2330 trade ideas

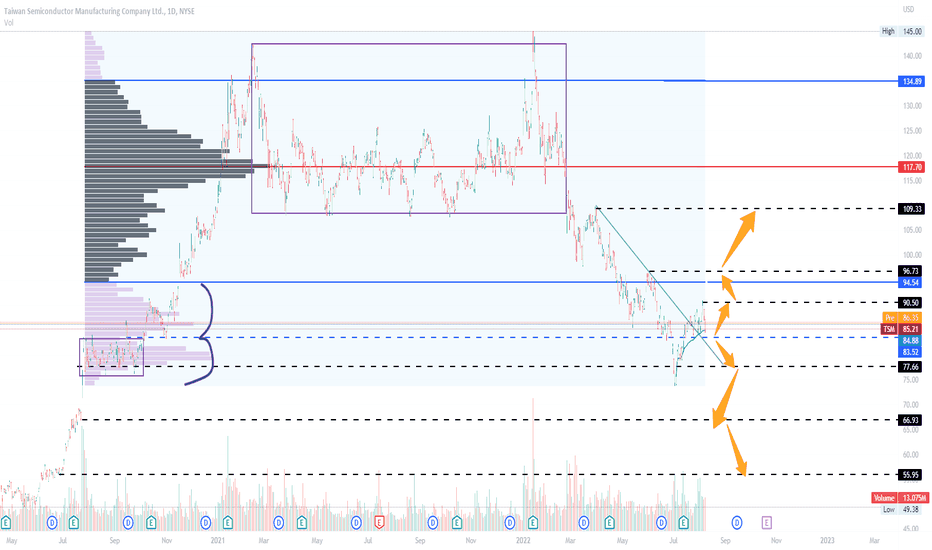

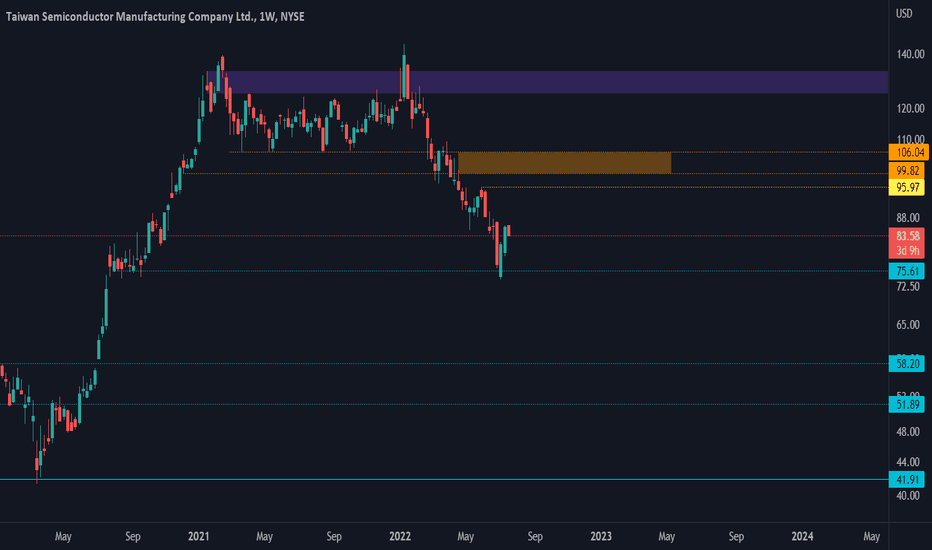

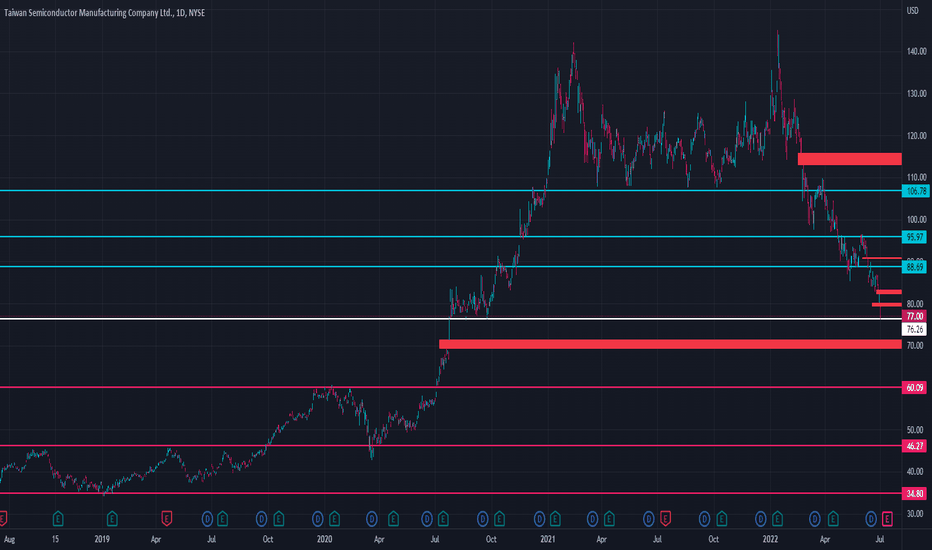

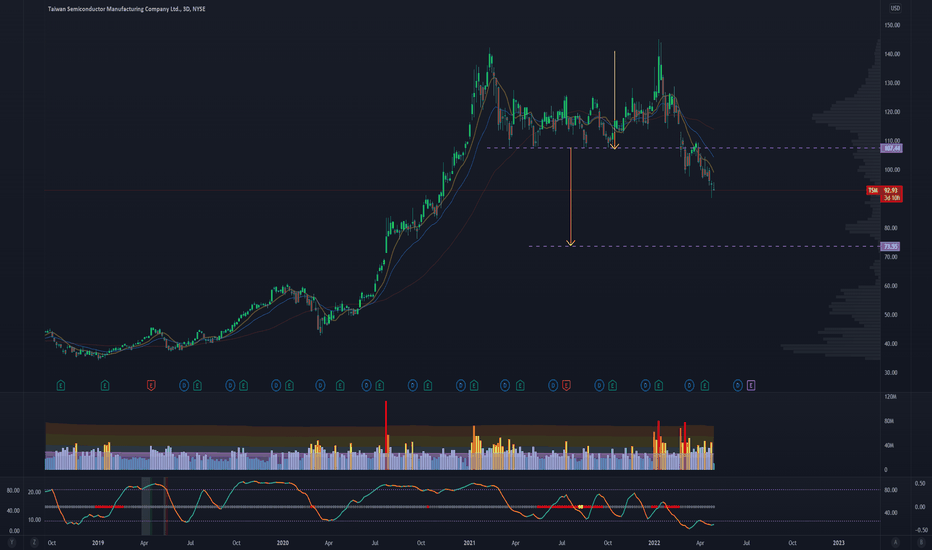

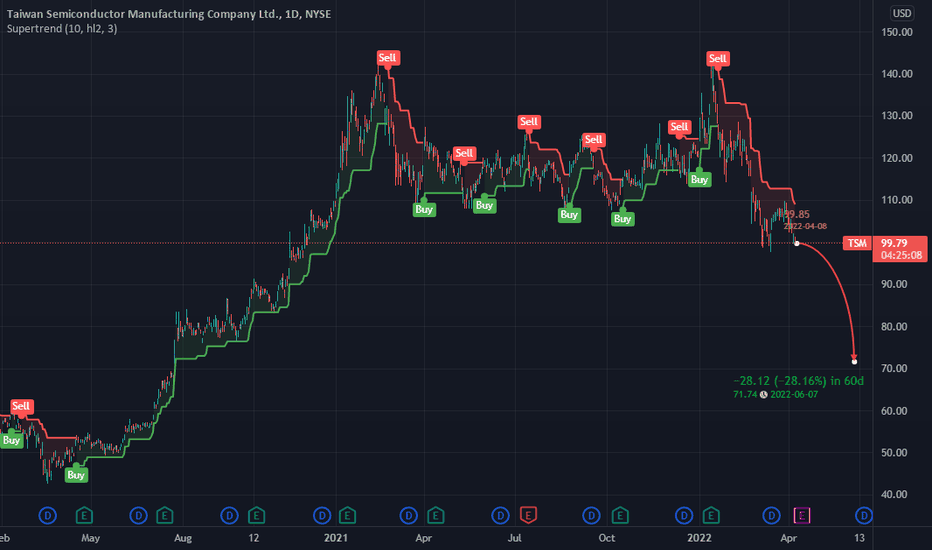

TSM - Starting to Accumulate.TSM - currently down 42% from the high, and up 12% from the recent low.

Currently in a downtrend that changes if gain of yellow giving targeted orange area.

If continuation of downtrend targeting levels below in cyan particularly support at untested levels - 58.20,51.90.

Purple is the last resistance before new ATH.

Taiwan Semiconductor Manufacturing (TSM) LONG!! Semiconductor industry is poised for a decade of rapid growth, with many end products relying heavily on the essential supply of semiconductor chips and products. Automotives, mobile phones, laptops, tablets and the like all require chips to work. Amongst this industry lies a semicon giant poised to rear its head: TSM.

TSM is the main supplier of chips for AAPL, with a huge backlog of stocks yet to be supplied.

Fundamentals:

- TSM is poised to produce 2NM chips by 2025.

- Chips are price inelastic, demand normally has to contend with rising costs imposed by suppliers.

- Innovation is strong in the semiconductor industry with huge capital spend on R&D for better and smaller chips

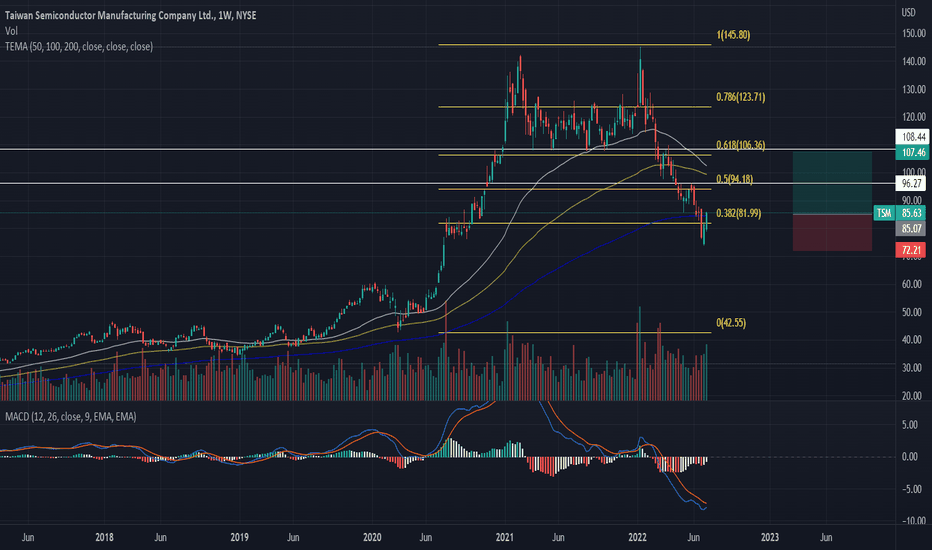

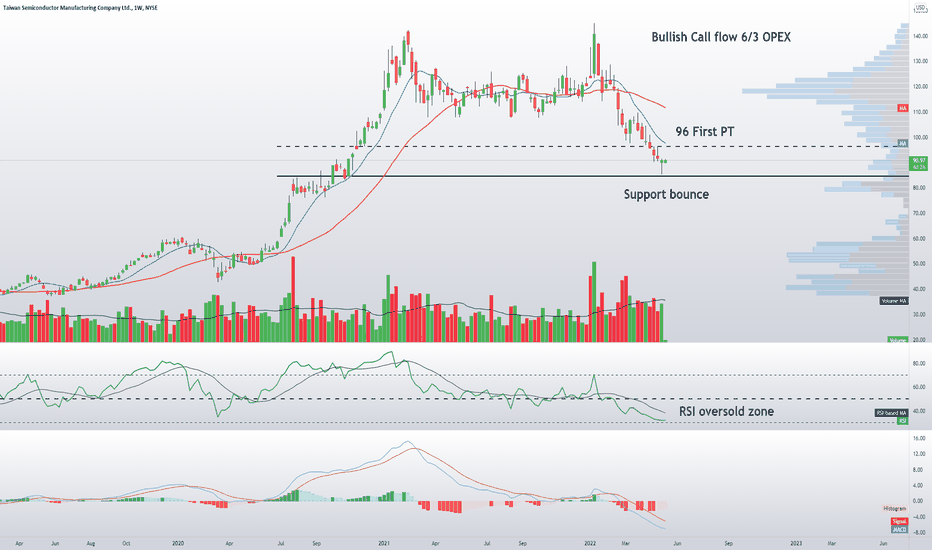

Technicals:

- MACD oversold with MACD line slopping upwards

- MACD selling momentum weakening with histogram shortening

- Prices have reached and bounced from the 200 TEMA + 61.8% fibonacci retracement levels

- Price action show huge BULLISH ENGULFING candle

TARGETS:

108.4

96.3

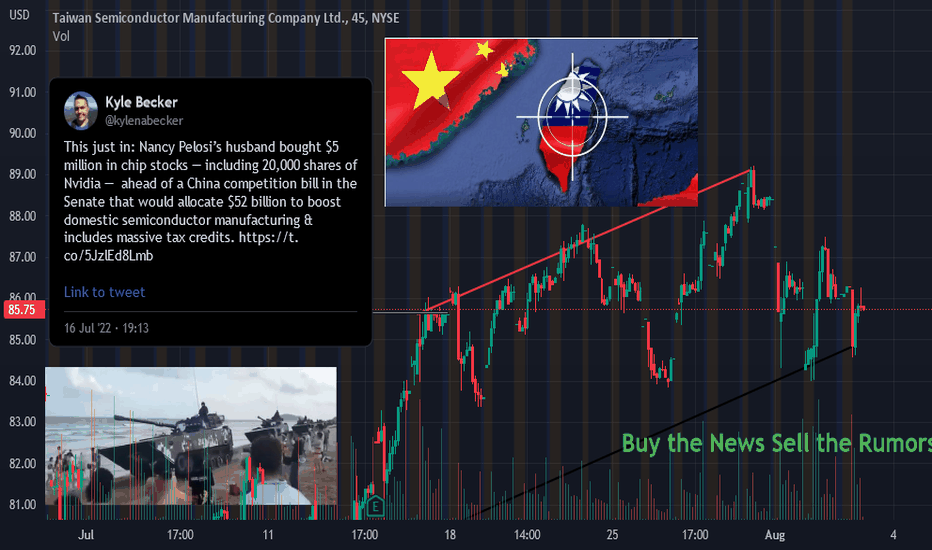

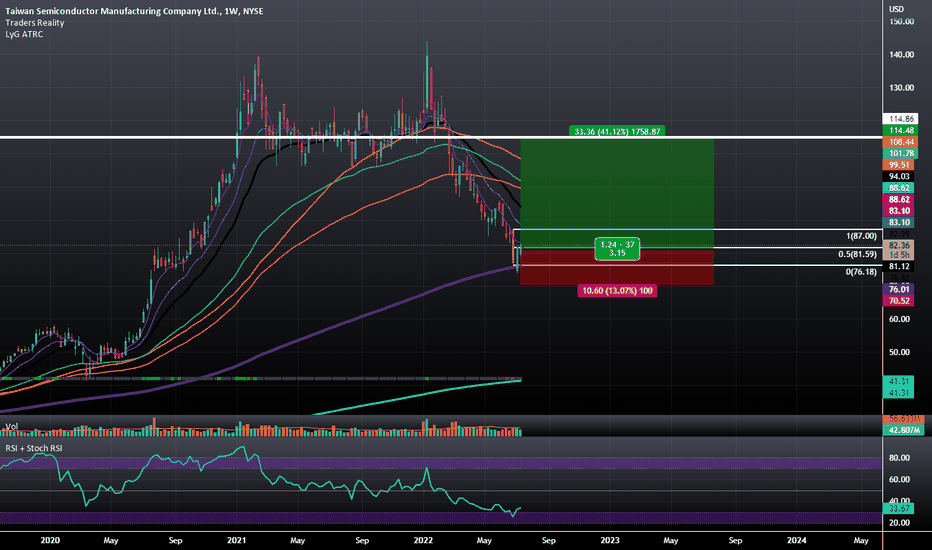

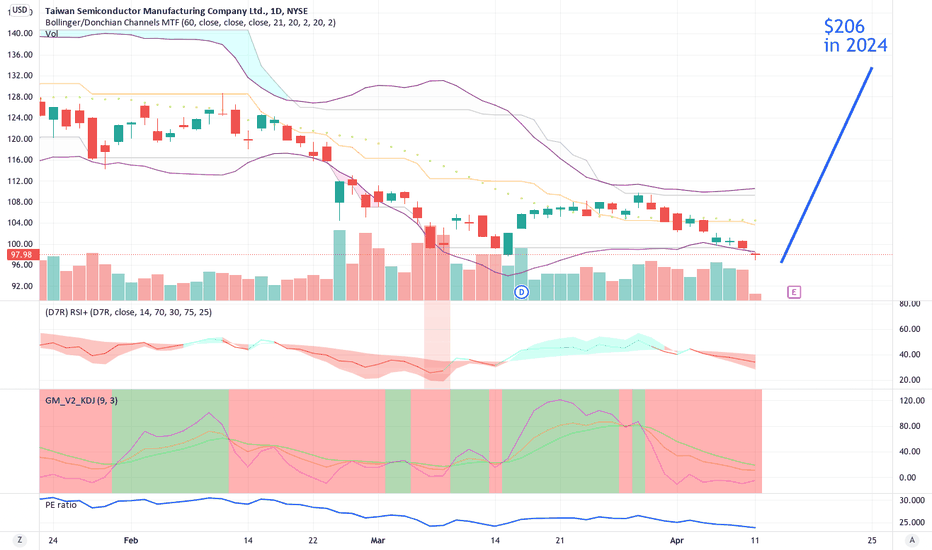

Taiwanese Semiconductors: Piercing Line Visible on the WeeklyWe have a Textbook Confirmed Piercing Line Visible on the Weekly on the Taiwan Semiconductor Manufacturing Company I was made aware of this a few days ago but opted to wait for the earnings report before taking action. We got a positive report so I am now taking action and my Bullish Target for TSMC will be around $100-$110 to fill the Gap Visible on the Daily Timeframe.

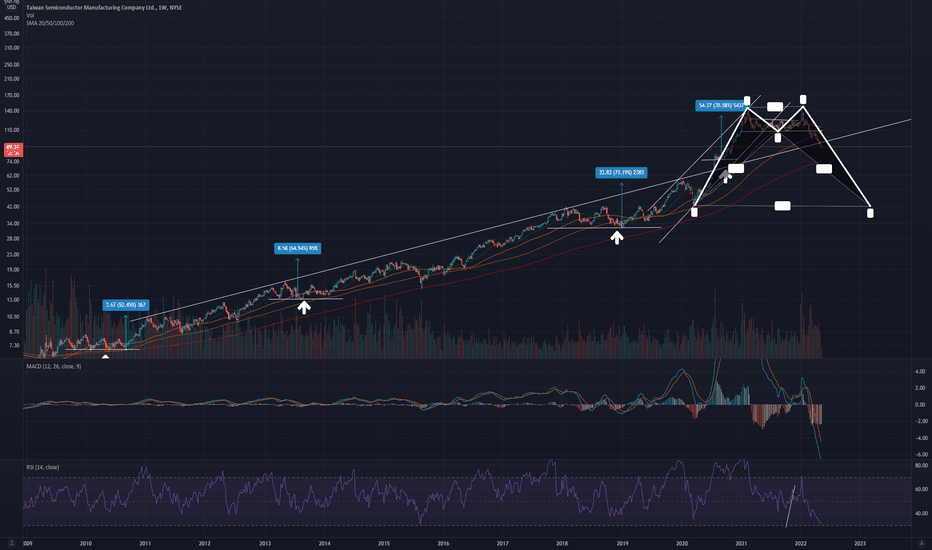

$TSM Taiwan Semiconductor Manufacturing WYCKOFF$TSM Taiwan Semiconductor Manufacturing Company Ltd. completed a clear as day WYCKOFF distribution TOP.

Currently it is sitting on major support. Losing this $76 area would be bearish to $60 because there isn't much support below $76 to hold it up.

$TSM is GAP city (Gaps are marked in Red), big gap below Support and many gaps above.

So far, this stock has not shown any signs of reversal, however $TSM is a giant in chip manufacturing. TSM makes $aapl chips and with ongoing shortages they are well positioned for advantage as these tech giants add autonomous driving to their business plans. Financially they are well positioned for growth in the years to come.

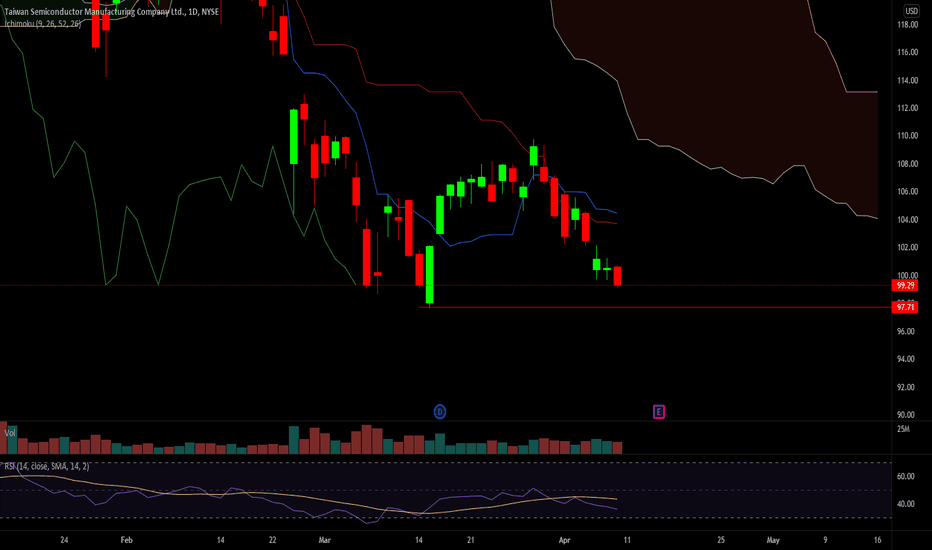

TSM - a decade hangs in the balanaceTSM now encounters the situation where the prior decade resistance is now being tested as a 'support' level.

Unfortunately for TSM since the Russian invasion of Ukraine the threat of China invading Taiwan has become ever more possible and as such the markets are attempting to price this in.

However this company is still very much fair value generating strong cash flows with no real rivals in the space. As such, if TSM holds and generates some structure around this support level it would be well worth a revisit.

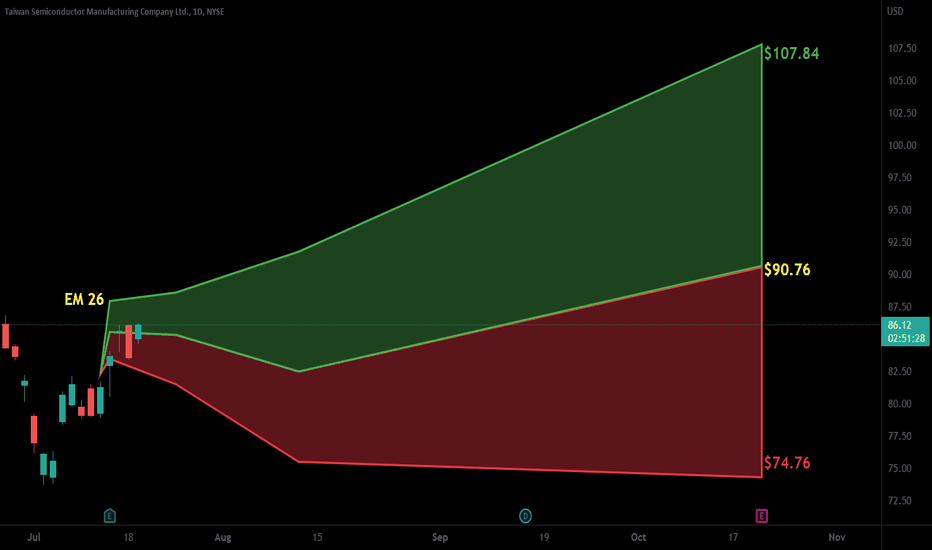

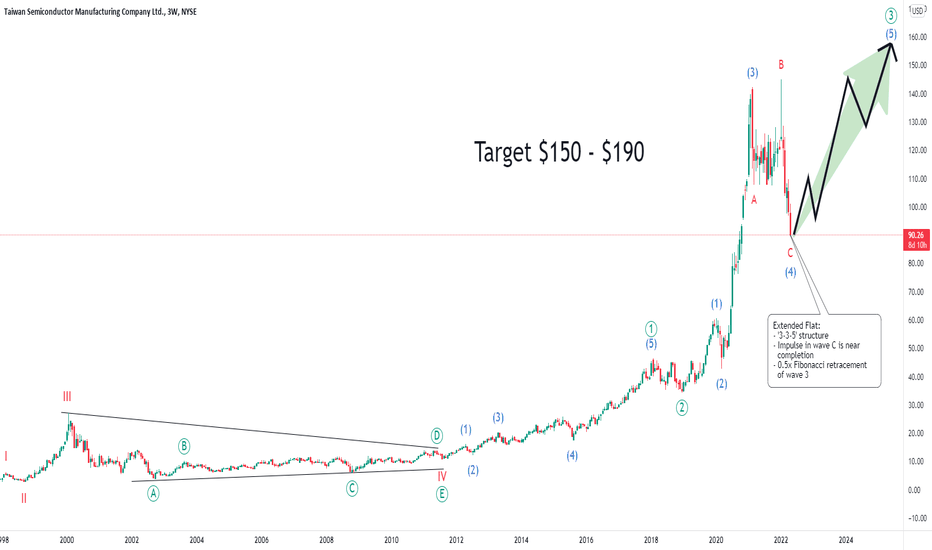

TSM - New Growth Cycle with 100% Potential?Is the world leading chip maker TSMC about to start a new growth cycle?

Fundamental indicators:

Revenue and Profits - exponential growth

Profit margin - is at circa 37%, impressive figure considering the growth levels

P/E - reasonable at 23x

Liabilities - no problems there

Risks:

Recession - is not likely to have a big impact on TSMC as demand on its products keeps growing, but it may impact share prices when the market starts correcting

China tensions - this is the highest risk to stability and future of this business which is difficult to assess but it certainly needs to be taken into account

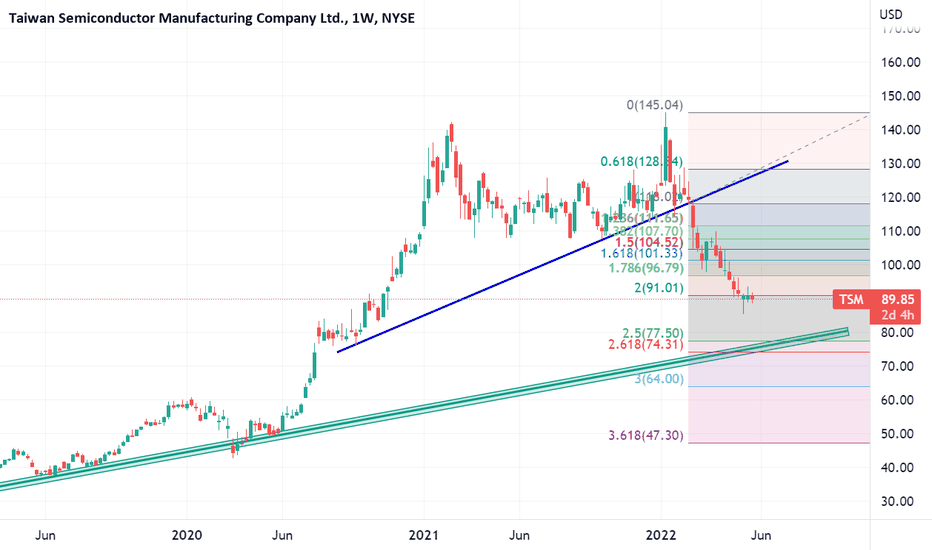

Technically:

Following correction of 2020 there was an explosive growth in the share price of TSMC which indicates that it was wave 3 using Elliott Wave analysis

And looking at the structure of the correction that has developed since the peak - the impulse like movement at the end suggests it is an Extended Flat

At the lower time timeframe it is visible that the fifth wave of this impulse is quite choppy which indicates that ending diagonal is developing and soon there will be a reversal

Given the depth of the forming wave 4 is 50% (using Fibonacci level) the fifth wave maybe not as explosive and may reach $150 to $190, which is impressive 100% jump from the current price level

Alternative scenario - there is a possibility that wave 4 has not completed yet and it may drop further, however, at the moment it looks unlikely

Do you think that TSMC is going to start another impressive bull cycle?

Please share your thoughts in the comments and like this idea if you would like to see more stocks analysed using Elliott Waves.

Thanks

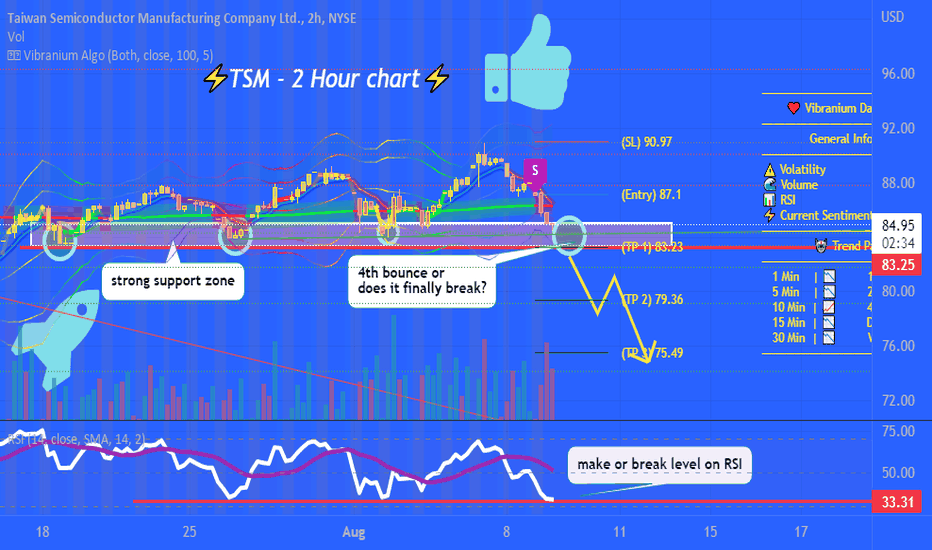

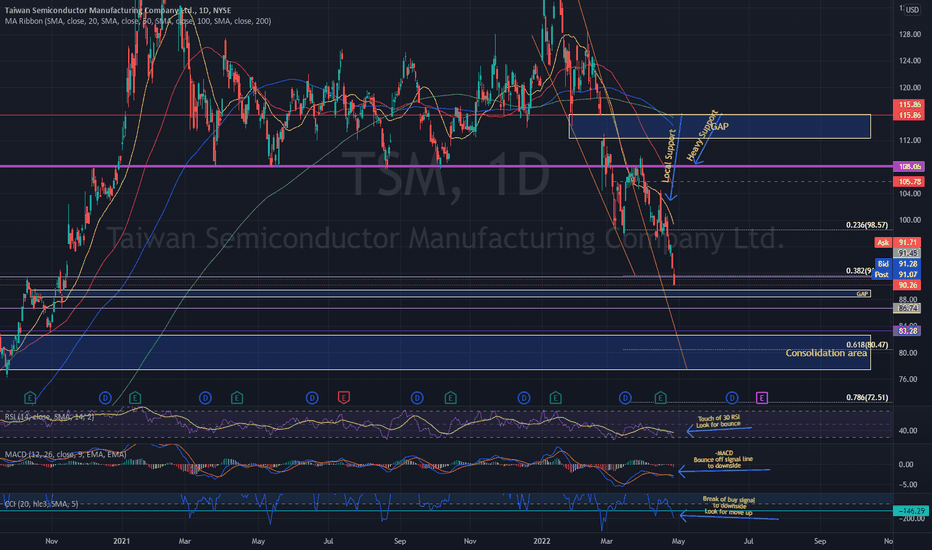

TSM looking for a bottom Good afternoon traders,

Today I am updating my TSM analysis...I have exited completely from trade but will look for another entry point...We have filled the GAP at the $93 area and are currently sitting on resistance turned support at $91.50ish area...It has had an 11% move to the downside in the last 5 days so I can see this moving up possibly back to the .236 at the $98ish range before a bigger move down...All in all the entire semi conductor sector is weak with no end in sight so I can see this moving down to the $77 to $83 range before it possibly finds a bottom...Let me know what you think in the comments below...As always Happy Trading!!!!!!!

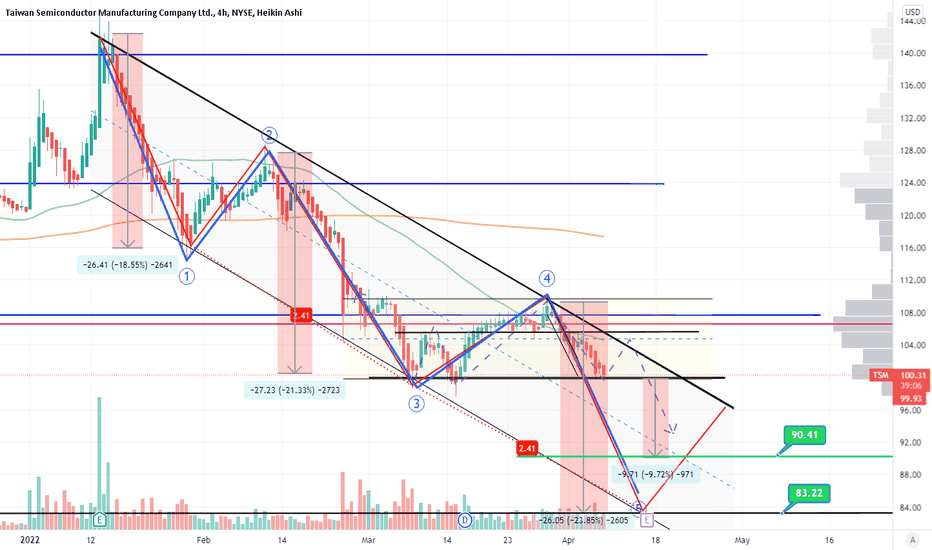

TSM - 5th leg down, 3 drive pattern SHORT CITYIt is in my humble opinion TSM is looking at a rather large drop looming ahead - symmetrically the pattern meets the harmonic qualifications as well as the elliot wave theory macro wave iterations.

It is possible TSM will make a small shoulder before breaking the $100 price level - should it break this level and close below I believe it will be a swift fall to the $85 level, however if it wasn't "quick" the position I hold does allow for some time.

Trade: 6/17 exp $85 PUTS @ 1.17 on 4/1 - currently trading at 1.62 at time of post

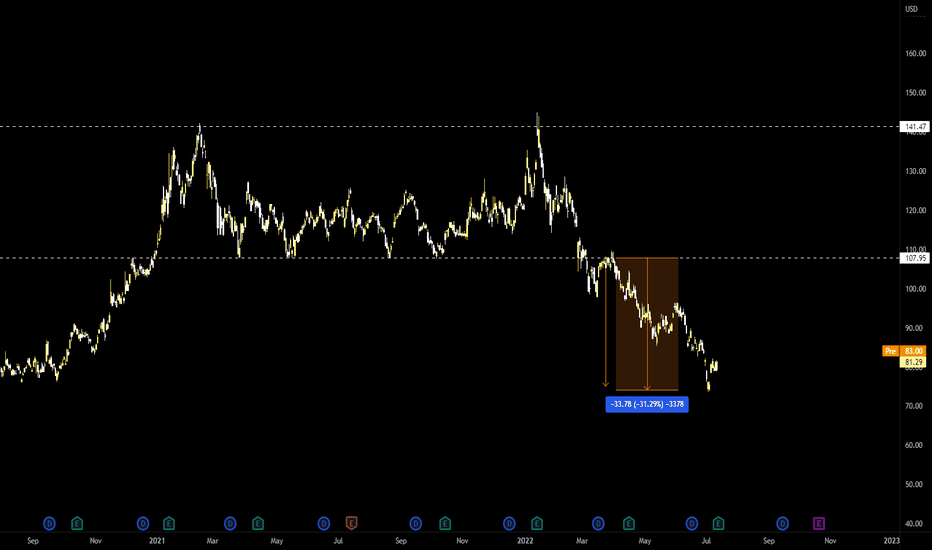

TSM will breach support and continue lowerThere is no better crystal ball to predict the future performance of an asset than its own chart.

Keeping it simple, TSM broke bellow a 15-month lateral range, and several days later failed to reconquer the lost grounds. It's been under distribution, and the last candle is the most bearish.

TSM won't be able to hold at support and will continue lower.

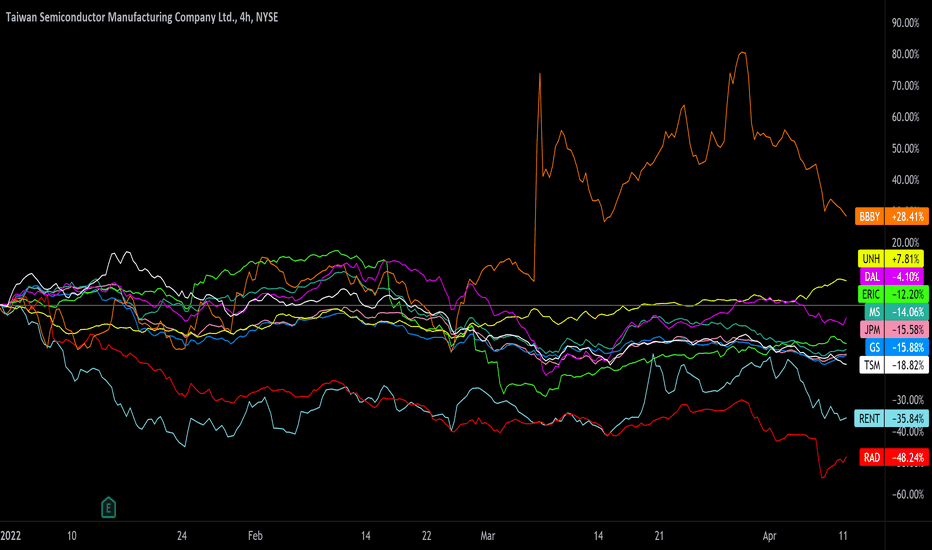

Earnings this weekEarnings this week 4/11-4/15. Here's a YTD comparison so far up till 4/11:

4/13 earnings

DAL

JPM

BBBY

RENT

4/14 earnings

TSM

UNH

GS

MS

RAD

ERIC

YTD comparison

BBBY +28.43%

UNH +7.75%

DAL -4.1%

ERIC -12.21%

MS -14.06%

JPM -15.59%

GS -15.86%

TSM -18.82%

RENT -35.81%

RAD -48.23%

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.sweetlogin.com