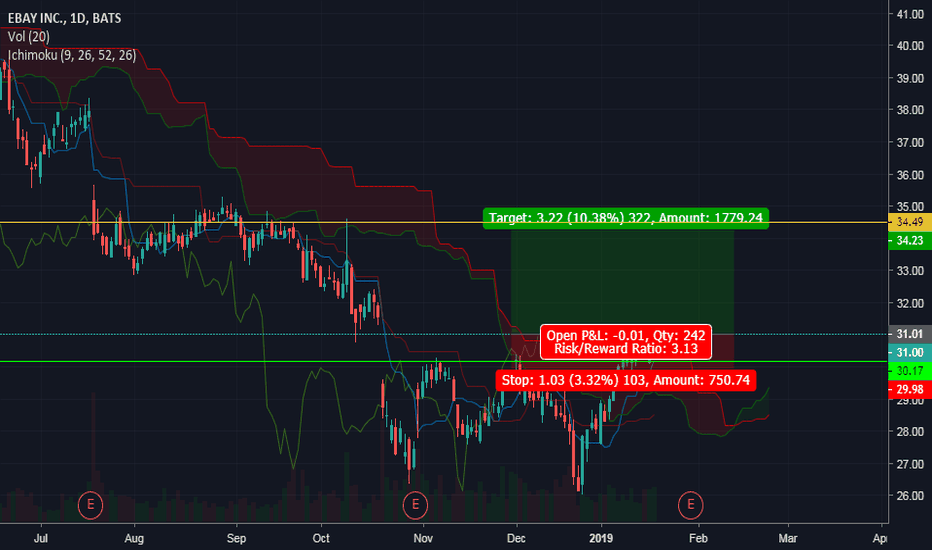

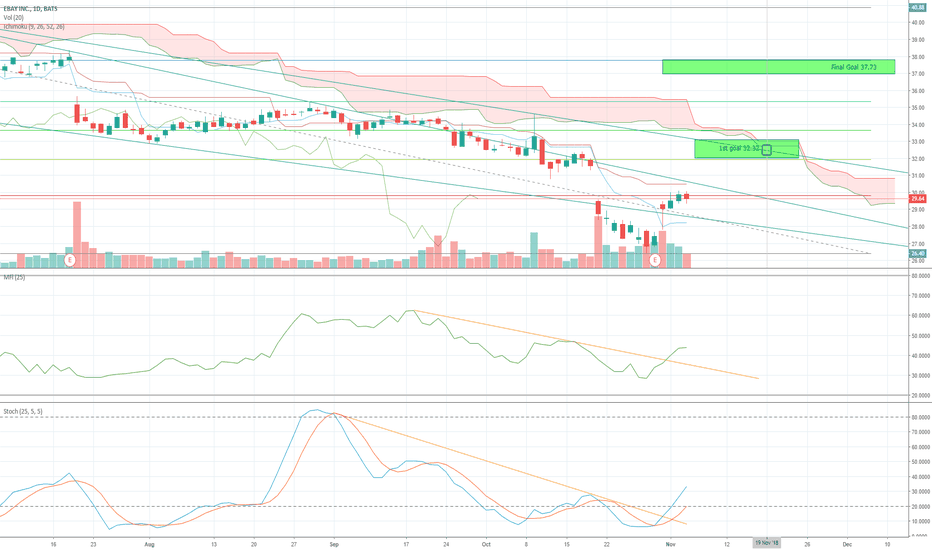

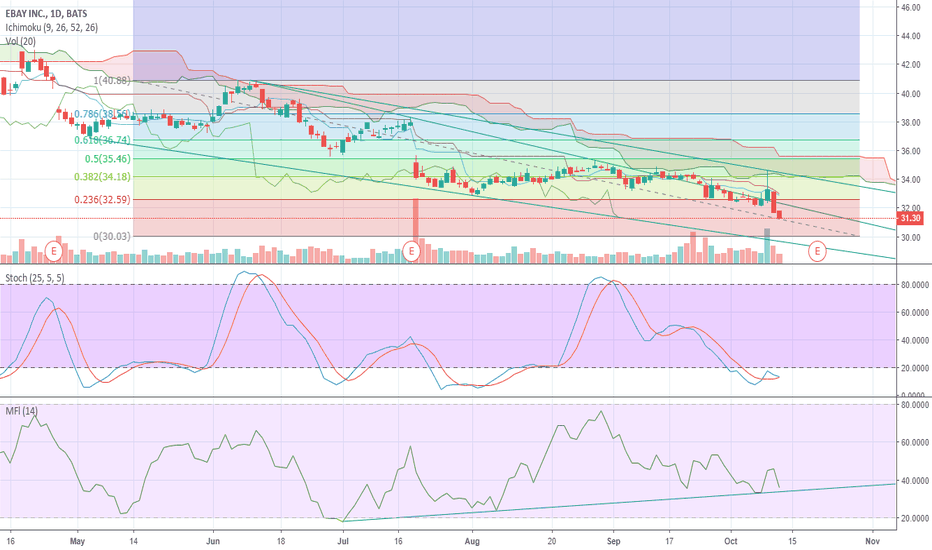

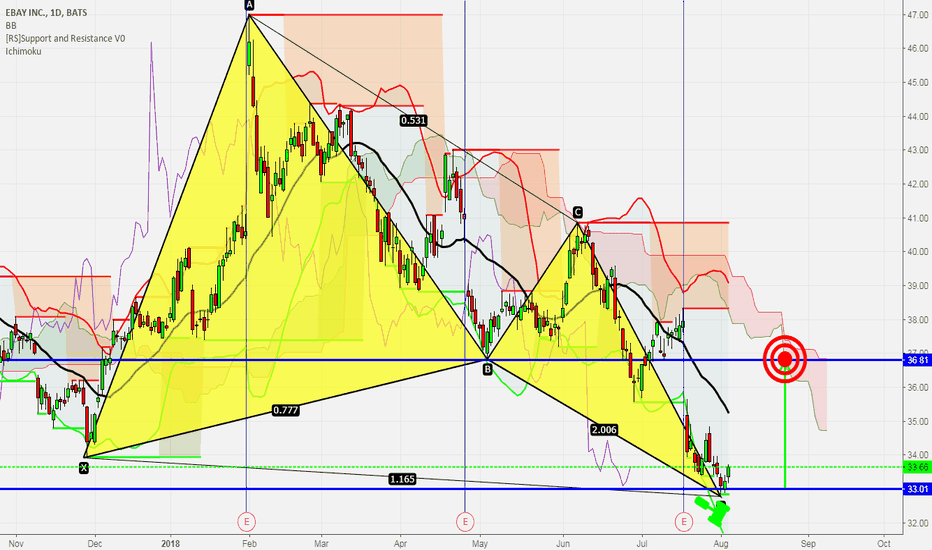

EBAY ichimoku signalIchimoku singal

Conversion over base

Bullish cloud

Candle closed above cloud

Lagging span closed above cloud

Trend continuation signals

Higher highs, higher low

double bottom

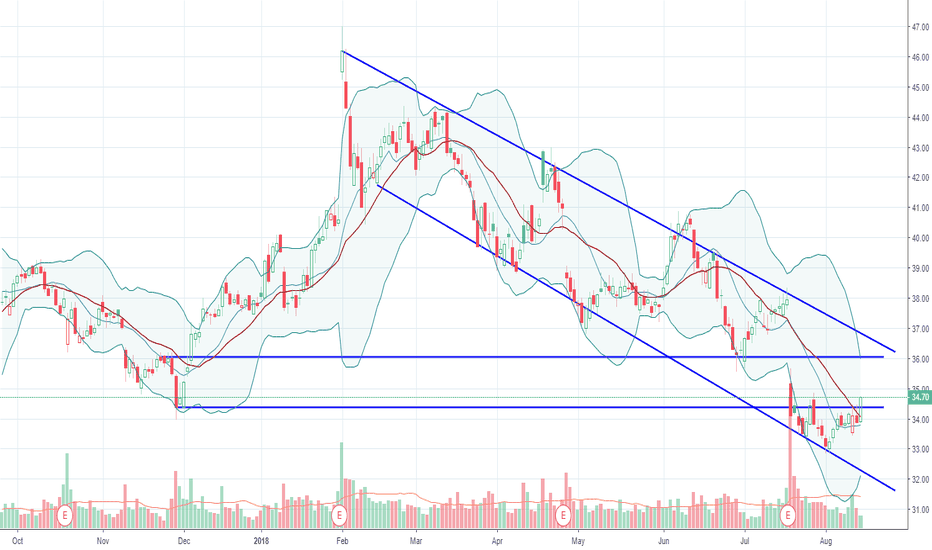

Support/Resistance

green previous support on daily

Yellow strong resistance on the daily (there's a couple of weaker resistance lines on the daily on the way up)

3:1 Risk/Reward

appreciate the feed back from the experienced guru's out there as this is the first analysis i'm sharing. i'm just a dumb boilermaker!

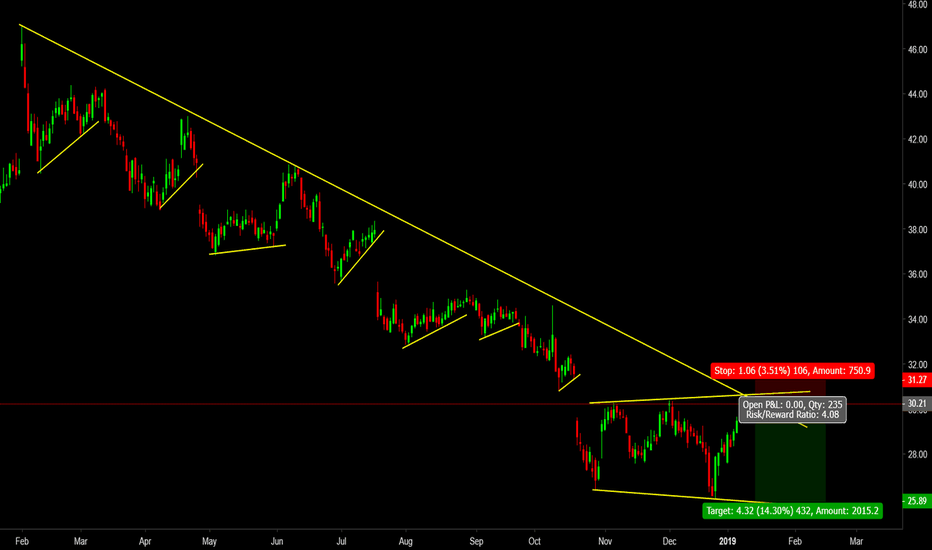

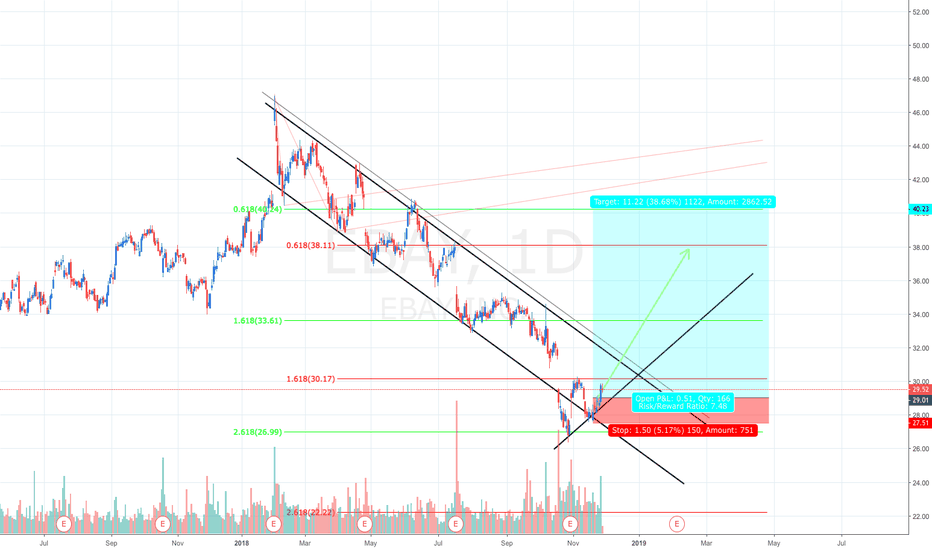

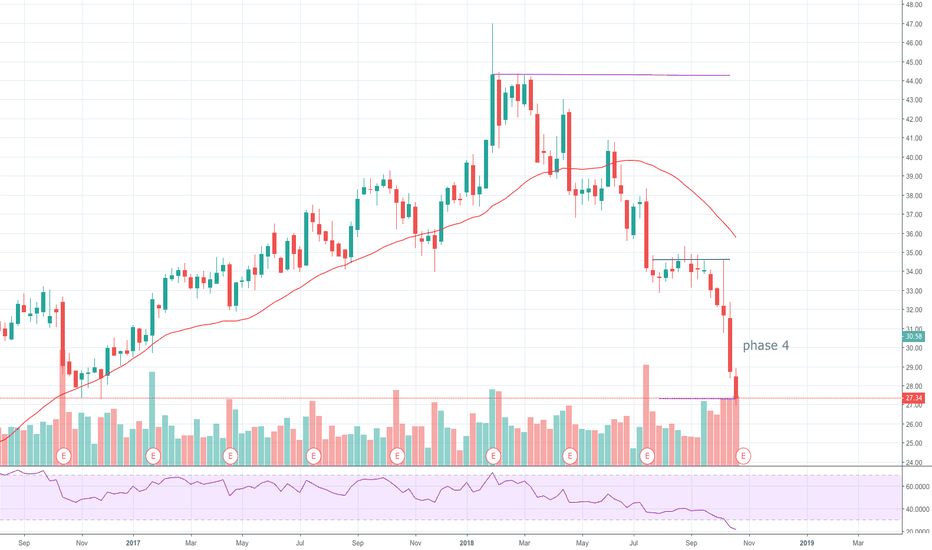

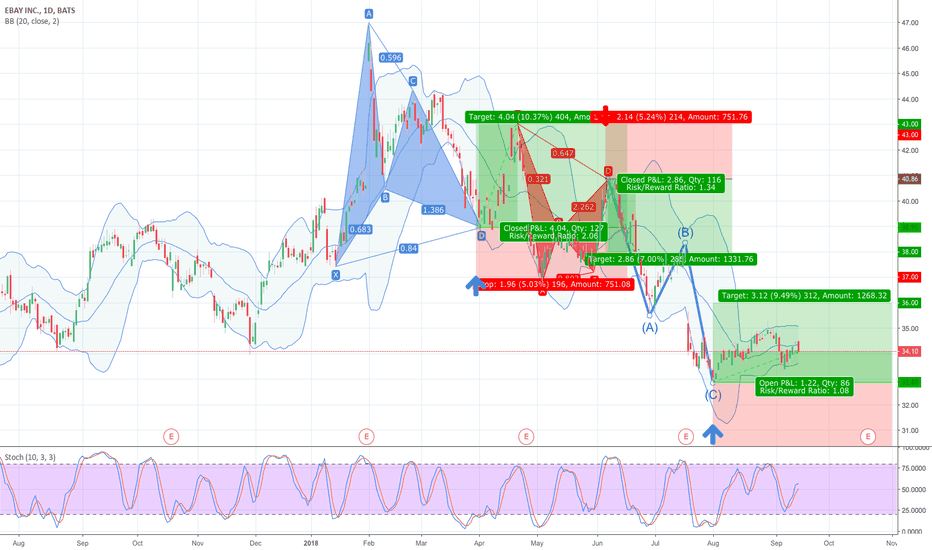

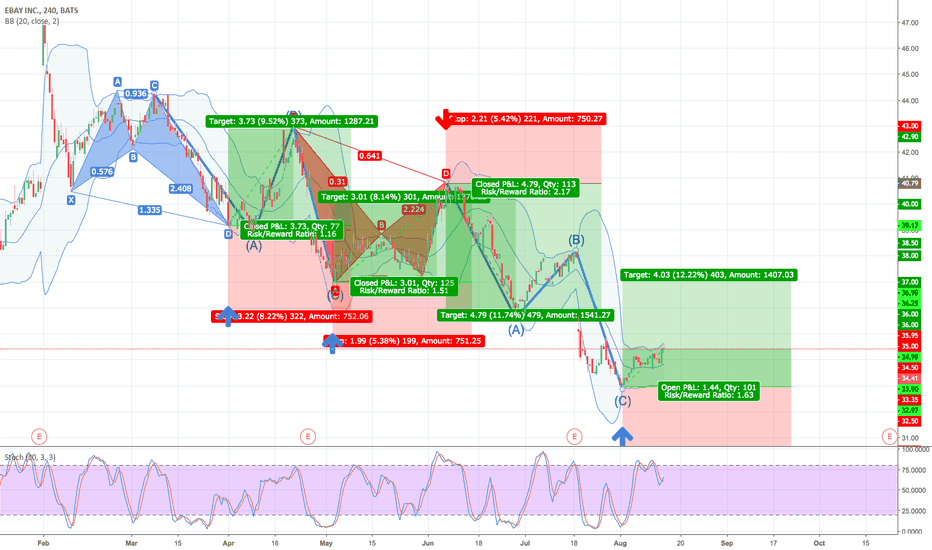

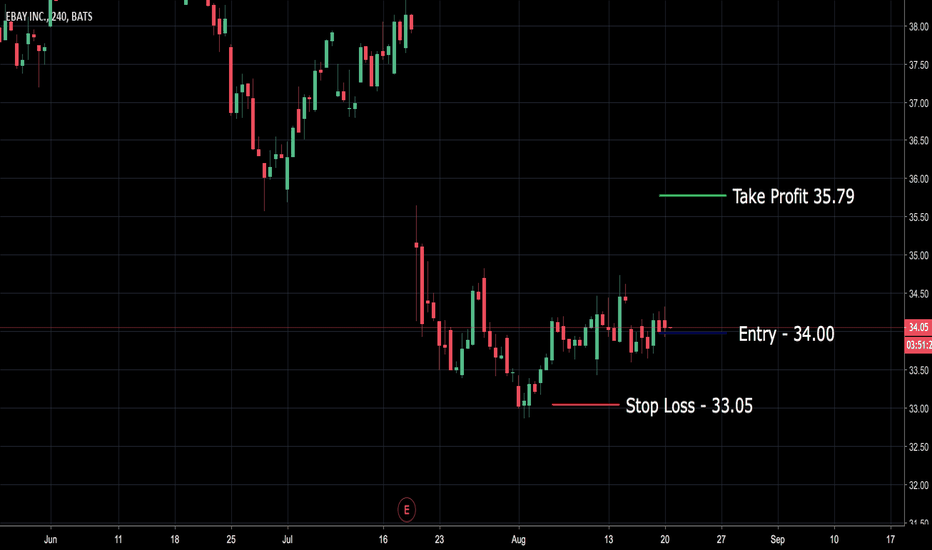

EBA trade ideas

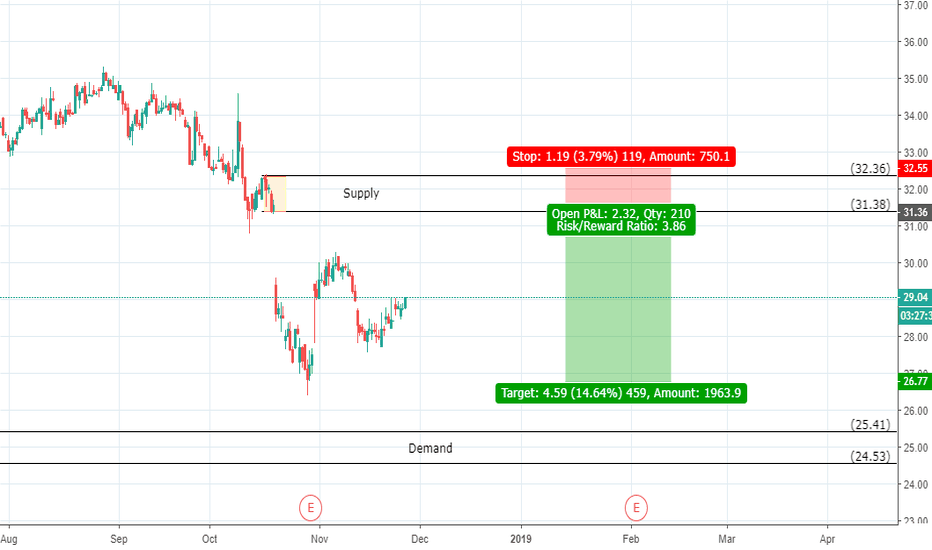

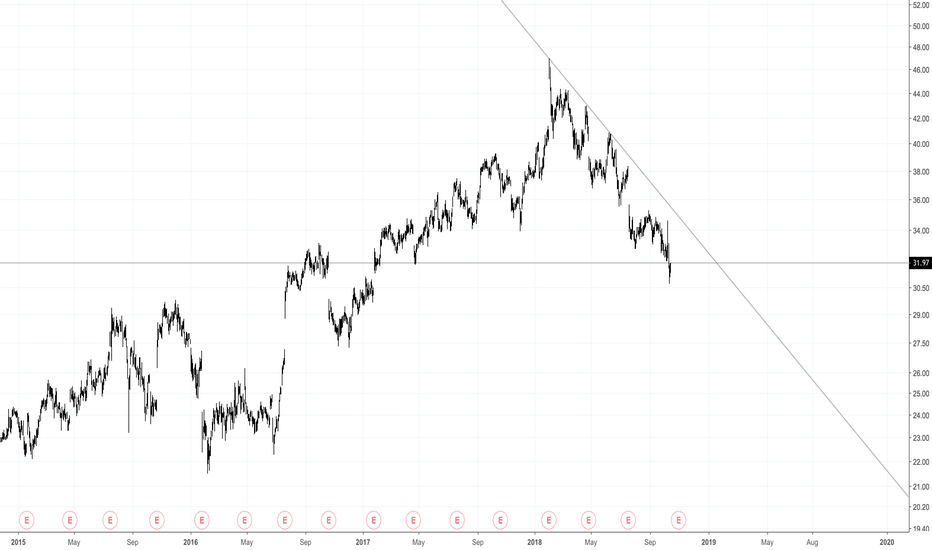

Ebay Stock SpeculationBigger picture suggests we are close to significant demand. As we move to the lower time frame we can see supply above. Looking to use the supply to take us down to demand to ultimately get long. For now we will focus on this intra-day level. Look forward to another post of this chart soon.

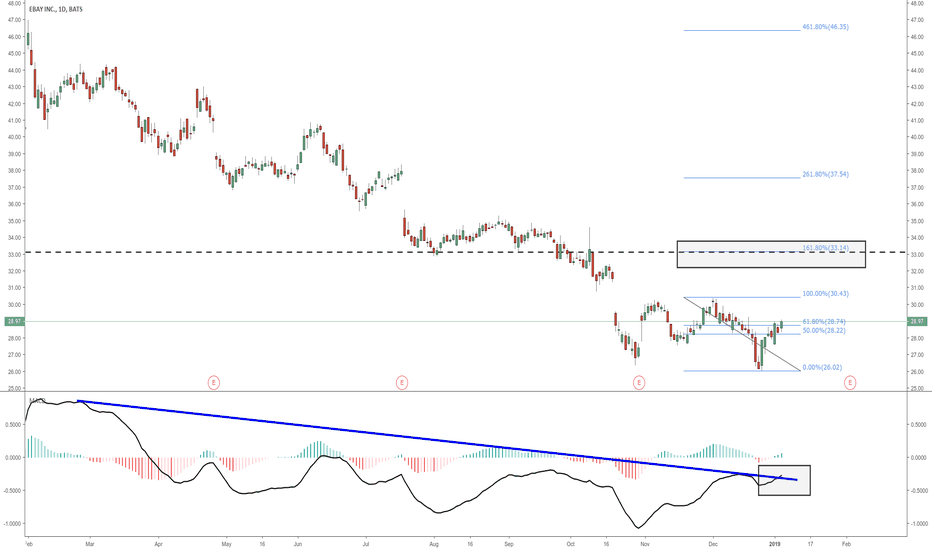

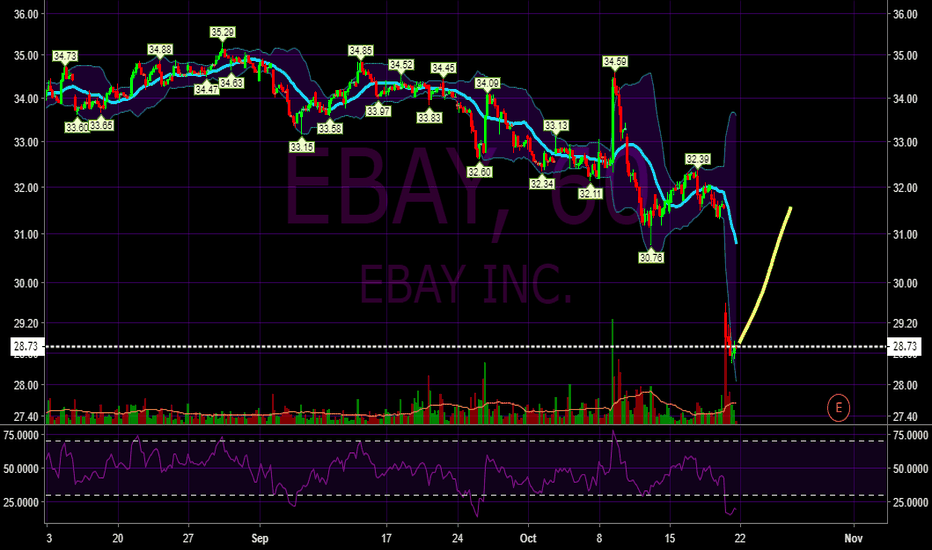

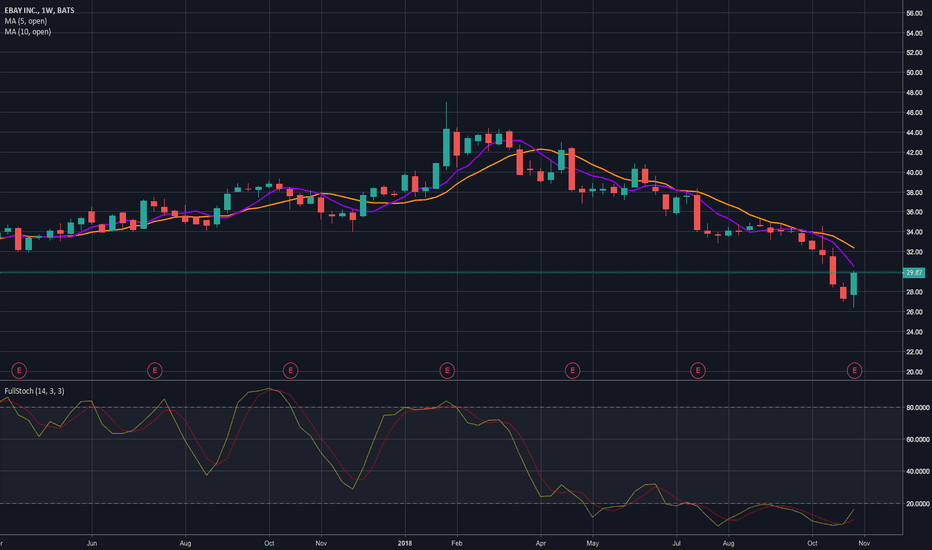

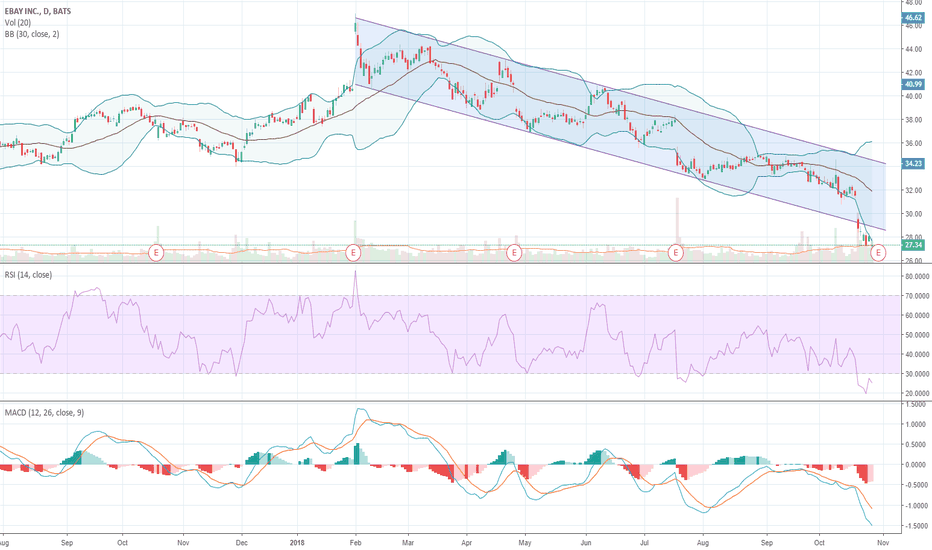

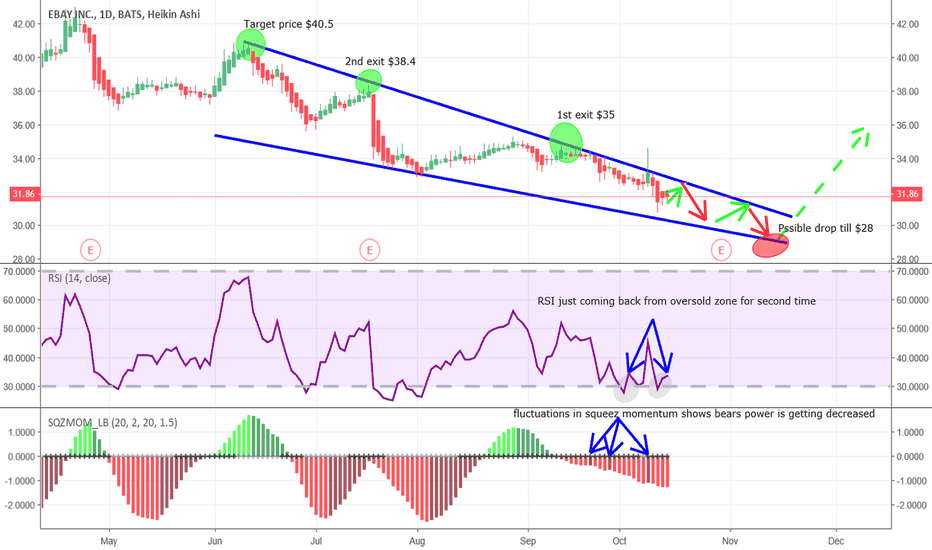

EBAY finally getting ready for bullish divergenceHi guys:

Since 11 June 18 the EBAY priceline is moving within a falling wedge but now it is going to break the resistance of wedge and bulls are going to take charge soon.

RSI went to oversold zone for second time now it moving back

Candles are almost at the end of wedge but there is some more cushion for pirceline to move down till $28

The squeeze momentum has fluctuated for 3rd time which is indicating that bears are loosing charge and bulls will take over soon

Profit possibility: 15 to 40 percent (depends on entry point)

Entry point: $28 - $32

1st exit: $35

2nd exit: $38.4

3rd exit and target price: $40.5

Best of luck and regards,

Atif Akbar (Moon333)