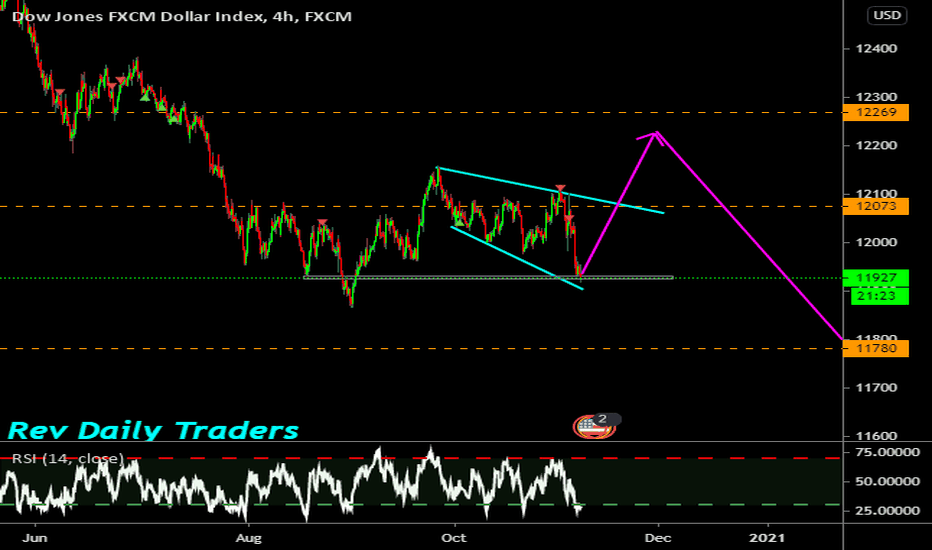

US Dollar is Bottoming ! Hello Traders,

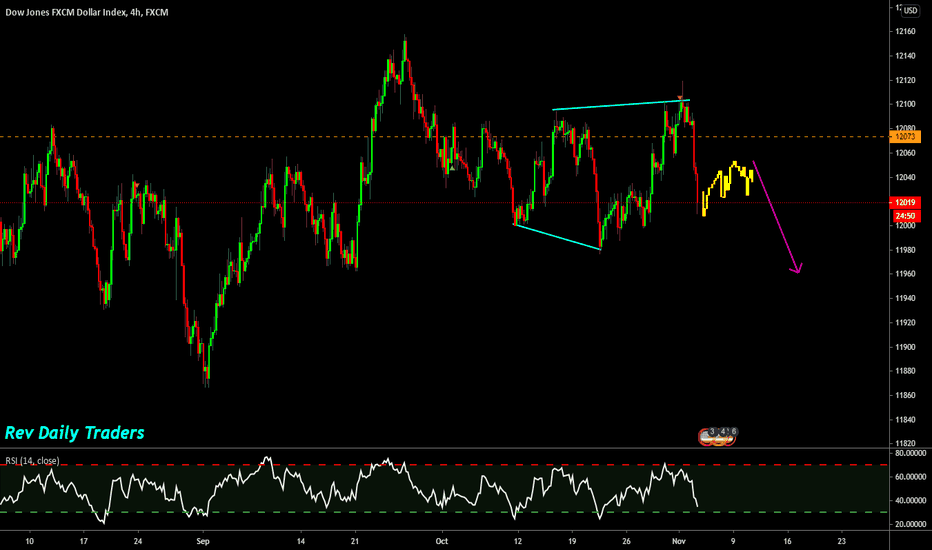

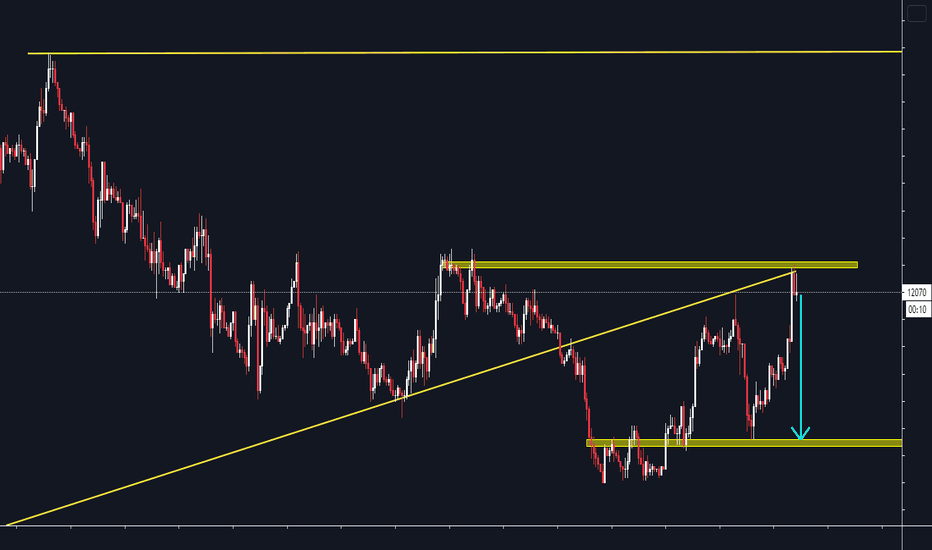

Recent US Dollar action (H4) and the next week or two is bottoming pattern. Like what we had in EUR/USD daily (ceiling). I copied the bar pattern from EUR/USD and mirrored it to make it more clear what I mean by that.

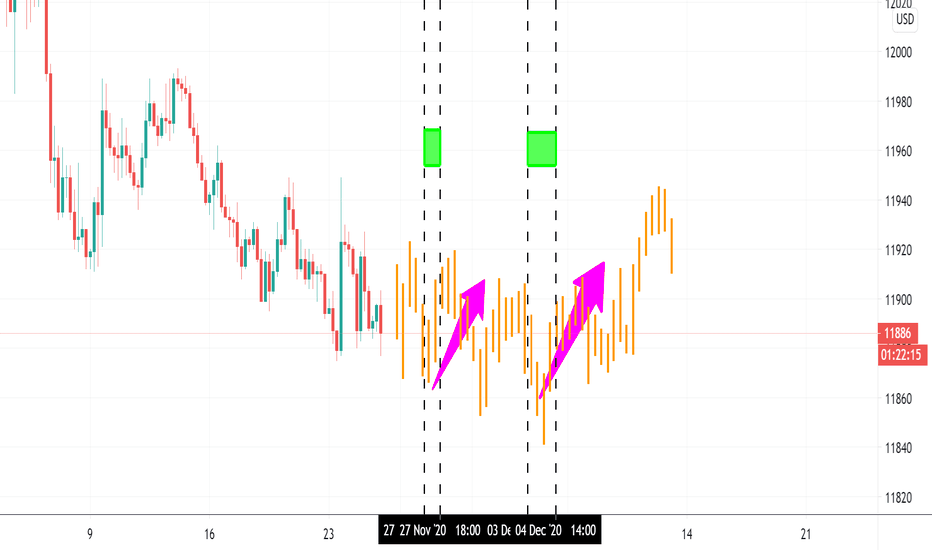

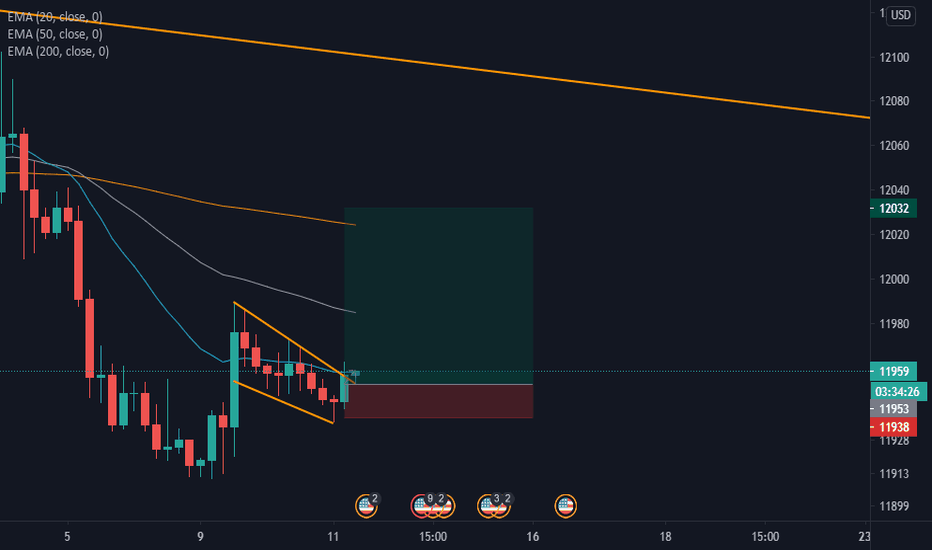

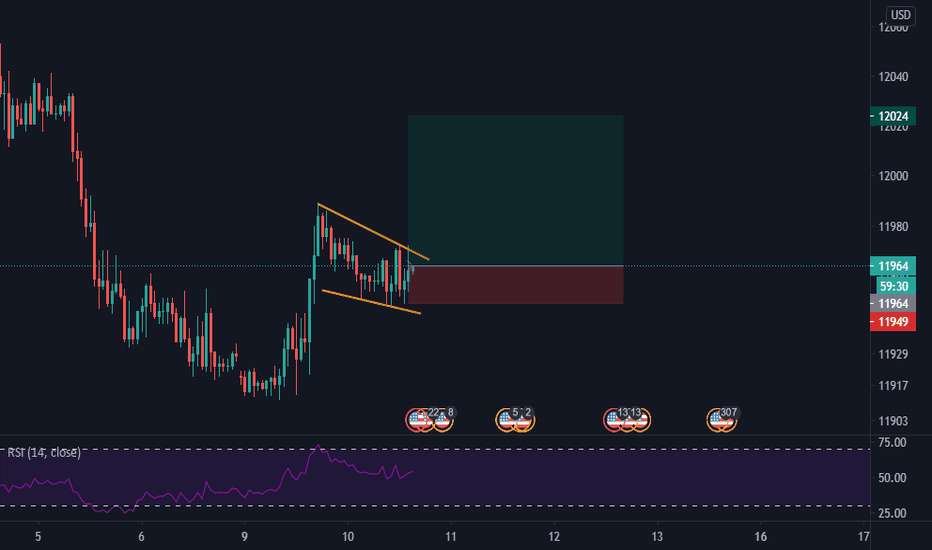

A broad bottoming out in US Dollar (H4) suggests that each lowest low could be a reversal but I will pay attention to those which happens during the time cycles zones or near them.

I pointed out two time cycle zones (two green rectangles) on the chart. If price makes swing low during these time cycles then there would be a high probability of reversal. It might also have a reversal between them or near them.

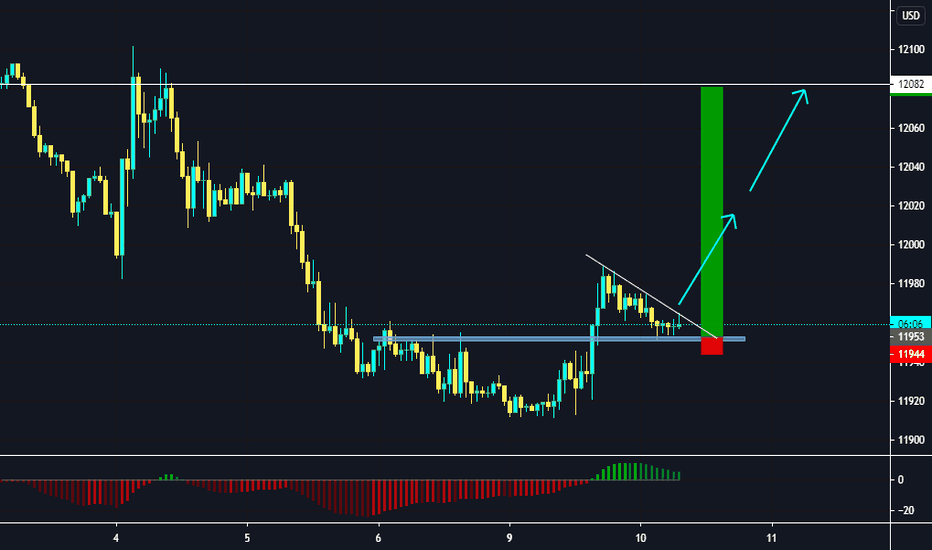

Here is the EUR/USD ceiling that I mentioned above. By putting the bar pattern on US Dollar I don’t mean that it will move exactly like that. Just tried to make it clear what I mean by bottoming.

Please Like and follow if you enjoyed my analysis.

Please check my previous forecasts to see how these time cycles work. I put few links below for your attention:

Good luck

USDOLLAR trade ideas

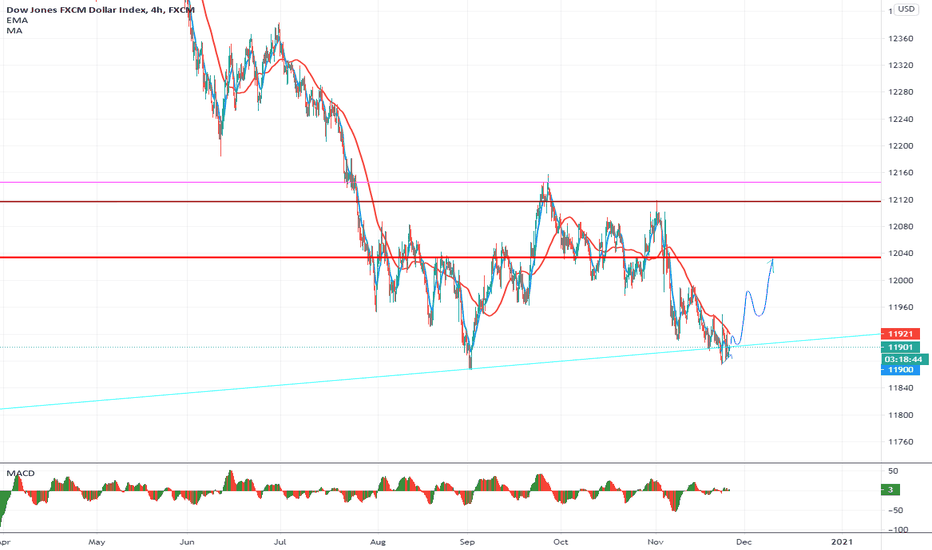

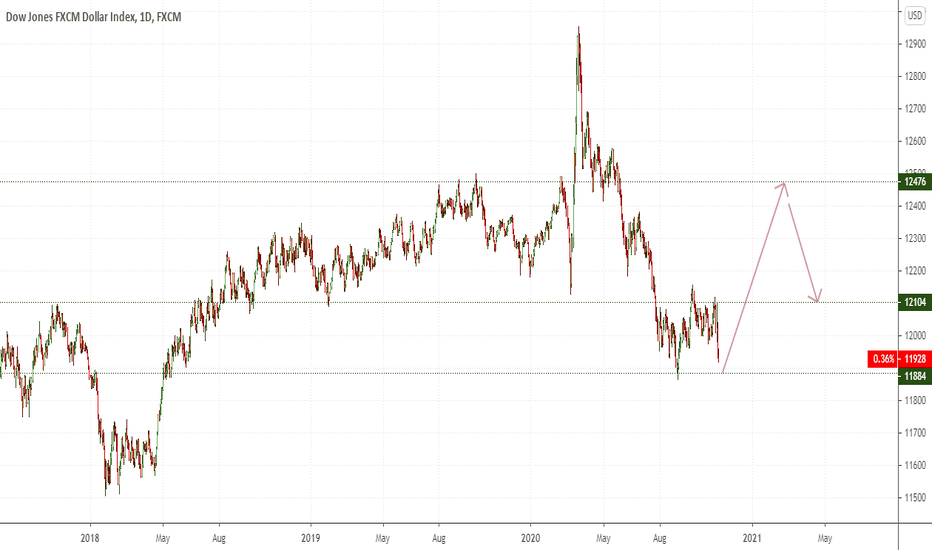

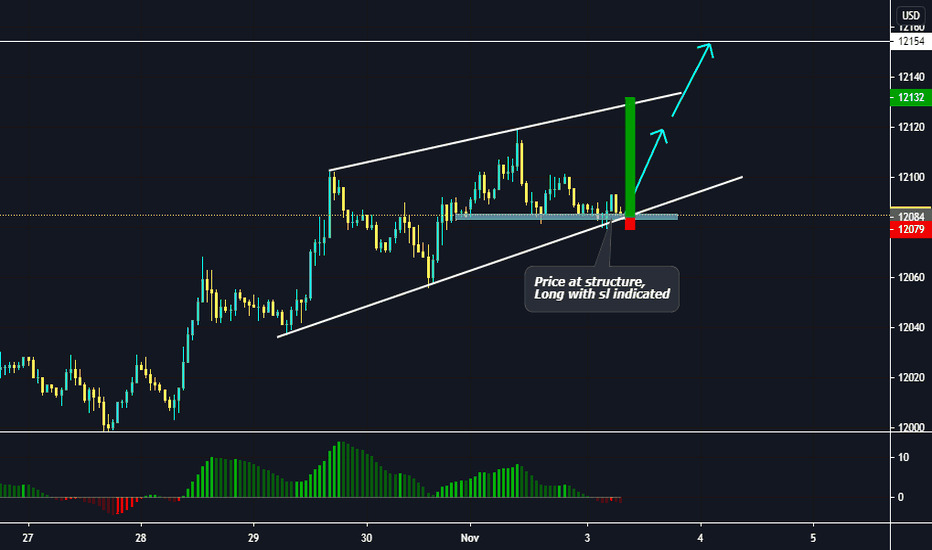

US Dollar Forecast Nov 2020Volatility in the US Dollar will start to subside now that the US Elections is coming to a close. We expect the overall direction of the USD to establish in the coming weeks.

We forecast US Dollar bullishness over the next 6-month cycle as the US Dollar gains support on upbeat economic conditions. Furthermore economic stimulus from the US government will sustain this economic growth. Stimulus is much alike to the quantitative easing programs of the early 2010’s.

We are seeing strong gains in employment with the unemployment rate down to 6.9% (November release) from 7.7% the previous month. NFP’s released an upbeat figure of 638k jobs added to the economy over October whilst Manufacturing PMI’s rose sharply.

Gaining employment leads to more spending in the economy which sustains job growth, manufacturing activity and services growth. These factors combined will sustain high GDP growth.

With Biden likely to win the election and his promise to raise taxes, this growth will ultimately be capped. We should see the US Dollar rally to pre-Covid19 levels against the major currency pairs before any significant pull backs.

A second wave of Covid19 is becoming likely over the festive season and could shake markets to produce another black swan. We therefore urge caution regarding USD longs.

Read more at alloutforex.com

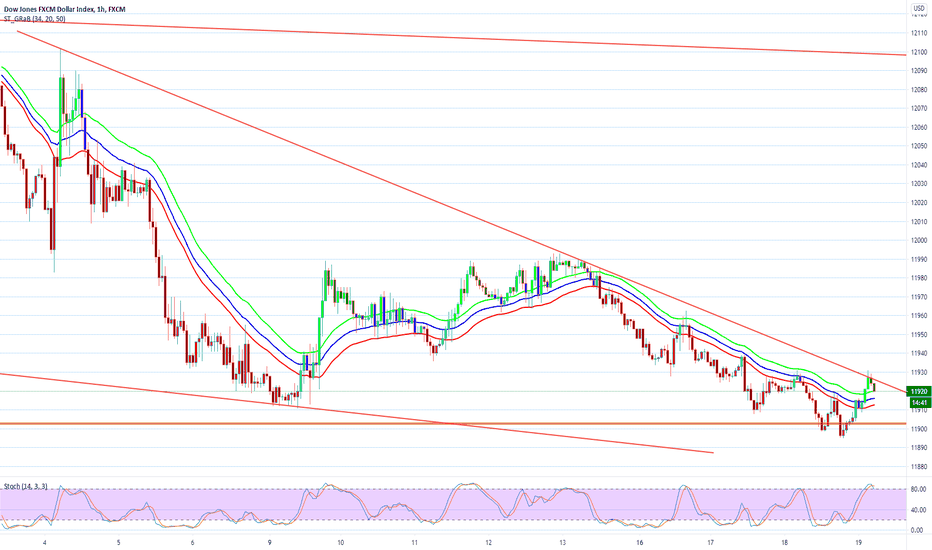

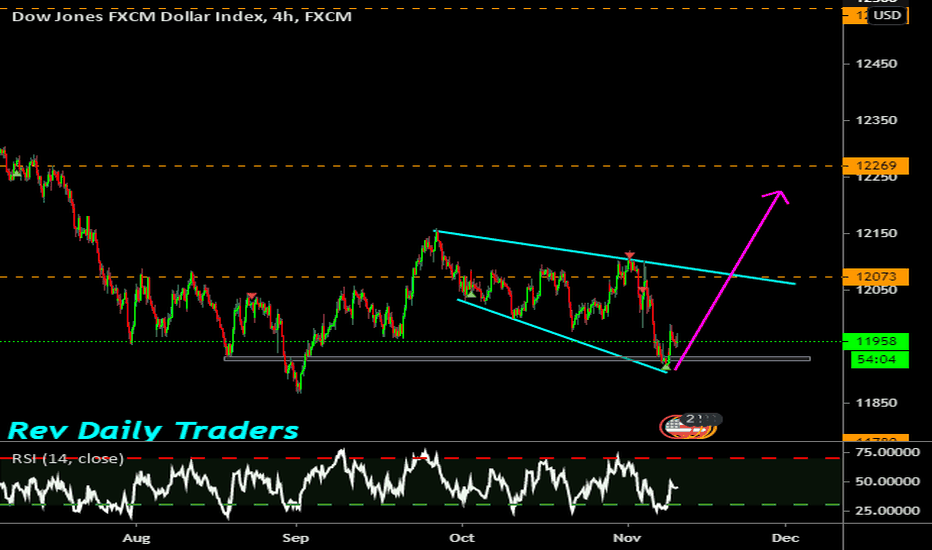

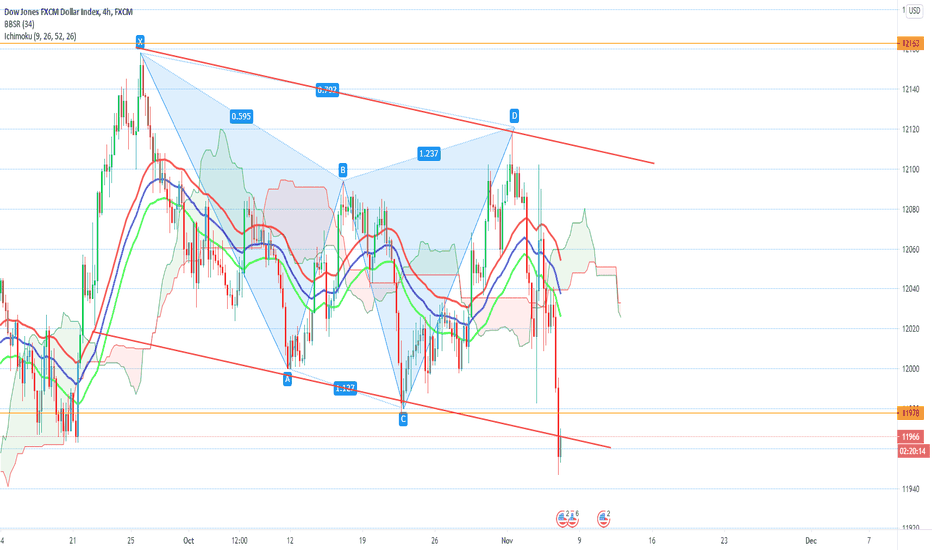

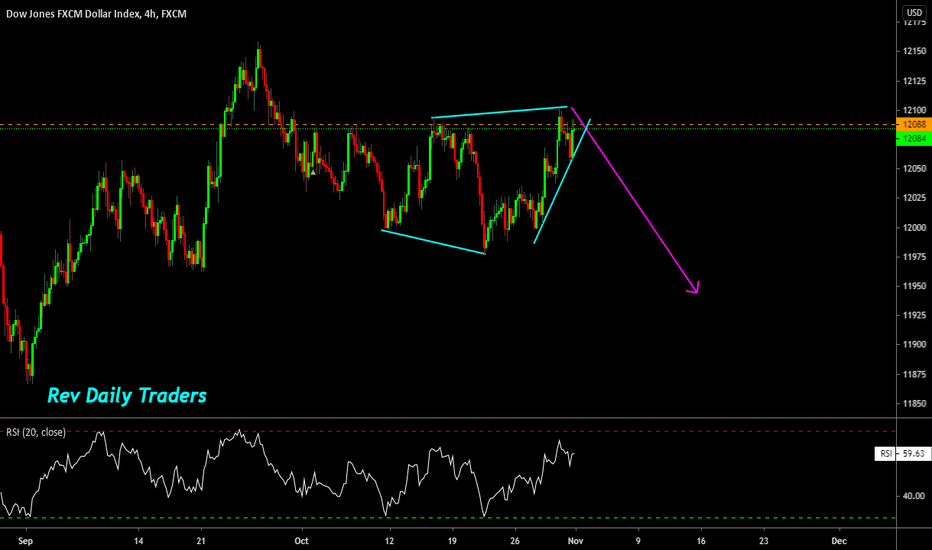

DOW JONES about to reverse?Hi traders

watch for price to turn to upside. look for up wave price action setup for us to complete a C wave. I am looking to for setup. if you looking for sell then you have to wait for the price to create correction then that will confirm sell

thanks for support

like and share

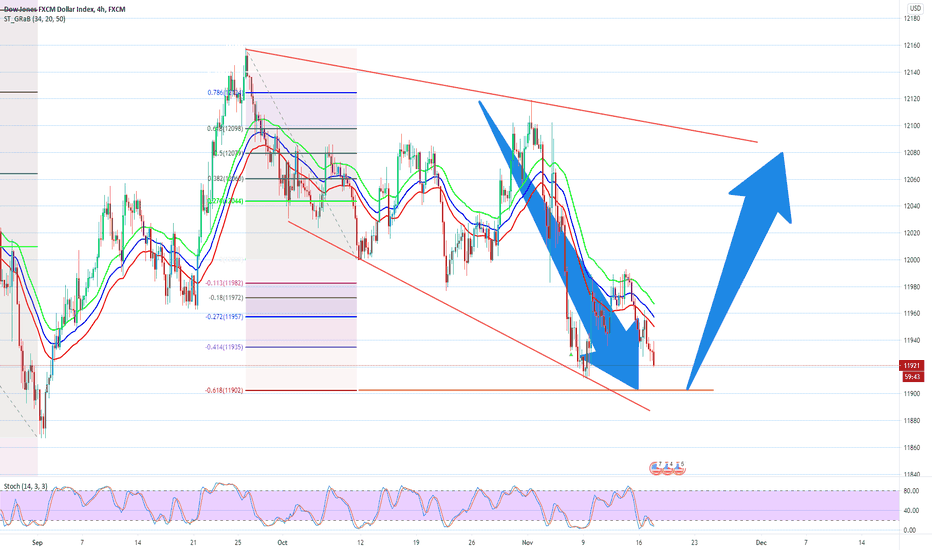

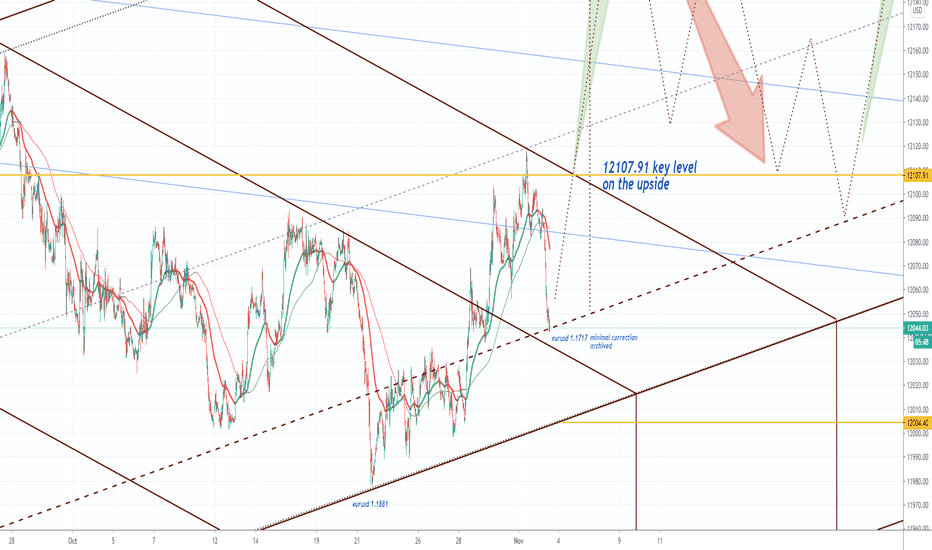

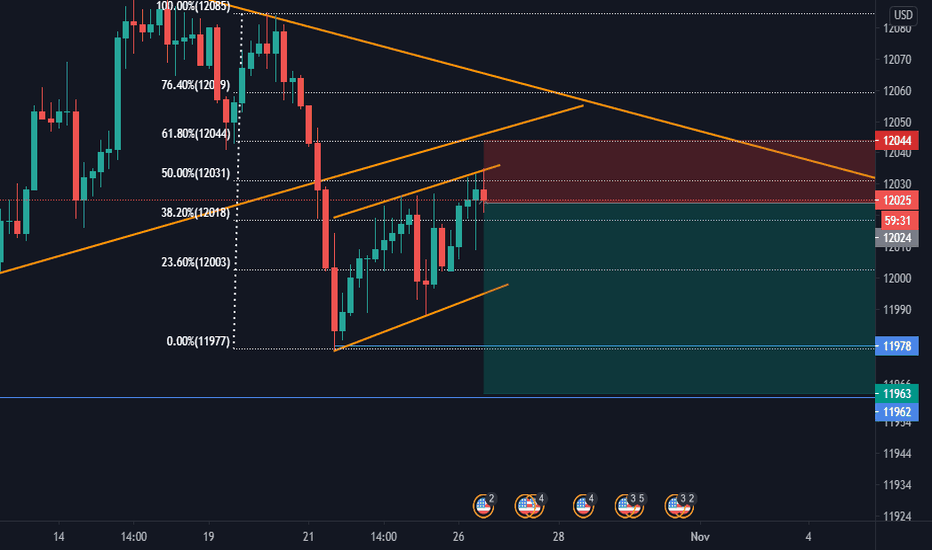

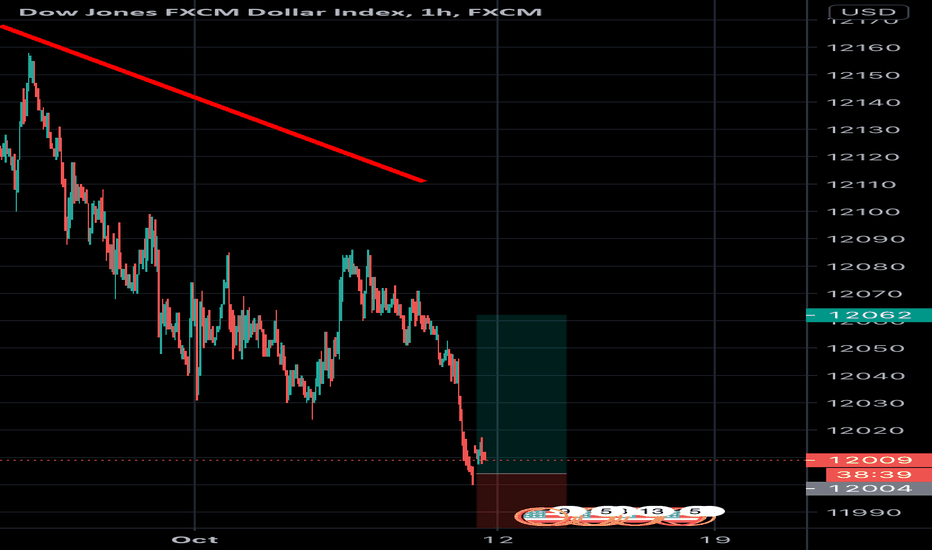

USD Index Pre/Post ElectionUSA Election coming to a close but take caution as volatility can still occur.

Here we are looking "left" to see what has happened in the past elections.

Uncertainty = volatile market

Certainty = trending market

Pre elections we have seen USD weakness and right after we see USD strength in the remaining year months. With USD technicals in the buy zone and a retrace that has not yet occured from a trendline break we should see USD strength as well after the election.

But as always, remember risk management when trading USD pairs into the election. I'd personally advise staying out and looking at other pairs until the election is officially over.

Good luck and let me know if there are any questions.

Charles V

CVFX Management

Trading made Simple

Will US Dollar go higher and is this the breaking point?I am not trading the US Dollar index, Im just analyzing him for US pairs. His movement I use like a conformation for the direction of movements of US pairs.

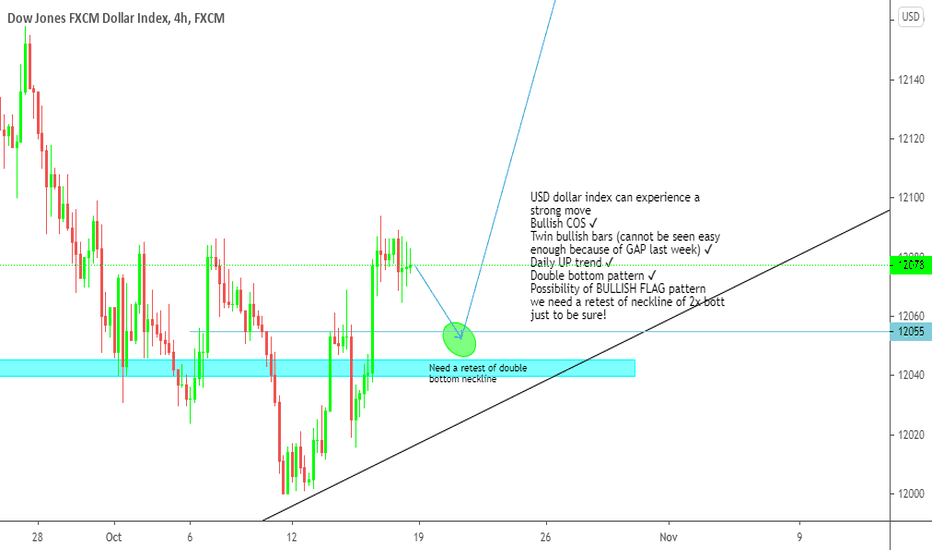

In this case, I can see (clearly) a signs of US Dollar resurection. This can be the breaking week and US Dollar can gain strenght this week. Will be looking closely these days.