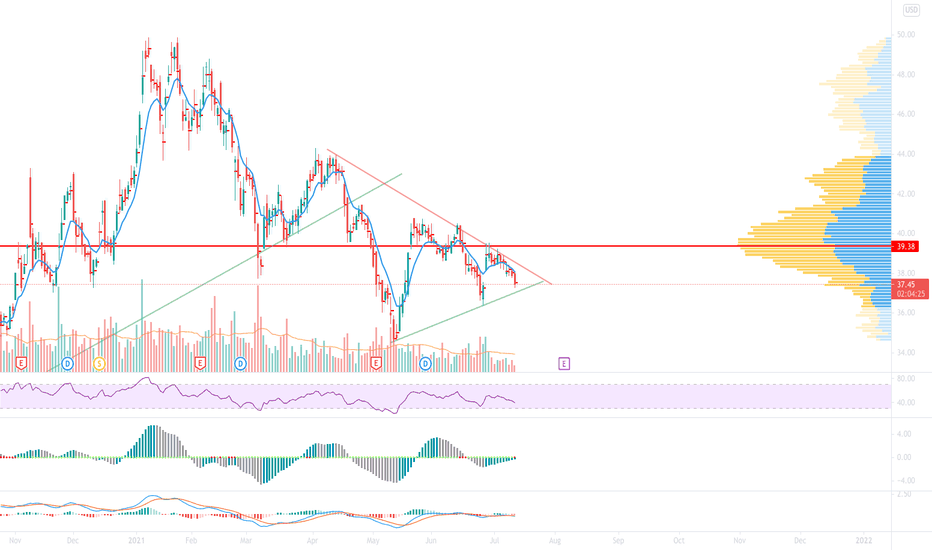

BEPI have been waiting tirelessly for something tasty to present itself on solar stocks for months and we finally have what looks like accumulation occurring at the .886-.786 level.

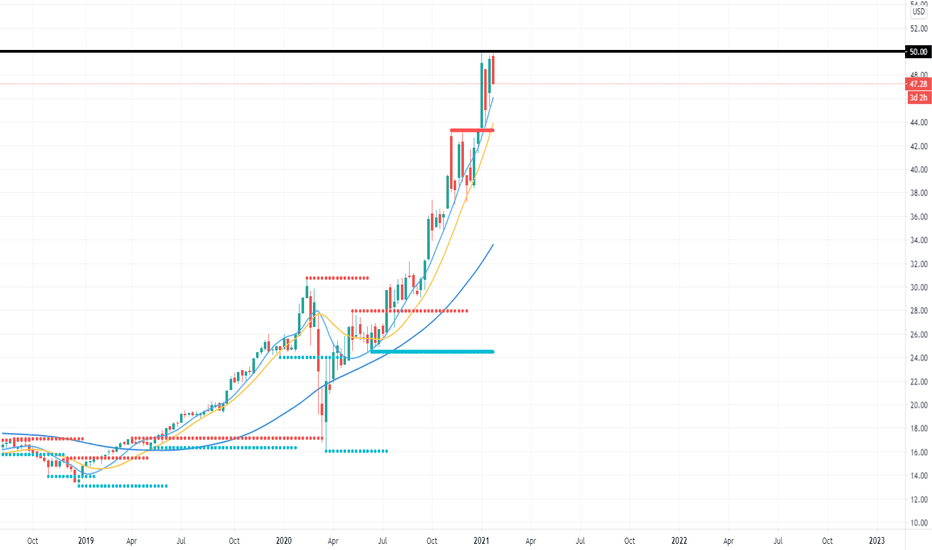

I present to you BEP - a globally diversified portfolio of high-quality renewable power assets.

Given Trump's victory,

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.41 CAD

−298.65 M CAD

7.92 B CAD

273.86 M

About BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18

Sector

Industry

CEO

Connor David Teskey

Website

Headquarters

Hamilton

Founded

2011

FIGI

BBG016QC8D85

Brookfield Renewable Partners LP engages in the ownership of a portfolio of renewable power and sustainable solution assets. It operates through the following segments: Hydroelectric, Wind, Utility-Scale Solar, Distributed Energy and Sustainable Solutions, and Corporate. The Distributed Energy and Sustainable Solutions segment includes distributed generation, pumped storage, renewable natural gas, carbon capture and storage, recycling, and cogeneration and biomass. The company was founded on June 27, 2011 and is headquartered in Hamilton, Bermuda.

Related stocks

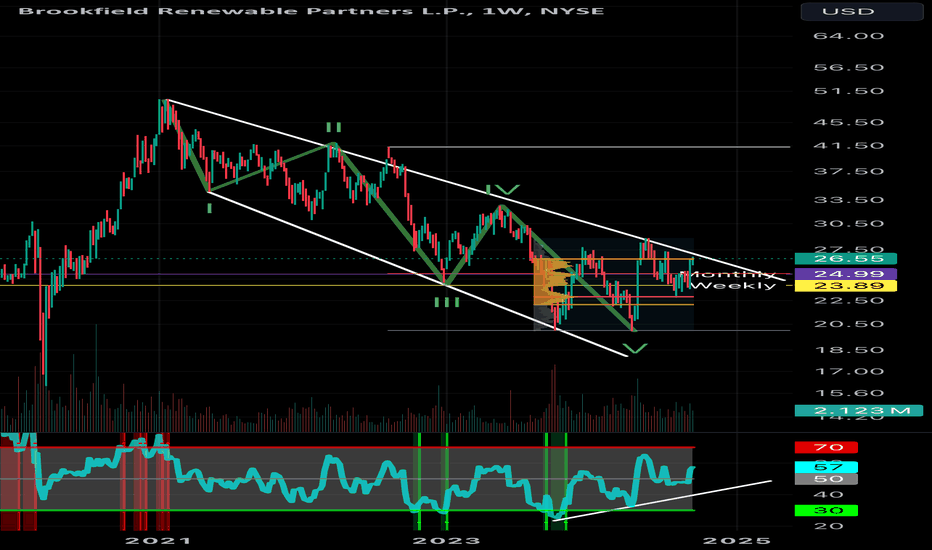

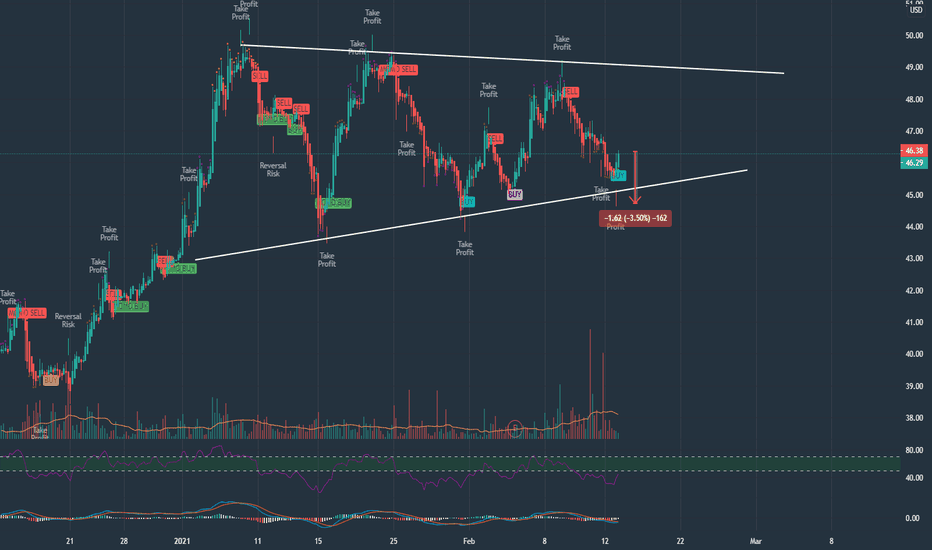

Imminent breakout? Swing trade potential Brookfield looks like it may have bottomed, held support very well at $25 and is about to break this descending channel to the upside. It’s reached the value area high of the local range and about to break out of this consolidation area, to the upside. I’d like to see it break out of the wedge as co

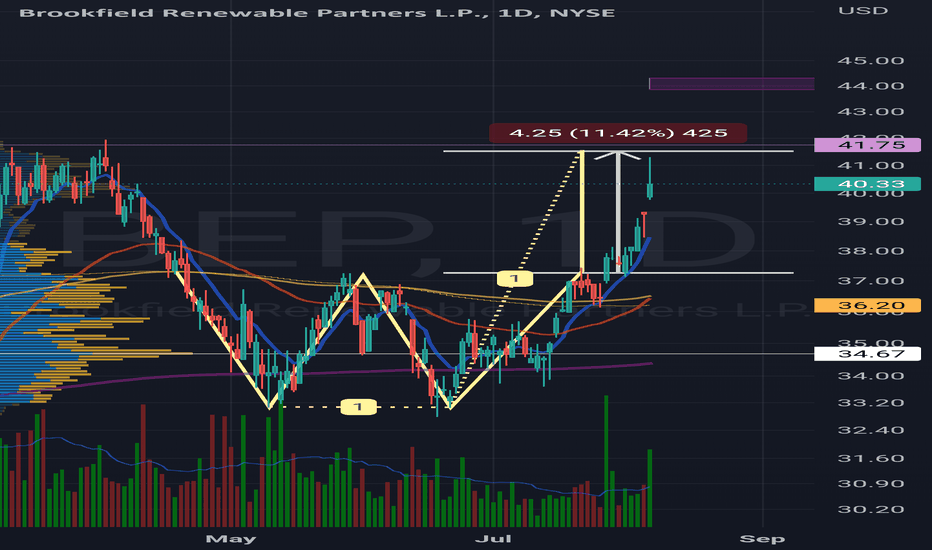

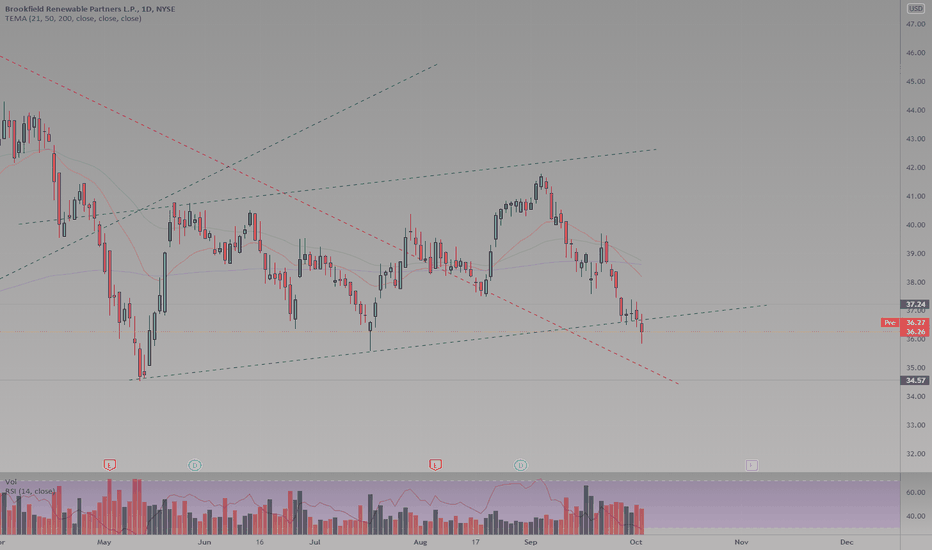

BEP - Inverted H&S IdeaPrice is clearly on this daily timeframe within a down channel

I am suggesting that price establishes a support along the lower line with an inverted H&S structure

This will push price back up into the down channel or even breaking the channel

Bars pattern in green shows my thoughts

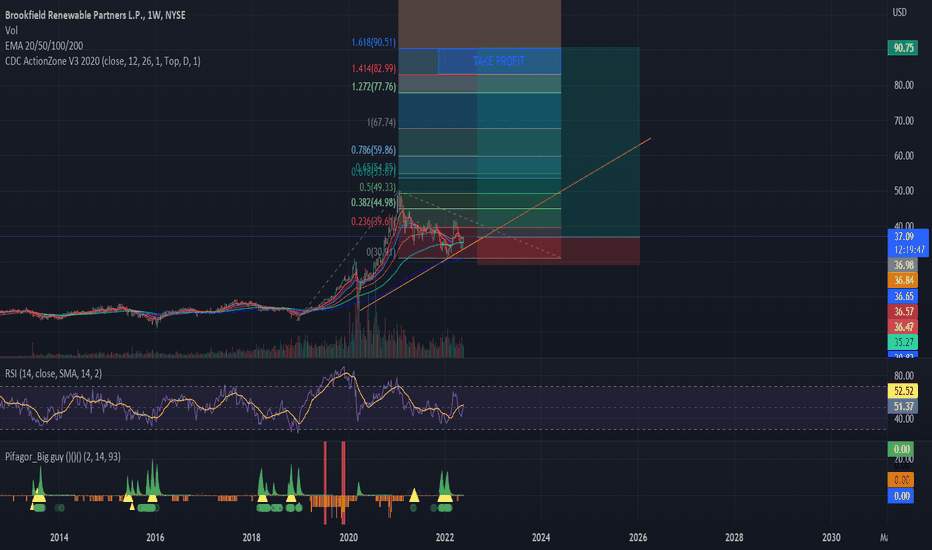

BEP - Nice dividend and turnaround play- Largest pure play energy stock I can find.

- Has assets in 4 continents and $59 billion in power assets.

Revenue generated today by power source

50% Hydro

24% Wind

15% Solar

11% Energy transition

Brookfield wishes to diversify away from Hydro and tap into other resources

___________________

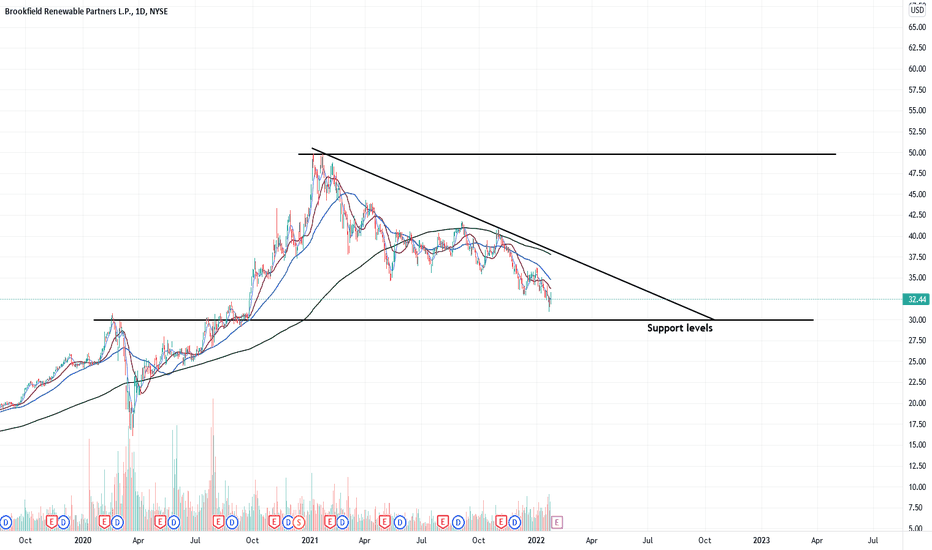

BEP Broke the parallel channel, heading to nearest supportChart explains it all. BEP broke the upward parallel channel and is now heading towards its nearest support around 34 $

Disclaimer: This is not a financial advice. Just my technical analysis for educational purposes. I do not hold any positions in the stock discussed above.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GLBL4597870

TerraForm Global Operating LP 6.125% 01-MAR-2026Yield to maturity

6.06%

Maturity date

Mar 1, 2026

BEP4896903

TerraForm Power Operating, LLC 4.75% 15-JAN-2030Yield to maturity

5.90%

Maturity date

Jan 15, 2030

BEP4571623

TerraForm Power Operating, LLC 5.0% 31-JAN-2028Yield to maturity

5.35%

Maturity date

Jan 31, 2028

BEP4571622

TerraForm Power Operating, LLC 5.0% 31-JAN-2028Yield to maturity

—

Maturity date

Jan 31, 2028

See all BEP.PR.R bonds

Curated watchlists where BEP.PR.R is featured.

Frequently Asked Questions

The current price of BEP.PR.R is 20.40 CAD — it hasn't changed in the past 24 hours. Watch BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TSX exchange BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 stocks are traded under the ticker BEP.PR.R.

BEP.PR.R stock has fallen by −0.24% compared to the previous week, the month change is a 0.25% rise, over the last year BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 has showed a 10.57% increase.

BEP.PR.R reached its all-time high on Apr 14, 2022 with the price of 24.80 CAD, and its all-time low was 14.99 CAD and was reached on Oct 23, 2023. View more price dynamics on BEP.PR.R chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BEP.PR.R stock is 0.99% volatile and has beta coefficient of 0.17. Track BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 stock price on the chart and check out the list of the most volatile stocks — is BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 there?

Today BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 has the market capitalization of 9.74 B, it has decreased by −2.11% over the last week.

Yes, you can track BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 financials in yearly and quarterly reports right on TradingView.

BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 is going to release the next earnings report on Aug 1, 2025. Keep track of upcoming events with our Earnings Calendar.

BEP.PR.R earnings for the last quarter are −0.50 CAD per share, whereas the estimation was −0.36 CAD resulting in a −40.16% surprise. The estimated earnings for the next quarter are −0.21 CAD per share. See more details about BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 earnings.

BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 revenue for the last quarter amounts to 2.27 B CAD, despite the estimated figure of 1.25 B CAD. In the next quarter, revenue is expected to reach 1.40 B CAD.

BEP.PR.R net income for the last quarter is −133.44 M CAD, while the quarter before that showed −12.59 M CAD of net income which accounts for −960.22% change. Track more BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 financial stats to get the full picture.

Yes, BEP.PR.R dividends are paid quarterly. The last dividend per share was 0.34 CAD. As of today, Dividend Yield (TTM)% is 5.91%. Tracking BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 dividends might help you take more informed decisions.

As of Jun 22, 2025, the company has 5.27 K employees. See our rating of the largest employees — is BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 EBITDA is 4.22 B CAD, and current EBITDA margin is 51.85%. See more stats in BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 financial statements.

Like other stocks, BEP.PR.R shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 stock shows the buy signal. See more of BROOKFIELD RENEWABLE PARTNERS L P PFD LTD PARTNERSHIP UNIT CL A SER 18 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.