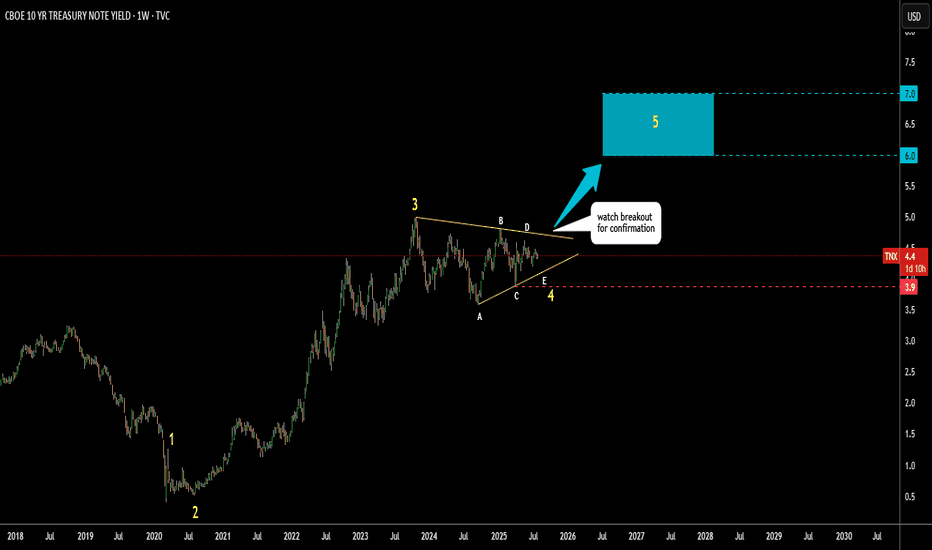

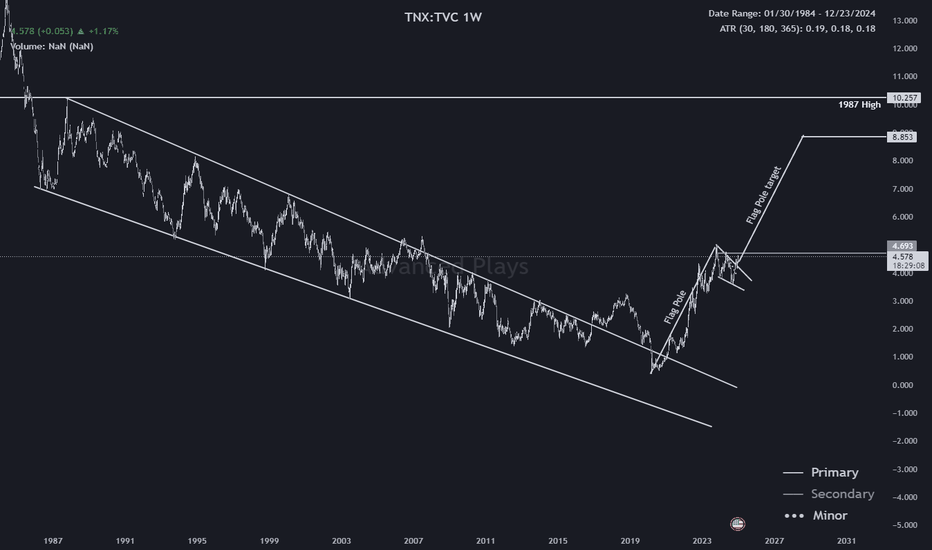

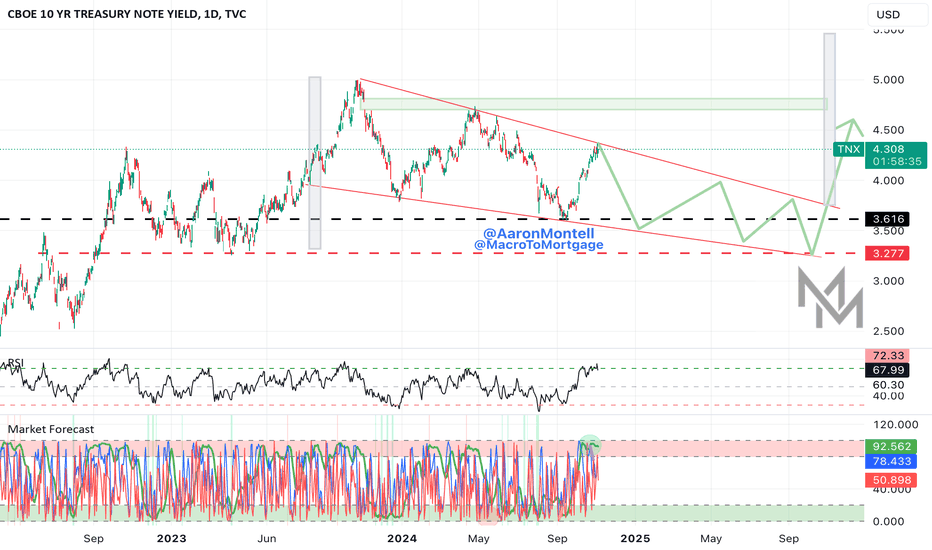

US 10Y yield: Triangular Consolidation, next 6-7%I’ve spotted a well-known triangular pattern forming on the US 10-year Treasury yield.

This appears to be the development of a large Wave 4.

Wave E of Wave 4 may still be unfolding.

Watch to see if it holds above the Wave C low at 3.9%.

A breakout above resistance near 4.7% would confirm the patter

Related indices

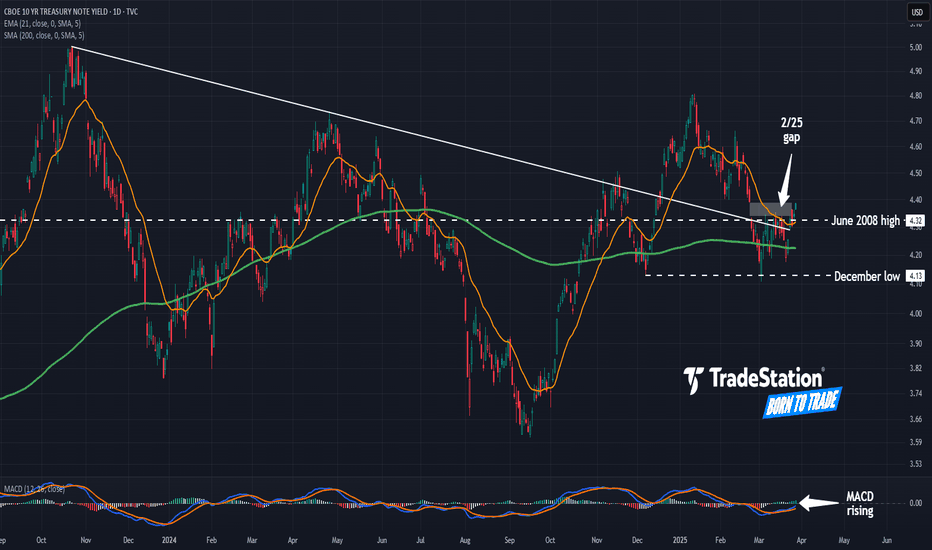

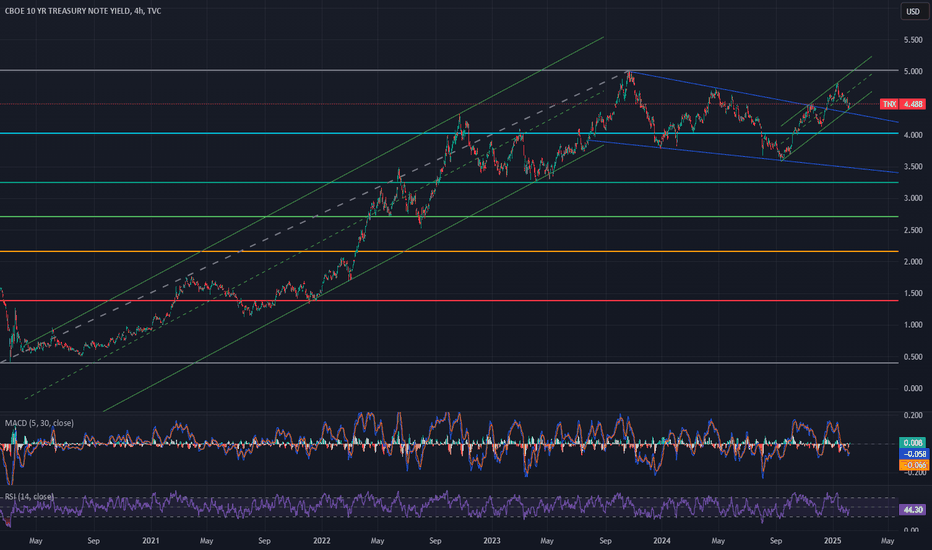

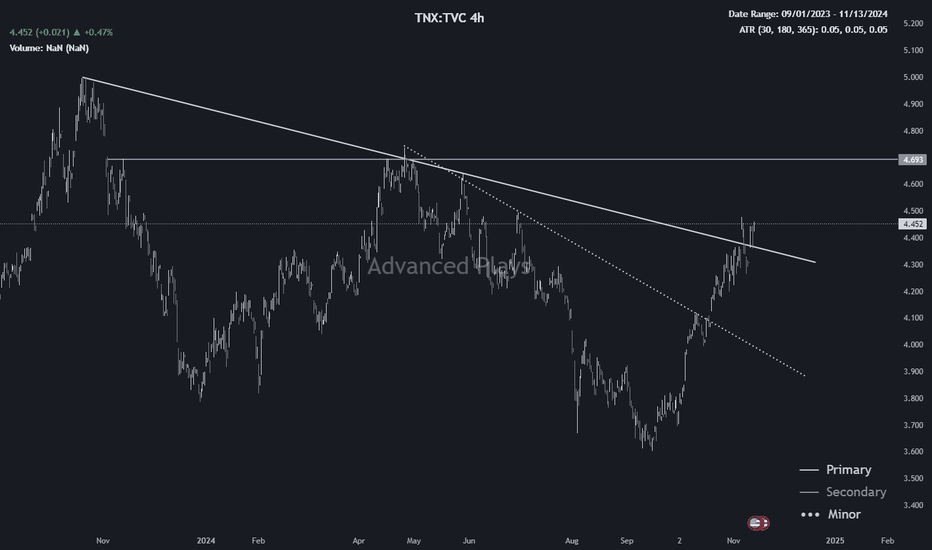

10-Year Treasury Yield Nudges HigherThe 10-Year Treasury yield has been rangebound for about 1-1/2 years, but some traders may see upside risk.

The first pattern on today’s chart is the series of lower highs since October 2023. TNX violated the trendline in December and may be holding above it now. That could suggest a period of down

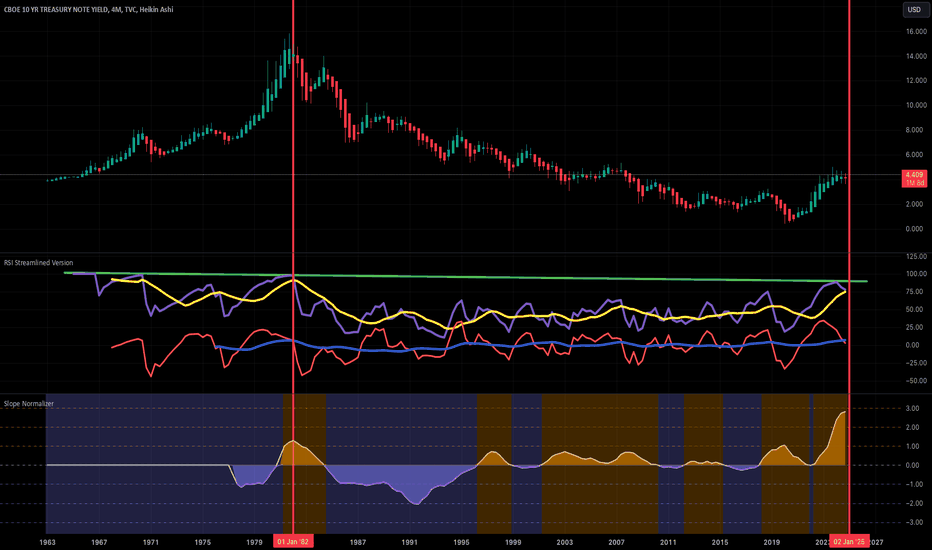

Stay Neutral on 10-Year Treasury as Market Uncertainty Looms

- Key Insights: The 10-Year Treasury yield is at a critical juncture amid

ongoing market uncertainty. With central banks selling US Treasuries, yields

are volatile. Analysts recommend maintaining a neutral stance, suggesting

that holding onto bonds and cash is prudent in the face of unpredict

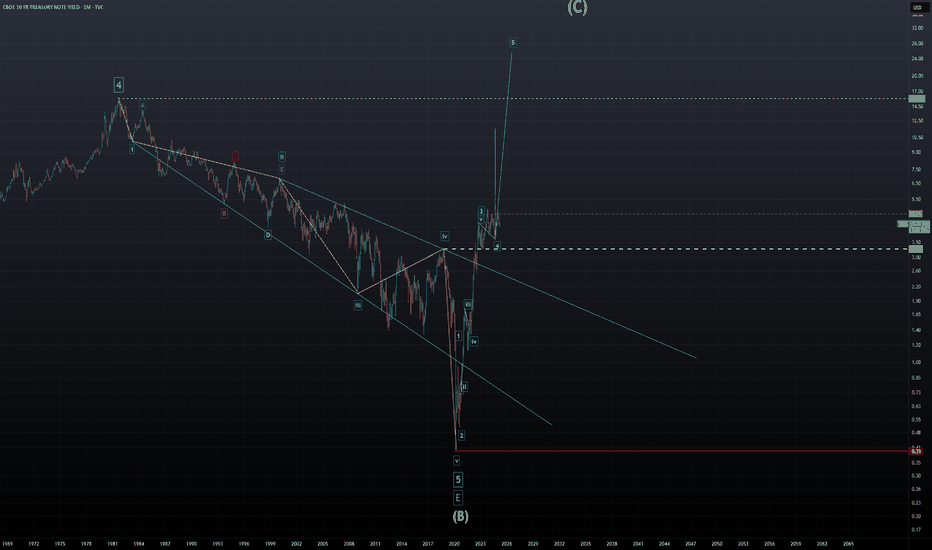

AriasWave Market Update - You Might Want To Watch This... Part 1In this video, I'm finally breaking my silence. I can’t hold back my bearish outlook any longer, so I’m launching a series of videos to break down exactly why I see trouble ahead and what it could mean.

While I won’t cover everything in this first video, I’m kicking off the conversation now that t

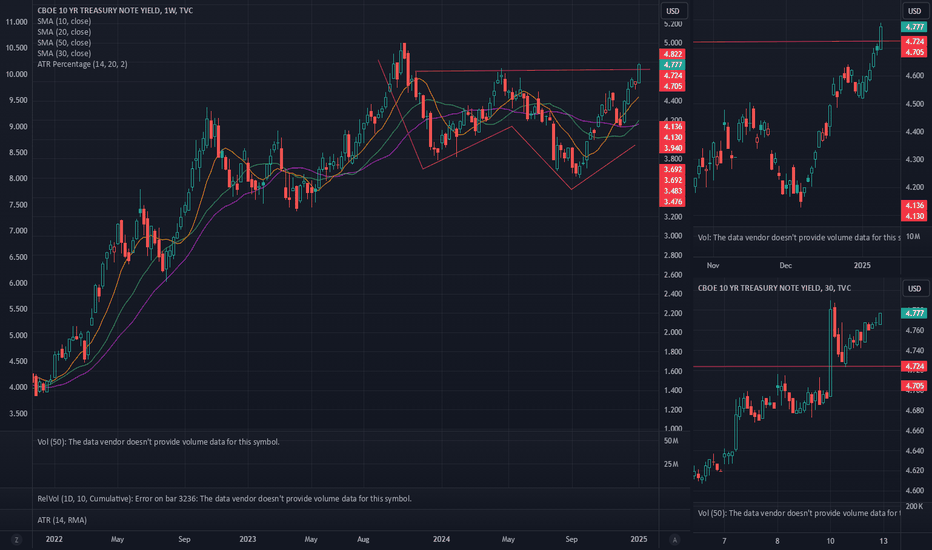

TNX Explosion IncomingI think I've made my point with my thesis on interest rates, but I will continue to beat this drum until something breaks. Something is going to break soon. The market is fighting the fed ever since they started cutting and the market is calling out Powell's rate cut nonsense. They cut by 100bps, bu

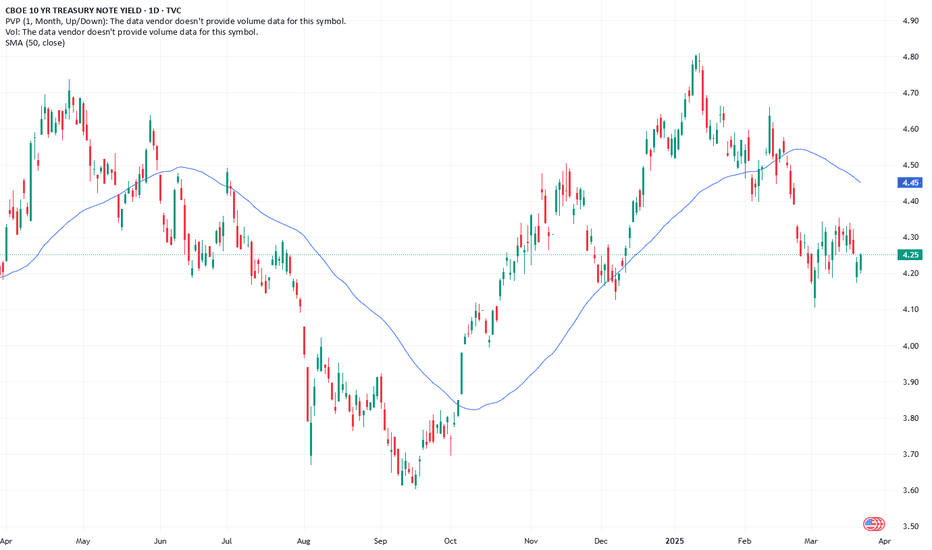

TNX - ten year note yield still in an uptrendIs it just me or is it weird that even the yield of treasury notes trades within channels and diagonals like stocks and oil ?

This chart pattern could be described as a bull flag.

Rising yields don't necessarily lead to lower stock prices:

But the bigger picture issue could be the interest

TNX BreakoutTNX failed on the first breakout attempt but quickly reclaimed and is now looking poised for another leg up. Many are calling for a move back up to 5% and I personally think that is likely to happen as well. We may get a reaction tomorrow morning after PPI and jobs data and I expect it to be up for

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.