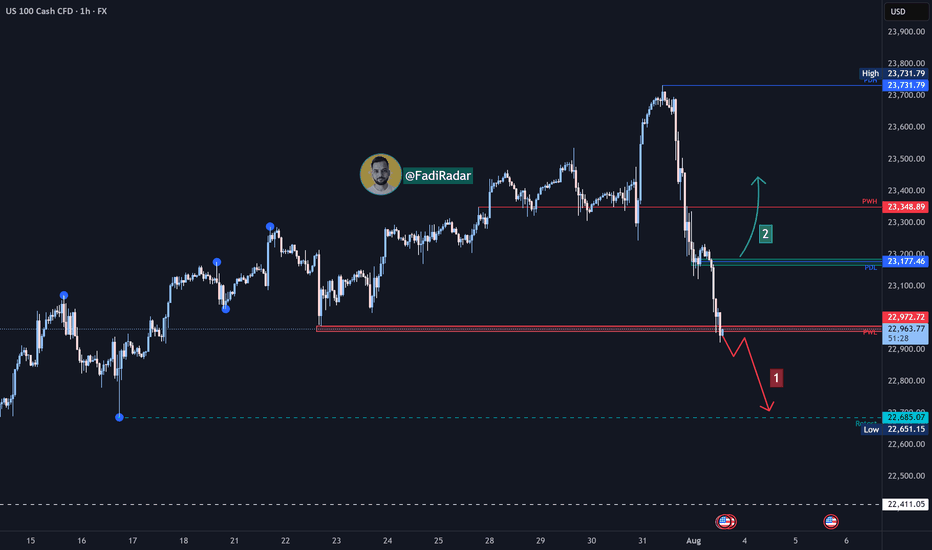

Nasdaq Index Analysis (US100 / NASDAQ):The Nasdaq index experienced a sharp decline yesterday and today, currently testing the 22,950 USD level.

1️⃣ If the price breaks below 22,950 USD and holds, it may lead to further downside toward 22,680 USD as an initial target, followed by 22,400 USD.

2️⃣ On the other hand, if strong buying momentum drives the price above 23,170 USD and holds, we could see a move toward 23,350 USD, and potentially 23,700 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.