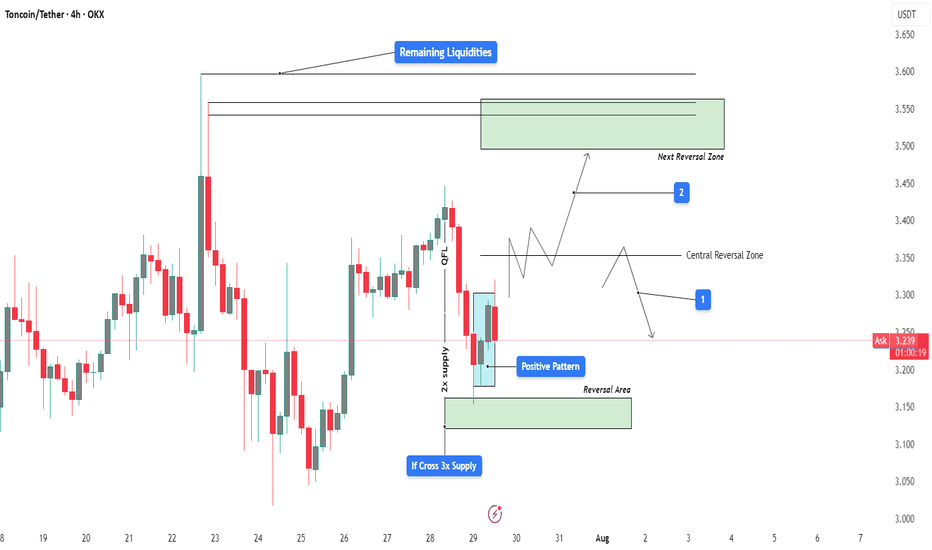

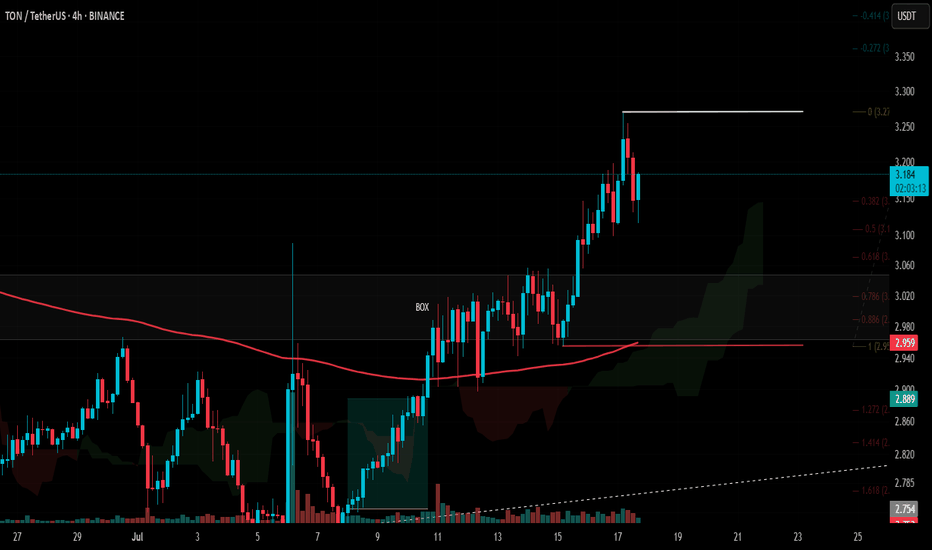

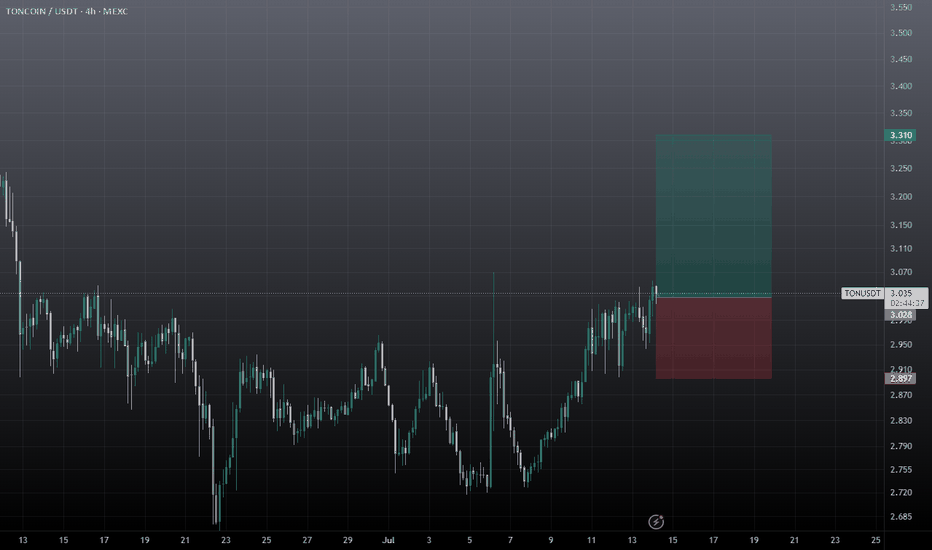

TONUSDT Bullish Reversal from Demand with QFL Base | MMC Setup📊 Technical Breakdown – 4H Chart

✅ Overview

TON/USDT is exhibiting early signs of a bullish reversal after a structured decline into a key smart money demand zone. The setup reflects multiple layers of confirmation—QFL base, multi-supply absorption, liquidity inefficiencies, and a positive reversal pattern—suggesting a high-probability opportunity for upside.

🔹 1. Impulsive Move & Liquidity Sweep

Price rallied aggressively on July 22–23, pushing toward $3.60, breaking short-term highs and triggering liquidity grabs above recent consolidation zones.

This surge absorbed significant buy-side liquidity, leaving a supply zone behind, now marked as the Next Reversal Zone.

After liquidity was collected and orders filled, the market reversed sharply, consistent with institutional profit-taking or engineered liquidation traps.

🧠 Smart Money Insight: Institutions often push price into illiquid zones (above highs) to trap retail and fill large orders. This marks the first phase of the trap.

🔻 2. QFL Base and Multi-Supply Absorption

The price structure created a Quick Flip Level (QFL) — a smart money concept where price forms a base, drops, then rallies, leaving behind an institutional demand zone.

The current pullback has revisited this exact QFL base, now reinforced by 3x supply absorption, enhancing the zone's strength.

This confluence increases the probability of a strong reaction to the upside from this level.

📌 Note: The “If Cross 3x Supply” label shows that this zone has absorbed multiple attempts to break down. It's now acting as a demand pocket.

🔄 3. Reversal Area – The Engine Room of Smart Money

The Reversal Area is carefully marked at $3.20–$3.28 — the ideal discounted price zone where large buyers tend to step in.

This zone is structurally important:

Past breakout level

Aligned with QFL base

Beneath stop levels of breakout traders

A Positive Pattern has now formed within this area—likely a bullish engulfing, morning star, or pin bar, depending on candle confirmation.

📌 Psychology: This zone acts as a trap. Retail traders often panic sell here, while smart money accumulates quietly before launching price upward again.

🧭 4. Dual Scenario Structure – Projected Paths

You’ve beautifully mapped two valid future price scenarios based on reaction to the Central Reversal Zone (~$3.35):

🔵 Scenario 1 – Healthy Pullback Before Continuation

Price climbs toward the central zone, then pulls back slightly to retest support near $3.28–$3.30 (label 1).

This allows further accumulation before price breaks higher.

This is a safer re-entry scenario for patient traders looking for a retest.

🟢 Scenario 2 – Direct Impulsive Rally to Next Reversal Zone

Price continues with bullish momentum, slicing through $3.35 and aiming for the Next Reversal Zone at $3.52–$3.60 (label 2).

This zone contains remaining liquidity, left uncollected from the previous impulse.

Price is likely to reverse or pause at this level again due to heavy supply.

📌 Key Tip: If price reaches that zone without significant resistance or exhaustion, it may signal continuation potential with minor corrections.

💼 Strategic Trade Plan (High-Probability Setup)

Entry Zone: $3.20 – $3.28 (Reversal Area)

Stop-Loss: Below $3.15 (beneath structure + QFL base invalidation)

Target 1: $3.35 (Central Reversal Zone)

Target 2: $3.52–$3.60 (Liquidity Completion & Next Reversal Zone)

🧮 Risk-Reward Estimate:

Conservative: 1:1.8

Aggressive: 1:2.5 or better if price reaches high liquidity zone.

🔄 MMC Flow Summary – What the Market Makers Are Doing:

Create a trap at the top (collect liquidity and fake the trend)

Force price down into demand (scare retail + grab stops)

Absorb sell orders in bulk at QFL/demand zone

Form bullish reversal pattern (positive structure)

Push price upward again, aiming for uncollected liquidity above

📌 This is a classic MMC cycle — engineered by large players, and now you’re aligned with their strategy.

🧠 Why This Matters

This chart isn’t just about entry and exit; it’s about understanding the underlying psychology and structure. By aligning with the smart money footprint — QFL, supply absorption, and liquidity targeting — you're maximizing edge and minimizing guesswork.

TONUSDT trade ideas

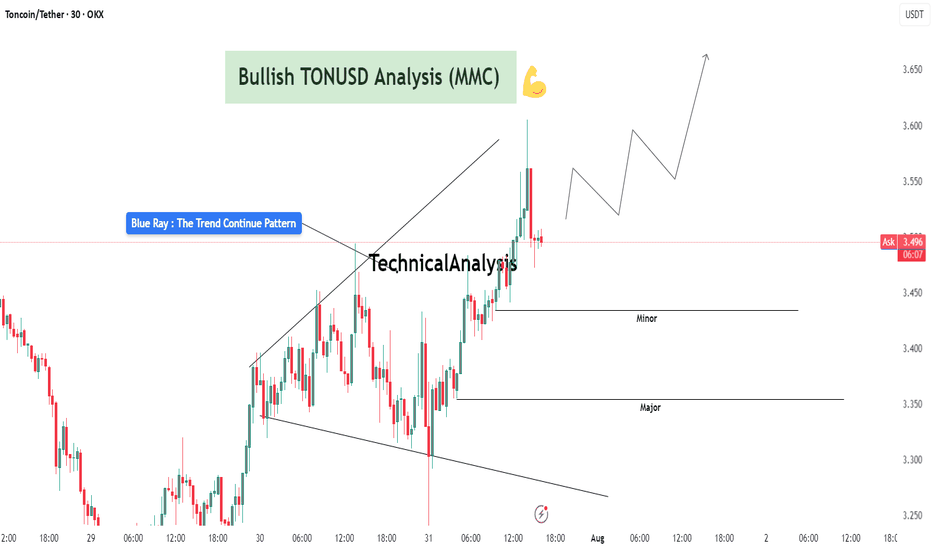

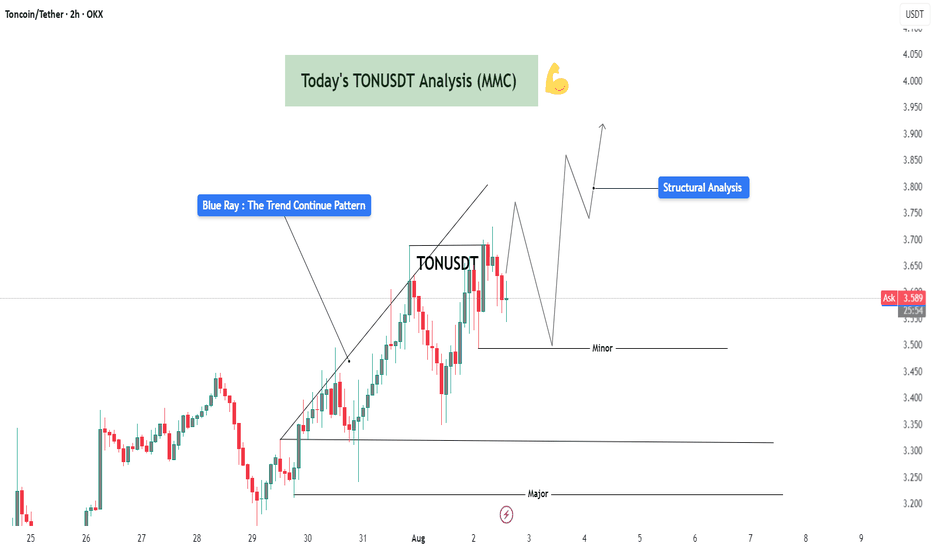

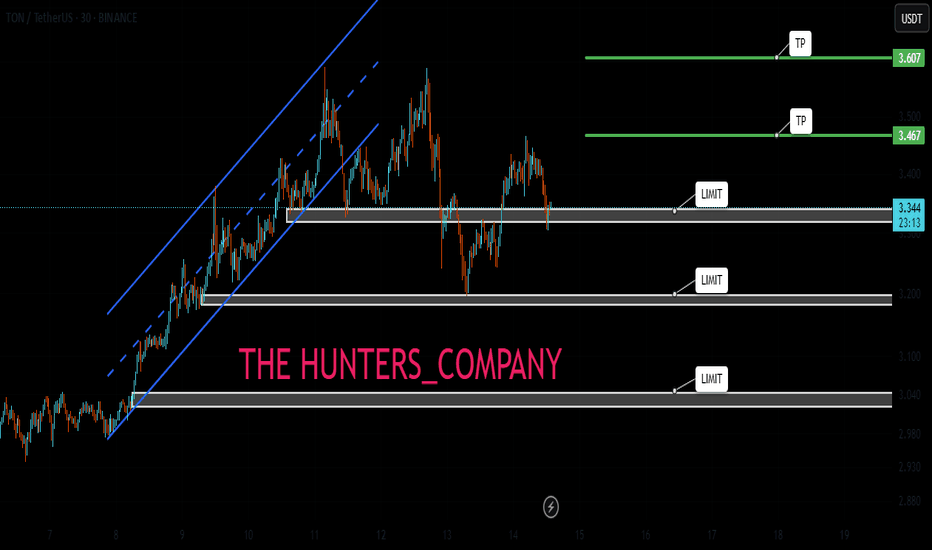

TONUSDT Analysis : Bullish Setup Breakout – Advanced MMC Analyze“Blue Ray Pattern Breakout Confirms Bullish Trend Continuation”

The 30-minute chart of TONUSDT highlights a clean and structured bullish setup based on the MMC (Mirror Market Concepts) methodology. The price action exhibits disciplined market behavior, respecting structural levels, breakout dynamics, and volume-based reactions.

🔷 1. Blue Ray Pattern – Trend Continuation Phase

This chart begins with the formation of the Blue Ray, a visual representation of trend consolidation and energy buildup. This pattern functions as a trend continuation flag or wedge. Prices compressed within a narrowing range, forming higher lows and lower highs, signaling accumulation under buyer control.

Once the pattern matured, we witnessed a decisive bullish breakout, where the price closed above resistance with conviction. This event marked a clear market intention shift and established a new impulsive leg.

🔍 2. Breakout Confirmation and Follow-Through

Post-breakout, TONUSDT experienced:

High-volume candles with elongated bodies, indicating increased buyer participation.

Immediate upside momentum that pushed the asset into a short-term overextended condition – often a healthy sign of strength when followed by a controlled pullback.

The breakout wasn’t just a false move – it was sustained, and the price held above the broken structure, proving that supply was absorbed and buyers were dominant.

🔑 3. Demand Zones (Minor and Major)

Two key MMC demand zones are highlighted:

🔹 Minor Demand Zone (~3.43–3.45):

This is the most immediate support and current price is hovering just above it. It's the first zone of interest for buyers and may serve as a re-entry or scaling point.

🔸 Major Demand Zone (~3.34–3.36):

In case of deeper retracement or volatility, this zone is expected to act as a strong bounce region based on past structure and MMC’s reversal logic. Price memory here suggests accumulation or reactive interest.

📐 4. Structure, Momentum, and Higher Timeframe Confluence

TONUSDT is in a confirmed uptrend, forming a clear sequence of higher highs and higher lows.

The structure supports a bullish flag breakout with minimal overhead resistance.

The projected path drawn on the chart illustrates a stair-stepping price pattern with continuation toward 3.60–3.70, if current levels hold.

📊 5. MMC Strategy Bias – Bullish

Using the MMC lens:

Blue Ray breakout confirms continuation

Volume absorption succeeded at the base of the flag

No signs of dominant supply entering post-breakout

Wave projection supports ongoing momentum

Structure favors buying dips, not shorting spikes

💡 Trader’s Takeaway:

TONUSDT is providing a textbook bullish opportunity under the MMC framework. As long as price stays above the Minor Demand Zone, continuation upward toward 3.60 and beyond remains in play. If price dips to the Major Zone, watch for strong buyer reactions for fresh entries.

Ideal for MMC traders and technical analysts looking to align with structured, logic-based entries and exits. This setup reflects market strength, technical clarity, and volume confirmation – a powerful trio for continuation plays.

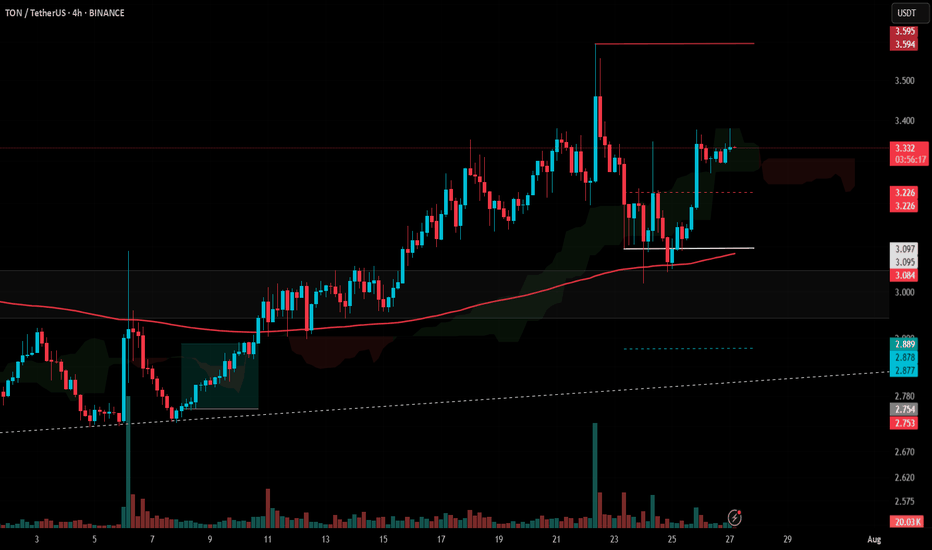

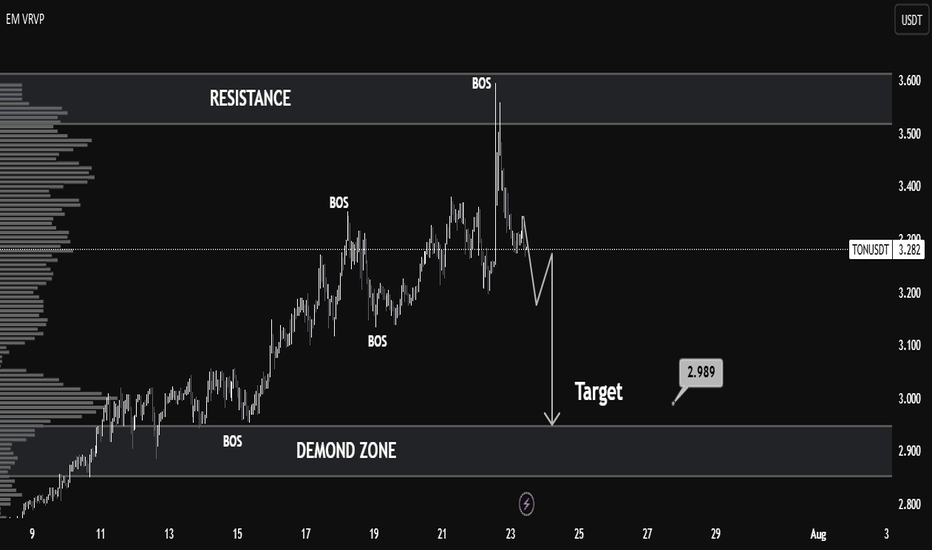

#TON Update #5 – July 27, 2025#TON Update #5 – July 27, 2025

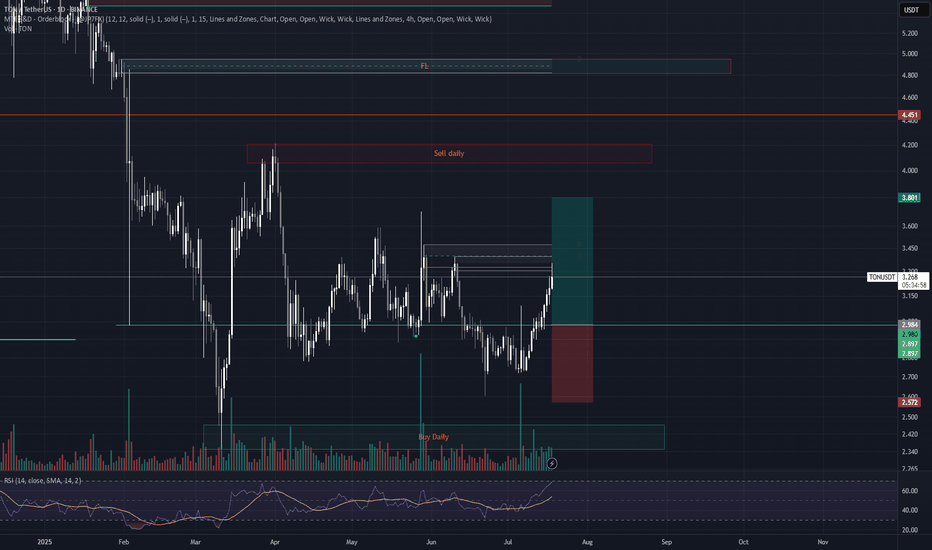

TON has moved below its last impulsive wave, initiating a bearish phase on the 4-hour chart. The presence of long wicks may be a sign of significant trapped positions, likely indicating that whales have already closed out their trades in this zone.

Based on the 4-hour chart, Ton’s bearish shift and the following correction point to a new target at the $2.88 level. Keep in mind this analysis applies only to the 4-hour timeframe, not the daily.

You should consider the timeframe in which you're trading. As long as TON does not break above the $3.60 level and close a candle with a new high, it will remain bearish on the 4-hour chart. Therefore, I do not recommend any trades on TON at the moment.

#TON Update #4 – July 18, 2025#TON Update #4 – July 18, 2025

Toncoin (TON) has completed its correction following the last impulsive move and is now pushing upward again. Technically, the next major target sits around the $3.35 level.

However, before reaching that level, TON faces a resistance at $3.27 — a level that has been tested multiple times in the past and may cause a temporary pullback.

On the TON/BTC pair, the price still hasn’t broken above the 200 MA band, which remains a limiting factor for bullish momentum.

For short-term traders:

Entry: $3.17

Target: $3.27

Potential Gain: 3%

This setup may offer a quick profit opportunity, but caution is advised.

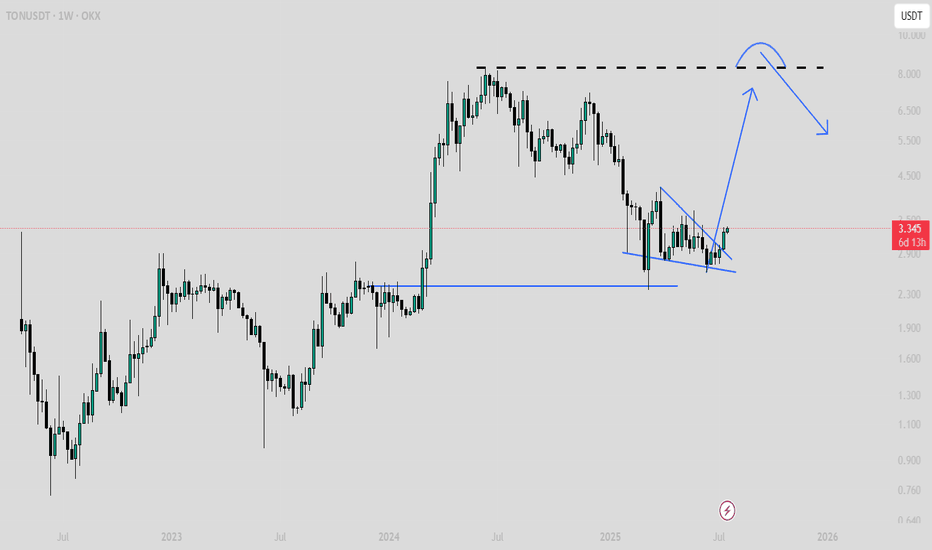

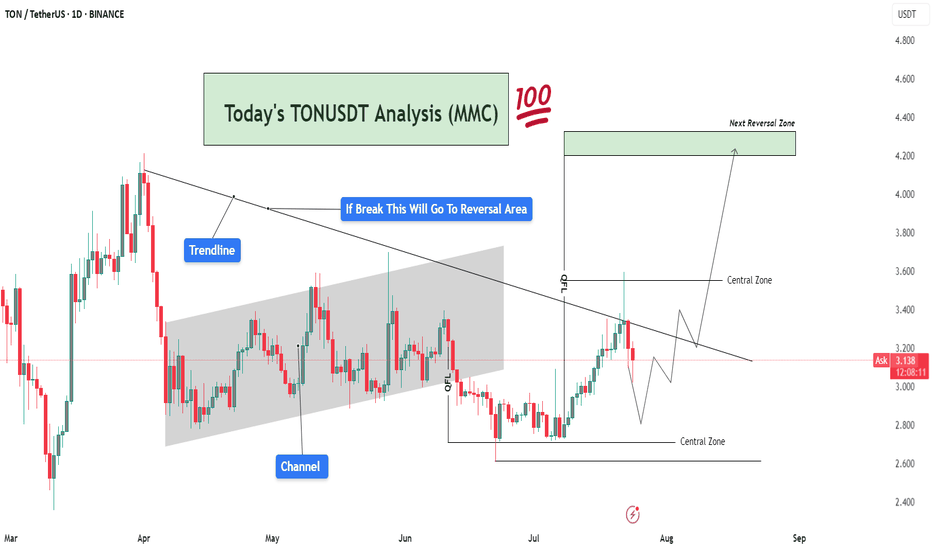

TONUSDT Analysis – Trendline Breakout Target To Reversal Area🧠 Market Sentiment & Context:

TONUSDT (Toncoin vs USDT) is currently trading at $3.13, showing signs of compression within a well-defined MMC structure. After forming a clear QFL (Quick Flip Level) base, the market is approaching a decisive breakout level, with a strong rejection or breakout likely in the coming days.

This chart displays confluence from trendlines, channel breaks, central zones, and QFL demand zones, providing multiple layers of structure-based decision-making. Here's a deeper dive 👇

🔍 Technical Breakdown – What the Chart Is Telling Us:

🔸 1. Major Trendline Resistance – Bearish Control Zone

The descending trendline drawn from prior highs is acting as dynamic resistance.

Price tested this line recently and faced rejection, showing that sellers are still active.

However, the consolidation below the trendline suggests accumulation, not panic selling — a classic sign of smart money positioning before a breakout.

🔸 2. Previous Channel Structure – Broken & Retested

The price previously moved inside a slightly rising parallel channel, reflecting a slow and steady bullish phase.

The channel has now been broken, but TON quickly reclaimed structure via a strong bullish engulfing candle from the QFL base, hinting that this was a liquidity grab (stop hunt) before the real move.

🔸 3. QFL (Quantity Following Line) – Institutional Demand Zone

The QFL base at around $2.85–$3.00 was created after a swift sell-off followed by immediate bullish response.

This is a high-probability MMC reversal structure, where large buyers typically enter.

Since this QFL held firm, it has created a solid foundation for bullish momentum, provided the trendline is eventually broken.

🧭 What's Happening Now – Price Action Update:

Price is caught between two major Central Zones:

Lower Zone: $2.85 – $3.15 (Support)

Upper Zone: $3.50 – $3.70 (Resistance)

The current movement shows price creating higher lows, indicating bullish pressure building beneath the trendline.

Volume remains low, which means the market is waiting for a catalyst (news or breakout) before a directional push.

📌 Key Reversal Zone Ahead – Eyes on $4.20 to $4.40

If price breaks and closes above the descending trendline and crosses the upper central zone, we can anticipate a strong bullish move toward the Next Reversal Zone marked around $4.20–$4.40.

This zone has historical confluence as:

Previous strong supply zone

Psychological round number

Fibonacci extension alignment

This will likely be the profit-booking area for swing traders and early buyers from the QFL zone.

📈 Trade Scenarios Based on MMC:

✅ Bullish Scenario (High Probability If Breakout)

Price breaks the trendline → Pullback → Retest of $3.50–$3.60 zone

Bullish continuation to $4.20–$4.40 Reversal Zone

Ideal entry on retest after breakout

Stop-loss below $3.00

❌ Bearish Scenario (If Rejected Again)

Rejection from trendline leads to re-test of lower Central Zone

Breakdown of QFL level (~$2.85) would invalidate bullish setup

Potential drop toward $2.60 zone for liquidity sweep

🧠 MMC-Based Observations:

🔹 MMC Element 📍 Explanation

🔺 Trendline Key resistance from macro downtrend

🟩 Central Zones Neutral battleground for buyers/sellers

🔻 Channel Break Confirmed bearish momentum earlier, now tested

✅ QFL Strong base, showing early smart money entries

🎯 Reversal Zone High-risk area, expect volatility and profit-taking

📌 Strategic Summary:

Bias: Bullish (as long as price holds above $3.00)

Confirmation Needed: Daily candle close above trendline & $3.50 zone

Target 1: $3.85

Target 2: $4.20–$4.40 (main reversal)

Invalidation: Close below $2.85 (QFL loss)

🚨 Final Thoughts:

TONUSDT is showing clear smart money footprints via the QFL formation and trendline pressure. The setup is ideal for MMC-based breakout traders waiting for confirmation before entering. Volume spike + trendline break will likely spark the next impulsive rally.

Stay patient, and trade the reaction, not the prediction.

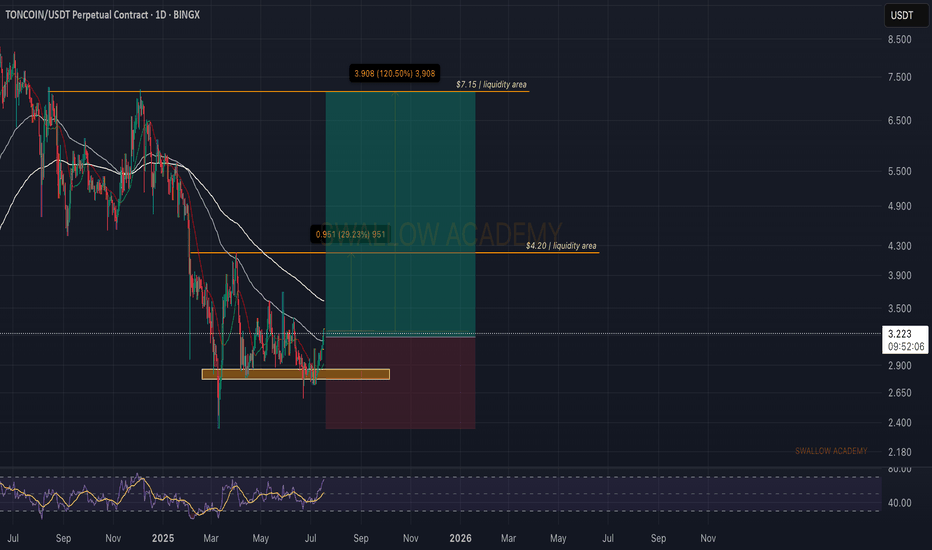

TONUSDT Technical Analysis – Bearish Shift with Clean TargetMarket Context:

TONUSDT recently showed strong bullish momentum, breaking multiple structure levels (noted as BOS – Break of Structure), indicating a clear uptrend. However, the most recent price action reveals a sharp rejection from the resistance zone around 3.55–3.60, marking a significant trend reversal.

Key Levels:

Resistance: 3.55 – 3.60

Price tested this zone and was strongly rejected, forming a potential top.

Demand Zone: 2.88 – 2.99

This zone provided previous accumulation and serves as a probable liquidity area and downside target.

Target: 2.989

The chart marks this as the near-term bearish objective, aligning with the volume node and prior demand.

Technical Signals:

Multiple BOS (Break of Structure):

Confirmed bullish structure earlier, but the latest BOS downward indicates a possible trend reversal.

Volume Profile (VRVP):

Shows high volume nodes around 3.00, suggesting strong market interest at lower levels — acting as a magnet for price.

Bearish Market Structure:

After the peak, the lower highs and lower lows pattern reflects short-term bearish dominance.

Liquidity Grab & Selloff:

The spike above resistance likely induced liquidity before a rapid selloff — classic distribution behavior.

Outlook:

If the market fails to reclaim levels above 3.35, a bearish continuation toward 2.989 remains likely.

The demand zone (2.88–2.99) is a critical area where buyers may re-enter — look for reversal signals here.

Conclusion:

TONUSDT has shifted from bullish to bearish in the short term. A clean rejection from resistance and strong structural breaks suggest a move toward the 2.989 demand zone. Traders should watch for confirmation of support or continuation upon reaching this level.

TONUSDT Bullish Structure Continuation – Minor Pullback Leg Up🧾 1. Overview of the Chart Setup:

The current TONUSDT (Toncoin/USDT) 2-hour chart exhibits a strong bullish market structure, characterized by a clear sequence of higher highs and higher lows. This confirms bullish momentum and suggests that the market is in a well-established uptrend.

The key highlight here is the "Blue Ray – Trend Continuation Pattern", which signals sustained bullish pressure following a clean breakout. This breakout was preceded by a consolidation phase, indicating accumulation by smart money before the expansion move.

🔍 2. Technical Structure and Pattern Breakdown:

🔵 Blue Ray – Trend Continuation Pattern:

This diagonal support trendline captured the initial breakout after the market bottomed near July 29–30.

Price respected this ascending line multiple times before accelerating, confirming bullish control.

Once the price broke above the previous swing high, it completed the pattern and triggered a momentum-driven rally.

🔲 Structural Zones – Major and Minor:

Minor Support Zone (~3.50 USDT):

Currently acting as short-term demand.

Price is showing early signs of rejection here, suggesting bulls may reload for a second impulsive move.

If this zone holds, we expect a new higher high to form, potentially targeting 3.80–4.00+ USDT.

Major Support Zone (~3.20–3.25 USDT):

Acts as long-term bullish defense.

In case of deeper retracement or shakeout, this is the key level to watch for possible trend continuation and re-entry.

📈 3. Structural Analysis and Price Projection:

The projected path on the chart shows a classic price action structure:

Impulse

Correction (toward minor support)

Next Impulse (break of recent high)

Higher low (continuation within trend channel)

Potential final push toward the 3.90–4.00 range

This type of Elliott Wave-inspired behavior suggests we're in wave 3 or 5 of a bullish sequence, with minor dips offering low-risk long setups.

📊 4. Candlestick & Market Behavior:

Recent candles show long lower wicks, suggesting buyers are stepping in during dips.

Bearish candles are relatively smaller and followed by immediate bullish response.

This indicates buy-the-dip sentiment, common in a trending market.

🔄 5. Trading Plan & Scenarios:

✅ Bullish Continuation (Base Case):

Wait for a clear bullish engulfing or price bounce at the minor support zone (~3.50 USDT).

Enter with confirmation: bullish candle close, volume spike, or trendline reaction.

Targets:

TP1: 3.80 USDT

TP2: 4.00–4.10 USDT

Stop Loss: Below 3.45 (or structure-based trailing stop)

⚠️ Bearish Case / Deeper Pullback:

If 3.50 fails, look for signs of accumulation around the major support (~3.20–3.25).

This zone can serve as the ultimate defense for trend continuation and provide a second long opportunity with better R:R.

🧠 6. Mindset for Traders:

Don’t chase: Let price come to your level, and focus on confirmation.

Trade with the trend: Structure supports bullish movement — trade in the direction of strength.

Use proper risk management: Define SL and TP before entering. Partial profits at key resistance zones are a smart strategy.

Avoid overtrading : Wait for structural retests or confirmation candles to stay on the right side of the market.

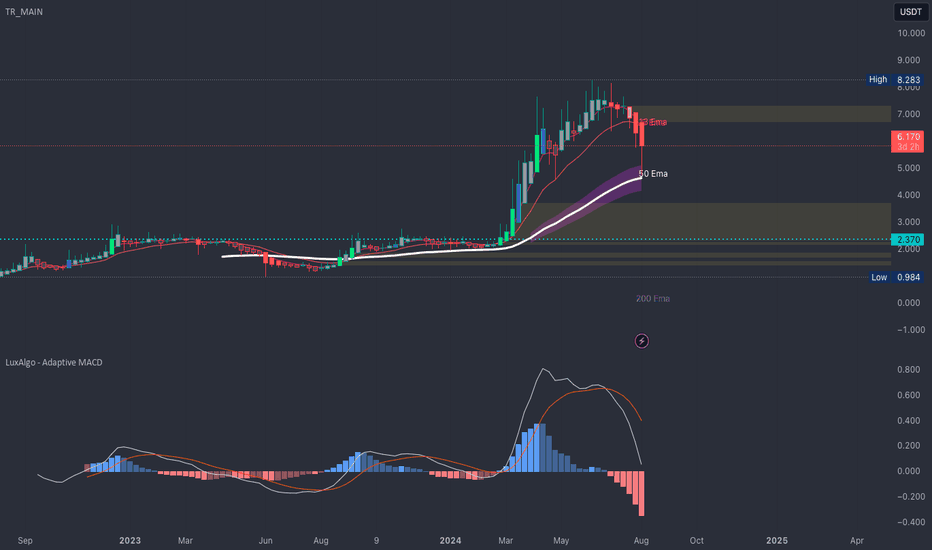

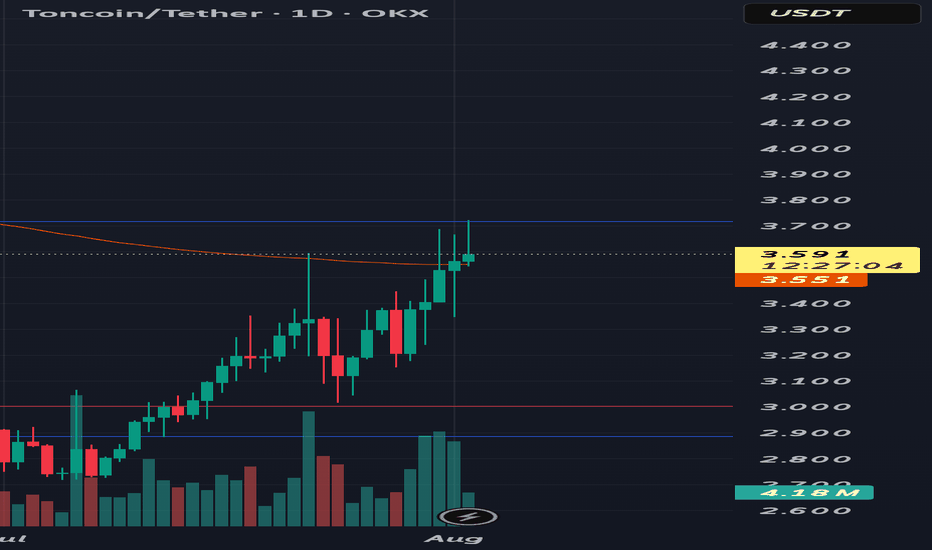

Up only desuTon has crashed a lot from its all time high and it seems to be rebounding now. Today will be the fifth daily green candles in a row and yesterday's daily closed above EMA 200

IN ADDITION TO THIS

Some bullish news for Ton i found from elfabot

The recent surge in CRYPTOCAP:TON price is primarily attributed to strong ecosystem activity, including significant NFT purchases by Pavel Durov (Telegram’s founder), such as buying a Plush Pepe NFT for 15,000 TON (about $53,000), which has boosted market confidence and demonstrated TON’s real-world utility. This has been widely discussed in the crypto community and cited as a bullish catalyst (source).

⦁ Additional bullish factors include Grayscale considering investment in TON, the launch of new Telegram NFT features, and US users being able to access TON Wallet directly inside Telegram without a VPN (source).

So, yea, i think we're breaking previous ATH and hitting $10 soon

cheers

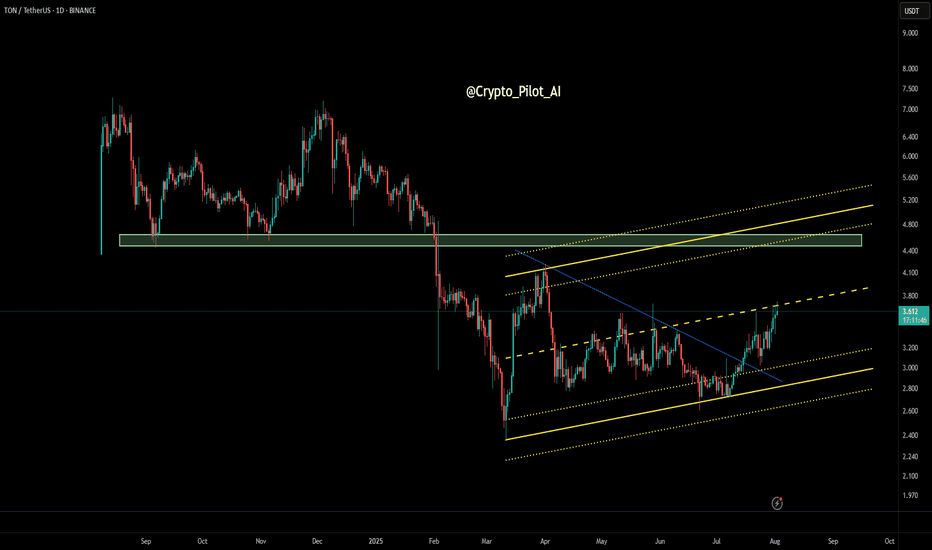

TON/USDT – Daily Price Action Analysis🔹 Price has broken a major descending trendline and entered an ascending channel.

🔹 Currently testing the mid-range resistance zone around $3.60 – $3.70.

🔹 If buyers hold above this area, the next targets could be $4.40 – $4.80.

🔹 If rejected, key supports are at $3.20 and $2.90.

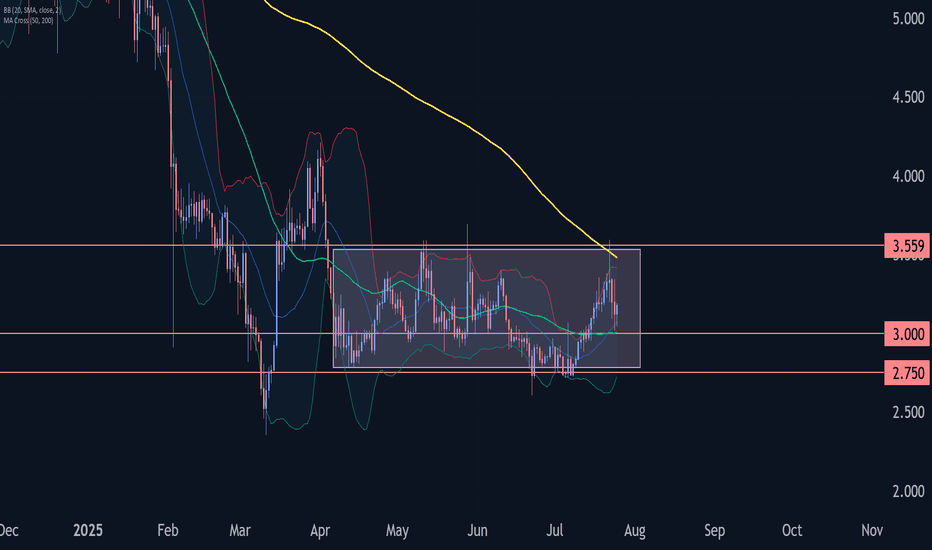

Toncoin Wave Analysis – 25 July 2025- Toncoin reversed from resistance level 3.5585

- Likely to fall to support level 3.0000

Toncoin cryptocurrency recently reversed down from the key resistance level 3.5585 (which is the upper boundary of the sideways price range inside which the price has been trading from April).

The key resistance level 3.5585 was strengthened by the upper daily Bollinger Band.

Given the strongly bearish crypto sentiment seen today, Toncoin cryptocurrency can be expected to fall to the next round support level 3.0000 (former resistance from the start of July).

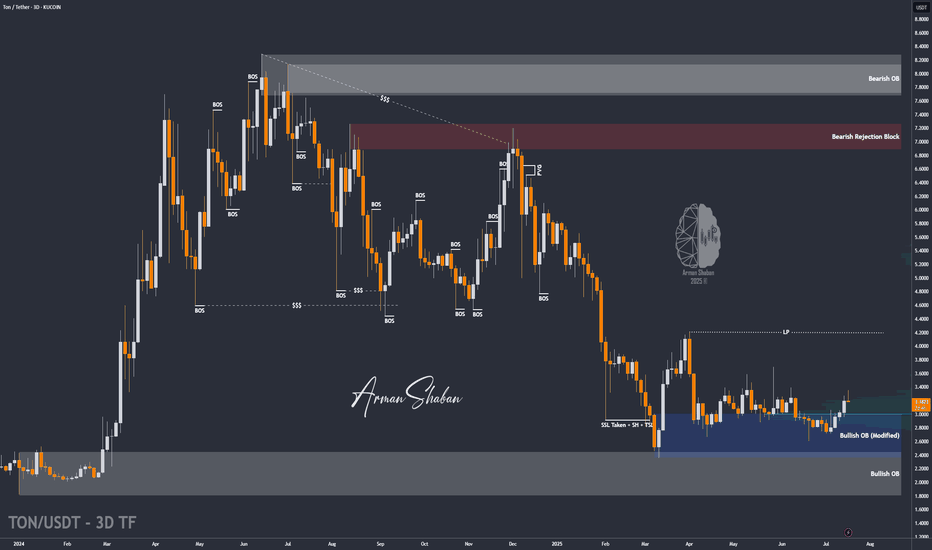

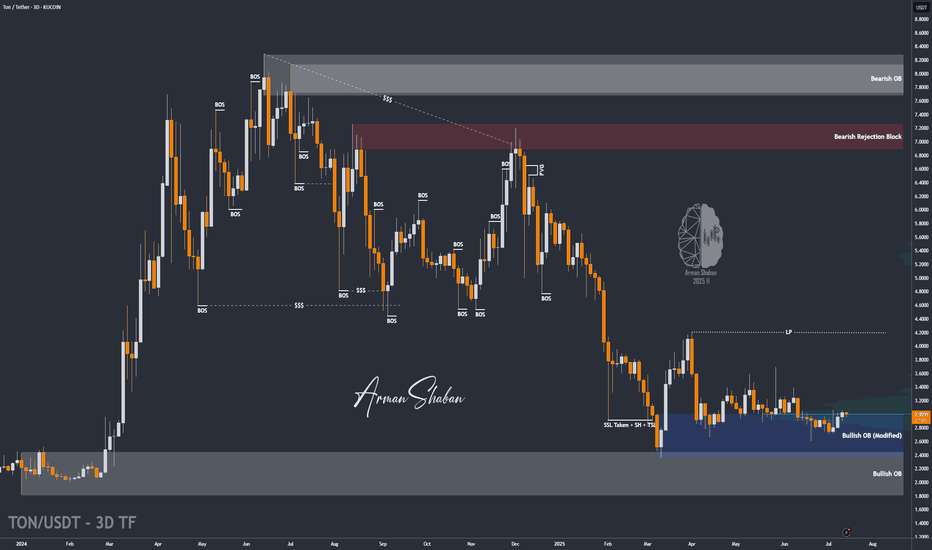

TON/USDT | Another Bullish Move Ahead? (READ THE CAPTION)By analyzing the Toncoin chart on the 3-day timeframe, we can see that, as per yesterday’s analysis, the price climbed to $3.36 before facing a slight correction — which is perfectly normal since every strong bullish trend needs a healthy pullback. The $3.05–$3.20 zone could serve as a good accumulation area for buyers, and we may soon witness another impressive rally from Toncoin! Based on the previous analysis, the next targets are $3.63, $4.20, and $4.68.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

TON/USDT : Get Ready for a new Rally! (READ THE CAPTION)By analyzing the Toncoin chart on the 3-day timeframe, we can see that the price has finally managed to grow over 3% as expected, and is currently consolidating above the $3 level. We’ll have to see how far this bullish momentum can continue — but to be honest, I expected a stronger move considering the market rally and Bitcoin repeatedly hitting new ATHs. Still, no worries — once Bitcoin takes a breather, altcoins will likely begin their powerful runs! Based on previous analysis, the next targets are $3.15, $3.63, $4.20, and $4.68 respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

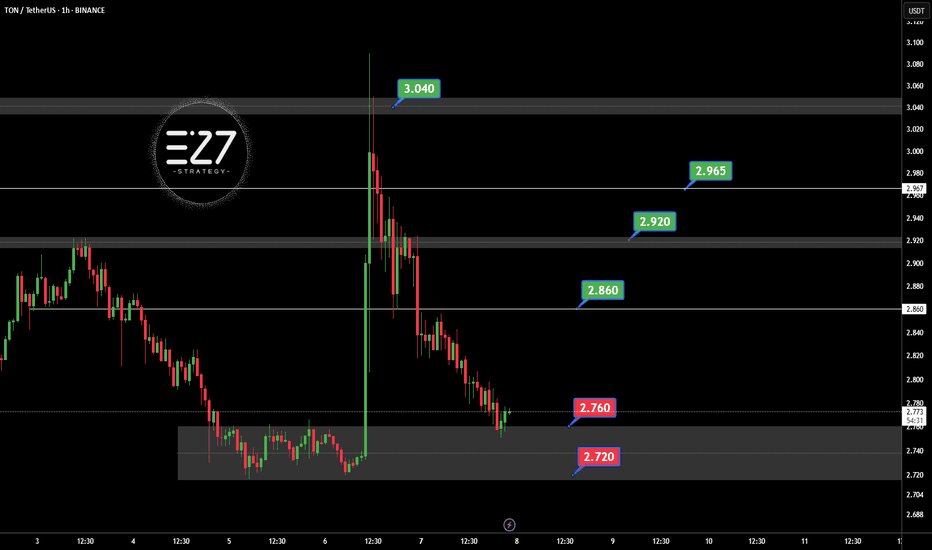

TONUSDT Following the official denial by UAE authorities regarding the possibility of obtaining a golden visa through staking OKX:TONUSDT , the bullish momentum driven by that rumor has faded. Selling pressure has increased, and TON is now consolidating within the key support zone of 2.720 to 2.760 USDT. If this support breaks, further downside is likely. However, if the price holds and reclaims the 2.860 USDT resistance, it could trigger a recovery toward 2.920 and 2.965 USDT. For now, the market sentiment remains bearish with a corrective bias.

Key Points:

UAE officially denied TON-based golden visa claims, weakening sentiment.

Current support zone: 2.720–2.760 USDT.

Key resistance: 2.860 USDT, then 2.920 USDT.

Break below 2.720 = further decline.

Break above 2.860 = potential bullish reversal.

⚠️ Please Control Risk Management in trades.

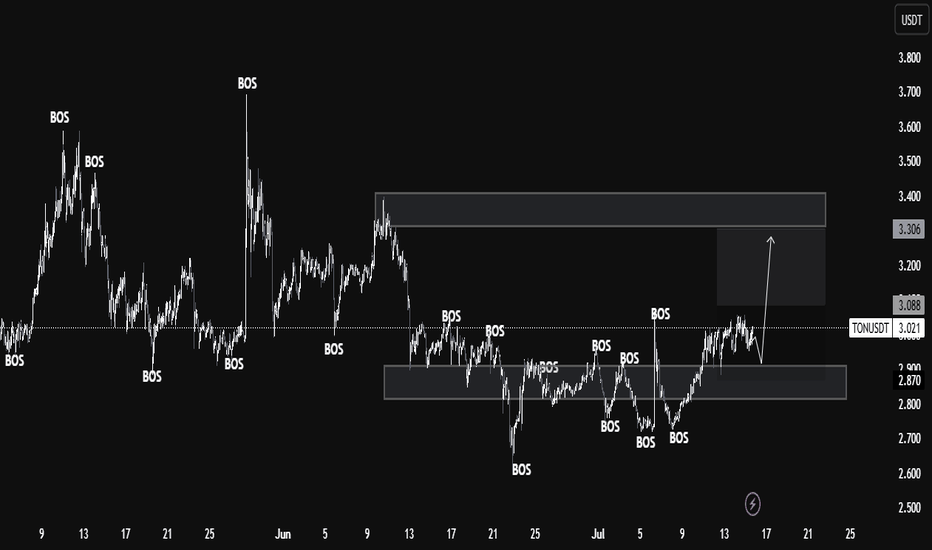

TON/USDT Monthly Structure Flip – Smart Money Targets $3.30+ Aft🔍 Key Observations:

Current Price: 2.974 USDT

Support Zone (Demand Area):

Strong demand zone around 2.870 - 2.800 USDT.

Price previously reacted multiple times from this zone, showing strong buyer interest and BOS confirmations.

Resistance Zone (Supply Area):

The next significant resistance lies in the range of 3.306 - 3.400 USDT.

This zone previously caused a BOS to the downside, making it a critical level to monitor for potential profit-taking or reversals.

Market Structure:

Price is currently consolidating just above the demand zone after a bullish BOS.

Recent BOS confirms a shift in structure from bearish to bullish bias.

Potential Price Path:

If price sustains above the 2.870 support, a bullish move targeting the 3.306 level is likely.

Expect short-term retracements within the structure but with a medium-term bullish bias.

Liquidity Mapping:

Liquidity is likely resting above the 3.088 local highs and the 3.306 major resistance.

Smart money may push price to these levels to mitigate orders or engineer exit liquidity.

📈 Educational Perspective:

This chart is a strong representation of Smart Money Concepts (SMC), particularly the use of BOS as confirmation for directional bias. Traders can look to:

Use the demand zone for potential long entries.

Watch for confirmation (like bullish engulfing or internal BOS) within the zone.

Manage trades toward the premium zone near 3.3 for a favorable risk-reward.

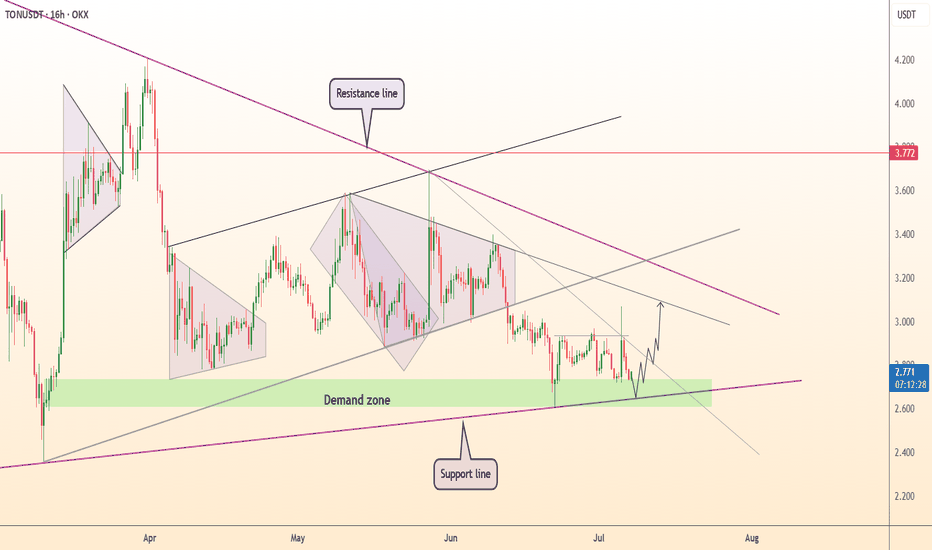

DeGRAM | TONUSD held the demand zone📊 Technical Analysis

● Price has just printed a third higher-low inside the green $2.60-2.75 demand zone and on the long-term purple trend line, forming a tight falling-wedge that is squeezing against $2.90 resistance.

● A 16 h close above $2.90 completes the wedge and opens the grey mid-channel target at $3.25; the pattern’s 1 : 1 swing and descending magenta resistance intersect at $3.77, offering follow-through scope.

💡 Fundamental Analysis

● Telegram’s plan to roll out the Ton-powered wallet to its global user base, alongside a new $115 M TON ecosystem fund, is expected to boost real-world demand and developer activity.

✨ Summary

Long $2.70-2.90; breakout > $2.90 aims for $3.25 → $3.77. Invalidate on a 16 h close below $2.58.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Toncoin Update v2.0 · How To Trade For Maximum ProfitsI am keeping the same chart drawings for simplicity. We continue to move forward on Toncoin and this is one of the trio we track and trade: Notcoin, Toncoin & Dogs.

Daily TONUSDT is now trading above EMA55. When this happened back in February 2024 Toncoin produced its biggest advance ever. The same is likely to repeat multiplied by ten.

(I just updated the targets for your convenience. $12 & $18 have been added to the chart.)

» July 2024 TONUSDT moves daily above EMA55.

» EMA89 is now sitting at $3.10. This resistance level is also about to be conquered. This simply means that the bullish bias is fully confirmed.

» MA200 is still a bit further away but once TONUSDT moves above this level, currently at $3.59, we can expect long-term growth. That is, six months or more. Can be 8, 9, 12, 14, 16, etc. Just beyond six.

"Toncoin will move straight up," this is just a way of saying things. There will always be some days red, some days green, some red some green but the trend, tendency and bias is bullish.

When you see prices rising and you start to enjoying higher profits do not be scared by sudden drops. These are shakeouts and only meant to scare you. Hold strong.

Toncoin can turn red 2 days, 3 days, even 6 days or 9 days and still remain 100% bullish and as soon as the retrace ends you will get additional growth.

It is all fine and great in the Crypto market.

Thanks a lot for your continued support.

Namaste.

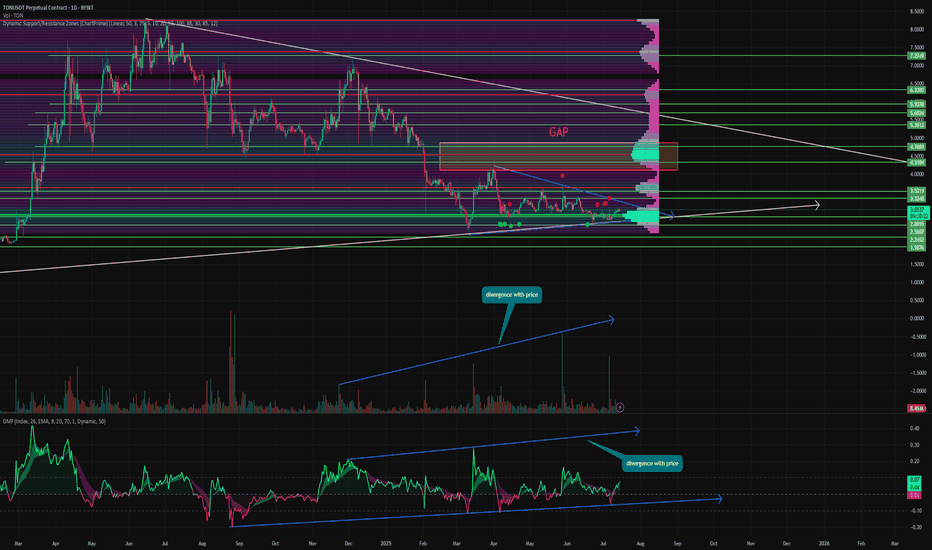

TON - the hidden GEM of this cycle?⚡️ Hello, everyone! While Bitcoin is reaching new heights, crypto gurus everywhere are already predicting an altseason. Whether it will actually happen is anyone's guess. But it's definitely worth being prepared and keeping an eye on a couple of tokens.

One such token is TON. After its hype on tapalki, the price corrected, forming a GAP at the top at $4.87 - $4.10. And as we know, 99% of GAPs close sooner or later.

An attempt was made to close it, but it was unsuccessful. And the token price reached its sloping support, which led to an 81% rebound in March.

Interestingly, did this coincide with a new wave of market growth? 🤔

⚙️ Let's take a deeper look at what the metrics and indicators are showing us:

Support/Resistance - the first thing to pay attention to. The price reached key support with the largest area of interest. At levels of $2.97 - $2.76. This, combined with other factors such as support and positivity in the market, could push for strong growth.

Volume - TON is one of the few tokens that did not experience a decline in sales during the correction. Instead, it experienced growing purchase volumes throughout the decline. This creates a large divergence with the price.

Money Flow - is also an extremely interesting indicator. In complete divergence with the price, an ascending flag pattern has formed here. This shows that liquidity continues to flow in. And the previous rebound to $4.22 saw an even greater influx of liquidity than the rebound to $7.22 in December 2024.

📌 Conclusion:

TON seems like an unremarkable token until you take a closer look. And I understand why investors have such faith in the asset.

1. Great growth potential. Almost 200% to ATH, which is simply fantastic for an asset with such a high capitalization.

2. TON could be the first real step towards the mass adoption of Web3 in society. They have their own messenger with a billion users, and they have already shown how easy it is to integrate them all into cryptocurrencies. All that remains is not to lose people this time.

➡️ Have a nice day, everyone, and write in the comments what you think about the future of TON!