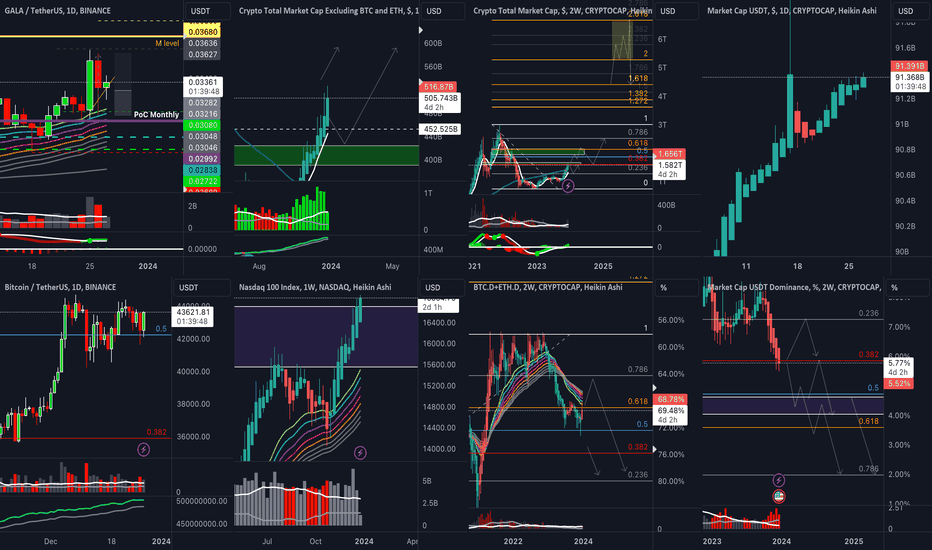

TOTAL trade ideas

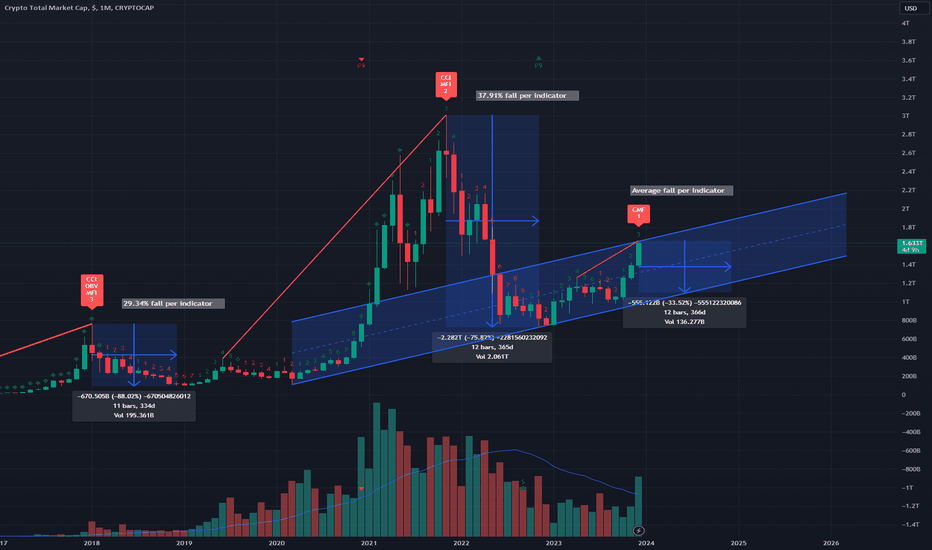

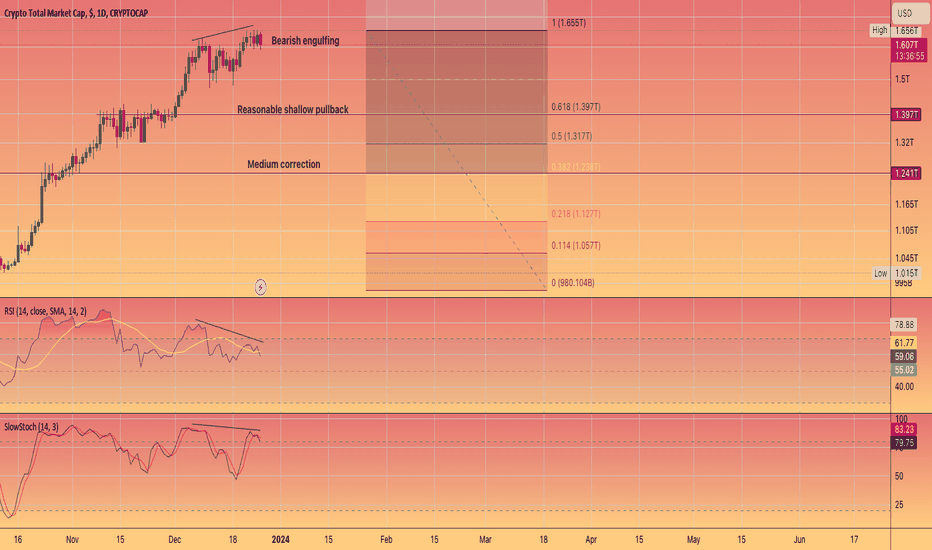

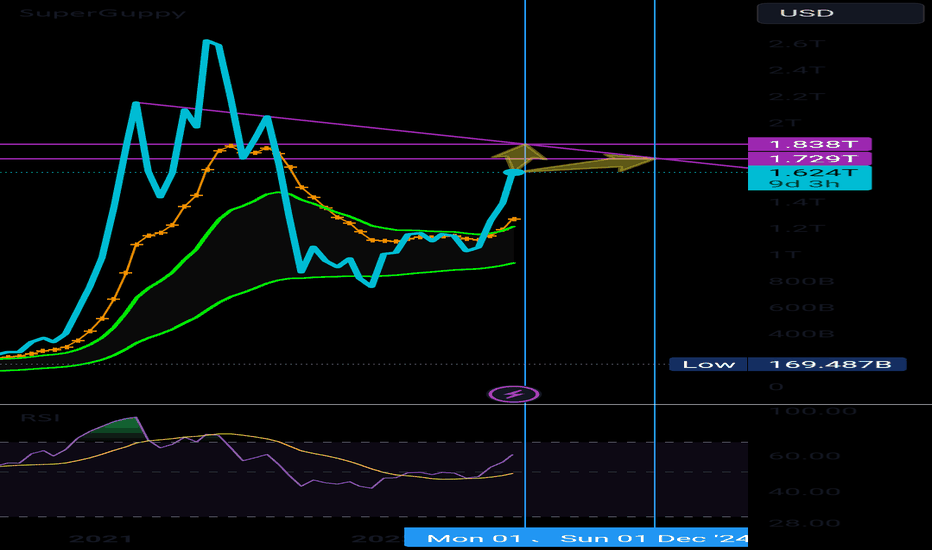

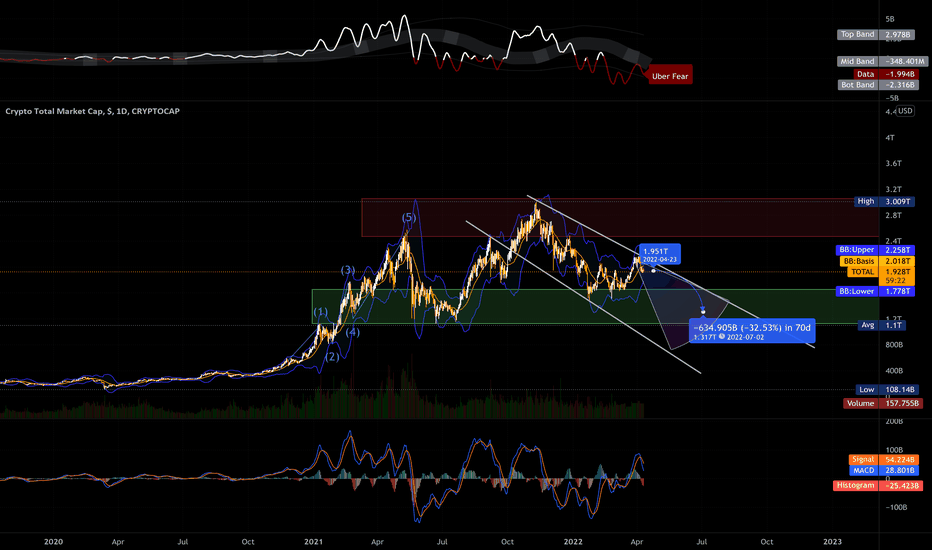

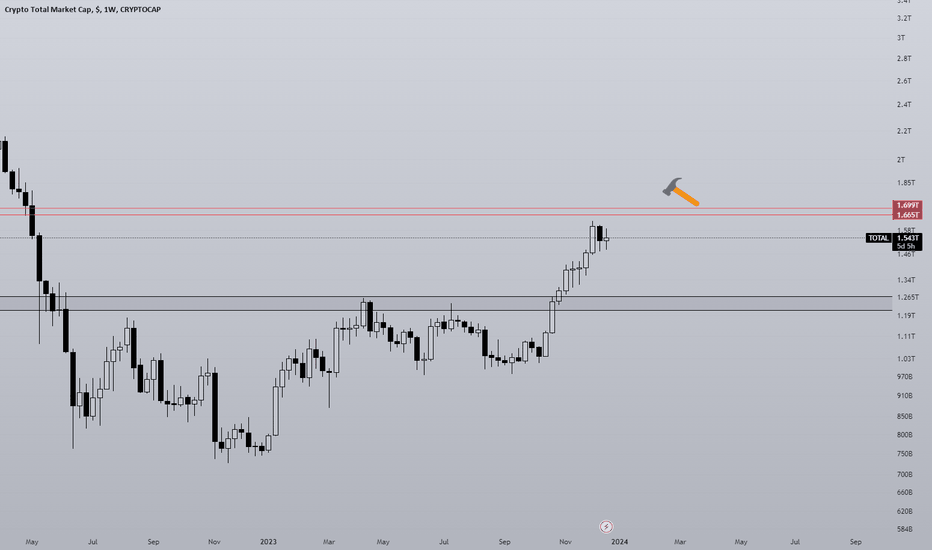

TOTAL Cryto Market Sell SignalCRYPTOCAP:TOTAL

The total crypto market has flashed a sell signal. By our estimate the entire crypto market will fall by around 33% and bottom between 1.1bn and 1.2bn. This is based on previous market cycles and the average fall per indicator. Right now only one indicator has flashed (money flow), thus our estimate is for a 33% fall. This also aligned with uptrend support.

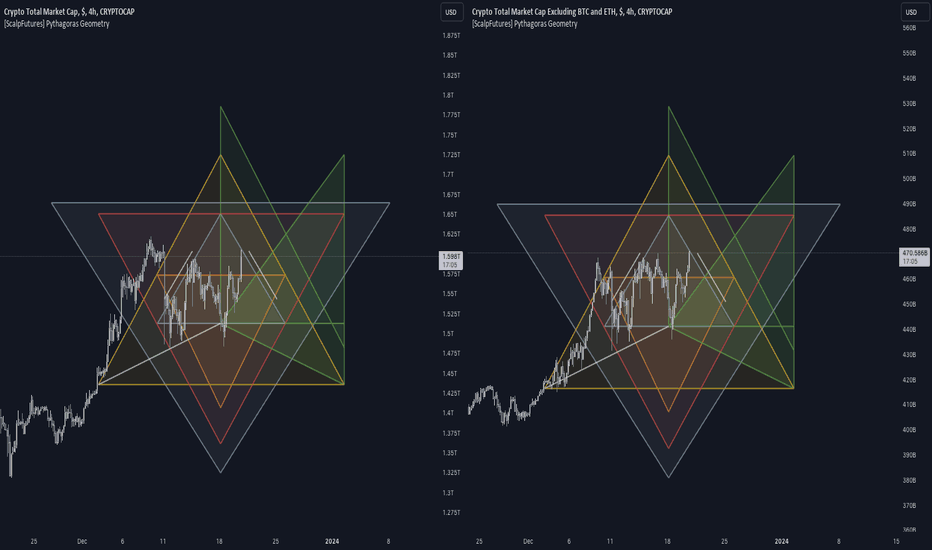

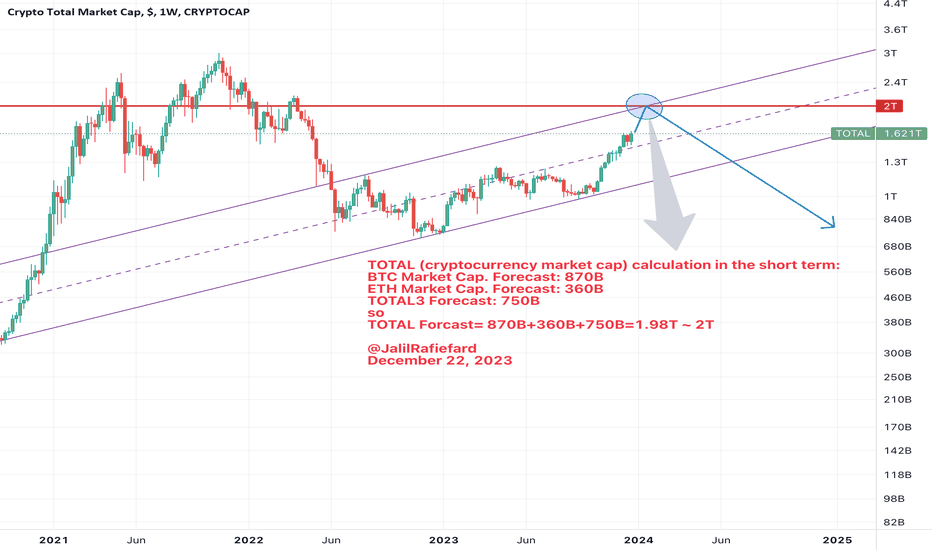

[20-12-2023] $TOTAL & $TOTAL3 - GEOMETRY ANALYSISIn this chart, we delve into the esoteric realms of geometry to decode the cryptic movements of the market. By applying the principles of Pythagoras, we've constructed geometric shapes that align with key pivot points, revealing potential areas of support and resistance.

Left Chart Analysis (Total Market Cap): As we observe the Total Crypto Market Cap, the Pythagoras Geometry brings forth a vivid tapestry of intersecting lines. The market's ascent seems to have found resistance at the peak of the green triangle, with the potential pivot around the 1.65T mark, aligning with the base of the red triangle. A clear pattern of consolidation within the geometric confines suggests a brewing momentum, possibly awaiting a breakout or reversal as it approaches the confluence of multiple geometric boundaries.

Right Chart Analysis (Market Cap Excluding BTC and ETH): Focusing on the market excluding Bitcoin and Ethereum, the geometry suggests a nuanced narrative. The recent price action has respected the diagonal support of the yellow triangle, while the overhead resistance is framed by the green and red geometrical ceilings. The convergence of these lines around the 471-475B zone may act as a crucible for the next significant move.

Traders might look for price action to breach these geometric bounds to confirm a directional bias. The key will be to watch for volume-backed movements as the price interacts with these critical lines, serving as a testament to the Pythagorean harmony that may govern the rhythms of the market.

While the mystique of Pythagoras' theorem is often confined to the realm of mathematics, in the financial markets, its application through geometric charting can provide a unique perspective on price dynamics. As always, while the patterns provide a roadmap, it is the price action, corroborated by volume and other indicators, that should guide the final trading decisions.

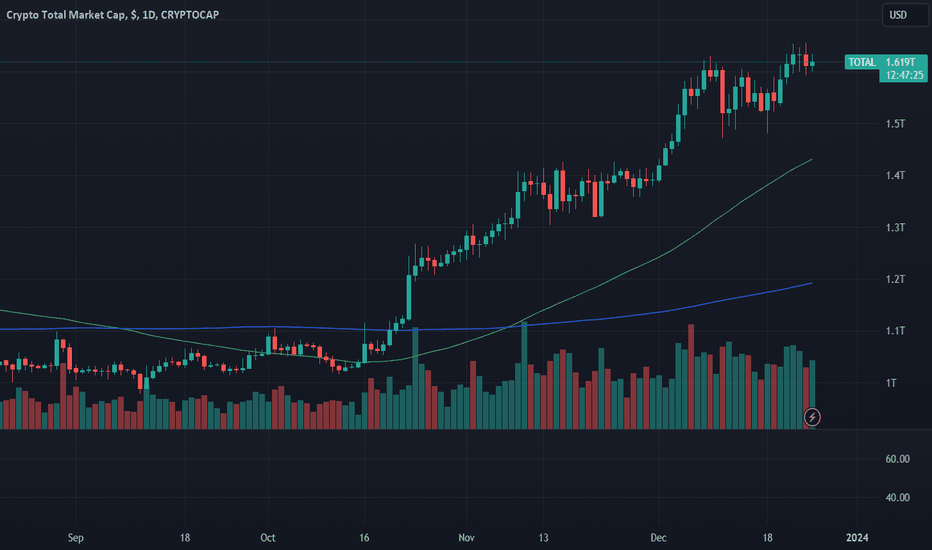

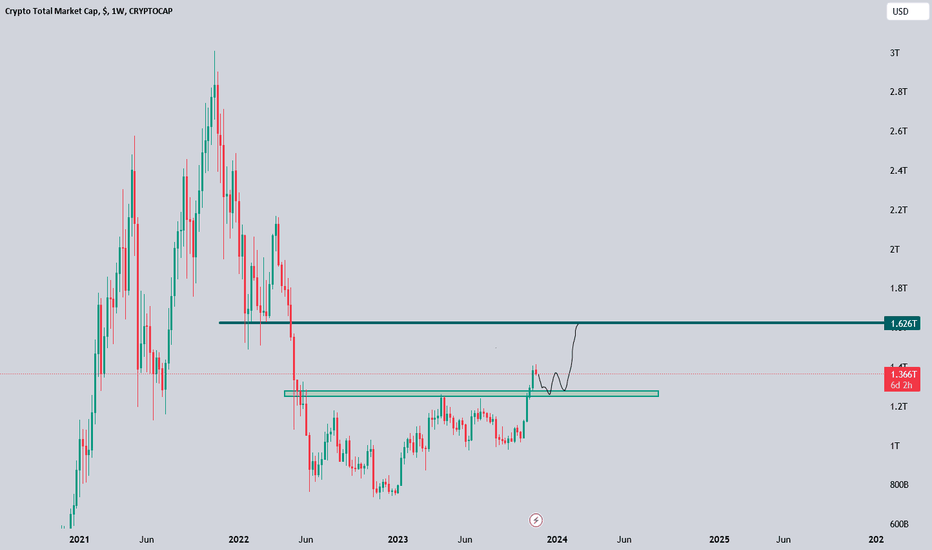

Crypto Total Marktcap --- suggests pullback is occuring.Shorts have been getting their pants pulled down for too long :)

We may have reached a point where a pullback may be necessary and even healthy.

(Some coins will still do well of course, but will be fighting the general tide of the market)

Included a couple zones where could correct to.

MARKETS week ahead: December 24 - 30Last week in the news

During the previous week the Western markets were preparing for the forthcoming Holiday session before the year-end. The positive market sentiment continued to prevail on the markets, as traders were preparing to book profits this year. The US equity markets were closed higher from the week before, with S&P 500 closing the week at yearly highs. Gold continued to hold above $2K level, as USD was losing some of its value. The US Treasuries continue to be in the spotlight of the market, with decreasing yields and increased prices. The crypto market finished the week also in a positive sentiment, where BTC is ending another week modestly below the $44K.

After the Fed decided to keep its interest rates unchanged in December, the markets got a new level of optimism, wondering when the first pivoting point will occur. The majority still perceive that the Q1 of next year could mark the start of Fed`s cutting interest rates. As for Powell's rhetoric, the Fed is still not thinking about this step. Certainly, by their projections, it is clear that rate cuts will occur during the course of 2024, where the expected rate at the end of the year ahead would be 4.6%. The dynamics of rate cuts would certainly depend on the inflation behavior in the coming period. During the previous week the Personal Consumption Expenditures price index was published for November, showing further relaxation in inflation in November. The index was standing at 3.2% for the year, while core PCE was up 0.1%, for the month, which was below Fed`s expectations. This is an indication to markets that the inflation will most probably continue to move within the down-road, decreasing the probability of any sort of rate increases in the coming period, while at the same time increasing the probability that the Fed might cut rates sooner than expected.

Last week in the news was an astonishing yearly result of the British fin tech company Revoult. Its revenues have increased by 45%, for the year, regardless of a drop in net profits to 6 million pounds. The company has a significant base of clients, reaching 26.2 million, and has filed with the British authorities to obtain the banking license. Revoult is by far the most valuable start-up in Britain.

As markets are still focused on a question whether the first BTC ETF will be approved or not, the SEC continues to be focused on making some order within the crypto industry. Last week, SEC Chair Gensler commented that frauds continue to be one of the main concerns for regulators within the crypto industry and its full compliance with the regulation. Last week BarnBridge DAO, a company within the crypto industry, made a settlement with SEC, in order to settle SEC`s allegations. Total agreed amount to be paid by BarnBridge is $1.7 million. The SEC accused the company for offering illegal securities in crypto to the U.S investors. This refers to their product called SMART Yield.

Crypto market cap

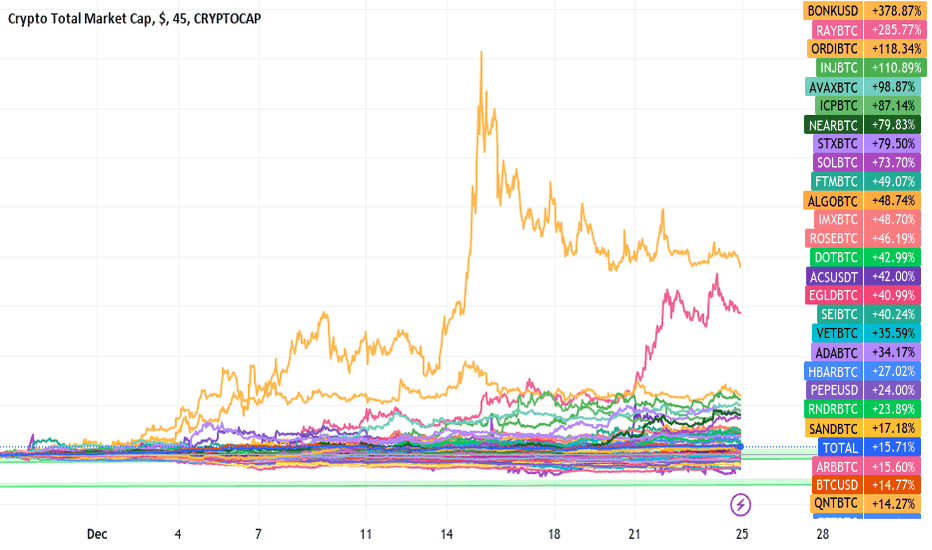

The year-end market optimism was holding also on the crypto market during the whole last month. Although the initial frenzy was initiated by the stories related to the first BTC ETF fund, still, during the second half of December, US macro fundamentals left their mark on the positive market sentiment. Two weeks ago, there was a small correction in this cycle, however, the last trading week brought some profit-taking season also on the crypto market. A clear slow down in the US inflation, as well as anticipation that the Fed might quite soon start with rate cuts, increased the appetite in investors to search for riskier assets in order to increase their potential for profitability in the year to come. Despite some volatility during the course of this year, the crypto market is managing to end the year 116% higher from the end of the previous year. Total crypto market capitalization was increased during the previous week by another 6%, adding a total of $88B to its market cap. Daily trading volumes continue to be at a higher level, moving around $127B on a daily basis. Total crypto market capitalization increase since the beginning of this year currently stands at 116%, where it has added a total $874B to the market cap.

Regardless of a general increase in cap during the previous week, not all coins contributed to it. It was another week with domination of Bitcoin and Ether, while some other altcoins ended the week with a small decrease in value. BTC has another positive week, where it has increased its value by 3.56% on a weekly basis, followed by ETH, which managed to add 2.11% w/w.

Ethereum Classic was also in the spotlight of investors, where the coin managed to increase its value by 4.6%. Few of altcoins had excellent performance during the week, where Solana managed to increase its cap by an incredible 27.13% w/w, while Algorand was up by 17.03%. From other coins, it should be mentioned Binance Coin, with an increase in value by 9.54%, NEO was up by almost 8% on a weekly basis, while LINK added 7.92% to its cap. On a losing track were DOGE and Cardano, which both decreased their cap by more than 1% while Miota was down by 2.6% on a weekly basis. As for coins in circulation, there has not been significant changes on a weekly basis. Certainly, this does not include Tether, which continues to strongly add its circulating coins, adding new 0.14% during the previous week.

Crypto futures market

Positive market sentiment was also reflected on the crypto futures market, and this time especially in long term crypto futures. Both BTC and ETH futures gained during the previous week. BTC short term futures were traded above 3% higher, in line with the spot market. December 2024 ended the week at a price of $43.815. It was interesting to see that BTC long term futures are still trading higher, where December 2024 ended the week at $47.340, while those futures maturing in March 2025 were last traded at price $48.215 or even 2.6% higher from the week before. These are reflections of a positive sentiment for the future value of BTC, as the market is currently not expecting that the BTC`s price might return to some lower levels from current.

ETH futures were also traded higher, less than 3% compared to the week before. Futures maturing in December were closed at 2.97% higher value from the week before, closing at $2.324. Those futures maturing in December next year were last traded at $2.500, for the first time since last year. However, futures maturing in March 2025 ended the week at $2.408, expressing market insecurity whether ETH could sustain these levels on a longer run.

Bitty holding the beers before launchThese are the top lead Alts in my portfolio.

I am diversifying by following a Market-Cap weighted average distribution.

We are at the early stage of a multi-year Crypto Bull market where Web3 will lead innovation in all ecosystems from DeFi, Smart Cities, supply chain management, healthcare, quality news accessibility through credible birdwatching oversight, and open source governance.

The debt-based fiat standard system is a broken one. The Bankers' Wars are keeping plebs in a debt spiral enslavement to perpetuity. Please read my other published ideas to understand my narrative.

On inflation, the numbers are cooked. Central banks are not accounting for the cost of the spoilage done to the planet and the costs of the dying ecosystems that keep us alive. They are kicking the can towards the precipice. The rogue climate change pivot point from melting permafrost (i.e. methane) is less than six years away (i.e. busting the 1.5-degree threshold).

Web2 Giants with Aylo are all data traffickers. Web2 is manipulating the information and its availability, having the effect of dividing and confusing the masses. The Uber Elites are making sure that we live in an economy driven by competition and fear in which the military and security surveillance industries prevail. Populist nationalism and fascism are flourishing again. You are the product of their bad dreams of wars.

Dare to dream better.

Web3's love and peace to all (go FWB:PEPE ).

OMS

📈 Marketwide Crash.... What If?➖ What would you do if there is a sudden marketwide crash?

➖ What would you do, what would be your reaction if everything suddenly starts going down, no warning?

➖ Are you prepared?

What if a sudden crash does come, it does happen but you know that everything will be fine because it is only temporary and we know the market moves in waves...

➖ Are you prepared to wait 3-9 days?

➖ Are you prepared to wait for 6 weeks or 2 months?

There is no action to take if you bought low, near support.

There is no action to take if you've been selling on the way up.

There is nothing to do if you plan ahead...

➖ What if you don't have a plan?

It can lead to mistakes.

Forget what is happening or what will happen or what can happen... Just prepare!

Think and consider multiple different scenarios and see how this would affect your portfolio and if you would sell everything or hold long.

Consider selling high up at resistance, doesn't need to be 100% nor 80%, maybe just a little bit, whatever you think is best for you based on your trading style and your tolerance risk.

It doesn't matter how much higher the market goes, the main strategy remains the same forever —We sell high and buy low.

➖ Are you prepared?

➖ What if everything continues rising, when will you sell and by how much?

➖ What if the crash starts tomorrow?

Consider all scenarios and you will always be safe.

Secure profits on the way up.

Rebuy and reload red/near support.

That's all for today.

Thanks a lot for your amazing support.

Thank you really... Enjoy your holidays.

Namaste.

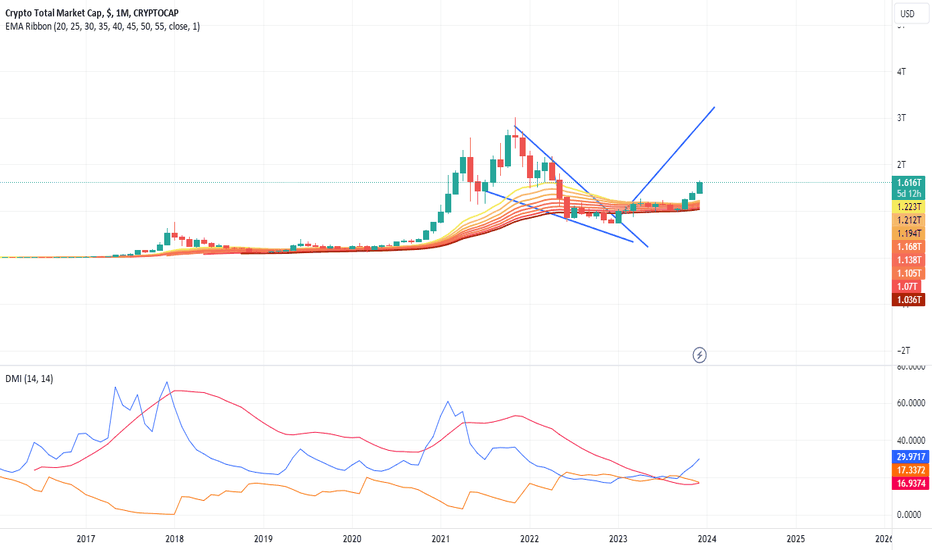

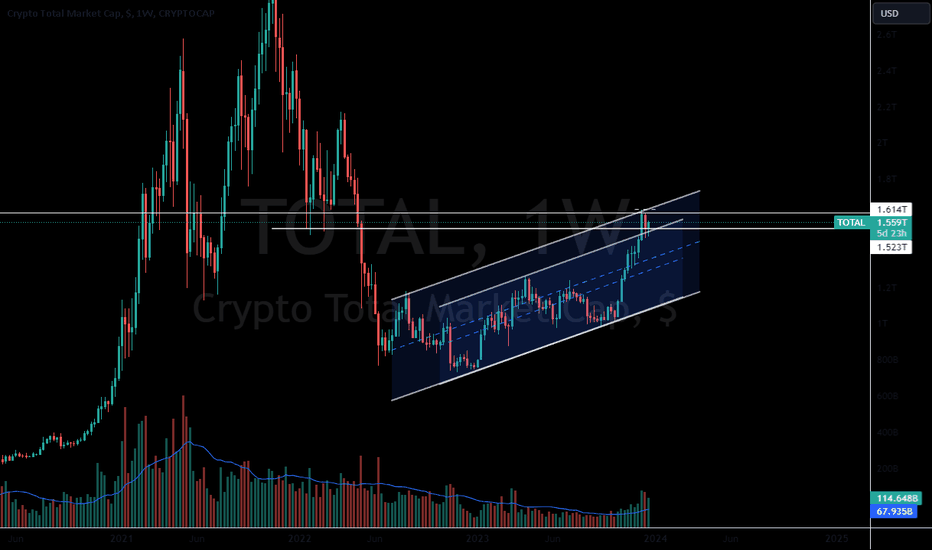

TOTALTOTAL

TOTAL is the total market capitalization of all cryptocurrencies.

On the chart, after a long accumulation since May 2022, we see the first glimpses of growth, as on TOTAL2.

For overall growth, you need to break through the red resistance at 1.281 and gain a foothold above it. After this, we will have the opportunity to take the following targets: 1.434 - 1.63.

There are no large volumes up to the level of 1.63. We are currently monitoring the situation.

Don't forget to show your support by like(rocket) and comment✅

TOTALAs of current data, the total market cap of cryptocurrencies is around $1.6 trillion. However, predicting the exact total market cap of cryptocurrencies in the future is challenging due to the volatile nature of the market. It is important to note that the market cap of cryptocurrencies can fluctuate significantly in a short period of time due to various factors such as market demand, regulatory developments, and technological advancements. Therefore, any prediction of the total market cap of cryptocurrencies should be taken with caution.

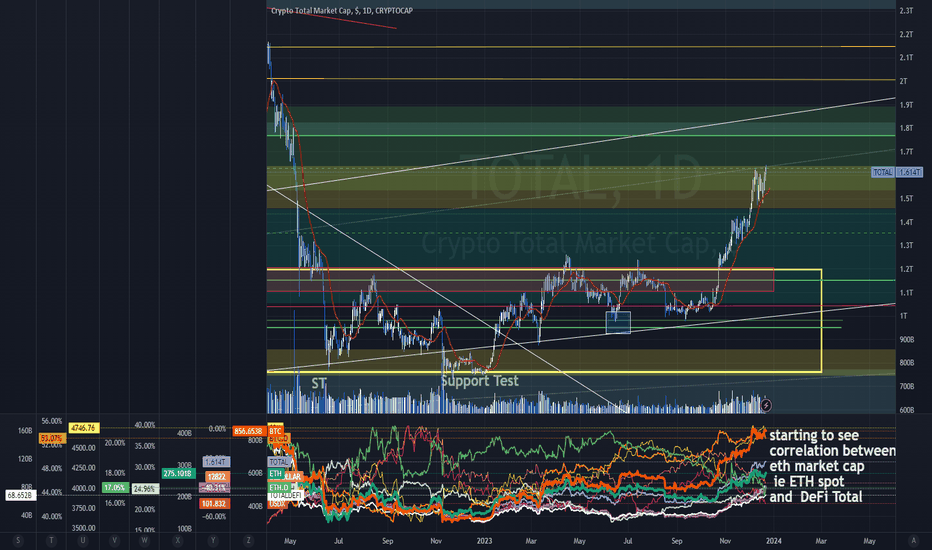

TOTAL / ToTal "Crypto Market" Cap Chart "Singles" & "GO" singlesstarting to see

correlation between

eth market cap ie ETH spot

and DeFi Total

Seeing other correlation

via ETH Spot or Market Cap

as well

>ETH is becoming "THE Highways"

IE you buy ETH then Buy X or\and

>Decentralized etc projects and DEXs that offer

leverage and derivates, shorts longs etc

all secured and paid out in /ith ETH

You see on the bottom where

ETH {Thicker Green Line}

and

BTC (Thicker Burnt Orange Line)

cross... since then the

Toatal Crypto Market cap or TOTAL

has gone up a bit more than

half a trillion/from 1T to 1.5T-ish

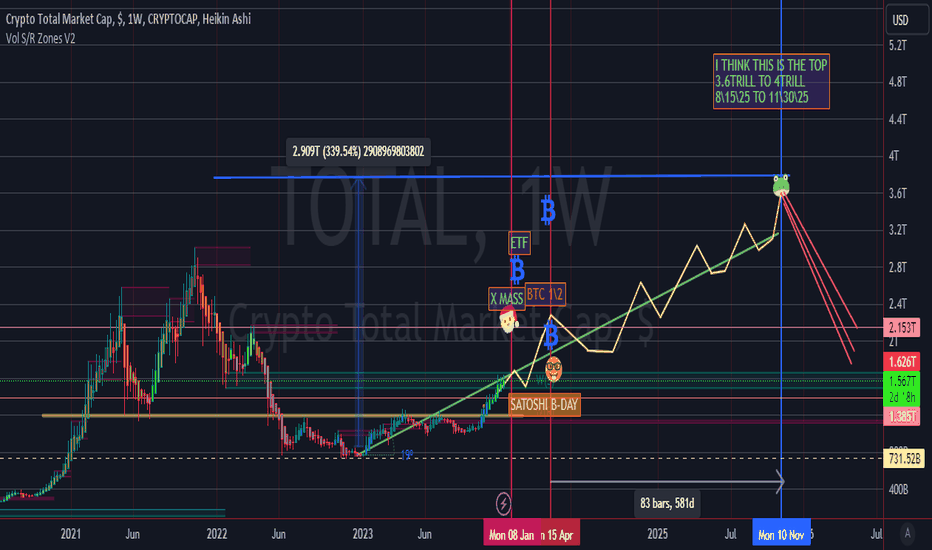

TOTAL CRYPTO MARKETCAPI feel that the total crypto marketcap will top out at 3.2 TRILL to 3.8 TRILL, and you can see by the chart that all these events are pretty close together in time. Then if you add in the rate cuts and the American election, that I feel Crypto will be a topic in said election, and it will be a positive one in the end for crypto. all so with; hopfuly congress taking the lead on regulations. The intisapated blood bath, as the balence of power in D.C. on this topic is fairly even in regards to pro and anti crypto.

When I was calculating the chart I was taking all this into account, as well as the angle.

Then all that was needed was taking the events and the timing of the bussiness cycle into account when I was calculating the mean revertion. WA - LA there is what is going to happen, if you look close at the last couple of months you will see I have gotten it so close you can hardly see the line, go ahead and check the one I posted like 2mns ago. this is an up date so fa so right on the money.

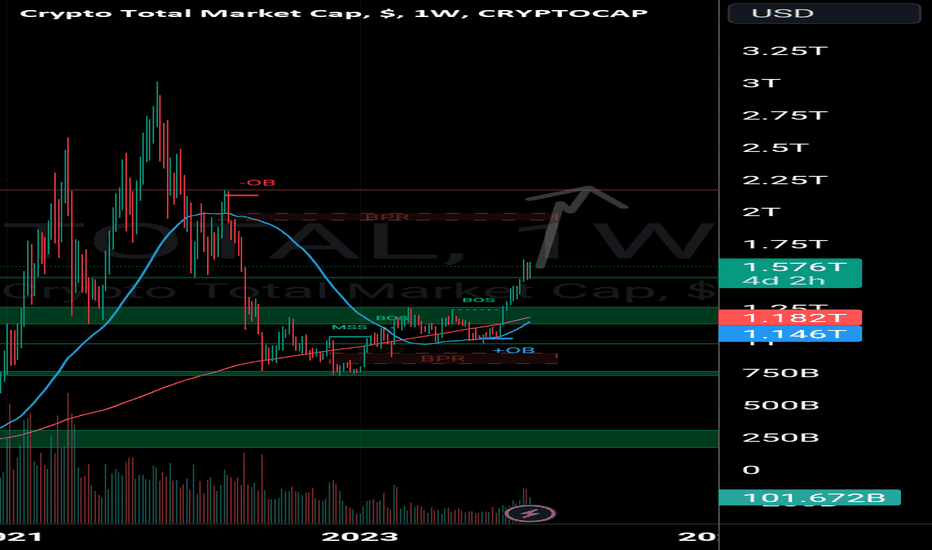

Crypto TOtal market cap analysis by ict According to the chart of the total market capacity of digital currencies, we can see that a BPR range has been formed on the market capacity of 1.930 trillion to 2 trillion dollars. This area is one of the most reliable areas for trading. As a result, we expect the growth of digital markets up to this range. According to this capacity, the price of Bitcoin is around 56-60 thousand dollars.

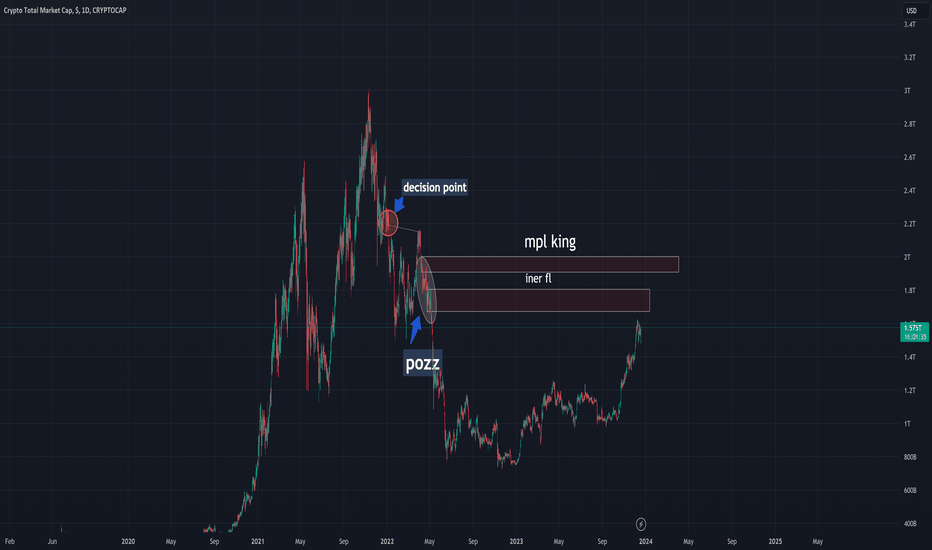

total Daily time frame review and analysisThe point of checking charts like total should be kept in mind that these charts should have an important point called decision point. In terms of RTM, this point is exactly the price and level where most of the market leaders have reached a point of view. Generally, it is to break a level or reverse the market

As you can see, in this chart dp is clearly defined and a level of the price has reached dp and orders have been transferred to mpl king and orders have been transferred from mpl king to inner fl by a pozz area and the price level is close to it, which is likely that the price It hits the surface very slowly and falls very slowly

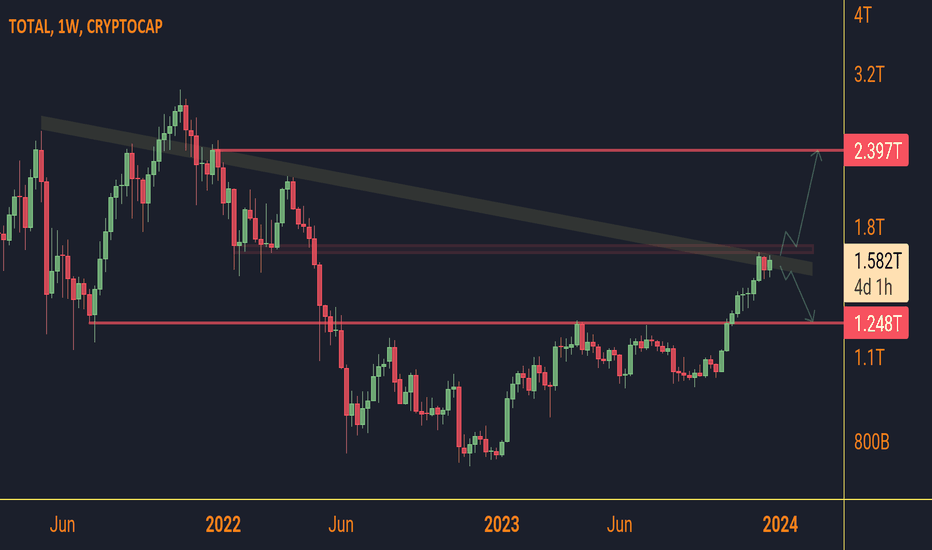

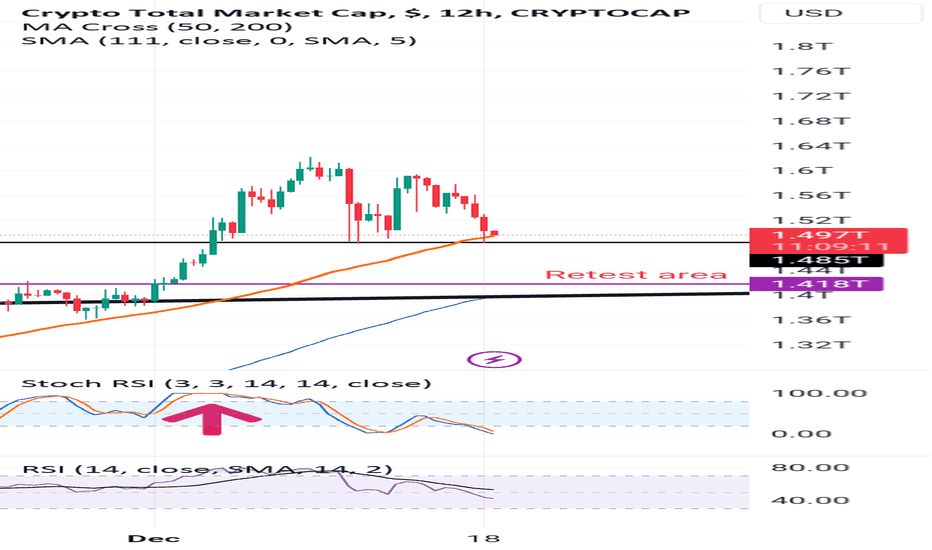

Total losing 1.48T opens up 1.4T and retest of breakout areaNot financial advice.

As highlighted you can see the pump up where I have arrow.

And potential retest area of 1.4T area

Had 2 retest of 1.48 already and my guess is it'll eventually breakdown.

Area of interest is 1.4 followed by 1.15T and 1.2T

Always do your own research

#PIK

Patience is Key

And always #TLAW

Think Like A Whale

MARKETS week ahead: December 18 – 24Last week in the news

Both the FED and the ECB left the rates unchanged during the previous week. The US Treasury yields slipped further in expectation of rate cuts, while US equities finished another week in green. The USD lost some in value, while Gold gained on a weaker dollar. The crypto market eased during the previous week, where Bitcoin slipped toward $ 42K, from $45K week before.

The FOMC members left rates unchanged on December`s meeting. The rhetoric of Fed Chair Powell in after-the-meeting statement was finally aligned with the market, and estimation that there will be no more rate hikes. The Fed acknowledged that the inflation has eased, without a significant drop in employment. However, the FOMC estimate is that the inflation is still high, and that further effort is needed in order to bring it down to the targeted 2%. The economic activity in the US has slowed down substantially in Q4, so the Fed is expecting GDP growth rate to reach 2.5% in 2023, as a result of strong consumer demand. FOMC members are projecting that the inflation will clearly reach level of 2% in year 2026. Although Powell did not exclude possibility for further rate increases if necessary, the FOMC members continue to perceive Fed's funds rate at 4.6% at the end of 2024, and its further decline during the consecutive years. As per CME Group`s FedWatch tool, the market is currently pricing a 25 bps rate cut in March, with expectations for current Fed funds rate to be lower by around 150 bps by the end of year 2024.

The European Central Bank also held a policy meeting during the previous week, leaving the rates unchanged. Although their US colleagues are at least mentioning expectations of rate cuts in 2024, the ECB diverged from such a scenario, mentioning that the rates will stay sufficiently higher for as long as necessary. The most recent inflation reading in November for the Euro Zone, shows that the inflation has eased to the level of 2.4% on a yearly basis. Still, considering Europe’s dependence on energy, analysts are noting the possibility for prices to swiftly move to higher grounds. On the other side are economists, which are projecting first ECB`s rate cut in June 2024.

During the year 2022 Coinbase submitted a request to the Securities and Exchange Commission with a petition for the establishment of the crypto regulation. The SEC finally provided an answer to the petition noting that there is no need for such a course of action as “the existing securities regime appropriately governs crypto asset securities”.

The US Financial Stability Oversight Council met during the previous week, issuing a report on risks coming from the crypto assets. The same report was issued also as of the end of the previous year, while the latest report did not add almost anything new to last year`s topics. The risks that should be overseen and regulated continues to be the volatility of the crypto assets, a high amount of leverage, the cyber security and risks for investors and potentially financial markets.

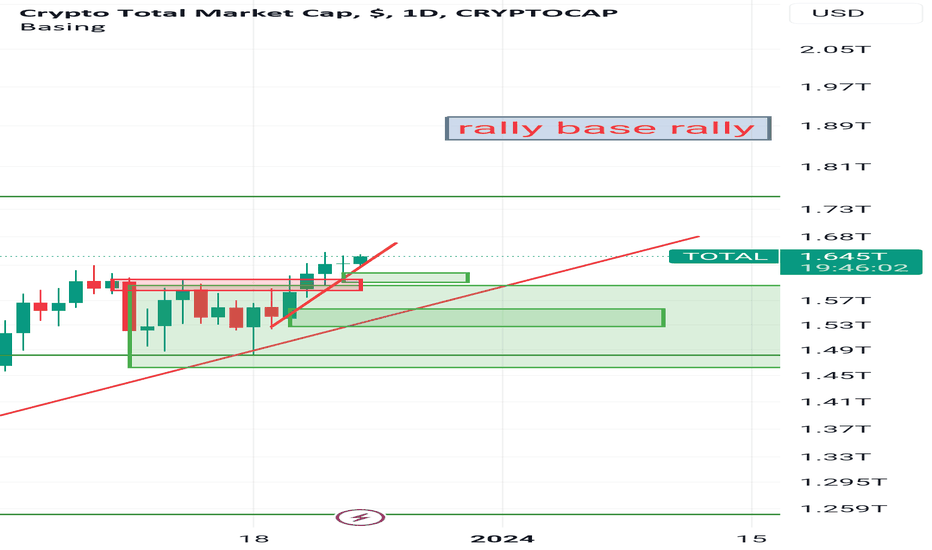

Crypto market cap

The Fed has finally aligned with the market. Although Fed is still not excluding the option of further increase of interest rates, still, Powell noted that majority of FOMC members are perceiving rates at 4.6% as of the end of the next year. Such rhetoric stands in line with the market expectation on further easing of inflation and Fed`s cut of interest rates by 25 basis points in March 2024. Market reacted positively to Powell's speech, and brought US equities to higher grounds, while Treasury yields fell sharply on the news. Still, the crypto market reacted in a negative manner to news that the SEC does not have plans to introduce new regulation which will cover specifically crypto assets. Instead, SEC Chair Gensler is of the opinion that current regulation in the US is sufficient to cover all regulatory aspects of crypto currencies.

Total crypto market capitalization modestly dropped during the previous week by 2,4%, losing around $39B. On a positive side that daily trading volumes remained at higher level, moving around $94B on a daily basis, a bit lower from $121B traded a week before. Total crypto market capitalization increase since the beginning of this year currently stands at 107%, where it has added total $810B to the market cap.

A drop in total market capitalization during the previous week was mostly driven by major coins, BTC and ETH. Bitcoin dropped around 3.4%, losing $ 29B in market capitalization. ETH lagged a bit behind the BTC, with a drop in value of 4.6% or above $13B. XRP was also in a group of significant losers with a weekly drop of more than 9% or $3.5B. Other altcoins were mostly on a weekly losing side, except a few which managed to finish the week in green. Among higher losers on a weekly basis were, ZCash, Link and Bitcoin Cash which dropped by more than 10% each. Algorand and Maker decreased their value by more than 9%. Litecoin, Stellar and EOS were down by more than 7%. Among several coins which managed to gain during the previous week were OMG Network, with a gain around 10% in value, while Filecoin increased its market cap by almost 3.5% w/w.

There has been some increased activity with circulating coins, where Polygon managed to add 2.9% of new coins into circulation and was followed by LINK, which made an increase of 2.0%. Within a group of higher weekly gainers of coins are Uniswap, with an increase of 1.7% and Filecoin whose coins on the market surged by 0.8%. For several weeks Tether continues to build the number of coins on the market, increasing it by an additional 0.6% during the previous week.

Crypto futures market

After three weeks of strong push to the upside, crypto futures eased during the previous week, in line with developments on the spot market. However, it is important to note that long term ones are managing to hold at elevated levels, despite the modest drop.

BTC short term futures were traded more than 5% lower from the week before. Futures maturing in December this year were last traded down by 5.73% on a weekly basis, still ending the week at level of $42.450. Longer term futures dropped a bit less, around 4.5%, with December 2024 ending the week at price $46.500, which is 5.18% lower from the week before. March 2025 is still holding above the $47K level.

ETH short term futures dropped by more than 5%, while longer term once had a drop of more than 2%. December 2024 closed the week at $2.257, or 5.84% lower on a weekly basis. Futures maturing in December 2024 were down by 2.3%, closing the week at level of $2.433. March 2025 is still holding above $2.4K level, despite the drop of 2.26% w/w.