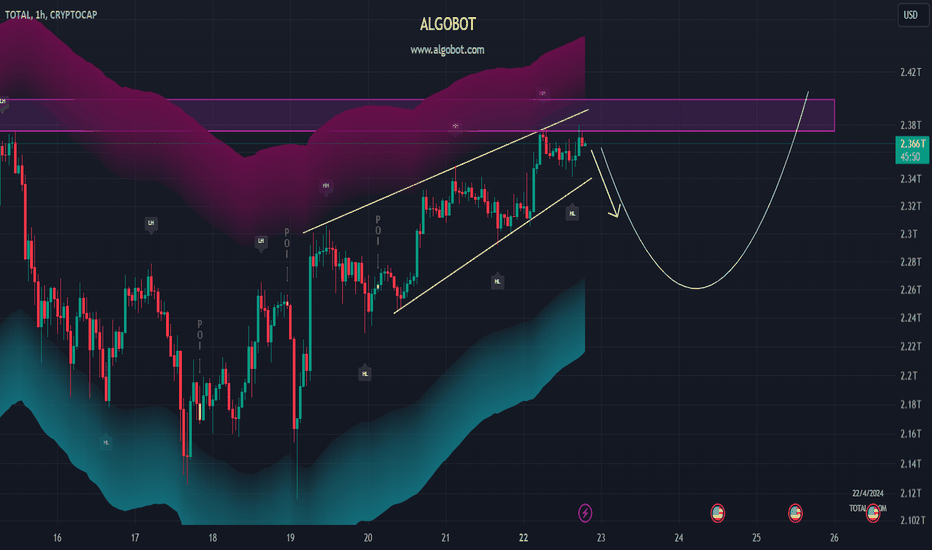

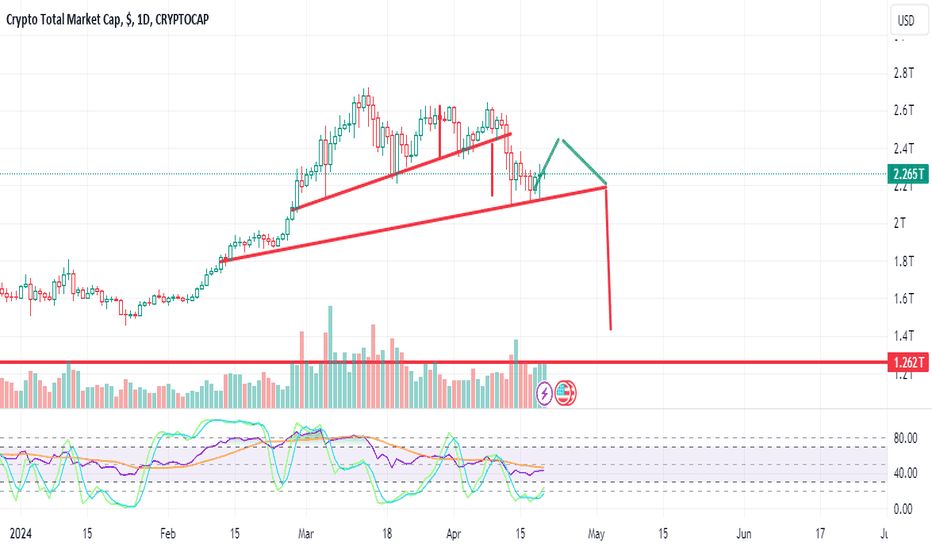

TOTAL (1H) forming a possible bearish patternLooking at TOTAL chart in 1H timeframe, it's possible that a rising wedge pattern is being formed. if confirmed, market can dump a little for a couple of days. in case the pattern fails and TOTAL crosses above the resistance zone, the current pump in the market shall continue with a better momentum.

TOTAL trade ideas

MARKETS week ahead: April 22 – 27Last week in the news

Higher for longer was for one more time rhetoric which influenced market sentiment during the previous week. In expectation of less rate cuts during this year, the US equities entered into the correction mode, with the S&P 500 ending the week at level of 4.967. The US Treasuries had another relatively strong week, where 10Y benchmark sustained levels above 4.6%. The price of gold remained under the influence of geopolitics, while the US Dollar also held in strength during the week. The crypto market was recovering from a strong sell-off two weeks ago, but still sustained relatively higher volatility in expectation of Bitcoin halving, which occurred this weekend. Bitcoin is ending the week above the $ 65K levels.

The US economy continues to show its resilience to tight monetary policy. Retail sales in March were increased by 0.7% on a monthly basis, which was much higher from market estimate of 0.3%. This was another issue for markets, considering its potential impact on inflation in the coming period. Markets are currently losing positive sentiment, and adjusting positions accordingly, in expectation that three rate cuts will not occur during the course of this year.

CNBC spoke with leading ECB economists during the IMF Spring Meeting in New York, held last week. The ECB President Lagarde once again noted her standing from the last ECB meeting, that it could be expected first rate cut in June within the European Zone, in case that inflation continues to move with a clear down trend. However, in case of some extreme shocks, the rates might stay on hold. She noted this disclaimer considering recent negative developments in the Middle East and its impact on oil prices. Also, other twelve members of the Council Board were in agreement with such a course of action in June, and also aligned with potential threats coming from geopolitical issues.

Quite a positive sentiment came last week from CEO of VanEck fund, Jan van Eck. He noted in his opinion that the world economy is starting its new growth phase, putting special emphasis on China, and suggested that investors should eye commodities now. At the same time, it should be noted that his funds have large exposures toward commodities, including gold and copper.

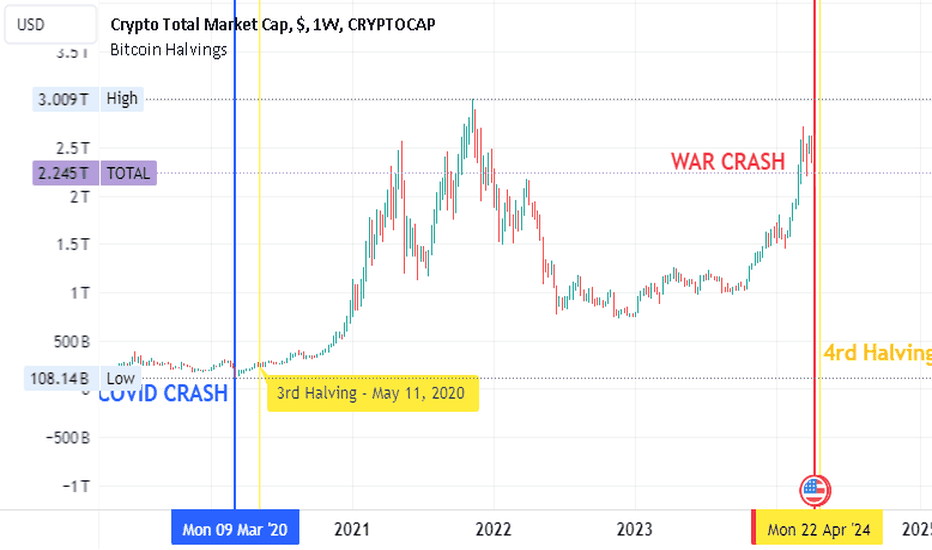

The long awaited Bitcoin halving started early Saturday, where the 840.000th block was added to the blockchain. Fees already soared while at the same time a new Bitcoin-based system was launched. The name of the new system is Runes. Although BTC`s price was relatively volatile during the week, still the BTC held strongly around the level of $65K. Still, whales took the chance to buy the BTC dip at $60K. News are reporting that a total of $1.2B worth of BTC was bought during this time.

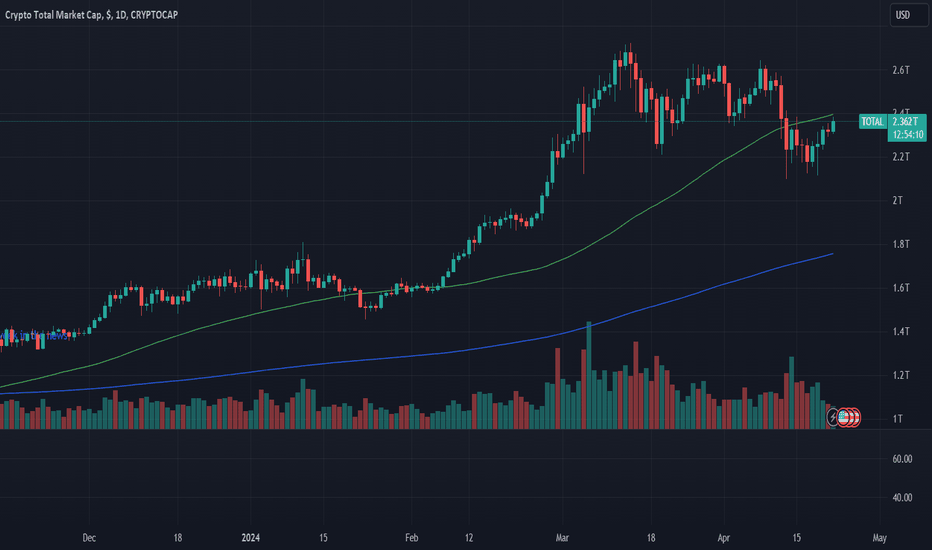

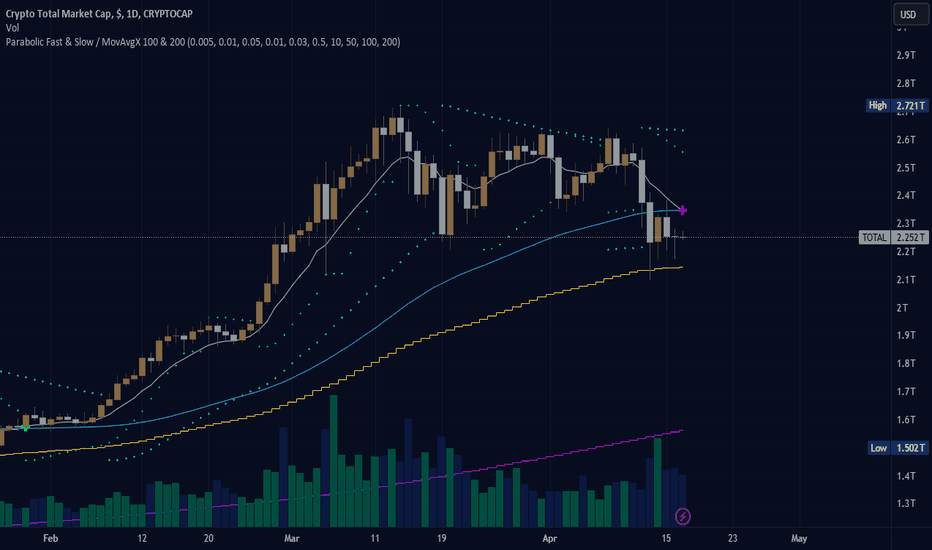

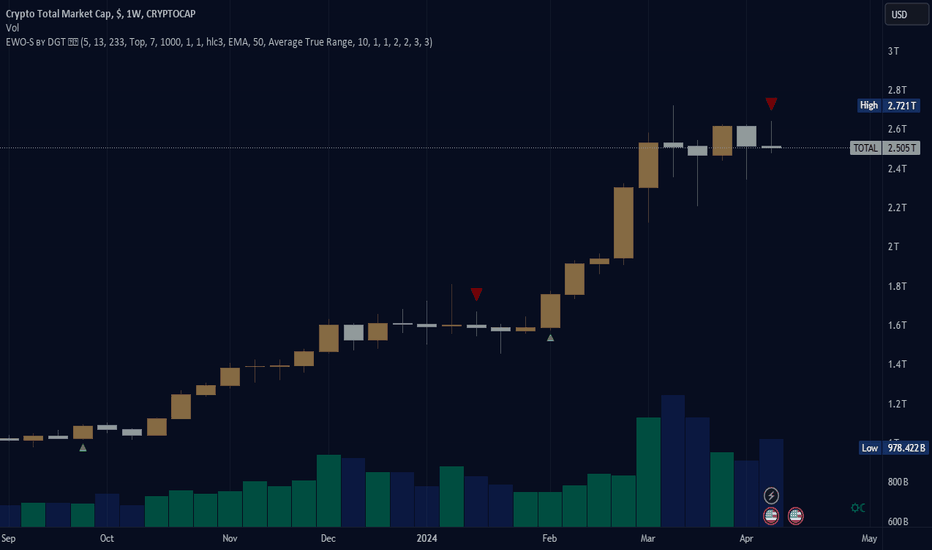

Crypto market cap

Bitcoin halving took place. Markets were waiting with anticipation for this event, considering that no one was really sure where the price might go prior to halving. On one side were analysts who were noting a possibility that the price might significantly drop, while on the other side were the ones noting that the price will hold and move further to the upside in the coming period. Now that the event passed, we know that the price managed to hold around $ 65K, although there had been some prior higher volatility. BTC whales took the opportunity to buy the dip and increase their positions in this coin. Two weeks ago, there was a huge sell off on the crypto market, however, the situation relatively stabilized during the previous week. Total crypto market capitalization dropped by modest 1% on a weekly level, losing a total $25B. Daily trading volumes decreased to the level of $128B on a daily basis, from $131B traded a week before. Total crypto market capitalization increase from the end of the previous year, currently stands at $680B, which represents a 42% surge from the beginning of this year.

Although the majority of altcoins were leading the market to the upside, BTC and ETH are the ones which lost in value on a weekly basis. BTC dropped by a modest 2.3%, where the coin lost around $30B in the market cap. ETH was down by 1.2%, where around $4.8B was a decrease in its market capitalisation. Bitcoin Gold also lost some of its value during the week, dropping its market cap by 3%. There were several altcoins, who ended the week in red, like Monero, Binance Coin and Tron, but the drop was less than 1% in value. Majority of altcoins were leading the market to the upside. In this sense, Cardano increased its market cap by $1.1B, which is an increase of 6.5% on a weekly basis. Polkadot should be especially mentioned as the coin added more than $ 3B to the total crypto market cap, increasing its own by 4.2%. Solana also added $ 3B which is an increase of 4.7% on a weekly level for this coin. Among excellent weekly performers in relative terms were Filecoin and Maker, where both managed to increase market cap by more than 11%. Interestingly, THETA was one of coins who managed to add 10.5% to its market value. Other altcoins were mostly traded higher between 2% and 8% on a weekly level.

Relatively stronger developments continue when coins in circulation are in question. During the previous week Filecoin added 0.4% of new coins on the market, while Miota`s number of coins were higher by 0.6%. Certainly, this week's winner was Monero, with an increase in circulating coins by 5.4%. On the opposite side was Litecoin, who, this time, decreased its coins on the market by even 4%.

Crypto futures market

In line with the spot market, there were some major developments on the crypto futures market during the previous week. Both BTC and ETH futures were traded lower for all maturities. It should be taken into account that CME was closed during the weekend, in which sense, developments during the weekend are still not fully priced in futures. In this sense, some increase in futures prices are possible in Monday trading sessions.

BTC short term futures were last traded by some 5% lower from the end of the week before, while the longer term ones were down by less than 10%. Futures maturing in December 2024 ended the week at price $67.450, while those maturing a year later were last traded at $72.160. This was a significant drop, considering that two weeks ago these futures were traded at $80.095 for the first time in history.

ETH short term futures were also down by some 4% on average, while the major drop was with the longer term ones, which closed the week down by some 12.8% on a weekly basis. Futures maturing in December this year reached the price at $3.246, while those maturing in December 2025 closed the week at $3.377.

Post Bitcoin Halving, is it time for ALTS now ?

This is something I am seeing so many people asking and the only Answer is, "It is impossible to say jsut yet.

Historically, if we look at the BTC.Dominacne Chart below, we can see that, on average, iit is around 200 days after Halving that we see ALTS seasons.

This does not follow that Bitcoin outperform all ALTS however and it is worth noting that Just because BTC.D Drops, BTC PA does not always follow, in fact, in times of strength, is creates Divergences.

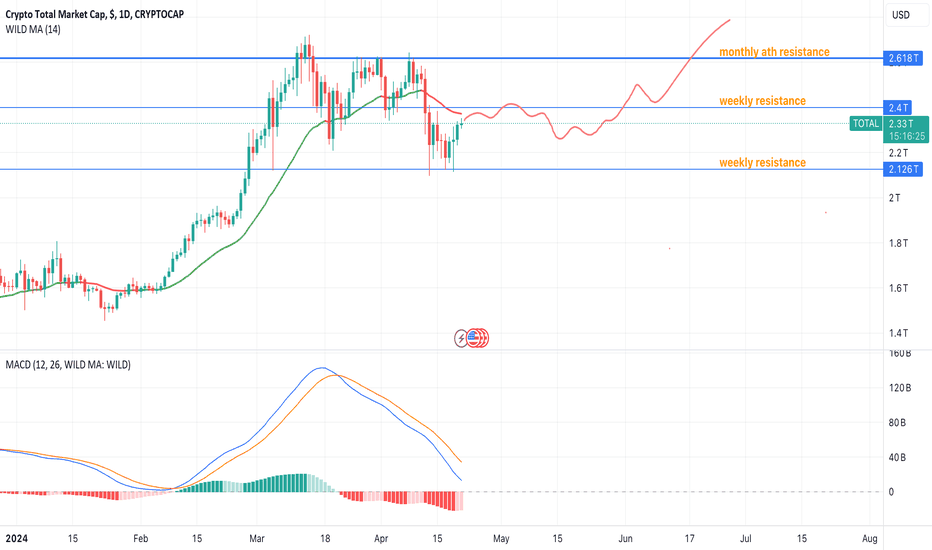

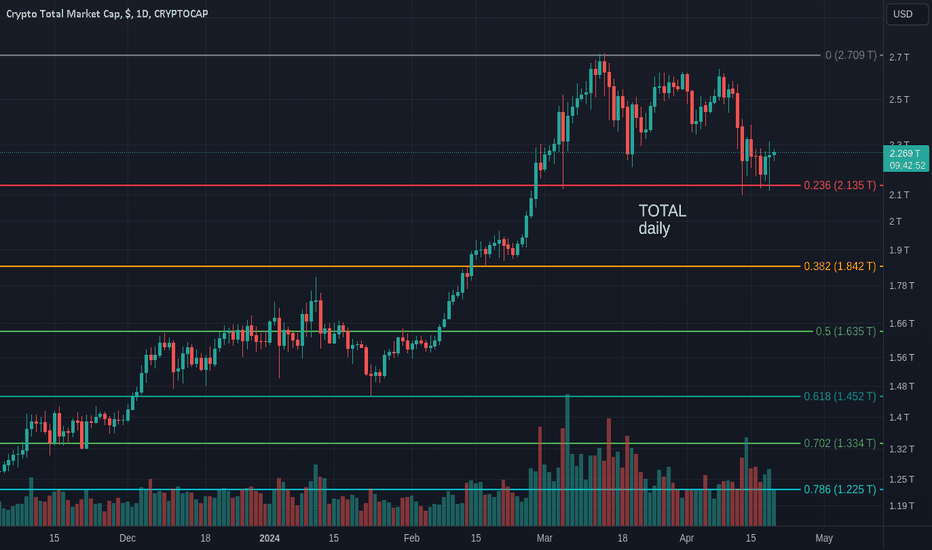

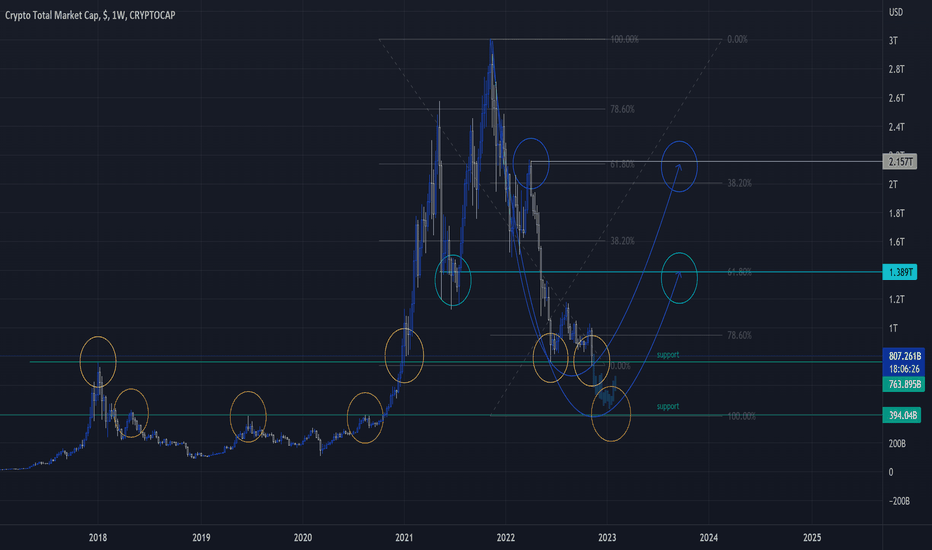

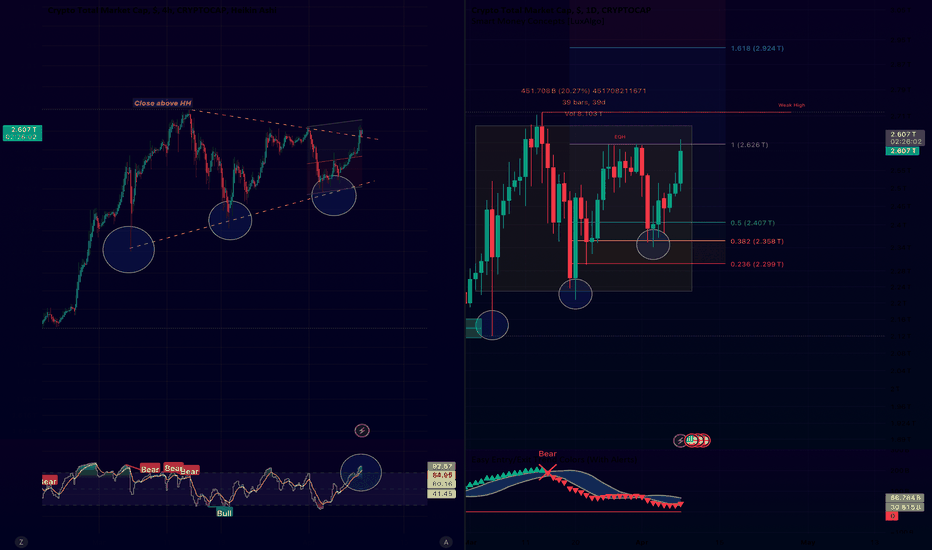

But something to take note of right now is simply that on a Daily chart, the TOTAL Crypto market Cap has retraced to sit on the 236 Fib retracenebt line. ( below ) and is currently bouncing off it.

On the other hand, the OTHERS total crypto Market Cap chart ( Minus TOP 10 Crypto ) shows us that it has retraced to BELOW the 236 Fib Line. (below)

This maybe a tough line for OTHERS to cross, even more so if the Supply of BTC is getting Tight, no one is selling and so liquidity is not spreading across from BTC to ALTS and we also find new

Liquidity entering the market getting scarce as the USA monetary policy keep interest rates high for the foreseeable Future. .

So where does this leave us ? With All the TOTAL charts Ranging ? This is a possibility but I can see the Bitcoin "formula" working as it always has....We may see another 200 day Range, With BTC being Top, maybe even pushing to a new ATH. 100K USDT is certainly a possibility as Corporate money flows in,

We have seen profit taking, the sell off of Greyscale BTC that has been soaked up and yet PA continues to range.

Bitcoin is Still in control.

We need to pay attention to the OTERS to see how that copes with the 236 Fib line but , for me, and this is just my opinion, we are now wgere near ALT season yet.

Time will tell

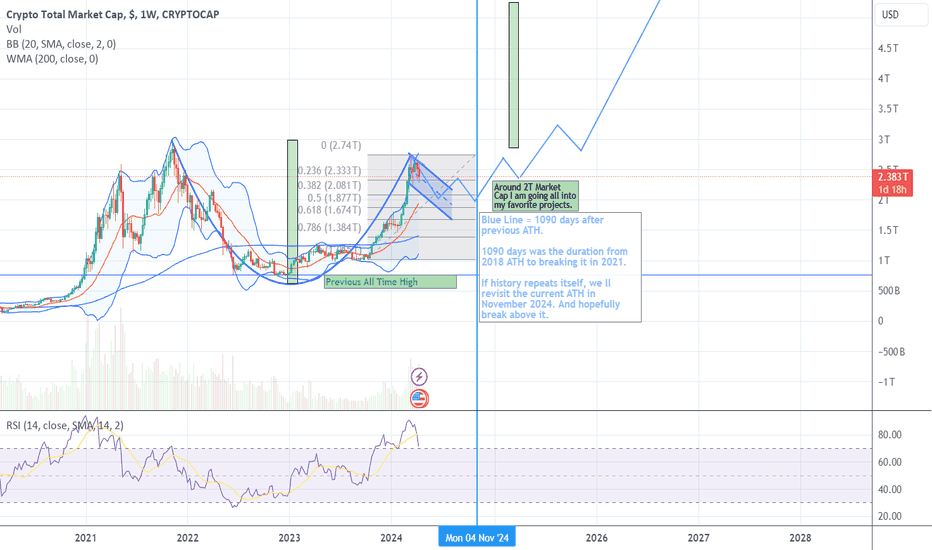

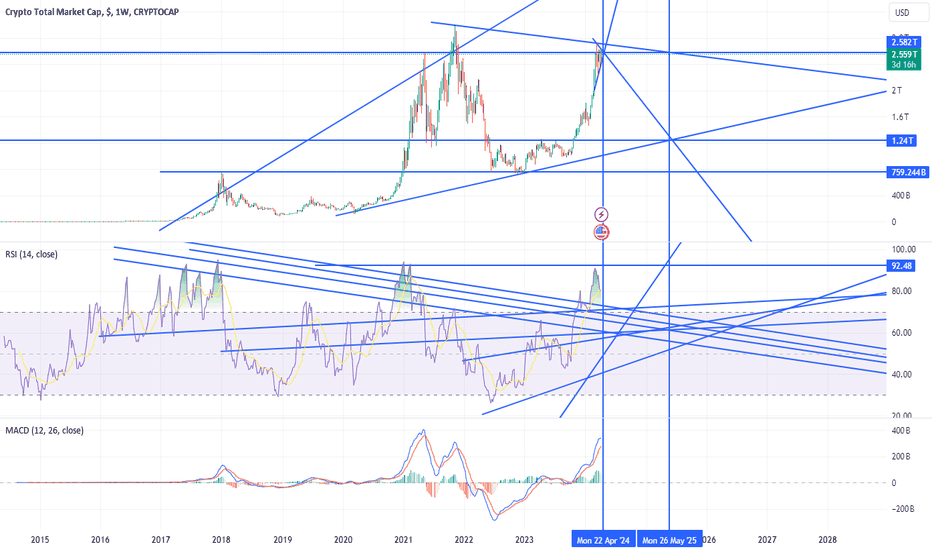

Total crypto marketcap similar to large-cap and small-cap stocksWhile Bitcoin rose to new all-time highs this year, many altcoins seem to lag behind it, showing a somewhat similar dynamic to that observed between large-cap and small-cap stocks (where large and well-established companies managed to recover in the past year or so while their smaller counterparts have been struggling). In addition to that, it is often overlooked that despite a huge rally in Bitcoin, the total cryptocurrency market cap has not reached its previous all-time highs from late 2021 (even despite Coinmarketcap currently listing more than 2.4 million different cryptocurrencies on its website, which is far more than at the peak in 2021).

Illustration 1.01

Illustration 1.01 shows the weekly charts of the three largest cryptocurrencies (excluding Bitcoin and stablecoins). Unlike Bitcoin, each token failed to reach new all-time highs (thus far). The same applies to other large cryptocurrencies, including XRP, DOGE, and Cardano.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not serve as a basis for taking any trade action by an individual investor or any other entity. Your own due diligence is highly advised before entering a trade.

Be the winner of the market! ;)A decrease in total value is a sign of withdrawal of funds from the crypto market, and as a result, as the value of the crypto market decreases, the price of all coins also decreases.

And in future posts, I will show you the right time and place to enter a short trade on all coins.

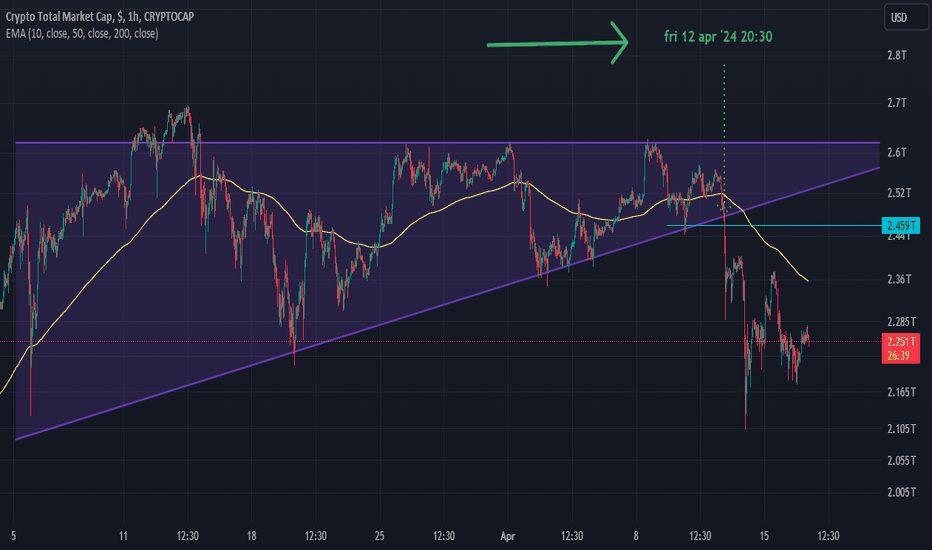

fri 12 apr '24 20:30!

fri 12 apr '24 20:30!

fri 12 apr '24 20:30!

fri 12 apr '24 20:30!

MARKETS week ahead: April 14 – 20Last week in the news

Inflation fears are for one more time those to shape investors confidence. Posted US inflation data during the previous week, impacted negative sentiment on the market, and made US Treasury yields move to the higher grounds, while US equities were pushed to the downside. For one more week in a row geopolitical risks were pushing the price of gold to new ATH. Uncertainty over the forthcoming Bitcoin halving impacts higher volatility on the crypto market. However, regardless of current higher volatility, BTC futures maturing in December 2025 reached the level of $80K for the first time in history.

The pivotal point on financial markets was a release of the US inflation data for March. As posted, the inflation in March was 0.4% for the month, which brought it to the level of 3.5% on a yearly basis. The data was higher from the market forecast of 3.4%. In line with significantly increased non-farm payrolls posted two weeks ago, data scared markets that the inflation could further accelerate which would impact Fed's decision not to cut rates during this year, or, most probably, that there will be less than three cuts during the year. The FOMC meeting Minutes were released during the week, where it has been revealed that Fed officials were looking for more convincing data in order to trigger rate cuts. Economists and analysts are currently quite divided on this topic, considering that this question is not at all easy to answer. Larry Fink, CEO of largest investment fund BlackRock, commented on potential Fed`s move, noting a possibility that there will be two rate cuts this year, however, the estimate of 2% targeted inflation will be missed. He sees high probability that the Fed will cut rates, even as inflation remains elevated. Jamie Dimon, CEO of JPMorgan Chase noted several challenges for the world and the US economy, noting geopolitical risks and “persistent inflation pressures” but still perceives many economic indicators as favorable.

While US markets are concerned over the potential for rate cuts, investors in European markets are heating up sentiment for the first rate cut by the ECB in June this year. The ECB held a policy meeting during the previous week, where rates were left unchanged, as widely expected. However, comments from ECB officials heated the market expectation that the first rate cut by the ECB might occur in June this year, in case that inflation continues its down-track.

The pressure on the chip industry continues. As news is reporting, Chinese officials issued a directive, where it is requested by Chinese telecom systems not to use any foreign chips within their products. All processors made by foreign companies should be replaced by the year 2027 in China. This news was first posted by the Wall Street Journal, which specifically mentioned companies AMD and Intel, which will be hit by such a decision by Chinese authorities. Share prices of these two companies significantly dropped after the news was published.

Crypto market cap

Bitcoin halving is coming during the end of the week ahead. However, this represents only one side of the current market nervousness. Investors are highly concerned regarding the potential for Fed's rate cut, as well as, ongoing geopolitical uncertainties. The combination of these factors impacted a significant drop in the value of the crypto coins, but also other financial markets were affected, like US equities and US Treasuries. It could be expected that the same combination of factors will continue to impact markets for some time in the short future period. However, what is optimistic about the crypto market is that BTC futures maturing in December 2025 for the first time in history reached the level of $80K. This is another significant milestone for BTC, as it shows current market sentiment that BTC can only grow in value in the future. Certainly, whether this will be the case is about to be seen. For the moment, total crypto market capitalization decreased by 5%, where $121B was wiped out from the market. This time a significant portion of altcoins lost in value, where major coins were participating with roughly 40% in this drop. Usually majors are the ones that are leading the market to one side, however, this time was different. Daily trading volumes were also significantly increased from the week before, reaching even $250B on a daily basis, from $131B traded a week before. Total crypto market capitalization increase from the end of the previous year, currently stands at $705B, which represents a 43% surge from the beginning of this year.

BTC and ETH had another volatile week, however, the majority of altcoins were the ones that lost the most during the week. Regardless of the fact that BTC for one more time tested levels above $70K, the coin is ending the week by more than 2% lower from the week before, where total weekly loss in value was $28,2B. ETH`s market cap dropped by $18B on a weekly basis, which is around 4.5%. The list of altcoins who lost in value above $ 1B is significant for the first time in many weeks. XRP, Bitcoin Cash and Cardano all lost above $ 4B in value. However, one of the most significant drops among altcoins was with Solana. This coin lost almost $ 15B in value during the week, dropping it by around 19%. Significant losers in a relative terms were Uniswap, with a drop of more than 35% on a weekly level, OMG Network was also down by 30%, Filecoin lost almost 30%, while Maker was down by 26% within a single week. Other altcoins also lost between 10% and 20% in value. The only coin that gained was Tether, however, through an increase of its coins in circulation by 0.5%.

Although it was a red week for the majority of altcoins, still, for the majority of circulating coins it was a green week. Filecoin, although significantly lost in value, still managed to add 0.9% new coins to the market. Polkadot added 0.3% more circulating coins, while Polygon`s total coins were higher by 0.2%. Majority of other altcoins added around 0.1% of new coins during the week.

Crypto futures market

The crypto futures market had bad news and also good news during the previous week. The volatility on the spot market continued for the third week in a row, and so were the crypto short term futures. In this sense BTC short term futures were traded down around 0.9%, while ETH`s ended the week 3% lower from the end of the week before. Still, regardless of the short drop in short term futures, the major development occurred with longer term ones, which for both BTC and ETH ended the week higher from the week before.

BTC long term futures ended the week by 2.8% higher from the week before, but the most important news is that for the first time in history, futures maturing in December 2025 reached the price above $80K. This is the most significant development, as it shows that investors still believe that BTC will rise in value during the course of time. Futures maturing in December this year ended the week at price $75.090, which is also a new weekly high for this maturity.

ETH long term futures also ended the week with a positive sentiment. They were traded around 5.8% higher from the week before. Futures maturing in December this year were last traded at price $3.720 and those maturing a year later closed the week at $3.877.

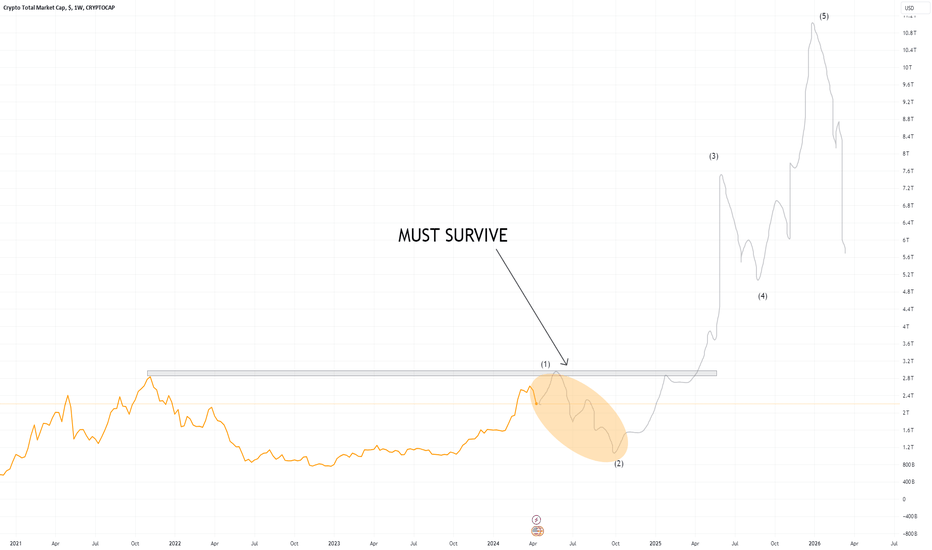

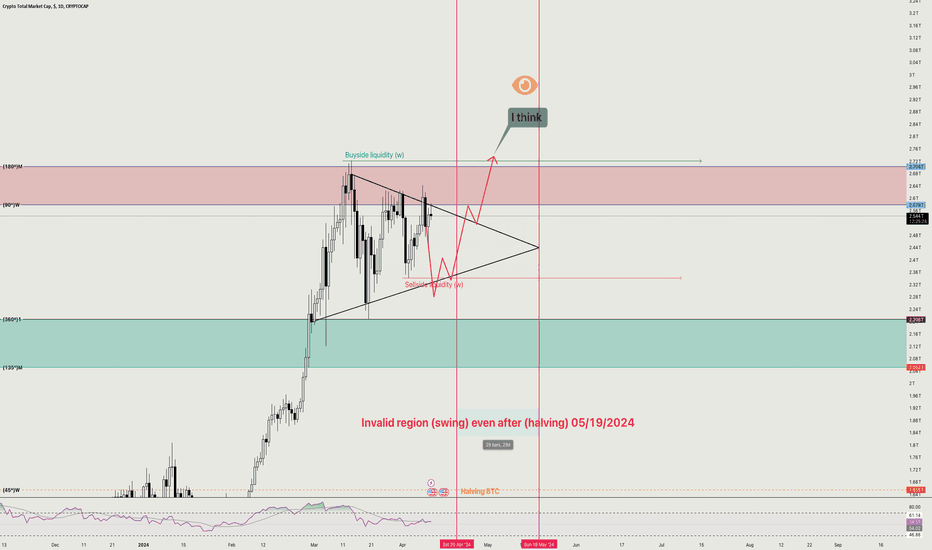

The Super CycleThere is still the possibility of a higher high this quarter with the most recent dump providing such an amazing inval level.

Goes to show that the liquidity holding this market up is few and far between (at least for now).

This rally will fail to hold until global liquidity conditions improve drastically.

The catalysts are all building and I don't really care/know what they all are.

Markets will do what they have always done.

The improbable.

After events play out we will get the fabled super cycle.

You have 1 job until then:

Survive.

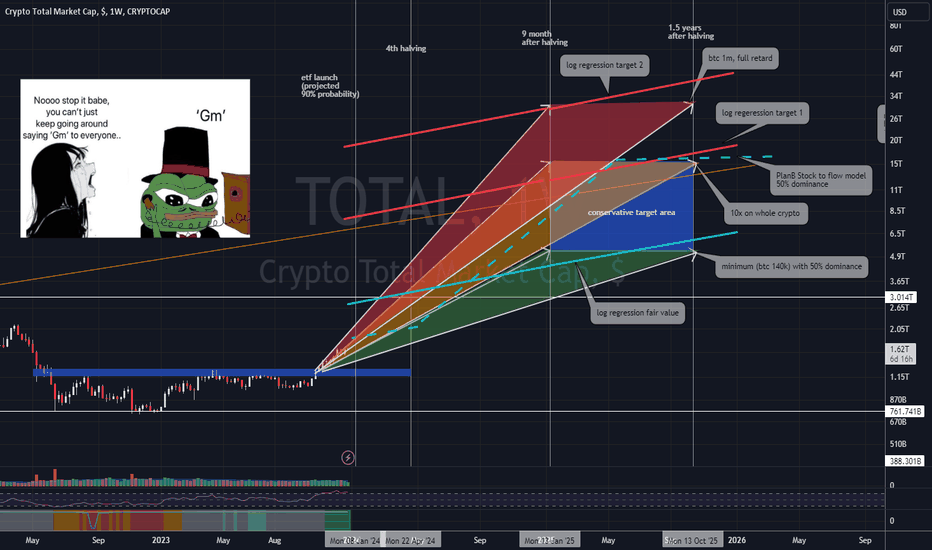

Cycle HeatmapGm, the cycle heatmap says we are still early.

This idea is purely based on the 4 year boom and bust cycle theory.

We expect btc to bottom about 1 year before the halving and top at least 6 months but probably 9-18 months after the halving. So I adapt this theory to the total market cap and estimate a conservative 50% btc dominance to get an idea of the total crypto market cap targets of this new cycle.

We can also combine different cycle based models to create a heatmap.

- 140k BTC target as minimum conservative target

- 10x total target

- 1M BTC target

- trololol log regression aasasoft.org

- log log price chart price.bublina.eu.org

- stock to flow www.lookintobitcoin.com

- halving en.bitcoin.it

This allows us to track where we are in the big picture and identify mean reversion risks.

#dubious #speculation

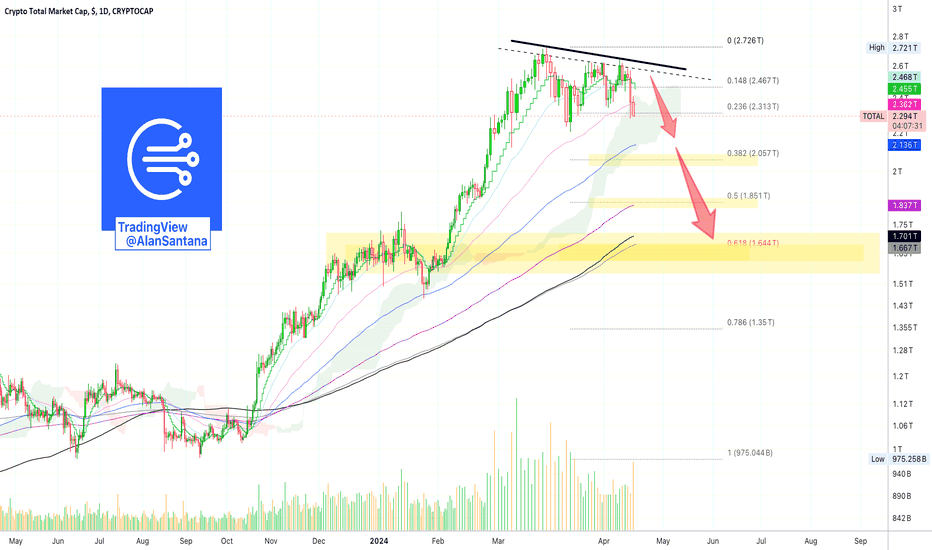

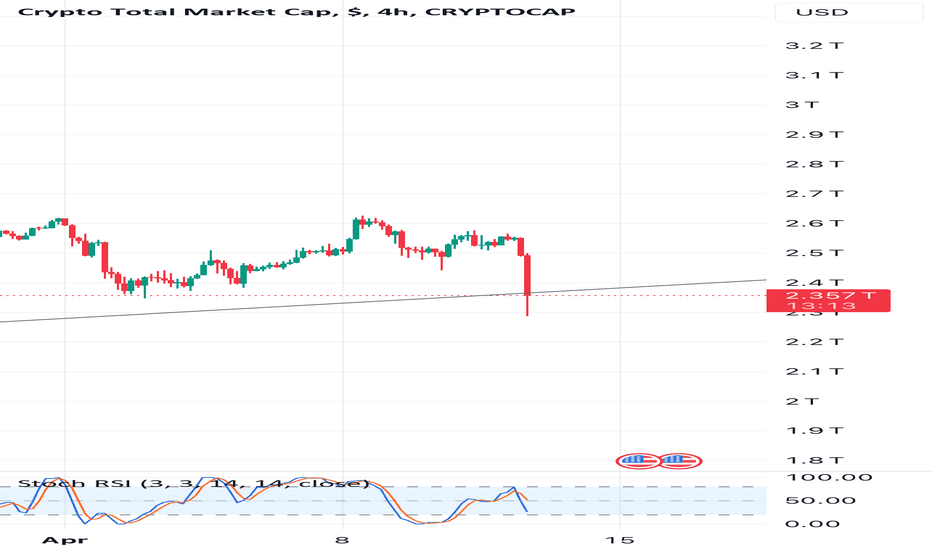

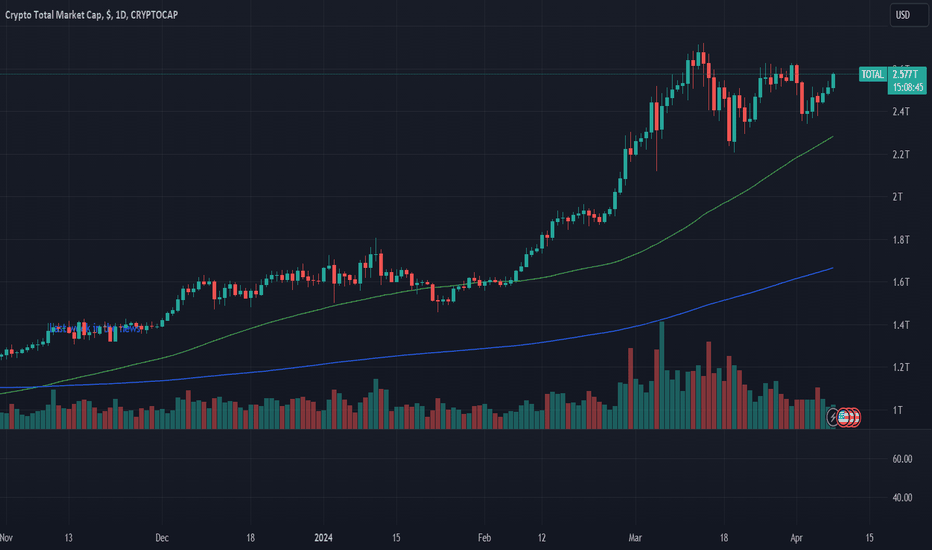

📈 TOTAL Breaks Support➖ Yesterday TOTAL closed above EMA50; support holds.

➖ Today, TOTAL broke below EMA50 on high volume; support breaks.

Chart signals

➖ EMA50 is a medium-term moving average, which for us means a time duration between 1-3 months.

➖ Breaking below EMA50 opens up the possibility for the TOTAL index to drop medium-term, i.e. 1-3 months.

➖ A positive signal is the fact that TOTAL is still trading above its 20-March low but this is likely only temporary. Related pairs and markets went on to produce lower lows and some are trading all the way down already; what one does, the rest tends to do the same.

➖ The RSI is already way below 50, almost reaching 40.

(Weak RSI confirmed.)

👉 I guess we will be looking at new bullish action within 4-6 months and new highs late 2024 or early to mid-2025.

What's your take?

You can find the targets (support) on the chart.

Namaste.

Cup and Handle Pattern in the Crypto Total Market Cap.We can see a cup and handle pattern forming in the Total Crypto Market Cap.

Technically a correction to around 2T, which is between 38%-50% Fibonacci is possible, a perfect "buy the dip" opportunity.

I am expecting a retracement to those levels, to load up the track with

BTC, ETH, LTC, MKR, TAO, RNDR, LINK.

What do you guys think will happen from here?

Let me know in the comments!

TOTAL - What next ?Excited to buy and HODL again

Analysis of TOTAL. (Left 4H, Right 1D)

We can see price oscillating between

2.2 - 2.6T in a channel, hinting at a possible bullish BOS on Daily TF.

Daily Fib lvls, showcasing bullish activity at 0.382 creating a daily Demand Area.

on 4H, price made LHs and HLs creating a bullish Pennant Structure that has been broken out of.

Our RSI on the left indicates a strong trend and the market is currently overbought at 92, hinting at recent in flow of cash, to strengthen the bullish Trend which was turning bearish.

On Wed, 10/04 I anticipate major market moves after News and inflation rates. Higher rates might be a good thing for crypto projects that actually contribute to the community.

So I'm long on certain projects with intention of HODL.

Leave your thoughts in the comment section, thanks.

MARKETS week ahead: April 8 – 13Last week in the news

Much higher than expected Non-farm Payrolls in March in the US was a major event for the week on financial markets. Equity markets were still holding strong, despite the first major drop since the beginning of this year, while US Treasures reacted with higher yields. Gold reacted to new geopolitical tensions, which pushed the price of oil to higher grounds. The USD had increased volatility, but still managed to hold around 1.08 to euro, while the crypto market continued with higher price fluctuations. Bitcoin shortly tested $ 65K during the week, however, ending it above $68K.

The major event for markets during the previous week was a release of the US jobs data. The number of 303K new jobs in March was far above the expected 200K. The unemployment rate was standing at 3.8% in March, which was in line with market expectation. The market reacted strongly to the jobs data. Although this is positive for the US economy, showing its resilience to monetary measures, it still represents a fear that the Fed might hold interest rates at current levels for a longer period of time than previously expected. Namely, the market perceives that the stronger economy might drive inflation to higher grounds, in which sense, the reaction of the Fed might be to hold interest rates at current levels for a longer period of time, putting in question potential rate cuts during the course of this year. Aside from it, the Federal Reserve Governor Michelle Bowman noted on Friday the possibility for rates to be lifted to the higher grounds, in case that inflation remains persistent. The 10Y US Treasury benchmark reacted by ending the week at the level of 4,4% from 4.2% where they were previously traded.

Aside from potential negative impact on inflation from the heated jobs market, aspects of oil prices are also considered by markets. New geopolitical tensions between Israel and Iran, put pressures on oil futures and the price of oil on the market. Brent crude reached the highest weekly price of $90,65 per barrel. The US Brent crude was up by 18% during the course of this year, while the US crude added around 21%.

The US Treasury Secretary Janet Yellen is traveling to China in order to strengthen the relationships with this country which will be beneficial for both countries, as per her notes. She also noted that the main target of her visit is to discuss issues of “overcapacity and national security-related economic actions”.

The issuer of XRP token, a blockchain company Ripple announced that it will launch a US dollar stablecoin. Current estimate of the US stablecoin market is $150 billion. The company noted that the coin will be 100% backed by the US dollar, through cash, USD deposits and US government bonds, which the company will hold as a reserve for the back of their stablecoin. It is also noted that information on their reserves will be publicly available on a monthly basis. The market of the US stablecoin is currently split between USDT, whose issuer is Tether, and USDC issued by Circle. PayPal also launched its own stable coins, the PayPal USD, which is issued by Paxos.

Crypto market cap

Quite a volatile week is behind the crypto market. Since the middle of the week, Bitcoin has been driven to the downside, where the coin reached $65K. The market had a general reaction to the news that the US jobs market might be a game-changer when it comes to expected Fed rate cuts during the course of this year. Namely, at the latest FOMC meeting, Fed Chair Powell spoke about potential three rate cuts till the end of this year. However, as released data are showing that the jobs market is heating up, this might bring a surge on the demand side and as a consequence, increased inflation. Following the theory of market efficiency, markets had to make an adjustment to their forecast with expectations that the interest rates might stay higher for a much longer period of time. The reaction was visible on equity, US Treasury markets, as well as the crypto market. During the previous week total crypto market capitalization lost $97B in value, which was a drop of 4% on a weekly basis. Daily trading volumes remained elevated, moving around $131B on a daily basis, same as the week before. Total crypto market capitalization increase from the end of the previous year, currently stands at $ 826B, which represents a 50% surge from the beginning of this year.

Bitcoin and Ether were leading the market drop, however, the majority of other coins gave their contribution. On a weekly level, BTC lost around $ 40B in value, decreasing it by 2.9%. Ether followed general market sentiment, with a drop in value of more than $23B or 5.5%.

Another coin with significant drop in value was Solana, who lost almost $8.5B, which represents a decrease of almost 10% within a single week. Binance Coin decreased its market cap by $3.2B or 3.5%, while DOGE was down by $2.3B or almost 8% on a weekly basis. XRP should also be mentioned, as it followed the negative market reaction with a drop in value of $ 2B or almost 6%. Some of coins which lost significantly in relative terms were Miota and OMG Network, who both lost more than 13% in value. Uniswap and Algorand both lost more than 12% during the week, while Filecoin and Cardano were down by 10%. There were only a few coins who managed to end the week in a positive territory, where the absolute leader was Bitcoin Cash, with an increase in market cap of incredible 17%. Maker hold the grounds, with an weekly increase in value of 1.1%.

Coins in circulation continue with increased activity. Tether should be especially mentioned, as it continuously surging its circulating coins, adding 2.2% during the previous week. Miota added 0.6% of new coins to the market, same as Filecoin, while Algorand added 0.4% of new coins this week. XRP and Polkadot increased their coins on the market by 0.2% during the previous week, while the majority of other coins increased by less than 0.1%.

Crypto futures market

Previous week markets had a general reaction to stronger than expected US jobs data, where the crypto futures market reacted in a same manner. Both BTC and ETH futures were traded lower from the week before. BTC short term futures were traded around 5% lower, while longer term futures dropped by modest 0.5%, still trying to hold the previous week`s levels. At the same time ETH short term futures were traded down around 8% on a weekly basis, while longer term ones were down by around 5%.

Regardless of a drop in prices of short term futures, BTC longer term ones managed to hold relatively stable. Futures maturing in December this year were last traded at price of $73.220, while those maturing in December next year closed the week at price $77.865. This shows that the market still believes that BTC will hold higher levels in the future period. Still, not the same sentiment holds for ETH futures. This comes as the market priced longer term futures at lower levels from the week before. In this sense, futures maturing in December this year ended the week at price $3.519, while those maturing a year later were closed at $3.664. On a positive side is that the price of ETH manages to hold levels above the $3K for all maturities.