USNAS100 - Mideast Conflict & Fed Uncertainty Pressure FuturesWall Street Futures Edge Lower Amid Prolonged Mideast Conflict

U.S. stock index futures slipped slightly on Tuesday as the ongoing Middle East conflict entered its fifth day, weighing on global sentiment ahead of the Federal Reserve’s upcoming policy meeting.

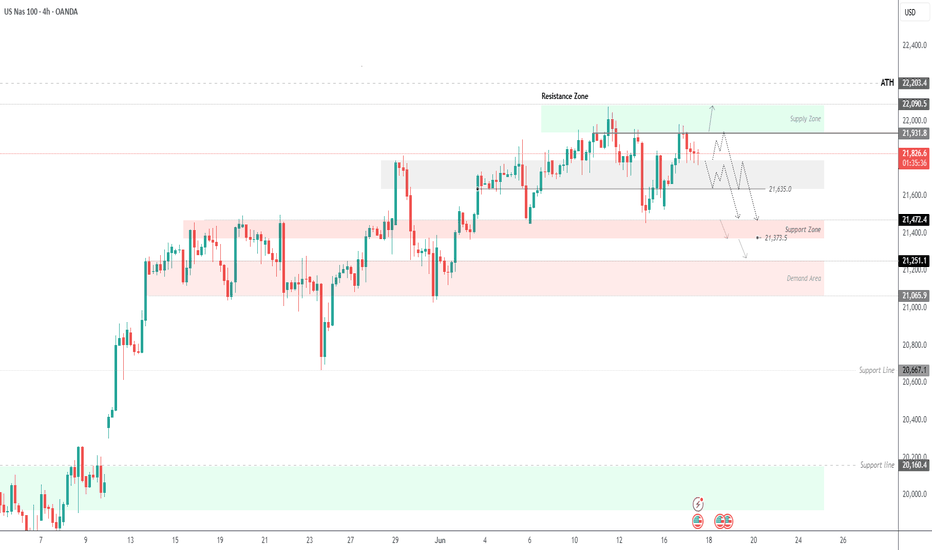

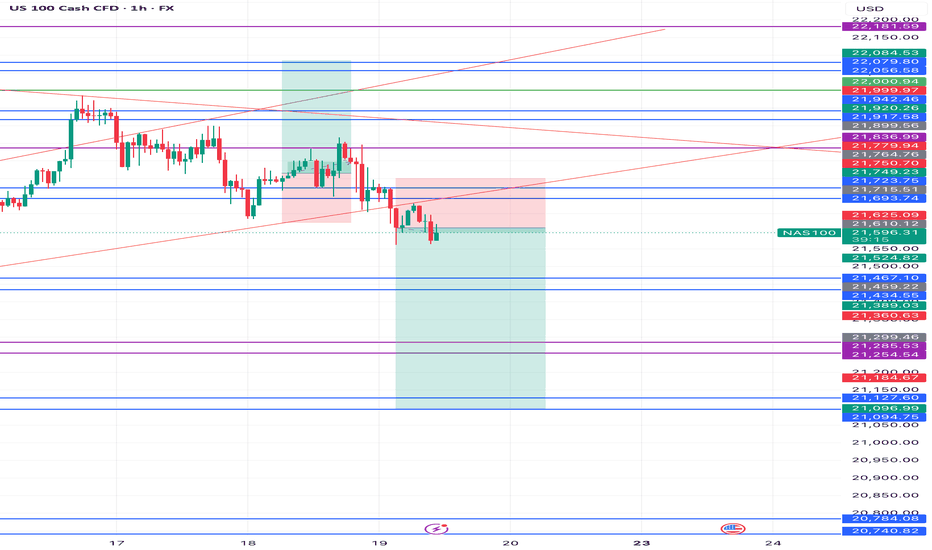

Technical Outlook:

Price action remains in a sensitive zone, but the bias stays bearish below 21930.

🔻 A confirmed 1H close below 21790 would likely trigger a deeper move toward 21635, and potentially 21470.

🔺 On the upside, a break above 21930 would indicate renewed bullish momentum, opening the path toward 22065 and 22200.

📌 If price holds above 21790, a test of 21930 is likely.

Any positive geopolitical developments or ceasefire negotiations could spark a stronger upside move.

Key Levels:

• Pivot: 21790

• Resistance: 21930 / 22065 / 22200

• Support: 21635 / 21470 / 21375

USTEC trade ideas

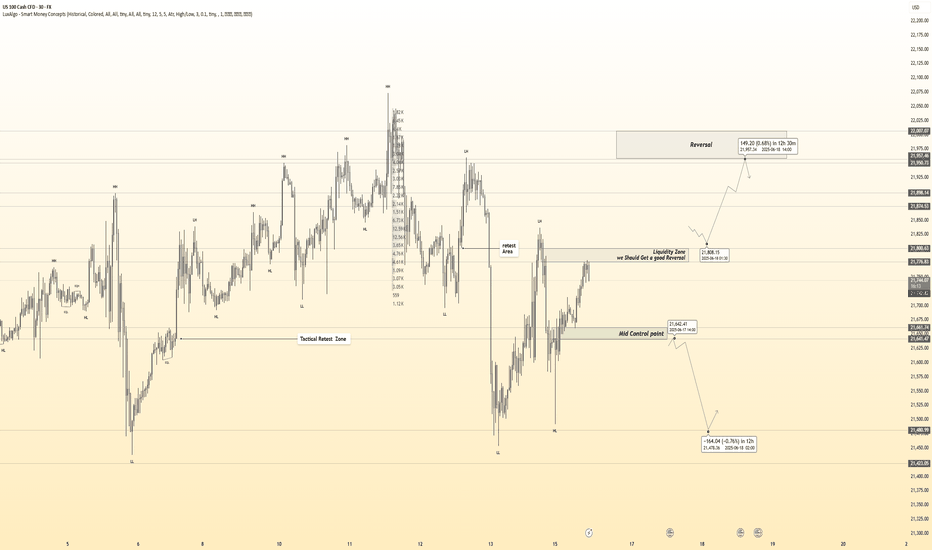

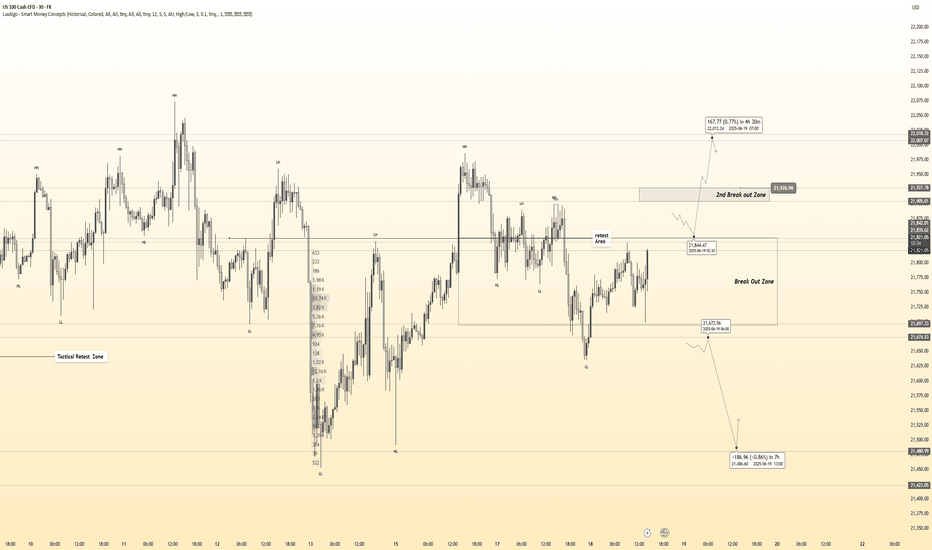

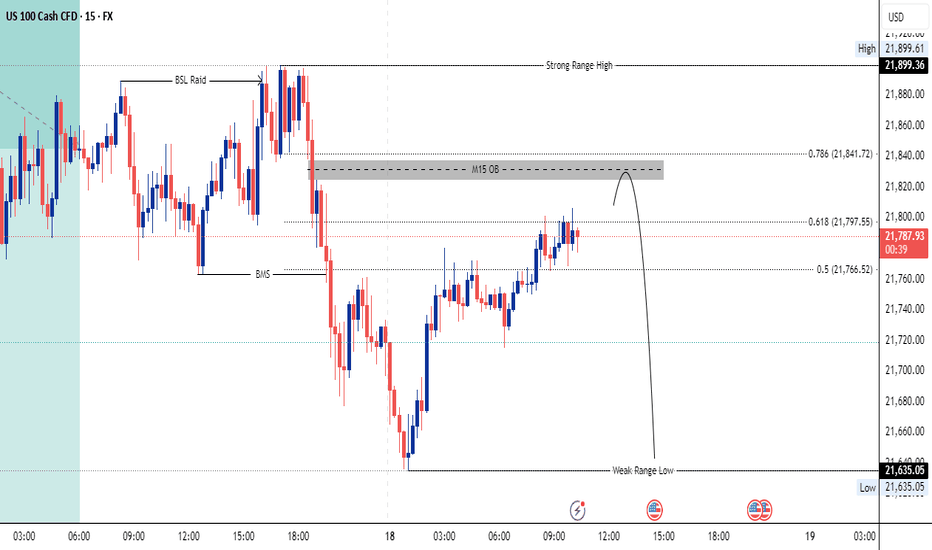

Hanzo / Nas100 30 Min ( Accurate Tactical Break Out Zones )🔥 Nas100 – 30 Min Scalping Analysis (Bearish Setup)

⚡️ Objective: Precision Breakout Execution

Time Frame: 30-Minute Warfare

Entry Mode: Only after verified breakout — no emotion, no gamble.

👌Bullish After Break : 21810

Price must break liquidity with high volume to confirm the move.

👌Bearish After Break : 21640

Price must break liquidity with high volume to confirm the move.

☄️ Hanzo Protocol: Dual-Direction Entry Intel

➕ Zone Activated: Strategic liquidity layer detected — mapped through refined supply/demand mechanics. Volatility now rising. This isn’t noise — this is bait for the untrained. We're not them.

🩸 Momentum Signature Detected:

Displacement candle confirms directional intent — AI pattern scan active.

— If upward: Bullish momentum burst.

— If downward: Aggressive bearish rejection.

🦸♂️ Tactical Note:

The kill shot only comes after the trap is exposed and volume betrays their position.

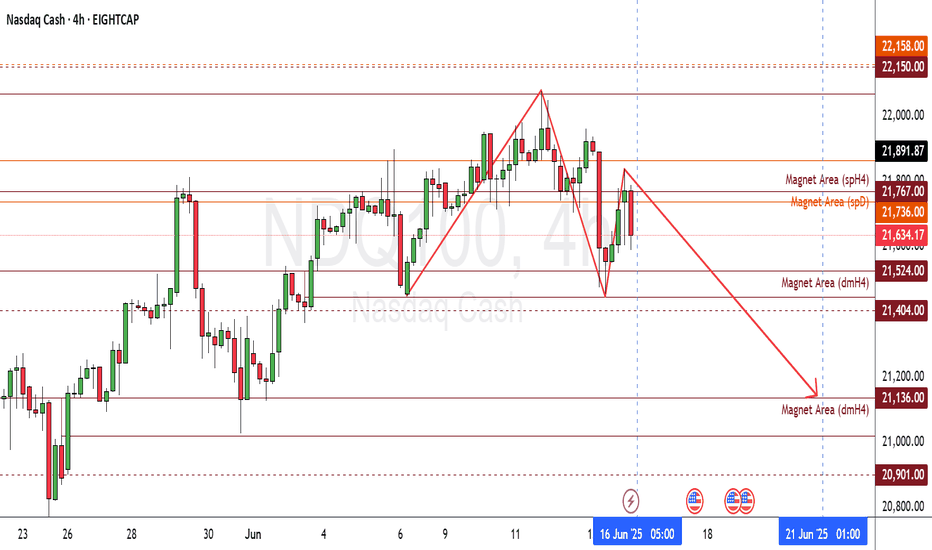

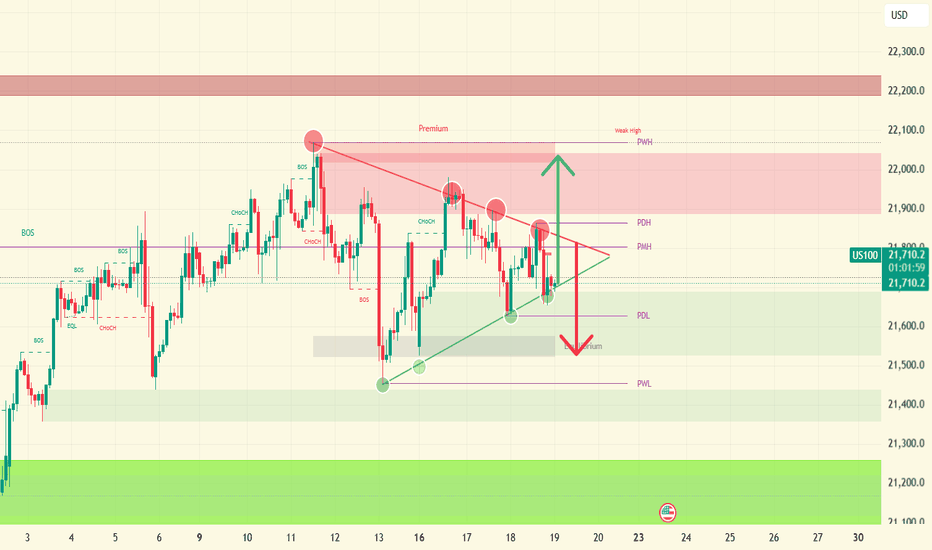

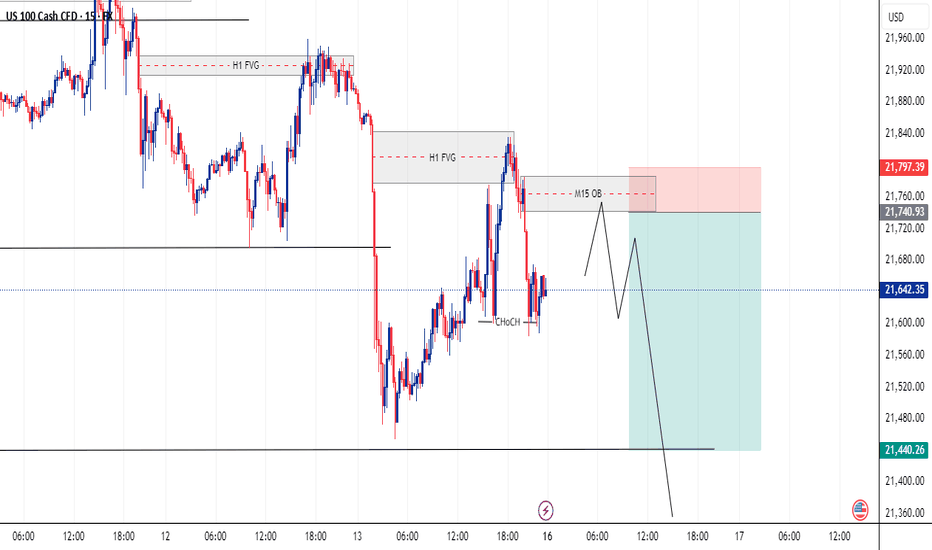

NASDAQ TRADING ROADMAP 16 - 20 JUNI 2025📉 NASDAQ TRADING ROADMAP – STRATEGY OUTLOOK 📉

The NASDAQ has rejected Magnet Area (SpH4) 21767.00 – 22067.00, signaling potential downside movement.

As long as price stays below Magnet Area (dmD) 21736.00 – 21863.00, the market is likely to continue its decline toward Magnet Area (dmH4) 21136.00 – 21020.00, especially if price breaks through Magnet Area (dmH4) 21524.00 – 21445.00.

📌 Roadmap Summary:

🔻 Rejection confirmed from (SpH4)

⬇️ Bearish bias valid while below (dmD)

🚨 Breakout trigger: (dmH4) 21524.00 – 21445.00

🎯 Target zone: (dmH4) 21136.00 – 21020.00

⚠️ DISCLAIMER:

This content is for educational purposes only and does not constitute financial advice. Trading involves substantial risk. Always conduct your own analysis and apply proper risk management before making any trading decisions.

Hanzo / Nas100 30 Min ( Accurate Tactical Break Out Zones )🔥 Nas100 – 30 Min Scalping Analysis (Bearish Setup)

⚡️ Objective: Precision Breakout Execution

Time Frame: 30-Minute Warfare

Entry Mode: Only after verified breakout — no emotion, no gamble.

👌Bullish After Break : 21930

Price must break liquidity with high volume to confirm the move.

👌Bearish After Break : 21770

Price must break liquidity with high volume to confirm the move.

☄️ Hanzo Protocol: Dual-Direction Entry Intel

➕ Zone Activated: Strategic liquidity layer detected — mapped through refined supply/demand mechanics. Volatility now rising. This isn’t noise — this is bait for the untrained. We're not them.

🩸 Momentum Signature Detected:

Displacement candle confirms directional intent — AI pattern scan active.

— If upward: Bullish momentum burst.

— If downward: Aggressive bearish rejection.

🦸♂️ Tactical Note:

The kill shot only comes after the trap is exposed and volume betrays their position.

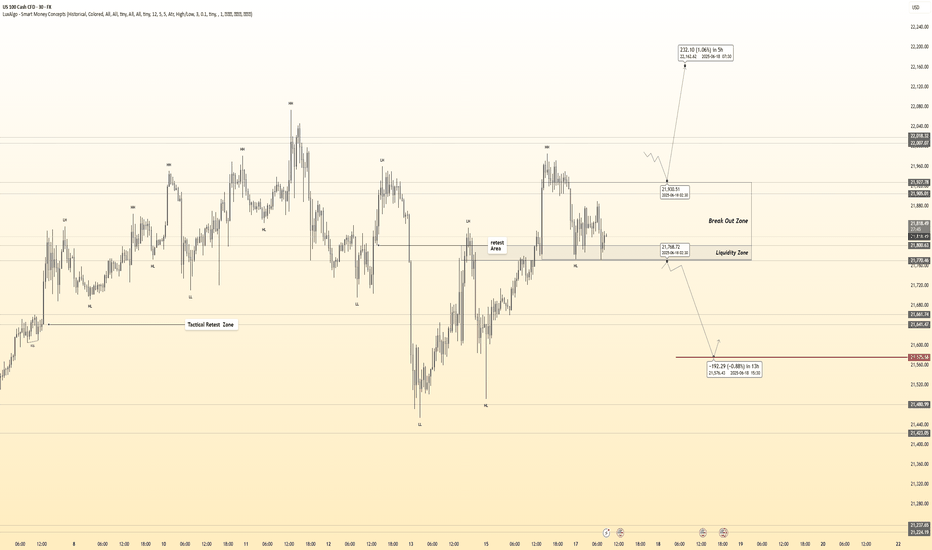

Hanzo / Nas100 30 Min ( Accurate Tactical Break Out Zones )🔥 Nas100 – 30 Min Scalping Analysis (Bearish Setup)

⚡️ Objective: Precision Breakout Execution

Time Frame: 30-Minute Warfare

Entry Mode: Only after verified breakout — no emotion, no gamble.

👌Bullish After Break : 21840

Price must break liquidity with high volume to confirm the move.

👌Bullish After Break : 21930

Price must break liquidity with high volume to confirm the move.

👌Bearish After Break : 21755

Price must break liquidity with high volume to confirm the move.

☄️ Hanzo Protocol: Dual-Direction Entry Intel

➕ Zone Activated: Strategic liquidity layer detected — mapped through refined supply/demand mechanics. Volatility now rising. This isn’t noise — this is bait for the untrained. We're not them.

🩸 Momentum Signature Detected:

Displacement candle confirms directional intent — AI pattern scan active.

— If upward: Bullish momentum burst.

— If downward: Aggressive bearish rejection.

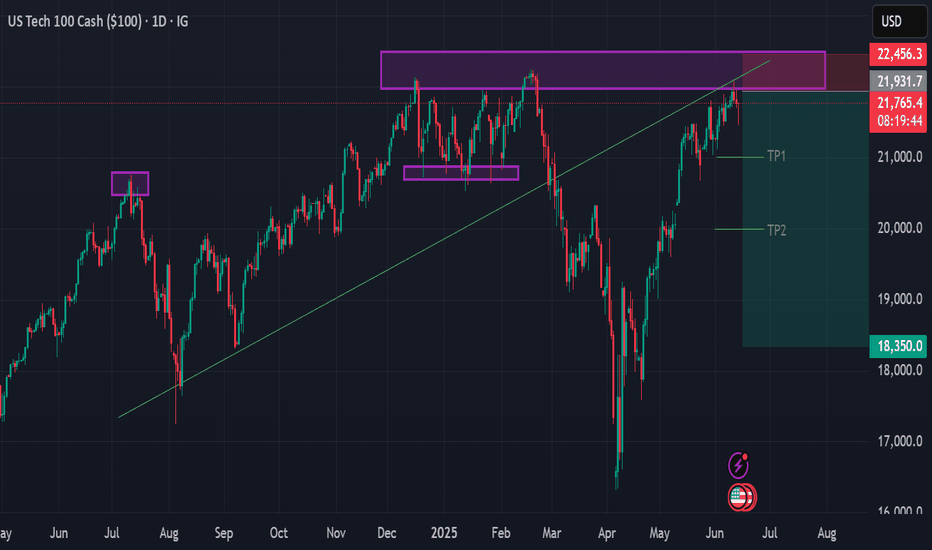

Bearish SignalPrice is currently at the highest resistance NAS100 ever reached in its lifetime and failed to break, the last time it tested the resistance it dropped dismally confirming it’s a very strong resistance. There’s also a dynamic resistance supported by the trend line in green which was a support zone prior. Im very confident the resistance won’t break, if it were to ever break it’ll need a strong pull back which will definitely suppress TP1

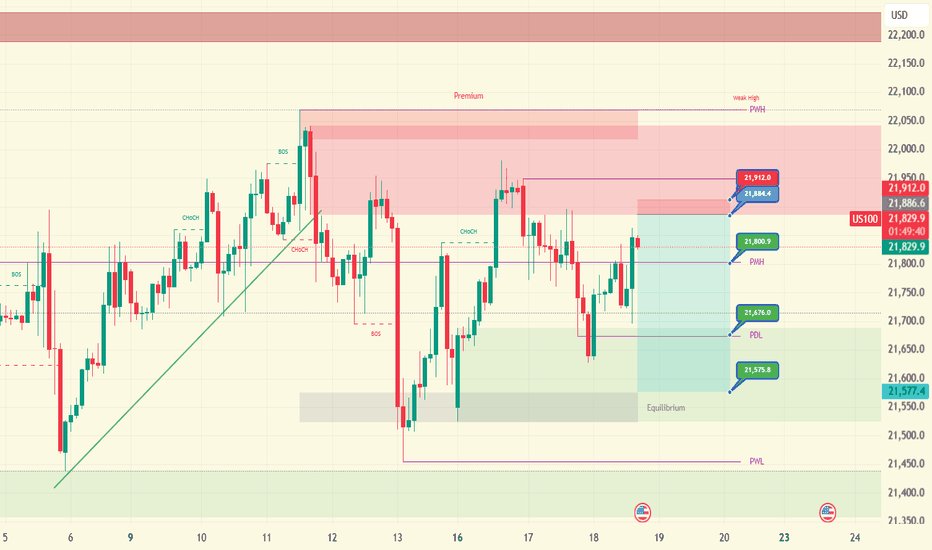

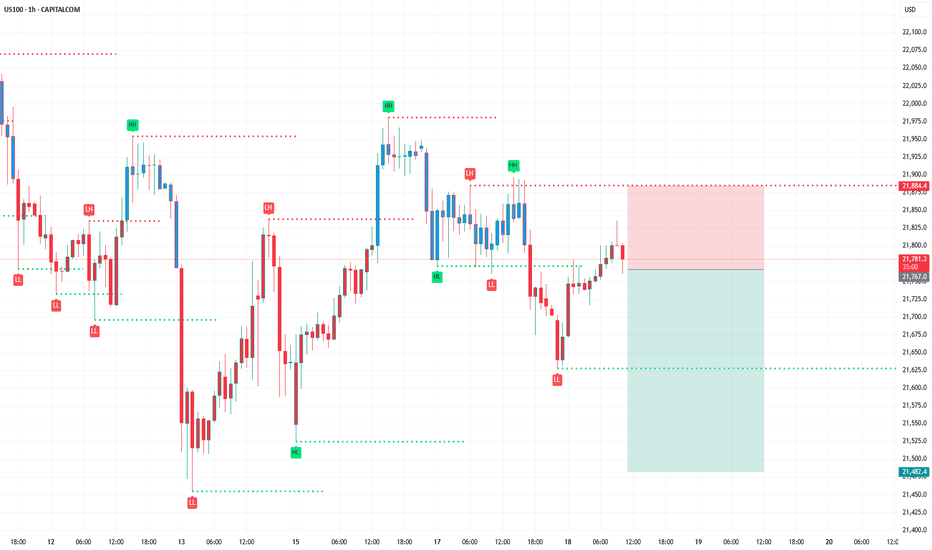

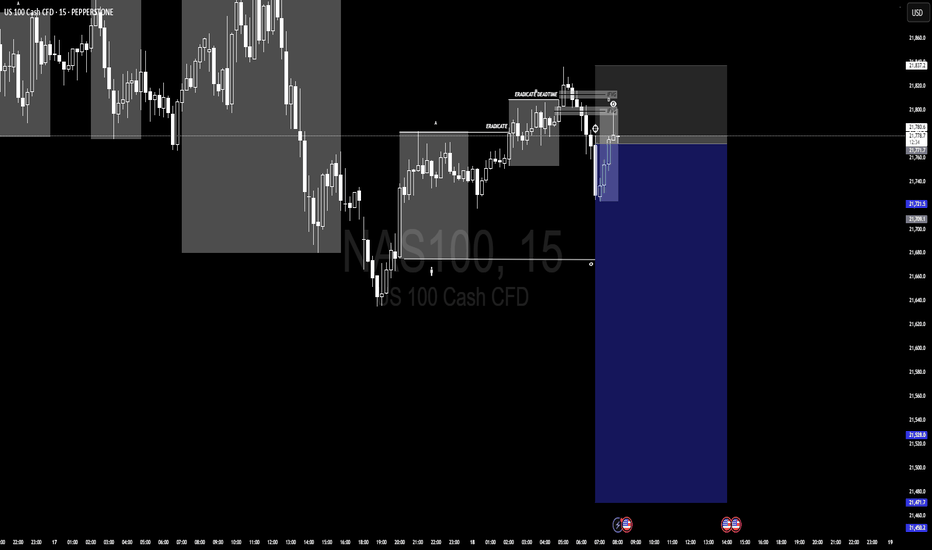

FOMC short: waiting for this short entry to get activated.1. Entry ~21,884.4

Why here? Price has rallied into that red “supply” zone (fair-value gap + bearish order block), then chopped down and back up to retest its lower edge. That level also coincides with the broken swing pivot (Change-of-Character from bull→bear). We short the retest, expecting supply to push price lower.

2. Stop-loss 21,912.0

Why there? Just above the top of the supply zone/weak high. If price climbs above 21,912, it’s cleared the zone and negated the bearish bias—so we get out.

3. Take-Profits

TP1 at 21,800.9 (the old swing-high turned support, labeled “PMH”)

First support zone—locks in quick gains and covers your risk.

TP2 at 21,675.0 (the previous day’s low, labeled “PDL”)

A deeper support area where sellers will likely pause or flip to buyers.

(Optional TP3 at 21,575.8 if you want a final scalp into the gray “equilibrium”/demand zone.)

USNAS100 | Bearish Below 21635 Amid Geopolitical UncertaintyUSNAS100 | OVERVIEW

The index is currently under bearish momentum driven by escalating geopolitical tensions.

As long as the situation remains unresolved, downward pressure is expected to continue.

Outlook:

As long as the price stays below the pivot at 21635, the index is likely to drop toward 21470.

A confirmed break below 21470 could accelerate the decline toward 21250, and eventually 21065.

Pivot Line: 21635

Support Levels: 21470, 21250, 21065

Resistance Levels: 21790, 21930, 22090

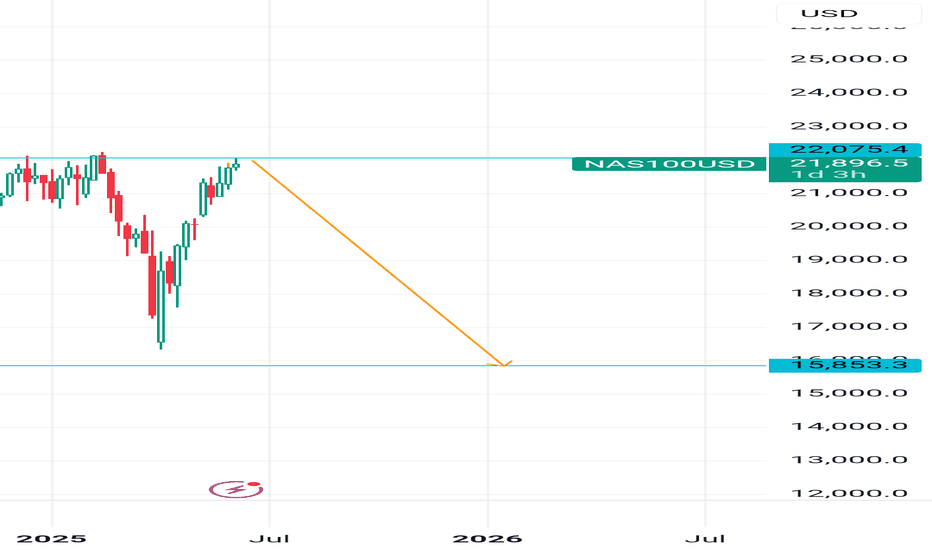

My View on NAS1001. Price has been trending up for a long time.

2. A possible Reversal Pattern spotted

3. Head and Shoulder Pattern

4. Almost all elements of the Pattern have appeared

5. Refer to the Chart for entry details

6. Apply proper risk management based on your account size.

"Direction is Better than Speed"

Aliyu Gital

Hanzo / Nas100 30 Min ( Accurate Tactical Break Out Zones )🔥 Nas100 – 30 Min Scalping Analysis (Bearish Setup)

⚡️ Objective: Precision Breakout Execution

Time Frame: 30-Minute Warfare

Entry Mode: Only after verified breakout — no emotion, no gamble.

👌Bullish After Break : 21840

Price must break liquidity with high volume to confirm the move.

👌Bullish After Break : 21930

Price must break liquidity with high volume to confirm the move.

👌Bearish After Break : 21755

Price must break liquidity with high volume to confirm the move.

☄️ Hanzo Protocol: Dual-Direction Entry Intel

➕ Zone Activated: Strategic liquidity layer detected — mapped through refined supply/demand mechanics. Volatility now rising. This isn’t noise — this is bait for the untrained. We're not them.

🩸 Momentum Signature Detected:

Displacement candle confirms directional intent — AI pattern scan active.

— If upward: Bullish momentum burst.

— If downward: Aggressive bearish rejection.

🦸♂️ Tactical Note:

The kill shot only comes after the trap is exposed and volume betrays their position.

Hanzo / Nas100 30 Min ( Accurate Tactical Break Out Zones )

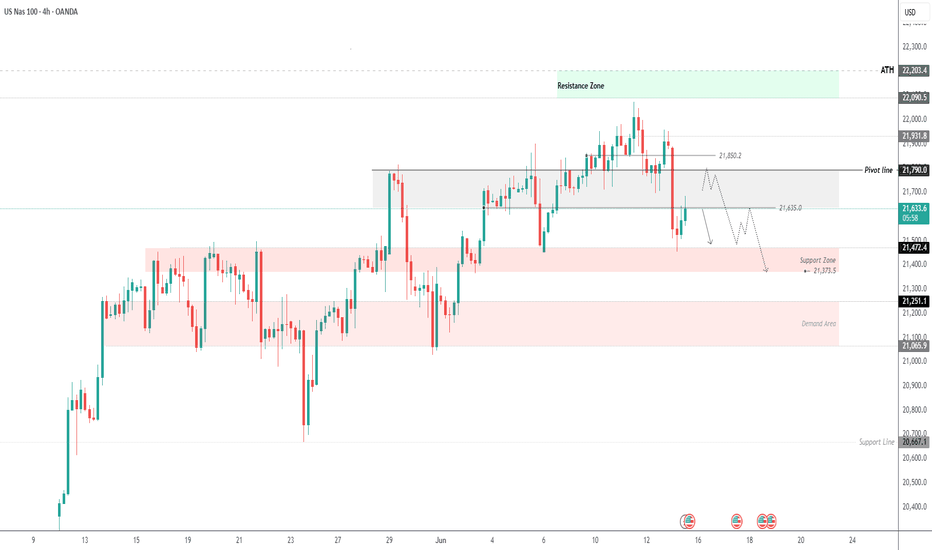

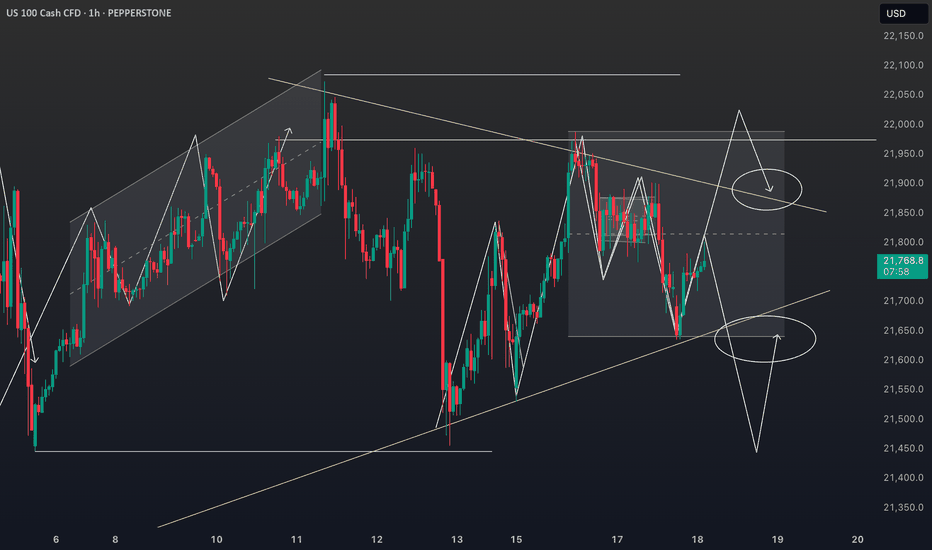

US100 2H in a Symmetrical Triangle—Eyes on BREAKOUT!1. A Symmetrical Triangle in Play

Rising support line (green) connecting the sequence of higher lows.

Falling resistance line (red) connecting the lower highs.

Price is squeezing into the apex of that triangle – classic consolidation/indecision.

What to watch:

A clean break above the red trendline (~21,820–21,850) would be a bullish signal.

A break below the green trendline (~21,650–21,670) would open the door for a move down toward 21,500 or even the 21,400 zone.

2. Value & “Premium” Zones

The green shaded area around 21,500–21,600 is marked “Equilibrium/Value,” where buyers have stepped in repeatedly.

Above ~21,950 there’s a “Premium” supply zone (red) where heavy selling has shown up.

These zones can act as sensible targets or rejection areas once price breaks out of the triangle.

3. Key Reference Levels

PDH / PDL (Previous Day High / Low): ~21,860 / ~21,620

PWH / PWL (Previous Week High / Low): ~21,960 / ~21,430

Traders often use these to confirm break-outs (e.g. holding above PDH now that it’s pierced).

4. Momentum Indicators

MACD: Lines hovering just under zero, histogram weakening → suggests the bulls aren’t quite firing on all cylinders yet.

RSI: Sitting around mid-40s, neutral but with a slight downside bias.

Neither is over-extended; momentum is “sleepy,” which aligns with the triangle/consolidation picture.

5. What This Means for Traders

Neutral bias until one side wins the breakout.

Bull scenario: Triangle → breakout → retest of ~21,820 → rocket toward 22,000–22,200 supply zone.

Bear scenario: Failure at the red trendline → drop through support → test 21,600 then 21,400 demand areas.

My trade idea on NASDAQ 100 For the coming week I'm seeing NAS100 dropping lower to pull/draw on liquidity below there heading to where we have what looks like a strong POI...

Drop your comment below if you're seeing something totally different from what I'm seeing here and lets have a discussion about our views.

NASDAQ Consolidation: Why Sitting Out Is Sometimes the Best PlayI'm currently monitoring the NASDAQ (US100) closely, and on the 4-hour chart, we can clearly see that the market is in a phase of consolidation 🔍

Yesterday, I was anticipating a bullish breakout, which could have signaled the start of a structure with higher highs and higher lows — something that would have presented a clean long opportunity 📈. However, during the U.S. session, the NAS100 momentum shifted and we instead saw a bearish breakdown, invalidating the previous setup 🚫

As things stand now, there's no clear directional bias on the 4H — just a sideways range with neither bulls nor bears in full control 🤝. This type of environment calls for patience and discipline.

It's worth noting that knowing when not to trade is just as important as knowing when to pull the trigger. Sitting on the sidelines and allowing the market to make the next move — whether that’s a break above or below this consolidation range — is a valid and often wise decision 🧘♂️📊

At the moment, my preference is to remain neutral and let price show its hand before committing to a position.

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and apply proper risk management when trading.

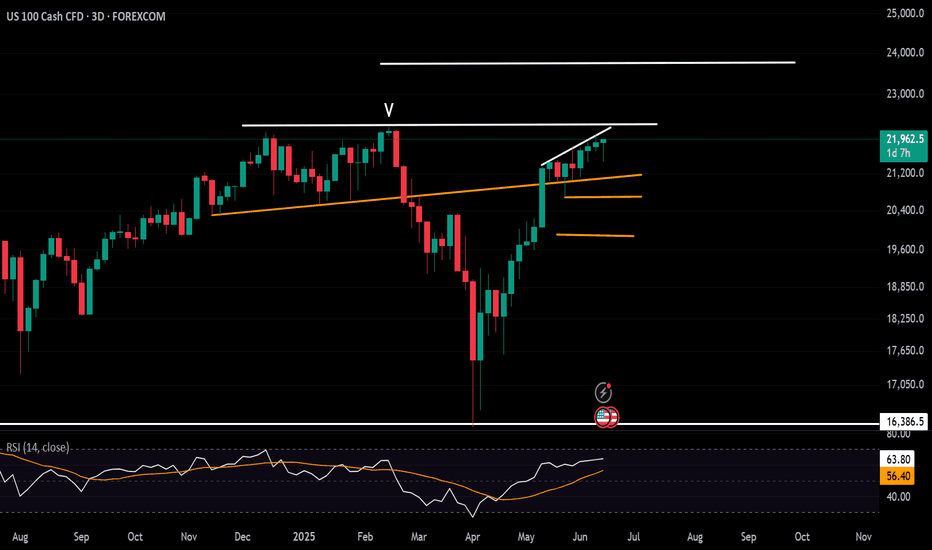

Nasdaq Challenges Record HighsNasdaq continues to trade just below a one-month resistance line, which connects consecutive higher highs formed between May and June 2025. This line has capped the index just shy of the 22,000 mark, as price action navigates the push and pull between summer momentum, geopolitical tensions, and economic uncertainty.

To the upside, a decisive break and hold above 22,200 would be a bullish trigger, potentially opening the path toward the 23,700 resistance zone. This level notably aligns with the 0.618 Fibonacci extension, projected from the 2023 low, 2025 high, and 2025 retracement low.

On the downside, risks remain for a deeper correction if the index retraces toward the 21,000–20,600 region. This zone represents the neckline of the December–January double top, and stands as a critical threshold separating a bullish continuation scenario from the possibility of a deeper bearish pullback.

- Razan Hilal, CMT

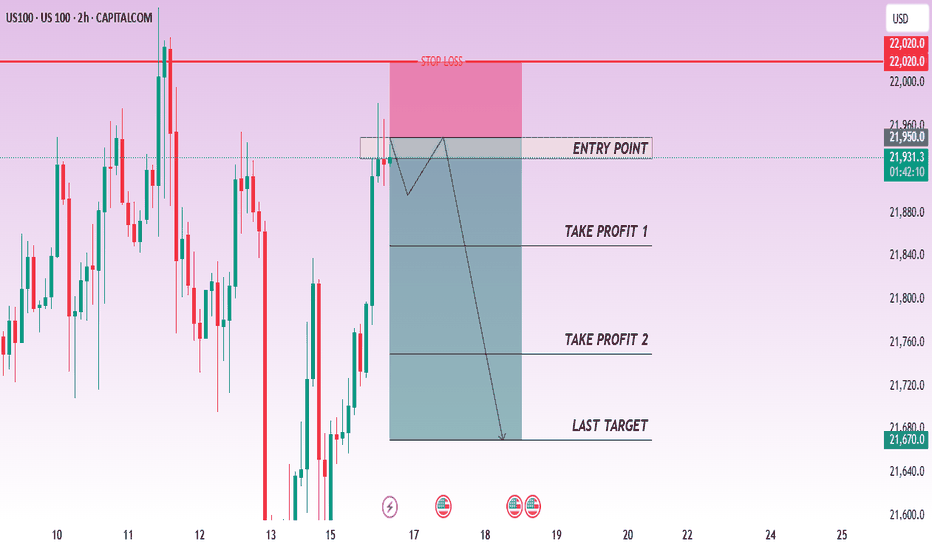

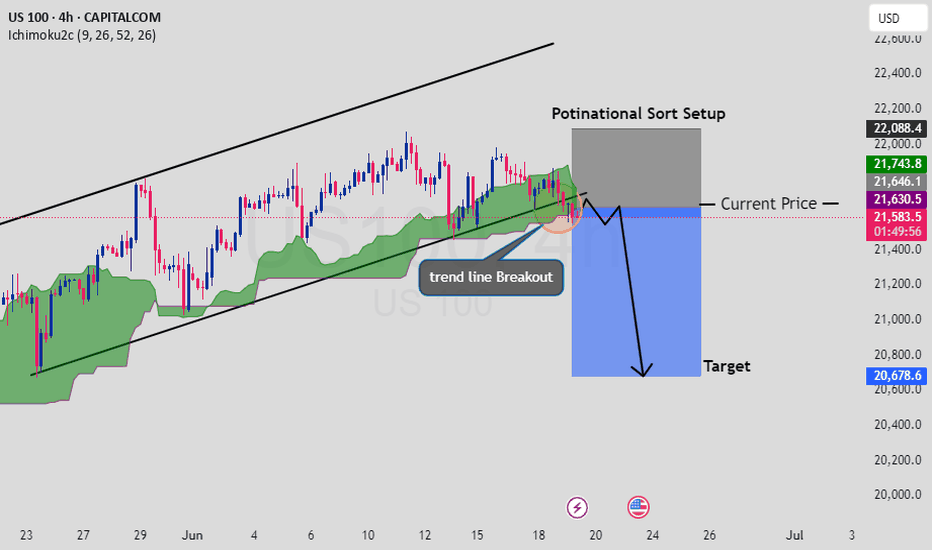

US100 – Bearish Shift (Positional Short Setup Active)US100 Trendline Breakout Suggests Bearish Setup

The US100 has broken below a key ascending trendline on the 4H chart, signaling a possible end to the recent uptrend. Price is now trading below the Ichimoku cloud, confirming a bearish bias and activating a positional short setup.

🔹 Pattern: Trendline Breakout (Bearish Signal)

🔹 Current Price: ~21,590

🔹 Target: 20,678

🔹 Resistance Zone: 21,743 – 22,088

🔹 Technical Outlook: Bearish momentum building below trendline and cloud

🔹 Fundamental View: Rising rate concerns and tech sector pressure could weigh on US100

Short trade in play—selling pressure expected to increase below resistance. Manage risk accordingly. 📉📊

Note :If you found this helpful, like and follow for more trade ideas!

Share My Idea With Your Firends Mention Your Feed back Comment Section

This is not financial advice. Please conduct your own research and manage risk accordingly.