TOTAL trade ideas

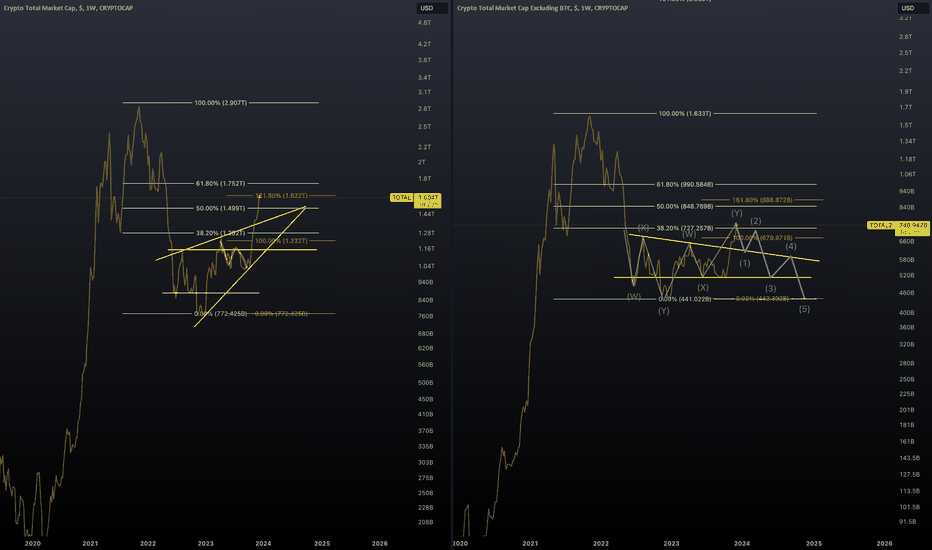

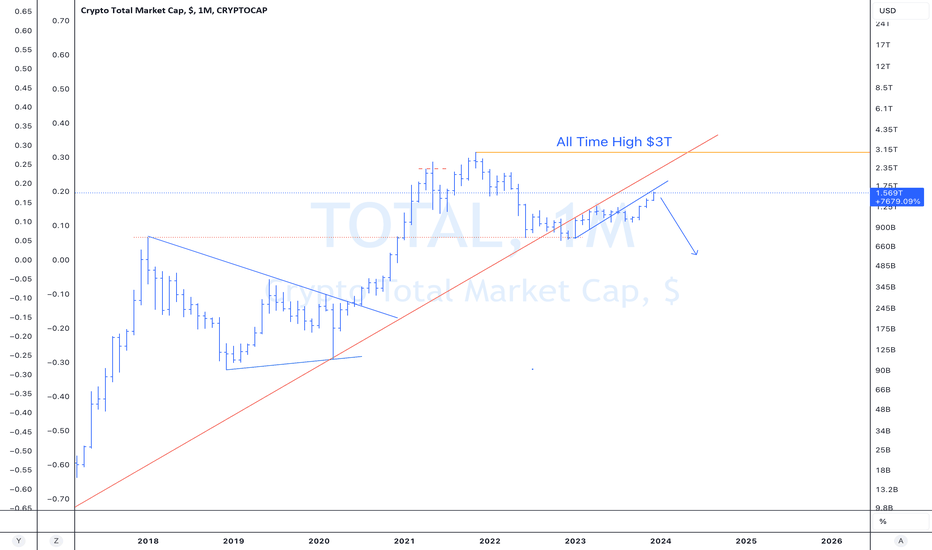

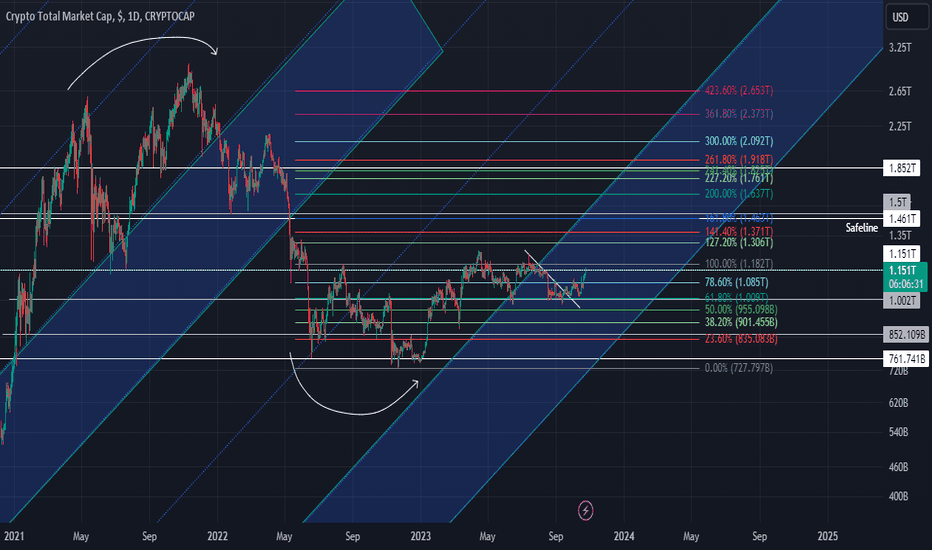

"Heading: Altcoins on Track for $5 Trillion Surge by 2025"Anticipating a Massive Altcoin Season: Exploring Potential Growth in Market Cap

Introduction:

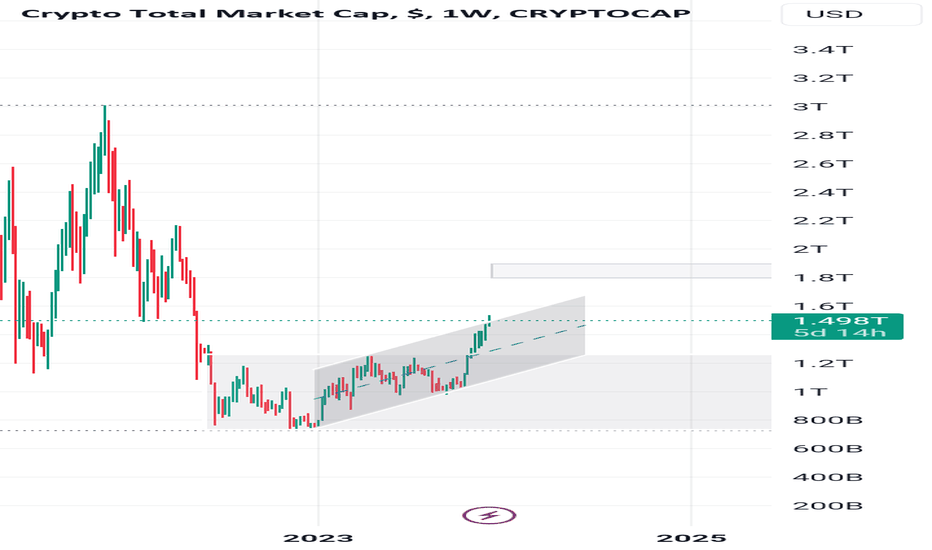

The cryptocurrency market is abuzz with predictions of an impending altcoin season that could lead to a staggering $5 trillion Altcoin MarketCap by 2025. This forecast is grounded in historical data, fractal analysis, and chart patterns, suggesting a pattern reminiscent of previous market cycles.

Historical Context:

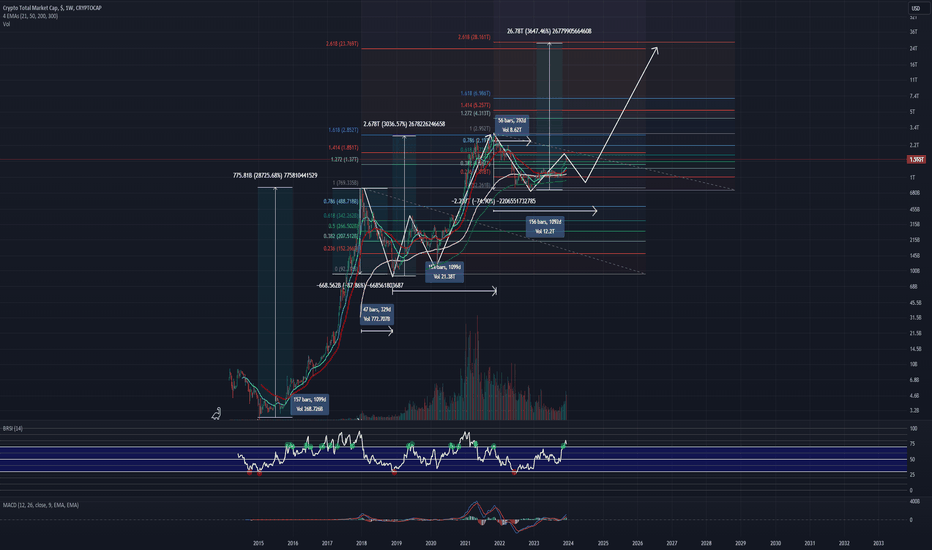

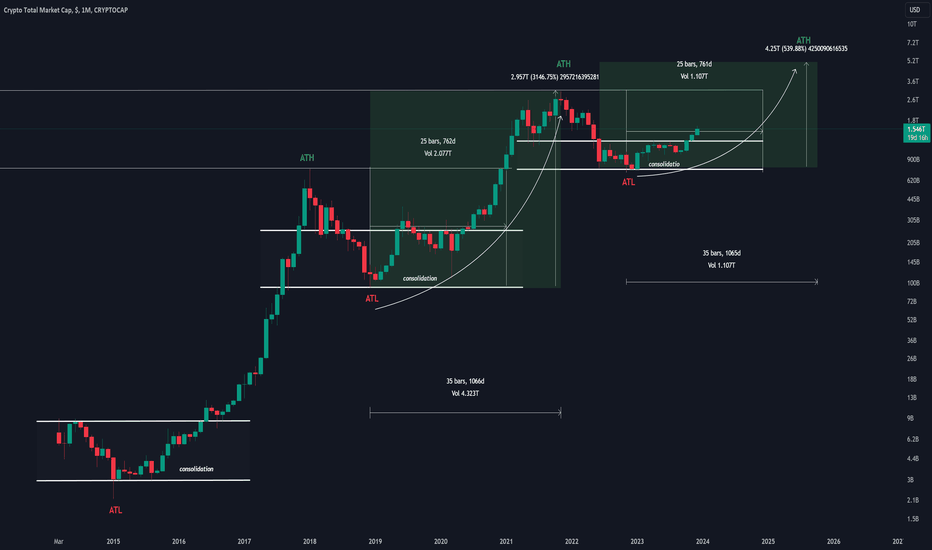

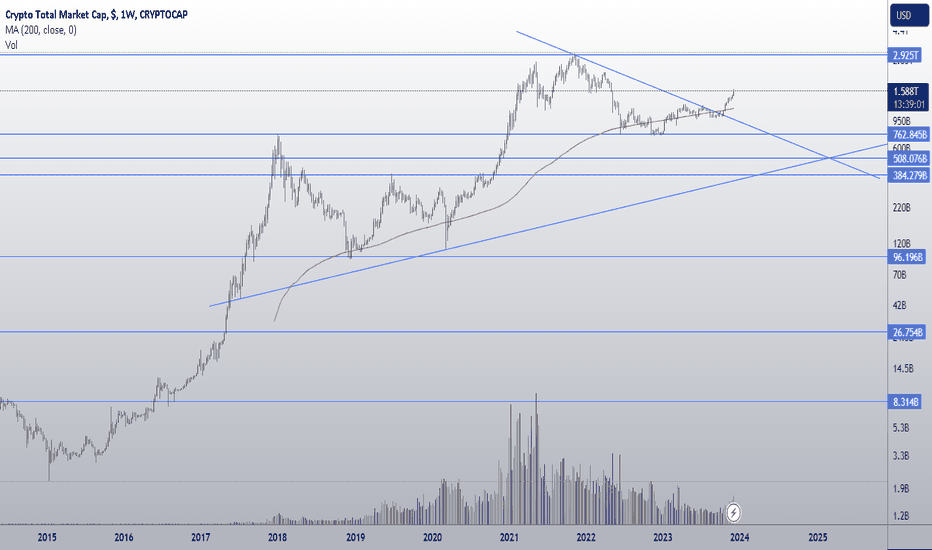

Examining the historical data reveals intriguing patterns:

After the all-time low (ATL), it took 762 days for the Total Market Cap to surpass its previous all-time high (ATH).

If history repeats itself, a new ATH could be reached approximately 761 days from today, potentially around December 2024.

The last bull run lasted about 1066 days, and the current one is expected to span between 1071 to 1064 days.

Fractal Analysis:

The fractal analysis unveils a compelling narrative:

In 2014–2015, the market experienced 610 days of consolidation.

2016-2017 witnessed a parabolic rise in Altcoin MarketCap, hitting Extension 3.168 at around $400 billion.

2018-2019 saw another 609 days of consolidation before a breakout.

Currently, in 2022-2023, the market has undergone 548 days of consolidation, hinting at an imminent breakout.

Future Projections:

Building upon the historical context and fractal analysis, the projection for 2024-2025 unfolds:

Anticipating that Altcoin MarketCap will experience a surge, reaching Extension 3.168, estimated at $5 trillion.

The expected timeframe for this extraordinary surge is set for the period of September to October 2025.

Conclusion:

Considering the historical patterns, fractal analysis, and projected timelines, the narrative paints a bullish outlook for altcoins in the long term. The predicted Altcoin MarketCap of $5 trillion by 2025 suggests significant potential for growth and underscores the importance of keeping a keen eye on market dynamics in the coming years. As the cryptocurrency landscape evolves, investors may find compelling opportunities in the altcoin space, marking the potential for a substantial shift in market dynamics.

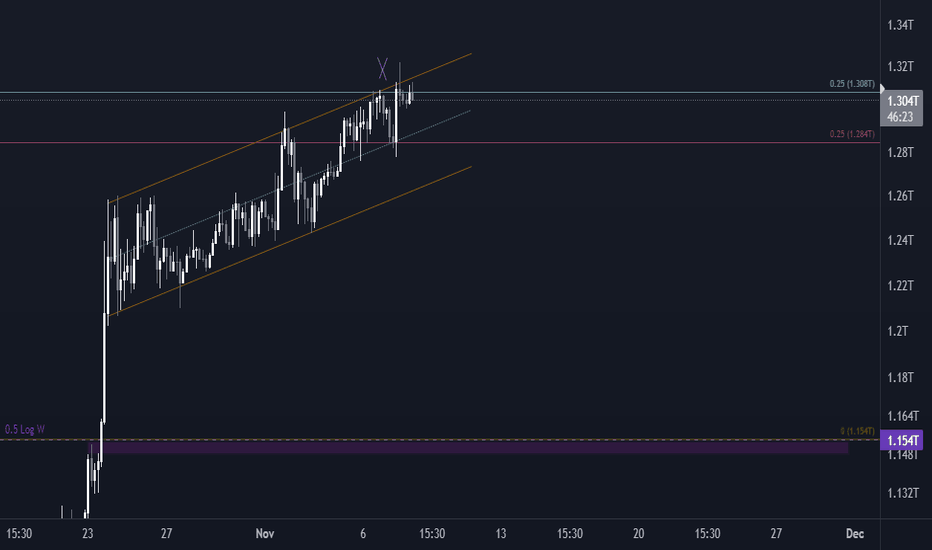

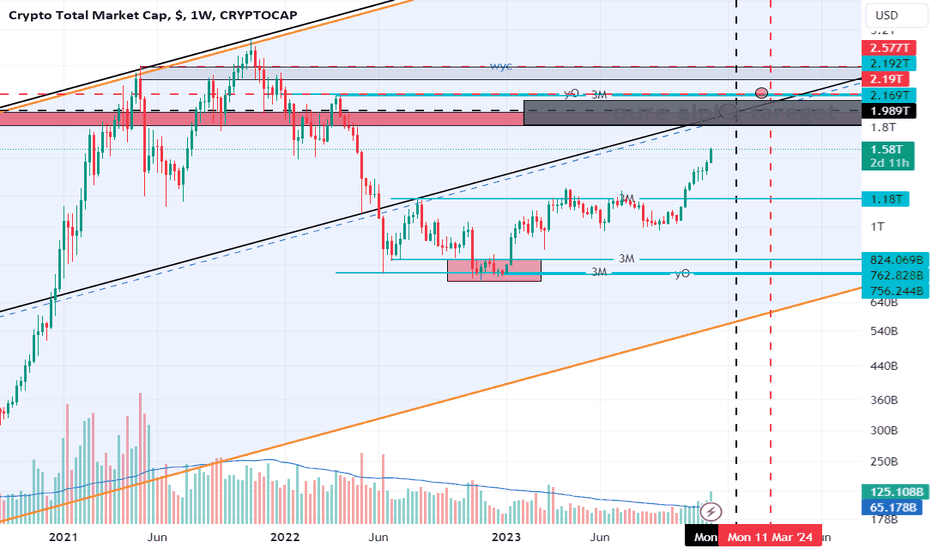

TOTAL 1 Will Crypto Christmas come early?I was thinking to wait till tomorrow till I post this analysis so more people could see it but oh well, let us do it today cause you never know what happens.

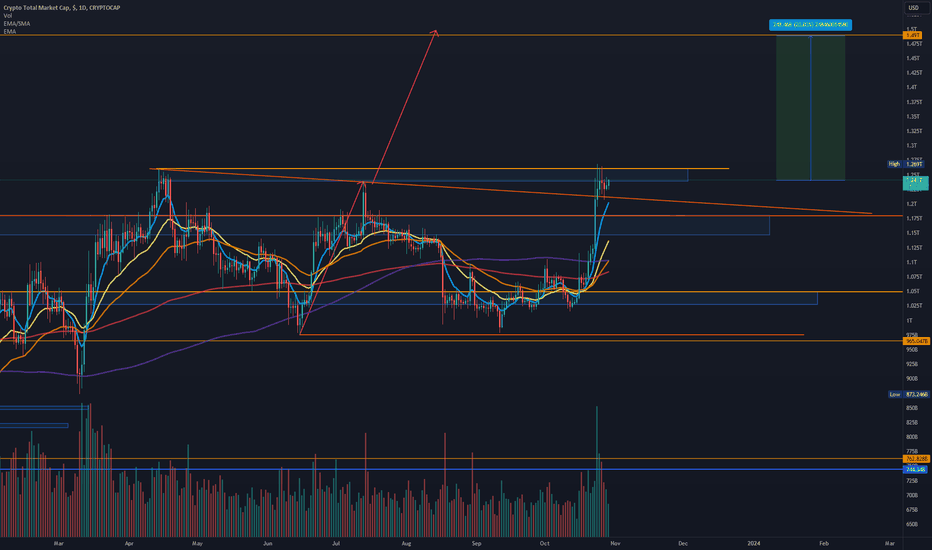

I think this is one of the most important charts when following crypto markets. (cause it shows crypto markets money inflows and outflows).

Bitcoin has broken out already from this years highs week ago (I'll add picture down), BUT Total 1 marketcap hasn't made higher highs yet.

If and when this breaks I believe we will see surge on BTC and possibly on alts that will wake up the bull narrative again. (News etc)

Target is 1.49 Trillion so that would be 250 Billion inflows to crypto markets, that's 20% rise!

Better to be prepared than get caught with pants down

Two active trades going on DYDX and GOLD

-PalenTrade

MARKETS week ahead: December 11 – 17Last week in the news

The strong resilience of the US economy continues to support market optimism, after the latest posted US jobs data for November. The USD gained during the week as well as both US and EU equities. While Gold is trying to get back into correlation with USD, US Treasury yields continued with a decline. The crypto market continues to be supported by both the resilience of the US economy and the BTC ETF frenzy, with Bitcoin reaching new highs for this year, below $45K.

The US non-farm payrolls rose by 199K in November, modestly better from market forecast. At the same time, the unemployment rate fell down to 3.7%, from 3.9% posted for October. The job market continues to be resilient to macroeconomic developments. November figures came as a surprise to analysts, but eventually some of them call it a “relief” as it shows that despite strong rate increases during the past year, the US economy managed to sustain jobs and businesses.

The European Union is aiming to regulate AI technology and products like ChatGPT. There has been a lot of discussion during the previous months, related to data privacy on platforms like ChatGPT or biometric models. At the same time, Italy, France and Germany are opposing tight regulating rules, especially for foundation models, stressing the concern that it might impact their competitiveness with the Chinese and the US tech industry.

The Binance exchanger has withdrawn their license for the investment license in Abu Dhabi. The company has noted that such a move is not related to recent legal settlements with US regulators, but they find it “unnecessary for the company’s global needs”.

A global regulator of the financial industry, the Basel Committee, is looking at risks that stablecoins pose for financial security, aiming to bring up regulations which will decrease identified risks. This regulation should address bank`s exposures to the crypto industry and mitigate potential risks of defaults like recently Silvergate Bank and Silicon Valley Bank.

El Salvador, the first state that made Bitcoin a legal tender, is going further with its state experiment with crypto currencies. The recently started project called “Freedom VISA” aims to attract 1.000 people on a yearly basis, which will gain El Salvador long-term residency permit, based on a minimum $1 million investment worth of bitcoin or USDT stablecoin. The country is estimated to receive at least $1 billion of cash inflow every year through this program.

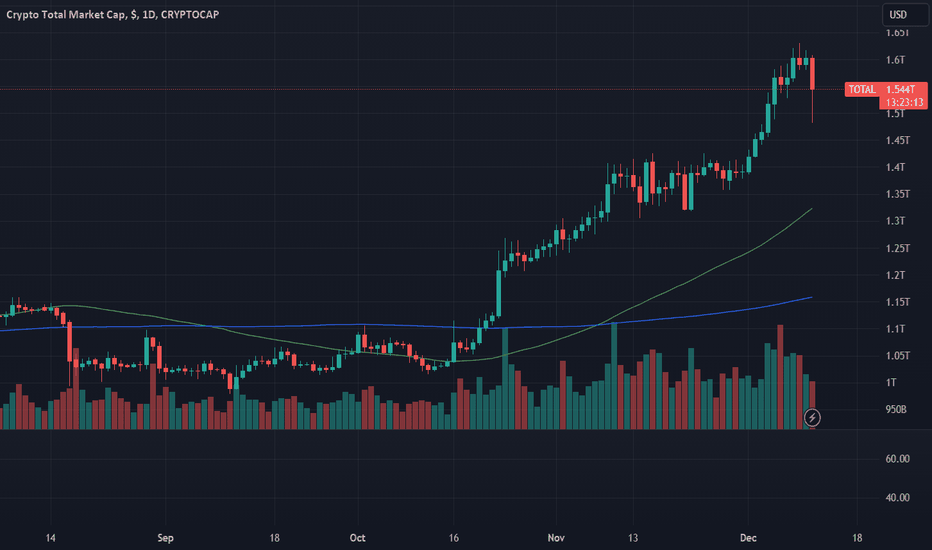

Crypto market cap

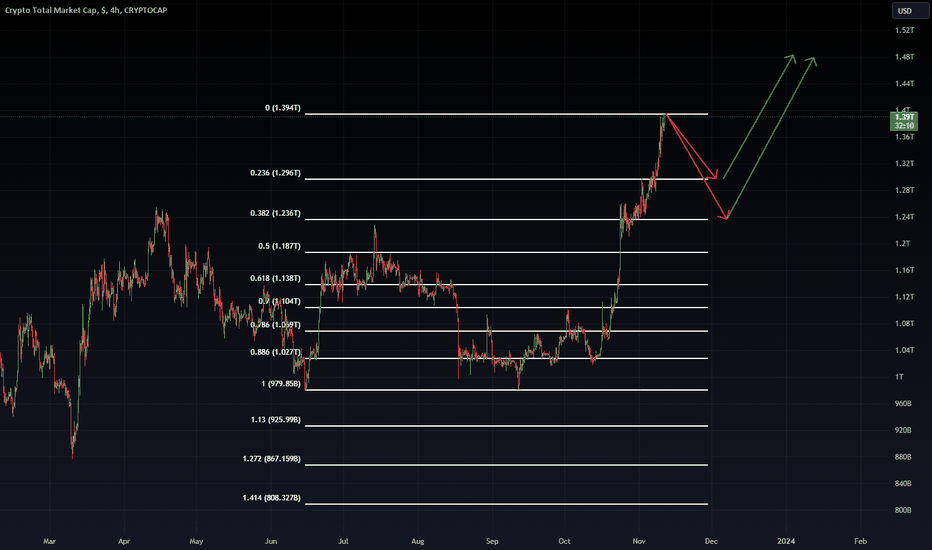

The positive mood on financial markets continued through December, promising a very happy forthcoming New Year holidays. The latest published jobs figures for November this year supported further market optimism over the resilience of the US economy. Both EU and US stock markets reacted in a positive manner, boosting also further the crypto market, which is in addition, still moving within a sentiment over its further adoption by the mainstream. Analysts and investors are currently moving away from the US Fed rhetoric and pricing their view on the course of the economy in the future period. Total crypto market capitalization was increased by significant $179B, with an increase of 12.6% on a weekly basis. Daily trading volumes have also significantly increased to the level of $121B on a daily basis, which is a further boost from $ 67B traded the week before. Total crypto market capitalization increase since the beginning of this year currently stands at 112%, where it has added a total $840B to the market cap.

Total crypto market significantly gained during the previous week, with the majority of coins finishing the week in green. In nominal terms, Bitcoin was once again star of the week, adding 13.8% to its market cap, or almost $105B. The second place belongs to Ether, with a surge in value of 12.6%, adding $ 32B to its market cap on a weekly basis. As a significant gainer should be mentioned Cardano (ADA) with a surge in value of $8.2B or 60.2%. This was a reflection of Cardano`s Robinhood listing in the EU. Solana was also in the spotlight of the market with a gain of $6.3B in market cap or more than 24%, which was supported by the successful network upgrade. DOGE gained $2.5B, increasing its cap by 21%, BNB also gained $ 2B which surged its value by 6%. Polkadot was also a $ 2B gainer of the week, adding more than 24% to its value. Majority of other altcoins gained significantly during the week, where especially should be mentioned Algorand, with an incredible surge in cap by 52.5%. There is still no official news what exactly was standing behind such a move.

Activity in circulating coins remains relatively high during the last couple of weeks. The highest changes during the week were with Tether, which added 0.9% of new tokens, Stellar increased the number of circulating coins by 0.4%, while Filecoin traditionally continued with a surge in coins on the market, adding 0.6% during the previous week. The only negative change was with Polkadot, which decreased its coins by 3.7% on a weekly basis.

Crypto futures market

In line with the spot market, the crypto futures market made its significant move during the previous week. This market is also providing some important inputs over the sentiment of investors on the crypto market.

BTC both short and long term futures were higher by more than 14% on a weekly basis. Futures maturing in December this year reached the last price of $45.030. At the same time those maturing in December 2024 reached the price of $49.040, which is the first time within the last year that those futures finished the week around the level close to $50K resistance. Still, it should be noted that prices of futures maturing in March 2025 reached $47.760, which is a bit lower from December 2024.

Similar situation was with ETH futures. Short term ones were traded higher by around 11% on average. December 2023 ended the week at a price of $2.397, while December 2024 was last traded at $2.490. It should be also noted that March 2025 ended the week at $2.525 indicating current investors positive sentiment regarding future ETH price.

Bearish divergence This is likely to break down around the 17 December a historical break day when everyone goes on Christmas holidays an takes profit to buy presents very likely the overheated crypto space will correct before the halving at some piont between now an the halving around April not a problem for long term investors but for the short term there is potential profit taking likely to line up with btc hitting 48k ,as someone who is bullish I cant see 50k in my minds eye this year

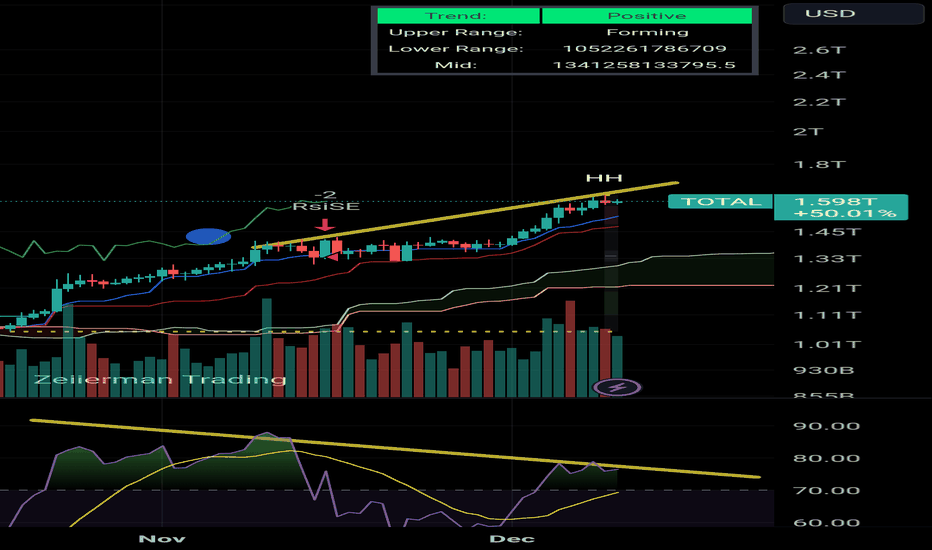

TOTAL MACRO ANALYSISTOTAL CRYPTO MARKET CAP;

-Has exploded since it entered into Ichimoku Cloud.

-Typically, we see prices reach the opposite side of the cloud.

-That area also lines up with the yellow neckline as resistance.

-I think we pump the remainder of the year for the most part.

-Could see a sell-off after the end of the year.

-I would think dips on the new year are for buying before the BTC halving

Please follow me here for more crypto analysis and a safer way to read charts to minimize risk.

**This idea is not financial advice, its just my 2 cents.

Thanks for your time!

~Cosmicbag

🚨 Bye Bye Crypto! .... AGAIN 🚨Here is a list of all the ridiculous nonsense narrative that the the "pros" and media pump:

First they say: “Nobody knows what will happen”

Followed by the clown talk:

"Buy the dip" 🤡 🤡 🤡

"LFG"

"Santa rally" 🤡 🤡 🤡

"The tortoise and the hare"

"V-bottom recovery"

"Focus on the long term"

"It’s priced in" 🤡 🤡 🤡

"Stay invested" 🤡 🤡 🤡

"Transitory inflation" 🤡 🤡 🤡

"Tesla is the future" 🤡 🤡

"Bitcoin is the future " 🤡 🤡 🤡

"Elon is a genius" 🤡 🤡 🤡

"The ruble is strong" 🤡 🤡 🤡

"China opening back up"

"AI"

"GameStop" 🤡 🤡 🤡

"A little macro / a little micro"

"Smart money buys bonds"

"Tom Brady"

"Matt Damon"

"A little earnings play"

"This is why it’s important to watch earnings" - TV verbatim.

Crypto Marketcap Ascending Triangle -MicroStrategy huge purchaseFacts:

In last 30 mays, 26 875 BTC was mined.

In same period, MicroStrategy has purchased 16 130 BTC.

Purchased amount equates to 60.0% of total Bitcoins mined in given time period.

Price action:

On above chart we can see that supply is drying up, hence higher lows.

Also, while expecting higher prices, nobody is willing to buy higher, resulting in same highs.

This combinations forms an ascending triangle, which is usually a bullish pattern.

Conclusion:

While smart money is buying big, dumb money is waiting for the dip to outsmart the smart money. Everyone wants the price to go higher without buying higher.

Eventually, when supply is exhausted, shorts will be liquidated, and dumb money will end up buying higher.

Trend is your friend, until the end. Only then he is your enemy.

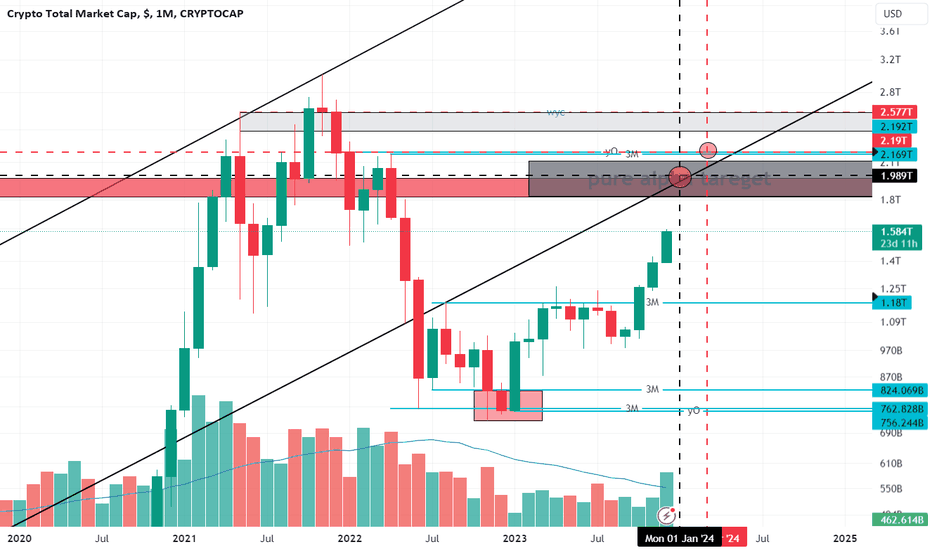

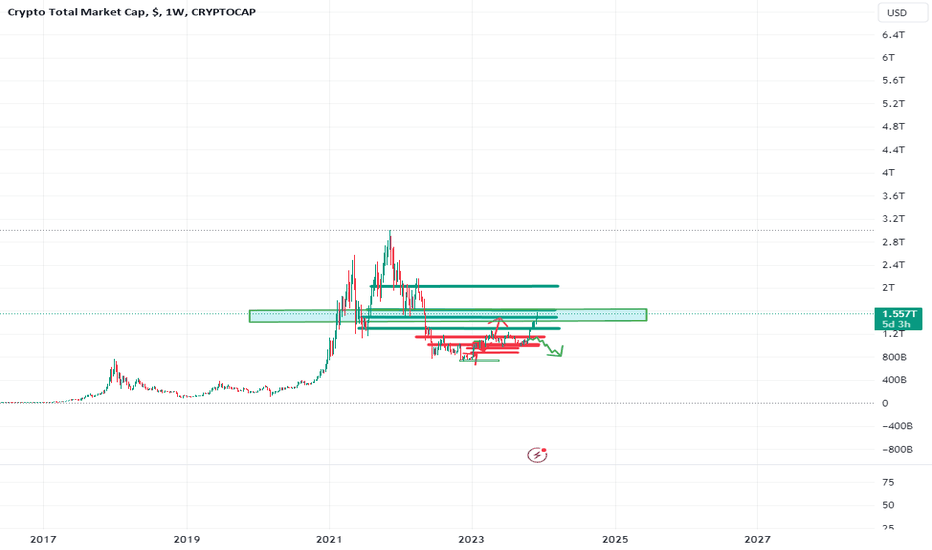

Market volume analysis

The market volume is also in the Ardar Block area

If it can reject the resistance I have already drawn and there are ahead of the analysis

Can act exactly like 2019 and 2020

Note that the market has increased by 718 percent over the years and has reached $ 3 trillion.

If you say it can also be a volume this time, I can estimate the market volume in 2024 - 2025 - 2026 years between $ 8 and $ 10 trillion.

You may be surprised now, but those who are more than 5 years old in the market are not surprised and can also get a volume

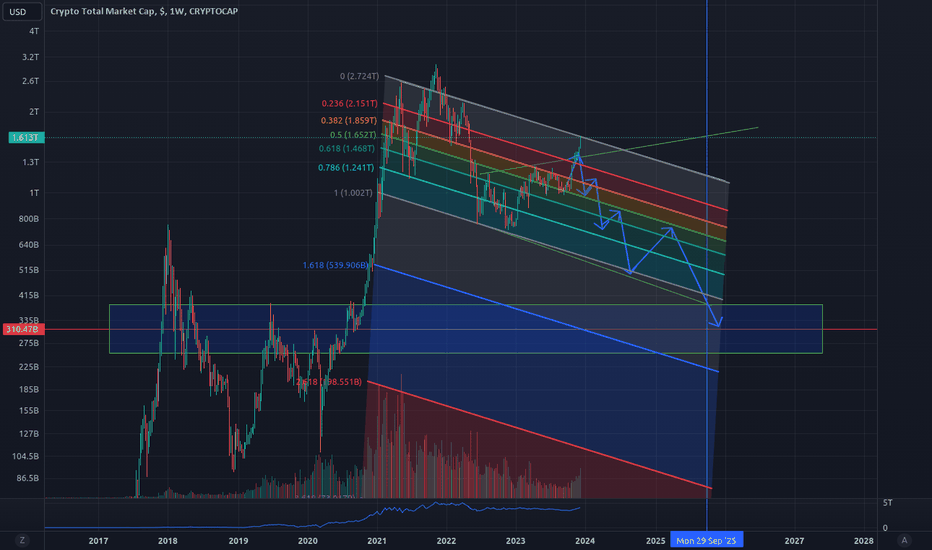

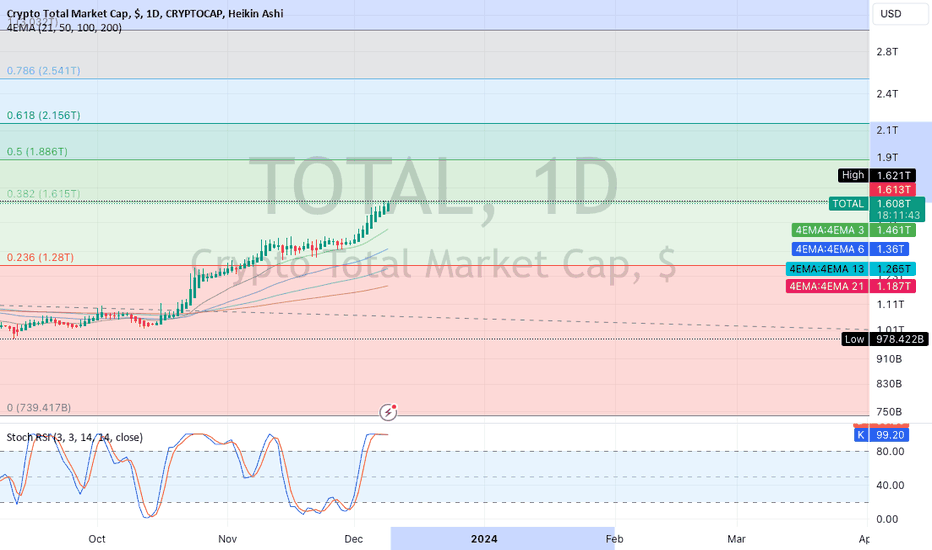

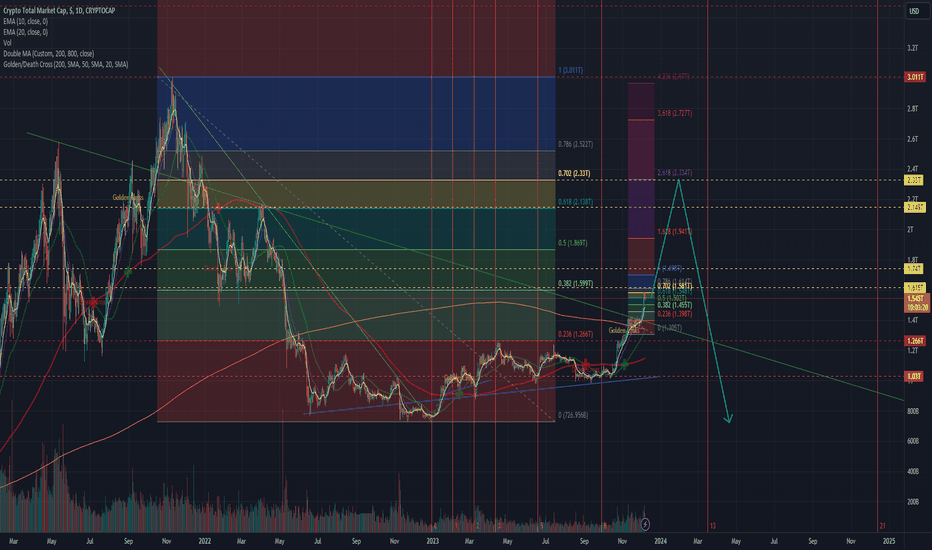

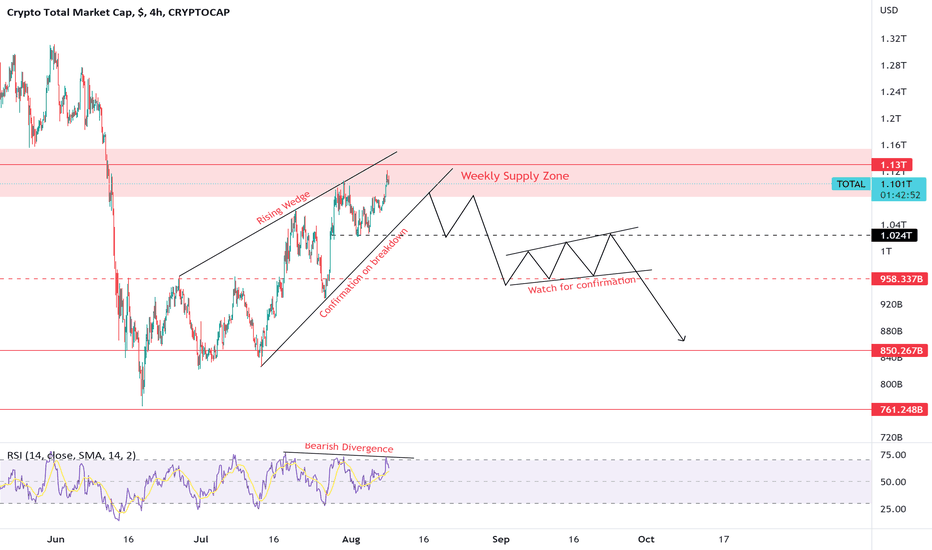

Crypto TOTAL Market Cap is about to DUMPThis chart represents the total market cap of Cryptocurrencies. Bullish momentum in this chart means money is coming in cryptocurrencies and vice versa.

Currently, TOTAL is at Weekly Supply Zone and Forming Rising Wedge which is a Bearish Traditional Chart Pattern.

RSI is showing Bearish Divergence on H4 and Daily.

If it breaks the trendline support of Rising Wedge, I will be looking to Short on BTC and other alts with the mentioned targets.

Hit the boost button if you like my idea.

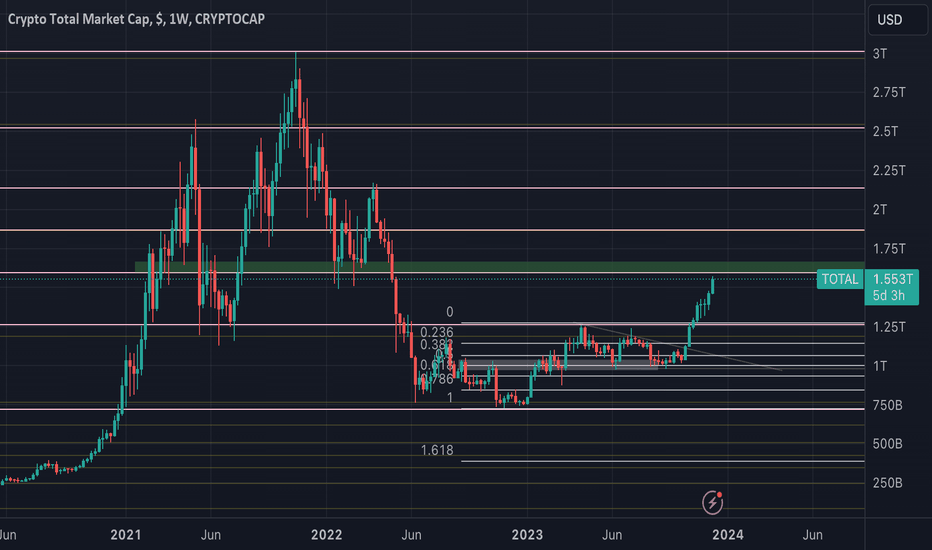

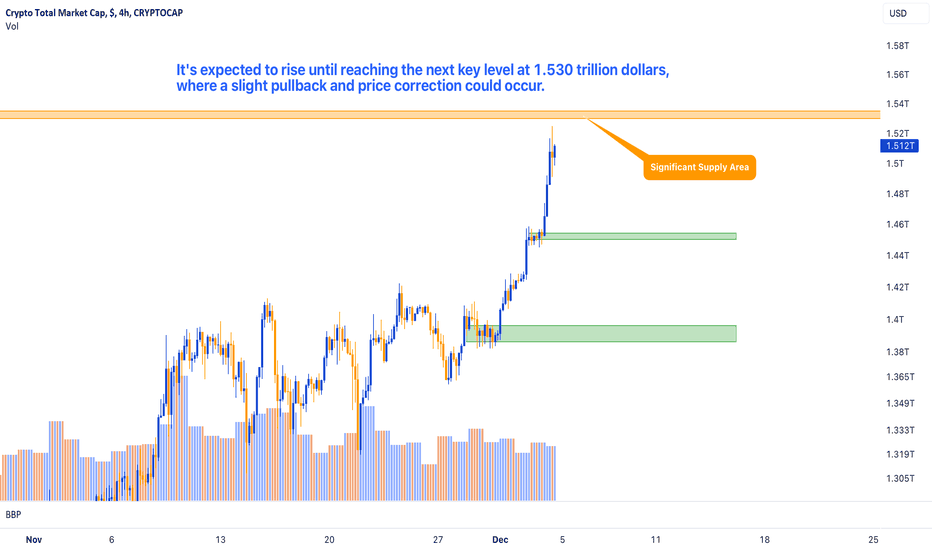

Market Cap SurgesThe Total Market Cap has successfully broken through a key resistance level that it had struggled with multiple times, signaling a positive upward momentum.

The market is currently on a strong upward trend.

After surpassing this resistance zone, it is expected to continue rising until it reaches the next significant supply area, around the 1.530 trillion dollar mark. At this point, we might see the market take a breather, potentially leading to a slight pullback in prices as part of a natural market correction.

This analysis is for informational purposes only and should not be considered as financial advice.