Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.66 CAD

5.38 B CAD

53.77 B CAD

1.71 B

About MANULIFE FINANCIAL CORP

Sector

Industry

CEO

Philip Witherington

Website

Headquarters

Toronto

Founded

1887

FIGI

BBG006YQ8MF8

Manulife Financial Corp. engages in the provision of financial services and insurance for individuals, groups, and businesses. It operates through the following segments: Asia, Canada, U.S., Global Wealth and Asset Management (WAM), and Corporate and Other. The Asia segment offers insurance products and insurance-based wealth accumulation products. The Canada segment includes insurance products, insurance-based wealth accumulation products, and banking services. The U.S. segment consists of life insurance products and insurance-based wealth accumulation products and has an in-force long-term care insurance business and an in-force annuity business. The Global WAM segment delivers investment solutions to retail, retirement, and institutional clients. The Corporate and Other segment refers to investment performance on assets backing capital, costs incurred by the corporate office related to shareholder activities, property and casualty reinsurance business, and run-off reinsurance operation including variable annuities and accident and health. The company was founded in 1887 and is headquartered in Toronto, Canada.

Related stocks

Long Manulife/Short SLFI worked for both companies and I preferred Manulife. It is larger than SLF for a reason: it's just better.

The other main reason I would want short SLF is that it DENIED me service which is basically fraud (lawsuits coming, right Arvid Shamiri who can be reached at (416) 213-7450).

The other reas

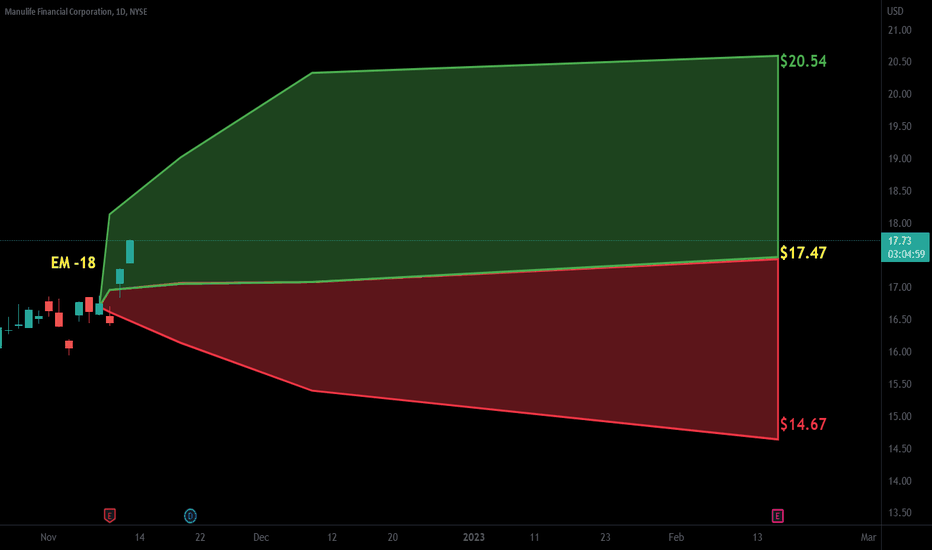

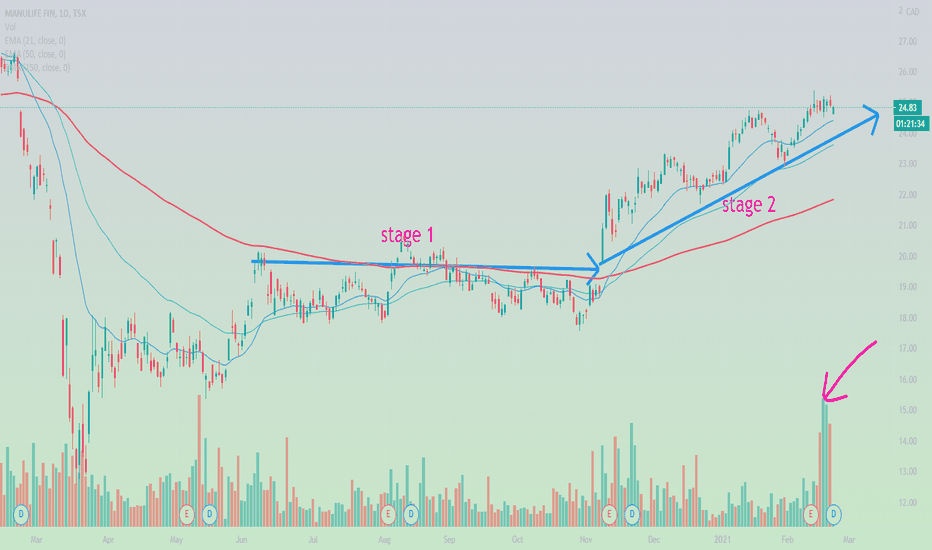

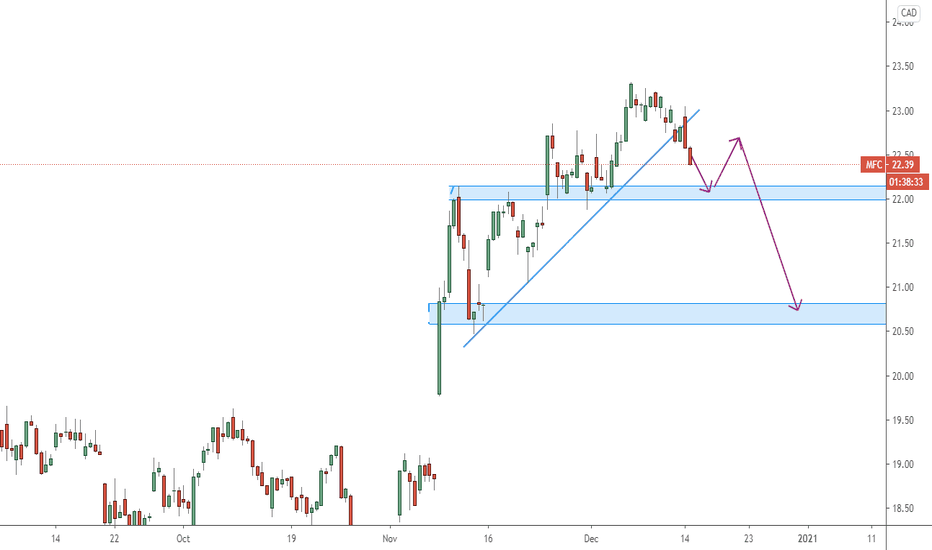

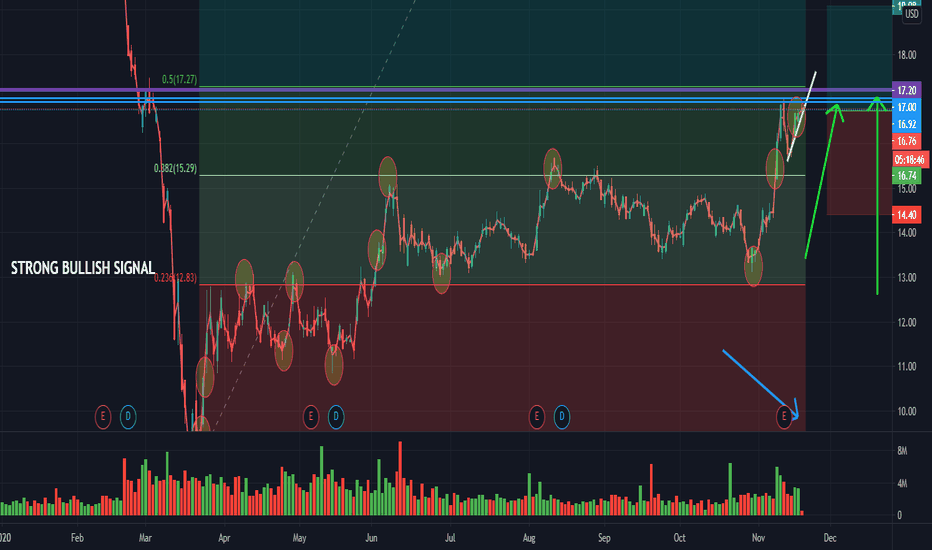

MANULIFE FINANCIAL CORP Perspective DailyHey my friends, MANULIFE FINANCIAL CORP is in an uptrend with stable buying volume and abortive sellers' attempt. Leaning on the TIMEFRAME M1 it shows us a panic with a low paid sales volume. There is a good chance of reaching the next higher point which is a major resistance on (MULTI TIMEFRAME D1

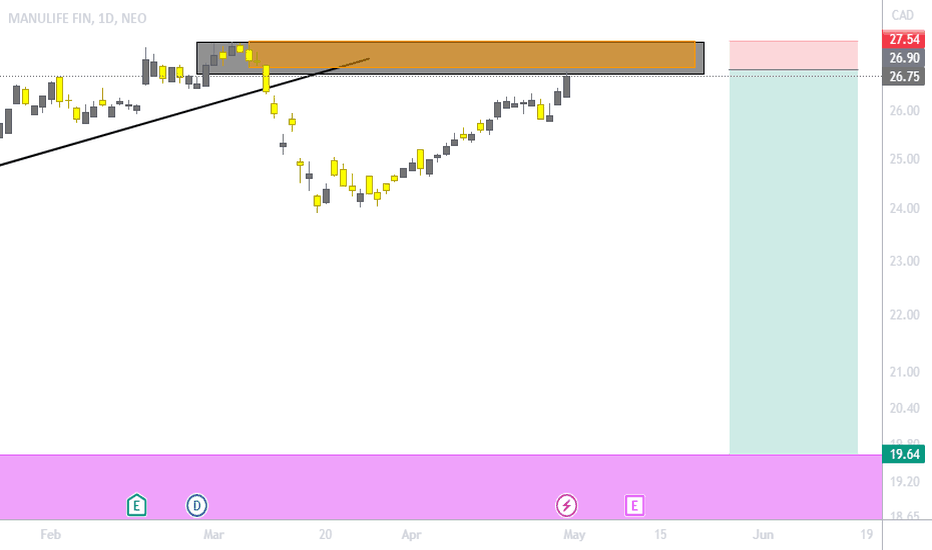

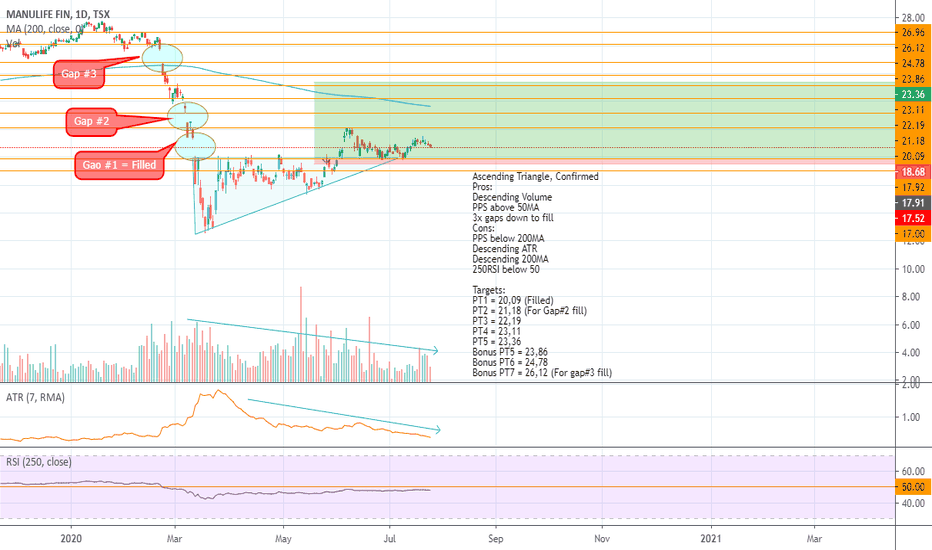

MFC.CA: Ascending triangle, ConfirmedAscending Triangle, Confirmed

Pros:

Descending Volume

PPS above 50MA

3x gaps down to fill

Cons:

PPS below 200MA

Descending ATR

Descending 200MA

250RSI below 50

Targets:

PT1 = 20,09 (Filled)

PT2 = 21,18 (For Gap#2 fill)

PT3 = 22,19

PT4 = 23,11

PT5 = 23,36

Bonus PT5 = 23,86

Bonus PT6 = 24,78

Bonus PT

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MFC5772756

Manulife Financial Corporation 3.05% 27-AUG-2060Yield to maturity

8.16%

Maturity date

Aug 27, 2060

MFC4341034

Manulife Financial Corporation 5.375% 04-MAR-2046Yield to maturity

5.59%

Maturity date

Mar 4, 2046

J

MFC3702621

John Hancock Life Insurance Company (U.S.A.) 5.6% 15-NOV-2027Yield to maturity

5.21%

Maturity date

Nov 15, 2027

J

MFC3670248

John Hancock Life Insurance Company (U.S.A.) 5.3% 15-MAR-2032Yield to maturity

5.04%

Maturity date

Mar 15, 2032

MFC5379265

Manulife Financial Corporation 3.703% 16-MAR-2032Yield to maturity

4.81%

Maturity date

Mar 16, 2032

J

MFC3702588

John Hancock Life Insurance Company (U.S.A.) 6.0% 15-NOV-2027Yield to maturity

4.81%

Maturity date

Nov 15, 2027

J

MFC3670183

John Hancock Life Insurance Company (U.S.A.) 5.2% 15-MAR-2032Yield to maturity

4.77%

Maturity date

Mar 15, 2032

J

MFC3703500

John Hancock Life Insurance Company (U.S.A.) 5.05% 15-JUN-2028Yield to maturity

4.61%

Maturity date

Jun 15, 2028

J

MFC3703532

John Hancock Life Insurance Company (U.S.A.) 5.1% 15-JUN-2028Yield to maturity

4.56%

Maturity date

Jun 15, 2028

J

MFC3702417

John Hancock Life Insurance Company (U.S.A.) 5.6% 15-OCT-2027Yield to maturity

4.51%

Maturity date

Oct 15, 2027

J

MFC3670124

John Hancock Life Insurance Company (U.S.A.) 5.2% 15-MAR-2032Yield to maturity

4.49%

Maturity date

Mar 15, 2032

See all MFC.PR.M bonds

Frequently Asked Questions

The current price of MFC.PR.M is 23.56 CAD — it has increased by 0.30% in the past 24 hours. Watch MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TSX exchange MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 stocks are traded under the ticker MFC.PR.M.

MFC.PR.M stock has risen by 1.86% compared to the previous week, the month change is a 2.66% rise, over the last year MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 has showed a 9.58% increase.

MFC.PR.M reached its all-time high on Nov 20, 2014 with the price of 25.83 CAD, and its all-time low was 9.31 CAD and was reached on Mar 18, 2020. View more price dynamics on MFC.PR.M chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MFC.PR.M stock is 0.68% volatile and has beta coefficient of 0.28. Track MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 stock price on the chart and check out the list of the most volatile stocks — is MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 there?

Today MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 has the market capitalization of 75.07 B, it has decreased by −0.54% over the last week.

Yes, you can track MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 financials in yearly and quarterly reports right on TradingView.

MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

MFC.PR.M earnings for the last quarter are 0.99 CAD per share, whereas the estimation was 0.98 CAD resulting in a 1.22% surprise. The estimated earnings for the next quarter are 0.99 CAD per share. See more details about MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 earnings.

MFC.PR.M net income for the last quarter is 485.00 M CAD, while the quarter before that showed 1.64 B CAD of net income which accounts for −70.39% change. Track more MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 financial stats to get the full picture.

Yes, MFC.PR.M dividends are paid quarterly. The last dividend per share was 0.35 CAD. As of today, Dividend Yield (TTM)% is 3.83%. Tracking MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 dividends might help you take more informed decisions.

MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 dividend yield was 3.62% in 2024, and payout ratio reached 56.10%. The year before the numbers were 4.99% and 55.78% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 30, 2025, the company has 37 K employees. See our rating of the largest employees — is MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 on this list?

Like other stocks, MFC.PR.M shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 stock shows the strong buy signal. See more of MANULIFE FINANCIAL CORP NON CUM SER 17 CL1 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.