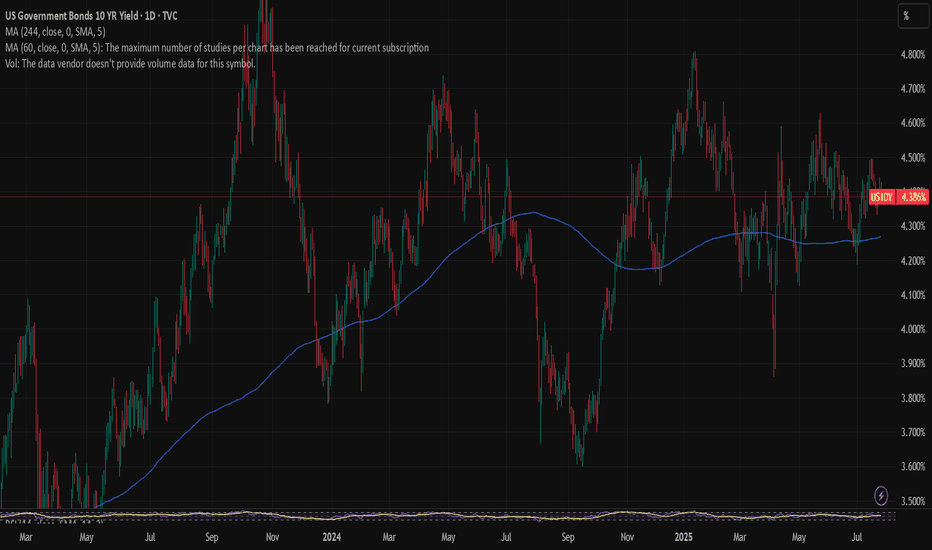

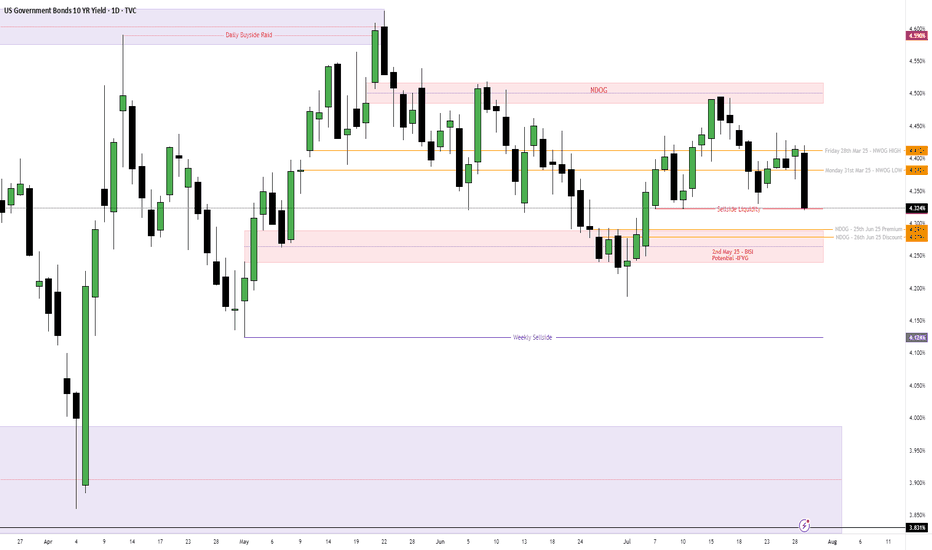

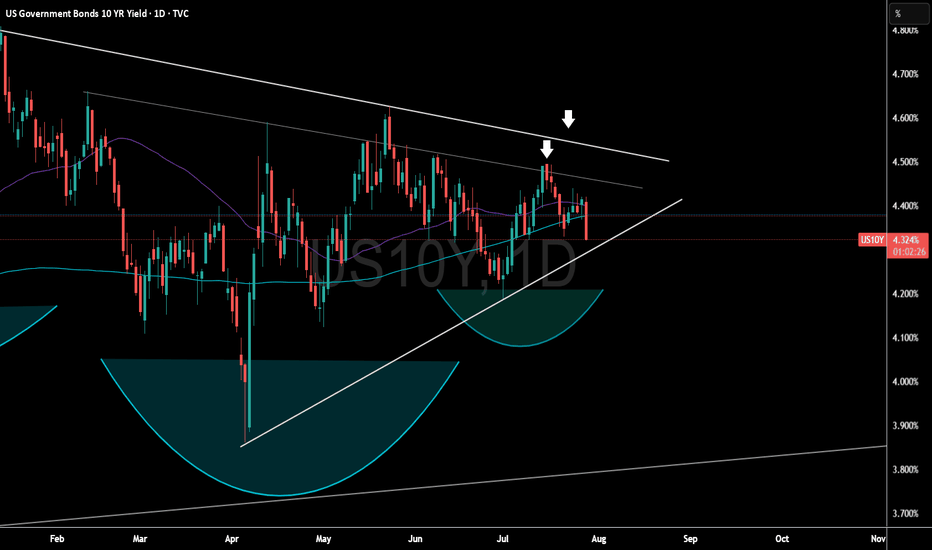

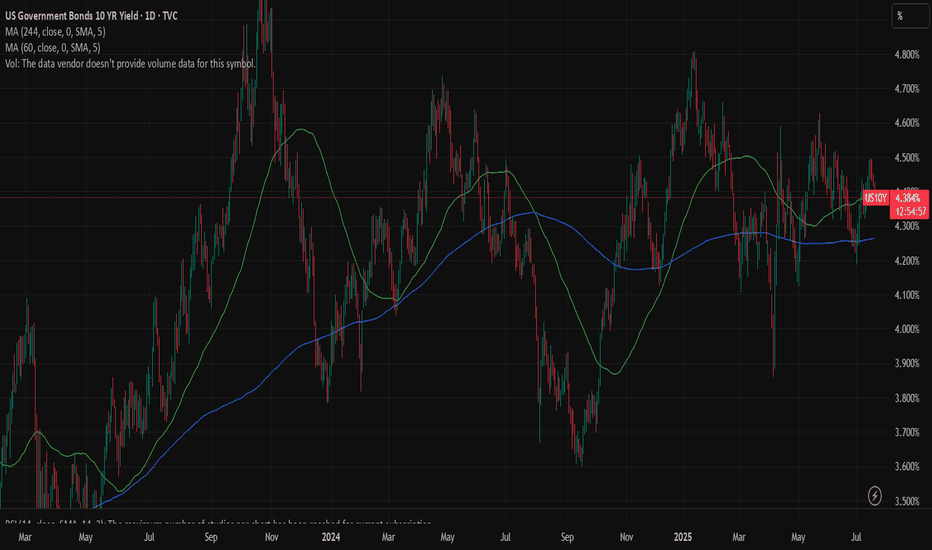

US 10Y TREASURY: FOMC week During the previous week investors were digesting the latest macro data aiming to set expectations for the forthcoming FOMC meeting, which is scheduled for Wednesday, July 30th. The 10Y Treasury yields were moving between 4,32% and 4,44%, closing the week at 4,38%. The drop in yields during the seco

Related bonds

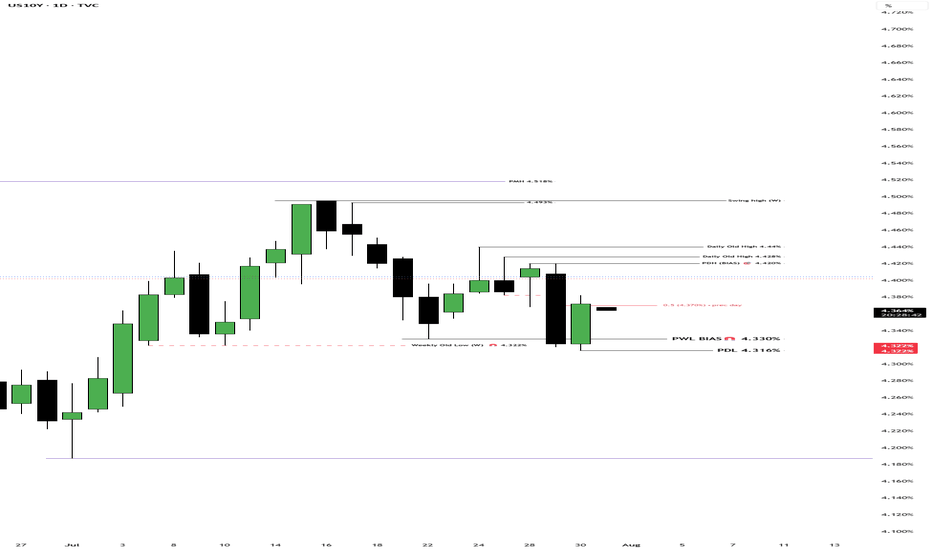

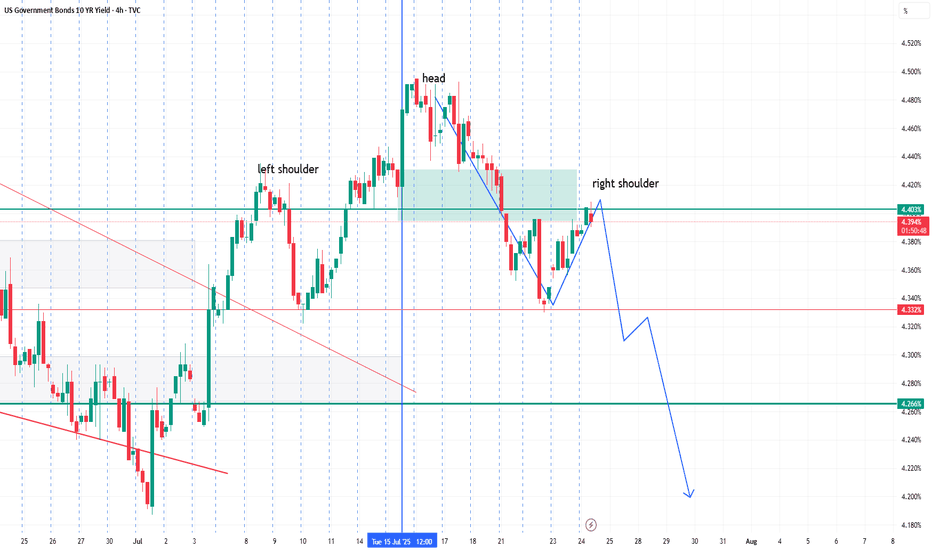

US Treasury 10Y Technical Outlook for the week July 28-Aug 1 US Treasury 10Y Technical Outlook for the week July 28-Aug 1 (updated daily)

Overnight

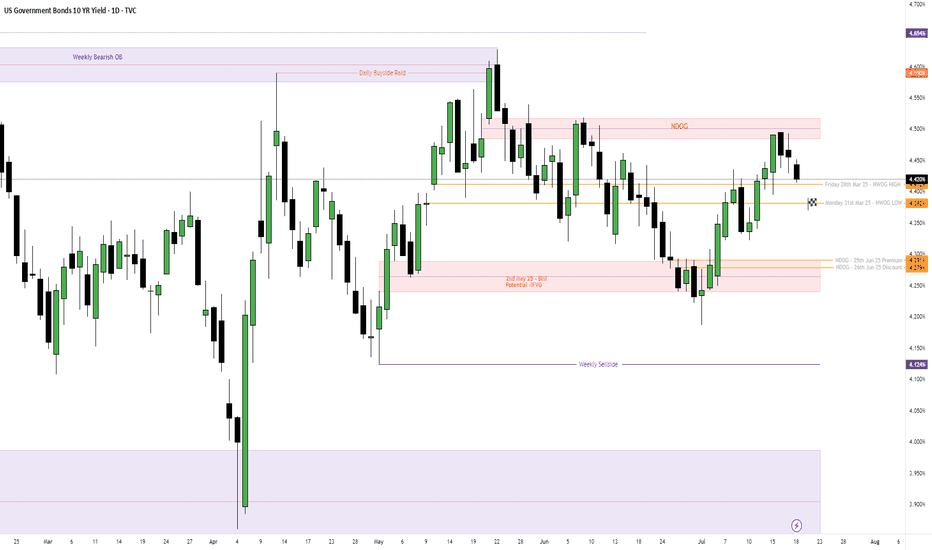

Overnight, U.S. Treasury yields reversed their upward trend and traded lower as investors awaited key developments from the Federal Reserve’s upcoming policy meeting and ongoing U.S.-China trade talks. The benchm

Crude Oil Spikes - Russia / Ukraine / USA sanction? Concerns about the possibility of tighter global oil supplies are supporting crude prices after President Trump warned of "secondary sanctions" if Russia fails to reach a ceasefire in Ukraine within 10 to 12 days.

These sanctions have absolutely burned the shorts in oil and can cause a 3 bar surge

U.S. homebuilders tumble as rate cut bets decrease after Powell'** Shares of U.S. homebuilders slide on Weds after Fed chair Powell says no decision yet on rate cuts

** Markets now pointing to odds dropping below 50% that the Fed will cut rates at its next meeting in Sept, as benchmark U.S. 10-year yield

US10Y

extends rise

** Rising yields can potentially le

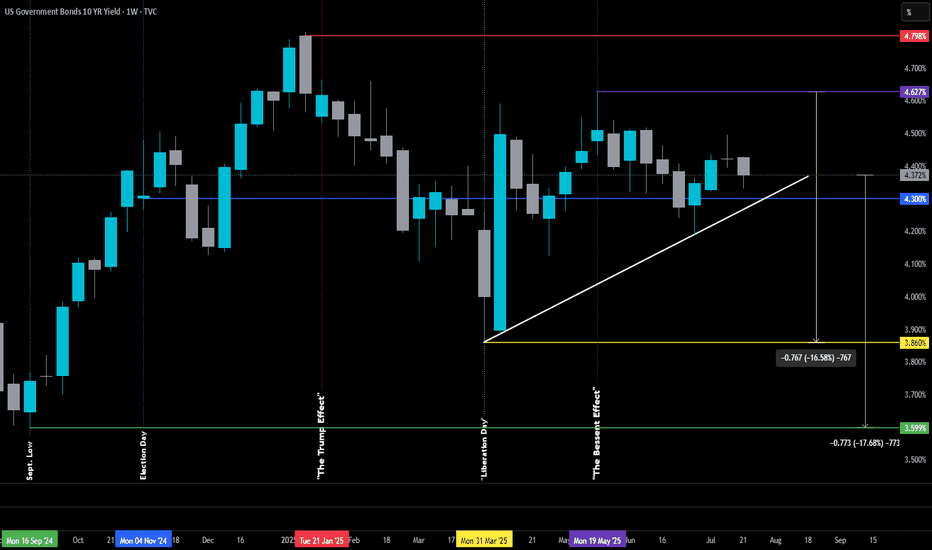

The Bessent Effect: Part I-Challenge the FedThe Bessent Effect: Part I-Challenge the Fed

Originally posted on June 30th, 2025, but it was removed by a moderator — I misinterpreted the posting guidelines (I tend to read a little too deep between the lines sometimes).

For context, the original version didn’t include the White or Green lines.

US 10Y TREASURY: June data cools rate cut hopesThe US inflation and jobs data shaped investors sentiment during the previous week, where 10Y US Treasury yields eased as of the end of the week. The US inflation remains relatively steady and in line with expectations, with 0,3% increase in June or 2,7% y/y. The producers price Index was holding at

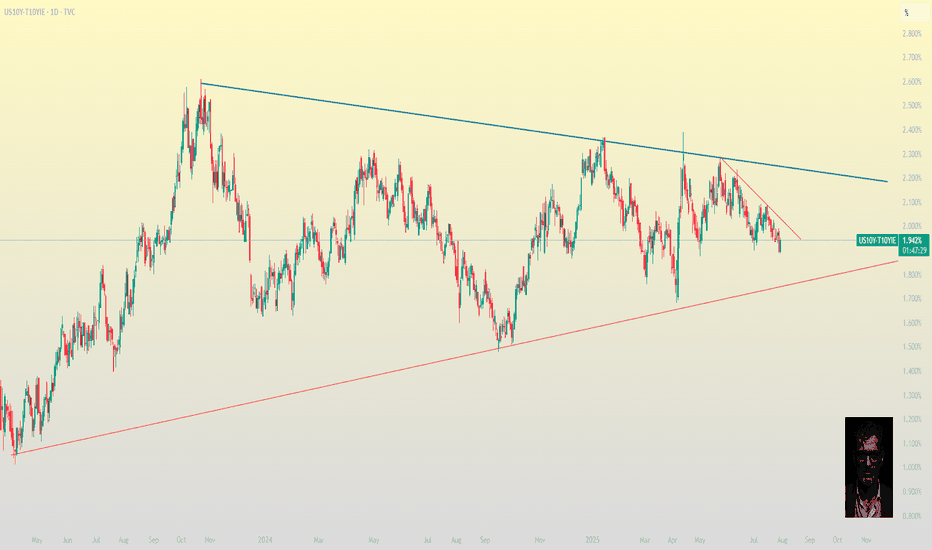

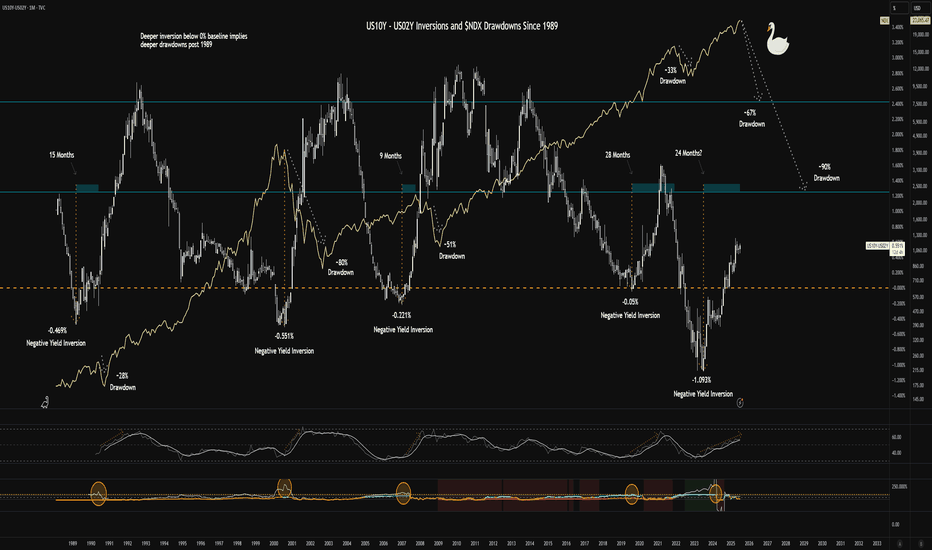

$US10Y - $US02Y Inversion and $NDX Drawdowns Since 1989I cleaned the chart a bit for readability.

The chart shows historical inversions in the TVC:US10Y and TVC:US02Y and the drawdowns in the NASDAQ:NDX that followed. The implication is that we should expect to see a >50% drawdown within 4 months. I'm not calling the "why" but only drawing paral

See all ideas

A graphical representation of the interest rates on debt for a range of maturities.

Frequently Asked Questions

The current yield rate is 4.216% — it's decreased by −4.18% over the past week.

The current yield of United States 10 Year Government Bonds is 4.216%, whereas at the moment of issuance it was 3.520%, which means 19.77% change. Over the week the yield has decrased by −4.18%, the month performance has showed a −0.71% decrease, and it has risen by 4.56% over the year.

Maturity date is when a debt comes due and all principal and/or interest must be repaid to creditors. For example, the United States 10 Year Government Bonds maturity date is May 15, 2035.

You can buy United States 10 Year Government Bonds through brokers — choose the one that suits your needs and go ahead. You can also purchase bonds directly from the issuing organization. Closely track the price dynamics and market news before making any decision.

A bond is a debt security issued by a corporation or a government. By buying bonds, investors loan the issuer money in return for an interest rate. By issuing bonds, the state receives funds that can then be injected into the economy, and corporations raise funds for new research or other operational activities. The alphanumeric code of government bonds represents the abbreviated name of the issuing state, as well as its time to maturity. For example, United States 10 Year Government Bonds is the US government bonds with the maturity of 10 years.

Bonds can be of various maturities, e.g. short-term (less than three years), medium-term (four to 10 years), or long-term ones (more than 10 years). So United States 10 Year Government Bonds are medium-term bonds — they have the maturity of 10 years.