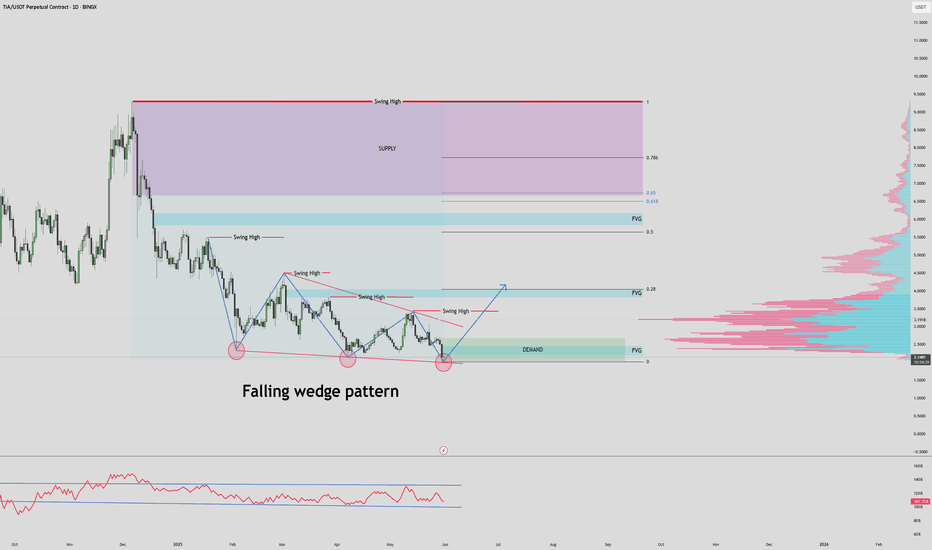

$ENS / USDT Daily Time frame, MAJOR PUMP?Chart Overview

- Pattern Identified: Falling Wedge Pattern

- A bullish reversal pattern, often appearing after a downtrend.

- Three major touchpoints on the lower trendline indicate strong support and pattern validity.

Demand Zone (Support Area)

- Marked near the current price level (

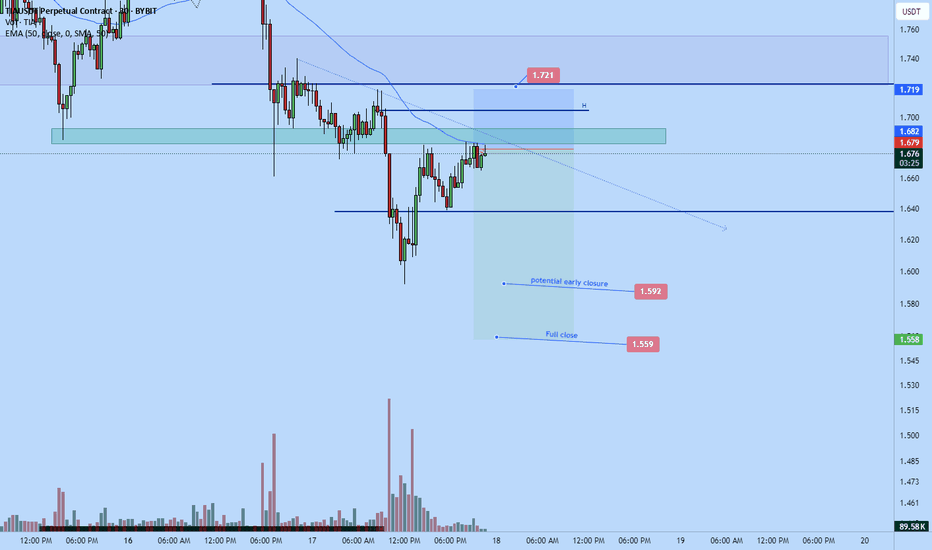

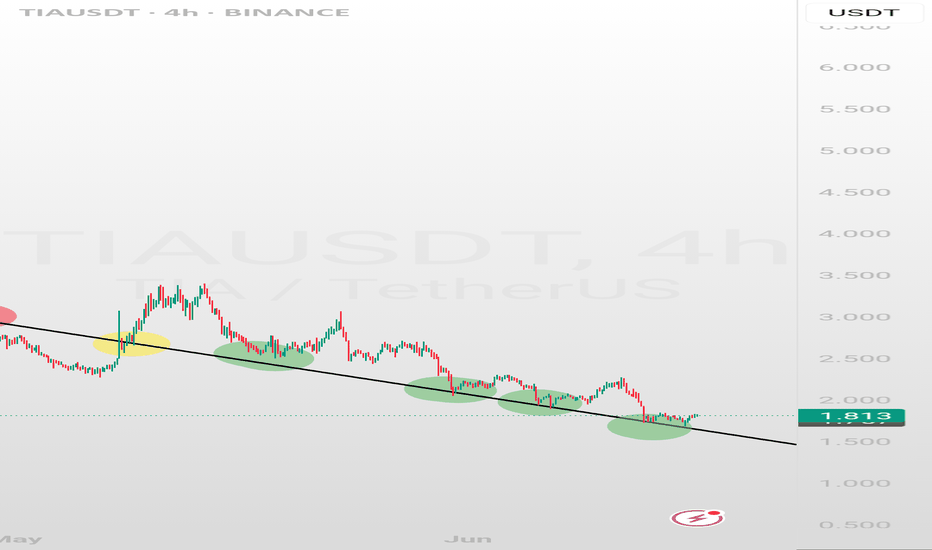

Tia short-dump continues to $1.56Just took a short position on Tia.

Target: $1.56

Stop: $1.721

roughly 3RR

Market likely to continue dumping soon

DTT applied.

OVerall market is heading down, market objective is likely to make new lower lows. Correction happening now before continuation. Market is back at supply area that sold

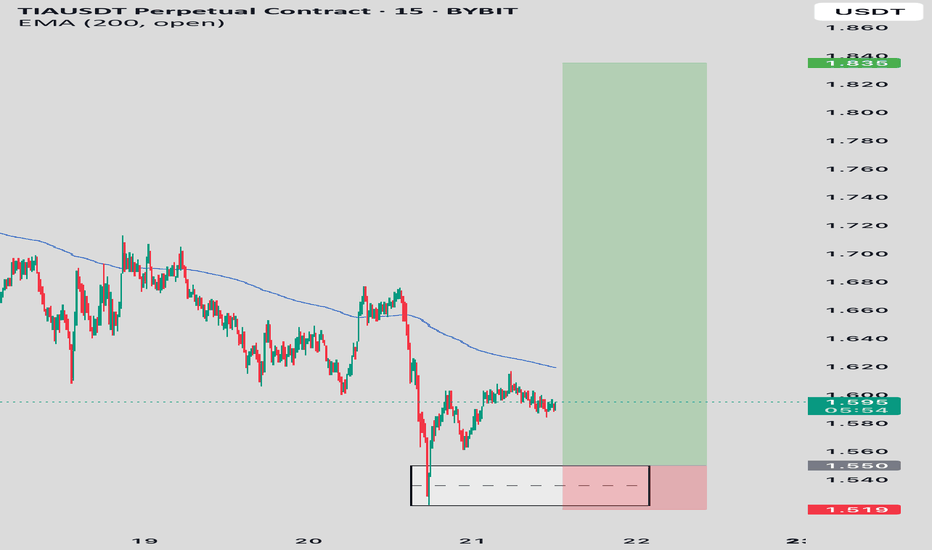

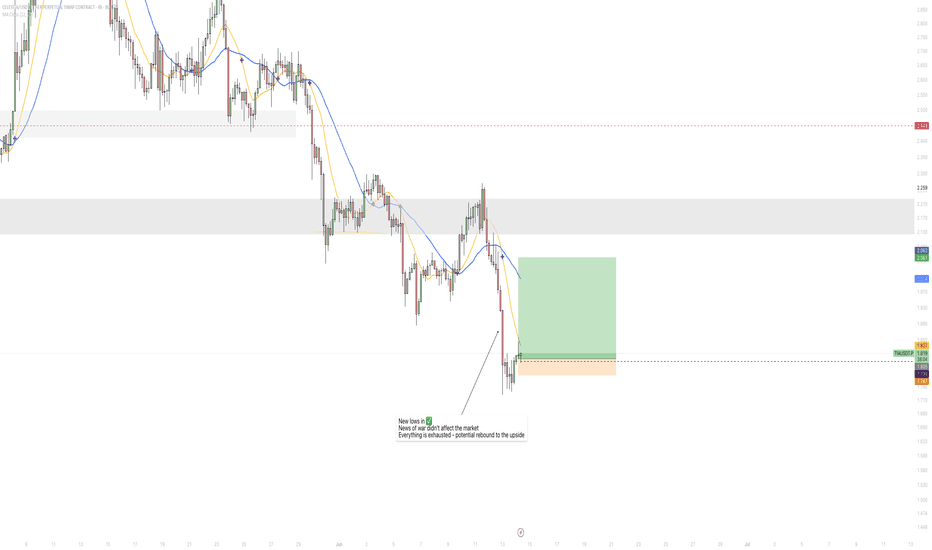

TIAUSDT – Potential Reversal in Play Price is showing early signs of a bullish reversal after a prolonged downtrend.

Currently testing the 200 EMA from below, a key decision zone.

Plan:

• Entry Zone: Above 1.550 (pending confirmation)

• SL: 1.519 (below recent demand zone)

• TP: 1.835

• RR: 1:5+

⚠️ If price reclaims the 200 EMA

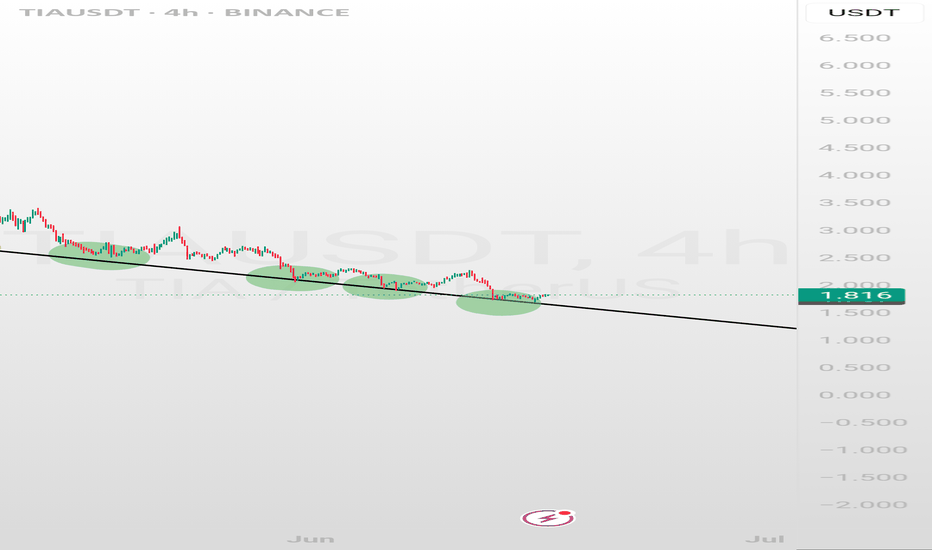

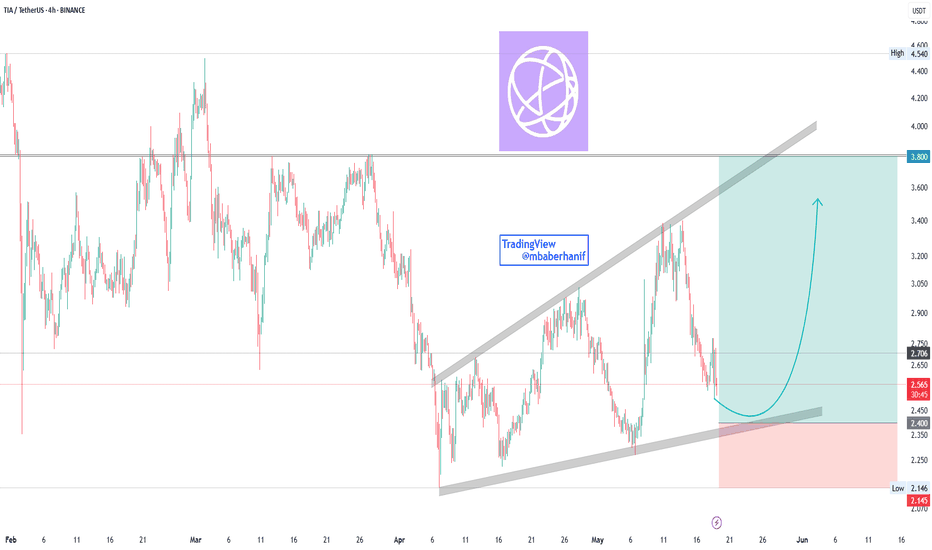

TIA/USDT Ascending ChannelThis chart of TIA/USDT on the 4-hour timeframe. Here's a breakdown of the chart and what it's suggesting:

1. Pattern: Ascending Channel

The price appears to be moving within an ascending channel (marked by two parallel trendlines).

The support and resistance levels of the channel are well defin

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.