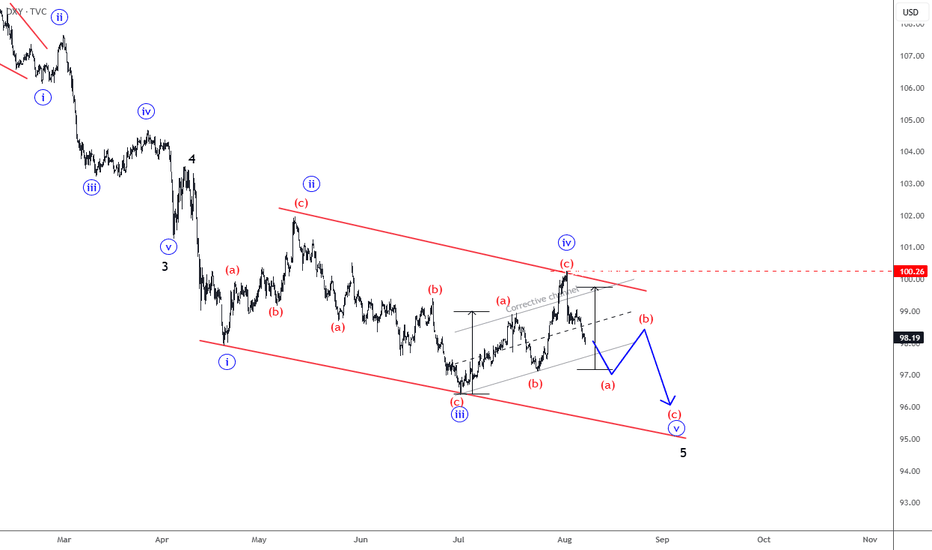

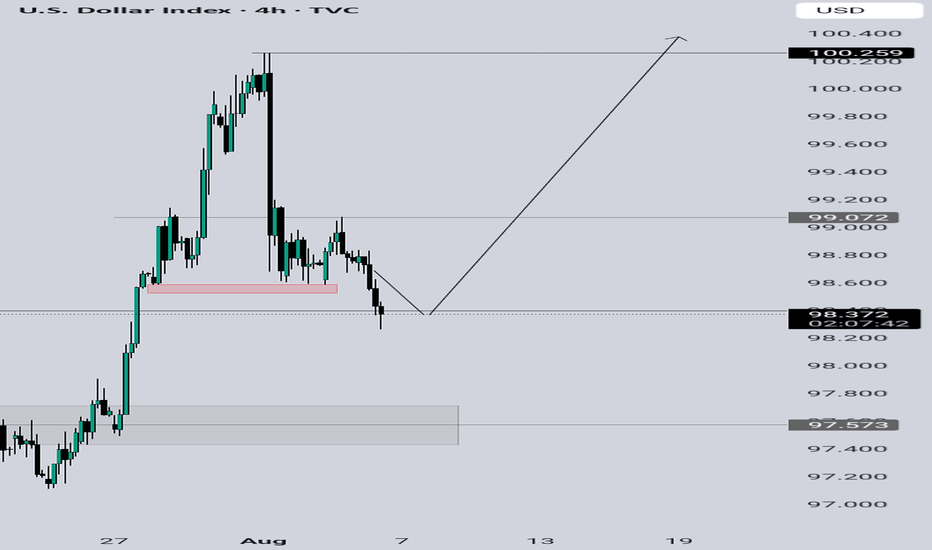

DXY Is Still Bearish; Final Leg Of The Wedge Pattern?DXY Is Still Bearish, but it can be trading in final leg of ending diagonal a.k.a. wedge pattern from technical and Elliott wave perspective.

US Dollar Index – DXY made only a three-wave rise from the lows, which indicates for a correction within downtrend. So recovery can basically still be a fou

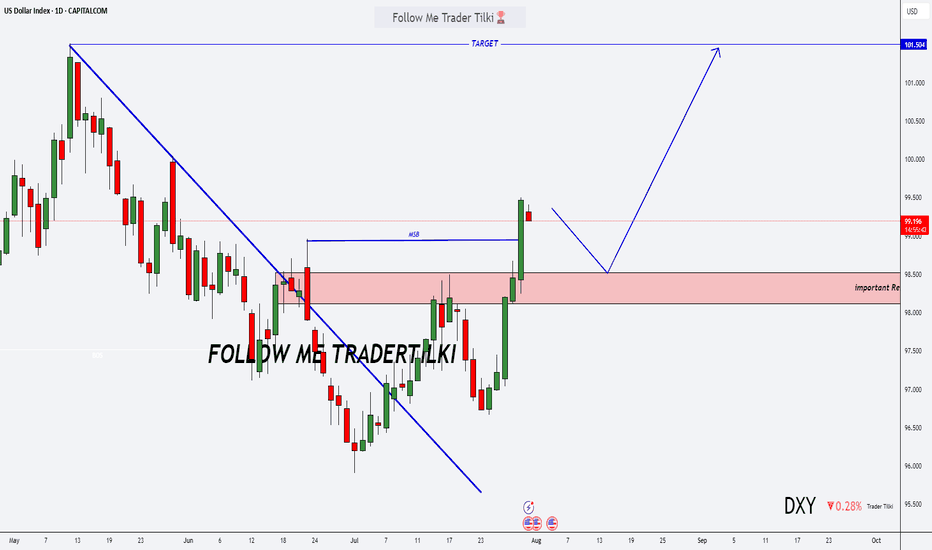

DXY Just Broke Through the Lock… Where’s the Market Headed Now?🌅 Good Morning, Friends!

A few days ago, I marked 98.950 as a key threshold for the DXY index. As of today, that level has officially been broken—and the bullish momentum we anticipated is now kicking in. 📈

The next target? 101.000.

That said, it’s crucial to remember: DXY is heavily influenced b

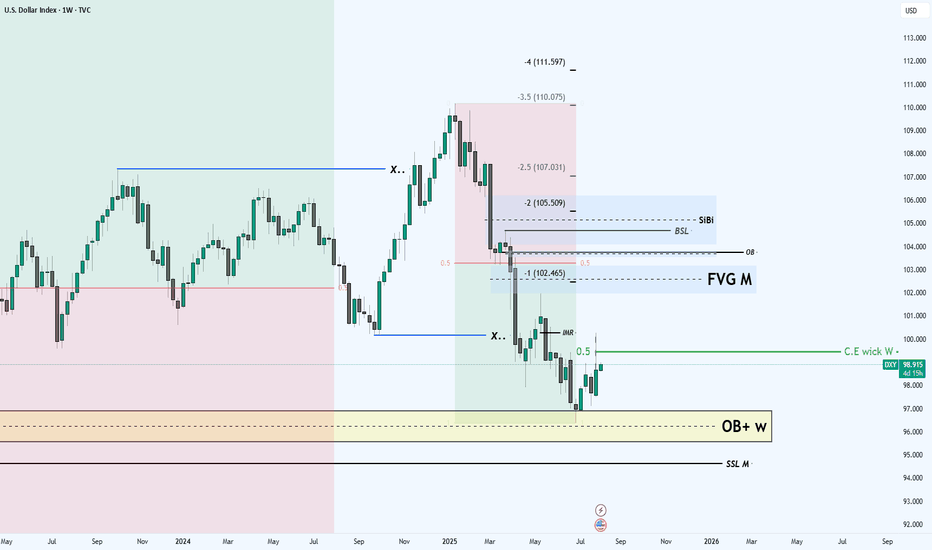

future of the DXYHi to every one

In the DXY we are in the middle of the decisioning area which means

we should wait for the market to show its hands

First sensitive level that i am looking for is the C.E of the weekly candle(Prev.week)

IF we get resistance at that level we can wait for the price to dee

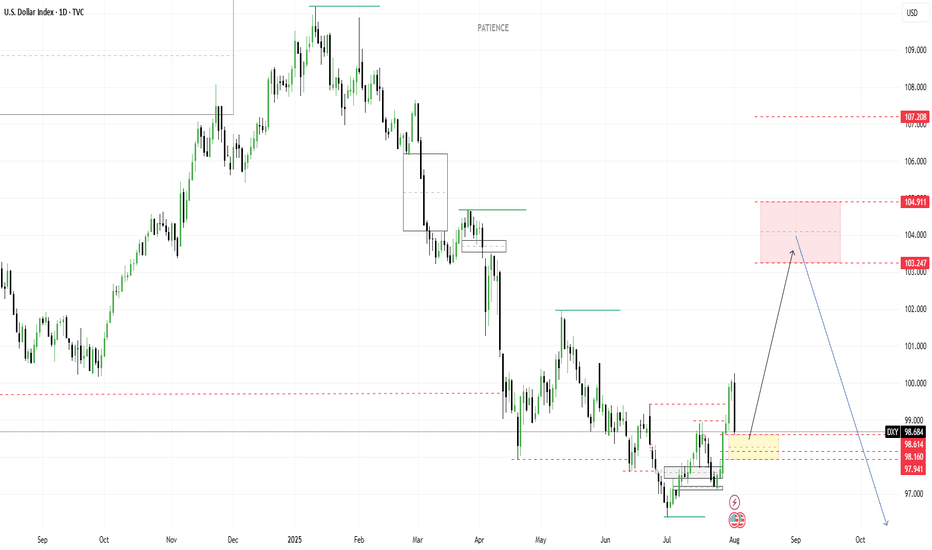

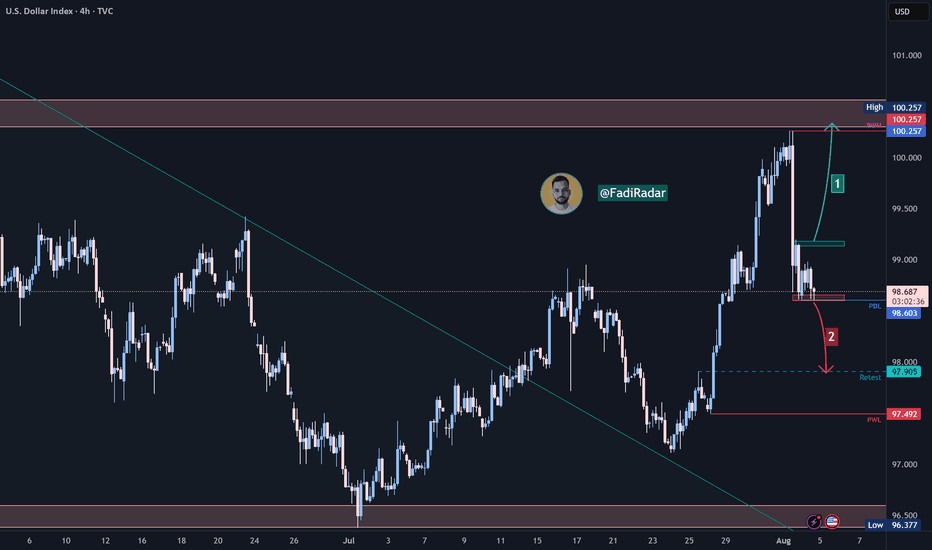

US Dollar Index (DXY) Technical Analysis:The DXY is currently moving sideways near the 98.65 support zone after a sharp drop from the 100.25 resistance, which marked last week’s high.

🔹 Bearish Scenario:

If the price breaks below 98.65 and holds, a continuation toward 97.90 is likely, with potential to reach the 97.50 support area.

🔹 Bul

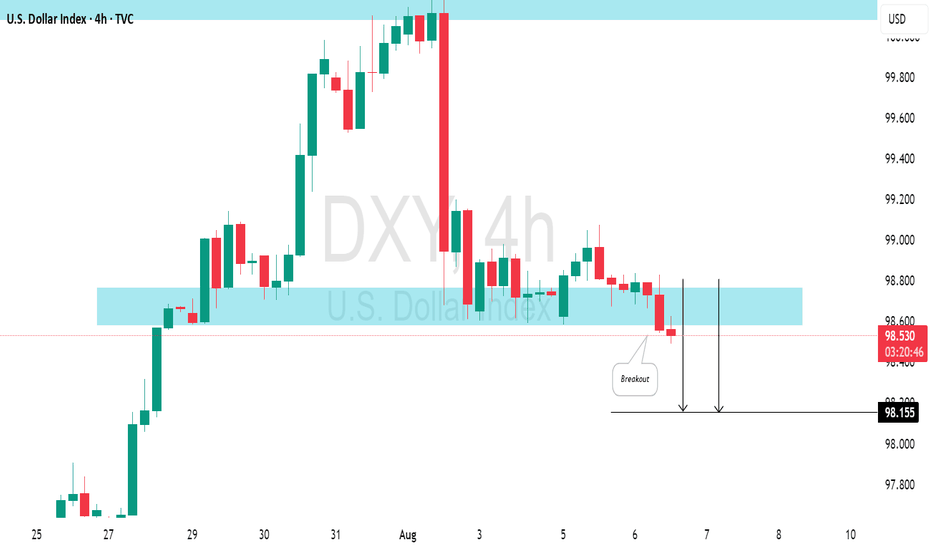

US Dollar Index (DXY) Plummets Following Labour Market DataUS Dollar Index (DXY) Plummets Following Labour Market Data

The US Dollar Index (DXY) fell by approximately 1.4% on Friday after the release of disappointing US labour market figures. According to Forex Factory:

→ The unemployment rate rose from 4.1% to 4.2%;

→ The Nonfarm Employment Change figu

US Dollar Index: Was Friday the Start of a Pullback Or Reversal?Welcome back to the Weekly Forex Forecast for the week of Aug 4 - 8th.

In this video, we will analyze the following FX market:

USD Index

The DXY had a strong week, but turned bearish Friday on weak jobs numbers. Was this just a retracement from the impulsive move up? Will price now find support

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

US Dollar Index reached its highest quote on Sep 28, 2022 — 114.691 USD. See more data on the US Dollar Index chart.

The lowest ever quote of US Dollar Index is 72.700 USD. It was reached on May 4, 2011. See more data on the US Dollar Index chart.

US Dollar Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy US Dollar Index futures or funds or invest in its components.