TOTAL trade ideas

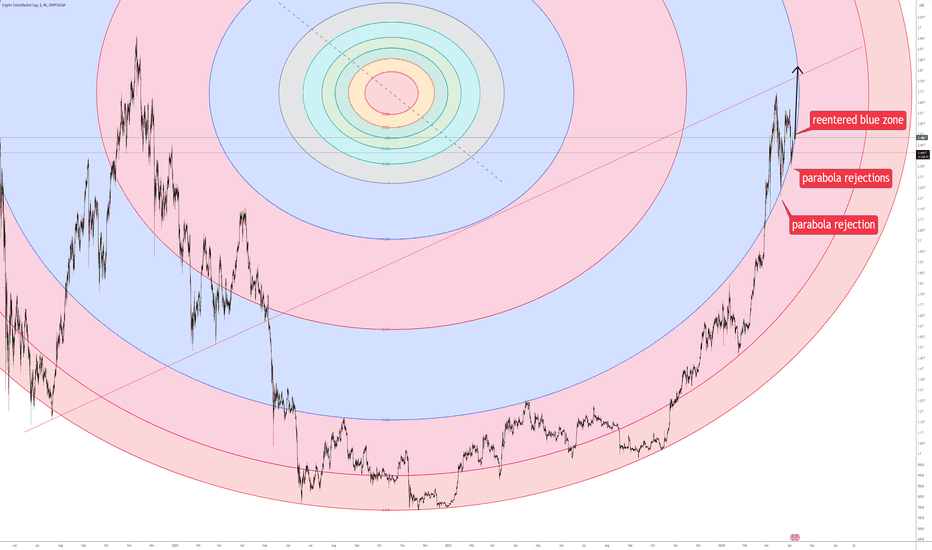

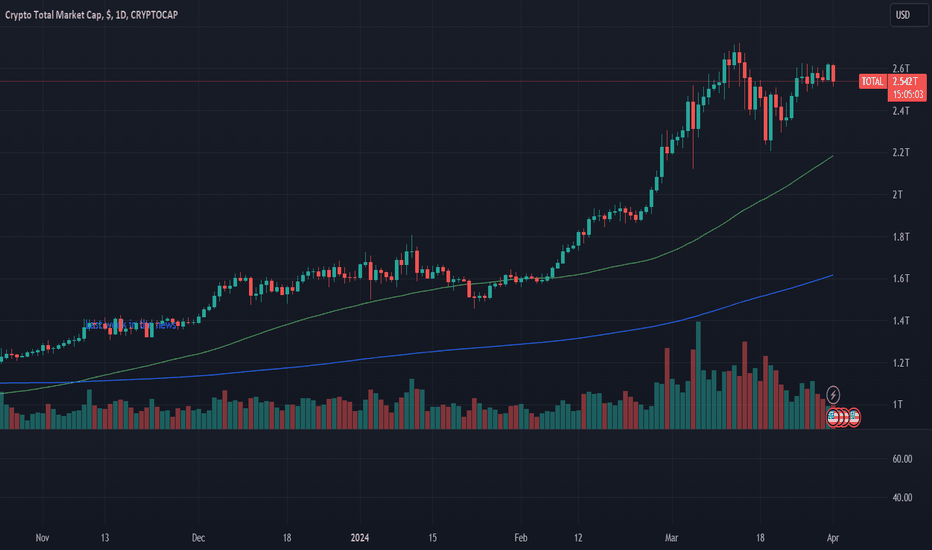

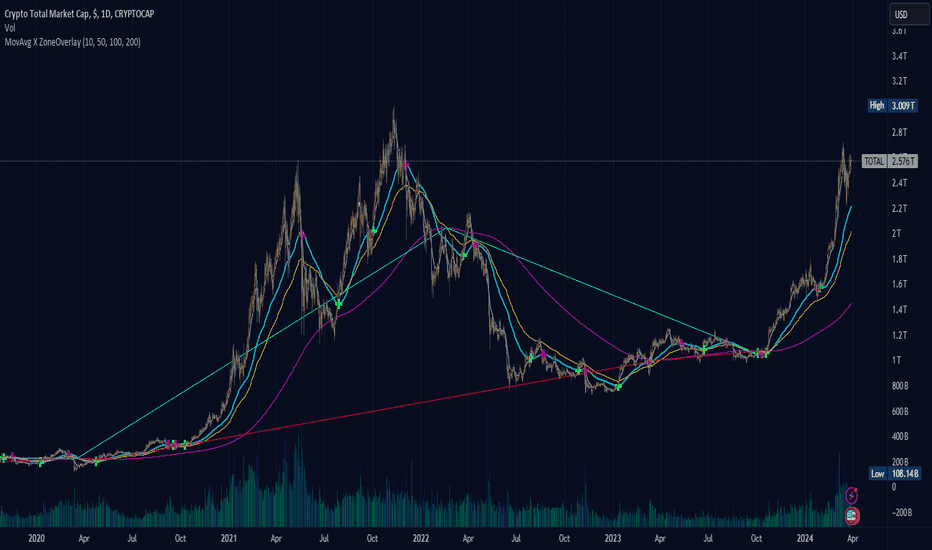

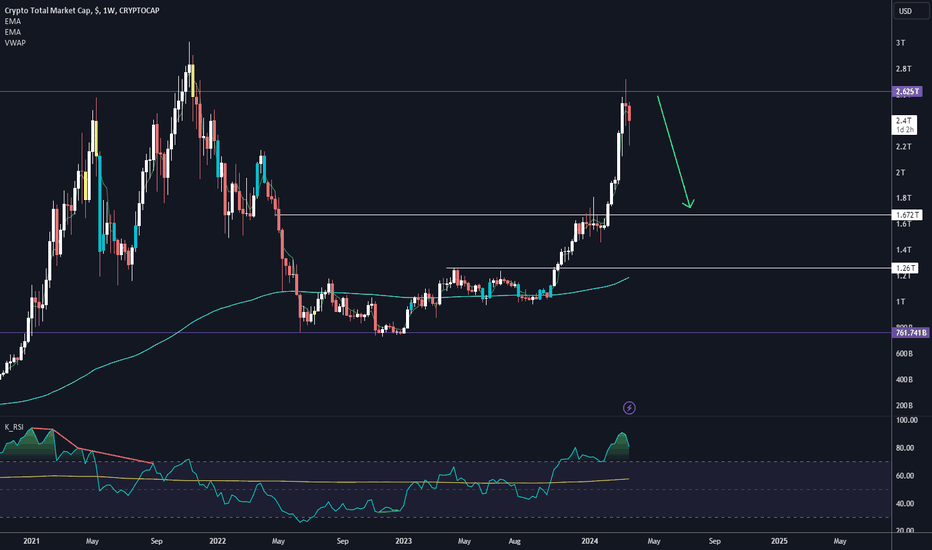

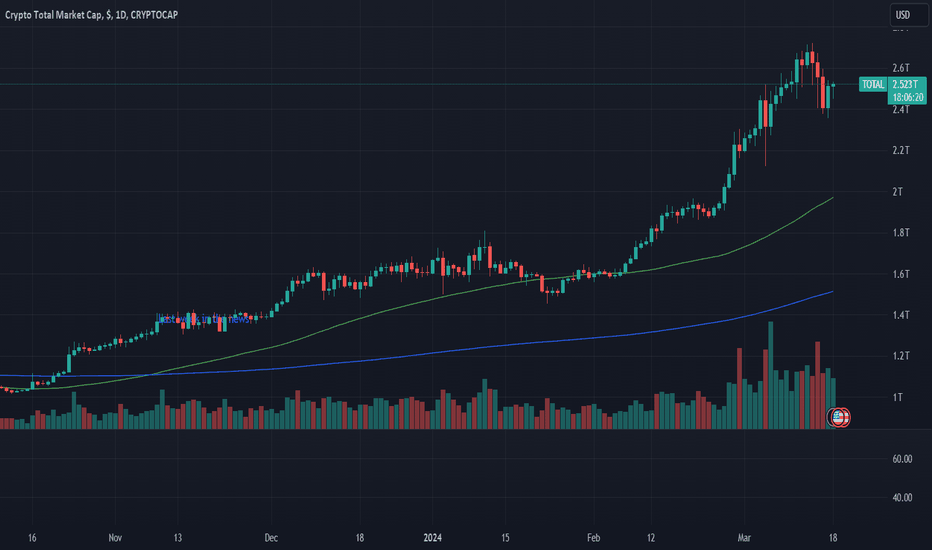

TOTAL - YikesA lot of people will not like this post, but it needs to be said. April 2024 is looking to be a bad month for cryptocurrencies. Of course with the right factors this can change but let me voice my concerns for the short term.

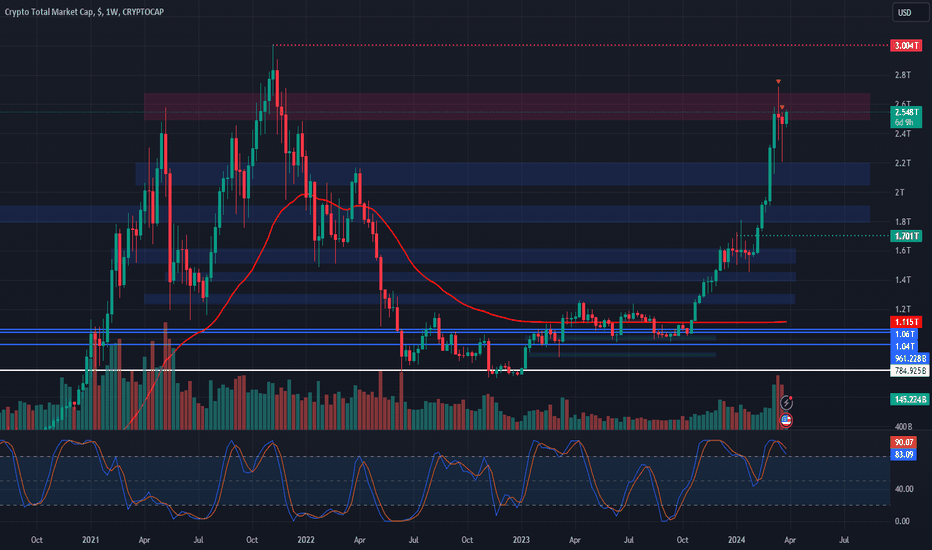

Looking at the candle stick chart on the left, we can see March's monthly candle could not close above our 2021 monthly top candle. This is also in alignment with the 0.786. Based on technicals, this should at least bring the total marketcap down to the 0.618 around 2.15 T.

Of course, still macro bullish as the monthly RSI is likely to test our upper yellow trendline at some point in the cycle.

The line chart also show something scary for the short term. We see a double top forming. In my opinion, we will not see the euphoria of a full blown crypto bull market until the TOTAL surpasses and close a monthly candle above $2.63 T.

We will re-examine this chart with April's candle close. If we are able to close this month's candle above that double top level then the bearish thesis will be negated, but as things stand right now be more cautious.

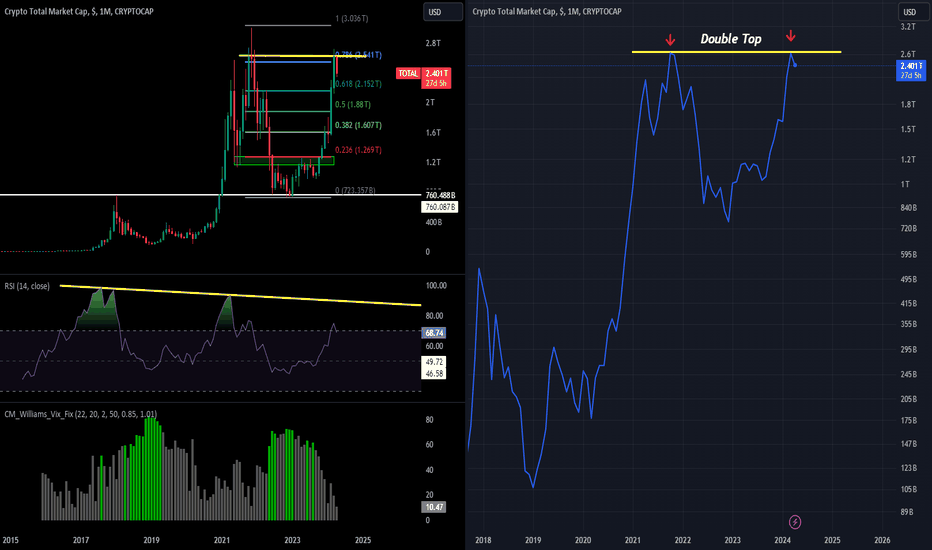

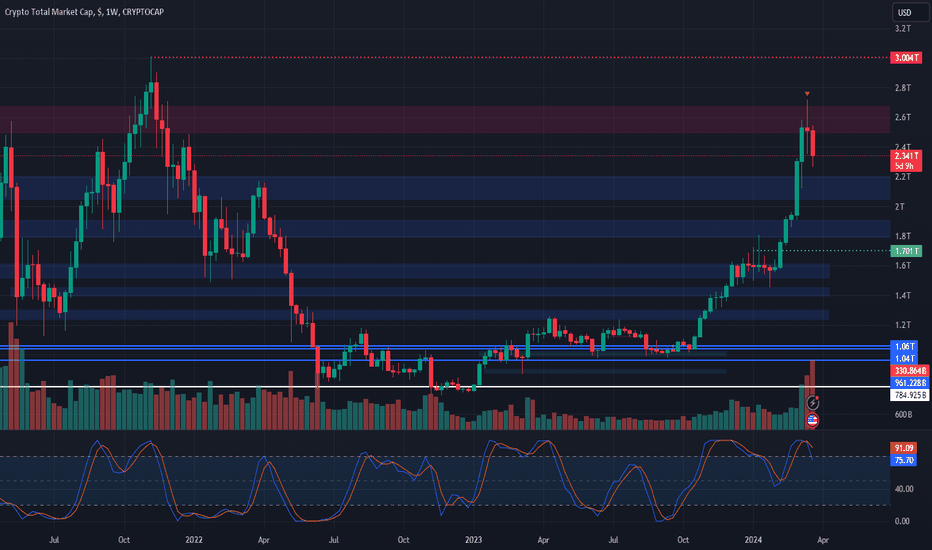

Going ALL IN when the Total Market Cap reaches those LevelsWe reached an All time high in BTC, the previous weeks.

We retested those levels above the 70k, and it seems that the bears

are not allowing the price to keep going higher. At least for the short term.

We haven't reached an ATH in the Total Cryto Market Cap yet.

A retracement between the 38.2%-50% fibbonaci is absolutely possible,

combined with the rumors about the next black swan event which is around the corner.

Geopolitically there is a dangerous escalation...

I believe that something will happen, which will crash the markets,

giving the perfect opportunity for those prepared, to accumulate cheap digital assets,

before the current Bull market continues to new ATHs.

1.8-2 trillion dollars of Total Market Capitalization, are my entry Levels,

where I will go ALL IN my favorite crypto projects.

What do you think?

Kind Regards

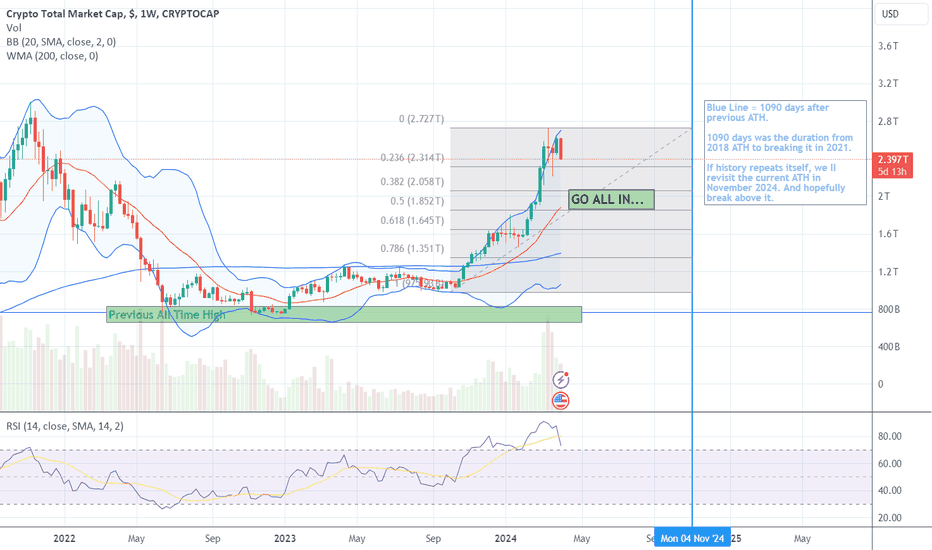

''Woof Woof'' swapping the weak dog memes narrativePlease find my updated posted idea.

More than a #CardanoGirls as my bags are loaded with CRYPTOCAP:PEPE coins, as we are booting this dog-eat-dog greedy toxic alpha males world, governed by Uber Elites destroying our beautiful planet, life, freedom, cooperation, peace and love…

DYOR is for real this time, for real girls' power.

Swapping all my fog memes into CRYPTOCAP:PEPE as it's turning more than into a Prince.

Women, Life, Freedom now!

OMS

P.S. please read my posted idea of February 17, 2024 to catch up!

You have homework to do here. Peace and love to humanity right now.

MARKETS week ahead: April 1 – 7Last week in the news

Positive market sentiment continued ahead of the holiday season on western markets. The S&P 500 was closed at level of 5.254, which was the new highest level reached in the history of the index. Although USD gained in value, the price of Gold also headed to the higher grounds, ending the week at 2.233, a new ATH. The US Treasuries remained relatively stable during the week. Bitcoin reached for one more time levels above $70K, while the crypto market spent another week trading within a positive territory.

The core personal consumption expenditures price index, a Fed's favorite inflation gauge, rose 0.3% in February, bringing it to a total increase of 2.8% on a yearly basis. The news was released on a Good Friday, a holiday in Western countries, so the market will most probably continue after-the-holiday season pricing the positive inflation developments. Speaking at the Economic Club of New York gathering, Fed Governor Christopher Waller noted that there is no rush for cutting interest rates. He saw a rationale in keeping interest rates at current levels for longer to help inflation on its “sustainable trajectory toward 2%”.

CoinDesk is reporting that the market for tokenized U.S. Treasury debt is in its “booming” phase. Analysts from the crypto firm 21.co noted in a report that the total value of tokenized Treasury notes reached levels of above $1 billion. Tokenization has been done through several public blockchains like Ethereum, Polygon, Avalanche, Stellar and few others. These tokens can be traded on the blockchain. The increase in trading tokenized Treasuries has particularly boomed after BlackRock announced its tokenized fund BUIDL on Ethereum network. As reported, the BlackRock`s funds BUIDL had a strong inflow during the first week on the market, collecting $245 million in deposits, out of which Ondo Finance alone transferred $95 million.

The London Stock Exchange will allow listings of the exchange traded notes (ETNs) for bitcoin and ether coins. Trading of these assets will start on May 28th this year and will be available to institutional investors only. All listings on the LSE will be a subject of the approval of the Financial Conduct Authority. The FCA noted that requests from Recognized Investment Exchanges will not be turned down.

A CEO of the BlackRock, the largest US asset manager, Larry Fink, released his annual investor letter, where he noted a concern regarding “providing for retirement”. He is of the opinion that Social Security and other retirement assets need to be rethought from the perspective of their long-term inclusion into capital markets. He also commented on overspending by the US Government, which is creating increasing debt. His proposal for the solution of the issue is to create a public-private partnership in order to finance infrastructure projects.

Crypto market cap

It was another positive week on the crypto market. Although the majority of the market is positioning for the expected Fed rate cuts during the course of this year, the crypto community turned their discussion to the topic of forthcoming Bitcoin halving. There is a question of its impact on the price of Bitcoin, considering that rewards for bitcoin miners will be halved. On a positive side is that this halving will increase the supply of new bitcoins until the maximum of 21 million BTC`s is finally reached. Analysts are arguing that more supply of BTC will increase its transactions and its further adoption by people and institutions. With increasing demand and limited supply, the price of BTC could be expected to increase. However, this is only an opinion of several analysts, and whether this scenario will actually occur on the market is up to be seen during April. During the previous week total crypto market capitalization was increased by 6%, adding total $141B to the market. The market cap is holding well above $2.5 trillion. Daily trading volumes continue to be at higher levels, dropping a bit as of the end of the week, due to the Holiday on the Western markets, but still with high $131B on a daily basis. Total crypto market capitalization increase from the end of the previous year, currently stands at $923B, which represents a 56% surge from the beginning of this year.

Majority of coins gained during the previous week. Bitcoin was the one which led the market to the upside, with a total inflow of $87B, which increased its market cap by 6.8%. Ether also had a positive week, by adding $15.2B to its value, increasing it by 3.7%. Another coin with very good weekly performance was Solana, which added almost $ 10B to its value, surging by 12.7% within a week. Binance Coin continues to add to its value, increasing it by $6.8B or 8.1%. This week DOGE was in the spotlight of the market, with a surge in value of $3.5B or 14.3%. Bitcoin Cash performed well during the week, ending it with an increase in value of $2.45B or more than 26%. Within the higher gainers, it should be mentioned Litecoin, which added $1.13B to the market cap increasing it by 17.5%. Other weekly gainers with excellent performance in relative terms were Maker, who increased its value by almost 20%, Solana was up by 12.7%, Miota was up by 11%, while NEO surged by 9.6%. There were only a few losing coins, where Monero lost 4.37% of its value on a weekly basis.

As for coins in circulation, increased activity continues. Filecoin added 0.6% of new coins to the market, Polkadot`s coins in circulation were higher by 0.2%, while Stellar managed to add 0.3% to its circulating coins. Tether should be especially mentioned, as it managed to continuously add new coins to the market, where last week this number was 0.5% higher from the week before.

Crypto futures market

The crypto futures reflected the positive market sentiment from the spot market during the previous week. Both BTC and ETH futures were traded higher from the previous week, for all maturities. BTC short term futures ended the week around 11% higher from the end of the week before, while the long term ones were up by almost 5%. Futures maturing in December this year ended the week at $73.435, while those maturing in December next year were closed at price $78.255. The highest value reached for this maturity was $79.235, three weeks ago, with currently high probability that these levels can be reached again in a short future period.

ETH futures were traded around 7% higher from the week before, however, long term ones were up by relatively modest 1.1% on a weekly basis. Futures maturing in December this year ended the trading week at level $3.700, while those maturing a year later were last traded at price $3.856.

Creative FreedomBrought to you by Terminator, Ai, and Megaman.

Word of the day - satire.

You know, everyone needs a bit of comedy.

This one's for you!

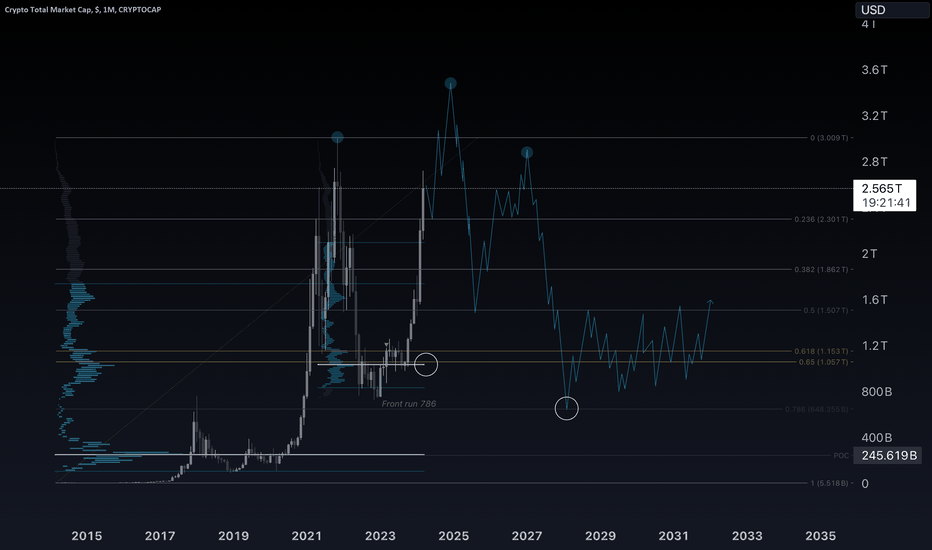

Seriously though that 786 was front run. We never actually came back to hit it.

The entire market looks like a range.

BTC has diminishing gains per cycle as it gets adopted.

Meme world cant last forever.

And finally, the entire market reacted to the fib retracement so far on each cycle.

Not

Ever

Financial

Advice

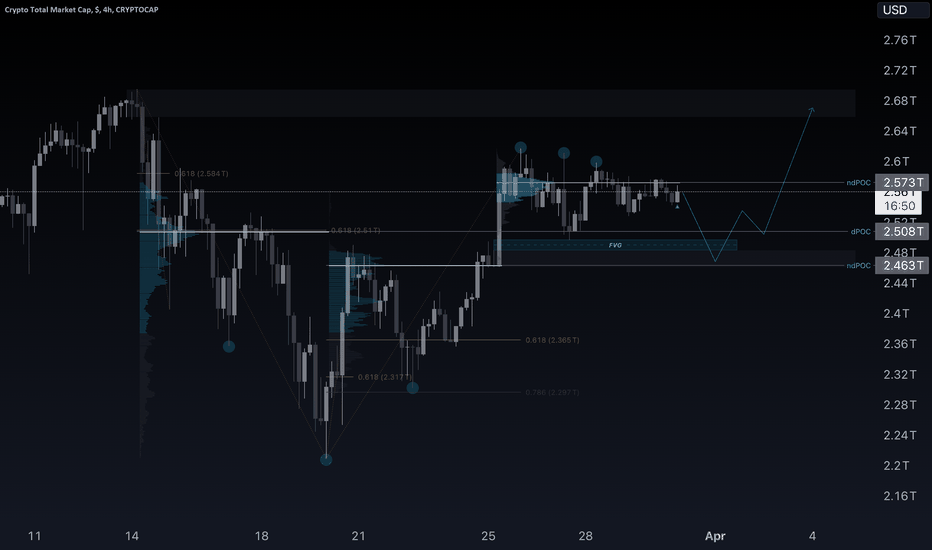

Idea updateI think the market needs a news to move up and otherwise we will have a downward movement because stopping the market from a psychological point of view will cause investors to fear, and as a result, it will be associated with the sale of funds and its conversion to Tether. will be...

Also, the price of Bitcoin is at its historical high, and 95% of buyers are in profit, and these stops can scare them...

There will be very important news in the next few days! ;)

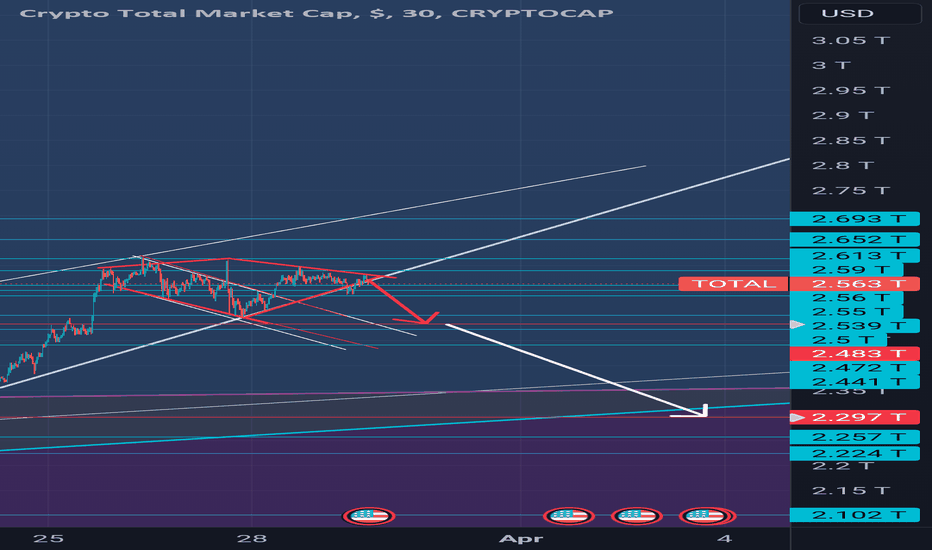

total short...The amount of capital in crypto is at a determining point and with the failure of the support of 2.537T, we can witness the withdrawal of capital from crypto, which will cause the price of the entire crypto market to fall, the least of which is in bitcoin, and most of it in altcoins and the most We will see the effect in the memes

So, with the failure of this support point, we can expect profitable short positions.

The Sunday Pump day TheoryWhy Crypto Markets Sometimes Pump on Sundays: A Global Market in Motion

The idea that Sundays are boom days for crypto prices is a persistent one. While there can be occasional weekend surges, it's not a guaranteed bonanza. Here's a deeper look at the reasons behind the Sunday pump theory, including the role of global time zones, and why it's important to consider a broader picture:

The Sunday Pump Theory: A Multi-Faceted Story

Reduced Weekend Activity: Traditional financial markets operate weekdays, leading to a general decrease in trading activity for cryptocurrencies (which are 24/7) over the weekends. This can sometimes lead to lower trading volume, which in theory could be influenced more significantly by larger purchases on Sundays.

Institutional Investor Hibernation (…Maybe): Some believe that institutional investors, who tend to trade during regular business hours, are less active on weekends. This could leave the market more susceptible to retail investor influence, potentially causing price swings.

Retail Investor Activity on Their Time: Retail investors, with more free time on weekends, might be more likely to trade cryptocurrencies. If a large number of these investors, particularly in Asia with a significant time zone difference, buy at the same time, it could cause a temporary price increase.

Global Time Zones and the Crypto Market:

The cryptocurrency market operates 24/7, constantly influenced by activity across different time zones. While weekends in some regions might see a dip in traditional market participation, Asia's booming markets could be entering their prime trading window on a Sunday evening (GMT+8). This overlap between a potential slowdown in Western markets and a potential ramp-up in Asian markets could contribute to price fluctuations.

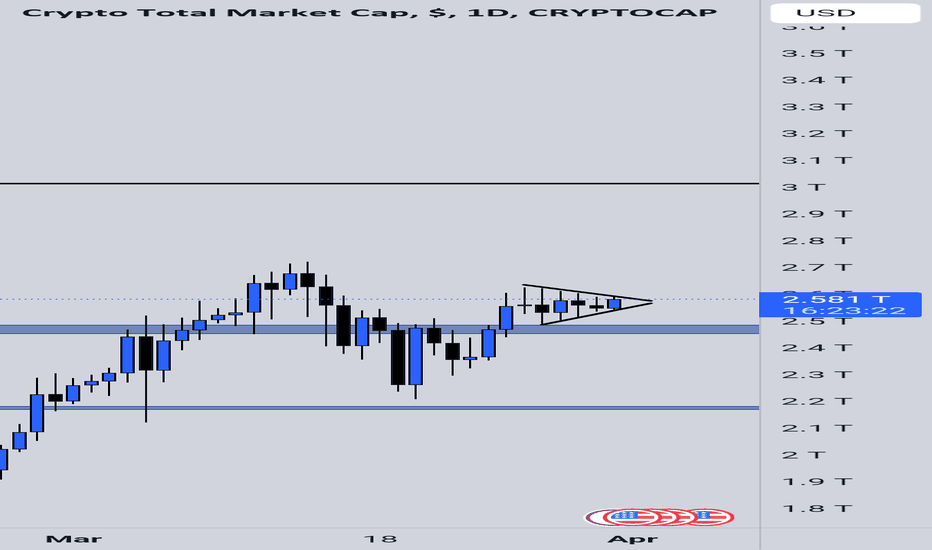

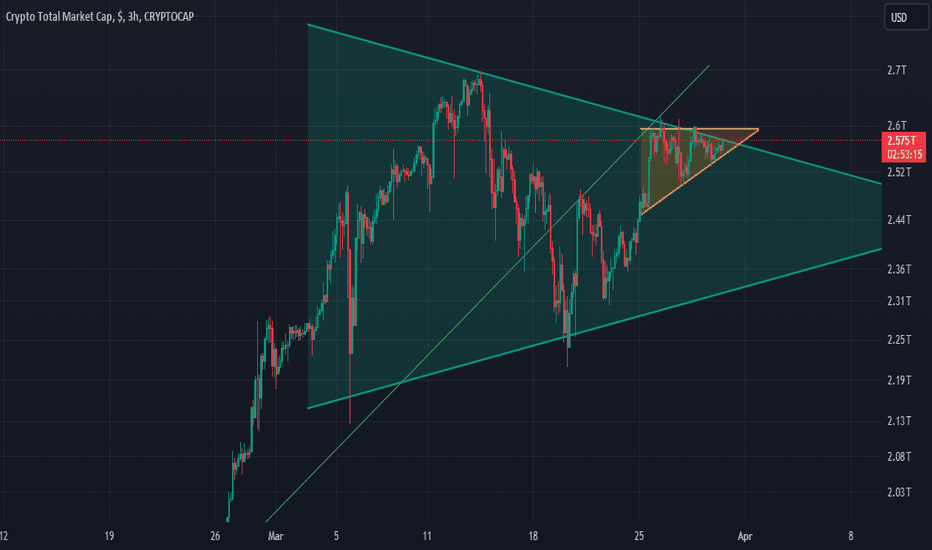

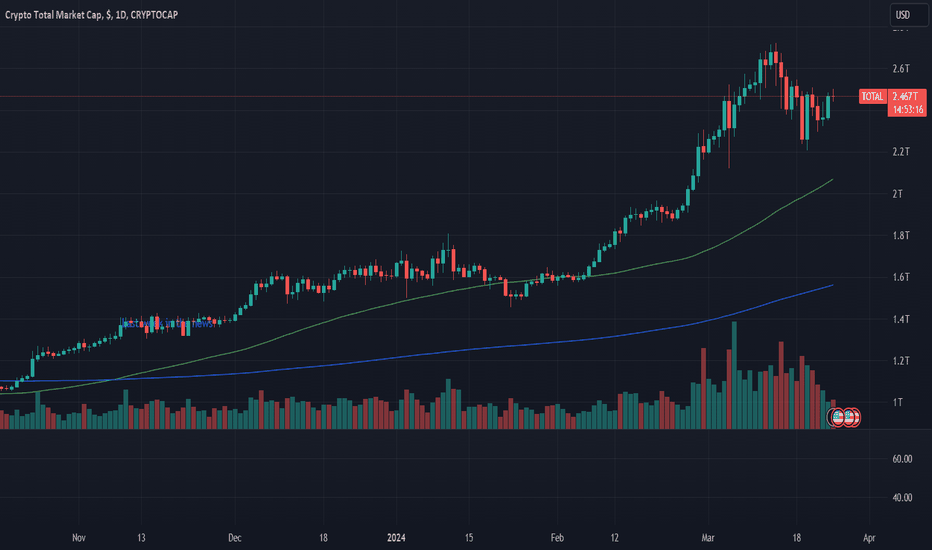

📉 Market Analysis: A Crucial Juncture for TOTAL 📊🔍Overview:

The TOTAL market cap is currently at a critical juncture, testing the bottom of the range resistance level at $2.5 trillion.

Recent price action indicates volatility and uncertainty, highlighting the importance of careful analysis and risk management.

Key Insights:

Recent Rejection: Two weeks ago, the TOTAL faced rejection at the $2.7 trillion level, signaling strong selling pressure and a potential shift in market sentiment.

Support and Reversal: After retracing to a low of $2.2 trillion last week, the TOTAL found support and initiated an upward movement, indicating resilience in the market.

Current Test: With the TOTAL now testing the bottom of the range resistance at $2.5 trillion, caution is warranted as a rejection could lead to further downside movement.

Support Levels: Significant support levels are observed between $2.2 trillion and $1.8 trillion, suggesting potential areas for the TOTAL to retest in case of a rejection.

MARKETS week ahead: March 25 – 31Last week in the news

Based on the news from the previous week it seems that major central bankers are slowly reaching their pivotal point. The Fed`s view on potential three rate cuts during this year moved the markets to higher grounds. S&P 500 reached a new all time highest value at 5.234. The US Dollar gained during the week, while gold was holding grounds at levels above 2.150. The US Treasuries were also traded higher, with dropping yields. Bitcoin had another volatile week, still ending it above the $65K.

The FOMC meeting was held during the previous week which was closely watched by financial markets. As expected the Fed held its interest rates unchanged. However, after the meeting statement, Fed Chair Powell provided two important informations for markets. Firstly, he noted the possibility of three rate cuts during the course of this year, and secondly, FOMC members raised the US expected growth rate for year 2024 to 2.1% on an annual basis, from 1.4% previously projected. Although the majority of market participants perceived as positive news on rate cuts, there are still several scepticals on the topic. In this sense, officials from Vanguard asset management company expressed their view that the Fed will most probably keep the rates unchained till the end of this year and that the equity market in the US is currently overvalued. At the same time officials at Sycamore Tree Capital Partners also agreed that there is a high probability for no rate cuts this year. The CME FedWatch Tool notes market expectations of 68% chances that the first rate cut might occur in June this year.

Bitcoin ended another volatile week which was once again impacted by the sale from the Grayscale Bitcoin Trust (GBTC). As reported, total outflow from the fund on Thursday was $359 million. Analysis from Coinbase Institutional notes that GBTC selling is partially influenced by Genesis selling shares due to its bankruptcy process.

The US authorities led by SECs Chair Gary Gensler are planning further to dive into the regulation of the crypto market. During the previous week the US Securities and Exchange Commission, Commodity Futures Trading Commission and Treasury Department asked for additional funds for the year 2025 which will be used to attain 33 new employees with the goal to pursue further crypto currency businesses in the US into regulatory frame. In a speech during the week, SEC Chair Gensler noted that the crypto industry continues to be non-compliant with the US regulation and that they are “whittle away at the SEC's disclosure regime”.

BlackRock has turned its view to asset tokenization. As announced, they have created the first tokenized asset fund on Ethereum network. The fund`s name is Institutional Digital Liquidity fund and is represented by the BUIDL token, while the fund is fully backed by cash, US Treasuries and REPO agreements. The yield on the token will be paid through blockchain every day.

Crypto market cap

Ongoing positive market sentiment was additionally supported during the previous week through after the FOMC meeting statement. Although the Fed kept rates unchanged, still the most important news from the meeting of Fed`s officials was a potential three rate cuts till the end of this year. The Fed is planning further cuts also in 2025, until the rate finally reaches 2.6% as a “neutral” level perceived by the Fed. On the other hand, the crypto market continues to be highly volatile during the last two weeks. Although there is open market interest for crypto currencies and especially Bitcoin, still, some huge sales continue to occur. On one side, analysts are mentioning the closing of speculative positions, especially during the BTCs ATH. On the other hand, there are still huge sales occurring with Grayscale Bitcoin Trust (GBTC) shares, partially influenced by the Genesis sale due to its bankruptcy process. As it has been noted by analysts involved in a matter, this kind of BTC volatility might continue as there are still outstanding GBTC shares in Genesis bankruptcy process which will be sold in the future period.

During the week total crypto market capitalization dropped to the level of $2.2 trillion, however, has soon reverted to the upside, ending the week at level of $2.42 trillion. This level represents a 2% drop on a weekly basis, where $ 37B was wiped from the market. Daily trading volumes eased a bit, but still continue to be elevated around $172B on a daily basis. Total crypto market capitalization increase from the end of the previous year, currently stands at $782B, which represents a 48% surge from the beginning of this year.

The crypto market was traded in a mixed manner during the week. Although BTC had a significant drop in the value, still, the coin managed to finish the week with weekly outflow of $27B which is a drop in value of modest 2% on a weekly level. ETH was also following increased selling orders on the market, and ended the week by 5.6% lower from the week before, dropping its market cap by $24.3B. Solana was also on a losing side, dropping its value by 4.8%, or almost $4B. Binance Coin finished the week in red, by decreasing its market cap by $3.2B or 3.7%. Other altcoins with a drop in value during the week were OMG Network, who was down by 6.67%, Tron was down by 5.6%, Polygon lost 6.6% in value, while Algorand lost 6.4%. On the opposite side were coins with relatively solid weekly performance like Maker, which managed to gain even 15.8% in value, while DOGE ended the week 21% higher. Stellar and EOS gained around 4.5% both, while XRP gained 4.3% on a weekly level.

The increased activity with coins in circulation continues on the crypto market. During the previous week Polkadot added 10% new coins on the market, which was probably its highest increase on a weekly level. Tether continues to gain the market cap by increasing its coins in circulation by additional 0.7% on a weekly level. This week Miota managed to add 0.6% more coins to the market, while Filecoin`s coins were up by 0.4%.

Crypto futures market

The crypto futures market reacted to developments on the spot market during the previous week. Both BTC and ETH futures closed the trading week lower from the week before for all maturities. BTC`s short term futures were traded lower by more than 6%, while the longer term ones closed the week between 6.3% and 5.87% lower. Regardless of a drop, the futures prices are holding above $70K for maturities as of the end of this and next year. Futures maturing in December 2024 were last traded at $70.300, while those maturing a year later closed the week at $74.585.

ETH futures were traded lower around 9% for all maturities. Futures maturing in December this year were last traded at price $3.681, while those maturing in December 2025 ended the week at level $3.812. Same as BTC`s futures, on a positive side is that ETH futures are still managing to hold prices above the $3K.

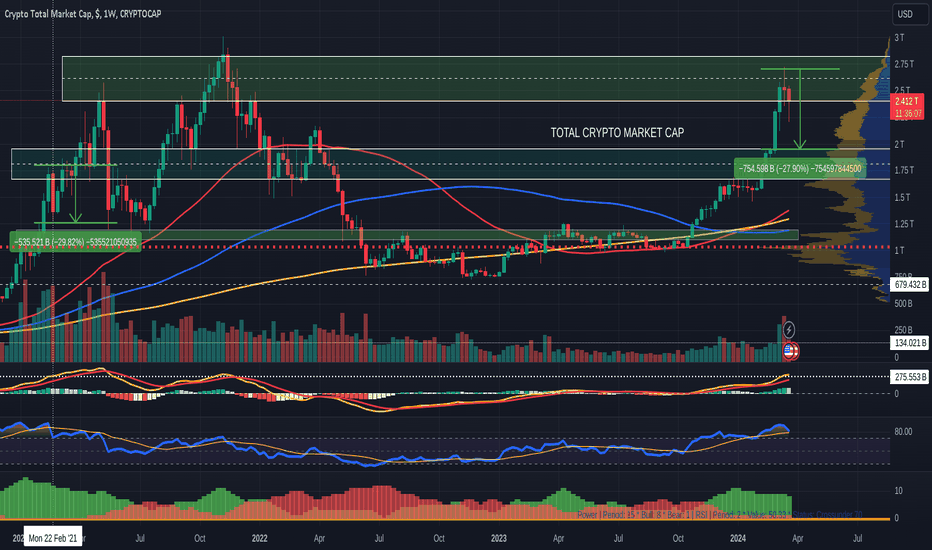

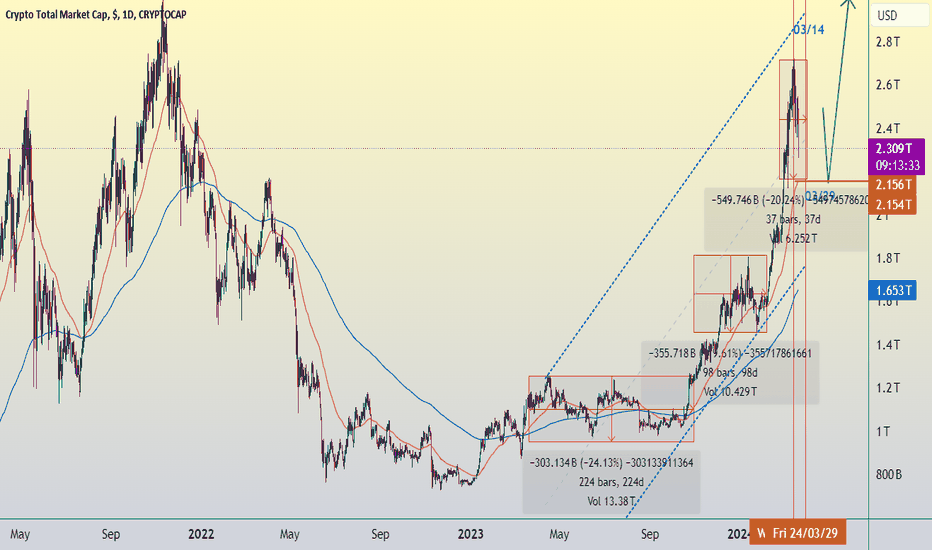

TOTAL Crypto Market Cap update

In Feb, 2021, while enroute to the 1st ATH that year, The TOTAL chart saw a -29% pull back that had many questioning if that was it for the season.

This happened after a Sharp push up after PA had ranged for a while at the end of the previous Year. Some noted at the time, that the MACD was not oversold yet and so a potential for more existed.

That pull back lasted for 7 days and then took off again.

Could we be about to see the same now ?

The Scales are larger right now. For instance, the range at the beginning of this year lasted 8 weeks, compared to the 4 in 2020. We also have the added Value of ETF entering the market and they may not sell off as quickly. We are also in the 2nd week of pull back right now.

We are also finding support on that line of "Danger Zone" I placed on this chart months ago.

A few things to note here, that Kind of contradict each other.

Look at this MACD chart - The Vertical line on the left is where the -29% pull back took place

The Horizontal line is where that date intersected the MACD - See how much further it went up. To the ATH 10 weeks later.

We are currently slightly above that line, with the signal line a similar distance below.

This points towards MORE upside being possable.

BUT, Look at this RSI

The same vertical shows the retrace in 2021, Note how the RSI and the MA of that RSI are crossing at this point.

Now see where we are today. RSI is alreadi oversold and Falling back towards the MA.

This is BEARISH. Look back and see what happened in 2021 when the RSI crossed the MA while dropping.

So we have a story of 2 halves here. Signals pointing in both directions.

Should TOTAL drop that -29%, it does take us to a strong line of support, there is little doubt about that and if we are to reach the expect highs in Early 2025, and maybe more later that year, then we do need to reset to this level to cool off MACD, RSI etc.

As mentioned in other posts, the DMI is also showing change coming but we do not yet know in which direction.

So, Trade with sense, be cautious untill we seea set direction.

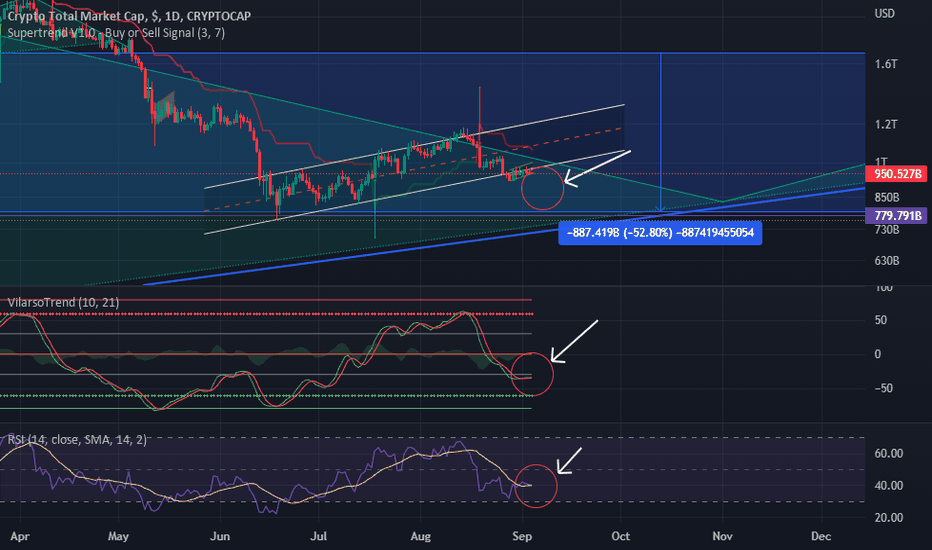

Crypto total market cap (CTMC) CRYPTOCAP:TOTAL looks very controversial, please pay attention to that it is under the D TF's bottom channel. And there is struggle for several days to go upper. As usual, it more money could be poured in, same as more money could be withdrawn out.

I hope that BTC price go down to 17 thousand immediately, CTMC has to be reduced to 779 billion. To support my hypothesis i'm taking into account that MA line has not touched the bottom yet since last max, while RSI touched once the bottom and showing healthy state, but it could do double bottom too.

Not a financial advice.

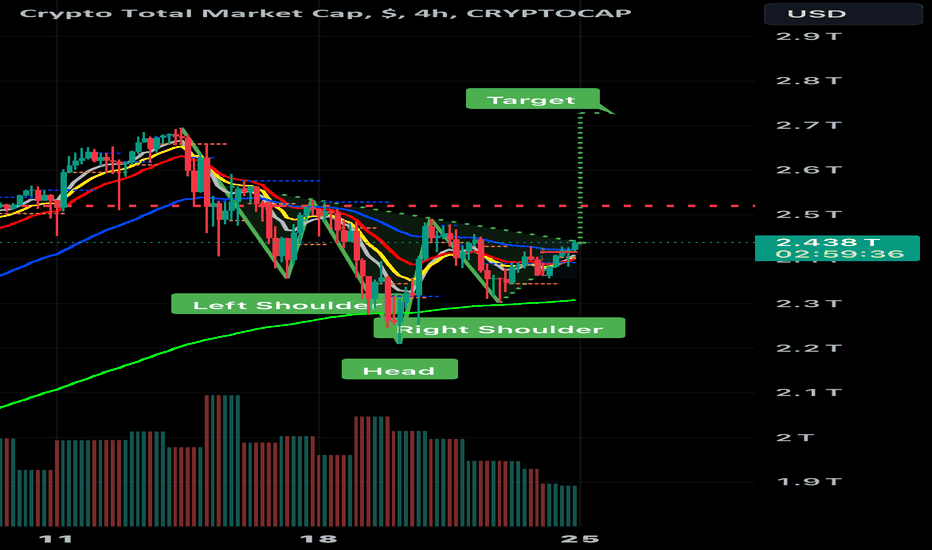

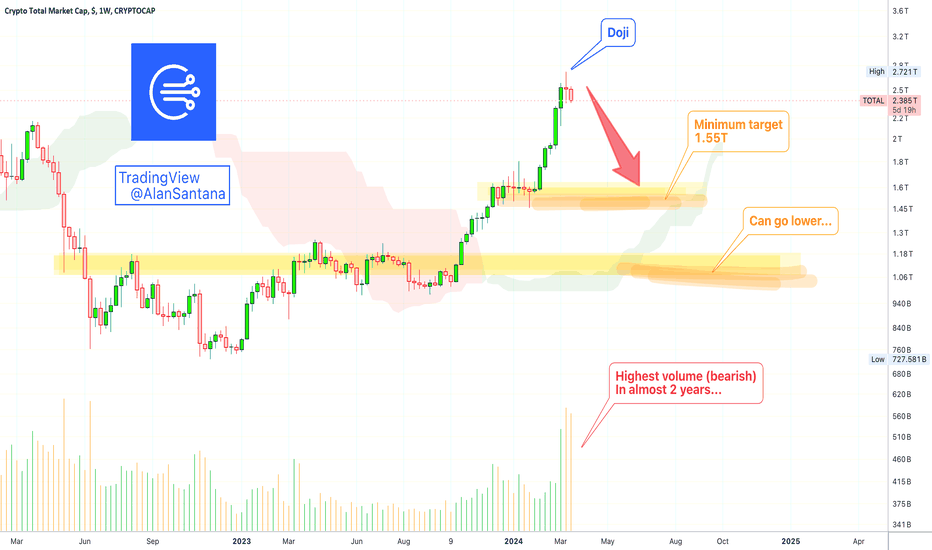

⚡ TOTAL Market Analysis ⚡📊 Market Overview:

Recent Movement: The TOTAL cryptocurrency market capitalization faced rejection at $2.70 trillion and is now retracing to test lower support levels.

Current Situation: The next major support is anticipated in the range of $2.05 trillion to $2.20 trillion.

Alts Potential: There is a belief that altcoins will experience a significant bounce once the market finds support.

📈 Trading Strategy:

Observation: Anticipate potential support levels for entry opportunities in altcoin trades.

Preparation: Prepare trades in advance to capitalize on the expected bounce in altcoins.

Entry Plan: Look for confirmation of support in the TOTAL market before executing trades in altcoins.

Risk Management: Set stop-loss levels to manage downside risk in case of unexpected market movements.

🌐 Note: Stay vigilant for signs of market stabilization and consider factors such as volume, market sentiment, and overall trend direction before initiating trades. Adjust your strategy based on evolving market conditions to optimize trade outcomes.

📈 Major Correction: Caught By Surprise?I remember a time when I was feeling so good and great with my paper gains... This is not bad, we tend to feel down when we incur some paper loss.

Neither is real.

When Bitcoin is up and we have a good entry, the only way to win is by securing profits or waiting long-term... Even with the long-term wait, at one point we have to use our assets or cash-out in some way.

When the market is moving down-low and our paper losses are big, we can decide to take the loss and move on or hold. Holding is easy of course... Taking a loss can happen if we are not prepare or simply meet our stop-loss.

Sometimes panic and market-psychology can be the cause of a loss.

Say Bitcoin drops by 30% in a matter of days and instead of waiting since the worst is already over, we sell and the market turns. This can be both panic and market-psychology at work.

Many of us are used to the feeling of losing, selling while down, just being beat and being down.

Some of us are humble enough to secure profits on the way up. The biggest winners are the most humble but that is something most people don't know.

But the topic is not about feelings but about the market; Bitcoin.

It is going down... Are you prepared?

Don't get caught by surprise.

Thanks a lot for your support.

Namaste.

MARKETS week ahead: March 18 – 24Last week in the news

Previous week brought back inflation fears on financial markets. The US equities and tech companies ended the week under pressure considering investors fears that the Fed might take a bit more time until the first rate cut, due to persistent inflation. US Treasuries also reacted on the same issue, ending the week one more time higher by 22 basis points. Price of gold and USD remained relatively stable during the week, however, with some volatility. Bitcoin reached its new all time highest levels, but still, ending the week a bit lower, above the $65K.

Inflation continues to be the number one concern for investors on financial markets. During several prior months, it has been on a clear down path, however, the latest data are showing that the Fed`s targeted 2% is going to be a bit harder to achieve. The latest figures for February are showing that the inflation in the US reached 3.2% on a yearly level, which was modestly above market estimate of 3.1%. At the same time, core inflation was standing at 3.8%, also higher from market estimate of 3.7%. Also, it should be considered that the PPI index was higher by 0.6% for a month, which points to a potential for further growth in inflation figures in the coming period. February inflation data were a bit concerning for investors, considering that it might mean that the Fed might take a bit longer time for the first rate cut during the course of this year. What Fed`s opinion on the latest inflation data will be better known during the week ahead, when the FOMC meeting is scheduled, as well as FOMC economic projections.

The Bitcoin frenzy continued during the previous week, with BTC reaching its new all time highest level at $73.4K. Although it finished the week around $66K, the MicroStrategy founder, Michael Saylor, announced a new debt issuance in order to collect additional $525 million with the aim of purchasing additional BTCs. It is currently estimated that MicroStrategy holds 205.000 BTC.

For the last several years, Bitcoin was named by the crypto enthusiasts as a digital gold. The latest analysis is showing that investors are currently almost equally investing in both gold and BTC, but are not transferring funds from one asset to another. As per research report conducted by JPMorgan, the conclusion is that there are no funds flows from BTC funds to gold, or vice versa, but it is rather that investors are just equally buying both gold and BTC. Among buyers are mainly speculative institutional investors and partially retail investors. The report concludes following: “We believe the debt-funded bitcoin purchases by MicroStrategy add leverage and froth to the current crypto rally and raise the risk of more severe deleveraging in a potential downturn in the future”.

CoinDesk is reporting that El Salvador`s President Bukele posted on the X platform that this country stored $400 million worth of Bitcoin into a cold wallet “in a physical vault within our national territory”. The post also included the picture of a wallet holding 5.689,68 BTC.

Crypto market cap

At the beginning of the week, the crypto market had its bull run continued, when the highest market capitalization reached $2.7 trillion. However, the second part of the week brought surprising US inflation data, as well as sort of market exhaustion, considering forthcoming BTC split and disappointed inflation data in the US, so the market entered into correction, ending the week with a total market cap of $2.4 trillion. News are reporting that over $800 million was wiped out from the futures market in forced liquidation. Analysts involved in the matter noted that historically highest levels were the trigger for liquidations in profit taking moves, and that some further moves to the downside are possible in the coming days. Whether this will be the case the market will decide, however, as there are sellers, there are also buyers, like for example MicroStrategy, who prepared a new round of debt securities in order to make new BTC purchases. Regardless of a new all time highest levels, total crypto market capitalization is ending the week around 2% lower from the week before, decreasing it by $62B. Daily trading volumes remained at relatively higher levels, moving around $252B on a daily basis. At Friday`s trading session, daily trading volumes reached the levels of around $400B. Total crypto market capitalization increase from the end of the previous year, currently stands at $819B, which represents a 50% surge from the beginning of this year.

Although the majority of coins finished the week in red, there were several altcoins which continued to perform in a positive manner. Bitcoin had a positive start of the week, however, it ended it with a cap decrease of almost 2%, where $26.7B was wiped from its capitalization. ETH had a higher drop of $38B in value, which was a decrease of 8.1% on a weekly level.

Several other coins with a significant weekly drop in value were Dogecoin, with a drop of $3.7B in value or 15.4%, Cardano lost $2.3B, or 9% in value, Polkadot decreased its cap by $1.1B or almost 8%, while Uniswap lost $1.25B or 14.6% in value. On the opposite side were several coins with quite good performance. Solana completely outperformed the crypto market, with a surge in value of 25% within a single week, adding $16.3B to its market cap. Binance Coin should also be mentioned with an increase of $14.5B in value or almost 20%. Maker managed to gain during the week 9.3% in value, which is an additional increase from 15.9% two weeks ago.

When it comes to coins in circulation, the increased activity still holds. Filecoin added an additional 0.5% of new coins on the market, while Cardano, Solana, Stellar and Polkadot added 0.2% of new coins each. It should be mentioned that Tether still continues to strongly add new coins on the market, increasing the number by 1.7% during the previous week.

Crypto futures market

Despite a significant drop in the value of BTC on the spot market, the BTC futures market managed to catch only a small drop on a weekly basis, related to short term futures. In this sense, futures maturing in March and April this year ended the week by 1.19% lower from the end of the previous week, while the longer term ones were traded higher from the week before. BTC futures maturing in December this year were last traded at level of $74.880 or 1.47% lower on a weekly basis, while those maturing in December 2025 were traded at $79.235 or 2.19% higher from the week before.

At the same time, ETH futures experienced a drop on a weekly basis for all maturities. ETH short term futures were traded lower by more than 7.5%, while the longer term ones were down by more than 4%. ETH futures maturing in December this year are still holding modestly above $4K level, but were down by 3.7% on a weekly basis. Futures maturing in December next year closed the week at price $4.183 or 4.03% lower from the week before.