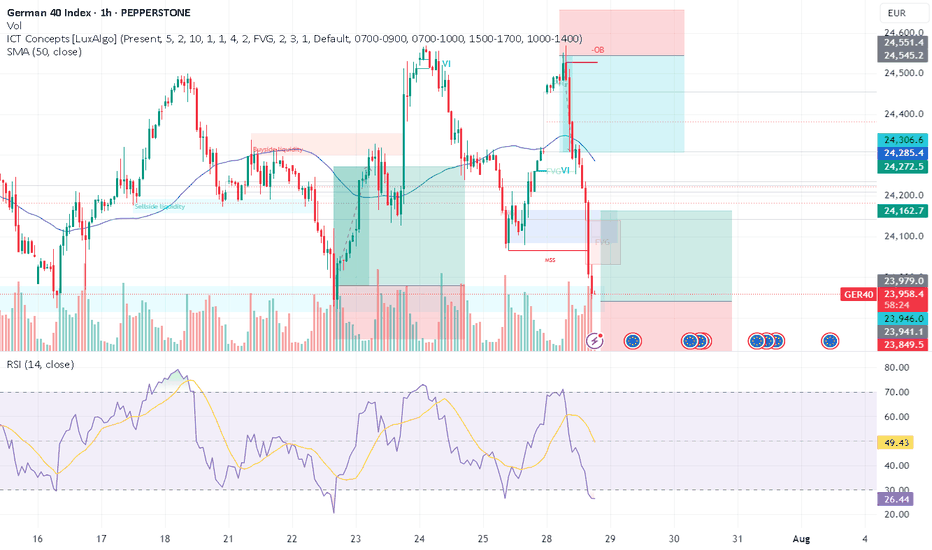

DAX / GER - ANOTHER ROUND OF ENTRY LONGTeam, we have successfully short DAX.GER earlier today with more than 300 points. both target hit

However the market has exceeding the dropping. We decide to go LONG

at the price range 23964-23945

With STOP LOSS at 23865-82

Once the trade hit above 21030-45 - BRING STOP LOSS TO BE

Target 1 at 2108

Related indices

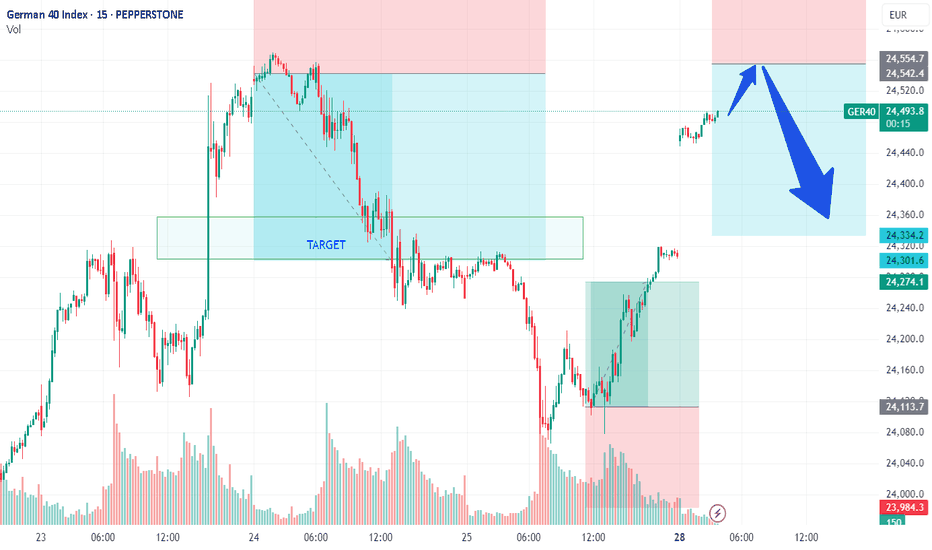

DAX/GER - PREPARE TO SHORT on DAX market opening Team,

We all know that the European Union and the United States agreed on Sunday to a broad trade deal that sets a 15 per cent tariff on most E.U. goods, including cars and pharmaceuticals.

The 27-nation bloc also agreed to increase its investment in the United States by more than $600 billion abov

GER/DAX - TIME FOR RECOVERTeam, this morning, the DAX target hit our target 1, we took some profit, we set a stop loss at BE, and it got stopped out

Time for us to re-enter the DAX again at 23880-23855

STOP loss 23780

Once the price move at 23950 - bring STOP LOSS TO BE

Target 1 at 23985-24015

Target 2 at 24065-24096

lets

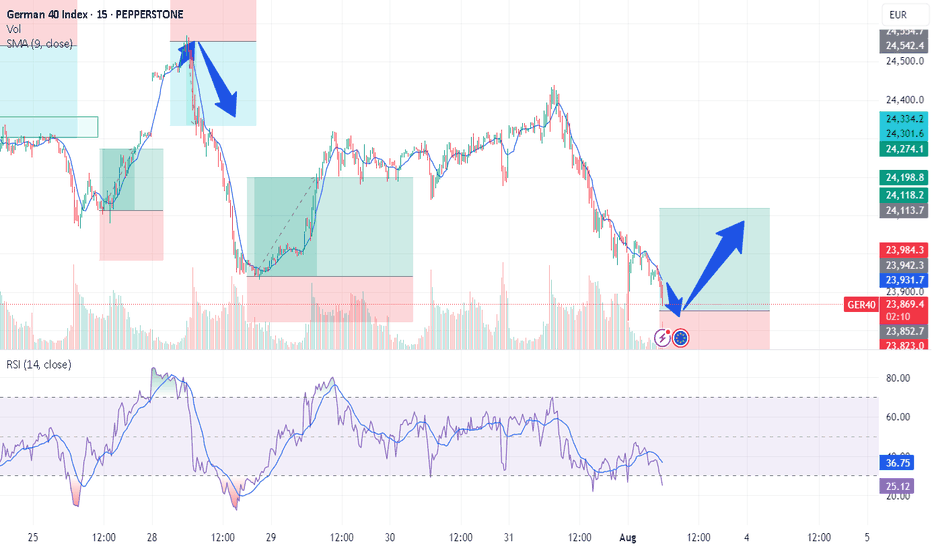

DAX sideways consolidation support at 24070The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 24070 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24070 would confirm ongoing up

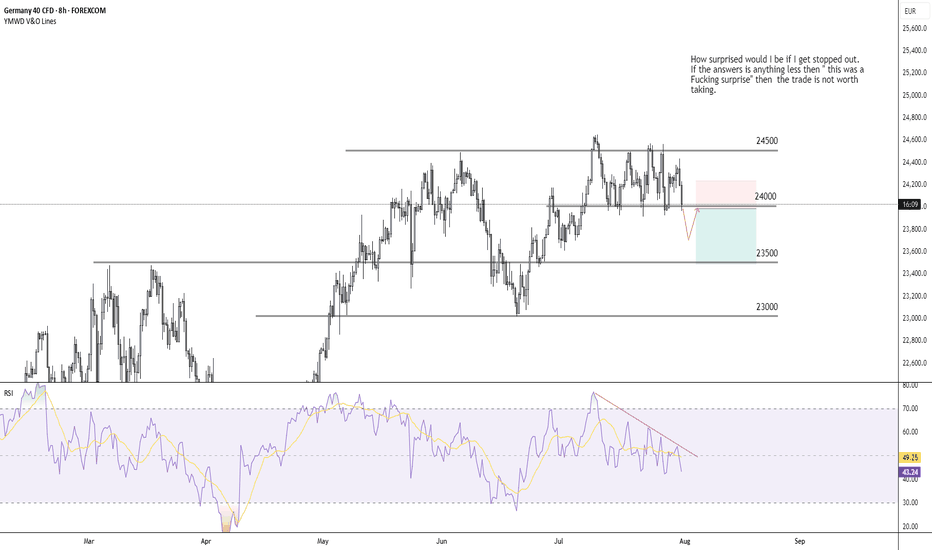

DAX: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 24,252.78 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmati

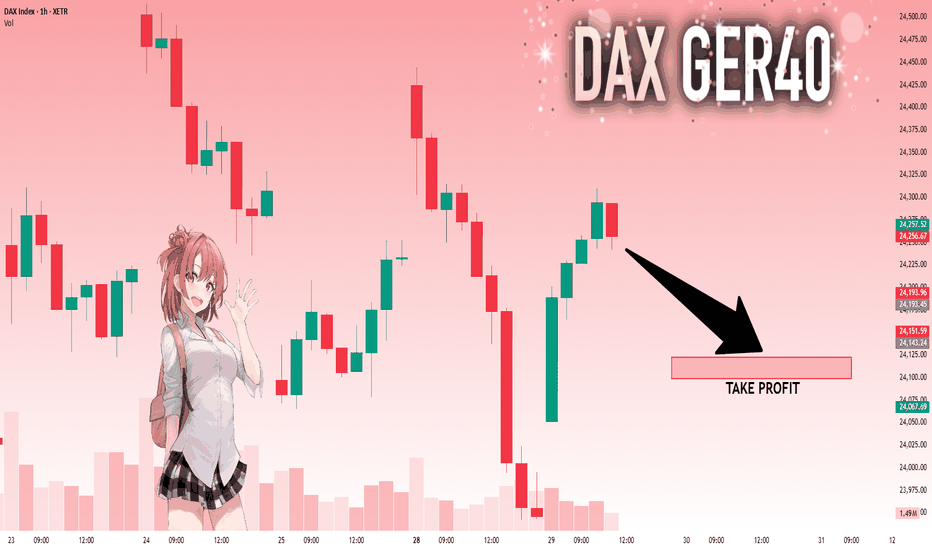

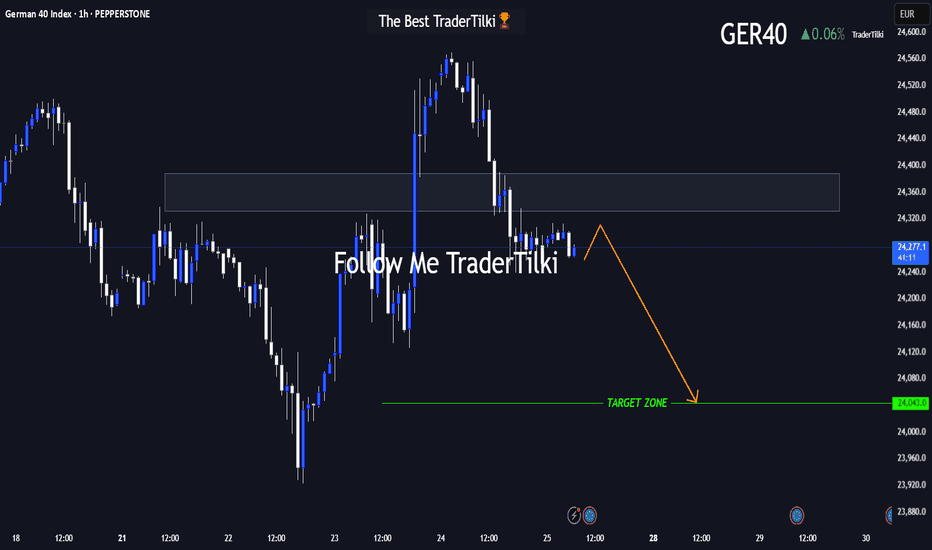

GER40 in Motion: This Setup Speaks Volumes 🌅 Good morning, my friends,

I’ve put together a fresh GER40 analysis just for you. Even if the 1-hour timeframe shows some upward momentum, I fully expect the price to reach my target level of **24,050**.

I'm holding firm until that level is hit.

Every single like from you is a massive source of

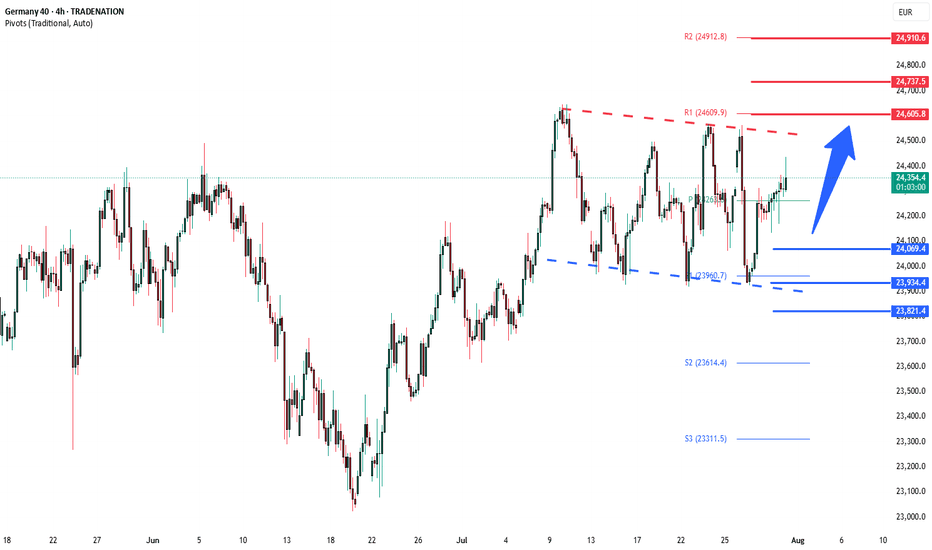

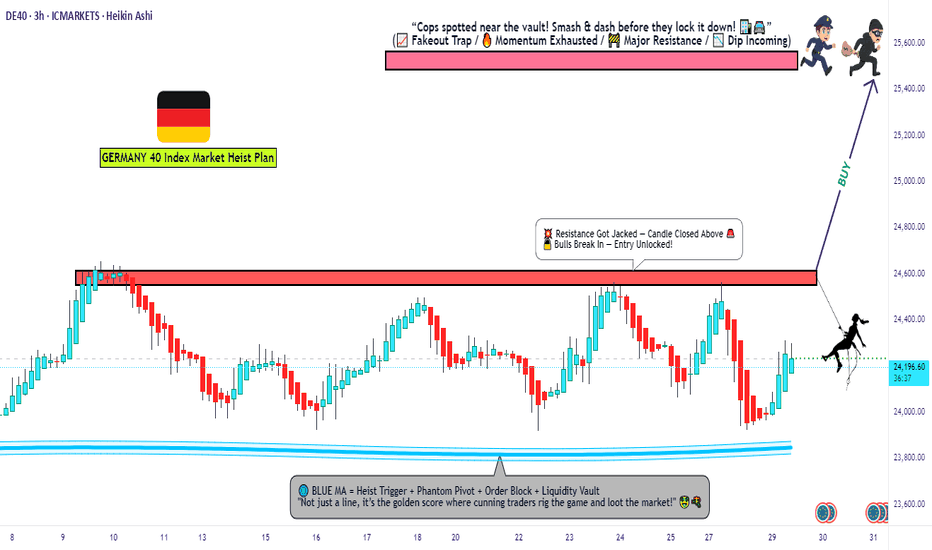

DE40 Breakout Robbery – Bullish Setup Revealed!💣 DE40 / GER40 INDEX BREAKOUT RAID 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Robbers, Money Makers, and Chart Bandits 🕶️💰💣,

We’re rollin' out our latest Thief Trader Heist Plan based on laser-sharp technical + fundamental recon 🧠💼 on the Germany DE40 / GER40 Index. It’s time to ge

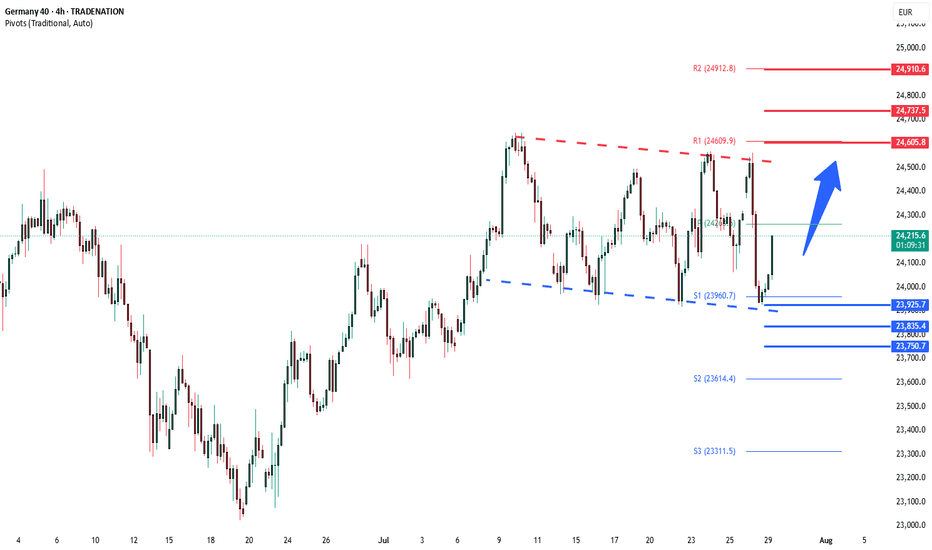

The DAX Index Is Losing Its Bullish MomentumThe DAX Index Is Losing Its Bullish Momentum

At the end of May, we noted that the German stock index DAX 40 was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed,

DAX oversold rally support at 23925The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 23925 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 23925 would confirm ongoing up

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of GERMAN STOCK INDEX (DAX) is 23,425.98 EUR — it has fallen by −2.66% in the past 24 hours. Track the index more closely on the GERMAN STOCK INDEX (DAX) chart.

GERMAN STOCK INDEX (DAX) reached its highest quote on Jul 10, 2025 — 24,639.10 EUR. See more data on the GERMAN STOCK INDEX (DAX) chart.

The lowest ever quote of GERMAN STOCK INDEX (DAX) is 372.30 EUR. It was reached on Nov 6, 1974. See more data on the GERMAN STOCK INDEX (DAX) chart.

GERMAN STOCK INDEX (DAX) value has decreased by −2.79% in the past week, since last month it has shown a −1.53% decrease, and over the year it's increased by 27.09%. Keep track of all changes on the GERMAN STOCK INDEX (DAX) chart.

The champion of GERMAN STOCK INDEX (DAX) is XETR:ENR — it's gained 266.33% over the year.

The weakest component of GERMAN STOCK INDEX (DAX) is XETR:P911 — it's lost −39.10% over the year.

GERMAN STOCK INDEX (DAX) is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy GERMAN STOCK INDEX (DAX) futures or funds or invest in its components.

The GERMAN STOCK INDEX (DAX) is comprised of 40 instruments including XETR:SAP, XETR:SIE, XETR:DTE and others. See the full list of GERMAN STOCK INDEX (DAX) components to find more opportunities.