JXY trade ideas

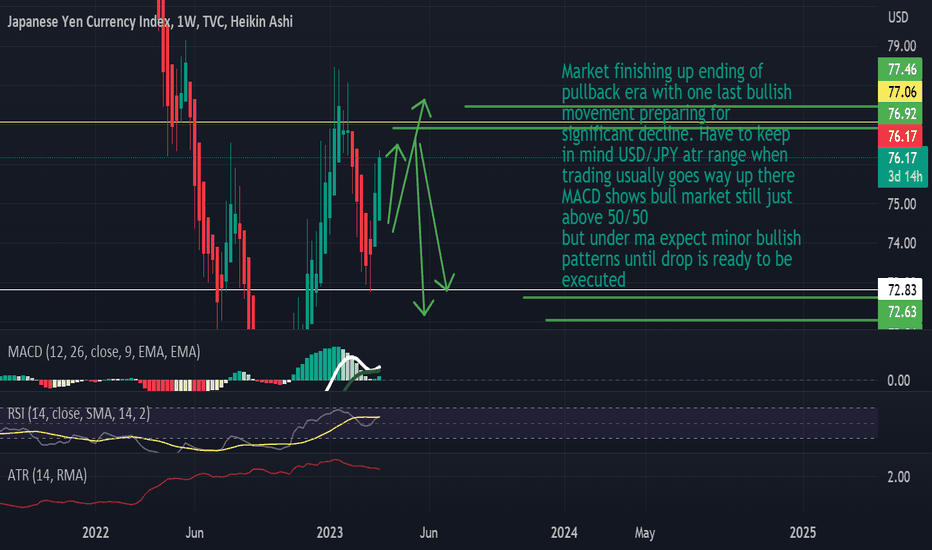

JXY ANALYSISMarket finishing up ending of pullback era with one last bullish movement preparing for significant decline. Have to keep in mind USD/JPY atr range when trading usually goes way up there MACD shows bull market still just above 50/50

but under ma expect minor bullish patterns until drop is ready to be executed

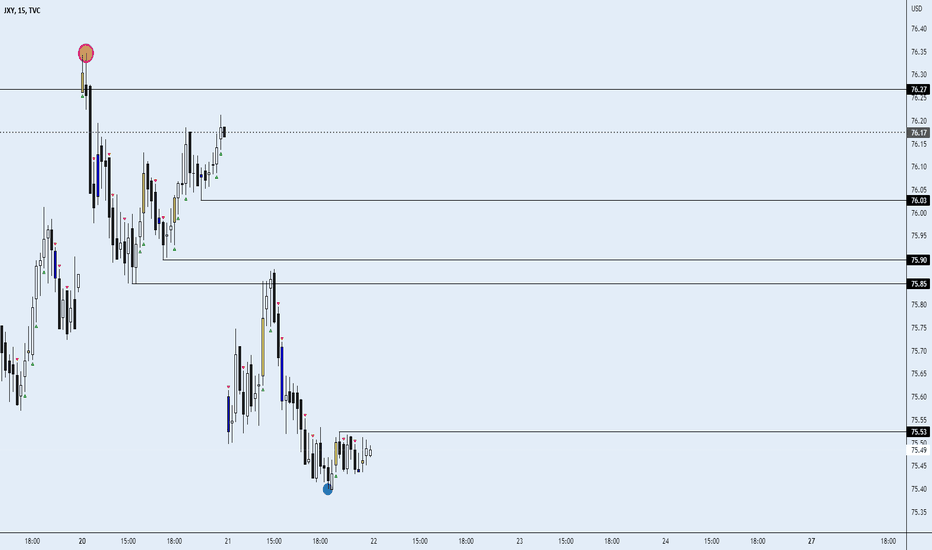

SYLYNTEXCHANGE.COM SITE UPDATED FOR WEEK OF 20-27

I have also implemented an 36HR-48HR Forecast analysis chart on the site that is on the economic Calendar page

Here on our site we are building we keep track of market sentiment and align it with more data to get a better idea of price movement. The site is updated Daily/every week & quarterly... TIME PERIOD UPDATE- SYLYNT EXCHANGE will incorporate a markets full day close to a 19hour period instead of 24 hours for daily deviation/growth % broken down according to region for target accuracy (this is daily basis type trading).

We welcome all and provide access to the Sylynt SEC Board where you can follow weekly projections on appreciation %, visual of market sentiment (monthly, weekly, & quarterly), economic calendar, and encourage all to use the forum to share ideas as traders/investment consultation area between one another.

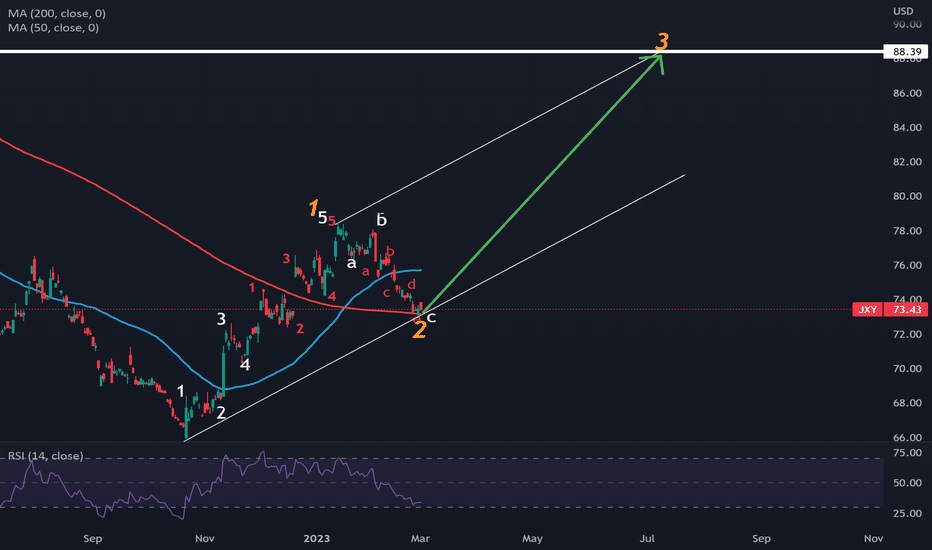

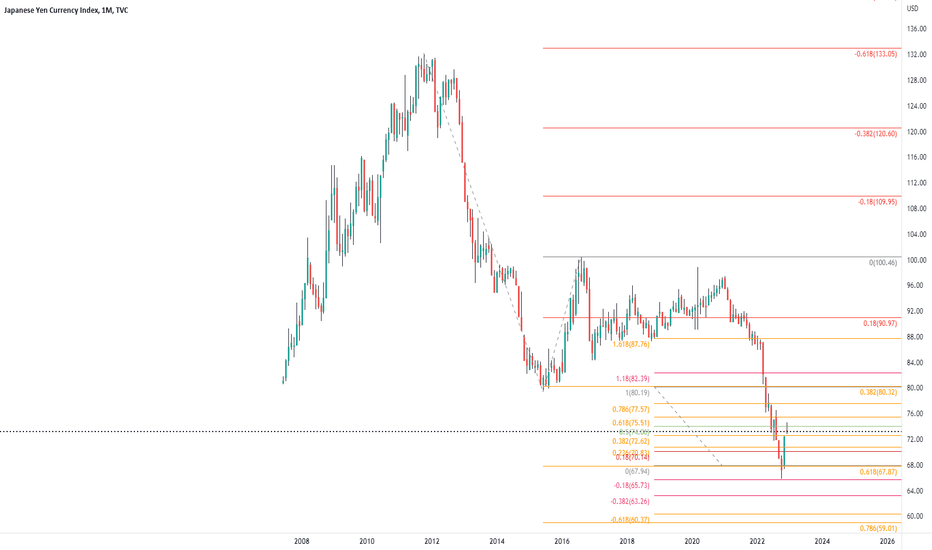

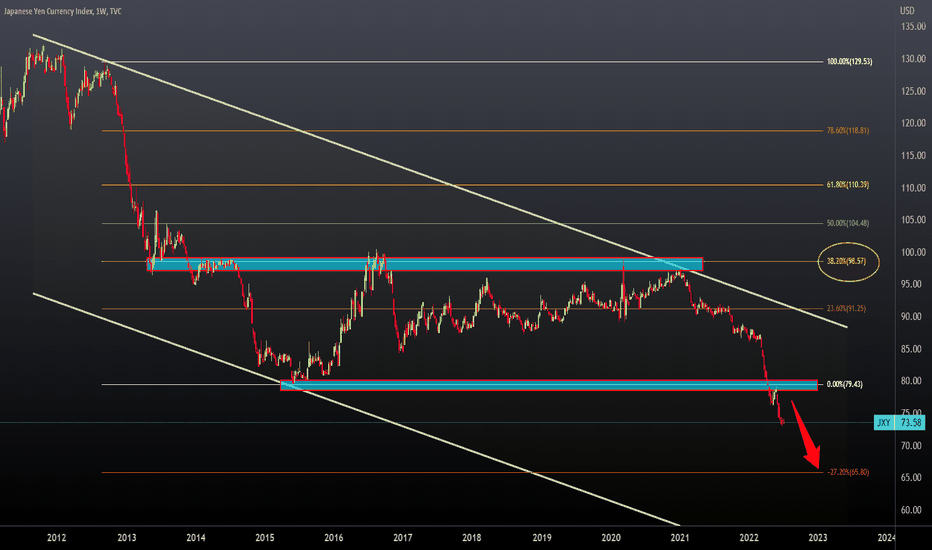

JXY WAVE ANALYSIS (FULL PICTURE)The JPY has taken a major beating following rate rise in major economies to curb inflation and the ultra easy monetary policy in Japan. Nevertheless, the Japanese Yen Index (JXY) seemed to have found a bottom at about 65.85 in October 2022. The has recovered some ground following the bottom in Oct 2022, and has successfully completed major wave 1 and formed a wave 2 correction which found support on the 200 daily MA. Further the pair has formed a golden cross (cross of the 50 daily MA to the upside of the 200 daily MA). Golden crosses are usually good indication of bullish price action adding a further bullish bias. If the wave hypothesis is correct and the 200 MA holds as support, I expect the JXY to start major wave 3 with potential target of 88. This means AUDJPY, NZDJPY, EURJPY, GBPJPY, CHFJPY as well as the Nikkei225 could all be potentially very bearish.

If you like these wave analysis, give it a like and follow me. It will encourage me to produce more fine analysis for you.

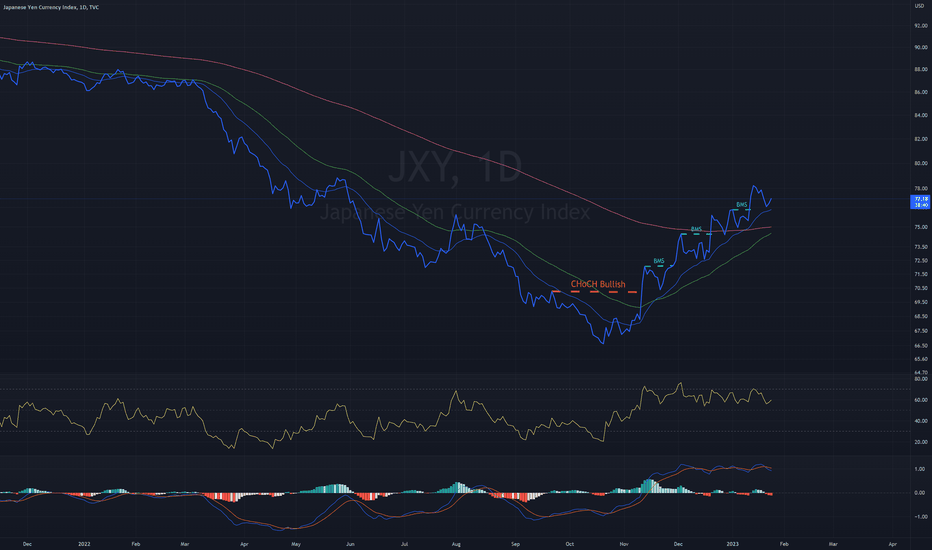

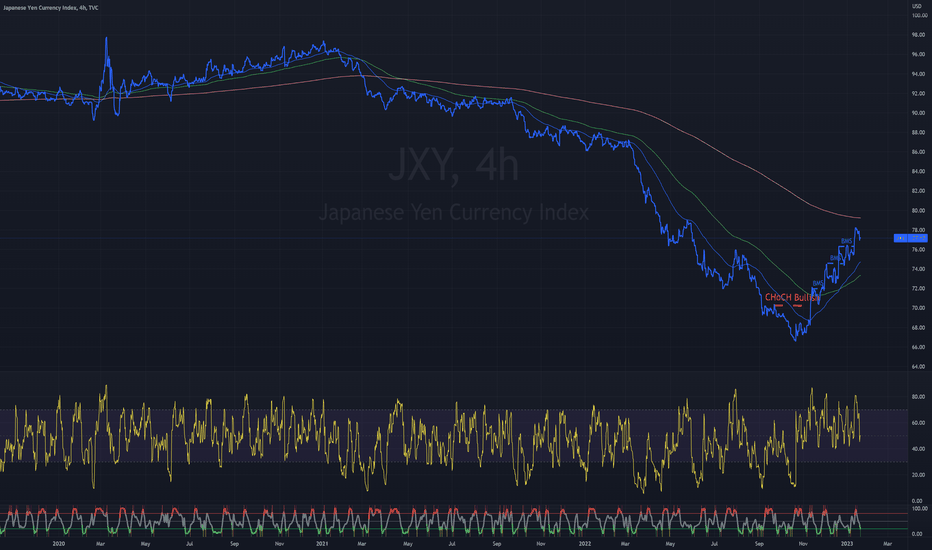

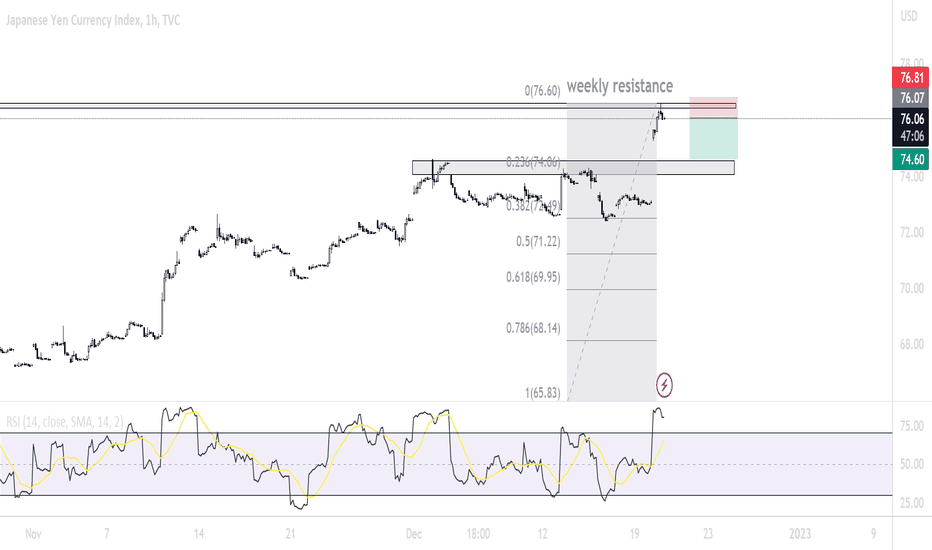

Bullish Trend for Japanese Yen as Technical Indicators Point UPThe Japanese Yen is currently experiencing a bullish market trend, as indicated by technical indicators such as a CHoCH and confirmation by 4 BMS. The currency is currently trading above key moving averages, and indicators such as RSI and MACD are showing consolidation in the bullish zone. Japan has a large and unique economy, known for its manufacture and export of automobiles and electronic goods, as well as its focus on high-tech and precision goods. As the third most commonly traded currency in the world, the Japanese Yen is closely watched by investors and traders.

The information provided by LewkP is for educational and informational purposes only. It should not be considered financial or investment advice. The analysis presented may not be suitable for all investors. Any opinions expressed in this analysis are solely those of LewkP and do not represent the opinions of any other party. LewkP does not provide financial advice and any analysis provided should not be used as the sole basis for making investment decisions. LewkP does not intend for the analysis to be used for intraday trading. LewkP advises that any trading should only be done with caution and only by individuals who are fully in control of their emotions and have a high risk tolerance. LewkP is not responsible for any losses incurred as a result of using the information provided.

Bullish market flowThe JXY is showing bullish market flow, with the RSI consolidating above the 50 line, the CCI at the bottom of a down stroke, and price making new structure highs. The 20 and 50 DEMA are trending up with price. Volatility increased on Friday due to profit taking and the upcoming Lunar New Year holiday in Asia. Speculators are betting that the Bank of Japan, the last major central bank to still employ a loose monetary policy, is edging toward a shift to a tighter stance. Japan's core consumer prices in December rose 4.0% from a year earlier, double the BOJ's target. Experts believe that the dollar/yen pair will continue to decrease and that the dollar will move back into the 130-135 yen range. The greenback has been mostly on the defensive this week, as data from consumer spending to business activity and inflation across major economies highlighted an increasingly fragile outlook for U.S. growth. Investors are waiting for the first Federal Reserve meeting of the year in early February to see if it raises interest rates.

The information provided by LewkP is for educational and informational purposes only. It should not be considered financial or investment advice. The analysis presented may not be suitable for all investors. Any opinions expressed in this analysis are solely those of LewkP and do not represent the opinions of any other party. LewkP does not provide financial advice and any analysis provided should not be used as the sole basis for making investment decisions. LewkP does not intend for the analysis to be used for intraday trading. LewkP advises that any trading should only be done with caution and only by individuals who are fully in control of their emotions and have a high risk tolerance. LewkP is not responsible for any losses incurred as a result of using the information provided.

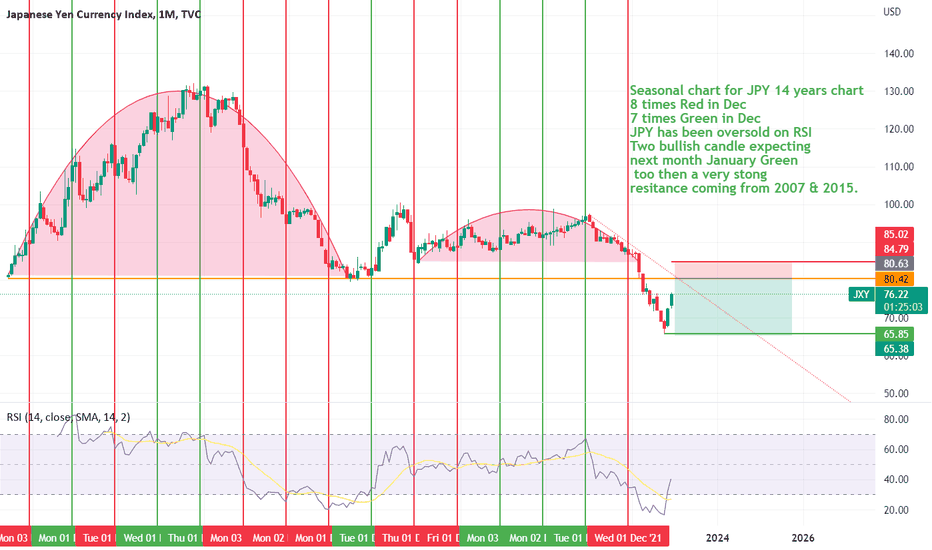

Seasonal Anaylsis of JPY As per my anaylsis JPY has been on oversold on RSI and now making a good reversal strong and bullish from last two months but on a month time frame Dec is the month of green candles and red candles on 15 year charts. Please there is an very strong Resistance on 80.42 if its did not break it then jpy chart lools ugly. Because it is also creating a Inverse Cup&handle if if if it complete the move JPY will go around 50-52 Range.

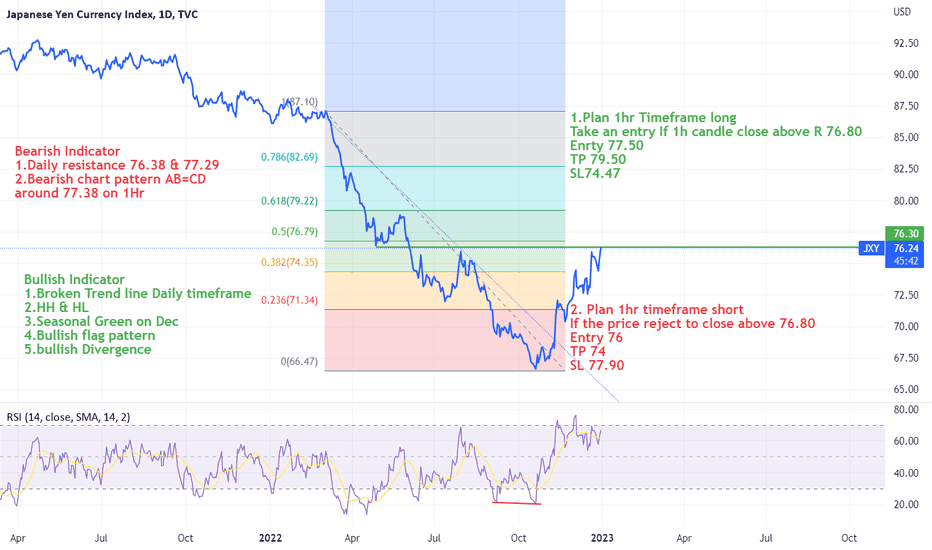

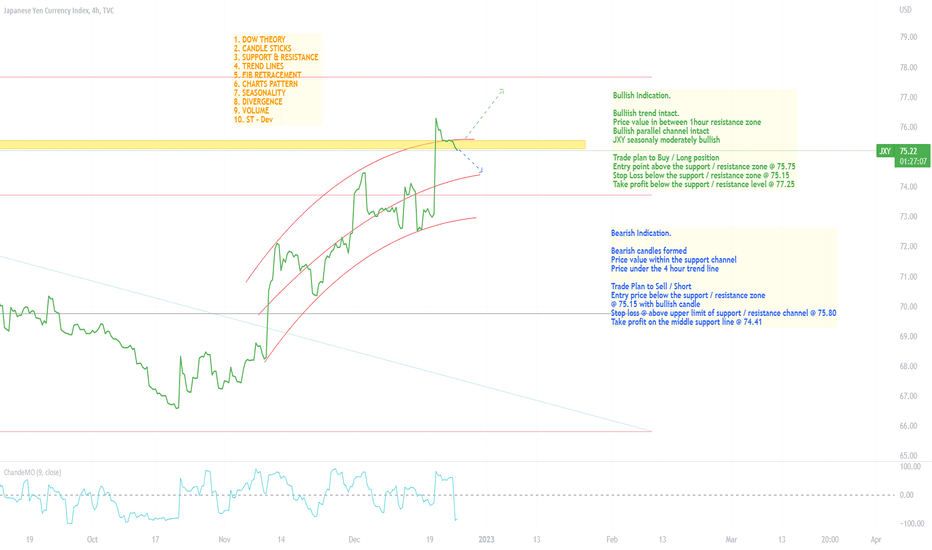

Going Short in JXY Japanies Yen Index.Bullish Indication.

Bulliish trend intact.

Price value in between 1hour resistance zone

Bullish parallel channel intact

JXY seasonaly moderately bullish

Trade plan to Buy / Long position

Entry point above the support / resistance zone @ 75.75

Stop Loss below the support / resistance zone @ 75.15

Take profit below the support / resistance level @ 77.25

Bearish Indication.

Bearish candles formed

Price value within the support channel

Price under the 4 hour trend line

Trade Plan to Sell / Short

Entry price below the support / resistance zone

@ 75.15 with bullish candle

Stop loss @ above upper limit of support / resistance channel @ 75.80

Take profit on the middle support line @ 74.41

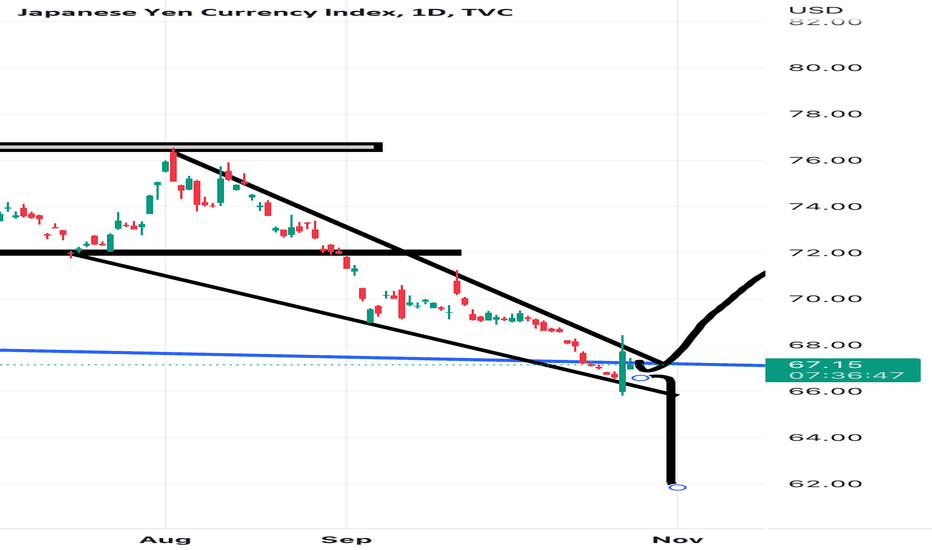

yen index precisely jumped at trend line touchI wonder how market randomness can be explained with such precision! the chart shows how yen index precisely jumped at trend line touch. This surged the pair USDJPY for more than 600 pips in two hours!

The bank of Japan declined to comment bout any intervention!

MACRO-ECONOMIC ARBITRAGE- Buy the Yen short the dollarBoth the Nikkei and the S&P have moved in the same direction along w the yen and the dollar. However recently the Dollar has appreciated dramatically while the Yen has depreciated dramatically. It therefore presents an arbitrage opportunity. The US dollar will eventually come back down and stabilize along w the yen rebounding. The problem i'm running into is how long this could take for the market to correct . Anyone have any inputs or comments?

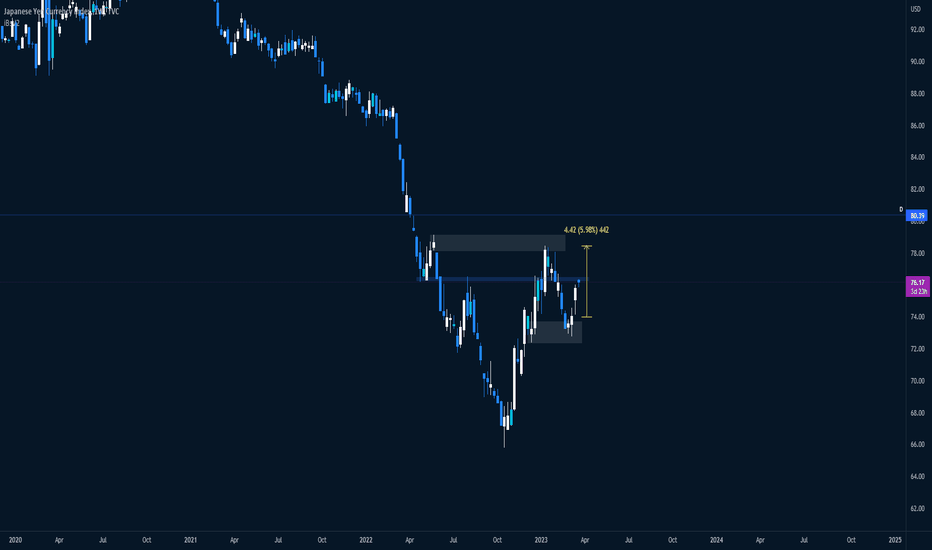

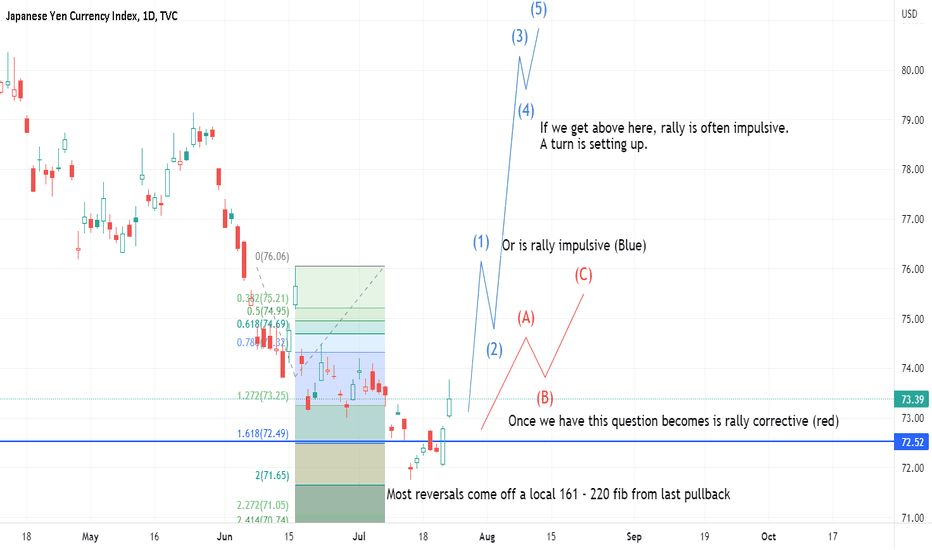

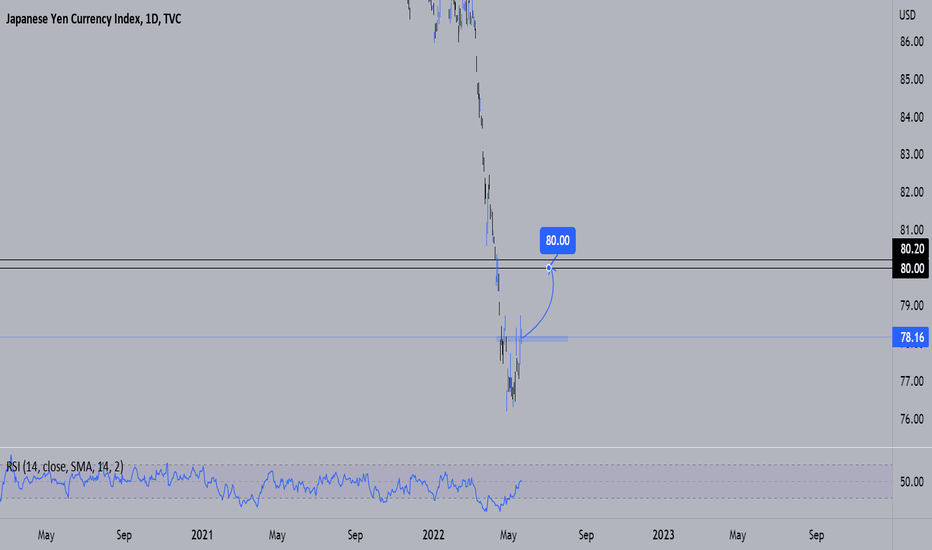

Early reactions on supports for Yen - What's next?JPX still has to retake 72 for it to be showing signs of the big butterfly reversal being in play.

Here's a few shorter-term signals that help to define the area in which to bet most aggressively on the low and place tight stops. Once there's a pullback a low should stop before the 220 fib. As we got close to this 220 fib was where I scaled up my long Yen positions.

An early bounce on this level often indicates we'll go up at least a bit more. The question at this point is most often will we see a 2 leg correction in the downtrend or will we see an explosive 5 wave climb breaking the downtrend?

I very much doubt the breaking of the Yen downtrend would come without news. Might be BoJ news. Could be world markets/risk-off news. And sadly the theme of news during the bear moves of 2020 and 2022 has often been news related to real world suffering and death.

But usually "Something" has to happen for a big turn like this to come into effect. Most often something I could not predict (And guessing the headline does not matter).

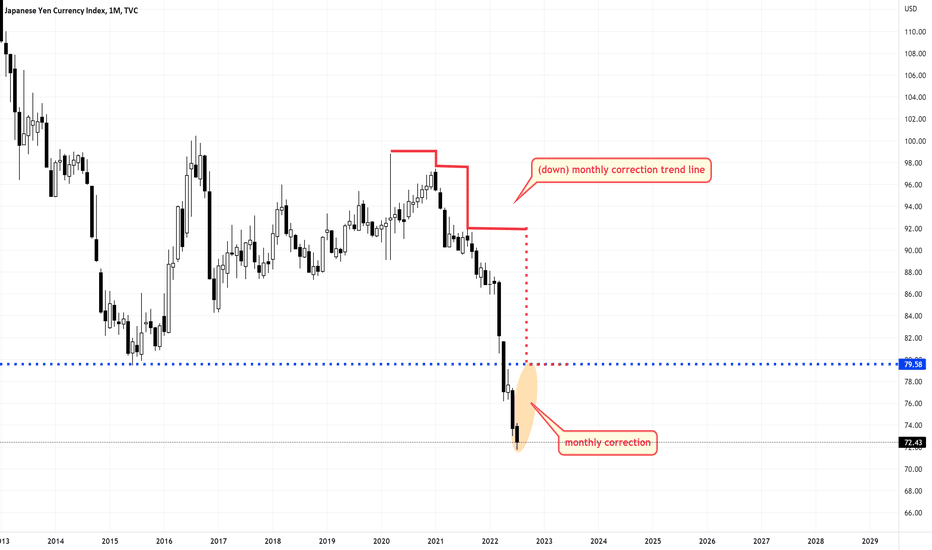

JPY is in a monthly downtrend.JPY is in a monthly downtrend.

In order for the downtrend to continue, a new monthly correction trend line must be drawn for it to continue. If a correction occurs, the monthly correction is more likely, and the blue support line is more likely to be tested. If it settles above the blue line, the monthly downtrend will stop and the chance that the uptrend will resume is very high. The reason is that the low is the starting line of the yearly correction trend of the upward wave.

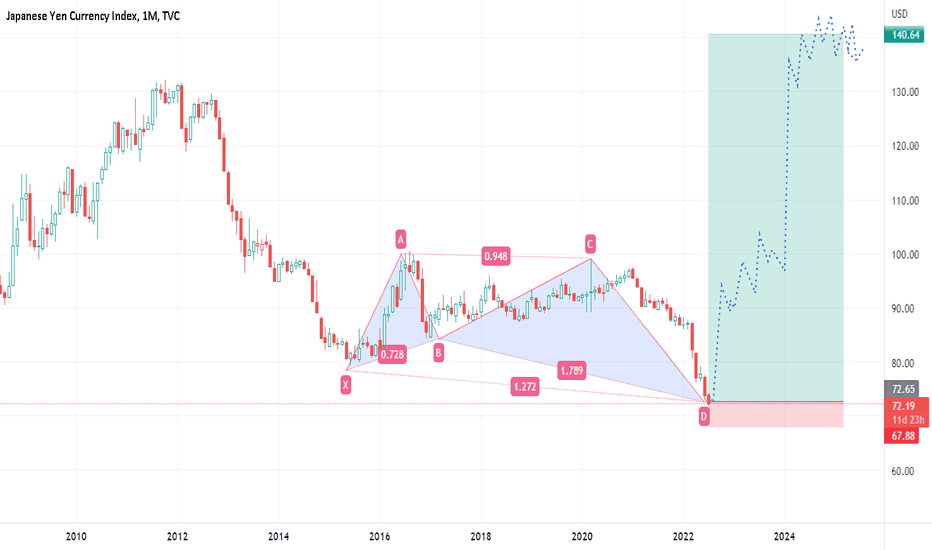

Long Yen is my largest position. Adding more to my JPY long position. It's already my biggest position and scaling it up more. The index has now completed a big butterfly pattern. With the classic capitulation in the D leg, news driven. When the butterfly reversal works, we now begin to uptrend. Often also news driven.

Short GBPJPY, NZDJPY, AUDJPY and EURJPY.

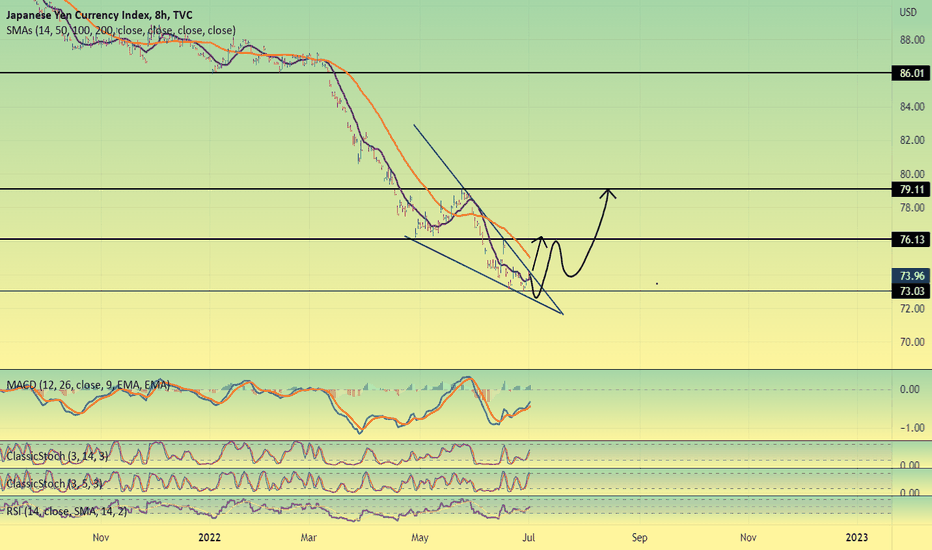

JXY longhello tradingview community, lets get straight into technical... currently the JXY is completing the falling wedge, it could break the falling wedge or may pull back and stay in the falling wedge since it is still in the bearish momentum area according to RSI and Macd for 8hr tf.. Price has made a strong support around 73.03 where the could or may not test again.... Our main target is 76.16 which is the next resistance it need to test or break through...

good luck -

Japanese Yen Bullish Divergence on DailyTrade Safe - Trade Well

Regards,

Michael Harding 😎 Chief Technical Strategist @ LEFTURN Inc.

RISK DISCLAIMER

Information and opinions contained with this post are for educational purposes and do not constitute trading recommendations. Trading Forex on margin carries a high level of risk and may not be suitable for all investors. Before deciding to invest in Forex you should consider your knowledge, investment objectives, and your risk appetite. Only trade/invest with funds you can afford to lose

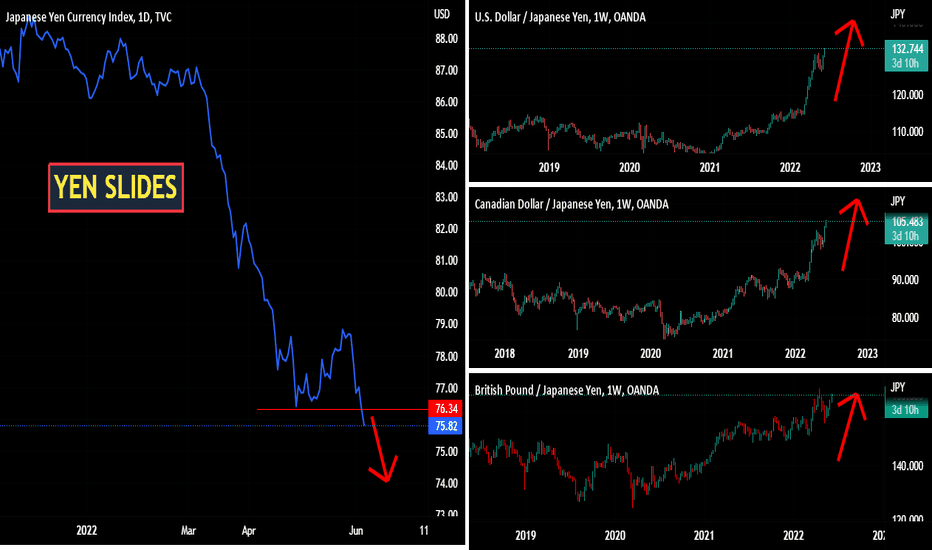

YEN CROSSES ON THE RISE | USDJPY CADJPY GBPJPY

JXY, Yen has technically taken out the support and price slides further downside. All the crosses looks like to make all time high specially USDJPY

BoJ Stance:

BoJ would adhere to its ultra-loose policy until the Bank achieved its inflation target of 2%.

With Kuroda doubling down on the Bank’s accommodative policy, the risk for the yen is clearly tilted to the downside, barring a decline in US Treasury yields.

-----

How you do see the direction of Yen in future.

JXYYen hitting ATL recently is interesting, now its retracing, but to what level before a continuation of this downtrend? Looking back at prehistoric res/sup levels we can clearly see that the area around 80.00 is significant. 80.00 is also a nice psychlogical level. We could expect a monthly closure around 80.00.

Keep in mind, you win some, you lose some. And u need to do your own research too!