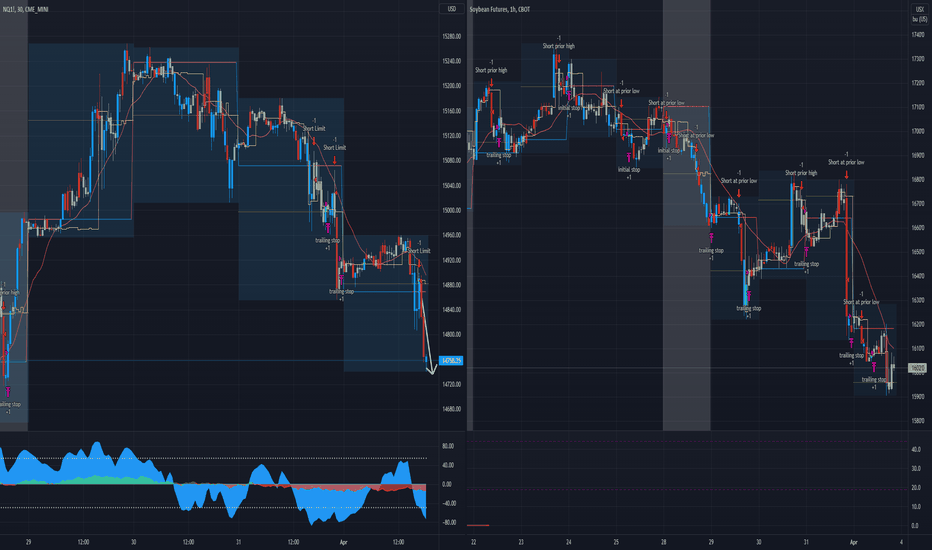

Updated on selll at prior low strategywell i would not recommend using the strategy, backtest only good results on

nasdaq 30 min RTH

and CL 30 min ETH

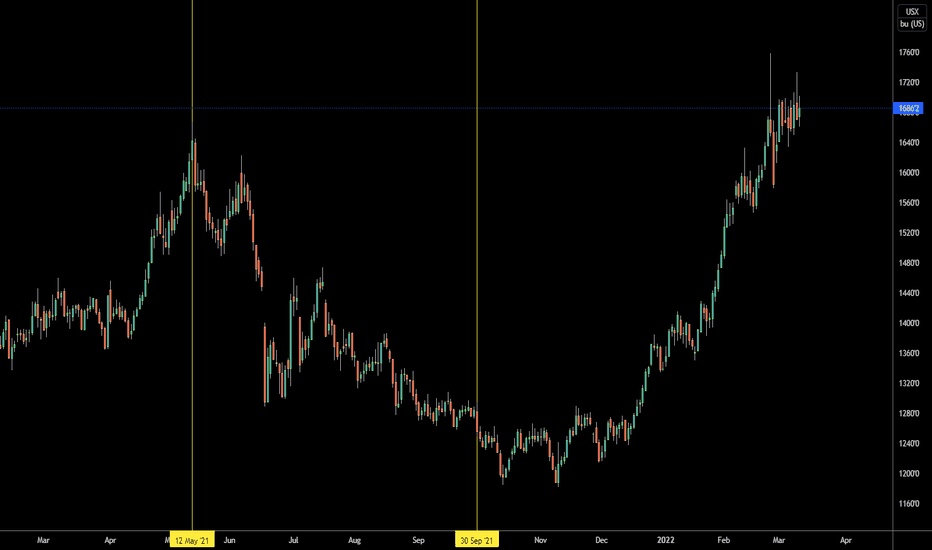

as well as ZS 60 min ETH charts

keep in mind nasdaq as well as other choppy markets don't down down on the first though of prior days low (enter with a limit order on the bar that broke prior low.

soybeans and crude oil

sometimes break prior days low in the morning, so 1 trade per day es enough avoid chop!

A reversal at prior days high is even more unlikely.

Maybe its just current market conditions but shorting is in general more tricky, so consider looking at daily chart patterns and only short weak markets

TGSB1! trade ideas

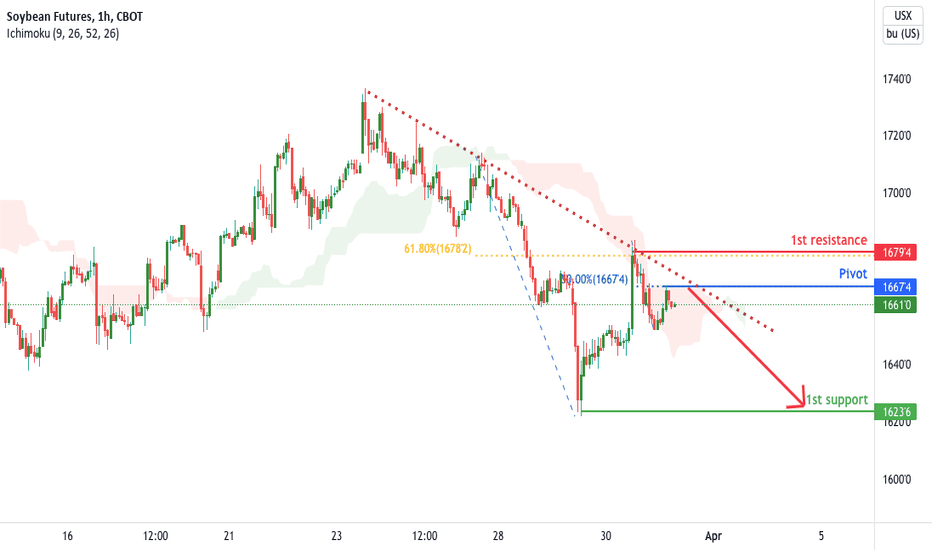

Soybeans Future (ZS1!), H1 Bearish DropType: Bearish Drop

Resistance : 1679'4

Pivot: 1667'4

Support : 1623'6

Preferred case: With price expected to reverse off the ichimoku resistance and the descending trend line, we see the potential for bearish drop from our Pivot level at 1667'4 in line 50% Fibonacci retracement towards our 1st support level at 1623'6 in line with the horizontal swing low support.

Alternative scenario: If price breaks out, it can potentially move towards our 1st resistance level at 1679'4 which is in line with 61.8% Fibonacci retracement and horizontal swing high resistance.

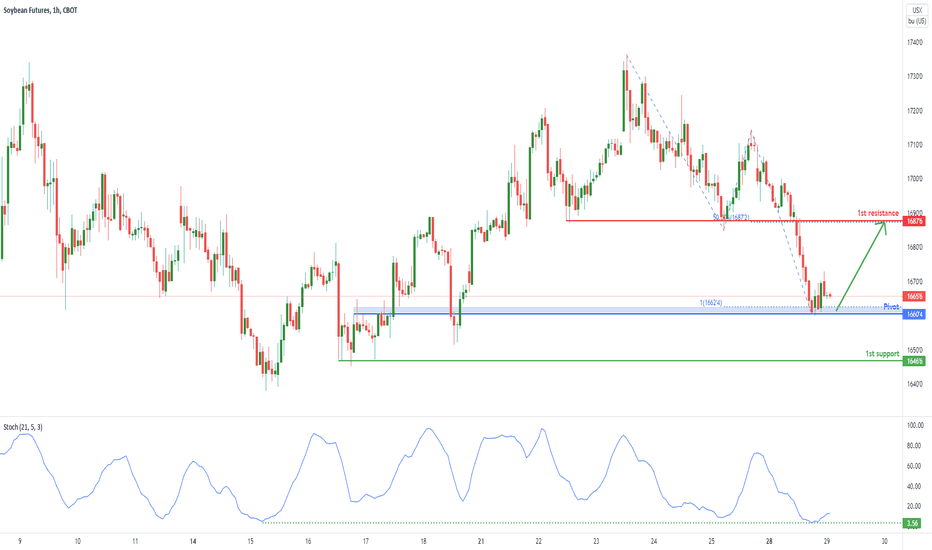

Soybean futures (ZS1!), H4 Potential for Bullish bounce!Type : Bullish bounce

Resistance : 1687'6

Pivot: 1660'4

Support : 1646'6

Preferred case: With price expected to reverse off the stochastics support, we have a bullish bias that price will rise from our pivot at 660'4 in line with the 100% Fibonacci projection to our 1st resistance at 1687'6 in line with the horizontal pullback resistance and 50% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st support at 1646'6 in line with the horizontal swing low support.

Fundamentals: No major news

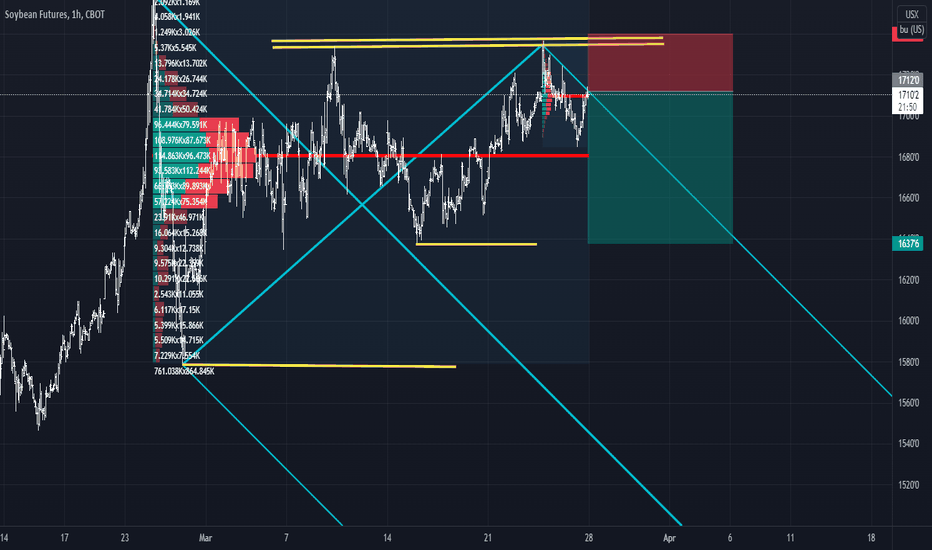

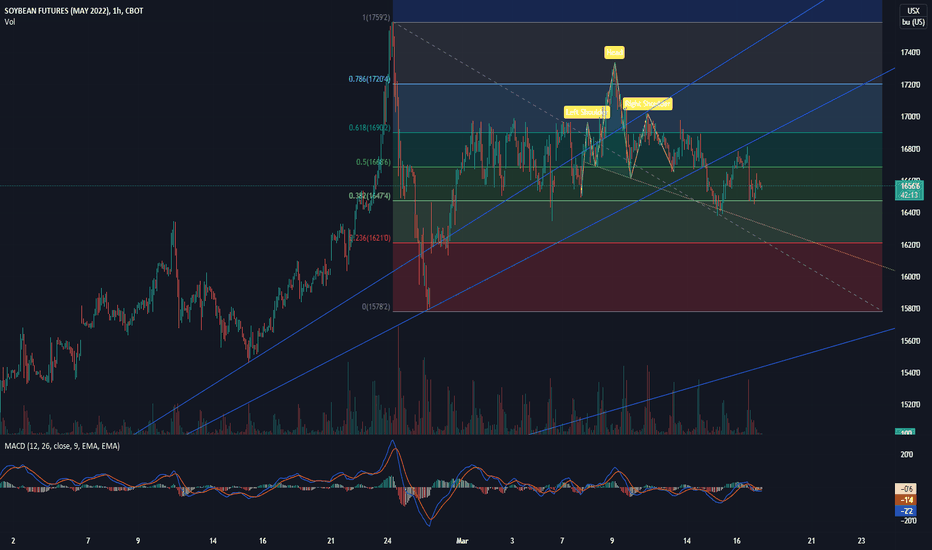

Soybean futures (ZS1!), show up Bearish drop!Hello my friends, today I want to talk with you about Soybean futures

price retest the sliding parallel with good separation

FROM MY ANALYIS I THINK PRICE WILL GO bearish

for now the bull scenario seems more logical.

So be ready for such scenario.

lets see

Enjoy the market

This is an article, not financial advice, always do your own research.

If you have any questions, you can write it in comments below, and I will answer them.

And please don't forget to support this idea with your like and comment, thank you.

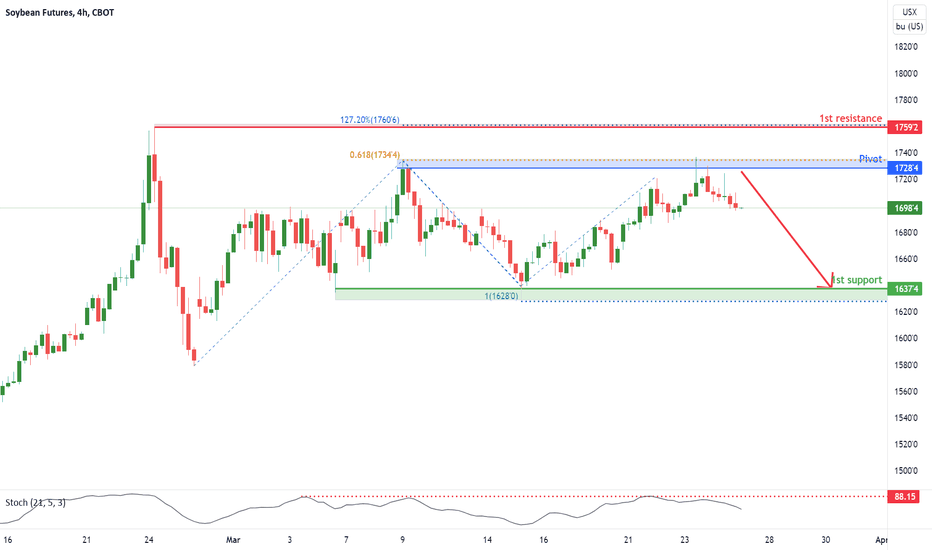

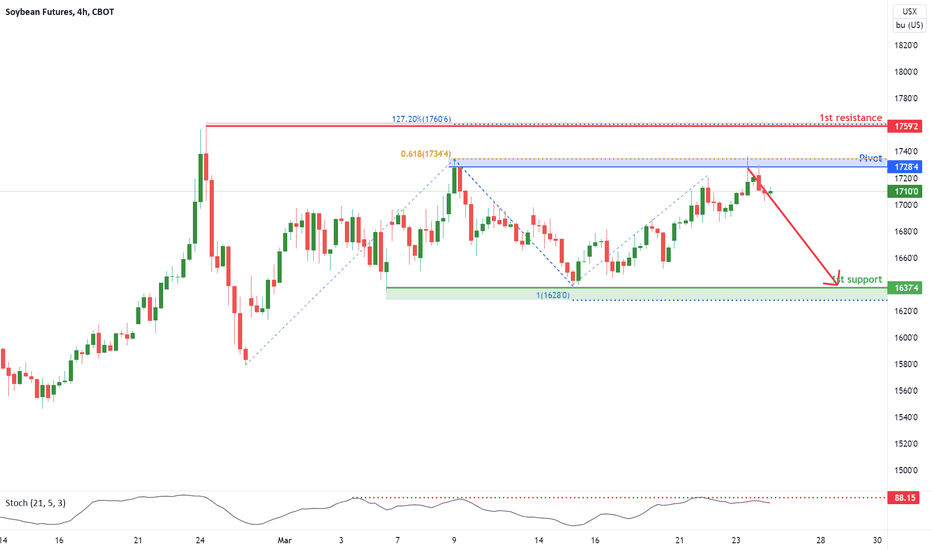

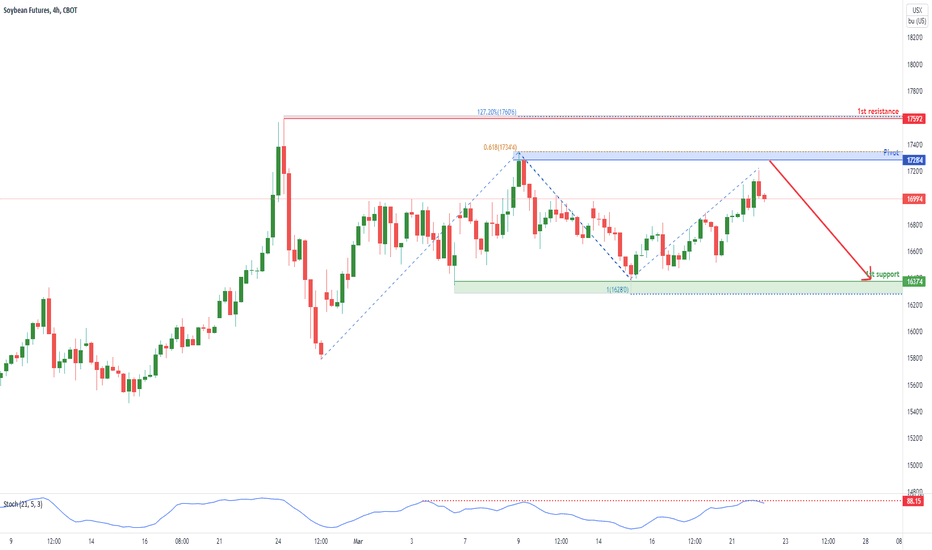

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1759'2

Pivot: 1728'4

Support : 1637'4

Preferred case: With price expected to reverse off the stochastics resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 100% Fibonacci projection from our pivot at 1728'4 in line with the 61.8% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1759'2 in line with the horizontal swing high resistance and 127% Fibonacci extension

Fundamentals: No major news

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1759'2

Pivot: 1728'4

Support : 1637'4

Preferred case: With price expected to reverse off the stochastics resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 100% Fibonacci projection from our pivot at 1728'4 in line with the 61.8% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1759'2 in line with the horizontal swing high resistance and 127% Fibonacci extension

Fundamentals: No major news

Soybean futures (ZS1!), H4 Potential for Bearish drop!Title: Soybean futures (ZS1!), H4 Potential for Bearish drop!

Type : Bearish drop

Resistance : 1759'2

Pivot: 1728'4

Support : 1637'4

Preferred case: With price expected to reverse off the stochastics resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 100% Fibonacci projection from our pivot at 1728'4 in line with the 61.8% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1759'2 in line with the horizontal swing high resistance and 127% Fibonacci extension

Fundamentals: No major news.

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1759'2

Pivot: 1728'4

Support : 1637'4

Preferred case: With price expected to reverse off the stochastics resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 100% Fibonacci projection from our pivot at 1728'4 in line with the 61.8% Fibonacci retracement .

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1759'2 in line with the horizontal swing high resistance and 127% Fibonacci extension

Fundamentals: No major news.

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1759'2

Pivot: 1728'4

Support : 1637'4

Preferred case: With price expected to reverse off the stochastics resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 100% Fibonacci projection from our pivot at 1728'4 in line with the 61.8% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1759'2 in line with the horizontal swing high resistance and 127% Fibonacci extension

Fundamentals: No major news.

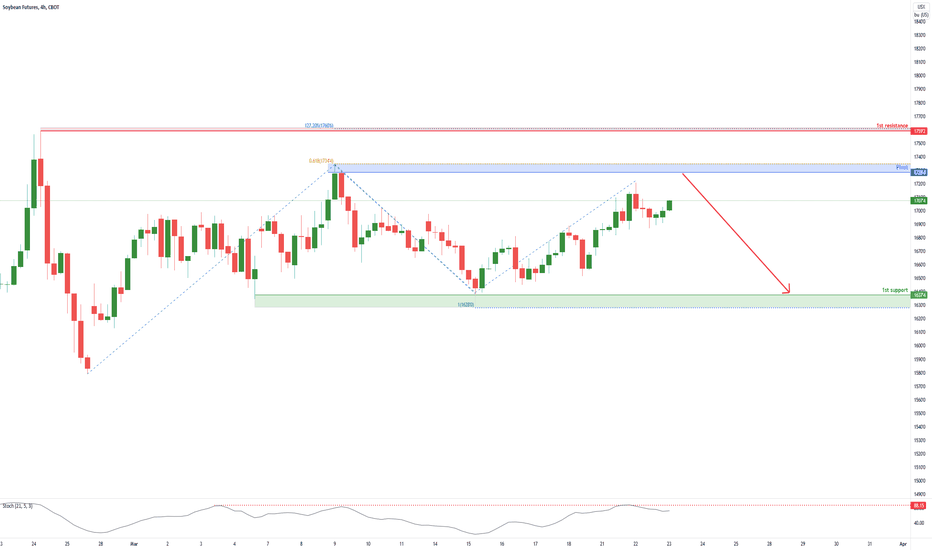

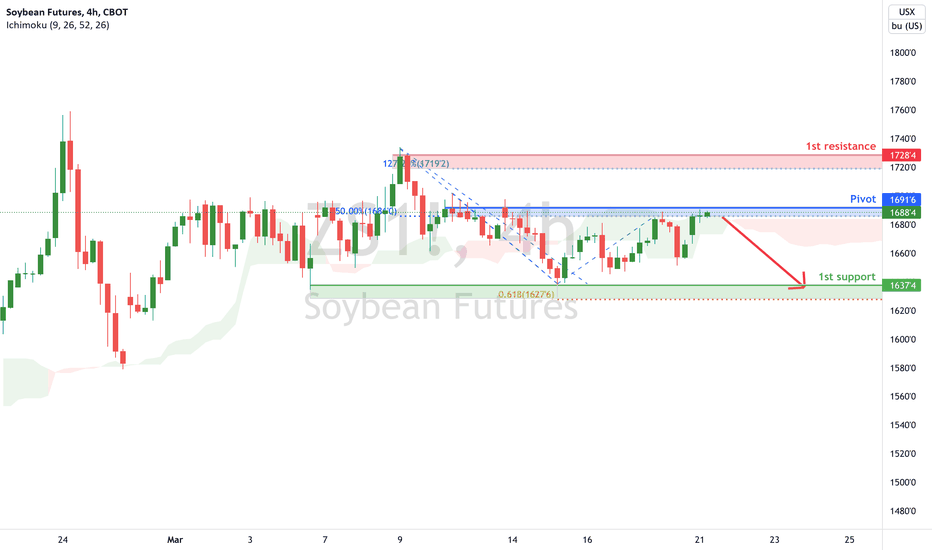

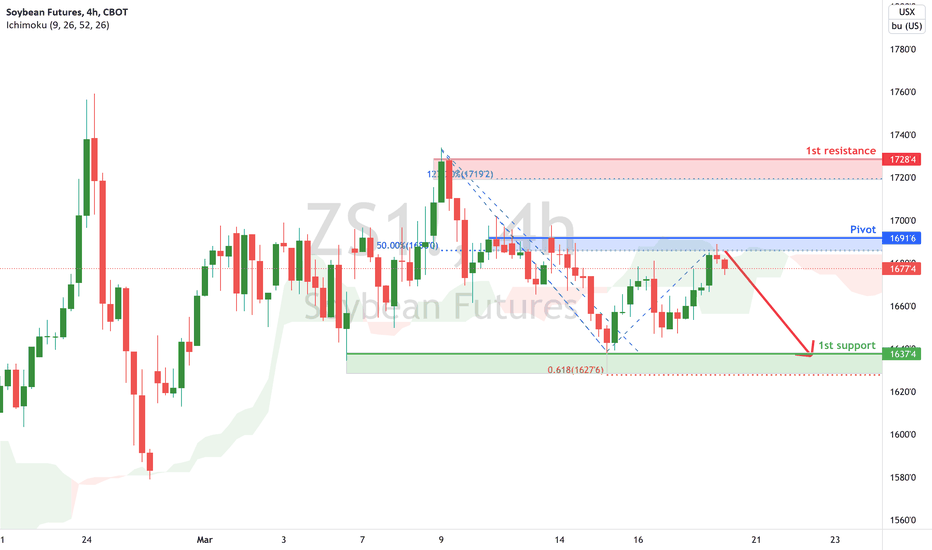

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1728'4

Pivot: 1691'6

Support : 1637'4

Preferred case: With price expected to reverse off the ichimoku cloud resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 61.8% Fibonacci projection from our pivot at 1691'6 in line with the 50% Fibonacci retracement .

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1728'4 in line with the horizontal swing high resistance and 127% Fibonacci extension

Fundamentals: No major news.

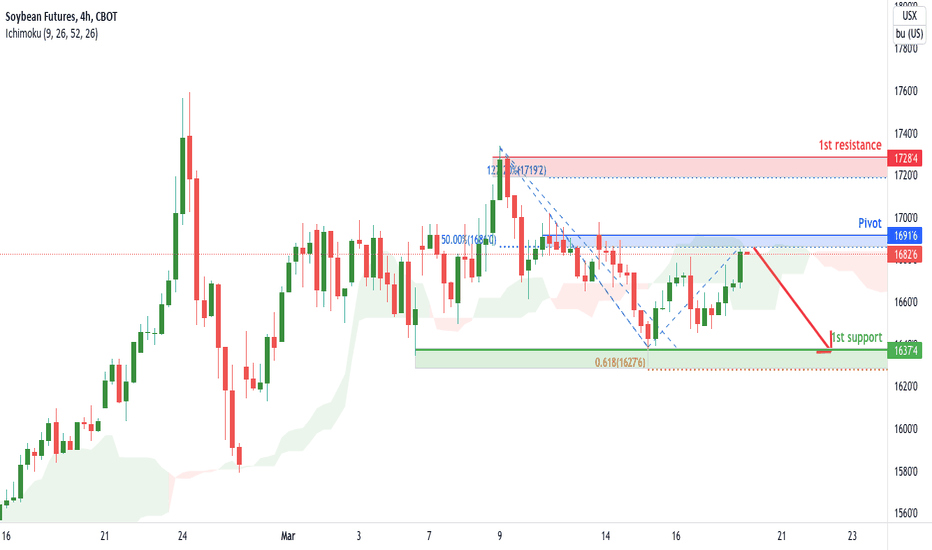

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1728'4

Pivot: 1691'6

Support : 1637'4

Preferred case: With price expected to reverse off the ichimoku cloud resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 61.8% Fibonacci projection from our pivot at 1691'6 in line with the 50% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1728'4 in line with the horizontal swing high resistance and 127% Fibonacci extension

Fundamentals: No major news.

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1728'4

Pivot: 1691'6

Support : 1637'4

Preferred case: With price expected to reverse off the ichimoku cloud resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 61.8% Fibonacci projection from our pivot at 1691'6 in line with the 50% Fibonacci retracement .

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1728'4 in line with the horizontal swing high resistance and 127% fibonacci extension

Fundamentals: No major news.

Soybean futures (ZS1!), H4 Potential for Bearish drop!Type : Bearish drop

Resistance : 1728'4

Pivot: 1691'6

Support : 1637'4

Preferred case: With price expected to reverse off the ichimoku cloud resistance , we have a bearish bias that price will drop to our 1st support at 1637'4 in line with the horizontal swing low support and 61.8% Fibonacci projection from our pivot at 1691'6 in line with the 50% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st resistance at 1728'4 in line with the horizontal swing high resistance and 127% fibonacci extension

Fundamentals: No major news.

Soybean futures (ZS1!), H4 Potential for Bullish Bounce!Type : Bullish bounce

Resistance : 1686'0

Pivot: 1667'2

Support : 1658'4

Preferred case: With price expected to bounce off the RSI indicator, we have a bullish bias that price will rise to our 1st resistance at 1686'0 in line with the horizontal swing high resistance and 50% and 78.6% Fibonacci retracement from our pivot at 1667'2 in line with the 23.6% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st support at 1658'4 where the 50% Fibonacci retracement is.

Fundamentals: No major news.

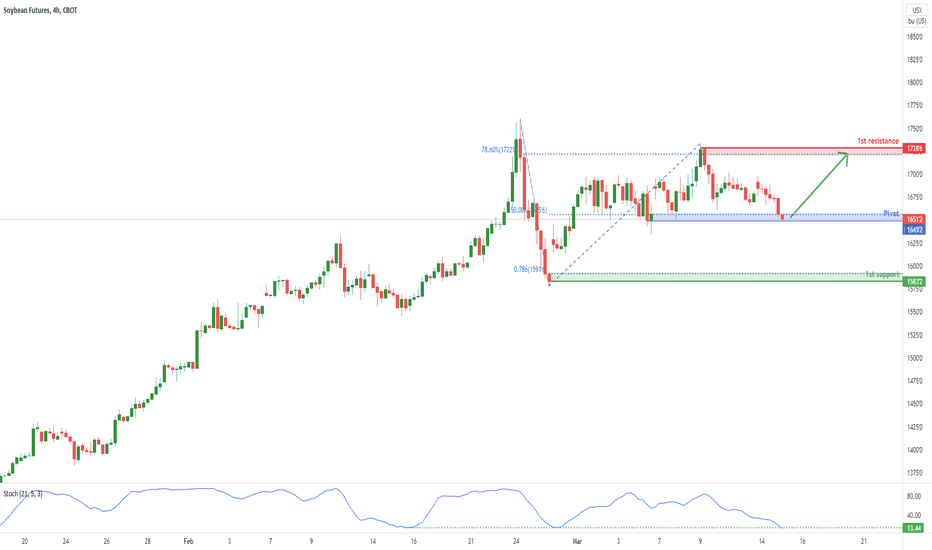

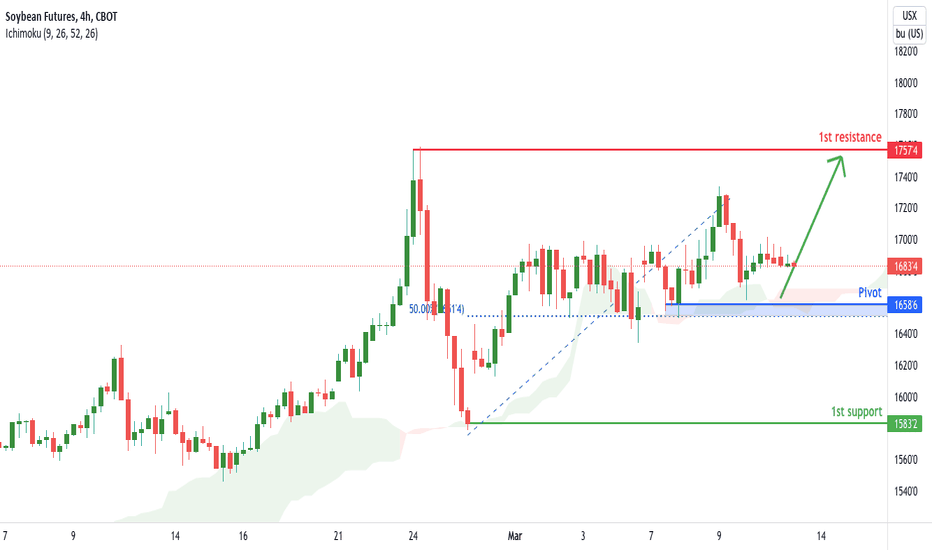

Soybean futures (ZS1!), H4 Potential for Bullish Bounce!Type : Bullish bounce

Resistance : 1728'6

Pivot: 1637'2

Support : 1583'2

Preferred case: With price expected to bounce off the horizontal swing low support and the support of the stochastics indicator, we have a bullish bias that price will rise to our 1st resistance at 1728'6 in line with the horizontal swing high resistance and 78.6% Fibonacci retracement from our pivot at 1637'2 in line with the 50% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st support at 1583'2 in line with the horizontal swing low support and 78.6% Fibonacci projection.

Fundamentals: No major news.

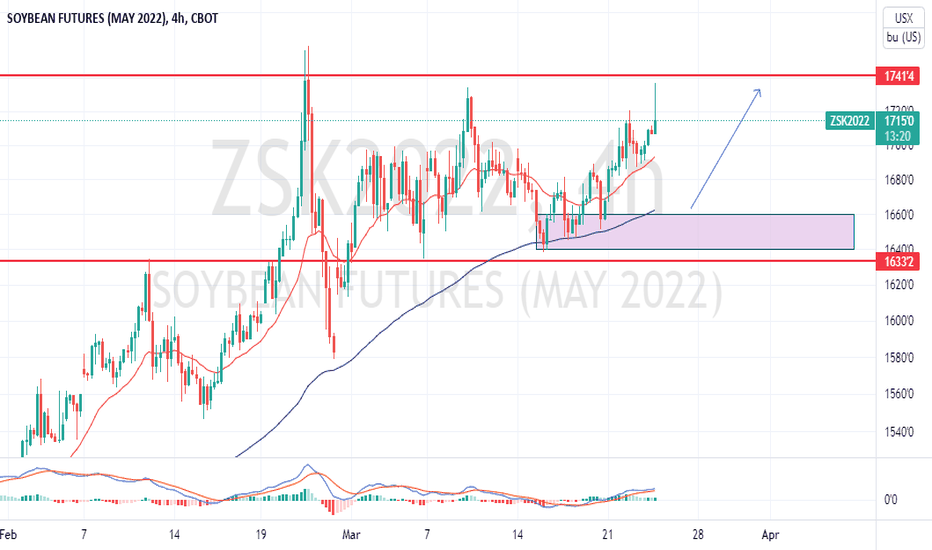

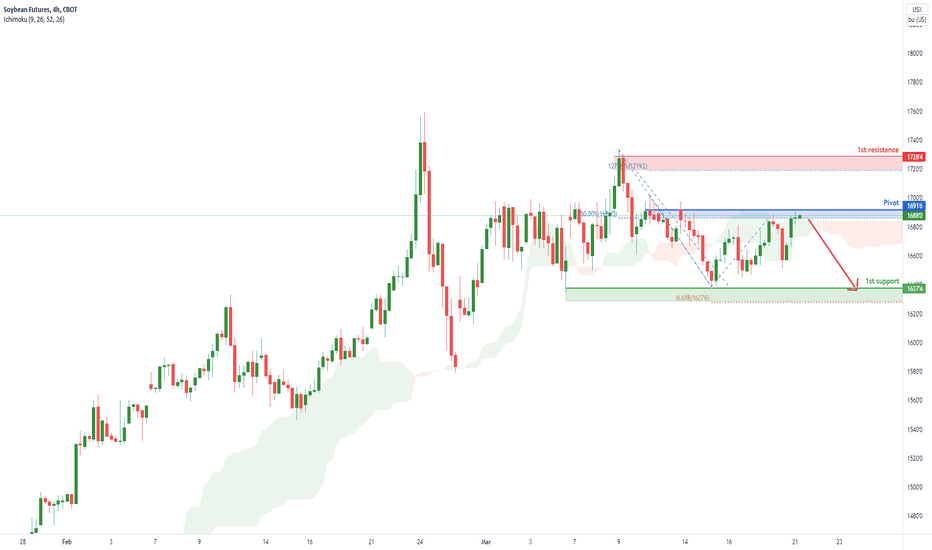

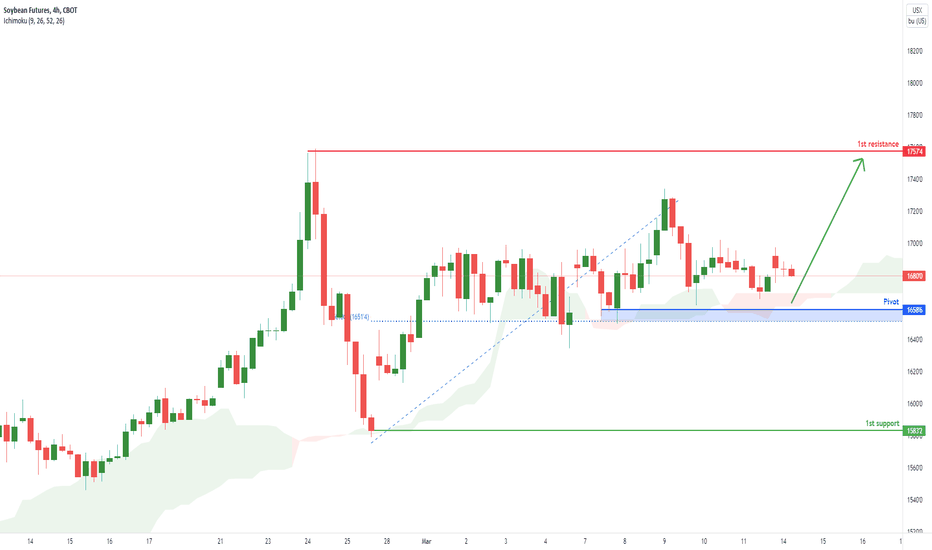

Soybean futures (ZS1!), H4 Potential for Bullish Bounce!Type : Bullish bounce

Resistance : 1757'4

Pivot: 1658'6

Support : 1583'2

Preferred case: With price moving above our ichimoku cloud, we have a bullish bias that price will rise to our 1st resistance at 1757'4 in line with the horizontal swing high resistance from our pivot at 1658'6 in line with the 50% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st support at 1583'2 in line with the horizontal swing low support.

Fundamentals: No major news.

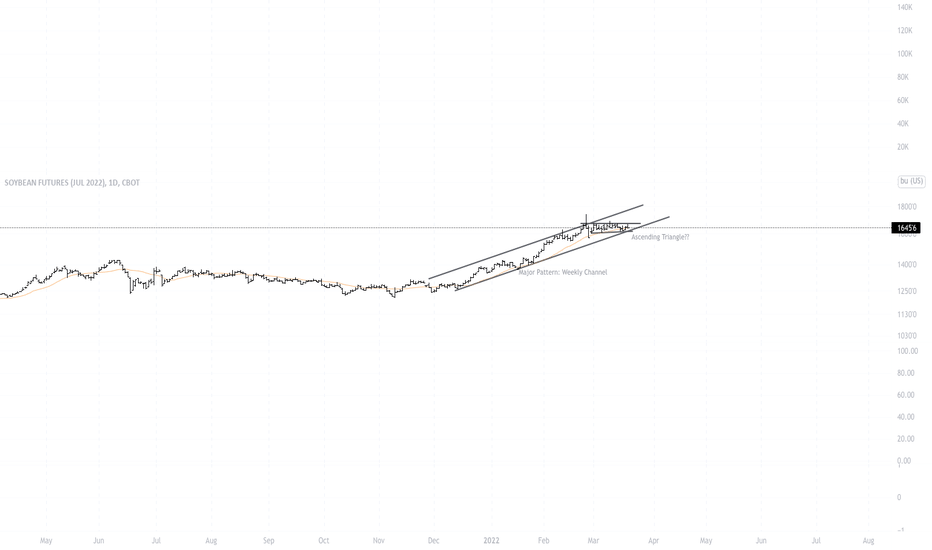

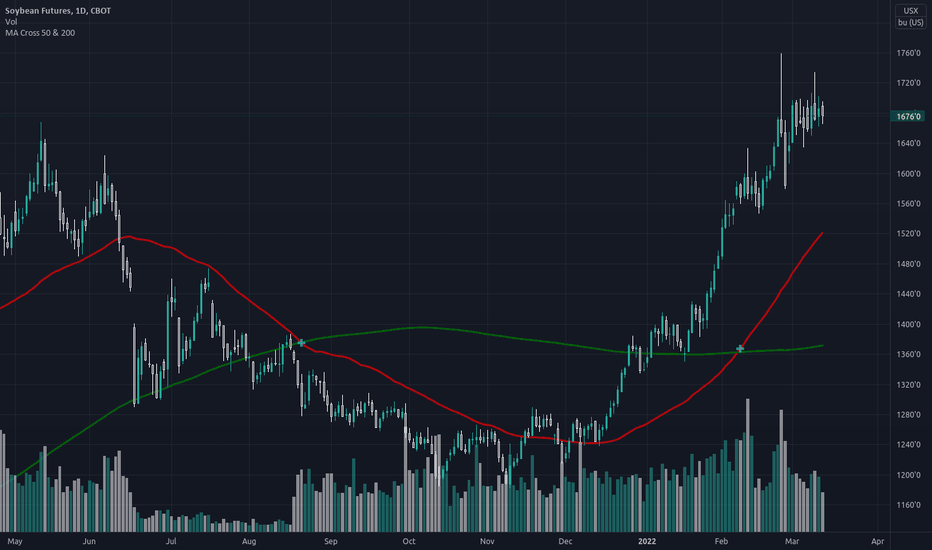

Speculative bubble on commodities.The recent fearmongering about a war that we (as the human race) cannot afford to have and tensions/economic partitions have created a small speculative bubble that is about to pop and wreck some people.

We are indeed in a greater commodities bull cycle (particularly energy) given the string of consecutive poor decisions taken by European and US leaders and monetary policy errors made by central bankers, but prices cannot sustain these unprecedented levels for long and they will eventually tumble before coming back up.

Entering a short now (1676 cents/bu) an ideal target would be 1392 cents/bu or ~17% of the position size. A conservative target would be 1501 cents/bu ~= current 50-day SMA ~= 10% of the position size.

Soybean futures (ZS1!), H4 Potential for Bullish Bounce!Type : Bullish bounce

Resistance : 1757'4

Pivot: 1658'6

Support : 1583'2

Preferred case: With price moving above our ichimoku cloud, we have a bullish bias that price will rise to our 1st resistance at 1757'4 in line with the horizontal swing high resistance from our pivot at 1658'6 in line with the 50% Fibonacci retracement.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st support at 1583'2 in line with the horizontal swing low support.

Fundamentals: No major news.

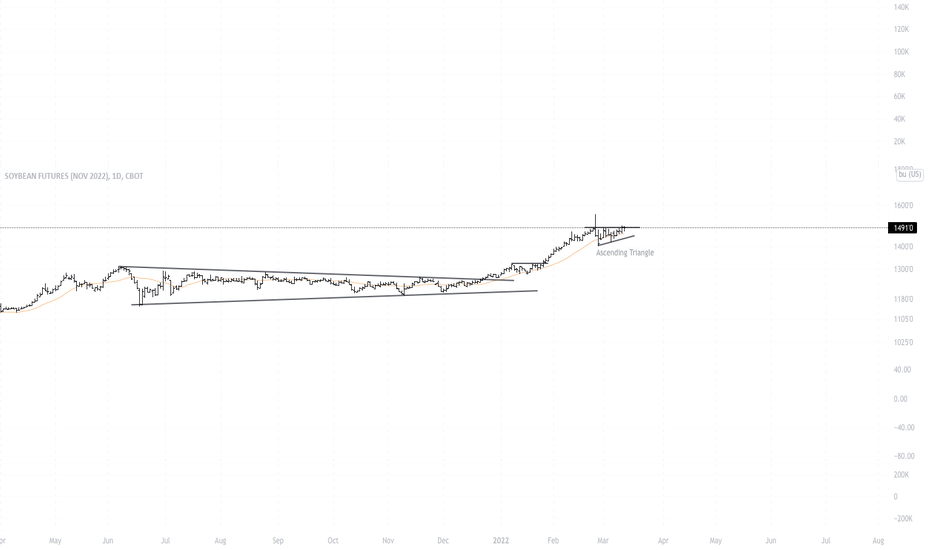

Seasonal Futures Market Patterns Corn SoybeansSeasonal Futures Market Patterns Corn Soybeans

Hey traders today I wanted to go over the best Seasonal Patterns in the Corn & Soybeans Futures Market. Corn and Soybeans and other grain markets follow an annual reliable seasonal pattern revolving around supply demand planting cycles. Knowing when to find these seasonal market patterns on your charts can really benefit us in our trading of Corn and Soybeans.

Enjoy!

Trade Well,

Clifford