uraniumThe 10-year Treasury bond yield plays a significant role in the energy markets, including uranium, by influencing financing costs, investment decisions, and broader economic sentiment, which in turn affect uranium demand and pricing dynamics.

Significance of the 10-Year Bond Yield in Uranium and Energy Markets:

Benchmark for Financing Costs

The 10-year Treasury yield serves as a benchmark for long-term borrowing costs for utilities and mining companies involved in uranium production and nuclear energy infrastructure.

Higher yields increase the cost of capital, potentially delaying or raising the cost of new uranium mine developments and nuclear plant investments. Conversely, lower yields reduce financing costs, supporting expansion and production.

Indicator of Economic and Inflation Expectations

Rising 10-year yields often signal expectations of stronger economic growth and inflation, which can boost energy demand, including uranium for nuclear power generation.

Declining yields typically reflect economic caution or slowdown, which may temper energy demand growth.

Impact on Utility Procurement Behavior

As uranium accounts for only about 5–10% of nuclear power generation costs, utilities prioritize securing supply to avoid operational disruptions, even at higher prices.

When bond yields are stable or falling (indicating lower financing costs and economic uncertainty), utilities are more likely to lock in long-term uranium contracts aggressively, driving prices higher.

Recent market conditions with the 10-year yield around 4.5% have coincided with utilities purchasing uranium in record quantities, pushing prices to 15-year highs.

Geopolitical and Supply Risk Amplification

The uranium market is sensitive to geopolitical risks, especially given that over half of global uranium supply and processing is controlled by countries within Russia’s sphere of influence.

Rising bond yields amid geopolitical tensions can increase risk premiums on uranium prices as investors and utilities seek supply security.

Investor Confidence and Capital Flows

The 10-year Treasury yield reflects investor confidence and risk appetite. Higher yields can attract capital away from commodities toward fixed income, potentially dampening speculative interest in uranium.

Conversely, lower yields can boost commodity investment appeal as investors seek higher returns, supporting uranium prices.

In essence, the 10-year Treasury yield is a crucial macro-financial gauge that indirectly shapes uranium market dynamics by affecting financing, demand expectations, and risk perceptions, thereby influencing uranium prices and investment decisions in the energy sector.

Key Use Cases of Uranium

Uranium serves critical functions across multiple sectors:

Nuclear Energy Fuel for commercial reactors generating electricity which Provides 10% of global electricity with low carbon emissions

Medical Isotopes ,the Production of radioisotopes (e.g., Technetium-99m) Enables cancer diagnostics and treatment through PET scans

the Military/Defense use uranium for Nuclear weapons , naval propulsion systems and the Powering of submarines and aircraft carriers

Space Exploration using Nuclear thermal propulsion with Potential fuel for long-duration space missions.

Scientific Research and Geological dating and particle physics which Studies earth's age and fundamental particles all apply uranium .

Demand drivers:

72 new nuclear reactors under construction globally (as of 2025)

Medical isotope market growth (7.2% CAGR projected)

Space agency investments in nuclear propulsion

Investment Considerations

Price volatility: Uranium spot prices impact producer profitability but long-term contracts provide stability

Sector-specific risks: Regulatory constraints, waste management challenges, and geopolitical factors affect uranium investments

Growth areas: Small modular reactors (SMRs) and radioisotope production represent emerging opportunities

Conclusion: Uranium's value stems from its diverse applications in energy, medicine, defense, and science. While no dedicated "uranium bond" exists, the sector's performance is reflected in mining stocks and long-term contracts. The metal's fundamental importance in clean energy and advanced technology underpins its long-term market position.

URANIUM trade ideas

URANIUMThe 10-year Treasury bond yield plays a significant role in the energy markets, including uranium, by influencing financing costs, investment decisions, and broader economic sentiment, which in turn affect uranium demand and pricing dynamics.

Significance of the 10-Year Bond Yield in Uranium and Energy Markets:

Benchmark for Financing Costs

The 10-year Treasury yield serves as a benchmark for long-term borrowing costs for utilities and mining companies involved in uranium production and nuclear energy infrastructure.

Higher yields increase the cost of capital, potentially delaying or raising the cost of new uranium mine developments and nuclear plant investments. Conversely, lower yields reduce financing costs, supporting expansion and production.

Indicator of Economic and Inflation Expectations

Rising 10-year yields often signal expectations of stronger economic growth and inflation, which can boost energy demand, including uranium for nuclear power generation.

Declining yields typically reflect economic caution or slowdown, which may temper energy demand growth.

Impact on Utility Procurement Behavior

As uranium accounts for only about 5–10% of nuclear power generation costs, utilities prioritize securing supply to avoid operational disruptions, even at higher prices.

When bond yields are stable or falling (indicating lower financing costs and economic uncertainty), utilities are more likely to lock in long-term uranium contracts aggressively, driving prices higher.

Recent market conditions with the 10-year yield around 4.5% have coincided with utilities purchasing uranium in record quantities, pushing prices to 15-year highs.

Geopolitical and Supply Risk Amplification

The uranium market is sensitive to geopolitical risks, especially given that over half of global uranium supply and processing is controlled by countries within Russia’s sphere of influence.

Rising bond yields amid geopolitical tensions can increase risk premiums on uranium prices as investors and utilities seek supply security.

Investor Confidence and Capital Flows

The 10-year Treasury yield reflects investor confidence and risk appetite. Higher yields can attract capital away from commodities toward fixed income, potentially dampening speculative interest in uranium.

Conversely, lower yields can boost commodity investment appeal as investors seek higher returns, supporting uranium prices.

In essence, the 10-year Treasury yield is a crucial macro-financial gauge that indirectly shapes uranium market dynamics by affecting financing, demand expectations, and risk perceptions, thereby influencing uranium prices and investment decisions in the energy sector.

Key Use Cases of Uranium

Uranium serves critical functions across multiple sectors:

Nuclear Energy Fuel for commercial reactors generating electricity which Provides 10% of global electricity with low carbon emissions

Medical Isotopes ,the Production of radioisotopes (e.g., Technetium-99m) Enables cancer diagnostics and treatment through PET scans

the Military/Defense use uranium for Nuclear weapons , naval propulsion systems and the Powering of submarines and aircraft carriers

Space Exploration using Nuclear thermal propulsion with Potential fuel for long-duration space missions.

Scientific Research and Geological dating and particle physics which Studies earth's age and fundamental particles all apply uranium .

Demand drivers:

72 new nuclear reactors under construction globally (as of 2025)

Medical isotope market growth (7.2% CAGR projected)

Space agency investments in nuclear propulsion

Investment Considerations

Price volatility: Uranium spot prices impact producer profitability but long-term contracts provide stability

Sector-specific risks: Regulatory constraints, waste management challenges, and geopolitical factors affect uranium investments

Growth areas: Small modular reactors (SMRs) and radioisotope production represent emerging opportunities

Conclusion: Uranium's value stems from its diverse applications in energy, medicine, defense, and science. While no dedicated "uranium bond" exists, the sector's performance is reflected in mining stocks and long-term contracts. The metal's fundamental importance in clean energy and advanced technology underpins its long-term market position.

URANIUM Uranium Correlation with Dollar Index (DXY), 10-Year Bond Yield, and Interest Rates, and Its Industrial Use Cases

1. Correlation with Dollar Index (DXY), 10-Year Bond Yield, and Interest Rates

Uranium and Dollar Index (DXY):

Uranium, like many commodities priced in US dollars, generally exhibits an inverse correlation with the dollar. A stronger dollar (DXY↑) tends to make uranium more expensive for holders of other currencies, potentially reducing demand and putting downward pressure on prices. Conversely, a weaker dollar supports uranium prices by making it cheaper internationally.

Uranium and 10-Year Bond Yields / Interest Rates:

Uranium’s price correlation with bond yields and interest rates is less direct than financial assets but still relevant:

Rising interest rates and bond yields often signal tighter monetary policy, which can slow economic growth and reduce demand for industrial commodities, including uranium.

However, uranium’s demand is strongly tied to the nuclear energy sector and geopolitical factors, which can decouple it from traditional interest rate dynamics.

Inflation expectations and real yields influence uranium prices indirectly through investment demand and energy market dynamics.

2. Use Cases of Uranium in Industry

Nuclear Energy Generation:

The primary use of uranium is as fuel in nuclear power plants. Uranium-235 undergoes fission, releasing heat used to produce steam that drives turbines for electricity generation. Nuclear energy is a significant source of low-carbon power worldwide.

Commercial reactors typically use uranium enriched to about 3% uranium-235.

Uranium also powers naval vessels, including submarines and aircraft carriers.

Medical Applications:

Uranium isotopes are used to produce medical isotopes for cancer treatment (radiotherapy) and diagnostic imaging. Depleted uranium (DU) serves as radiation shielding in medical equipment and teletherapy units.

Military Uses:

Depleted uranium is used in armor plating and armor-piercing ammunition due to its high density and hardness. It also serves as counterweights in military aircraft.

Industrial Applications:

Uranium is used in radiation shielding for transporting radioactive materials and in scientific research. It has historical uses in ceramics and glass coloring, though these are now largely obsolete.

Agriculture:

Uranium compounds have been used in soil sterilization and as inert components in fertilizers, though these uses are limited and carefully controlled due to radioactivity.

Scientific Research and Space Exploration:

Uranium isotopes are used in geological dating and as fuel for deep-space missions.

#METAL #GOLD #COPPER #SILVER # ALUMINUM

Nuclear energy rises again in the race for energy independence“The decision here is the most powerful symbol of the rebirth of nuclear power as a clean and reliable energy resource,” – Constellation Energy CEO Joe Dominguez, September 2024.

The decision in the quote above refers to the deal Microsoft has struck with Constellation Energy, the operator of the Three Mile Island nuclear plant, to restart operations and power the tech giant’s data centres. Constellation plans to bring back online its Unit 1 reactor, which ceased operations in 2019 when nuclear energy struggled to compete with natural gas and renewables. This so-called rebirth, expected to see the reactor operational by 2028, is significant not only because it reflects renewed confidence in nuclear energy’s economics but also a positive shift in sentiment and political will to restart a site associated with a past incident in a different reactor. The confidence in nuclear energy’s improved safety through technological progress, its economic viability, and its environmental credentials is growing as the world pursues energy independence to power energy-intensive technologies like artificial intelligence.

The world’s energy needs are rising rapidly

If a single ChatGPT query requires ten times as much energy as a Google search1, and with the increasing number of devices making such artificial intelligence (AI) queries, global energy demand is poised to rise significantly. Data centres, which underpin technologies like AI, are power-hungry and are expected to see their energy needs increase swiftly. How the world meets these energy needs will be one of the most compelling themes for the rest of this decade and beyond.

Big tech is striking big deals

Microsoft is not alone. Other tech giants are also turning to nuclear. In October last year, Google announced a deal with Kairos Power to source multiple small modular reactors (SMRs), expected to be deployed between 2030 and 2035. According to Google, “this deal will enable up to 500 MW of new 24/7 carbon-free power to US electricity grids and help more communities benefit from clean and affordable nuclear power.”2

SMRs, with their modular design, offer several advantages: they are smaller, safer, and faster to deploy than traditional reactors, making nuclear energy more accessible and scalable.

Amazon, also in October last year, announced three agreements to source new SMRs, highlighting their commitment to achieving net-zero carbon despite growing energy needs. Amazon struck deals with Energy Northwest to develop four advanced SMRs in Washington, led a $500 million funding round for X-energy to scale SMR technology, and partnered with Dominion Energy to explore SMR projects in Virginia, all aimed at advancing carbon-free energy solutions for its data centres.3

Given that power outages in data centres would mean major disruptions to global tech services, the importance of uninterrupted power is increasingly critical. With SMRs deployable close to demand sources, nuclear energy is positioning itself not only as a carbon-free solution but also as a key enabler of energy independence, much like wind and solar.

Countries are advancing their nuclear plans too

Europe learned valuable lessons from the 2022 gas price crunch when it scrambled to reduce its reliance on Russian gas. In February 2022, President Emmanuel Macron announced plans to construct six new nuclear reactors and consider building an additional eight over the next 30 years, aiming to bolster France’s energy independence and reduce carbon emissions.4

In the United Kingdom, the proposed Sizewell C nuclear power station is set to generate low-carbon electricity for approximately six million homes, supporting the nation’s transition to net-zero emissions. The project is also expected to support 70,000 jobs across the UK and engage over 2,000 UK-based suppliers.5

Nuclear energy’s strong credentials in terms of low emissions and reliability are clearly encouraging both companies and countries to advance their plans.

Conclusion

There is a clear upswing in sentiment towards nuclear power. The rapidly rising energy needs of power-hungry technologies like AI and data centres seem to be the catalyst. Both companies and countries are turning to sustainable and independent energy sources, and nuclear has firmly joined the ranks. As technologies like small modular reactors advance, we can expect more big headlines from big tech and beyond. Nuclear energy has arrived—and it’s here to stay.

1 International Energy Agency, 2024.

2 Google, October 2024.

3 Amazon, October 2024.

4 World Nuclear Association, Jan 2025.

5 Sizewell C, Jan 2025.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

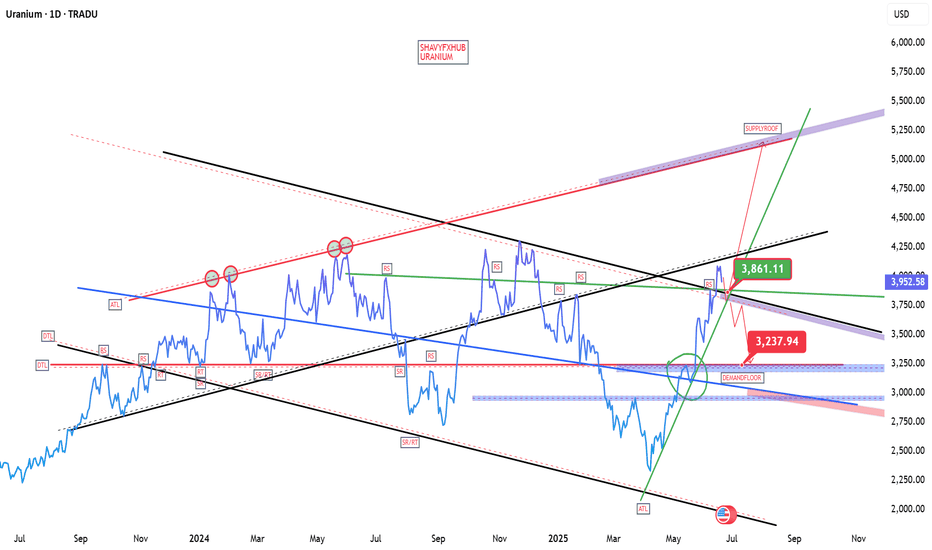

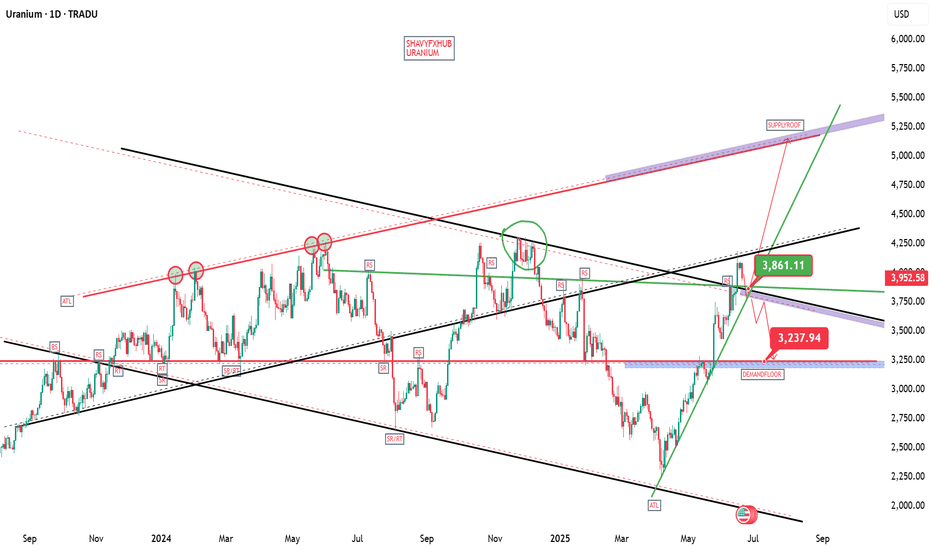

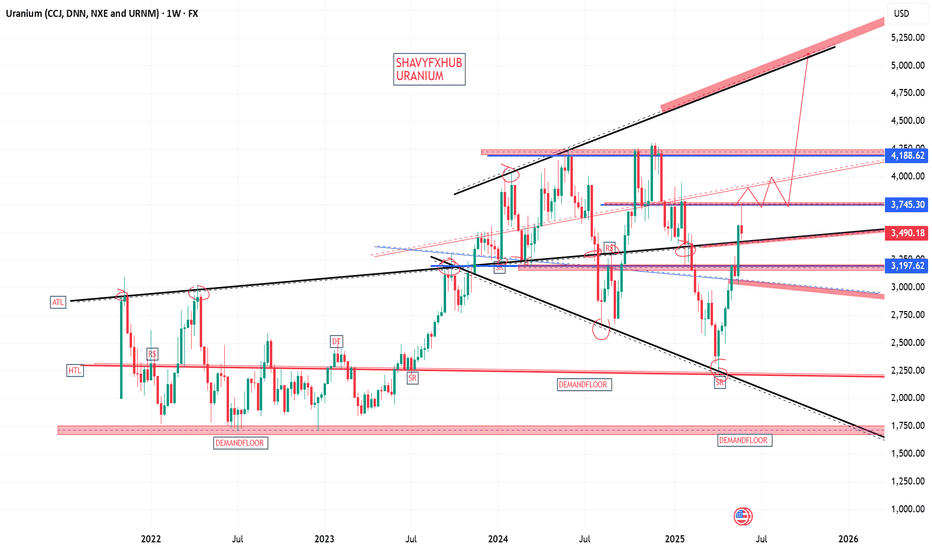

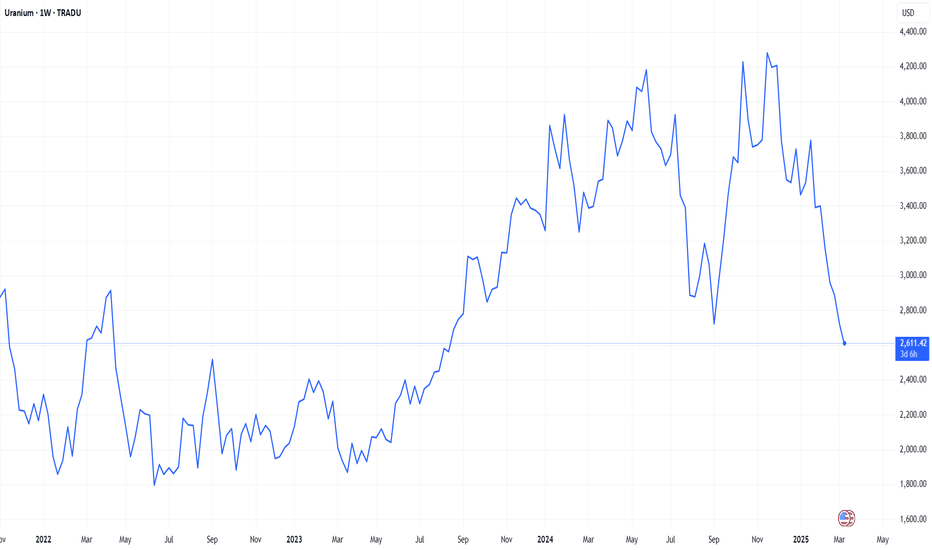

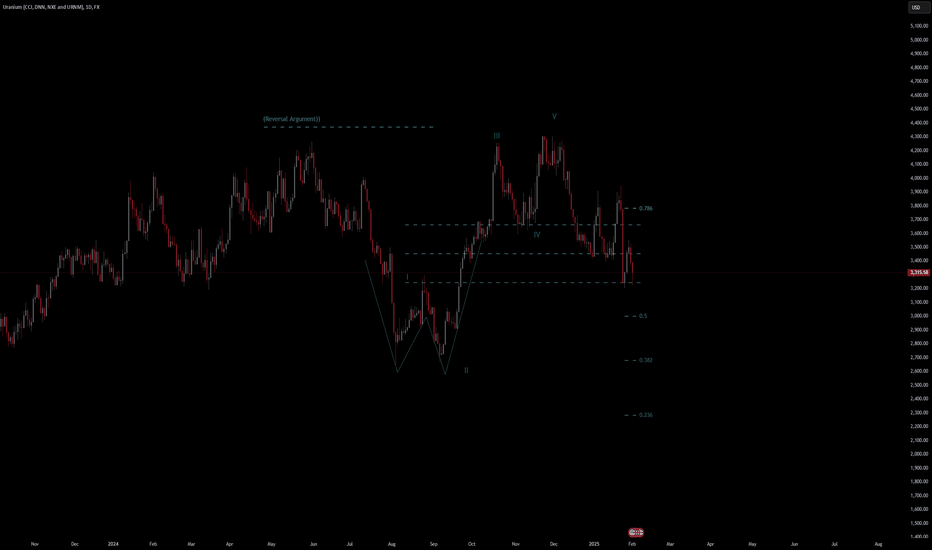

Uranium Commodity Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Uranium Commodity Quote

- Double Formation

* (Reversal Argument)) | Completed Survey & Entry Feature

* 012345 | Wave Count | Subdivision 1

- Triple Formation

* 1st Retracement | Downtrend Bias | Subdivision 2

* 2nd Retracement | Continuation Entry | Subdivision 3

* Daily Time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell